Former United States President Donald Trump has shifted his stance on Bitcoin. Once critical of the cryptocurrency, branding it a scam during his presidency, Trump now concedes that BTC is gaining traction and acceptance.

In a recent interview on Fox News, Trump was questioned about his perspective on the ascent of the Chinese digital currency and whether countering it necessitates embracing a decentralized currency like Bitcoin.

Trump reiterated his preference for the US dollar but acknowledged Bitcoin’s increasing popularity, stating:

“I like the dollar, but many people are doing it [using Bitcoin], and frankly, it’s taken a life of its own.

You probably have to do some regulation, as you know, but many people are embracing it.

And more and more, I’m seeing people wanting to pay Bitcoin, and you’re seeing something that’s interesting. So I can live with it one way or the other.”

This marked a departure from Trump’s previous disdain for Bitcoin during his presidency, where he had labelled it a scam and reportedly directed the treasury secretary to take action against it.

Amidst his campaign for the 2024 U.S. presidential election, speculation arises within the crypto community regarding the motive behind Trump’s newfound openness to Bitcoin.

Some view it as a strategic move to court votes from the expanding crypto sector, while others perceive it as typical of Trump’s ambivalent approach to issues.

One user, Blairja, suggests that Trump strategically alternated between pro-BTC and pro-US dollar statements to gauge public opinion, likening it to a fishing expedition to ascertain the prevailing sentiment among voters.

Indeed, politicians have increasingly leveraged cryptocurrency to appeal to tech-savvy demographics.

Trump currently leads the race for the Republican Party’s presidential nomination, with fellow Republican Nikki Haley trailing behind him.

Bitcoin witnessed continued weakness on as consolidation coincided with a brief slowdown in institutional investment.

According to data from Cointelegraph Markets Pro and TradingView, BTC struggled to maintain its price around $51,000.

Bulls found themselves confined within a narrow trading range for over a week, with concerns arising over the inflows to spot Bitcoin exchange-traded funds (ETFs).

Recent days saw a significant deceleration in these inflows, with February 21st even experiencing a net outflow of approximately $36 million, as per data shared on X (formerly Twitter) by sources including BitMEX Research.

February 22nd showed heightened activity, with net inflows surpassing a quarter of a million dollars, even after factoring in outflows from the Grayscale Bitcoin Trust (GBTC).

“Normality resumed with a $251M inflow into the Bitcoin ETFs,” responded James Van Straten, research and data analyst at crypto insights firm CryptoSlate.

Addressing the pace of buying from ETF operators, Thomas Fahrer, CEO of crypto-focused reviews portal Apollo, predicted that BlackRock’s iShares Bitcoin ETF (IBIT), the largest among them, would alter BTC supply dynamics in the future.

“98% of all the #Bitcoin in existence already costs >100K if you tried to buy it,” he argued alongside a chart of IBIT holdings.

“Remember that the current price is just the marginal trade. Blackrock is going to test this theory, so we’ll find out soon enough.”

As of February 23rd, IBIT held 124,535 BTC ($6.35 billion), according to data from Apollo’s own ETF tracker.

Turning to low-timeframe BTC price analysis, popular trader Skew encapsulated the sentiment among seasoned market observers.

He concluded that the uptrend remained intact, but significant support levels were now back in focus.

These included the 88-period and 100-period exponential moving averages (EMAs) on the four-hour chart at $50,017 and $49,654 respectively, along with the 18-period EMA on the daily chart at $49,645.

“Currently, price trades around range low & 4H 55EMA which typically is a near term trend inflection point, meaning momentum picks up soon,” part of his latest X analysis read.

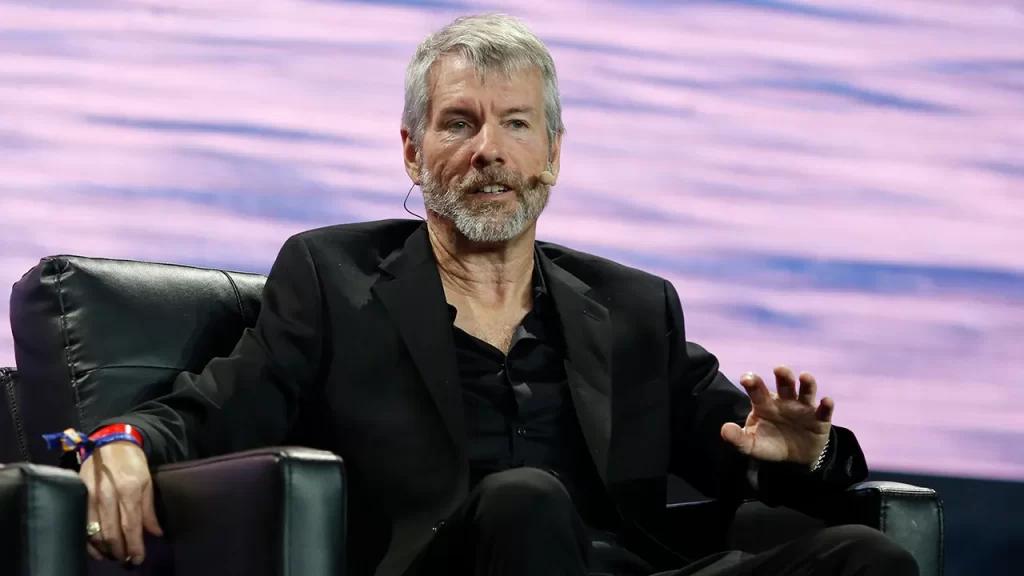

Michael Saylor has affirmed his steadfast commitment to holding onto Bitcoin, despite his company MicroStrategy’s holdings swelling to an unrealised profit of almost $4 billion.

“I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor declared in an interview with Bloomberg on Feb. 20, when queried about the possibility of his firm selling its stash of 190,000 BTC — presently valued at approximately $9.88 billion.

Presenting his bullish argument for Bitcoin, Saylor asserted that the cryptocurrency is “technically superior” to gold, the S&P 500, and real estate, notwithstanding the significantly larger market capitalisations of these asset classes compared to Bitcoin’s $1 trillion.

“We believe capital is going to keep flowing from those asset classes into Bitcoin,” he remarked. “Bitcoin is technically superior to those asset classes.

And that being the case, there’s just no reason to sell the winner to buy the losers.”

MicroStrategy, a business intelligence software firm, made headlines as the first publicly traded company to begin accumulating Bitcoin in 2020.

READ MORE: Zap Protocol – How Can You Buy ZAP and is it a Good Investment?

The 190,000 BTC it held as of the fourth quarter of 2023 were acquired at an average price of $31,224 each, resulting in a total investment cost of $5.93 billion.

Data from HODL15Capital indicates that United States-based spot Bitcoin exchange-traded funds (ETFs), excluding the Grayscale Bitcoin Trust (GBTC), collectively hold an estimated 270,000 BTC as of Friday, Feb. 16.

Saylor highlighted the demand for Bitcoin, driven by an increasing appetite for ETF products, which has exceeded the supply from miners, sometimes by “10 times as much.”

Nevertheless, he dismissed concerns that ETFs might impede MicroStrategy’s ability to acquire Bitcoin, stating that the company employs a “levered operating strategy” for investing in the digital asset.

“The spot ETFs have opened up a gateway for institutional capital to flow into the Bitcoin ecosystem,” Saylor explained.

“They’re facilitating the digital transformation of capital, and every day, hundreds of millions of dollars of capital is flowing from the traditional analog ecosystem into the digital economy.”

“This is a rising tide. It’s going to lift all boats,” he concluded.

Bitcoin is poised for a downturn around its upcoming block subsidy halving, though the exact timing remains uncertain.

Renowned trader and analyst Rekt Capital, in his latest YouTube presentation on February 20, forecasted BTC’s price trajectory mirroring the bullish trends of 2016 and 2020.

The deliberation revolves around the timing of the 2024 “pre-halving retrace” for Bitcoin, which has lingered within a narrow band for over a week, encountering resistance around $52,000.

Despite dampened sentiment and subdued performance of alternative cryptocurrencies, seasoned market observers maintain a positive outlook.

Drawing from historical patterns leading to all-time highs, Rekt Capital identified common phases in bull market formations.

He elucidated, “In the past, a macro downtrend break always precedes upside going into the halving. Then we have a pre-halving retrace and then a post-halving reaccumulation period and then parabolic price action toward new all-time highs.”

A chart accompanying the analysis depicted BTC/USD breaking its initial downward trendline, only to encounter resistance from a previously established zone.

The absence of breaking through and subsequently retesting this zone as support — the “pre-halving retrace” phase — characterises the current state of affairs in 2024.

READ MORE: Ethena Labs’ High Yield Stablecoin Sparks Investor Concerns in Crypto Community

Rekt Capital asserted, “We’re going to have the same thing in this cycle as well.” The focal point for the anticipated pre-halving pullback resides around $45,000, as corroborated by data from Cointelegraph Markets Pro and TradingView.

The query persists, “Are we going to retest this resistance this month in the pre-halving period?” as the analyst highlighted the recurrent failure to do so in preceding pre-halving periods.

Earlier assessments by Rekt Capital indicated Bitcoin’s complete immersion in its pre-halving surge, with recent observations suggesting accelerated key price developments compared to previous cycles.

Turning to current market dynamics, others expressed reluctance to adopt a bearish stance amidst the ongoing lateral movements.

Caleb Franzen, founder of research platform Cubic Analytics, remarked on Bitcoin’s steadfast trading range, observing minimal deviation over the past week.

Similarly, analyst Matthew Hyland underscored the significance of the 0.618 Fibonacci retracement level from all-time highs, cautioning that a breach below $49,000 could alter the outlook, while consolidation within an upward trajectory favours its continuity.

Bitcoin (BTC) soared to a fresh 2024 peak of £53,019 on February 20, only to sharply decline to £50,000 on select exchanges.

Traders attribute consistent inflows of spot BTC ETFs and the forthcoming supply halving event as pivotal drivers behind this surge, with BTC currently trading above £52,100 at the time of writing.

Let’s delve into the primary factors underpinning today’s volatility in the Bitcoin price.

Bitcoin futures’ open interest (OI) has surged to a new yearly pinnacle, reminiscent of levels last witnessed in November 2021.

This surge suggests heightened trading activity surrounding the foremost cryptocurrency by market capitalisation.

Data from cryptocurrency futures trading and information platform Coinglass reveals that total OI for BTC futures reached £22.69 billion on February 20, the highest since November 11, 2021, closely approaching the peak of £23 billion recorded at that time.

Bitcoin futures OI surged by over 30% in 2023, correlating with Bitcoin’s 23% year-to-date surge to £53,000, reaching levels last observed in December 2021.

Open interest serves as a gauge of the overall value of all unsettled Bitcoin futures contracts across exchanges, with an uptick indicating increased market activity and trader sentiment surrounding the pioneering cryptocurrency.

Investor sentiment remains buoyant, buoyed by rising inflows to spot BTC ETFs despite outflows from gold ETFs on the rise.

Bitcoin has surpassed the £49,000 peak reached subsequent to the January 10 approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission.

READ MORE: Ether Surges Past $3,000 Mark for First Time in Nearly Two Years

Data from Farside Investors reveals that £4.91 billion has flooded into Bitcoin ETFs within six weeks since trading commenced on January 11.

The total weekly inflows into the newly issued spot Bitcoin ETFs reached £2.5 billion last week, as per CoinShares Digital Asset Fund Flows Weekly Report.

CoinShares analyst James Butterfill remarked, “These inflows, alongside recent positive price movements, have propelled total assets under management (AuM) to £67 billion, marking the highest level since December 2021.”

On February 17, financial commentator Tedtalks Macro underscored the steady rise in net inflow to spot Bitcoin ETFs, averaging £182 million per day, asserting,

“Post-halving we only need ~£25M of net inflows to spot ETFs per day, to offset the miner production.”

The impending Bitcoin halving, anticipated to slash miners’ rewards by 50%, is also projected to significantly stoke investors’ interest in BTC.

Historically, the halving event has preceded Bitcoin embarking on a parabolic uptrend in the months post-event.

Bitcoin holdings on the Coinbase crypto exchange have dwindled to their lowest point in nine years as users relocate a substantial portion of their holdings away from the exchange.

According to a report from CryptoQuant, whales shifted 18,000 Bitcoin, valued at nearly $1 billion, away from Coinbase over the weekend, with transfer amounts ranging from $45 million to $171 million.

The public order book of Coinbase presently contains approximately 394,000 BTC, estimated to be valued at $20.5 billion.

The movement of BTC holdings away from centralised exchanges by whales is viewed as a positive indicator as it reduces the availability of Bitcoin for sale.

Nonetheless, opinions on social media regarding the nature of these transfers are mixed.

Some speculate that the funds are being transferred to custodial wallets in anticipation of a price surge, particularly with the forthcoming Bitcoin halving just two months away, causing a supply shock.

Conversely, some believe that the transferred funds might be utilised for liquidity in over-the-counter (OTC) trades.

Others suggest that the funds might be transferred to a different custodian and that these are not individual withdrawals, remarking that the majority of assets held on these exchanges do not actually belong to them, thus the actual withdrawal figure should be much lower.

READ MORE: Australian Federal Police Officer Accused of Wiping Bitcoin Wallet at Crime Scene

With each Bitcoin halving cycle, the influx of new BTC into the market is halved, leading to a supply squeeze as demand rises.

The next Bitcoin halving is scheduled for April at a block height of 740,000, reducing the block reward from 6.25 BTC to 3.125 BTC per mined block.

This halving coincides with significant institutional demand, evidenced by the approval of 11 spot Bitcoin exchange-traded funds (ETFs) in the United States in January.

Presently, approximately 900 BTC are mined daily, while the daily net inflows of Bitcoin ETFs amount to around half a billion dollars, equivalent to about 9,650 BTC, notwithstanding Grayscale registering nearly $100 million in daily outflows.

Following the April halving, the daily production of BTC will decrease to about 450 BTC, while institutional demand is expected to persist.

This significant disparity between supply and demand historically favours a bullish trajectory for the Bitcoin price, often resulting in new all-time highs within a year of the halving.

Bitcoin is currently trading at around $52,000, marking its highest level since December 2021, albeit a 25% decrease from its peak of approximately $69,000.

Bitcoin re-entered the spotlight within an intraday trading span by the close of the week on February 18th, with bullish trends gaining ground during weekend trades.

Data sourced from Cointelegraph Markets Pro and TradingView revealed that at $52,000, Bitcoin’s price consolidation reached a pivotal juncture.

The primary cryptocurrency experienced a downturn to $50,680 on Bitstamp a day earlier, marking its lowest levels in several days.

However, a swift recovery ensued, adding nearly $1,500 within hours. As of the time of writing, there hadn’t been a fresh retesting of these lows.

Analysing the week’s developments, prominent trader Skew observed a shift in trader behaviour during the latter half of the Wall Street trading week.

He noted a decline in spot buying towards the weekend, with “mostly taker driven dips & bounces since.”

“So far seeing some spot buyers return here with binance spot leading,” he remarked on the day.

Simultaneously, burgeoning open interest (OI) on CME Group’s Bitcoin futures markets, reaching a record $6.8 billion, hinted at impending volatility, according to data from monitoring resource CoinGlass.

However, discussing open interest more broadly, popular trader Daan Crypto Trades highlighted a discrepancy when denominated in BTC.

“This +100% rally from October has been healthy in terms of leverage imo,” he argued.

READ MORE: OpenAI’s Valuation Soars to £80 Billion as Company Explores New Ventures and Partnerships

“Funding has mostly kept it’s neutral rate and open interest denominated in $BTC is lower. In USD value of course it has gone up during this time as the underlying asset (BTC) went up in value.”

Skew further emphasised that bulls must maintain upward momentum in Bitcoin’s relative strength index (RSI) on 4-hour timeframes by the weekly close.

The 21-period exponential moving average (EMA), currently positioned at $51,500, also carried significance.

“In terms of spot flows around $52K – $53K area, notable spot selling into bounces which is often the case with profit taking,” he explained about the landscape on Binance.

“Key from here with current uptrend is seeing sufficient spot demand on dips, mostly seen as absorption at the lows where limit buying outweighs taker selling.”

Fellow trader and analyst Matthew Hyland highlighted $49,000 as the critical threshold to defend for the close.

Cryptocurrency exchange Coinbase opines that the sanction for bankrupt crypto lending firm Genesis to offload its Grayscale Bitcoin Trust (GBTC) shares will not disrupt the crypto market.

It contends that the majority of the funds will re-enter the crypto ecosystem, resulting in a neutral impact on the market.

Genesis received approval from a bankruptcy judge on Feb. 14 to liquidate approximately £1.3 billion worth of GBTC to reimburse creditors.

Nevertheless, since Grayscale Investments obtained approval to convert GBTC into a spot Bitcoin exchange-traded fund (ETF) on Jan. 10, GBTC has witnessed outflows exceeding £5 billion.

There are concerns within the crypto industry that Genesis’ recent approval to sell-off GBTC shares could further depress the price of Bitcoin.

In its weekly report, Coinbase argued that although it remains uncertain whether the additional GBTC outflows will enter other spot Bitcoin ETFs or go directly into Bitcoin for creditor reimbursement, it believes the funds will likely remain within the crypto ecosystem.

“Our view is that much of these funds will likely remain within the crypto ecosystem, contributing to a neutral overall effect in the market,” Coinbase stated.

The bankruptcy plan permits Genesis to either convert GBTC shares into the underlying Bitcoin asset for creditors or sell the shares outright and distribute the cash.

The confirmation hearing is set for Feb. 26.

READ MORE: Bitcoin Hash Rate Expected to Drop by Up to 20% Post Halving, Analysts Predict

Genesis holds 35.9 billion shares of GBTC, 8.7 million shares of the Grayscale Ethereum Trust (ETHE), and 3 million shares of the Grayscale Ethereum Classic Trust (ETCG).

Furthermore, it emphasised that net inflows for Bitcoin ETFs in the initial 30 days surpassed those of State Street’s SPDR Gold Shares ETF in its debut month.

Sam Callaghan, senior analyst at Swan Bitcoin, mentioned in an X post that there will be some “netting” in the crypto market due to Genesis’ GBTC sales.

However, Callaghan expressed uncertainty regarding the number of creditors who will sell their Bitcoin holdings.

Meanwhile, Bitfinex head of derivatives Jag Kooner indicated to Cointelegraph that the significant discount offered to GBTC investors was a primary driver for the high volume of share selling in recent weeks.

Grayscale, the crypto asset manager, has seen a deceleration in outflows from its spot Bitcoin ETF, although analysts suggest there’s more potential for further depletion.

As per data from Bianco Research and Farside, the total outflow from the Grayscale Bitcoin Trust (GBTC) since its transition to a spot Bitcoin ETF reached $7 billion by Feb. 16.

Despite the significantly reduced rate of outflow, observers like ETF Store President Nate Geraci caution that the bleeding may not have ceased entirely.

January marked the peak of the exodus, witnessing $5.64 billion exiting GBTC by month-end, whereas February has recorded only $1.37 billion in outflows thus far.

In a Feb. 18 post on X, Jim Bianco, the founder of Bianco Research and a former Wall Street analyst, attributes much of the outflow to investors rebalancing portfolios and migrating to spot Bitcoin ETFs with lower fees.

He notes that the recent wave of ETF launches has slashed fees to between 0 and 12 basis points, in contrast to Grayscale’s 150 bps charge.

Bianco also highlights another factor contributing to the ongoing outflow from GBTC: the fund traded at a considerable discount to the BTC market price, approximately 44%, when BlackRock applied for its spot ETF in June 2023.

He explains, “A lot of money flows into ‘cheap’ BTC,” suggesting that Grayscale began closing this arbitrage-type trade upon its ETF conversion in January 2024.

READ MORE: Ether Price Surge Continues: Approaching $2,800 Mark Amidst Optimism and Caution

Nate Geraci remains cautious, indicating that it’s premature to assume the asset bleed has concluded.

He speculates that even with a substantial reduction in assets, Grayscale could still surpass other issuers combined.

Moreover, Geraci anticipates the potential launch of a “mini-GBTC,” a new spot Bitcoin ETF by Grayscale, with considerably lower fees.

Further outflows could materialise following a recent court order permitting bankrupt crypto lender Genesis to liquidate a portion of its investments in Grayscale.

Genesis reportedly held approximately $1.6 billion worth of shares in GBTC, the Grayscale Ethereum Trust, and the Grayscale Ethereum Classic Trust.

The National Anti-Corruption Commission (NACC) of Australia has alleged that a federal police officer erased a Trezor hardware wallet containing 81.62 Bitcoin at a crime scene.

The authorities utilised crypto tracing software to claim that he transferred the Bitcoin into his own possession.

As per a recent report, the Australian police discovered the hardware wallet during a drug raid at a residence but waited approximately three weeks to obtain court permission to access it.

However, upon accessing the wallet, there was no Bitcoin at all, as federal agent William Wheatley allegedly transferred it out shortly after the raid.

The hardware wallet purportedly held 81.62 Bitcoin, valued at $309,000 at the time of the raid in 2019. However, it is currently worth approximately $4.2 million.

Detective Sergeant Deon Achtypis of the cybercrime squad indicated that authorities initially suspected an associate of a crime syndicate for the Bitcoin theft.

“The suspicion arose as the police force also discovered a device containing the seed phrase to the hardware wallet, which is a sequence of 12 to 24 random words that can be used as a recovery method in case the wallet is stolen or lost.”

However, after an extensive investigation into IP addresses used to access the stolen Bitcoin using crypto tracing software, Achtypis allegedly found a link to Wheatley.

“I formed the opinion that a police member may have been involved in the movement of the cryptocurrency.”

Enforcement authorities around the world are adopting crypto-tracing software to tackle illicit activity with digital assets.

In August 2023, Canadian law enforcement announced it had started using Chainalysis Reactor software to help trace illicit crypto transactions.

READ MORE: Coin Metrics Research: Nation-States Unable to Destroy Bitcoin and Ethereum Networks

Moreover, advancements in crypto detective software technology are leading to a higher rate of recovered stolen crypto.

On Jan. 29, Cointelegraph reported that over $674 million was recovered from more than 600 large-scale crypto hacks in 2023.

Meanwhile, Wheatley is pleading innocent against accusations of exploiting his position as a public officer for personal gain, theft, and involvement with proceeds of crime.

He is reportedly prepared to contest the charges regarding the stolen Bitcoin from the Trezor wallet.

This comes amid Trezor’s acknowledgment of a security breach affecting nearly 66,000 users.

On Jan. 20, Cointelegraph reported that Trezor disclosed unauthorised entry into a third-party support portal on Jan. 17.

The company warned that individuals who had engaged with Trezor’s support team since December 2021 might have had their data compromised in the incident.