Gary Gensler, the head of the U.S. Securities and Exchange Commission (SEC), has been vocal about his concerns regarding the cryptocurrency and blockchain industry, indicating a contentious atmosphere between regulatory bodies and the crypto sector in the United States.

This discord is further amplified by some U.S. lawmakers who oppose Gensler’s stance, challenging the SEC’s approach to regulating crypto assets.

This disparity within the government has created an uncertain environment for crypto projects based in the U.S., largely due to the ambiguous and fluctuating criteria used by the SEC to determine what constitutes a security, primarily relying on the outdated Howey test.

The heart of the issue lies in the mechanism of law creation in the U.S., which differs significantly from that in other countries, leaving the cryptocurrency industry in a precarious position.

Two Supreme Court cases, Loper vs. Raimondo and Relentless, Inc. vs the U.S. Dept of Commerce, are poised to potentially redefine federal agencies’ discretion in interpreting laws, a change that could significantly impact the crypto industry’s regulatory landscape.

At the center of this debate is the principle of Chevron deference, established by the 1984 Chevron vs. Natural Resources Defense Council case.

This legal doctrine allows federal agencies considerable leeway in interpreting laws, provided their interpretation is reasonable and Congress has not explicitly legislated on the matter.

Critics argue this deference has allowed agencies like the SEC to overextend their regulatory reach, especially in rapidly evolving sectors like cryptocurrency.

Coinbase CEO Brian Armstrong has been vocal about the detrimental effects of vague regulations on the crypto industry, pushing for clearer legislation.

The ongoing discussion around the Chevron deference and its potential recalibration by the Supreme Court could empower the public and their elected representatives to demand more precise laws governing digital assets.

The Supreme Court’s decision in the cases of Loper vs.

READ MORE: Bitcoin Surges to Record Highs Against the Euro and Multiple Currencies

Raimondo and Relentless, Inc. vs the U.S. Dept of Commerce could narrow the SEC’s interpretative authority, possibly aligning the regulation of cryptocurrencies more closely with Congressional intent.

Attorney Jeremy Hogan, known for his coverage of the Ripple vs. SEC case, highlights the significance of these cases for the crypto industry, suggesting that a ruling against Chevron deference could positively influence major litigation involving digital assets and the SEC.

However, Hogan also notes that the direct impact on the crypto industry might be limited since the SEC primarily relies on the Howey test for regulatory authority over digital assets.

Nonetheless, any mention of cryptocurrencies in the Supreme Court’s ruling could bolster arguments against the SEC’s regulatory overreach.

As the crypto industry continues to evolve, it’s increasingly intersecting with broader regulatory concerns, emphasizing the importance of vigilant and proactive engagement with legal developments.

This dynamic underscores the critical role of legal interpretations and the potential for future cases to shape the regulatory landscape for cryptocurrencies in the U.S.

American business intelligence and cloud-based services firm MicroStrategy is mulling investing in Ethereum, sources told Crypto Intelligence News on Wednesday.

New Ethereum holdings would be in addition to MicroStrategy’s impressive Bitcoin holdings, and will not in any way impact their continued accumulation of BTC, a person familiar with the matter emphasised.

Crypto Intelligence News has approached MicroStrategy for comment, but has not received a response at the time of publishing this article.

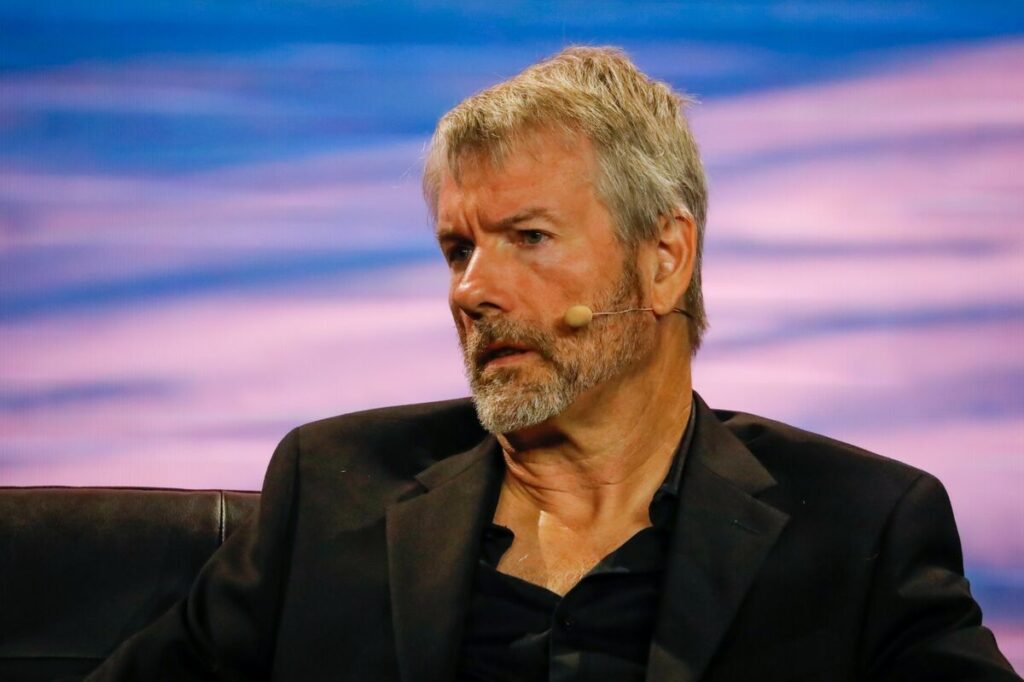

These reports come after MicroStrategy, led by Michael Saylor, its founder and current Executive Chairman, announced on Tuesday that it intends to raise $600 million through the sale of convertible debt in a private offering.

The purpose behind this significant financial move is to further increase the company’s bitcoin holdings. Since the middle of 2020, MicroStrategy has aggressively been buying bitcoin, now holding approximately 193,000 tokens valued at over $13 billion, based on the current bitcoin price of $67,500.

The decision to issue convertible debt comes at a time when MicroStrategy’s stock has seen substantial growth, with its value almost doubling in 2024. This includes a notable 24% rise in just one day’s trading session. However, in early trading on Tuesday, the company’s shares experienced a 6% drop.

This strategy reflects MicroStrategy’s ongoing commitment to bitcoin as a central component of its investment approach, leveraging the recent strong performance of its stock to finance further acquisitions of the cryptocurrency.

Bitcoin recently achieved a remarkable milestone, reaching a new all-time high (ATH) of $69,300.

This significant achievement comes after a challenging period that began in November 2021, when Bitcoin experienced a downturn, marking the onset of a prolonged crypto winter.

The landscape remained bleak until early 2023, when the cryptocurrency market began to show signs of recovery, with Bitcoin’s price steadily increasing and entering a new phase of price discovery.

The breach of a new ATH is a critical moment for any asset, signaling a shift into uncharted territory without clear resistance or support levels to guide traders.

Chris Dunn, a seasoned crypto investor and Bitcoin educator, shared his insights with Cointelegraph regarding the potential market dynamics in this new phase.

Dunn anticipates a domino effect that could propel Bitcoin’s price to even greater heights.

He explained, “I expect the trend to accelerate through the all-time high break as people buy breakouts, shorts get liquidated, and potential sellers pull their asks off the order books.”

Bitcoin’s ascent has been remarkable, particularly since February 16, when its price began to surge significantly, marked by large “green candles” indicating substantial price increases.

Despite expectations of a pullback, Bitcoin continued to defy predictions, with another substantial price jump on February 27.

This unexpected rise caught many short traders by surprise, leading to significant liquidations.

On February 27 alone, $161 million in BTC shorts were liquidated, with total liquidations reaching $268 million as Bitcoin’s price briefly exceeded $57,000.

The phenomenon of short liquidations and the ensuing short squeeze effect contribute to the rapid price increases and heightened market volatility.

Amid these developments, the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States has played a crucial role in attracting investment.

Notably, BlackRock’s iShares Bitcoin Trust surpassed $10 billion in assets under management in just over seven weeks, a milestone that took the first U.S. gold-backed ETF two years to achieve.

Will Clemente, co-founder of Reflexivity Research, remarked on the remarkable inflows into Bitcoin ETFs, highlighting their significant impact compared to gold ETFs.

Chris Dunn emphasized the importance of Bitcoin ETFs in introducing Wall Street and institutional investors to the cryptocurrency market.

The continued influx of capital into these ETFs underscores the growing demand for Bitcoin and its potential to drive prices higher as more investors engage with the market through these financial products.

El Salvador’s venture into Bitcoin has marked a significant milestone, with its holdings now valued over $150 million.

This comes after the country’s bold decision to adopt Bitcoin as legal tender in 2022, a move that has seen its investments grow substantially.

According to BitcoinTreasuries, the value of El Salvador’s Bitcoin stash has surged by $50 million beyond the initial purchase cost, illustrating a remarkable turnaround from previous market downturns to achieving historic financial highs.

Under President Nayib Bukele‘s directive, El Salvador has accumulated around 2,380 BTC, worth approximately $158.5 million, with the value peaking at $164.7 million in March, demonstrating a 53% profit margin from its cost basis of $44,300 per Bitcoin.

President Bukele, freshly reelected in February, has openly critiqued the mainstream media’s portrayal of El Salvador’s Bitcoin strategy on social platforms like X.

He pointed out the stark contrast in media coverage, highlighting the lack of attention now that the nation stands to gain significantly from its Bitcoin investments.

READ MORE: Investiva: Pioneering Excellence in CFD Trading with Innovation and Expertise

Bukele emphasized the enduring value of Bitcoin, irrespective of market fluctuations, while mentioning the success of their citizenship program as a major source of Bitcoin revenue, stating a firm stance against selling the digital currency.

El Salvador’s adoption of the Bitcoin standard sets it apart on the global stage, with no other nation-states yet to follow its lead despite speculation about potential adopters in South America and beyond.

Samson Mow, a prominent figure in the Bitcoin community and head of Jan3, remains optimistic about future nation-state adoption alongside corporate and institutional investments.

During his appearance on The Bitcoin Podcast, Mow identified nation-states, corporations, and institutional investors as crucial players in driving Bitcoin’s value upward, alongside retail investors contributing through smaller purchases, signaling a broad-based confidence in Bitcoin’s long-term trajectory.

Bitcoin has recently achieved a significant milestone, setting a new record high against the euro, with its value surging to an unprecedented $65,000.

This remarkable achievement marks a new multi-year high for the cryptocurrency, highlighting its growing strength in the financial market.

On March 4, Bitcoin surpassed the 60,000-euro mark, a historical event as it reached this level against the euro for the first time.

TradingView data shows that Bitcoin hit 60,393 euros at 8:30 am UTC, witnessing a roughly 5% increase from its intraday low of 57,521 EUR.

Currently, Bitcoin’s value stands at 59,981 euros, boasting a significant 56% increase since the beginning of the year.

Before this achievement, Bitcoin had already been setting records, breaking the 53,000-euro mark on February 28, a record previously set in late September 2021.

This year, Bitcoin has been on a record-breaking spree against various fiat currencies, including the Chinese yuan (CNY), which is the largest fiat currency by market capitalization globally.

Late February saw Bitcoin surpass its previous all-time high against the CNY, reaching 467,506 CNY from an earlier high of around 414,000 CNY, as per Xe.com.

Balaji Srinivasan, a prominent angel investor and former Coinbase CFO, noted that as of February 28, Bitcoin had surpassed all-time highs in over 30 countries, including major economies like China, India, Japan, South Korea, and Argentina.

READ MORE: Massive Transfer of 3 Trillion Shiba Inu Tokens to Robinhood Wallet Sparks Crypto Frenzy

Despite these achievements, Bitcoin has yet to set new records against several major currencies, such as the U.S. dollar, British pound, Swiss franc, Brazilian real, and Mexican peso.

As it stands, Bitcoin is trading at $65,000, approximately 6% below its all-time high of $69,000 recorded on Coinbase in November 2021.

Sam Wouters, River Intelligence marketing head, identifies the Mexican peso as a particularly challenging target for Bitcoin, noting its current value at 1.1 million pesos, a 24% decrease from its peak of about 1.4 million pesos in November 2021.

The cryptocurrency’s recent success can be attributed to increased exposure following the launch of spot Bitcoin exchange-traded funds (ETFs) in the U.S. on January 11, 2024.

Since the launch, ETF issuers have acquired at least 340,000 BTC by March 1, not including significant sales by the Grayscale Bitcoin Trust ETF, further cementing Bitcoin’s growing influence in the global financial landscape.

Bitcoin’s movement away from exchanges is accelerating at a notable pace, with the cryptocurrency’s price striving to reach unprecedented highs.

James Van Straten, a research and data analyst at CryptoSlate, highlighted significant Bitcoin withdrawals from exchanges in a recent post, marking a trend reminiscent of 2021.

Despite the lack of mainstream investor return to cryptocurrency, Bitcoin reserves on exchanges are diminishing.

Van Straten, utilizing data from Glassnode, pointed out that on March 1, approximately $2 billion in Bitcoin was withdrawn from exchanges.

This activity, he remarked, was unprecedented.

“I don’t think I’ve quite seen anything like this before,” he said, noting that the day saw one of the largest Bitcoin withdrawals in more than five years, totaling over $2.3 billion.

Glassnode’s data suggests that the daily Bitcoin outflows around this period were comparable to those observed on June 28–29, 2021, a time of record withdrawals.

The influence of United States spot Bitcoin exchange-traded funds (ETFs) was notable, excluding around $200 million transferred to Coinbase Pro for custody.

READ MORE: US Energy Officials Reach Agreement with Texas Blockchain Council and Riot Platforms

Binance experienced approximately $400 million in outflows, with Coinbase handling the remainder. Van Straten found Binance’s outflows particularly intriguing, as they were not related to ETF activities.

According to Glassnode, the total Bitcoin assets held on major trading platforms dropped to 2,286,347 BTC ($142.5 billion) by March 2, reaching its lowest since March 2018 when the price of Bitcoin was around $8,000.

Further analysis by Crypto Dan from CrryptoQuant in a Quicktake market update revealed shifts in Bitcoin’s market composition.

The analysis highlighted an increase in activity from “younger” coins, while “older” ones, dormant for six months or more, began to circulate again.

This trend signals the arrival of new investors and suggests an impending influx of individual investors.

“New investors are flowing in, and in the near future we can expect the influx of many new ‘individual’ investors,” he summarized, indicating a sharp decline in the ratio that could herald the onset of a true bull market.

The UK government has recently taken a significant step towards strengthening its legal framework against the misuse of cryptocurrencies in criminal activities.

In a statutory instrument issued on February 29, it was announced that from the end of April, UK law enforcement will have the authority to freeze crypto assets tied to criminal acts without the necessity of a prior conviction.

This development is a part of the amendments to the Economic Crime and Corporate Transparency Act 2023, which grants the National Crime Agency expanded powers to confiscate and seize cryptocurrencies linked to illegal activities, bypassing lengthy legal processes.

The documentation further clarifies that this will enable the authorities to directly access cryptocurrencies held in exchanges and by custodian wallet providers.

An additional measure included in the amendment is the authority to eliminate crypto assets if deemed necessary.

Although the method for this was not specified, the common practice involves “burning” the crypto tokens by transferring them to a wallet from which they cannot be retrieved, effectively removing them from circulation.

This new law is scheduled to be enforced starting April 26.

READ MORE: Eight State Attorneys General Challenge SEC’s Authority in Kraken Lawsuit

The legislation, reported by Cointelegraph in September 2022, is designed to enhance the capability of UK authorities in combating crypto-related crimes, including cybercrime, scams, and drug trafficking.

It includes a provision for the recovery of crypto assets linked to criminal activities without the prerequisite of an arrest, addressing the challenge of perpetrators evading conviction by staying abroad.

Despite these advancements, concerns have been raised by a British national, a victim of crypto fraud who lost around $46,000, about the UK’s preparedness in dealing with cryptocurrency crimes, criticizing the agency’s response to his case.

In addition to these measures, the UK government is planning to introduce new regulations on stablecoins and crypto staking within the next six months.

At a Coinbase-hosted crypto event in London on February 19, Economic Secretary to the Treasury Bim Afolami expressed the government’s commitment to finalizing these regulations before the next election, slated for no later than January 28, 2025.

Afolami emphasized the urgency of these regulatory efforts, stating, “We’re very clear that we want to get these things done as soon as possible. And I think over the next six months, those things are doable.”

The Bitcoin bull market officially commenced on March 1, as stated by the pseudonymous quantitative analyst PlanB, renowned for the contentious stock-to-flow (S2F) model for Bitcoin’s price.

The accumulation phase for Bitcoin (BTC) has drawn to a close, along with the easily accessible Bitcoin buying opportunities, as highlighted in a recent post by PlanB, referencing the S2F chart.

“Bull market has started. If history is any guide, we will see ~10 months of face-melting [fear of missing out] FOMO: extreme price pumps combined with multiple -30% drops.”

This forecast from the anonymous analyst emerged just two days following Bitcoin’s surge past $60,000 for the first time in over two years.

Bitcoin observed a slight decline of 0.75% in the 24-hour period ending at 3:00 pm Central European Time, settling at $62,472.

Despite its popularity during the 2021 bull run, the S2F model isn’t infallible.

As per the chart, Bitcoin was projected to surpass the $100,000 mark in early August 2021, when it was hovering around $44,000.

READ MORE: Shido Token Plummets by 94% Following Exploit on Ethereum-Based Staking Contract

Ethereum co-founder Vitalik Buterin has also criticized the S2F model, citing it gives investors a “false sense of certainty.”

PlanB’s projections align with those of other analysts. According to Vetle Lunde, a senior analyst at K33 Research, Bitcoin typically consolidates immediately post-halving before rallying in subsequent months.

“While the immediate post-halving performance has tended to be sluggish, each halving has proven to be a solid point to enter the market.

150–400 days after the halving tends to be the sweet spot where the compounding effects of subdued miner selling pressure impact BTC positively directionally.”

Besides the much-awaited halving, the approval of spot Bitcoin exchange-traded funds (ETFs) has also bolstered investor interest in Bitcoin, contributing to its price appreciation.

Although Bitcoin prices corrected by 3% after Grayscale’s recently converted Grayscale Bitcoin Trust ETF offloaded $598.9 million worth of BTC on Feb. 29, they have surged over 22% in the past week, according to CoinMarketCap data.

A Bitcoin Ordinals trader recently recounted their unfortunate experience of mistakenly purchasing a nonfungible token (NFT) valued at $13,000 on the Bitcoin network.

The trader, expressing regret over what they described as their “biggest mistake” in Bitcoin-based NFT trading, shared their story on X on March 1.

Initially believing they had acquired the NFT for 0.021 Bitcoin (BTC), equivalent to approximately $1,287, the trader was taken aback upon realizing post-transaction that the actual listing price was 0.21 BTC, or around $12,877.

Feeling embarrassed and disheartened, the trader acknowledged that their oversight resulted in another party benefiting greatly.

They chose to disclose their mishap to caution fellow traders about the importance of verifying digital asset transactions prior to finalizing them.

Although the trader had come to terms with the loss, Dan Anderson, the NFT’s seller, came across the post on X and promptly offered to refund the funds.

Anderson, identifying himself as the seller, had already initiated a buyback offer in the marketplace at the original listing price of 0.21 BTC.

READ MORE: OANDA Launches Crypto Trading Services in UK Amidst Regulatory Landscape Shift

Encouraging the trader to accept the offer, Anderson emphasized his intention not to take advantage of an inadvertent error.

“I listed it at 0.21 BTC because it’s dank not to fish for a fat finger. I was like ‘huzzah’ tho until I saw your post,” Anderson conveyed.

Following the acceptance of the buyback offer, the funds were promptly returned to the trader, and the NFT was relisted in the market at the original price of 0.21 BTC.

While this trader was fortunate enough to recover their funds, not all recipients of mistakenly sent crypto display a willingness to return the money.

Recent court documents revealed that on Feb. 26, the Australian crypto exchange OTCPro mistakenly credited a user with $653,000 instead of $65,300 due to an error.

Despite attempts to reach out, the user has not responded to communications or appeared in court.

This incident echoes past cases, such as the couple who received $10.5 million in error from Crypto.com in 2022 and opted to spend the funds on luxury items instead of returning them.

Subsequently, legal actions were taken, resulting in consequences for those involved, as evidenced by Thevamanogari Manivel’s sentence of 18 months of community corrections and her husband’s guilty plea to a theft charge in December 2023.

Bitcoin is potentially poised for a meteoric rise, with projections suggesting it could reach $180,000, spurred by a bullish signal reminiscent of historical gains.

Caleb Franzen, founder of Cubic Analytics, disclosed on March 1 that BTC price returns may surge by 260% from current levels during this cycle, in a post on X.

Franzen highlighted the significance of an ultra-rare Williams%R Oscillator signal, which has appeared only four times in history.

This indicator, analyzed on three-year timeframes, recently surpassed the overbought level, signifying a bullish trend for Bitcoin.

“The 36-month Williams%R Oscillator just closed above the overbought level for the 4th time in history,” Franzen remarked, emphasizing the bullish sentiment.

This oscillator, instrumental in predicting Bitcoin’s recovery from the 2022 bear market lows, is now indicating a potential surge into “overbought” territory above -20, a phenomenon observed only thrice before in 2013, 2016, and 2020.

Franzen cautioned against dismissing overbought signals, emphasizing their bullish momentum implications.

READ MORE: Bitcoin Surges to Highest Point in Over Two Years on Institutional Endorsement and ETF Optimism

Despite diminishing returns in each cycle, with 2020 yielding 260%, matching this performance would propel Bitcoin to $180,000.

However, Franzen stressed the unpredictability of market behavior despite historical trends, urging caution in interpreting these signals as guarantees of future performance.

Another bullish indicator, the Relative Strength Index (RSI), has also surged into overbought territory on daily timeframes, reaching levels above 80/100 on Feb. 28.

This follows a reset in late December, preceding Bitcoin’s upward momentum fueled by the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States.

Monthly RSI trends further reinforce the optimism, with the indicator just entering the overbought zone, suggesting potential further upside for Bitcoin.

While indicators point to a bullish trajectory for Bitcoin, Franzen’s cautionary stance underscores the need for prudent interpretation and consideration of market dynamics beyond historical patterns.