BlackRock has made a significant alteration to its Bitcoin exchange-traded fund (ETF) application, aiming to facilitate participation by major Wall Street banks.

This change involves the creation of new fund shares using cash, rather than relying solely on cryptocurrency assets.

The innovative “in-kind redemption prepay” model is designed to enable banking giants like JPMorgan and Goldman Sachs to become authorized participants in the fund.

This would allow them to bypass restrictions that currently prohibit them from directly holding Bitcoin or other cryptocurrencies on their balance sheets.

This transformative model was presented jointly by six members of BlackRock and three from Nasdaq during a meeting held on November 28th with the United States Securities and Exchange Commission (SEC).

If granted approval, this development could prove to be a game-changer for Wall Street institutions with trillion-dollar balance sheets, as it opens up a new avenue for their involvement.

Many highly regulated banks are presently barred from directly holding cryptocurrencies.

Under the revised model, authorized participants (APs) would transfer cash to a broker-dealer, which would then convert it into Bitcoin before entrusting it to the ETF’s custody provider, Coinbase Custody in BlackRock’s case.

This arrangement also effectively shifts risk away from APs and places it more in the hands of market makers.

READ MORE: El Salvador’s “Volcano Bonds” Approved for 2024 Launch

Furthermore, BlackRock asserts that this new model enhances resistance to market manipulation, which has previously been a key factor in the SEC’s rejection of spot Bitcoin ETF applications.

Additionally, BlackRock contends that the new ETF structure will bolster investor protections, reduce transaction costs, and promote simplicity and consistency within the broader Bitcoin ETF ecosystem.

According to a filing with the SEC, BlackRock had its third meeting with the SEC, led by Gary Gensler, on December 11.

Notably, this meeting on November 28 with the SEC was a follow-up to an initial meeting held on November 20, where BlackRock introduced its original in-kind redemption model.

The SEC is obligated to make a decision on BlackRock’s application by January 15, with the final deadline set for March 15.

In the meantime, ETF analysts anticipate that the SEC will issue decisions on several pending spot Bitcoin ETF applications sometime between January 5 and 10.

Grayscale, Bitwise, VanEck, WisdomTree, Invesco Galaxy, Fidelity, and Hashdex are among the other financial firms eagerly awaiting the SEC’s decisions during this period.

Bitcoin’s price has remained below its 2023 high, indicating that the $44,000 resistance level has proven stronger than initially anticipated by investors.

Despite trading below $42,000, there is still potential for Bitcoin to reach $50,000 and beyond. In fact, signs suggest that this may be more likely than not.

A closer look at Bitcoin derivatives metrics reveals that traders have remained optimistic, even after a 6.9% drop.

However, the question remains: is this optimism justified for further gains?

On December 11, a significant $127 million liquidation of leveraged long Bitcoin futures occurred.

While this may seem substantial, it accounts for less than 1% of the total open interest, which encompasses the value of all outstanding contracts. Nevertheless, this liquidation triggered a 7% correction in less than 20 minutes.

Some argue that derivatives markets played a key role in this negative price movement, but it’s important to note that Bitcoin’s price rebounded by 4.2% in the following six trading hours after hitting a low of $40,200 on December 11.

This suggests that the impact of forceful liquidation orders had dissipated, disproving the idea of a crash solely driven by futures markets.

To assess whether Bitcoin whales and market makers remain bullish, traders can analyze the Bitcoin futures premium, also known as the basis rate.

In stable markets, these contracts typically trade at a premium of 5% to 10% due to their extended settlement period.

READ MORE: Solana’s Bonk (BONK) Emerges as Third-Largest Memecoin, Surpassing Pepe in Market Cap Surge

Data shows that despite the 9% intraday price drop on December 11, the BTC futures premium remained above the 10% neutral-to-bullish threshold throughout.

This indicates that there was no significant excess demand for shorts, as the metric did not drop into the neutral 5% to 10% range.

Examining options markets is another way to gauge investor sentiment. The 25% delta skew is a useful indicator that reflects whether arbitrage desks and market makers are charging excessively for upside or downside protection.

The BTC options skew has remained neutral since December 5, signaling balanced costs for both call and put options, showing resilience even after the 6.1% correction since December 10.

Furthermore, data on perpetual contracts, which include an embedded rate recalculated every eight hours, reveals a modest increase in the positive funding rate between December 8 and December 10.

This suggests increased demand for leverage among long positions, but the increase is not significant enough to burden most traders.

Overall, the recent rally to $44,700 and subsequent correction to $41,300 appear to have been primarily driven by the spot market.

This development reduces the likelihood of cascading liquidations due to excessive optimism related to the expectation of a spot exchange-traded fund (ETF) approval.

In summary, Bitcoin bulls can take comfort in the fact that derivatives metrics indicate that positive momentum has not waned despite the price correction.

Bitcoin speculators rushed to sell their holdings as the BTC price experienced a correction towards the $40,000 mark, according to the latest on-chain data.

On December 12th, figures from on-chain analytics firm Glassnode revealed that short-term holders (STHs), defined as entities holding BTC for 155 days or less, collectively offloaded over $2 billion worth of BTC.

This came as Bitcoin witnessed its most significant single-day drop of 2023, reaching a peak decline of 8.1%. The data was confirmed by Cointelegraph Markets Pro and TradingView.

Responding to the price drop, the more speculative segment of Bitcoin investors began reducing their exposure to the market, displaying signs of uncertainty about its future.

Glassnode’s data disclosed that on December 11th, STHs sent $1.93 billion worth of Bitcoin to exchanges, followed by another $2.08 billion on the subsequent day.

Both of these days marked record highs in terms of selling pressure from STHs, with entities in both profit and loss positions contributing to the trend.

The last time single-day selling exceeded the $2 billion threshold was in June 2022, triggered by concerns over the impending collapse of blockchain firm Celsius.

James Van Straten, a research and data analyst at crypto insights firm CryptoSlate, highlighted the significance of the week’s STH movements, noting that $2 billion was sold in total, with $1.1 billion resulting in losses.

READ MORE: Get Blue-Chip NFTs in BetFury NFT Lootboxes

This mainly impacted retail investors who had bought Bitcoin between December 6th and December 13th, likely due to the allure of Bitcoin’s 150% year-to-date gain.

While the trading volumes in BTC terms were less substantial, the December 12th figures marked the largest since the beginning of July when BTC/USD had just rebounded above the $30,000 level after dipping to $25,000.

Glassnode also pointed to various on-chain indicators suggesting that STHs might be growing wary of the bullish trend.

Profit-taking was noted around the month’s 19-month high near $45,000, and the researchers suggested that there might be a potential saturation of demand or exhaustion in play.

One of the key indicators highlighted was the Mayer Multiple, which gauges the relationship between the current spot price and the 200-week moving average.

The Mayer Multiple was approaching 1.5, a level that has historically acted as resistance during Bitcoin’s bull markets.

Glassnode stated that the current Mayer Multiple of 1.47 is close to the ~1.5 level, which has historically acted as resistance in previous cycles, including the November 2021 all-time high.

This level has not been breached for 33.5 months, the longest period since the 2013-2016 bear market.

Bitcoin’s price experienced a 5% dip within the last 24 hours, settling at $41,645 on December 11.

However, despite this sudden correction, technical indicators and on-chain data suggest that Bitcoin remains robust, as bulls actively work to push the price back above the $44,000 mark.

On-chain data indicates that Bitcoin’s price had become “over-extended.” It plummeted by as much as 7.2%, reaching $40,300 on Coinbase, which led to discussions among analysts.

Julio Moreno, head of research at CryptoQuant, an on-chain analytics firm, pointed out that Bitcoin’s price had become “overheated” following its recent surge above the psychologically significant $40,000 level.

Further data from the on-chain data analysis firm Lookintobitcoin revealed signs of exhaustion among bullish investors.

According to their December 2023 report, Bitcoin’s price had reached its near-term target as per the golden ratio multiplier, a metric based on the Crosby Ratio.

This highlighted that Bitcoin’s near-term price had become “over-extended,” necessitating a correction or at least a slowdown.

In essence, Bitcoin had entered overbought conditions above $40,000, with its relative strength index (RSI) indicating overbought status since December 5.

This early warning signaled a potential reduction in buying pressure as traders began to perceive the rally’s loss of momentum and took profits.

The primary challenge for Bitcoin’s price remains the formidable resistance at the $44,000 supply zone.

The Lookintobitcoin golden ratio multiplier indicator indicated that the 1.6 multiplier target had been reached around this area. Bitcoin has struggled to convincingly breach this level over the past week, facing significant rejection.

The intensity of the resistance at $44,000 is underscored by on-chain data from IntoTheBlock’s “in/out of the money around price” (IOMAP) model.

This data indicates that the $43,346–$44,627 price range is where approximately 585.77 BTC was previously acquired by approximately 1.43 million addresses.

READ MORE: VanEck Files Fifth Amended Application for ‘HODL’ Bitcoin ETF with SEC

Any attempts to surpass this level would likely encounter aggressive selling from this group of sellers.

Nonetheless, this ongoing correction may be viewed as a bear trap within an overall bullish trend that has developed over recent months.

Data from crypto market intelligence firm Santiment indicates that Bitcoin’s exchange outflows are on the rise, with the BTC exchange flow balance now at -347.

This negative reading implies that outflows are surpassing inflows, a sign that investors are more inclined to hold than sell, which is generally considered bullish.

From a technical perspective, Bitcoin has remained above all major moving averages, and these indicators have continued their upward trajectories, providing strong support levels.

The moving average convergence divergence (MACD) indicator also remains in positive territory, with the MACD line positioned above the signal line, favoring further upward movement in Bitcoin’s price.

Therefore, it is likely that Bitcoin’s price will continue to rise from its current levels, with buyers targeting a breakout above $44,000.

A successful break beyond this level could propel Bitcoin toward the psychological milestone of $50,000, either in early 2024 when the United States Securities and Exchange Commission is expected to decide on spot Bitcoin exchange-traded fund applications or during the next Bitcoin halving event.

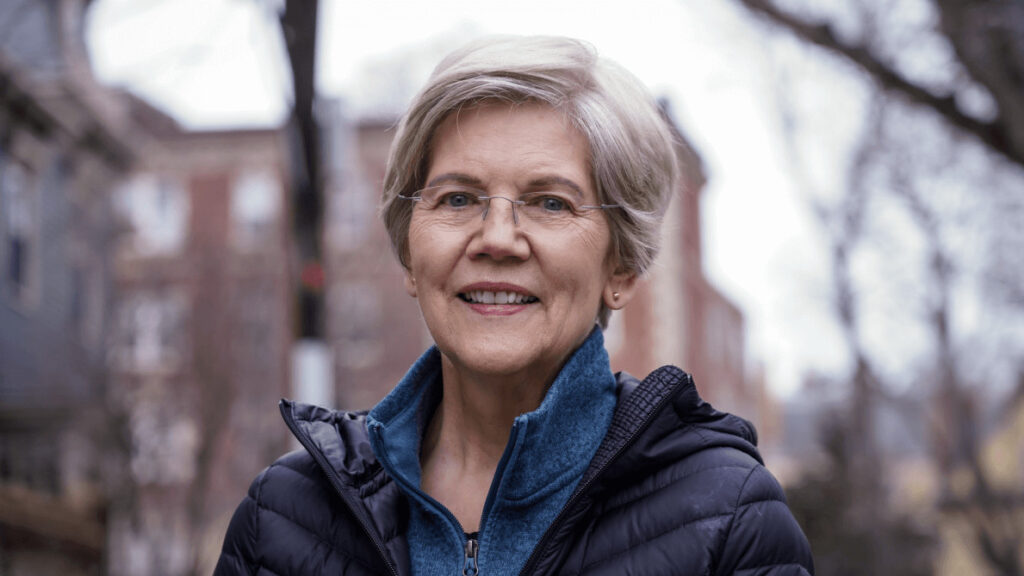

Massachusetts Senator Elizabeth Warren, a prominent critic of digital assets within the United States government, has recently revealed that five additional senators have pledged their support as cosponsors for her bill, which aims to combat money laundering within the digital asset sphere.

In her announcement on December 11, Senator Warren disclosed that Senators Raphael Warnock, Laphonza Butler, Chris Van Hollen, John Hickenlooper, and Ben Ray Luján have thrown their weight behind the Digital Asset Anti-Money Laundering Act.

This legislation was reintroduced in July and is laser-focused on curbing the illicit use of cryptocurrency for money laundering and the financing of terrorism.

Warren expressed her satisfaction with the growing support, stating, “I’m glad that five new senators are joining the fight to take action, including three members of the Banking Committee.”

She emphasized that their bipartisan bill represents the most stringent proposal currently on the table for combating the illicit use of cryptocurrency while also providing regulators with additional tools to enhance their oversight.

Even before this latest support, the bill had garnered backing from both sides of the aisle and received endorsement from various senators and organizations.

READ MORE: Defunct Crypto Firms FTX and Alameda Move $23.59 Million in Digital Assets to Top Exchanges

Notable supporters included the Bank Policy Institute, Massachusetts Bankers Association, Transparency International U.S., Global Financial Integrity, National District Attorneys Association, Major County Sheriffs of America, the National Consumer Law Center, and the National Consumers League.

Furthermore, Senator Warren reiterated a claim made during a December 6 hearing before the Senate Banking Committee and subsequent interviews.

She asserted that approximately half of North Korea’s missile program was funded through digital assets, underscoring the urgency of addressing money laundering in the cryptocurrency space.

Critics of the bill have argued that lawmakers should focus their efforts on targeting bad actors who misuse the technology rather than regulating digital assets and their underlying infrastructure.

However, cybersecurity expert Steve Weisman lent his support to the legislation during a Senate hearing in November, labeling it a “no-brainer” in addressing concerns related to money laundering.

In summary, Senator Elizabeth Warren continues to lead the charge in addressing the illicit use of digital assets through her Digital Asset Anti-Money Laundering Act, gaining increased support from fellow senators and organizations, despite some dissenting voices in the ongoing debate.

Bitcoin Core developer Luke Dashjr has refuted any involvement in the inclusion of Bitcoin inscriptions as a cybersecurity concern on the United States National Vulnerability Database’s (NVD) Common Vulnerabilities and Exposures (CVE) list.

This controversy arose when Dashjr, in a December 6th post on X (formerly Twitter), alleged that inscriptions, utilized by the Ordinals protocol and BRC-20 creators for embedding data in satoshis, were exploiting a Bitcoin Core vulnerability, thus “spamming the blockchain.”

Several days later, Bitcoin inscriptions surfaced on the U.S. vulnerability database as part of the CVE list on December 9th, describing it as a security flaw linked to the development of the Ordinals protocol in 2022.

Nonetheless, Dashjr, despite his vocal criticism of Bitcoin Ordinals, asserted that he played no role in adding inscriptions to the vulnerability database’s CVE list.

The CVE list is structured to allow any developer to report a vulnerability, subject to approval by the CVE Assignment Team for public awareness purposes.

As of December 11th, the NVD updated the listing, assigning inscriptions a base severity score of “5.3 Medium.”

This rating indicates that the exploitation of this vulnerability offers “very limited” access to a network or presents challenging hurdles for executing denial-of-service attacks, according to Atlassian, a software firm.

READ MORE: Defunct Crypto Firms FTX and Alameda Move $23.59 Million in Digital Assets to Top Exchanges

Dashjr explained that the CVE list’s 5.3 score primarily resulted from the vulnerability’s minimal impact on the availability of the Bitcoin network.

Nevertheless, he contended that the score might underestimate its long-term consequences, suggesting that if the availability impact were classified as “High,” the CVSS base score would reach 7.5.

The debate surrounding Bitcoin inscriptions continues to unfold on social media platforms.

While some Bitcoin enthusiasts argue that inscriptions are overloading the network, Ordinals proponents, including Udi Wertheimer, co-founder of Taproot Wizards, maintain that Ordinals are essential for the future adoption and revenue growth of the Bitcoin network.

The Bitcoin network has experienced increased congestion in recent months due to heightened interest in Ordinals’ nonfungible token inscriptions and BRC-20 token minting.

Data from mempool.space indicates over 275,000 unconfirmed transactions, with average medium-priority transaction costs surging from approximately $1.50 to around $14.

Patching the so-called inscriptions bug could potentially limit future Ordinals inscriptions on the network.

Google, the tech giant, is set to revise its cryptocurrency-related advertising policy to include advertisements for cryptocurrency trusts, starting from the end of January 2024.

This change coincides with the anticipated approval of spot Bitcoin exchange-traded funds (ETFs) in the United States in the same month.

In a policy update dated December 6, Google announced that its advertising policy for cryptocurrencies and related products would be adjusted on January 29, 2024, to permit advertisements from “advertisers offering Cryptocurrency Coin Trust targeting the United States.”

Cryptocurrency coin trusts were mentioned as examples of financial products that enable investors to trade shares in trusts holding substantial amounts of digital currency, which likely encompasses ETFs.

Google emphasized that advertisers must comply with local laws in the regions they target with their ads. This policy will apply universally to all accounts advertising these products.

READ MORE: Krist Novoselic Urges Microsoft to Reevaluate Generative AI Approach in Shareholder Proposal

Prospective advertisers for cryptocurrency trusts will need to be Google-certified, which involves obtaining the necessary licenses from local authorities and ensuring that their products, landing pages, and ads adhere to the legal requirements of the respective countries or regions where they seek certification.

While Google already allows advertising for certain cryptocurrency and related products, it continues to prohibit ads for cryptocurrency or nonfungible token (NFT)-based gambling platforms, initial coin offerings (ICOs), decentralized finance protocols, and services offering trading signals.

This policy shift aligns with Bloomberg’s ETF analysts’ prediction of a 90% likelihood of the approval of a U.S. spot Bitcoin ETF by January 10, 2024, with the potential for several pending applications to be approved simultaneously.

Currently, there are 13 Bitcoin ETF applicants, and detailed information about their approval processes remains limited.

Numerous fund managers, including BlackRock, Grayscale, and Fidelity, have reportedly engaged with the U.S. Securities and Exchange Commission (SEC) to discuss crucial technical aspects of their ETF proposals.

The cryptocurrency market is optimistic about these approvals, as evidenced by Bitcoin’s nearly 74% price increase in the past 90 days. Some analysts even anticipate a new all-time high for Bitcoin in 2024.

Google, the tech giant, is set to update its advertising policy related to cryptocurrencies, allowing advertisements for cryptocurrency trusts targeting the United States starting from January 29, 2024.

This policy shift aligns with predictions that spot Bitcoin exchange-traded funds (ETFs) will gain approval in the United States in the same month.

In a policy change log dated December 6, Google clarified that it will permit advertisements from “advertisers offering Cryptocurrency Coin Trust targeting the United States.”

Cryptocurrency coin trusts refer to financial products that enable investors to trade shares in trusts holding significant amounts of digital currency, possibly including ETFs.

Google emphasized that all advertisers must adhere to local laws in the areas where their ads are targeted.

This updated policy will apply globally to all accounts advertising these cryptocurrency-related products. To advertise crypto trusts, potential advertisers must be Google-certified, which necessitates having the appropriate license from the relevant local authority.

Their products, landing pages, and ads must also comply with the legal requirements of the specific country or region they wish to target.

READ MORE: Taiwan’s Central Bank Explores Wholesale CBDC as Part of ‘Banking 4.0’ Vision

It’s worth noting that Google already permits advertising for certain cryptocurrency and related products but excludes ads for crypto or nonfungible token (NFT)-based gambling platforms, initial coin offerings (ICOs), decentralized finance (DeFi) protocols, and services offering trading signals.

This policy adjustment is timely, as Bloomberg’s ETF analysts have assigned a 90% probability of a U.S. spot Bitcoin ETF receiving approval by January 10, 2024.

Multiple pending ETF applications could potentially be approved simultaneously. Currently, there are 13 Bitcoin ETF applicants, and detailed information about their approval processes remains limited.

Several prominent fund managers, such as BlackRock, Grayscale, and Fidelity, have reportedly engaged with the U.S. Securities and Exchange Commission to discuss critical technical aspects of their ETF proposals.

The cryptocurrency market anticipates these approvals with enthusiasm, as Bitcoin has surged by nearly 74% in the past 90 days. Analysts even predict the possibility of a new all-time high for Bitcoin in 2024.

This shift in Google’s advertising policy aligns with the evolving landscape of cryptocurrency investments and reflects the growing interest in digital assets among investors.

On December 11, 2:15 am UTC, the price of Bitcoin briefly dipped below the $41,000 mark, experiencing a sudden 6.5% drop from $43,357 to as low as $40,659 within a mere 20 minutes.

However, as of the latest TradingView data, Bitcoin has made a slight recovery, trading at around $41,960 after hitting the local low.

Ether, the second-largest cryptocurrency by market capitalization, also faced a sharp decline during the same timeframe, plummeting by more than 8.9%.

Presently, the price of ETH has stabilized at $2,233, reflecting a 5.3% decrease on the day. Other prominent cryptocurrencies like BNB, XRP, and Solana have also witnessed losses in value.

According to data sourced from CoinGlass, this abrupt drop led to the liquidation of long positions worth more than $270 million.

Additionally, it wiped out approximately $1.2 billion in open interest related to BTC, which currently stands at about $17.9 billion.

READ MORE: EU Reaches Landmark Agreement on Comprehensive AI Regulation

Interestingly, this price decline occurred just moments after Scott Melker of Wolf of All Street had remarked on Bitcoin closing its eighth consecutive green weekly candle, playfully asking, “When correction, sir?”

This recent drawdown constitutes the most significant single-day decline for Bitcoin in over a month, despite the asset’s impressive growth of more than 12% over the past 30 days.

Notably, Bitcoin has seen a remarkable rally of over 150% since the beginning of the year.

This uptrend has been primarily fueled by the anticipation that the United States Securities and Exchange Commission (SEC) will greenlight several spot Bitcoin exchange-traded funds (ETFs).

This approval would provide large institutions with a substantial avenue for exposure to the cryptocurrency for the first time.

Another contributing factor to Bitcoin’s rally is the prevailing market expectation that the U.S. Federal Reserve will commence interest rate cuts around the middle of 2024.

Investors are also gearing up for the release of the next round of inflation data and the final Federal Open Market Committee (FOMC) meeting of 2023.

Analysts largely anticipate improvements in core inflation and are betting on the Fed maintaining the current interest rate levels.

On December 8th, asset management firm VanEck made headlines by filing its fifth amended application for a spot Bitcoin exchange-traded fund (ETF).

This move was submitted to the United States Securities and Exchange Commission (SEC) as an update to the VanEck Bitcoin Trust, signaling the company’s continued pursuit of launching a Bitcoin ETF.

A spot Bitcoin ETF is a financial product that enables investors to acquire shares in a fund directly tied to the price of Bitcoin.

One intriguing aspect of VanEck’s application is its choice of ticker symbol for the ETF: “HODL.” This term, derived from a misspelling of “hold” or an acronym for “hold on for dear life,” is widely recognized among cryptocurrency enthusiasts.

It represents a strategy of holding onto Bitcoin without selling, regardless of market fluctuations.

While this ticker symbol may resonate with crypto-savvy individuals, some have suggested that it might be less familiar or clear to older generations, often humorously referred to as “boomers.”

Nate Geraci, the president of advisory firm The ETF Store, opined that those well-versed in the crypto space would appreciate the ticker symbol.

However, he humorously noted that it might leave “boomers” scratching their heads.

Submit a Press Release to Cointelegraph

Despite this potential generation gap, the choice of “HODL” could serve to emphasize the long-term holding strategy often associated with Bitcoin.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, highlighted that VanEck’s unconventional ticker symbol stands out in contrast to the more traditional choices made by companies like BlackRock and Fidelity when naming their financial products.

He characterized VanEck’s choice as a unique and creative approach.

VanEck even joined the playful banter, posting a comment on December 8th that humorously stated, “My #Bitcoin ETF will bring all the baby boomers to the yard, *if approved.”

VanEck is not alone in its pursuit of a spot Bitcoin ETF. Several other companies, including BlackRock, Fidelity, Valkyrie, and Franklin Templeton, are also vying for approval from the SEC to launch their own Bitcoin ETFs.

While the SEC has not yet expressed its support for these filings, it has engaged in discussions with the applicant firms to address technical aspects of their fund proposals.

VanEck remains optimistic about the prospect of SEC approval for its Bitcoin ETF, with expectations set for January.

If approved, the company estimates substantial inflows of approximately $2.4 billion in the first quarter of implementation.