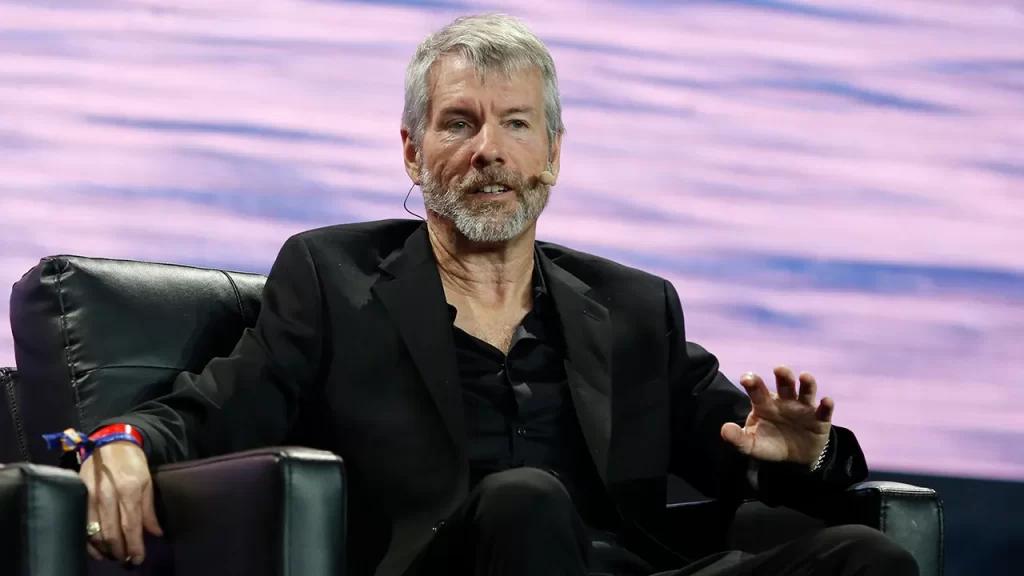

MicroStrategy, a software analytics firm based in the United States, recently acquired more Bitcoin (BTC) holdings, triggering mixed reactions from social media.

Company executive chairman Michael Saylor tweeted recently that his business had bought more Bitcoin, with its total holdings reaching 132,500 BTC at $4.03 billion at the time of purchase.

MicroStrategy has increased its #Bitcoin Holdings by ~2,500 #BTC. As of 12/27/22 @MicroStrategy holds ~132,500 bitcoin acquired for ~$4.03 billion at an average price of ~$30,397 per bitcoin. $MSTRhttps://t.co/lcMeULcGQk

— Michael Saylor⚡️ (@saylor) December 28, 2022

Its total holdings plummeted to just $2.1 billion to date, sparking discussions on Twitter.

While some praised him as a “rock star,” others stated Bitcoin backers should not celebrate the extra purchase as it could centralise ownership of the cryptocurrency.

Massive Bitcoin Sale Strategy?

The news comes after a recent sale of its Bitcoin holdings on Thursday, revealing further scrutiny from Bitcoin supporters. In a Yahoo! Finance analysis, the executive cited tax purposes for the sale.

He said at the time: “I think that this is going to be really helpful for Bitcoin because this is an educational moment. And people are realizing the benefits of buying a crypto asset that’s backed by the world’s most powerful computing network and by 10 gigawatts of energy and the difference between that and the 20,000 other cryptos that are, in essence, backed by nothing, and they’re just like other fiat currencies”

According to Yahoo!’s David Hollerith, MicroStrategy had launched a tax loss harvesting strategy by buying Bitcoin and later partially selling it. This allows it to use the losses at the middle selling period to hedge against capital gains taxes for the current fiscal tax year.

Recently, Saylor also stated his firm planned to adopt the Lightning Network in 2023, adding it was searching for software solutions to facilitate the measures.

The Lightning Network is a Layer-2 feature that helps boost Bitcoin capacity and faster transaction rates at scale. Exchanges such as CoinCorner and Bitnob adopted the Lightning Network in mid-December to facilitate cryptocurrency transactions and global remittances for African users.

Bitcoin enthusiasts have seen the cryptocurrency’s network hash rates recover to normal levels following a massive cold snap across the United States.

Due to the adverse weather, US power grids faced disruptive strains, forcing hash rates to dip temporarily. The country battled sub-zero temperatures, killing more than 28 people.

Bitcoin’s hash rate fell from up to 300 exahashes per second (EH/s) to around 170.60 EH/s on Christmas Day (25 December). It returned the following day to 241.29 EH/s, Blockchain.com data found.

Bitcoin (BTC) mining operations in Texas, where much of the nation’s hash rate takes place, temporarily halted or slowed to help with power shortages.

Bitcoin Capitals of the World

Texas is one of the leading producers of Bitcoin hash rates and is now one of the largest places in the world for Bitcoin mining.

As with many locations, power grid operations must accommodate the huge power consumption rates of BTC mining industries. Locations dependant on such sectors can affect global markets if hash rates slide due to power consumption problems or grid instability.

Data from Sunbird DCIM shows that countries with the largest Bitcoin hash rates include Dalian, China, the Genesis Mining Farm in Reykjavik, Iceland, Moscow, Russia, the GigaWatt Factory in Washington State, US, Linthal, Switzerland, and the Bitfury crypto facility in Amsterdam, Netherlands.

The top four locations produce 360,000 terahertz, 1,000 gigahertz, 38 petahertz, 1.3 petahertz, respectively.

The report also found that 65 percent of all BTC hash rates come from China. Firms such as Beowulf Mining aim to boost crypto mining capacities to 500 megawatts by 2025.

Binance, the world’s largest cryptocurrency exchange platform, has hit back at critics it claims have spread fear, uncertainty, and doubt (FUD) over its operations in a recent blog post.

In the post, it addressed seven key issues as it remains under severe scrutiny due to what it states are accusers that would like to see the exchange fail.

It aimed to firstly explain concerns over the stablecoin USD Coin (USDC), which was suspended earlier in December. A spokesperson from Binance said it wanted to consolidate all stablecoins to the ones with the most liquidity, including its native Binance USD (BUSD).

It also responded to claims it did not have sufficient liquidity to allow users to continue withdrawals.

According to the Chinese firm, Binance kept sufficient reserves between 12 and 14 December, with net withdrawals topping $6 billion at the time.

In a subsequent audit, CryptoQuant later confirmed Binance reserves were roughly 99 percent accurate. The latter confirmed it had entered talks with firms to provide services to verify reserves, adding that the world’s Big Four—Deloitte, KPMG, Ernst and Young (EY), and PricewaterhouseCoopers (PwC)–could not properly audit encrypted company reserves.

According to Binance’s fourth counterpoint, it addressed why it provided just Bitcoin (BTC) verification, stating it “takes the most cautious attitude towards” work involving user assets.

Due to the massive number of currencies, volumes, teams, and reserves needed to conduct verification processes, it needed to carefully conduct such verifications. The company added it did not have to disclose financial information as it was a private firm.

It also added: “Binance does not need to disclose detailed financial status for two reasons: First, listed companies must disclose company financial details to their investors, but Binance is a private company, not a listed company; second, Binance is financially healthy [and] self-sufficient, [has] no external financing needs and external investors, and no intention to go public at this stage.”

Citing a Reuters report, it stated in its sixth counterargument that mainstream media sources stated “ambiguities” and accused readers of only seeing “eye-catching headlines.”

It assured that it had the world’s largest number of approvals and licences, and aimed to tackle crime, responding to over 47,000 requests from law enforcement agencies since last year.

2 “FTX was killed by xyz (ie, a 3rd party)”

— CZ 🔶 Binance (@cz_binance) December 6, 2022

No, FTX killed themselves (and their users) because they stole billions of dollars of user funds. Period.

Concluding, Binance hit back at firms claiming it had “destroyed FTX,” stating the latter had “destroyed itself” due to misappropriation of user assets, citing a 6 December tweet from company chief executive Changpeng Zhao (CZ).

It said: Binance will not regard other exchanges as ‘competitors’. The current industry touches less than 6% of the population. We are more focused on continuously promoting and expanding industry adoption. We also hope to see more exchanges, blockchain, Wallet, etc. coexist in this ecosystem, so that more people can enter the field of blockchain cryptocurrency, without spending time and resources on any unhealthy ‘competition’ within the existing scope.”

A key United States Securities and Exchange Commission (SEC) official has cautioned investors to avoid fully trusting claims of proof-of-reserves (PoR) from global centralised crypto firms.

Paul Munter, SEC acting chief accountant, said in a Wall Street Journal interview that investors should remain “very wary of some of the claims that are being made by crypto companies.”

Munter added ongoing audits did not indicate companies were in a sound financial position, stating, “Investors should not place too much confidence in the mere fact a company says it’s got a proof-of-reserves from an audit firm.”

He continued that PoR lacked sufficient information to allow stakeholders to determine if companies held enough assets to cover liabilities.

The news comes as numerous crypto companies, including Binance, Crypto.com, and Kraken, among others, have offered to show customers their PoR data amid the ongoing FTX collapse.

The measures aim to ease fears of further bankruptcies and ensure customers of financial liquidity.

Crypto! From @SECGov Acting Chief Accountant Paul Munter. "Every time I think I've gotten my arms around the latest crypto structure, staff comes in and explains a new one to me that makes my head spin." #AICPASEC

— Nicola M. White (@nicola_m_white) December 12, 2022

The news comes after Munster voiced concerns over cryptocurrency platforms at a recent conference in the US Capitol in mid-December.

In the subsequent WSJ article, he stated that, should the SEC find additional patterns in the industry, it could escalate matters with law enforcement agencies.

Binance’s “proof of reserve” report doesn’t address effectiveness of internal financial controls, doesn’t express an opinion or assurance conclusion and doesn’t vouch for the numbers. I worked at SEC Enforcement for 18+ yrs. This is how I define “red flag. https://t.co/6oEqmArjS9

— John Reed Stark (@JohnReedStark) December 11, 2022

Earlier claims from former SEC Internet Enforcement chief John Reed Stark accused Binance of failing to address internal financial controls over its proof-of-reserves.

The news comes after three key crypto exchanges—Celsius, Three Capital Arrows, and FTX—have filed for administration in their respective markets over severe liquidity crunches triggering bank runs, among other problems.

As some people face account lock-outs from their banks, some have turned to Bitcoin and other cryptocurrencies to receive their salaries.

One such Bitcoin enthusiast, SVN, received his entire salary in Bitcoin for 2022, paid in fortnightly instalments.

In a Twitter thread, he stated that he used Coinbase’s direct deposit method, then migrated to Bitwage, Cash App, where his company paid him directly in cryptocurrency.

Took my entire salary in #Bitcoin this year. 100% net wage paid bi-weekly.

— svn ⚡️ (@rarepassenger) December 20, 2022

Started off with Coinbase direct deposit, migrated to Bitwage, Cash App, then got the company to pay me directly.

He stated direct deposit services were “simple and straightforward” from then.

He said: “Payment would go direct to wallet. Would send a % straight to cold storage for saving, the rest would use as needed.”

Explaining further, he stated the benefits of receiving his yearly wage in Bitcoin was that “accountants didn’t need to know [Bitcoin]” and that tax reporting was “easy.”

Conversely, he stated Know Your Customer (KYC) coins were a challenge.

Continuing, he said: “Getting the company to pay direct was a better experience. Because I was taking 100% net every other week, it required the business to change strategies for accumulation and earning.”

On the positive, he did not have to use KYC and was paid directly to his wallet. Despite this, he faced an “accounting nightmare.”

Getting the company to pay direct was a better experience. Because I was taking 100% net every other week, it required the business to change strategies for accumulation and earning.

— svn ⚡️ (@rarepassenger) December 20, 2022

Benefits:

Non-KYC coin

Direct to wallet

Cons:

Accounting nightmare

SVN added that obstacles to receiving his coins were transition tracking, with several wallets such as Sparrow Wallet and Mobile LN wallets offering separate transaction record-keeping.

Concluding, he wrapped up his analysis of a year’s worth of Bitcoin salaries, stating,

“Anyway, a whole year of accepting #BTC as pay has been interesting. Some days there’s a gain, some days a loss, other days neutral. It makes you take care of responsibilities faster, purchases are more considerable during drops and builds time horizon. Savings increases too.”

Anyway, a whole year of accepting #BTC as pay has been interesting.

— svn ⚡️ (@rarepassenger) December 20, 2022

Some days there’s a gain, some days a loss, other days neutral.

It makes you take care of responsibilities faster, purchases are more considerable during drops and builds time horizon. Savings increases too.

He added he would do things differently such as using less “off-ramps” or avoid automatic clearing house (ACH) payments, which conduct transactions between banks and credit unions.

Finally, he recommended using stablecoins more than other cryptocurrencies.

He concluded: “Haven’t had ANY banking issues considering I don’t have a bank account anymore. Would I go back? No. I really love the freedom having custody of my [hard-earned] funds feels.”

The United Kingdom has categorised “designated crypto assets” for Investment Manager Exemption (IME) for the 2022-2023 fiscal tax year.

Commissioners for His Majesty’s Revenue and Customs (HMRC) have enacted the legislation which lawmakers announced in April this year. The tax body of the UK government passed the new regulation this week, which will enter force on 1 January next year.

While the government has not defined “designated crypto assets,” the new regulations refer to “investment transactions” cited in Section Two of the Investment Transactions (Tax) Regulations 2014.

IME allows the UK to boost its status as a financial hub and allows non-UK investors residing in the country the right to select British investment managers. The latter can conduct some investments on their behalf without becoming subject to British taxation rules.

The new IME will place “designated cryptoassets” as stocks, included in Whitehall’s FinTech Sector Strategy in early April.

According to the consultancy paper, the measures,

“will provide certainty of tax treatment to U.K. investment managers and their non-U.K. resident investors who are seeking to include cryptoassets within their portfolios, and we anticipate that this will also encourage new cryptoasset investment management businesses to base themselves in the U.K.”

The news comes as multiple countries recommend financial regulations tighten across their respective governments. Countries such as Israel, South Korea, Australia, and the United States have submitted recommendations linked to the collapse of several key crypto exchanges.

This comes after FTX, one of the world’s largest cryptocurrency exchange platforms, filed for Chapter 11 bankruptcy after mismanaging billions in funding. Bahamian authorities have arrested the company’s former chief executive, Sam Bankman-Fried, who awaits extradition to the United States for his malfeasance.

Alaska is set to launch monetary regulations for virtual currencies starting 1 January next year, reports revealed this week.

According to the Cooley Law Firm, Alaska will force enterprises using virtual currencies to apply for and obtain money transition licences with the state government.

Alaska, the most northwestern state in the United States, changed money transmission regulations to determine the meaning of a “virtual currency.”

State Crypto Rules

The state’s Division of Banking and Securities (DBS) adopted changes to its local Administrative Code, stating: “[Virtual currencies are a] digital representation of value that is used as a medium of exchange, unit of account, or store of value; and is not money, whether or not denominated in money.”

The code will also require individuals “engaging in money transmission activity involving virtual currency” to submit licencing applications to conduct such transactions.

It also defines “permissible investments” and “monetary value,” but states reward programmes and online gaming virtual coins are not included as virtual currencies.”

Agreements Broken

Previously, crypto-linked platforms have received Limited Licensing Agreement (LLA) from Alaska’s DBS, but digital currencies were not included.

Under the current changes, Cooley Law Firm wrote: “As a result of the explicit inclusion of virtual currency activity as money transmission activity requiring a license, the DBS is phasing out the LLA requirement, and LLAs currently in effect will be voided and removed from the Nationwide Multistate Licensing System record on January 1, 2023. It is not clear if the change to the regulations will require current Alaska licensees that engage in virtual currency activity to take any action.”

Other nations such as Israel, Australia, South Korea, and others may require crypto firms to apply for licences under stricter regulations. The news comes amid the ongoing crisis with FTX, which collapsed into administration on 11 November this year, due to fraud and monetary misappropriation.

A key executive from one of the world’s largest cryptocurrency exchanges has backed decentralised protocols, adding open-source code and smart contracts were the “ultimate form of disclosure.”

In a blog post, Coinbase chief executive Brian Armstrong advocated tightening regulations on centralised platforms. He also outlined steps government regulators could take to reinstate trust in the crypto industry amid the ongoing FTX crisis.

In the post, he said:

“Second, smart contracts, which power DeFi and Web3 apps, are public and open source by default. This means anyone can go audit the code to see if it really does what it claims to do. This is the ultimate form of disclosure. Instead of ‘don’t be evil’ [we] can have ‘can’t be evil’, where you can trust the laws of math instead of human beings.”

A List of Recommendations

According to the executive, the industry needed “additional transparency and disclosure” to counter human error and fiscal malfeasance. Armstrong continued that the fall of disgraced crypto exchange FTX would “be the catalyst we need to finally get new legislation passed.”

He added that US lawmakers should pass stablecoin regulations to build standard financial service laws, where regulators could monitor implementing a state trust charter or similar mandate.

Stablecoin issuers should also meet “basic cybersecurity standards” and offer blacklisting [procedures] to comply with global sanctions regimes, he said.

Also, one major bill from US senator Bill Hagarty, the Stablecoin Transparency Act, is set to pass the Senate in the near future. Armstrong recommended targeting crypto exchanges and custodians with federally-sanctioned licencing and registration.

This would take place after Congress passed sufficient stablecoin regulation, according to the CEO. He also urged lawmakers to force the US Securities Exchange Commission (SEC) and the Commodities Future Trading Commission (CFTC) to sort the world’s top 100 crypto coins by market capitalisation and label them as securities or commodities.

Continuing, Armstrong stated: “If asset issuers disagree with the analysis, the courts can settle the edge cases, but this would serve as an important labelled data set for the rest of the industry to follow, as, ultimately, millions of crypto assets will be created.”

Foreign Sources, Domestic Consequences

He also called on regulators to determine how crypto exchanges from foreign sources operated in their respective subsidy branches worldwide.

He said: “If you are a country who is going to publish laws that all cryptocurrency companies need to follow, then you need to enforce them not just domestically but also with companies abroad who are serving your citizens.”

Concluding, Armstrong wrote,

“Don’t take that company’s word for it. Actually go check if they are targeting your citizens while claiming not to […] If you don’t have the authority to prevent that activity […] you will unintentionally be incentivizing companies to serve your country from offshore.”

The news comes as global regulators determine the next steps against cryptocurrencies amid the ongoing bankruptcy and prosecution of FTX and its executives. Currently, Bahamian authorities have detained FTX’s ex-chief executive Sam Bankman-Fried and may extradite him to the US.

Numerous countries, including Australia, South Korea, Israel, the United States, and others have begun developing recommendations for regulating cryptocurrency markets. The plans come amid a volatile bear market, which has seen numerous exchanges collapse due to fraudulent or mishandling of funding.

Stablecoins have gained popularity in the crypto industry despite ongoing market volatility.

A Coin Metrics report found that on-chain stablecoin settlements topped $7 trillion this year and is set to reach $8 trillion by the end of the year.

The donations have continued throughout the year, most recently with the United Nations’ plan to send $USDC to Ukrainians displaced from their homes. #Stablecoins have settled more than $7 trillion in value, a record-breaking value compared to previous years. pic.twitter.com/n81OfNCtWS

— CoinMetrics.io (@coinmetrics) December 20, 2022

Peter Johnson, venture co-head at Brevan Howard Digital, said in a Wednesday tweet that stablecoin settlements had surpassed those from Mastercard and American Express.

Currently, Visa, the largest card platform, processes $12 trillion a year. According to Johnson, on-chain stablecoin volumes would exceed those from Visa.

Despite his observations, others have noted that credit card and stablecoin settlement volumes are completely different. The former involves consumer spending, with the latter involving cryptocurrency trading and decentralised financing.

3/ (Note that this is just on-chain settlement volume, and does not include trading volume on centralized exchanges)

— Peter Johnson (@TheChicagoVC) December 21, 2022

Regulations remain the largest obstacle for stablecoins as they are an emerging technology compared to credit cards.

Some lawmakers in the United States Senate have submitted legislation to allow non-state and non-bank entities to issue stablecoins. Such institutions would need to receive a federal licence from the US Office of the Comptroller of the Currency (OCC) backed by “high-quality liquid assets.”

According to current figures, stablecoins also have a market capitalisation of 16.5 percent of the total market, or roughly $140 billion, with Tether (USDT) consisting of 66.3 billion.

South Korea’s northeastern and second-largest city Busan has announced it would drop most of its cryptocurrency partners on centralised global exchanges. The decision comes after several prominent exchanges and projects – FTX, Terra/Luna, and Voyager – collapsed in recent months.

The coastal city has been named South Korea’s blockchain capital and recently revealed an 18-person steering committee. None of the people sitting on the body were from major centralised platforms, including Binance, Gate.io, Huobi Global, FTX, and Crypto.com.

The steering committee aims to advise government authorities and investors on operating cryptocurrencies along with other digital assets. It also hopes to deepen cooperation for cryptocurrency frameworks and cooperate with foreign entities.

Second Thoughts?

News of FTX’s collapse forced Busan authorities to rethink including centralised exchanges. However, it stated it could proceed with its plans without assistance from outside sources.

According to reports, committee members stated problems with crypto platforms like FTX and others “seem to have influenced [the decision].” Other stated centralised exchanges were never included in city and supported initial liquidity offerings.

The city also plans to outline how it will separate securities and non-securities assets, along with listing and monitoring channels for assets. It established a fund for the initiative in the first half of the year, leading to the city founding a regulation-free zone for blockchain in July 2019.

Efforts to back the initiative increased after telecoms giant Korea Telecom (KT) collaborated with the city to develop infrastructure to support blockchain technologies.