Cudo Compute is revolutionizing the cloud industry by providing a democratic and sustainable alternative to the centralized cloud.

Why it matters: The cloud industry is growing rapidly as innovations in artificial intelligence, scientific computing, virtual reality and augmented reality tech continue to develop.

But the public cloud, as it exists today, is primarily owned by just three companies. This highly centralized cloud model faces several issues:

- Disruptive outages can take down key services for hours at a time due to a single point of failure.

- Sustainability issues result from energy consumption, water usage and electronic waste.

- Latency problems due to the distance between the data center and the end-user.

Through its distributed cloud marketplace, Cudo Compute is tackling these problems by providing an efficient, robust and cost-effective way to connect buyers and sellers of computing power.

Go deeper

Cudo Compute allows companies and individuals to find and use available compute resources more efficiently, moving beyond the inherent constraints of on-premise and centralized cloud environments.

This radical new cloud model provides a host of benefits, including:

- Increased availability. Those seeking specific types of processing power — e.g., GPUs — can be easily matched with suppliers offering exactly what they need.

- Lower cost. Computing suppliers can improve their returns by reducing under-utilized capacity, with corresponding price reductions for buyers.

- Closer proximity. A geographically distributed cloud makes it far easier for those seeking computing power to find a location as close as possible to the point of delivery.

- Reduced waste. Building new infrastructure has an environmental cost. Just one data center can consume as much electricity as 50,000 homes. Instead, Cudo Compute will help to maximize existing resources and take advantage of the billions of dollars of under-utilized computing resources available across the globe.

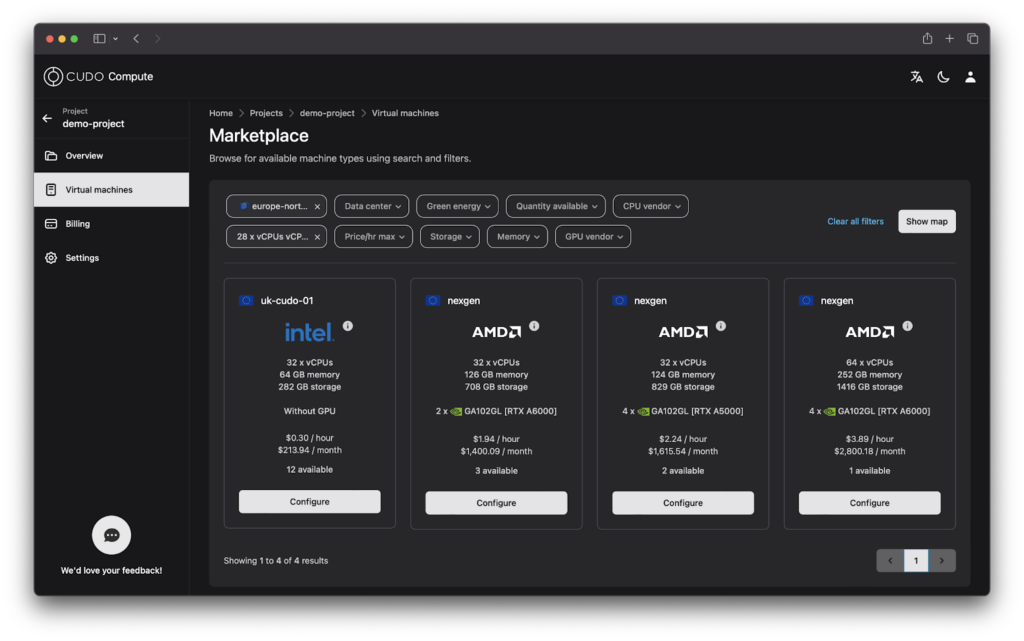

At launch, Cudo Compute will offer a user-friendly cloud service allowing you to find and use virtual machines hosted by a wide range of data center providers around the globe. Key features include:

- A high-performance infrastructure offered at a fraction of the cost of existing cloud providers.

- Access to latest-generation processors, including Nvidia GPUs, Intel Xeon and AMD EPYC CPUs.

- Robust security through hosting in data centers with ISO 27001 security and ISO 9001 quality certifications.

- One-click solutions for businesses in a range of specialized applications, including data science, deep learning, rendering and more.

Solutions

At present, Cudo Compute focuses on the following use cases and applications:

- Artificial intelligence and machine learning — Use purpose-built images for machine learning with or without Docker using TensorFlow and PyTorch.

- 3D rendering and motion graphics — Scale your video rendering to 100,000 GPUs and CPUs, which is faster and more cost-effective with Blender.

- High-performance computing (HPC) — Run all your HPC workloads without investing CAPEX on high-performance hardware sitting idle outside office hours using Parabricks and GROMACS.

- GPU cloud — Access to on-demand GPU instances with per-second billing hosted in data centers with ISO 27001 security and ISO 9001 quality certifications.

The future

Cudo Compute will serve as the infrastructure backbone for Web3 by eventually integrating with its sister company Cudos. The 100% carbon-neutral layer-1 blockchain offers low-cost, fast transactions.

Since Cudos is interoperable, it will integrate with all other major layer-1 chains, bringing cloud and blockchain closer together. Think Filecoin but for the entire compute stack where developers can access resources on- and off-chain independent of the network where they launched.

Enjoy the commercial and project acceleration benefits of expanding your access to scarce resources by contacting us or registering for an account at cudocompute.com.

About Cudo Compute

Cudo Compute is an ecosystem providing access to decentralized and sustainable cloud computing resources by leveraging under-utilized computing power on idle hardware globally.

We are the Airbnb for sustainable computing. Like Airbnb’s marketplace, which allows owners to rent out their unused homes, we facilitate businesses and individuals to lend their hardware’s unused computing to users and organizations that might need it. Our platform allows organizations and developers to deploy, run and scale based on their cloud demands.

European Union rules to regulate crypto assets will curb the market share of non-euro denominated stablecoins from 2024, potentially limiting EU competitiveness, industry representatives have said.

Ambassadors for the 27 EU states on Wednesday gave their approval to a deal on the new Markets in Crypto Assets Regulation (MiCA) thrashed out in June with the European Parliament.

To become law, the Parliament must vote on the rules, something which is expected to happen in December or early 2023.

The ambassadors also published a full text of the deal, revealing details such as that stablecoins not denominated in the euro will be limited to 1 million transactions and 200 million euros ($196 million) in transaction value when marketed in the euro zone.

A joint letter by crypto industry groups Blockchain for Europe and the Digital Euro Association said that the world’s three largest stablecoins – Tether, USD Coin and Binance USD – account for 75% of crypto trade volumes and already exceed the transaction-count and volume limits set out in the EU rules.

Anto Paroian, CEO of cryptocurrency hedge fund ARK36, said the curb “will likely limit the EU’s competitiveness and innovation potential”.

The European Crypto Initiative, a Brussels-based crypto lobbying group, said in a statement the outcome could be “burdensome”.

But it said a more favourable approach to euro-denominated stablecoins was likely to emerge after “initial fears for the EU’s financial stability and monetary sovereignty”.

Stablecoins are a type of cryptocurrency designed to maintain a constant value, usually via a 1:1 peg with a fiat currency.

“If the directive’s current wording does not change, it will significantly restrict the use of dollar-denominated stablecoins such as USD Coin, Tether, and Binance US,” Fabian Astic, Global Head of DeFi and Digital Assets at Moody’s Investors Service, said.

Stefan Berger, a member of the European Parliament who helped to negotiate the final deal, told Reuters: “Indeed, this might increase the euro-pegged stablecoins, which is a welcome development.”

Tether’s dollar-pegged coin is the world’s third largest cryptocurrency, with a market cap of $68 billion, compared to$202 million for the euro-pegged version, CoinGecko data shows.

W3E — the first-ever live tournament for Web3 esports — will be welcoming the world of Web3 gaming to Istanbul Blockchain Week.

The event will take place on Nov. 17 at the ESA Esports Arena in the heart of Istanbul, and will also include game showcases, exclusive announcements from developers, demo testing and nail-biting competition in one of the world’s most popular Web3 games. W3E is managed and overseen by team lead Damian Bartlett and marketing strategist Thang Phan, a former member of FaZe Clan. Both are veterans and ex-pros of the gaming and esports world.

Concurrently, W3E will also be hosting the world’s first Web3 gaming expo on the periphery of the W3E Tournament. Attendees will have the opportunity to see emerging projects, test upcoming Web3 games and network with the development team.

EV.io, a first-person shooter set in a series of futuristic arenas — and the most popular game on the Solana blockchain — will be the event’s league partner and lead game for the tournament. EV.io was built from the ground up with low system specs in mind, and designed to be open and accessible to all players. The game has a fast-paced style of combat with a range of weapons to choose from and complete with a range of exciting abilities, including teleport and impulse grenade for an exhilarating gameplay experience.

W3E will be inviting top-ranked European and Turkish teams for a live tournament in the heart of Istanbul. In an effort to expand the decentralized gaming ecosystem, W3E will also be inviting players of traditional Web2 FPS games to take part.

Web3 gaming like you’ve never seen before

EV.io is also a free-to-play, play-to-earn game where players can earn the in-game token “e,” which can be converted to Solana (SOL$33) and fiat currency. Unlike many play-to-earn games, EV.io’s revenue is generated from advertising, not from new players.

EV.io will also be producing bespoke W3E-branded skins and weapons for players to use during and after the tournament.

“I am incredibly excited to be leading the team putting on the first-ever live Web3 esports tournament, alongside the first Web3 games expo,” said Erhan Korhaliller, founder and CEO of W3E and Istanbul Blockchain Week. “Web3 gaming is the next leap forward in this revolutionary technology. Watching it mature over the past few years has been incredible, but 2022 feels like the inflection point. It is a privilege to have our contestants play EV.io, and I couldn’t be more proud to welcome the world to what will be a history-making event in this space.”

“We’re excited to be part of Istanbul Blockchain Week and contribute to a growing Web3 esports scene,” said Chriss Scott, co-founder and game director of EV.io. “We’re huge fans of W3E and support their initiatives in moving the needle forward.”

Putting Web3 gaming at the heart of Istanbul Blockchain Week

The inaugural W3E event will take place during Istanbul Blockchain Week. First founded in 2020 as the brainchild of EAK Founder and CEO, Erhan Korhaliller, Istanbul Blockchain Week was brought to life in order to bring a high-quality Web3 event to Turkey.

W3E is the latest event brand from Web3 agency EAK Digital, and follows on from the successful BlockDown Festival: Croatia, which took place in May earlier this year.

Media contact

W3E will be welcoming members of the media to attend the event, those wanting more information, or who would like to inquire about a media pass to Istanbul Blockchain Week should send an email.

A blockchain linked to Binance, the world’s largest crypto exchange, has been hit by a $570 million hack, a Binance spokesperson said on Friday, the latest in a series of hacks to hit the crypto sector this year.

Binance CEO Changpeng Zhao said in a tweet that tokens were stolen from a blockchain “bridge” used in the BNB Chain, known until February as Binance Smart Chain.

Blockchain bridges are tools used to transfer cryptocurrencies between different applications. Criminals have increasingly targeted them, with some $2 billion stolen in 13 different hacks, mostly this year, researcher Chainalysis said in August.

The hackers stole around $100 million worth of crypto, Zhao said in his tweet. BNB Chain later said in a blog post that a total of 2 million of the BNB cryptocurrency – worth around $570 million – was withdrawn by the hacker.

The majority of the BNB remained in the hacker’s digital wallet address, while about $100 million worth was “unrecovered,” the Binance spokesperson said by email.

BNB Chain supports BNB, formerly known as Binance Coin, which is the world’s fifth-largest token with a market value of over $45 billion, according to data site CoinGecko.

Elliptic, a London-based crypto blockchain researcher, told Reuters that the hacker had minted 2 million new BNB tokens before transferring most of the funds to other cryptocurrencies including Tether and USD Coin.

BNB Chain suspended its blockchain for several hours before resuming at around 0630 GMT, it said in a tweet.

BNB Chain was “able to stop the incident from spreading” by contacting the blockchain’s “validators,” – entities or individuals who verify blockchain transactions, it said in its blog post. There are 44 validators across several different time zones, it added without elaborating.

BNB Chain, described by Binance as a “community-driven, open-sourced and decentralized ecosystem,” said it would introduce a new “governance mechanism” to counter future hacks, as well as expand the number of validators.

In March, hackers stole around $615 million from a blockchain bridge called Ronin Bridge, in one of the largest crypto heists on record, linked by the United States to North Korean hackers.

Willemstad, Curaçao, 6th October, 2022, Chainwire

Today, BC.GAME announces the launch of its newly redesigned website with more and better features for its players. This is one of the many efforts of BC.GAME in order to continue giving the best experience and satisfaction to its players around the world.

BC.GAME Introduces a Newly Redesigned Website

The main website showcases a new UI layout with a cleaner and slicker design compared to the old version. Players can also select different languages if they want to translate the descriptions written on the site. Languages such as Portuguese, Indonesian, Russian, Vietnamese, Korean, and Spanish are now available for players.

Recently, BC.GAME formed partnerships with two of the most recognized names in football and eSports—AFA and Cloud9. The new website features a dedicated page for sponsorships to keep the community updated about the latest events involving the casino’s partners.

Bold and Better Features for BC.GAME Players

As part of the new design, players will now be able to access helpful content—from game recommendations for each user, details of the game providers, and game descriptions.

Game interactions are now also available. Players can rate games, like, comment, share, and provide feedback on the games they play.

More security features are added, such as new additional Official Staff Verification page feature and an updated KYC feedback feature.

All players will have access to these bold and better features on the new BC.GAME website.

Chris, Chief Operating Officer at BC.GAME shares, “The iGaming industry moves fast. Keeping up with it is no small feat. As industry trailblazers, we pride ourselves on doing more than just staying ahead of the curve. Our goal is to create the curve. The only way to accomplish this is by keeping the communication channels with our community open. On behalf of the BC.GAME team, I would like to thank our loyal community for all the feedback and suggestions they have given by presenting this latest upgrade.”

About BC.GAME

BC.GAME is a community-based crypto casino that offers players the best online casino experience. Launched in 2017, BC.GAME is among the first casinos to support Lightning Network, not only revolutionizing the casino industry but also the blockchain space. With the recent addition of sports betting, users can enjoy more than 8,000 games, including sports, slots, live table games and even the famous Bitcoin (BTC) crash game. BC.GAME has won multiple industry awards, making it the Crypto Casino of the Year 2022. The platform accepts many leading cryptocurrencies and recently started accepting fiat payments.

Learn more: http://bc.game

Contact

PR

- Issay Domingo

- BC Game

- larswriter@bcgame.com

Celsius Network’s co-founder and chief strategy officer Daniel Leon has stepped down, the bankrupt crypto lender said on Tuesday, joining a wave of executive departures from beleaguered digital asset companies.

The announcement comes a week after chief executive officer Alex Mashinsky’s resignation. Leon’s departure was first reported by CNBC.

Hoboken, New Jersey-based Celsius filed for Chapter 11 bankruptcy in July, a month after freezing withdrawals citing extreme market conditions.

Lenders such as Celsius boomed in lockstep with the surge in popularity of major cryptocurrencies like Bitcoin, as they offered interest rates much higher than traditional banks and easy access to loans.

However, the collapse of digital tokens terraUSD and luna, coupled with a tough macroeconomic environment, tested their business model and eroded customers’ optimism.

Voyager Digital Ltd, another major U.S. crypto lender, also filed for bankruptcy in July.

Follow Crypto Intelligence on Google News to never miss a story

Groundbreaking memecoin project Tamadoge has been making waves this week, as the token’s price surged over 200% following several significant listings.

Crypto-hungry investors can now buy TAMA through leading centralized exchanges (CEXs) like OKX and BitMart, with the token also available on decentralized exchange (DEX) Uniswap.

All eyes will be on Tamadoge’s price in the coming weeks as this momentum shows no signs of slowing, generating much-needed returns for investors during the ongoing crypto winter.

Major exchange listings prompt huge price momentum

OKX was the first major CEX to list Tamadoge last week, allowing traders to benefit from the tremendous hype surrounding the project. According to CoinMarketCap, OKX has over 1.4 million weekly visitors and regularly handles more than $1.3 billion in daily trading volume, ensuring TAMA has a massive audience of potential investors. TAMA is also available on the OKX DEX.

The popularity of the OKX exchange has certainly helped Tamadoge grow, as the token’s price is up over 200% since it was listed last week, leading many to consider TAMA as one of the best cryptocurrencies to buy. Notably, presale investors have experienced gains of more than 700%, given the discounted price point that they could buy TAMA at.

Tamadoge’s OKX listing was swiftly followed by a listing on BitMart, another widely used CEX. The awareness raised by these listings, combined with the increased accessibility, has helped boost demand even further, leading to the triple-digit returns that investors are experiencing.

Although these returns are impressive, it seems like Tamadoge is just getting started. As noted on the Tamadoge Telegram group, the development team has also filed an application to be listed on Binance, the world’s largest cryptocurrency exchange.

Tamadoge’s team has also lined up listings on LBank and MEXC this week, with the token going live on Oct. 5. Not only do these listings boost accessibility even further, but they also help increase the token’s standing within the market, providing hope that a Binance listing could be a real possibility.

Why are investors buzzing about TAMA?

According to CoinGecko, the price of Tamadoge is hovering around the $0.0726 region at the time of writing, giving the token a market capitalization of over $75 million — highly impressive for such a new listing. But why is TAMA attracting so much attention?

For those unaware, Tamadoge’s presale phase sold out in mid-September, raising a remarkable $19 million in Tether (USDT$1.00) for the project. The presale was originally expected to end in Q4 2022, yet record-breaking demand from investors meant that the token allocation was gobbled up ahead of time.

Much of this demand is driven by Tamadoge’s revolutionary platform, which includes play-to-earn (P2E) mechanics integrated into an ecosystem with a memecoin aesthetic. Tamadoge looks to combine the appeal of these memecoins with valuable utility, a feat that hasn’t been accomplished in the market thus far.

Although the Tamadoge project is still in development, the development team has already noted some impressive plans for the future, including Tamadoge-themed arcade games and even an augmented-reality mobile app.

Tamadoge’s team has even announced its intention to integrate with various industry-leading metaverse projects, providing an immersive way for market participants to get involved with TAMA.

Tamadoge NFTs — A catalyst for further price momentum?

Another reason investors have been clamoring to acquire TAMA tokens is the upcoming release of Tamadoge nonfungible tokens (NFTs). These NFTs are vital for those looking to participate in Tamadoge’s ecosystem, as they will inform the stats and attributes of each user’s Tamadoge Pet.

Tamadoge Pets form the foundation of Tamadoge’s P2E mechanics, enabling players to battle against others to earn “Dogepoints” and climb the monthly leaderboard. Naturally, those users who own Tamadoge Pets with better attributes will have a higher chance of winning battles and obtaining Dogepoints.

This is where Tamadoge NFTs come in, as a total of 21,100 will be available to investors. The collection will be split into three distinct classifications: Ultra-Rare, Rare and Common, which inform their strength level.

Although the Common and Rare NFTs do not have a specific release date, early investors can get their hands on Tamadoge’s Ultra-Rare NFTs from Oct. 6. Only 100 of these NFTs will be minted, ensuring an air of exclusivity around this exciting drop.

The release of these NFTs, combined with the upcoming launch of Tamadoge’s player-versus-player battle mechanic, has helped the project surge into the limelight during a challenging period in the crypto market. Thanks to this, all eyes will be on TAMA in the coming weeks as demand for the token continues to ramp up.

- Website: https://tamadoge.io/

- Twitter: https://twitter.com/Tamadogecoin

- Telegram: https://t.me/TamadogeOfficial

- Discord: https://discord.com/invite/Z2PqFvsXJa

- Instagram: https://www.instagram.com/tamadogecoin/

The Middle East and North Africa are the world’s fastest-growing cryptocurrency markets, with the volume of crypto received in the region jumping 48% in the year to June, blockchain researcher Chainalysis said in a report on Wednesday.

While the MENA region is one of the smallest crypto markets, its growth to $566 billion received in cryptocurrency between July 2021 and June 2022 shows adoption is rising rapidly.

Latin America saw the second biggest growth in the same period, at 40%. North America was next at 36% growth, followed closely by Central and Southern Asia and Oceania at 35% growth, Chainalysis said.

Three MENA countries are among the top 30 in Chainalysis’ 2022 Global Crypto Adoption Index, with Turkey in 12th place, Egypt taking the 14th spot and Morocco 24th.

“In Turkey and Egypt, fluctuating cryptocurrency prices have coincided with rapid fiat (traditional) currency devaluations, strengthening the appeal of crypto for savings preservation,” Chainalysis said.

The Turkish lira has weakened nearly 30% this year to new record-lows, after losing 44% of its value last year amid a currency crisis triggered by rate cuts.

Turkey tops the MENA region in terms of value of crypto received by far, having received $192 billion worth of crypto in the year to end-June, though only saw 10.5% year-on-year growth.

Egypt’s currency has also lost about a quarter of its value against the dollar at the start of the year.

“Remittance payments account for about 8% of Egypt’s GDP, and the country’s national bank has already begun a project to build a crypto-based remittance corridor between Egypt and the UAE, where many Egyptian natives work,” Chainalysis said.

The six countries of the Gulf Cooperation Council “seldom make it to the top of our grassroots crypto adoption index, as it weighs countries by purchasing power parity per capita, which favours poorer nations,” Chainalysis said.

“Nevertheless, their role in the crypto ecosystem should not be underestimated. Saudi Arabia, for example, is the third-largest crypto market in all of MENA, and UAE is fifth.”

Afghanistan, which was 20th in Chainalysis’ adoption index last year, has tumbled to the bottom of the list as Taliban authorities have “equated crypto to gambling,” which is forbidden in Islam, Chainalysis said.

From November 2021 to now, Afghanistan-based users received less than $80,000 in crypto a month on average from $68 million a month on average before the Taliban’s takeover, Chainalysis said.

Dubai will transform into the ultimate digital epicenter of the world next month as the UAE hosts the world’s largest tech show, converging the most advanced companies and best minds to deep-dive into the making of the Web3 economy.

From Oct. 10 to 14, 2022 at the Dubai World Trade Center, Gitex Global returns for its largest-ever edition, featuring 5,000 companies spanning 26 halls and 2 million square feet of exhibition space. The size difference is an extraordinary 25% year-on-year increase, pushing its capacity limit at the venue.

The Gitex 3.0 edition in its 42nd year presents the most empowering curation ever with seven multi-tech themes experimenting in the Metaverse, a decentralized future of the internet, and a sustainable global digital economy. Gitex sets to wow with the year’s biggest and most immersive Metaverse experience across multiple sectors, from music, fashion and sports to lifestyle and business

Gitex Global 2022’s scale reflects digital ambitions of UAE and the region

The five-day event’s record size and continued expansion mirrors the ambitions of the UAE and region’s digital transformation movement, as government initiatives such as the National Program for Coders, the Dubai Metaverse Strategy and Next GenFDI propels the UAE to the forefront of the global digital economy.

This is amplified by Gitex Global 2022’s new launches of X-Verse sponsored by TMRW Foundation in collaboration with Decentraland — one of the world’s most immersive Metaverse journeys featuring 28 experiential brands — and Global DevSlam, the Middle East’s largest-ever coder and developer meetup, both of which sold out to a global audience within two months.

UAE companies also held the lion’s share of a record-breaking $2.6 billion in startup funding across the Middle East and North Africa in 2021, figures that underscore an additional hall and 30% increase to 1,000 exhibitors at Gitex Global’s startup event, North Star.

His Excellency Omar Al Olama, Minister of State for AI, Digital Economy and Remote Work Applications, who delivered the welcome note at the official Gitex Global 2022 press conference today, said: “Gitex this year is bigger than ever. It spans 2 million square feet with over 5,000 exhibitors from more than 90 countries, which makes this truly the biggest tech show in the world. This year, my office has partnered with Gitex to ensure that we’re not just showcasing technology, but actually inventing and developing technology.”

In his speech, Al Olama also highlighted that the Global DevSlam event is poised to be one of the biggest developer events in the world. He concluded by thanking each and every single person that has believed in the UAE’s mission and who has supported the UAE.

Global interest accelerates UAE and region as a rising tech hub of the world

Gitex Global 2022 will welcome an unprecedented 52% new exhibitors this year choosing the show and the UAE as the first-choice partner in their market access strategies.

The influx of global interest will see North Star hosting the biggest Unicorn meetup of the year in Dubai, with 35 Unicorns from 15 countries looking to explore new opportunities and expand in one of the world’s fastest-growing markets.

Influential UAE entities inspire R&D in transformative technologies

UAE companies are shaking up the global tech scene with their bold undertakings and commitments in tech R&D and inventions, including Technology Innovation Institute (TII) a leading global scientific institution and the applied research pillar of Abu Dhabi’s Advanced Technology Research Council. TII will have a significant presence at Gitex Global showcasing AI and Digital Science, Directed Energy and Autonomous Robotics Research.

Gitex also unifies the participation of 250 government entities leading strategic digital projects and public-private partnerships, with Digital Dubai Authority and Abu Dhabi Digital Authority among the UAE government bodies advancing smart city and digital projects.

More information is available on the website.

About Dubai World Trade Center

With a vision to make Dubai the world’s leading destination for all major exhibitions, conferences and events, DWTC has evolved from being the regional forerunner of the fast-growing MICE industry into a multi-dimensional business catalyst, focusing on venues, events and real estate management. Complementary to the primary service offerings are a range of value-added services from media/advertising, engineering and technical consultation and wedding planning, security services and hospitality.

The Financial Stability Oversight Council (FSOC), a U.S. regulatory panel comprising top financial regulators, on Monday recommended that Congress pass legislation addressing risks digital assets pose to the financial system, including bills to bolster oversight of crypto spot markets and stablecoins.

In a report following U.S. President Joe Biden’s executive order this year “on Ensuring Responsible Development of Digital Assets,” the panel identified three gaps in the regulation of cryptocurrencies: limited oversight of the spot market for tokens that are not securities; opportunities for regulatory arbitrage, or taking advantage of favorable rules; and whether crypto firms should be allowed to integrate multiple services traditionally provided by intermediaries, like broker-dealers and clearing houses.

The report was published after an FSOC meeting on Monday.

In a statement, Treasury Secretary Janet Yellen said the report “provides a strong foundation for policymakers as we work to mitigate the financial stability risks of digital assets while realizing the potential benefits of innovation.

Although FSOC has previously urged Congress to regulate issuers of stablecoins like banks, Monday’s report included several new recommendations for legislators, including that they create a federal framework for stablecoin issuers to address market integrity and consumer protection.

FSOC’s report follows a slate of others that were released last month in connection with the White House’s executive order. In September, the Biden administration published a series of reports recommending that U.S. government agencies double down on digital asset sector enforcement and identify holes in regulation.

It remains unclear when Congress might pass crypto-related legislation, although several bills have been introduced to address stablecoins and digital commodities regulation.

The FSOC report also suggested Congress pass a bill to provide rulemaking authority to federal financial regulators over the spot market for cryptocurrencies that are not securities, in order to address conflicts of interest and abusive trading practices.

Lawmakers should also consider legislation that gives regulators authority to supervise activities of crypto firms’ affiliates and subsidiaries, which FSOC said could address regulatory arbitrage, the report said.