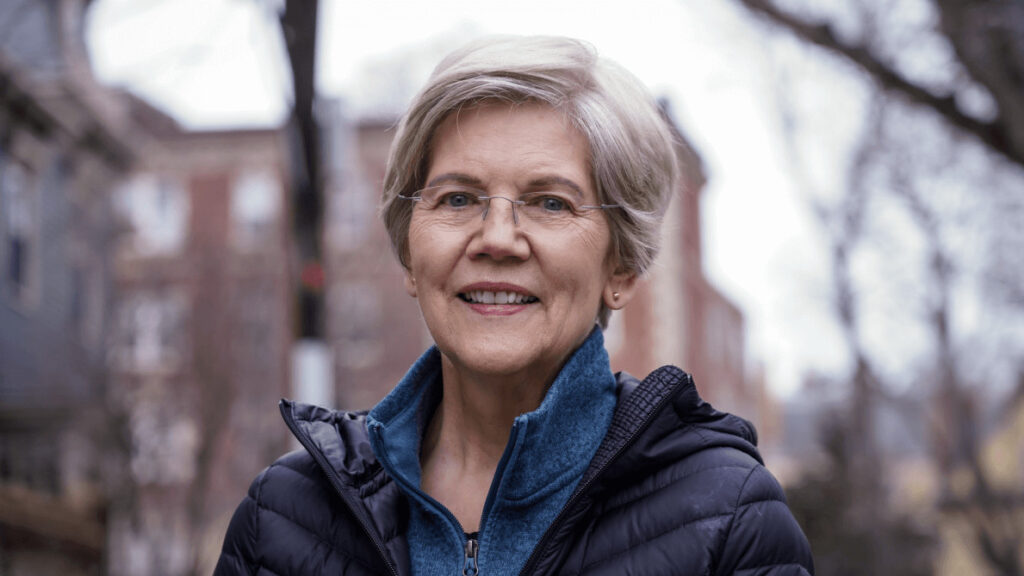

United States Senator Elizabeth Warren is known for her critical stance on the cryptocurrency industry, prompting backlash from various sectors for her actions against digital assets.

In February, the Blockchain Association, along with military and national security professionals, expressed their concerns about Warren’s proposed cryptocurrency legislation, especially her Anti-Money Laundering bill.

They argue that the bill could significantly slow down the blockchain industry’s development in the United States, potentially harming the country’s strategic position, job market, and having minimal impact on the illicit activities it aims to curb.

Kristen Smith, CEO of the Blockchain Association, shared with Cointelegraph the strong industry and congressional support following their letter to Congress, highlighting the industry’s dedication to fostering an innovative environment while addressing regulatory challenges.

Despite opposition, Warren remains steadfast in her critique of the crypto sector.

In a Bloomberg interview, she expressed a desire to work with the industry but criticized its resistance to regulatory measures aimed at curbing illegal activities, implicating the industry in facilitating transactions for drug traffickers, human traffickers, and even contributing to North Korea’s nuclear program.

The crypto community has responded critically to Warren’s regulatory approach.

Danny Lim, from MarginX, criticized the bill for its inefficiency and lack of suitability for the crypto environment, suggesting that traditional finance regulations cannot be directly applied to cryptocurrencies.

Zac Cheah of Pundi X echoed these sentiments, calling for regulations that balance innovation with effective anti-money laundering measures.

Warren’s position could be further challenged by John Deaton, a lawyer and XRP advocate, who announced his candidacy for the Senate in Massachusetts, posing a direct threat to Warren’s seat.

Deaton’s campaign has garnered support from notable figures in the cryptocurrency community, including Cardano founder Charles Hoskinson.

Deaton’s candidacy underscores the growing political influence of the crypto industry and signals a potential shift in the political landscape for those with anti-crypto platforms.

With a significant portion of Boston.com poll respondents viewing Warren as vulnerable to Deaton’s challenge, the upcoming election could mark a pivotal moment in the intersection of cryptocurrency and politics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

With only about 34 days left until the Bitcoin halving event, which will slash the Bitcoin issuance rate by half, there’s a buzz in the cryptocurrency market.

Basile Maire, D8X co-founder and former UBS executive director, in an interview with Cointelegraph, emphasized the significant impact this event could have on supply and demand dynamics.

He said, “There seems to be more demand and less supply, so according to the old economic rules, prices have to move up.

“So the question now: is the [Bitcoin halving] priced in? Probably not to the full extent.”

‘This anticipated event is set against the backdrop of Bitcoin’s price surging past $71,000 for the first time on March 11, signaling robust market optimism.

This bullish sentiment is further echoed in the Bitcoin futures market, where expectations are steering towards a remarkable climb to the $100,000 mark by May.

Maire detailed, “The option data says that people expect Bitcoin price to be in the range of $80,000 to $100,000.

READ MORE: Web 3.0 Gaming: Taki Games Set to Launch Genopets Match in April

“For instance, in May, there was quite a spike in open interest for $100,000. While it’s not a big volume [spike]. I still think this means something.”

Adding to the fervor is the upcoming U.S. presidential election, seen by Maire as a potential positive catalyst for the crypto market.

He believes measures to stabilize traditional markets will inadvertently benefit cryptocurrencies, especially with the enhanced linkage through ETFs.

The surge in Bitcoin’s value has also been partly attributed to the inflows from U.S. spot Bitcoin exchange-traded funds (ETFs), as noted by Sergei Gorev, a risk manager at YouHodler.

He highlighted the significant daily purchases by these ETFs, stating, “Spot Bitcoin ETFs buy 10 times more Bitcoin daily than miners produce each day.”

With a total on-chain holding of $60.5 billion as of March 13, and based on recent trends, Bitcoin ETFs are on track to absorb a substantial portion of the BTC supply annually, per Dune data, further underscoring the growing mainstream acceptance and investment in Bitcoin ahead of the halving event.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 14, Bitcoin hit a new all-time high, reaching $73,794 on Bitstamp, as captured by Cointelegraph Markets Pro and TradingView data.

This surge came after a strong overnight rebound, dispelling any previous signs of weakness before the latest Wall Street session.

The resurgence was highlighted by Rekt Capital, a well-known trader and analyst on X (formerly Twitter), who remarked, “Bitcoin dipped again earlier this week and once again successfully retested old All Time Highs as support.”

The excitement was partly fueled by notable supply trends, particularly the impact of the United States’ spot Bitcoin exchange-traded funds (ETFs), which recorded net inflows of $683.7 billion on March 13, as reported by the UK-based investment firm Farside.

These inflows significantly outstripped the day’s outflows from the Grayscale Bitcoin Trust (GBTC), indicating a bullish momentum.

Willy Woo, a statistician and the creator of Bitcoin data resource Woobull, commented on the institutional products’ future, sharing a sentiment similar to Cathie Wood, CEO of ETF provider ARK Invest.

Woo stated on X, “The ETFs are just getting started, institutions and wealth management platforms will take a couple of months to complete due diligence before proper allocation begins.”

This anticipation is visualized in a chart showing Bitcoin network inflows, highlighting the ETFs’ contributions.

Moreover, MicroStrategy, known for holding the largest Bitcoin treasury among public companies, announced plans to acquire more than 1% of the total BTC supply.

Currently owning 205,000 BTC, the company aims to invest an additional $500 million to surpass the 210,000 BTC mark.

Despite some concerns over Bitcoin’s ability to maintain its momentum, bullish sentiment prevailed.

Charles Edwards, founder of Capriole Investments, was among the optimists predicting a significant move for BTC/USD.

He emphasized the role of ETF inflows, stating on X, “Bitcoin’s getting ready for a big move,” and added, “a billion a day keeps the dip away.”

Previously, Edwards had declared the era of “deep value” Bitcoin dip-buying over, concluding, “That ship has sailed. You had 2 years to pick up undervalued Bitcoin.

Instead, an exciting new chapter has begun,” marking a transition to a new phase in Bitcoin’s market dynamics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Grayscale‘s spot Bitcoin ETF, a pioneering financial product in the U.S. since its inception on January 11, has experienced a significant market share drop, marking the first time it has fallen below 50%.

According to Dune Analytics, as of March 12, the Grayscale Bitcoin Trust (GBTC) managed $28.5 billion, constituting 48.9% of the combined $56.7 billion in assets under management (AUM) across ten U.S. Bitcoin ETFs.

Initially, Grayscale dominated the market, with its fund representing approximately 99.5% of the total AUM of the first ten U.S. spot Bitcoin ETFs.

However, the landscape has shifted dramatically due to persistent daily withdrawals from GBTC, which averaged $329 million per day in the preceding week.

These outflows, particularly pronounced in the initial month post-launch, with $7 billion exiting the fund, have gradually decelerated.

Yet, a mid-February court decision enabling crypto lender Genesis to sell off approximately $1.3 billion in GBTC shares reignited the outflow trend. To date, GBTC has seen over $11 billion in outflows, as reported by Farside Bitcoin ETF flow data.

READ MORE: Grayscale Proposes New Bitcoin Mini Trust to Offer Tax-Efficient Investment Option

Grayscale’s fund transitioned from a trust to an ETF following a successful legal battle with the Securities and Exchange Commission (SEC) and subsequent approvals of other spot Bitcoin ETF applications.

This transformation allowed institutional investors engaged in GBTC arbitrage to permanently withdraw or reallocate their capital to other Bitcoin ETFs offering lower fees.

The market initially reacted negatively to GBTC’s outflows. However, optimism has been renewed by significant net inflows into other ETFs, such as BlackRock’s iShares Bitcoin ETF (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which have collectively attracted $16.9 billion in inflows since their launch.

Market analysts attribute the substantial inflows into these new ETFs as a key factor behind the recent surge in Bitcoin’s price, which hit a record high of $72,900 on March 11.

BlackRock’s ETF now holds over 200,000 BTC, valued at roughly $14.3 billion, underscoring the shifting dynamics within the cryptocurrency investment landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Core Scientific (CORZ), a prominent player in the crypto mining industry, experienced a downturn in its annual revenue for 2023, reporting a total of $502.4 million, which marks a significant decrease of $137.9 million from the $640 million recorded in 2022, as revealed in their March 12 earnings release.

This decline in revenue was attributed to the company’s exit from the mining rig sales business and an increase in the global Bitcoin hash rate over the year.

Despite this drop in revenue, Core Scientific saw a notable improvement in its financial health, with yearly net losses reducing to $246.5 million in 2023, down from a substantial loss of $2.14 billion in 2022.

The Q4 2023 results further highlighted this positive trend, showing net losses narrowing to $195.7 million from the previous year’s $434.9 million in the same quarter.

The company also made headlines by being relisted on the NASDAQ on January 23, following a successful emergence from a bankruptcy crisis and a 13-month restructuring effort aimed at addressing $400 million in debt.

This financial turmoil was largely due to declining Bitcoin prices, escalating energy costs, and entanglements with the bankrupt crypto lender Celsius.

Core Scientific’s mining operations yielded a remarkable 13,762 BTC in the last year, positioning it as the top publicly traded mining firm in the U.S. based on Bitcoin mined.

READ MORE: Top 5 Promising Web3 Projects to Discover in 2024

Despite these achievements, Core Scientific’s stock experienced a decline, closing at $3.54 a share on March 12, which further slipped to around $3.40 in after-hours trading.

This market reaction did not overly concern the company, as a spokesperson pointed out the general downturn in the market sentiment towards publicly traded Bitcoin miners, citing similar trends in peers like Marathon Digital and Riot Blockchain.

Analysts attribute the falling share prices of mining companies to investor caution ahead of the Bitcoin halving, an event that will reduce mining rewards by half, potentially affecting profitability.

However, with Bitcoin’s price reaching $72,000, predictions suggest these firms will remain profitable post-halving, assuming stable hash rates and Bitcoin prices.

Core Scientific remains optimistic about its future, especially with the upcoming Bitcoin halving. The company is updating its fleet with the latest Bitmain S21 models and aims to enhance its hash rate utilization.

This confidence is echoed by analysts and investment firms, with HC Wainright and Compass Point upgrading their ratings of Core Scientific to “buy,” reflecting a growing interest in the crypto mining sector amid a resurgence in BTC and cryptocurrency values.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In late 2023, Coinbase Wallet, the self-custody crypto wallet service from Coinbase, significantly enhanced its security by incorporating the Blockaid security tool.

This strategic move, unveiled in a joint announcement to Cointelegraph on March 13, aims to fortify the digital assets of Coinbase users by introducing an additional layer of protection.

The collaboration between Coinbase Wallet and Blockaid has led to the safeguarding of over $75 million in user funds from potential theft.

This achievement was made possible by the integration of Blockaid’s technology, which effectively intercepted nearly 800,000 dubious wallet connections to harmful decentralized applications (DApps), after scrutinizing 114 million transactions and DApp interactions.

Ido Ben Natan, Blockaid’s CEO, shared with Cointelegraph the methodology behind quantifying the protected funds.

By analyzing the malevolent transactions at the wallet level and evaluating the transaction values at the time, Ben Natan affirmed, “We are able to confidently say that the minimum number of funds saved for users is over $75 million.”

Raz Niv, Blockaid’s CTO, referred to this figure as the “lower band” of detected scams for Coinbase Wallet users, emphasizing the calculation process based on transaction warning screens provided to users, which prevented these transactions.

An essential feature introduced through this integration is the enhanced transaction simulation capability, which predicts the outcomes of transactions before their execution on the blockchain.

READ MORE: Grayscale Proposes New Bitcoin Mini Trust to Offer Tax-Efficient Investment Option

This technology is crucial for averting cryptocurrency scams and thefts, as it enables users to foresee the implications of their transactions.

This predictive feature is bolstered by the use of three Blockaid application programming interfaces (APIs), enhancing security during the navigation of DApps, executing Web3 protocol transactions, and on-chain messaging.

The partnership has notably improved transaction simulation capabilities across seven blockchain networks, including Ethereum and six Ethereum Virtual Machine (EVM) compatible chains like Base, Optimism, and Polygon, as highlighted by Chintan Turakhia, Coinbase’s senior director of engineering.

Despite the advancements in transaction simulation technology, the report underscores the necessity of validation to ensure comprehensive protection against malicious activities, adding an extra layer of security by alerting users about potentially harmful transactions.

The adoption of Blockaid’s security measures is not exclusive to Coinbase Wallet.

MetaMask, another major EVM wallet, incorporated Blockaid’s security alerts in November 2023 and expanded its default security features to several blockchains by February 2024, marking a significant step forward in the collective effort to enhance the security of cryptocurrency transactions across the industry.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

MicroStrategy, along with its Executive Chairman Michael Saylor, remains committed to expanding their Bitcoin (BTC) portfolio, revealing plans for a new $500 million convertible note offering intended for further Bitcoin acquisitions.

Announced on March 13, this initiative marks another significant step in the company’s transition from a business intelligence entity to a “Bitcoin development” firm.

The offering, set to be privately issued as senior convertible notes, may also allocate a portion of its funds towards general corporate endeavors.

In the past two weeks alone, MicroStrategy has launched offerings totaling $1.3 billion, including a recently finalized $800 million senior convertible note offering.

This latest endeavor initially aimed to raise $600 million, but the target was subsequently increased to $700 million, plus an additional option for a $100 million aggregate principal amount under certain conditions.

These funds contributed to MicroStrategy’s acquisition of an additional 12,000 BTC, boosting its Bitcoin reserve to 205,000 BTC, valued at $15 billion.

This investment has yielded a 117% return, or a profit of $8.1 billion for the company.

MicroStrategy is nearing a milestone of owning at least 1% of Bitcoin’s theoretical maximum supply, needing just 5,000 more BTC to reach this goal.

With the current market prices, the proposed $500 million investment could secure approximately 6,850 Bitcoin.

READ MORE: Thetanuts Finance Launches Leveraged LRT Strategy Vault on the Ethereum Mainnet

The terms of MicroStrategy’s senior convertible notes, which are debt instruments convertible into equity or cash, include semi-annual interest payments and a maturity date of March 15, 2031.

These can be converted into cash, shares of MicroStrategy’s class A common stock, or a combination of both, depending on specific conditions.

Following this announcement, MicroStrategy’s stock (MSTR) saw a significant rise, increasing 10.85% to $1,766 on March 13 as per Google Finance.

Since February 6, the stock has surged by 254%, making it one of the Nasdaq’s top performers this year.

This uptick in MSTR’s stock price aligns with Bitcoin’s recent price rally, which recorded a 46.1% increase over the last month, reaching $73,050 according to CoinGecko.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The upcoming Bitcoin halving event, scheduled for April, is generating unprecedented excitement in the cryptocurrency world, fueled by a combination of unique factors.

This event marks the fourth Bitcoin halving, with previous occurrences in 2012, 2016, and 2020.

Significantly, this halving follows the U.S. Securities and Exchange Commission’s approval of the first spot Bitcoin ETFs in the United States, heightening the anticipation surrounding the event.

Experts are not just focused on the ETF approvals.

Julian Grigo, from Safe, emphasized the halving as a pivotal reminder of Bitcoin’s distinction from fiat currencies, particularly in a time of global inflation.

He highlighted Bitcoin’s fixed supply as a key attraction for investors, contrasting it with the inflating supply of fiat currencies and noting Ether’s decreasing supply as potentially even more appealing.

Joey Garcia from Xapo Bank predicts the halving will have a positive ripple effect on Ethereum and the broader market, likening Bitcoin’s scarcity mechanism to precious metals.

The reduction of mining rewards from 6.25 BTC to 3.125 BTC is expected to tighten Bitcoin’s supply, potentially increasing its price and, by extension, the prices of Ethereum and other cryptocurrencies as investors diversify their portfolios.

Alun Evans of Laos Network also acknowledged the halving’s broader impact, cautioning against the downsides of rapid price increases, especially for Ethereum, which powers numerous applications and smart contracts.

He suggested that future Ethereum network enhancements could mitigate these challenges by improving scalability and reducing transaction costs.

READ MORE: Shiba Inu’s Price Eyes Potential Surge Amid Market Speculation, Analyst Predicts Bullish Breakout

Beyond the halving, other factors are influencing the crypto market. Siddharth Lalwani of Range Protocol pointed to Ethereum’s upcoming Dencun upgrade and the potential for SEC-approved Ethereum ETFs as critical drivers of market dynamics.

Despite potential short-term liquidity shifts from Ethereum to Bitcoin, Lalwani remains optimistic about the crypto market’s bullish trend in 2024.

Jordi Alexander of Mantle and Aki Balogh of DLC.Link also weighed in, highlighting the role of Bitcoin’s price rally, upcoming Ethereum upgrades, and the strategic actions of entities like MicroStrategy in shaping market expectations.

They acknowledged the interconnectedness of Bitcoin and Ethereum’s fortunes, with Balogh emphasizing the broader impact of Bitcoin’s performance on the crypto ecosystem.

In summary, the forthcoming Bitcoin halving is viewed not just as a significant event for Bitcoin but as a catalyst for broader market movements, including Ethereum.

With factors like regulatory approvals, technological upgrades, and strategic market maneuvers at play, experts see a confluence of forces poised to shape the crypto landscape in the near and long term.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

CoinShares, a leading European digital asset investment firm, has successfully finalized the acquisition of Valkyrie Funds, gaining the sponsor rights to Valkyrie’s spot Bitcoin exchange-traded funds (ETFs).

Announced on March 12, this significant acquisition also includes Valkyrie Investments, the firm’s investment advisory branch, and the sponsor rights to the Valkyrie Bitcoin Fund, a physically-backed Bitcoin ETF.

The terms of the deal stipulate that the acquisition price will be determined at the conclusion of a three-year earnout period, reflecting Valkyrie’s financial performance.

Additionally, this agreement extends CoinShares’ management to include Valkyrie’s diverse ETF portfolio, such as the Valkyrie Bitcoin and Ether Strategy ETF, Valkyrie Bitcoin Miners ETF, and the Valkyrie Bitcoin Futures Leveraged Strategy ETF.

Jean-Marie Mognetti, CEO of CoinShares, emphasized the importance of the U.S. market for global asset managers and highlighted the acquisition’s strategic benefits: “The Valkyrie acquisition is yet another step in our growth strategy with a special focus this time in the U.S.

This acquisition brings an additional $530 million AUM to CoinShares, which makes it a top-line contributor from day one.

More importantly, it broadens our product offerings, strengthens our innovation capacity, and increases by a factor of 15 our total addressable market.”

In the wake of this acquisition, CoinShares plans to rebrand Valkyrie and its offerings within its ecosystem.

READ MORE: Bitcoin ETFs Will Hold Over 10% of BTC Supply By Q3

This move is part of CoinShares’ broader strategy to enhance its asset management platform in the United States, following an option to acquire Valkyrie that was held since November 2023.

The announcement arrives amidst a surge in interest for Bitcoin ETFs, notably after Bitcoin reached a new all-time high of $71,415 on March 11.

This increased attention is mirrored by the Bitwise Bitcoin ETF, which recently became the fifth fund to exceed $2 billion in Bitcoin holdings, according to Dune data, with Grayscale’s Bitcoin Trust ETF maintaining its position as the largest, managing $29 billion in Bitcoin.

Given the current pace, ETFs are expected to annually absorb 8.98% of the Bitcoin supply, potentially triggering a sell-side liquidity crisis by September, as per Ki Young Ju, founder and CEO of CryptoQuant.

Ju noted, “Last week, spot ETFs saw netflows of +30K BTC. Known entities like exchanges and miners hold around 3M BTC, including 1.5M BTC by U.S. entities… At this rate, we’ll see a sell-side liquidity crisis within 6 months.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In his budget proposal for 2025, President Joe Biden is revisiting the concept of imposing a 30% tax on the electricity consumption of cryptocurrency mining operations.

This initiative is outlined in the “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” a document from the U.S. Department of the Treasury.

The document criticizes the lack of current legislation specifically addressing the taxation of digital assets, aside from broker and cash transaction reporting.

To rectify this, the Biden administration proposes an excise tax on the electricity used in the mining of digital assets, akin to taxes on physical goods like fuel.

The Treasury explains, “Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.”

Under this proposal, crypto mining entities would be required to disclose both the quantity and type of electricity they consume.

For electricity bought externally, firms must also report its value, which will then be used as the basis for the tax.

READ MORE: MicroStrategy Bolsters Bitcoin Treasury With $800 Million Note Offering, Purchases 12,000 BTC

Similarly, miners leasing computational power must declare the electricity’s value provided by the leasing company.

This measure, aimed to take effect from January 1, 2025, plans a phased tax introduction: starting at 10% the first year, 20% the second, and reaching 30% in the third year.

Crypto mining operations that generate their own power will also be subjected to this tax.

The 30% rate will apply to the estimated costs of their electricity consumption, regardless of whether they are connected to the grid or not.

This includes those utilizing renewable energy sources such as solar or wind power.

Pierre Rochard of Riot Platforms has criticized the move as an attempt to undermine Bitcoin and facilitate the launch of a central bank digital currency (CBDC).

U.S. Senator Cynthia Lummis has expressed her opposition to the tax on X, suggesting that while the administration’s inclusion of crypto in the budget may indicate a positive outlook on cryptocurrency, the proposed tax could significantly harm the industry’s position in the U.S.

This initiative marks Biden’s second attempt to implement a 30% tax on the electricity used by crypto miners, following a similar proposal in the 2024 budget proposal announced on March 9, 2023.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.