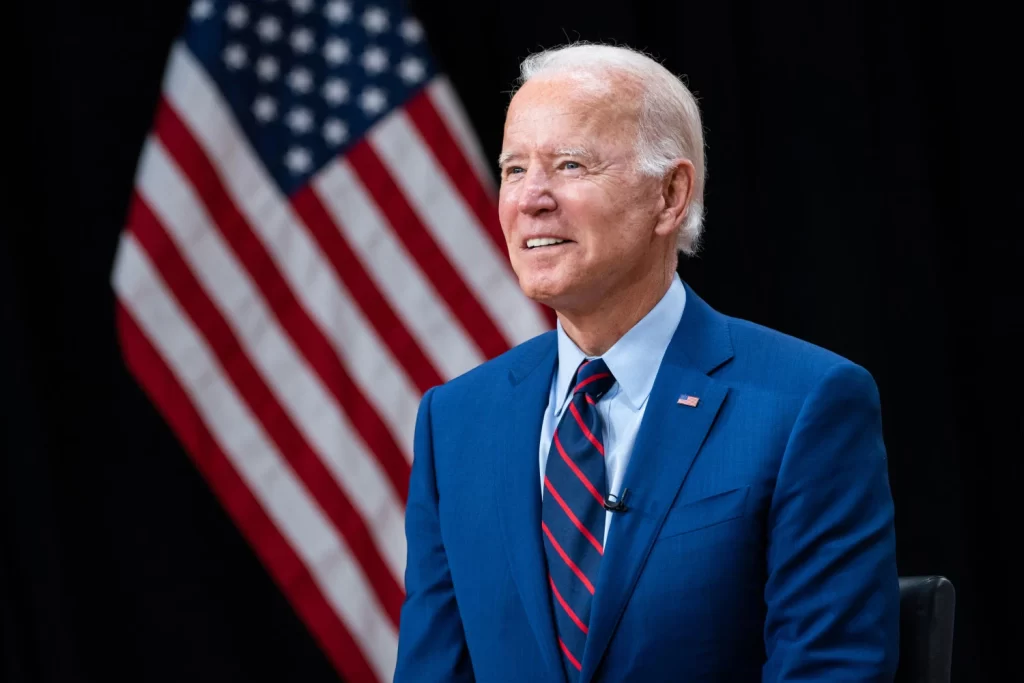

In his budget proposal for 2025, President Joe Biden is revisiting the concept of imposing a 30% tax on the electricity consumption of cryptocurrency mining operations.

This initiative is outlined in the “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” a document from the U.S. Department of the Treasury.

The document criticizes the lack of current legislation specifically addressing the taxation of digital assets, aside from broker and cash transaction reporting.

To rectify this, the Biden administration proposes an excise tax on the electricity used in the mining of digital assets, akin to taxes on physical goods like fuel.

The Treasury explains, “Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.”

Under this proposal, crypto mining entities would be required to disclose both the quantity and type of electricity they consume.

For electricity bought externally, firms must also report its value, which will then be used as the basis for the tax.

READ MORE: MicroStrategy Bolsters Bitcoin Treasury With $800 Million Note Offering, Purchases 12,000 BTC

Similarly, miners leasing computational power must declare the electricity’s value provided by the leasing company.

This measure, aimed to take effect from January 1, 2025, plans a phased tax introduction: starting at 10% the first year, 20% the second, and reaching 30% in the third year.

Crypto mining operations that generate their own power will also be subjected to this tax.

The 30% rate will apply to the estimated costs of their electricity consumption, regardless of whether they are connected to the grid or not.

This includes those utilizing renewable energy sources such as solar or wind power.

Pierre Rochard of Riot Platforms has criticized the move as an attempt to undermine Bitcoin and facilitate the launch of a central bank digital currency (CBDC).

U.S. Senator Cynthia Lummis has expressed her opposition to the tax on X, suggesting that while the administration’s inclusion of crypto in the budget may indicate a positive outlook on cryptocurrency, the proposed tax could significantly harm the industry’s position in the U.S.

This initiative marks Biden’s second attempt to implement a 30% tax on the electricity used by crypto miners, following a similar proposal in the 2024 budget proposal announced on March 9, 2023.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Relai, a Swiss-based Bitcoin-only application, has announced an exciting development for its users – the integration of Blockstream’s Greenlight solution, which will introduce Lightning payment functionality to the platform.

This collaboration aims to enhance the Bitcoin payment experience for Relai’s user base, according to a detailed announcement provided to Cointelegraph.

Blockstream’s Lightning-as-a-service offering is being woven into the fabric of Relai’s dedicated Bitcoin wallet platform.

This integration is poised to empower approximately 100,000 Relai users with the ability to conduct Bitcoin (BTC) transactions swiftly and affordably via the Lightning Network, all the while retaining control over their private keys.

Importantly, this move allows Relai to bypass the need for creating and managing its own Lightning infrastructure.

The inception of Greenlight by Blockstream in June 2023 marked a significant stride toward facilitating rapid, cost-effective Bitcoin payments for developers and platforms, emphasizing user sovereignty over private keys.

Traditional custodial solutions, while convenient and quick to set up, often compromise user security and privacy.

In contrast, noncustodial services, which prioritize these aspects, typically demand extensive technical and operational input.

Greenlight’s novel approach divides custodial Lightning nodes into distinct, independently functioning components.

READ MORE: Arbitrum to Release $2.32 Billion in Vested Tokens, Sparking Market Speculation

It utilizes Core Lightning for its foundational structure, enabling all operations related to private keys to be executed on the user’s device, effectively making it the signer.

The rest, including operational requirements, are managed on Blockstream’s infrastructure.

This infrastructure is grounded in the Validating Lightning Signer project, ensuring thorough verification and safeguarding user autonomy over fund-related operations.

It mirrors the architecture of hardware wallets, which combine a user-operated client interface and signer with the wallet provider’s Bitcoin node that connects to the broader network.

This setup facilitates payment initiation and invoice signing by the user, with Blockstream managing the node responsibilities.

Founded in 2020, Relai has exclusively focused on Bitcoin trading and custody, boasting over $300 million in trading volume in its four-year history.

The platform’s pivot towards Lightning payments follows broader industry trends, with leading exchanges, including Coinbase, enhancing their Bitcoin transaction capabilities.

In September 2023, Coinbase, the largest U.S. exchange, announced its plan to adopt Bitcoin Lightning payments, underscoring Bitcoin’s pivotal role in the cryptocurrency ecosystem and its potential to enable quicker, more economical BTC transactions, as highlighted by CEO Brian Armstrong.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 13, just before the Wall Street trading session commenced, Bitcoin achieved a new milestone in price discovery, demonstrating a bullish edge over selling pressures.

This achievement was recorded with Bitcoin reaching unprecedented highs of $73,679 on Bitstamp, as per data provided by Cointelegraph Markets Pro and TradingView.

Following a slight pause in its upward momentum the previous day, where Bitcoin stabilized near $72,000 and momentarily dipped by $4,000, it swiftly rebounded, mirroring the early week’s market dynamics that initially restricted gains due to resistance.

According to CoinGlass, resistance at $73,800 briefly capped further advances. However, the path towards $80,000 appeared largely unobstructed, a sentiment supported by minimal liquidation levels.

Jelle, a renowned trader, noted on X (formerly Twitter), “Bitcoin wiped out overleveraged longs, retested the 2021 cycle high & then bounced back to $72,000,” indicating a positive outlook for continued upward movement.

Tedtalksmacro, a financial analyst, highlighted the significant surge in institutional investments surpassing previous records, even considering the introduction of new spot Bitcoin ETFs in the United States.

READ MORE: Grayscale Proposes New Bitcoin Mini Trust to Offer Tax-Efficient Investment Option

He shared with his X audience, “Fund inflows like we have never seen before. It makes 2020 look small… price will continue to catch up over the coming months,” suggesting a steady ascent towards $100,000.

He cautioned that historically, a peak in these inflows often signals a critical juncture to exit the market within the following 2-3 months.

Record-breaking inflows were observed in the ETF sector, with a notable $1 billion of net contributions recorded on March 12. BlackRock’s iShares Bitcoin Trust was at the forefront of this influx.

BitMEX Research highlighted, “A record 14,706 BTC inflow on 12 March 2024,” underscoring the significant demand.

This influx represents a substantial fraction of Bitcoin’s newly-mined supply in 2024, estimated at around 65,500 BTC.

As of March 13, the combined holdings of the two largest ETFs, managed by BlackRock and Fidelity Investments, amounted to over 330,000 BTC.

This figure is quintuple the quantity of Bitcoin mined during the same period, illustrating the massive scale of institutional participation in the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Zap Protocol’s ZAP token has breached the $0.01 mark after surging 42% in the last 24 hours, according to CoinMarketCap data.

This comes just hours after Crypto Intelligence News predicted ZAP, which was trading around $0.007 at the time, to surge over $0.01 within “the coming days or even just hours.”

Looking ahead, ZAP token is well positioned to rally as high as the $0.02-$0.03 mark before the end of March, with a medium-term price target of between $0.20 and $0.45.

Zap Protocol now has a market cap of around $2.4 million, and the token is still more than 100x away from its all-time high, leaving it with plenty of room for growth amid the current bull market.

Bitcoin (BTC), meanwhile is up by around 3.2% over the last 24 hours, currently trading at slightly over $73,200.

The world’s largest cryptocurrency has been rallying as a result of high demand for the recently approved spot Bitcoin ETFs, and the BTC price has increased by over 9% in the last 7 days.

This has propelled the broader cryptocurrency market, with Shiba Inu (SHIB) posting strong gains in the first week of March, but trading sideways in recent days.

Over the last 24 hours, SHIB is up by 1.6%, according to CoinMarketCap data.

SHIB still has lots of upside potential, but with a market cap of $18.8 billion, it will take significant inflows for Shiba Inu’s price to generate a high double-digit increase.

Grayscale, a leading investment manager, has announced its intention to launch a smaller version of its Grayscale Bitcoin Trust, known as GBTC, through a new product dubbed the “mini” trust.

This new offering, aiming for a listing under the ticker symbol “BTC,” was introduced to the United States Securities and Exchange Commission (SEC) via an S-1 form on March 11.

Upon SEC approval, the Grayscale Bitcoin Mini Trust plans to make its debut on the New York Stock Exchange, operating independently from the original GBTC fund.

This innovative trust is designed to distribute shares to current GBTC investors, with an additional contribution of Bitcoin from GBTC itself, although the exact amount remains unspecified.

One of the main goals of this new trust is to provide GBTC shareholders with a tax-efficient method to gain exposure to Bitcoin.

Bloomberg ETF analyst James Seyffart elaborated on the benefits via a March 12 X post, stating, “There is no fee disclosed yet or what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost-competitive product.”

READ MORE: Bitcoin ETFs Will Hold Over 10% of BTC Supply By Q3

The timing of Grayscale’s filing coincides with Bitcoin reaching a record-breaking high of $71,415 on March 11, following Ether’s significant milestone of surpassing the $4,000 mark earlier in the month.

In response to the flourishing cryptocurrency market, asset manager VanEck announced a fee waiver for its Bitcoin Trust ETF, applying to the first $1.5 billion in funds through March 31, 2025, underscoring the competitive environment in the ETF space.

The broader ETF market is also witnessing significant activity, with U.S. spot Bitcoin ETFs achieving a historic $10 billion in daily trading volume on March 5.

This surge in activity surpasses the previous record set just a week earlier.

However, the SEC’s lack of communication regarding Ether-based ETFs has led to skepticism about their approval.

Senior Bloomberg ETF analyst Eric Balchunas expressed concerns about the prospects for Ether ETFs, noting, “The main thing is the fact that we’re 73 days from the final deadline, and there’s been no contact or comments from the SEC to the issuers.

“That’s not a good sign.”

This silence casts doubt on the potential approval of Ether-based ETFs by May, reflecting the regulatory uncertainties surrounding cryptocurrency investments.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Two prominent voices within the crypto community have recently made a call to action for their followers on X, emphasizing the urgency of acquiring Bitcoin, gold, and silver in the face of escalating U.S. national debt.

On March 11, Balaji Srinivasan, an entrepreneur and angel investor, took to X to express his view that Bitcoin represents a critical solution to counteract the challenges posed by rampant government expenditure and the threat of asset confiscation.

Highlighting the severity of the situation, Srinivasan, with nearly a million followers and a background as Coinbase’s former CTO, painted a grim picture of the current economic landscape, likening it to the decline of empires past due to treasury looting.

He pointed out the alarming growth in government debt, noting a 25% increase since 2020, bringing the total to a staggering $34.5 trillion.

Srinivasan, who also serves as a general partner at venture capital firm Andreessen Horowitz (a16z), outlined possible responses to this crisis.

These range from denial to attempting political solutions or succumbing to apathy.

However, he advocates for a more radical approach: leveraging Bitcoin to “starve the beast,” thereby limiting the government’s ability to confiscate or inflate currency.

He highlighted the current daily deficit spending of $10 billion as a sign of escalating problems.

READ MORE: Grayscale and Coinbase Meet with SEC to Push for Spot Ether ETFs

Echoing Srinivasan’s concerns, Robert Kiyosaki, author of “Rich Dad Poor Dad,” also advised on the importance of readiness, recommending investment in assets like Bitcoin for their value preservation qualities.

Kiyosaki’s post referenced the rapid increase in national debt, painting a bleak picture of America’s financial health.

Furthermore, Srinivasan warned of potential aggressive actions by a financially desperate state, such as asset confiscation.

He cited various international and domestic precedents where governments have taken control of private assets under different pretexts, underscoring the safety Bitcoin offers as an asset beyond state control.

In 2023, Srinivasan placed a significant bet on Bitcoin’s value skyrocketing due to U.S. hyperinflation.

His stance is particularly relevant as the U.S. prepares to release crucial economic data, including inflation rates, which could influence upcoming Federal Reserve decisions.

With interest rates holding steady at 5.5% since July 2023, the crypto community closely watches these developments, seeking refuge in decentralized assets amid financial uncertainty.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The London Stock Exchange (LSE) is gearing up to broaden its financial product offerings by incorporating crypto exchange-traded notes (ETNs) for Bitcoin and Ether.

This significant development is set to unfold in the second quarter of 2024, with the LSE poised to start receiving applications for these novel ETNs.

The announcement made on March 11 delineates a strategic move towards embracing the burgeoning realm of cryptocurrency within the established frameworks of traditional financial markets.

The LSE has outlined specific criteria for the admission of crypto ETNs in its recently published Crypto ETN Admission Factsheet.

Although an exact commencement date for accepting applications has not been disclosed, the exchange has made clear its requirements.

For an ETN to be considered, it must be physically backed by Bitcoin or Ether and refrain from leveraging.

A critical stipulation is the transparent availability of the market price or value of the underlying crypto asset.

Furthermore, the crypto assets backing the ETNs must be securely stored, preferably in cold wallets, and the custodians of these assets must comply with Anti-Money Laundering legislation from the UK, EU, Switzerland, or the US.

READ MORE: Grayscale and Coinbase Meet with SEC to Push for Spot Ether ETFs

ETNs, defined by the exchange as debt securities linked to an underlying asset, offer investors an opportunity to engage with the performance of cryptocurrencies within regulated trading hours.

This method presents a less direct approach compared to exchange-traded funds (ETFs), with ETNs being backed by issuer’s credit rather than a collective pool of assets, and is viewed as a softer alternative for those seeking exposure to crypto assets.

Parallel to the LSE’s initiative, the UK’s Financial Conduct Authority (FCA) has also indicated a willingness to accommodate Recognised Investment Exchanges (RIEs) wishing to establish market segments for crypto-backed ETNs, albeit restricted to professional investors.

This category encompasses authorized or regulated credit institutions and investment firms.

The FCA emphasizes the need for stringent controls to safeguard investors and mandates adherence to the UK’s listing regime, including ongoing disclosure and the provision of prospectuses.

Despite this openness towards institutional engagement with crypto-backed ETNs, the FCA maintains a cautious stance towards retail investors, citing the high-risk nature of cryptoassets.

The authority has reiterated its position that such investments are not suitable for the retail market, warning of the potential for total loss and underscoring the largely unregulated status of cryptoassets.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

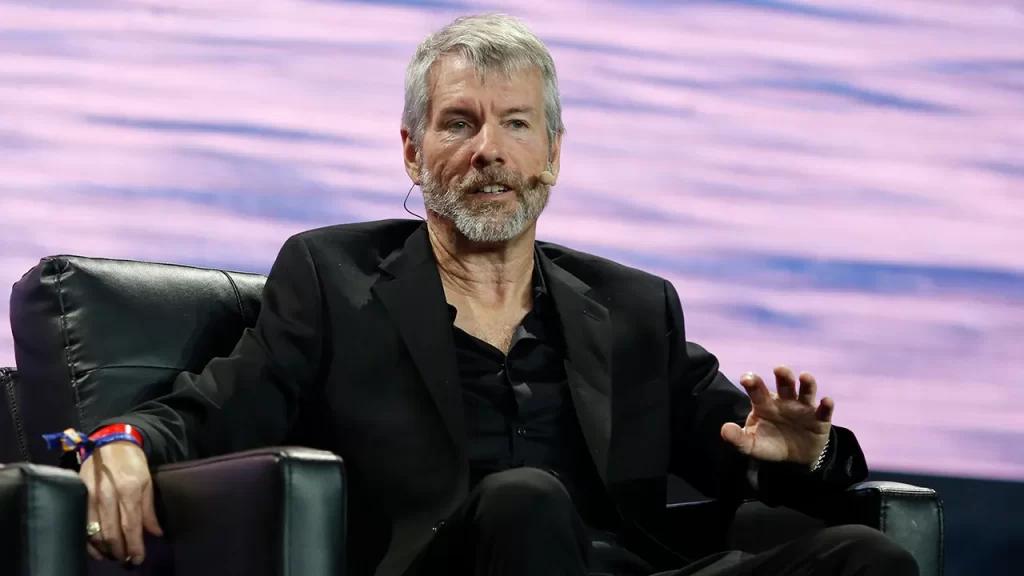

MicroStrategy, an American software technology firm, has once again made headlines with its aggressive Bitcoin investment strategy.

Completing a substantial $800 million convertible note offering, the company used the proceeds to purchase an additional 12,000 BTC for its treasury reserve.

This latest acquisition was announced after the firm declared its plans to issue new convertible notes on March 6, coinciding with Bitcoin hitting a new all-time high.

The offering was successfully finalized on March 8, reinforcing MicroStrategy’s commitment to Bitcoin.

The company’s founder and chairman, Michael Saylor, shared on the X social media platform that this strategic move utilized the net proceeds from the note offering along with surplus cash, securing the Bitcoin at an average price of $68,477 per unit.

Prior to this purchase, MicroStrategy’s Bitcoin portfolio comprised approximately 193,000 BTC, acquired at an average price of $31,544, totaling a value of $12.9 billion and marking a 112% return since the company first ventured into Bitcoin investments.

With the latest addition, MicroStrategy’s Bitcoin holdings have swelled to 205,000 BTC, acquired at a total cost of $6.91 billion, averaging $33,706 per Bitcoin.

READ MORE: Binance Ban Adversely Impacts Crypto Sphere

This latest note offering introduced by MicroStrategy features a modest annual interest rate of 0.625%, with payments due semi-annually starting September 2024.

The notes can be converted into cash, MicroStrategy stocks, or a combination thereof, with an initial conversion rate set at 0.6677 shares of MicroStrategy’s class A common stock per $1,000 of note value.

This conversion rate translates to a share price of approximately $1,497.68, a significant 42.5% premium over the share price on March 5, 2024.

MicroStrategy’s bold move to invest a significant portion of its capital into Bitcoin began in August 2020, under the guidance of Michael Saylor.

This strategic decision was motivated by the belief in Bitcoin’s reliability as a store of value and its potential for long-term appreciation over holding cash.

Saylor emphasized Bitcoin’s superiority over fiat currency as the mainstay of the company’s treasury reserve strategy.

Since then, the value of the company’s Bitcoin holdings has escalated by over $1 billion by early January 2024, underscoring the lucrative nature of its investment approach.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Spot Bitcoin exchange-traded funds (ETFs) will hold over 10 percent of the Bitcoin supply by the third quarter of this year, an analysis by Crypto Intelligence has found.

This analysis is contingent on the applications for Ether spot ETFs in the US being rejected in the coming weeks, as the approval of a non-BTC ETF could significantly impact demand for the existing Bitcoin spot ETFs.

This is because there would be another crypto product easily available to investors and institutions, and this would potentially limit demand for BTC ETFs.

This could be exacerbated by the fact that Ether is deflationary, while Bitcoin’s supply is continuing to grow; although the rate of this growth will decrease following the April halving.

READ: Tether Expands USDT Stablecoin to Celo Network, Offering Microtransactions at Sub-Cent Fees

The existing spot Bitcoin ETFs already hold over four percent of the 21 million BTC that will eventually be mined, and a supply crunch – which could send the BTC price well over the $120,000 mark – is expected to take hold in the coming months.

Bitcoin has already posted strong gains as a result of the demand that is flowing through the spot BTC ETFs, and the world’s first-ever cryptocurrency is currently trading at just under the $72,000 mark, according to CoinMarketCap data.

Ethereum, meanwhile, recently jumped above $4,000, but it is still yet to get close to breaching its all-time high.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The CEO of ARK Invest, Cathie Wood, has made a bold prediction regarding Bitcoin’s future, suggesting that the cryptocurrency will reach a value of $1 million much sooner than the initially forecasted year of 2030.

In an interview with the New Zealand Herald on March 7, Wood shared her insights, citing “new expectations for institutional involvement” as a key driver behind Bitcoin’s potential price surge.

Wood emphasized that the advent of the United States’ first spot exchange-traded funds (ETFs) has marked a significant transformation for Bitcoin.

Her confidence in Bitcoin’s future has only intensified, spurred by the momentum and interest surrounding these spot ETFs.

This has led ARK Invest to reassess its stance on Bitcoin, shifting its price target ahead of the previously predicted timeline.

According to Wood, the approval of spot ETFs by the Securities and Exchange Commission (SEC) was a pivotal milestone that has accelerated the cryptocurrency’s ascent toward the $1 million mark.

READ MORE: Consensys-Backed Transak Achieves System and Organization Controls (SOC) 2 Type 2 Compliance

Despite the enthusiasm, Wood pointed out that major financial institutions, such as Morgan Stanley, Merryl Lynch, or Bank of America, have yet to endorse Bitcoin.

However, she believes that the current price movement precedes their potential approval, suggesting that Bitcoin’s valuation could climb even higher once these platforms come on board.

Wood hinted that the revised target price for Bitcoin exceeds the $1 million mark, reflecting her optimistic outlook fueled by anticipated institutional participation, though she did not specify an exact figure.

As Bitcoin approaches new all-time highs, the market braces for a “wild week,” according to James Van Straten, a research and data analyst at CryptoSlate.

Traders and analysts anticipate continued price discovery, driven by ongoing ETF inflows.

Van Straten highlighted the critical moment if Bitcoin surpasses the $70,000 threshold before potential turbulence at Coinbase, the largest U.S. exchange.

This period is seen as crucial for determining Bitcoin’s true market value, especially after recent records saw BTC/USD trading at approximately $69,500.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.