Binance has remained open to unsanctioned Russian nationals following sweeping sanctions from the European Union (EU), a key executive told Cointelegraph on Friday.

Chagri Poyraz, Binance’s recently-appointed global head of sanctions, stated it had blocked several territories involved in the ongoing Ukraine-Russia war such as Donetsk and Luhansk.

Russia is one of Binance’s top ten markets, it noted in 2019.

In his interview, he noted there was “still an active war going on in the region” and that his company would continue to monitor developments with its massive workforce of compliance executives.

Roughly half of its 500 executives work with sanctions control mechanisms such as anti-money laundering and name screening, the report noted. He added Binance had “zero tolerance” for blocked accounts due to targeted sanctions directed at specific people or entities.

What are the Latest Sanctions?

He stated that EU sanctions were the “hardest part” and lacked clarity, namely after the bloc launched its eighth sanctions package. The firm claims it reached “no particular dialogue” with EU regulators.

Speaking further, he said: “We do obviously follow all the EU sanctions, but there is room for improvement when it comes to clarity. […] We are trying to follow sanctions as they are. The challenge is not overdoing, doing what you’ve been told. The regulation has to be clear.”

He added the lack of clarity over EU sanctions on Russia was an “industry problem” rather than solely with Binance. The EU’s sweeping restrictions in October ban “all crypto-asset wallet, account, or custody services, irrespective of the amount of the wallet.”

The news comes after platforms like Crypto.com, Blockchain.com, and LocalBitcoins informed users in October they would halt services across Russia after the EU imposed the sanctions.

The EU recently capped Russian crypto investments at 10,000 Euros, but the new regulations now ban “IT consultancy, legal advisory, architecture and engineering services.” Such measures aim to hit Russia’s dependence on importing foreign services amid the ongoing conflict, an EU spokesperson wrote.

Ethereum (ETH) has hit new liquidation highs, revealing the bearish nature of the ongoing cryptocurrency crisis, figures from CryptoQuant revealed this week.

The on-chain analytics platform found that short liquidations in USD had reached $500 million in just two days, shattering the market and leading to significant losses for traders.

Despite this, ETH/USAD climbed from $1,337 to $1,593 on Bitstamp, data from TradingView showed from 25-26 October. Markets were hit with both BTC and ETH shorts, triggering macro lows across platforms.

1) Total Liquidations

— BlackSwan DAO (@DAOblackswan) October 26, 2022

The number of liquidations of Short and long BTC positions jumped to 550M dollars in the last 24 hours.

If we add other coins to Bitcoin, then in total over 1.1 billion positions were liquidated in 24 hours! 🔥#Bitcoin #volatility #Liquidation #crypto pic.twitter.com/T0uc3jFxvw

Figures show that liquidations erased $275 million and $250 million USD on the 25 and 26, respectively, wiping out over half a billion in positions by the week’s end.

CryptoQuant Chief Executive Ki Young Ju said in a statement: “$ETH short squeezes for the last two consecutive days. Daily short liquidations across all exchanges reached an all-time high.”

The news comes after exchange platform FTX noted the event was the single largest liquidation in its history. Binance followed shortly after with $57.58 million and OKX reported a $46.72 million change.

A new report has found that the ongoing cryptocurrency crash has set record lows in average daily aggregate product volumes across digital assets.

CryptoCompare published the findings on Thursday, where it noted that global crypto products had plummeted 34.1 percent in average daily trading volumes in October, or $61.3 million USD.

/2 Despite this, average daily trading volumes of #crypto products fell 34.1% to $61.3mn – the lowest-ever volume reported (data tracked since June 2020).

— CryptoCompare (@CryptoCompare) October 27, 2022

Click below for the full Digital Asset Management Review report!https://t.co/s1cgGQTPWM

Currently, Bitcoin (BTC) sits just above $20,000, the benchmark health indicator for the coin following a heavy crash in June that plunged its value to $17,600.

Products featured in the report faced similar declines up to 77.5 percent, indicating a major fall in daily trading. October was one of the worst-performing months for crypto trading since September 2020, where volumes fell below $100 million USD.

Conversely, total assets under management (AUM) climbed 1.76 percent to $22.9 billion USD compared to the month before. AUM for trust products jumped 2.34 percent, or $17.7 billion, with exchange-trade funds (ETF)-linked AUM dropped 1.59 percent at $2.21 billion.

The report also mentioned that Valour’s Bitcoin product remained the highest-traded Ethereum Classic (ETC) despite the ongoing plunge in volumes across the market. Other products such as XBT Provider’s Ether (ETHONE) also recorded heavy losses at 54.7 percent, or $1.38 million, the report found.

A South Korean businessman may face up to eight years imprisonment for his alleged role in a cryptocurrency fraud scandal totalling $70 million USD, reports found on Wednesday.

Lee Jung-Hoon, former Bithumb chairman, has been charged with scamming cryptocurrency investors of roughly 70 million USD (100 billion won) from the chairman of the BK Group, Kim Byung Gun.

According to Yonhap News Agency, prosecutors involved in the case have asked the Seoul District Court to sentence Lee on 25 October, with a further hearing on 20 December.

Kim was chairman of the cosmetic surgery conglomerate in October 2018 and planned at the time to buy out the cryptocurrency exchange platform.

Kim alleges he transferred the $70 million to Lee for a “down payment” for the exchange, providing Lee listed the BXA token from the Blockchain Exchange Alliance formed.

Local prosecutors asked the 34th Criminal Settlement Section of the Seoul District Court for the sentence on Oct. 25, with a hearing to take place on Dec. 20, according to a report from Yonhap News Agency.

Bithumb never listed the token, causing the deal to fall through.

Responding, Lee Jung-Hoon’s lawyer stated the deal’s structure was a “typical stock sale contract” and had been carried out as needed according to the normal procedures for the contract.

Lee added in a final statement he was “very sorry for making it difficult for employees and causing social pressure,” just weeks after failing to join a parliamentary hearing on 6 October.

He stated he failed to show up for the meeting involving the $40 billion collapse of Terra Luna due to having a panic disorder.

Bybit Buyouts

The news comes just a day after Bybit, a Dubai-based cryptocurrency exchange, invested $3.8 million in the third-largest shareholder of the South Korean platform, T-Scientific, media reports found.

T-Scientific issued the 16 billion won of convertible debt at the end of September, allowing the firm to leverage its debt on interest, convertible to equity with stipulations.

The recent acquisition of debt will allow Bybit potentially a massive stake in the South Korean crypto platform with trading volumes of $239 million USD.

In late July, cryptocurrency trading platform FTX also entered talks with Bithumb to discuss acquiring the latter, Bloomberg reported, citing anonymous sources.

Both Bithumb and FTX spokespeople could not confirm the talks, the report added. Bloomberg based the report, which stated that the discussions have been underway for months, on an unnamed source.

The buyout comes as Sam Bankman-Fried, FTX co-founder, aims to buy out Bithumb to gain access to capital used for further acquisitions, it concluded.

A popular cryptocurrency analyst has recently claimed that Bitcoin could reach $100,000 in 2023, but would face a huge bear market afterwards.

Credible Crypto wrote in a Twitter thread that BTC could potentially halve sometime next year to roughly $10,000, becoming a major struggle for the leading cryptocurrency.

The analyst believes Bitcoin would settle from its “blow-off top” all-time high (ATH) to figures below its low of $17,600 this year, reaching around $10,000 up to 2025.

He agreed with Mr Parabullic, stating investors would face “the largest bear market we have seen yet that is worse than the current one in both time and price” which would take it “to the 10-14k” mark.

Agreed, probably in 2025 methinks. First, new ATH in 2023- blow-off top 5th wave above 100k- followed by the largest bear market we have seen yet that is worse than the current one in both time and price- taking us to the 10-14k that everyone is waiting for now. $BTC https://t.co/bv0jvzOG2A

— CrediBULL Crypto (@CredibleCrypto) October 21, 2022

IncomeSharks, another analyst, stated the rally would follow the “final Facebook adoption cycle” where “everyone and their parents and grandma finally buy after they’ve been skeptical [all] year.”

I call this the final Facebook adoption cycle. When everyone and their parents and grandma finally buy after they’ve been skeptical al year.

— IncomeSharks (@IncomeSharks) October 21, 2022

DecenTrader co-founder Filbfilb initially estimated $10,000, while Capo of Crypto speculated a return to $14,000-16,000 after a potential relief bounce of $21,000.

The Great Bitcoin Buyout

The developments come just hours after investors triggered a massive purchasing rush of 55,000 Bitcoin on the Binance exchange, following the coin’s return to $20,000.

Analyst Michael Wrubel said that he had seen “derivatives platform outflows now setting multi-month records.”

55,000 #Bitcoin (approximately $1.1 billion) were just withdrawn from #Binance.

— Michael Wrubel (@michaelwrub) October 27, 2022

This is a record high and we are seeing derivatives platform outflows now setting multi-month records.

I’m bullish. pic.twitter.com/jDgXCiuXCX

“I’m bullish,” he concluded, hinting at further potential instability in the market.

The purchase was the largest outflow in the platform’s history, topping its nosedive to $17,600 in June and the coin crash in March 2020, according to reports.

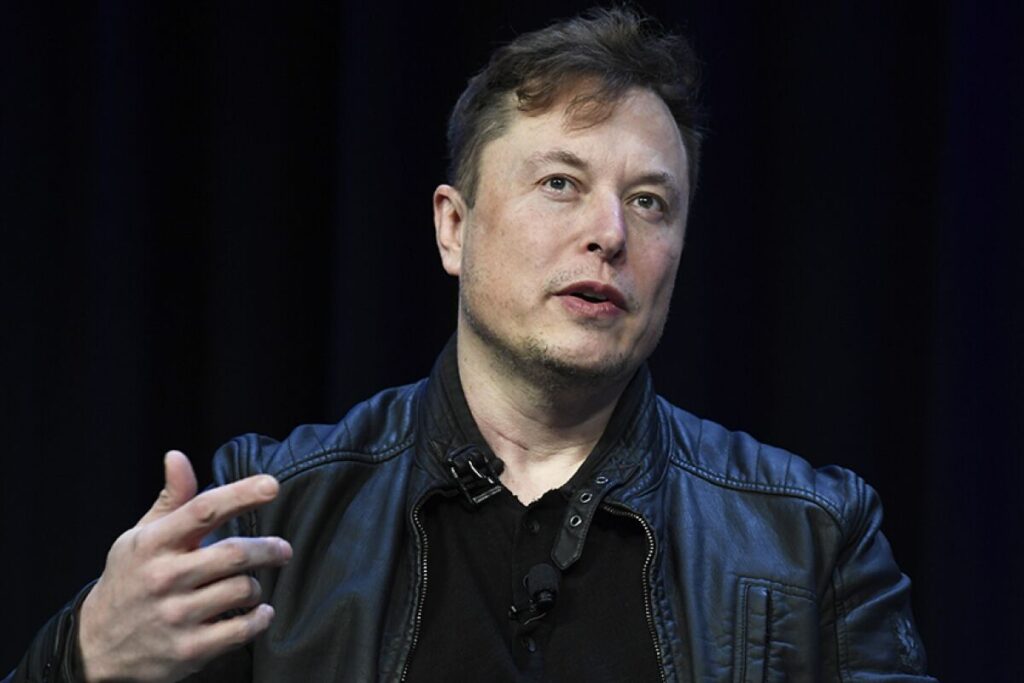

Tesla and SpaceX founder and Chief Executive Elon Musk officially acquired Twitter on Thursday following a series of court battles, memes, and terminations.

The $44 billion USD deal comes as Musk bought out the social media giant for $54.2 per share, following his successful bid on 11 April this year.

Musk also took the company private and delisted it from the New York Stock Exchange to remove it from public shareholders, the first time since it was listed in 2013.

To be super clear, we have not yet made any changes to Twitter’s content moderation policies https://t.co/k4guTsXOIu

— Elon Musk (@elonmusk) October 29, 2022

The NYSE mentioned Twitter will no longer be a public company and that the exchange would freeze its shares on 28 October, along with several trading platforms.

Public listing provides regulatory scrutiny, a key advantage following numerous rows the billionaire has faced with the Securities and Exchange Commission (SEC) in recent years over Twitter posts.

Conversely, Twitter as a private firm will allow it to avoid public oversight as it no longer needs to disclose quarterly reports.

Musk also ordered Twitter employees to print up to 60 pages of code from the platform for further evaluation, following his requests in recent months.

Why Musk Is Taking Twitter

The news comes as Musk, 51, aims to drastically restructure the social media platform by slashing key positions and hiring executives to lead the company’s new direction.

Speculators also believe the measures will allow for more free speech and less censorship under the new board’s leadership, which may entice a fresh user base to join the platform.

According to the New York Times, the company has struggled to grow its advertising operations and attract new users, triggering sweeping measures after he purchased the firm. Musk has dismissed several executives from the San Francisco-based firm, including CEO Parag Agrawal, general counsel Sean Edgett, chief financial officer Ned Segal, and legal and policy executive Vijaya Gadde.

The Twitter executives who were fired on Thursday include Parag Agrawal, the chief executive; Ned Segal, the chief financial officer; Vijaya Gadde, the top legal and policy executive; and Sean Edgett, the general counsel, said two people with knowledge of the matter. At least one of the executives who was fired was escorted out of Twitter’s office, they said.

Downing Street continued its drive for its Financial Services and Markets Bill on Tuesday to ink its position on using cryptocurrencies such as Bitcoin, following a crucial vote in the House of Commons in favour of the bill.

Commons scrutinised the legislation at the time to determine amendment and determine its value in post-Brexit Britain’s economic strategy.

The Bill is one of Rishi Sunak’s first successes as Prime Minister of the UK following the resignation of former PM Liz Truss, and aims to incorporate digital assets under the Financial Services and Markets Act 2000, which regulates financial activities unauthorised by the Government.

What’s in the Bill?

The bill advocates using “digital settlement assets” along with numerous measures “to maintain and enhance the UK’s position as a global leader in financial services,” it said.

Doing so would allow the UK to reach its goal of becoming a major hub for cryptocurrencies by implementing digital settlement assets (DSAs) rather than “crypto assets.”

According to the Government, the change in definition comes as it states crypto assets use “some form of distributed ledger technology (DLT)” compared to DSAs and stablecoins, which have greater potential to “develop into a widespread means of payment.”

Downing Street stated it would launch a “package of measures” to improve governance of cryptocurrencies, months after Rishi Sunak, then-Chancellor of the Exchequers at the time, backed digital monies after creating a Royal Mint non-fungible token (NFT) under the Johnson Administration.

As Prime Minister of the UK, he continues his push for cryptocurrency acceptance, namely central bank digital currencies (CBDCs).

Despite this, the bill must still face the House of Lords before receiving royal ascent under King Charles III.

The recognition of crypto and digital assets as financial instruments is yet to be scribed into law. The bill must pass crucial steps: The House of Lords will be required to approve or amend the bill before final royal approval by the new monarch, King Charles III.

ConsenSys, the parent company of MetaMask, announced on Wednesday it will fund $2.4 million for a MetaMask Grants decentralised autonomous organisation (DAO) to develop Web3 solutions.

MetaMask employees will lead the 12-month-long project and manage the DAO for Web3 developers outside the company’s workforce. The funding will finance solutions built for MetaMask’s ecosystem and the global Web3 market, reports show.

The DAO will receive and process proposals and votes via the SnapShot feature of its Codefi Activate platform, with the New York City-based firm pledging $600,000 each quarter to back Web3 across sectors.

Three Faces of Consensys DAO

According to the DAO, it will focus on three primary components:

- Employee-led DAO for more than 900 full-time ConsenSys employees, who can become a Grants DAO member with equal voting rights.

- Leadership Committee (mini-DAO) consisting of seven people that seek out projects with high potential, write governance proposals, develop other content, and receive feedback.

- Multisignature wallets, which ConsenSys supervises, operates the treasury and token contract. It also signs off on transactions for dispersing funds and mints tokens for new and past employees.

Additionally, the Leadership Committee of the DAO will consist of the Co-Founders of MetaMask along with its global product and extensibility leads, its senior DAO strategist. It will also include the directors of strategic initiatives and product management for ConsenSys.

MetaMask, Sardine Fiat-to-Crypto Integration

The news comes after MetaMask integrated new technologies from fintech company Sardine earlier in October to convert fiat monies to cryptocurrencies.

This will allow users to instantly transfer fiat currencies to their crypto wallets rather than using typical banking mechanisms or traditional transfers.

Sardine, an instant fiat and cryptocurrency settlement platform, boasts strict “compliance and fraud prevention infrastructure” used for crypto trading platforms like “FTX, MoonPay, Blockchain, and Autograph,” the company wrote in a blog post on 11 October.

Mara, a digital financial ecosystem project, is set to back 2 million potential users in Nigeria with a new cryptocurrency wallet.

It will provide users with crypto brokerage services via an app for buying, selling, and transferring both cryptocurrencies and fiat money. Using the app, people can also receive education on personal wealth management and cryptocurrencies, the company added.

Major companies such as Coinbase Ventures and Alameda Research support the initiative, which offers users to use the platform via an invitation-only onboarding process, which kicked off on Wednesday.

The project, currently valued at $23 million after fundraising from the two backing firms, Huobi, and others, will also take on users from Kenya and Ghana in due course.

Hello folks,👋

— GDG Nairobi #DevFestNairobi (@GDG_Nairobi) October 13, 2022

We are thrilled to announce the Web 3 Developer Roadshow brought to you by Mara Foundation & Circle, happening across Nigeria & Kenya.

The show will include hands-on workshops, panel sessions, talks on blockchain & much more 🤩

Link: https://t.co/BMcGiC6S4L pic.twitter.com/7b4dgJEAwj

Mara also plans to work with Google Developer Group’s Nairobi branch for a Web3 Developer Roadshow set to take place on 29 October, complete with workshops, panel talks, and discussions on emerging tech.

What is the Mara Foundation?

The Mara Foundation is a designated nonprofit aiming to support the sustainable development of blockchain use cases across the African continent, partnered with USD Coin (USDC), with Circle and Euro Coin (EUROC) facilitating the adoption of stablecoins.

The news comes as Mara targets one million developers in Africa for training with an initial “Hack the Mara” hackathon in September to build development systems for Kenya’s Maasai communities and conservation projects for the Maasai Mara, a massive wildlife reserve in the East African nation.

Some throwback pictures from our successful ‘Hack the Mara’ hackathon in Nairobi last month.#throwbackthursday pic.twitter.com/JcyH0WkWCM

— Chi Nnadi (@chi_maraverse) October 20, 2022

The hackathon awarded three of 24 teams with shares of $100,000 in prizes along with a further accelerator programme for developing products and solutions.

The organisation also opened a Mara Academy for free education initiatives for Web3 and blockchain technologies, offering certification to mentor other aspiring developers for the programme.

Bitcoin (BTC) rallied to $20,745 per coin on Wednesday, reaching its highest level since September, a jump of roughly 7 percent in 24 hours.

A massive liquidation of shorts of the cryptocurrency king, totalling $550 million USD, triggered BTC price spikes. Traders liquidated a total of $704 million in shorts on Tuesday, with Wednesday reaching an additional $275 million, Coinglass found.

Many crypto analysts took to social media to express their excitement about the latest liquidation.

Social Media Raves about Bitcoin

Trade analyst, investor, and trader Titans of Crypto stated that the two-weekly chart showed bullish trends, citing the relative strength index (RSI) had crossed the long-term trend line and 14 simple moving average (SMA).

“The combo is playing right now. We’ll have to wait till the 7th November for confirmation,” the user said.

#Bitcoin Bullish Combo Signal (2W)

On the 2 weekly chart :

1/ RSI crosses the long term trend line.

2/ RSI crosses the 14 SMA.The combo is playing right now.

We’ll have to wait till the 7th November for confirmation. pic.twitter.com/rCYt4bi6jG— Titan of Crypto (@Washigorira) October 26, 2022

Crypto analyst Josh also found evidence of the long-term bullish trend, stating Bitcoin had broken out of its downward trend and formed a bullish divergence, or a chart pattern where prices fall to lower lows but technical indicators reach higher lows, revealing strengthening market forces.

#Bitcoin breakout + bullish divergence. #BTC 👀 pic.twitter.com/12MhrvbkU8

— Josh (@CryptoWorldJosh) October 26, 2022

Cauê Oliveira, lead on-chain analyst for Brazilian media outlet Block Trends, stated the liquidation event at FTX was the largest “in its entire history.”

Yesterday we had the biggest shorts liquidations event at FTX in its entire history! 🚨

High leverage market pushes bears into the worst liquidation event of this bear, even with a price change of only +/- 5%.#Bitcoin pic.twitter.com/2I9yFO6Hq9

— Cauê Oliveira 💊⚡ (@caueconomy) October 26, 2022

Key figures from Coinglass revealed that over $1 billion in liquidations took place on Tuesday, with Bitcoin and Ethereum posting $500 million and $476 million, respectively. FTX held the highest number of liquidations totalling $862 million, 77 percent of which were shorts.