Singapore’s Monetary Authority (MAS) has launched measures to regulate cryptocurrencies after Three Arrows Capital (3AC) went into administration, it was revealed on Wednesday.

The city-state’s central bank revealed a series of proposals aimed at regulating digital payment token service providers (DPTSP) along with stablecoin issuers via the Payment Services Act.

It aims to target digital payment token (DPT) services for top cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and XRP in a bid to lower consumer exposure to risks and improve stablecoin-based transaction standards.

In a statement, the authority said it would target three key areas:

Consumer access, requiring DPT service providers to show relevant risk disclosures to allow retail consumers to “make informed decisions regarding cryptocurrency trading” while also banning use of credit facilities.

Business Conduct, where DPT service providers must properly segregate customer assets, mitigate potential conflicts of interest from their multiple roles, and “establish processes for complaints handling.”

Technology Risks, requiring DPT service providers to maintain “high availability and recoverability of their critical systems,” similarly to banking institutions.

Regarding stablecoins, MAS proposes in section 4.21 to restrict issuers of single-currency pegged stablecoins (SCSs) from lending and staking, as well as lending or trading additional cryptocurrencies.

SCS issuers must also hold a threshold of $1 million in base capital, or 50 percent of annual operating expenses, at all times, including liquid assets, the regulator added.

Starry Night Capital NFT Fund

The measures come after Teneo, a liquidation firm for Three Arrows Capital, acquired control of the firm’s non-fungible token (NFT) assets, moving them to a Gnosis Wallet, according to a filing from the company,

Three Arrows Capital fell into administration in July due to “extreme fluctuations” in the bearish cryptocurrency market crisis. Prior to the collapse, the firm had paid $21 million USD to build its Starry Night Capital NFT Fund amid the huge push for NFTs in 2021.

California, United States, 26th October, 2022, Chainwire

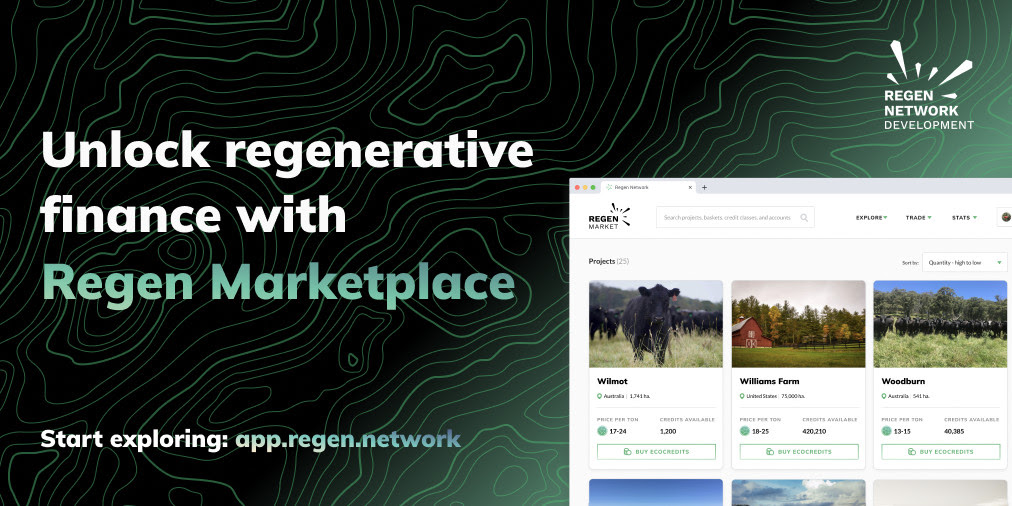

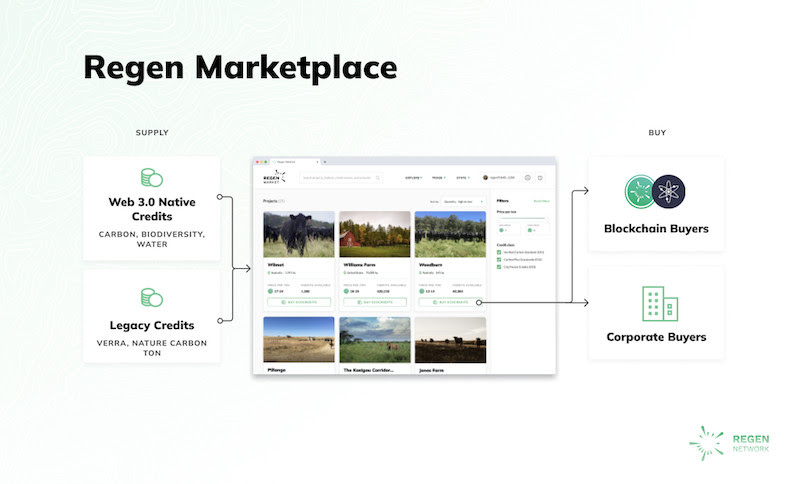

Regen Network Development released its marketplace application for tokenized carbon and ecological assets, Regen Marketplace. Regen Network allows carbon project developers to originate high-quality nature-based carbon credits to markets, catalyzing regenerative finance solutions to the climate crisis. Regen Marketplace takes advantage of Regen Ledger, the application-specific blockchain which brings transparency and public governance to voluntary carbon markets, built on the CosmosSDK.

Regen Marketplace is a blockchain platform for the origination, governance, and exchange of tokenized ecological assets. Climate impact projects can define, manage, mint, and sell tokenized carbon and other ecological assets in the blockchain-based registry system.

Using Regen Marketplace, blockchains and validators striving to meet their climate commitments are encouraged to purchase, transfer, retire, and bundle tokenized carbon on the blockchain for carbon offsetting purposes, effectively removing carbon dioxide and other greenhouse gasses from the atmosphere. Blockchain dApps are encouraged to export tokenized carbon for DeFi or consumer climate impact apps.

In addition to the Marketplace launch, Regen Network will be introducing the Nature Carbon Ton to the Interchain Economy. NCT will be the first IBC-compatible carbon token for the Interchain economy by the soon-to-be launched Regen Ledger to Polygon bridge, co-implemented by Regen Network Development and Toucan Protocol. This allows for the activation of the Cosmos ZERO campaign, a climate impact initiative for Cosmos-ecosystem blockchains to become carbon neutral. In this campaign, Cosmos-based protocols work to identify their carbon footprints, utilize protocol governance to make a carbon neutral commitment, purchase Nature Carbon Ton from the $NCT:$REGEN pool launching on the Osmosis decentralized exchange, and redeem NCTs for ecocredits, retiring them on Regen Ledger for carbon offsetting claims.

Since 2020, Regen Network Development has partnered with blockchain protocols to become verifiably carbon neutral, including Osmosis, Stargaze, and Cheqd, retiring over 10,000 tons of carbon. In doing so, participants are able to submit a personalized message about their climate impact as tokenized carbon is retired, to be memorialized on the blockchain.

The CosmosZERO campaign aims to catalyze protocol and validator carbon offsetting within the Cosmos-based ecosystem to achieve the goal of net zero carbon emissions on the blockchain.

Gregory Landua, CEO of Regen Network Development, said, “The launch of the Regen Marketplace is a historical milestone in the global effort to address the climate crisis. Bringing more nature-based credits to a market hungry for a supply of high-quality carbon credits will help scale the global effort to reverse climate change. The underlying characteristics of this disruptive new marketplace are critical – radical transparency, community governance, and an open-source tech stack designed to rapidly expand and decentralize the global movement to reverse climate change. Regen Network is a neutral, sovereign appchain to serve the demands of the growing climate impact movement and market for nature-based carbon and ecological assets.”

Regen Network’s strategic launch partnership with City Forest Credits Registry (CFC) aims to kick-start a market for urban forest carbon credits by tokenizing and listing the 2021 City Forest Credits portfolio in Regen Marketplace.

CFC is the US national standard for carbon emission reductions through urban forest preservation and carbon removal through urban tree canopy reforestation. The urban forestry projects featured in the marketplace launch have direct impacts on 20 million Americans in urban communities, represent all the verified city forest carbon across the United States, is the largest urban forest carbon placement in history, and the first blockchain-based urban forestry portfolio.

As Regen Network onboards more partners to participate in the growing ecosystem of climate impact champions, like Moss.Earth, Open Earth Foundation, Earthbanc, ERA Brazil, Shamba Protocol, and Terra Genesis International, the protocol hopes to gain mainstream participation in the end-to-end lifecycle of seamlessly designing, tokenizing, and purchasing carbon credits to retire them for climate change impacts. Over 20 partners are currently designing new ecological assets within Regen Marketplace, giving consumers access to a climate-positive economic system. In 2020, Regen Network sold and retired over 120,000 CarbonPlus Grasslands credits to Microsoft for its Moonshot goal on the Regen Network blockchain.

For more information visit www.regen.network

Gregory Landua, CEO of Regen is available for interview

About Regen Network

Regen Network is an application-specific blockchain designed to serve the demands of the growing climate impact movement and market for nature-based carbon and ecological assets. Regen Network’s blockchain infrastructure originates high-quality nature-based tokenized carbon to markets, catalyzing regenerative finance solutions to the climate crisis.

About Regen Network Development, Inc.

Regen Network Development, Inc. is a blockchain software development company focused on building applications for ecological regeneration on the Regen Network blockchain. RND, Inc has been a maintainer of the CosmosSDK software stack since 2019.

RND Inc. is responsible for the largest Australian-based carbon credit purchase, the largest US-based urban forest carbon purchase, and the largest soil carbon credit purchase in history. RND Inc. sold the first issuance of CarbonPlus Grasslands credits to Microsoft for its Moonshot goal.

Learn more at https://regen.network, Press Kit, and follow us on Twitter.

Press Contact: David Fortson, david@loalabs.io

About City Forest Credits Registry

City Forest Credits is a 501(c)(3) nonprofit carbon registry that manages carbon and impact standards for metropolitan areas in the United States.

Contact

Director of Marketing

David Fortson

Regen Network Development

david@regen.network

805-450-2357

Freeway, a cryptocurrency platform, blocked some of its services due to skyrocketing instability in the cryptocurrency market, it said in a statement on Sunday.

The British platform issued a statement on 23 October, where it said “unprecedented volatility in Foreign Exchange and Cryptocurrency Markets in recent times” had led the firm to block some of its services.

It added the company would diversify its assets to “manage exposure to future market fluctuations and volatility” to preserve the “sustainability and profitability of the Freeway Ecosystem” in the long-term.

Due to the measures, Freeway suspended purchases of Supercharger simulations until after fully implementing its strategies, the statement continued.

It continued, stating, “We will notify you when we are ready to recommence partial Supercharger simulation purchases (buy-backs) and then again as we can recommence full Supercharger simulation purchases as well as on platform Freeway Token (FWT) Deposits and Buys.”

Freeway’s website notes that Superchargers offer up to 43 percent annual yields, allowing users to deposit funds in regulated brokerage accounts with daily rewards, without buy-in or exit fees.

Cryptocurrencies with 43 percent Supercharger rewards include Bitcoin, Ethereum, USD, EURO, GBP, CAD, and AUD. The firm also offers 21.5 percent annual rewards on Binance, Cardano, Polkadot, and Gold.

As of 11 October, the company has issued $161 million in Supercharger simulations, totalling $37 million in annual rewards each year.

News of the halt sent the platform’s native cryptocurrency FWT nosediving roughly 74 percent, leading to anger and frustration over the crash and lack of access to personal accounts, according to Gizmodo reports.

Several other cryptocurrency platforms have faced insolvency in recent years, with crypto lending platform Celsius filing for bankruptcy, forcing the company to pay nearly $3.76 million in vendor claims and liens, reports found.

Terra/Luna also crashed to near zero, triggering further instability in the crypto markets and forcing Luna Market, a cryptocurrency, non-fungible token (NFT), and metaverse platform to rebrand as Insomnia Labs.

Singapore, Singpore, 19th October, 2022, Chainwire

The Bank for International Settlements (BIS) Innovation Hub and Bank Indonesia under the Indonesian G20 Presidency announced the winners of their jointly organized G20 TechSprint competition last week during a live award ceremony in Jakarta. This third edition of the TechSprint aims to catalyze the development of central bank digital currency (CBDC). Twenty-one finalists from more than 100 applicants worldwide developed and submitted innovative best-in-class CBDC solutions.

Dragonfly Fintech Pte. Ltd. from Singapore won the coveted “Effective and robust means to issue, distribute and transfer CBDCs” category ahead of about 100 participants globally, including some Fortune 500 companies. The other finalists for this category included BitMint, FIS, Mastercard Asia Pacific, R3, Ripple, Roxe CBDC, S.e.A.(Stellar, eCurrency and ANZ).

Other competition categories were “Enabling Financial Inclusion and “Improving Interoperability.” Eleven global expert judges conducted rigorous evaluation and scoring to decide the winners.

With the announcement of this year’s winners, Cecilia Skingsley, Head of the BIS Innovation Hub, said:

“This TechSprint has allowed us to improve our practical work on CBDCs. These technological solutions add to the central banks’ toolbox and provide a springboard for the further development of CBDCs. Our heartiest congratulations to the winning teams.”

Dragonfly’s winning production-ready solution showcased an effective and robust means for the issuance, distribution, and transfer of CBDC for wholesale and retail usage. The submitted solution included the following:

- nCore: Dragonfly’s proprietary blockchain infrastructure, designed for digital banking, enabling regulatory compliance, privacy and control, direct correspondent banking, and interoperability with legacy systems.

- Central Bank Solution: Integrated with an independent central bank-controlled network, a central bank can securely issue and distribute CBDC, execute monetary policy, and have complete oversight over CBDC in circulation. Onboarded financial institutions (FIs) can leverage the network to settle multi-currency transfers.

- mWallet: Integrated with an independently controlled FI network, Dragonfly’s mobile banking solution comes with a modularized backend operating management system that can quickly scale into a full-fledged digital bank.

Dragonfly followed key design principles to make CBDC SIMPLE, with its solution being:

- Scalable: The distributed multi-network design can quickly scale to serve a national CBDC rollout and facilitate cross-border payments.

- Interoperable: Operators can integrate with existing core banking ledgers and external payment and settlement rails.

- Modular: New digital banking modules can easily be plugged in using APIs and SDKs available in multiple common coding languages.

- Programmable: High programmability facilitates the design of innovative services, giving operators a competitive edge.

- Layered: The solution is a ready-to-use stack of future-proof layer one and two technologies.

- Extensible: A multi-touchpoint experience with dual offline capabilities that can serve the unbanked.

Dragonfly’s founder and CEO, Lon Wong, gave his thoughts on the optimal implementation for CBDC:

“For any country to embark on CBDC, I believe an implementation must be able to converge with the existing web of legacy financial systems. The financial burden for a significant CBDC rollout, especially for a vast and spaced-out archipelago like Indonesia, should be minimized through distributed and decentralized technology, preferably in a cloud environment, enabling the lowest possible cost of ownership with no single point of failure.“

Board member and advisor of Dragonfly, Jeswant Gill, outlined next-steps for the company:

“Our avant-garde platform infrastructure allows us to continue building more plug-ins, features, and functions. The modular design facilitates continuous innovation enabling our solution to advance and mature at an accelerated pace, staying the course as a market leader. A key focus moving forward is to engage and collaborate with the Indonesian government to pilot our CBDC solution.“

Winning this challenge serves as an affirmation that cutting-edge technology can be implemented cost-effectively. Dragonfly is inspired to bring its practical solution to emerging economies globally.

About Dragonfly Fintech

Dragonfly Fintech offers groundbreaking technology that is optimally cost-effective and easily accessible. Its customizable blockchain-powered fintech solutions help companies grow revenue and expand offerings while keeping costs at bay. Dragonfly solves legacy problems like complex infrastructure, slow transactions, and low interoperability with a technology suite that allows enterprises and governments to leverage blockchain technology, deploying cutting-edge fintech solutions with fast time-to-market and maximum accessibility.

To find out more about Dragonfly’s products, visit www.dfintech.com. Get in touch by emailing enquiry@dfintech.com.

Contact

Executive Director

Nicholas Watson

Dragonfly Fintech Pte Ltd

nicholas.watson@dfintech.com

The Tel Aviv Stock Exchange (TASE) (TASE.TA) said on Monday it would reshape its ownership structure and also create a blockchain platform to allow more trading of crypto currencies in an effort to match international standards.

TASE, which went public in 2019, said it would create a new publicly traded holding company that will own 100% of the bourse, which will become a private firm. Subsidiaries of the exchange will be units of the new holding company.

It said its board had given the nod to the plan but approval from the regulator and TASE shareholders were still awaited.

Under its five-year plan, TASE said it would focus on organic growth and bring in foreign investors through the expansion of international products traded and cleared on the bourse, including a relaunch of derivatives futures, it said.

Just 8% of daily share trading comes from foreign investors.

The exchange said it would create a platform for digital assets using blockchain, or distributed ledger technology. This would allow the trading of digital assets while exporting proprietary technological services to smaller foreign exchanges.

As a result, the TASE said it expects a compounded annual growth rate from revenue of 10% to 12% through 2027.

“We will leverage our home court advantage in Israel to adopt and develop fintech and position TASE as a hub of services and products,” said TASE’s chief executive Ittai Ben Zeev.

Over the first half of 2022, the bourse earned operating profit of 47 million shekels ($13 million) versus 55 million in all of 2021.

NEARStarter, a DAO-governed incubator on Near and Aurora, will be providing its incubation services to Meteor Wallet, a simple and secure wallet on the Near Protocol.

The NEARStarter incubator is a decentralized autonomous organization (DAO)-governed incubation program for early-stage projects launching on Near and Aurora.

In its two years of life, the popularity of nonfungible tokens (NFTs), decentralized finance (DeFi), gaming and other Web3 projects on the Near Protocol has grown significantly, forcing the adoption of high-quality incubators to support them.

As an incubator, NEARStarter not only helps projects like Meteor Wallet receive proper funding to benefit from liquidity but also introduces them to a significant and international crypto network, as well as increasing their social media presence by participation in AMAs or contests.

Meteor Wallet, one of the up-and-coming incubated projects on NEARStarter, is a simple and secure Wallet on the Near Protocol that allows users to collect NFTs, access DeFi and explore the Near Ecosystem. Jonathan Myburgh, head of growth at Meteor Wallet, noted:

“It’s pretty crazy to think that this all started from an NFT collection (Near Tinker Union) with the aim to build products that benefit the Near ecosystem. We started by building a no-code NFT launchpad but soon realized that Near lacked a wallet that matched its UX ambitions to help transition Web2 over to Web3.

Our goal is to be the go-to wallet that makes the Near blockchain simple and secure for users within one super wallet app (identity, financial, social, your gateway to the chain).

Edward Chew is the founder of Near Tinker Union NFT and leads the technical nature of Meteor Wallet. He previously worked at one of the largest e-wallet companies in Asia.

We are grateful for the NEARStarter team that has been alongside us from the early stages of the project.”

The incubator program aims to serve as the Near and Aurora ecosystem’s top growth engine. To do so, they have so far been successful in helping several projects to develop in the Near market with great partners and international Guilds that NEARStarter is collaborating with.

The wallet was founded by an all-star team that also developed top-notch projects like Near Tinker Union, a top five NFT project on Near in terms of volume, and Enleap, a leading NFT launchpad platform on Near.

Ramiro Gamen, head of accelerator at NEARStarter, shared:

“At NearStarter, we see tremendous potential in Meteor’s tech and community, but even more in their founders. They’ve harnessed their experiences from Near Tinker Union and their collective knowledge of the industry to develop an amazing tool for Near users to securely store, manage and exchange their digital assets, with unique features that prove ideal to new users coming into the Near ecosystem or blockchain in general.”

Moreover, NEARStarter incubates other projects, including a lending 2.0 protocol and a Web3 Career Hub.

The NEARStarter acceleration program is already recognized as one of the leaders in the Near ecosystem and has established partnerships with crucial projects, including Paras, Roketo, Shitzu, Fluxus and Decentral Bank among others.

Since the market is expanding at an unprecedented speed, NEARStarter, as an incubator, must constantly seek ways to enhance the services it offers. Future plans for the platform include continuing to expand the utility of the “Vicious Fishes” NFT collection, supporting incubated projects through additional high-quality partnerships, and launching the NSTART initial decentralized exchange offering soon. NEARStarter’s energy is in full swing to keep shaking the Near and crypto ecosystem.

More about NEARStarter

NEARStarter is a DAO-governed incubator acting as the ultimate growth engine for the Near and Aurora ecosystem.

Follow NEARStarter’s social media channels to be at the forefront of the Near ecosystem:

Telegram | Discord | Twitter | Blog | Website

The U.S. Justice Department on Wednesday sued the indicted founder of a cryptocurrency “mixer” to recover a $60 million civil penalty that was imposed on him in 2020 by U.S. financial regulators for alleged failures to maintain an effective anti-money laundering program.

The lawsuit was filed in Washington, D.C., federal court against Larry Harmon of Ohio who ran a cryptocurrency “mixer,” or “tumbler” called Helix, an anonymizing service that U.S. authorities said could send virtual currency in a way that concealed the source or owner.

The Financial Crimes Enforcement Network, a bureau of the U.S. Treasury Department, in October 2020 imposed a $60 million civil money payment on Harmon for alleged violations of the federal Bank Secrecy Act (BSA). FinCEN, as the bureau is known, alleged that Harmon was operating an unlicensed money transmitting business in connection with Helix.

Last year, Harmon pleaded guilty to a money laundering conspiracy charge in U.S. District Court for the District of Columbia. He has not been sentenced.

Charles Flood of Houston’s Flood & Flood, a lawyer for Harmon in the criminal case, did not immediately reply to a message seeking comment on Thursday.

In court filings in the criminal case, Flood said “Harmon never set out to break the law and if he had known in 2014 that operating a bitcoin tumbler was illegal, he never would have done it.”

A spokesman for the U.S. Attorney’s Office for the District of Columbia declined to comment. A representative from FinCEN did not immediately respond to a message seeking comment.

In a statement in 2020, FinCEN said its “investigation demonstrated that Mr. Harmon deliberately disregarded his obligations under the BSA and implemented practices that allowed Helix to circumvent the BSA’s requirements.”

FinCEN said Harmon failed to “collect and verify customer names, addresses, and other identifiers” on more than 1.2 million bitcoin transactions from June 2014 to December 2017 valued at the time at $300 million.

In the criminal case, Harmon agreed to a $311,000 restitution order, court records show. The authorities seized various bitcoin “wallets” from Harmon as part of the criminal investigation.

Harmon’s sentencing was deferred, pending cooperation with the U.S. that the government said last month “remains active and ongoing.”

Operated by Banyan Collective, Near Hacks successfully debuted in Lisbon, bringing together 18 builders and founders on Near Protocol under one roof. The Near Hacks Founders House by Supermoon Camp boasted a space for collaboration and creativity, while guests shared impressive projects and ideas.

Guests enjoyed the full Nearcon experience, with top panels and interviews alongside Supermoon gatherings. Supermoon Station, Supermoon’s media arm, met with the guests of Near Hacks House and Nearcon participants for a series of interviews uncovering the latest projects in the Web3 space.

As a part of the Near Hacks Founders House experience, Supermoon Station interviewed builders and founders from the Near ecosystem, including Alejandro Betancourt from Metapool, Robert Chen and Alex Donn from Ottersec, Mitchell Gildenberg from Switchboard, Odyssey co-founders Edward Bramanti and Parker Allen, Seung Hyun Lee from Coineasy, Kevin Mazi from Near Africa’s regional hub, Chad Ostrowski from Aha Labs and Luke Devern from Invoker Labs.

A few special guests attended Nearcon as well, including Nearverse founder William Bear and Baron Davis, a former NBA player who works on applications in the Web3 space.

The series of interviews culminated in a chat with Cameron Dennis, founder of the Banyan Collective, who shared the importance of fostering spaces for Web3 founders to organically connect: “The positive potential of decentralized ecosystems is undeniable. However, decentralization can lack coordination to scale long-term. Through the Near Hacks Founders House, we are starting to create the information highways for key players in the Near ecosystem to multiply their growth and win with other change-makers.”

Near Hacks runs hacker houses and hackathons to promote Near-native project development in the United States. Builders on Near can expect curated spaces to collaborate and learn, scaling their projects from MVP to seed and beyond. Near Hacks is operated by Banyan Collective, a grant recipient of the Near Foundation with the goal of providing Ecosystem-as-a-Service to Near-native projects and businesses. Follow Near Hacks on Twitter to learn more about its U.S. tour.

Powered by the Supermoon Camp team, Supermoon Camp organizes high-impact events with elevated networking experiences for talented professionals, founders and builders from different ecosystems with a mission to elevate the Web3 space.

Socials

The U.S. Treasury Department said on Tuesday that cryptocurrency exchange Bittrex Inc had agreed to pay $29 mln in fines for “apparent violations” of sanctions on certain countries and anti-money laundering law.

The Treasury Department’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN) had levied fines of about $24 million and $29 million, respectively, on Bittrex.

But according to terms of the settlement, FinCEN would transfer $24 million to OFAC after it receives its $29-million payment from Bittrex, as some of the violations stem from the “same underlying conduct” as the OFAC investigation.

Effectively, Bittrex will have to pay a penalty of about $29 million.

Bittrex failed to prevent people located in the sanctioned jurisdictions of Ukraine’s Crimea region, Cuba, Iran, Sudan and Syria from using its platform between March 2014 and December 2017, according to OFAC.

FinCEN said its investigation found that from February 2014 through December 2018, Bittrex did not maintain an effective anti-money laundering program.

“Bittrex’s AML program failed to appropriately address the risks associated with the products and services it offered, including anonymity-enhanced cryptocurrencies,” it added.

Cryptocurrencies and other digital assets have soared in popularity over recent years and are getting increasingly intertwined with the regulated financial system, saddling policymakers with monitoring risks in a largely unregulated sector.

Bittrex in an emailed statement to Reuters said it was “pleased to have fully resolved” the matter with OFAC and FinCEN on mutually agreeable terms.

A growing number of funds are betting on the long-term appeal of bitcoin and ether, a gritty gambit in the depths of a crypto winter.

Unfazed by a collapse in prices over the past 11 months, investment firms have unleashed a flurry of exchange-traded funds, anticipating that elite cryptocurrencies and their underlying technology will eventually prevail.

Of more than 180 total active crypto exchange traded products (ETPs) and trust products globally, half have launched since the bitcoin bear market started, Morgan Stanley said in a note published this month. The proliferation came even as the total value of assets in the market slumped 70% to $24 billion in that period as crypto prices tanked.

About 95% of those 180 funds are focused on the top two coins, bitcoin and ether, Morgan Stanley said.

“Naturally when the market is slower, prices are lower, people have lost money, the intensity of the appetite does diminish,” said Chen Arad, co-founder of crypto risk monitoring firm Solidus Labs. “But it’s not the case in the long run. As a whole, I don’t think anyone is giving up.”

The attraction of ETPs is that they provide exposure to digital assets on a regulated stock exchange, so retail and institutional investors don’t have to worry about securely storing their crypto and eluding hacks and heists.

In terms of money, cryptocurrency investment products have attracted about $453 million in net inflows this year with much of it going into bitcoin and investment vehicles that include the biggest cryptocurrencies, according to a report from digital asset manager Coinshares.

“There is more asset allocation towards baskets that combine the top five or 10 crypto assets by market cap. It’s a flight to quality compared to alternative assets in the crypto industry,” said Eliezer Ndinga, director of research at 21shares.

Other major cryptocurrencies include solana, cardano and ripple .

Most active crypto ETP products are registered outside the United States, though, with Switzerland, Canada, Australia and Brazil racing ahead with spot crypto offerings.

One reason is that U.S. regulators have turned down several applications for spot bitcoin funds, which mirror the cryptocurrency’s price movements tick-by-tick, citing multiple reasons including a lack of surveillance-sharing agreements with regulated markets relating to the spot funds’ underlying assets.

Investors in futures-based funds must often shoulder the additional cost of the futures rollover as contracts approach settlement day, to maintain their position.

Bitcoin has lost 17% in the past three months, while ProShares Bitcoin Strategy’s ETF , which tracks bitcoin futures, has shed about 21%. The world’s largest bitcoin fund, Grayscale Bitcoin Trust (GBTC.PK), is down 34% in the same time.

ProShares Bitcoin Strategy ETF, has seen assets under management (AUM) shrink to just over $600 million as of the end of September, according to Refinitiv Lipper data. At its debut a year ago it pulled in over $1 billion in a matter of days.

At Grayscale’s Bitcoin Trust, the AUM have tumbled to $12.2 billion from over $30 billion at the end of 2021, data from the firm showed.

Will Peck, head of digital assets at WisdomTree, whose spot bitcoin ETF was blocked by U.S. watchdogs last week, said he wasn’t surprised by the decision, but expressed hope that an agreement could be reached.

“I think we’ll ultimately get there. But we’ll be in a holding pattern for the foreseeable future.”