Bitcoin mining is becoming increasingly environmentally friendly and sustainable, with the level of emissions continuously decreasing.

For the first time, the intensity of emissions from Bitcoin mining has fallen below 300g/KWh, marking an all-time low.

Climate technology venture investor and environmental activist Daniel Batten published his observations on May 29th. He highlighted that the Bitcoin network has managed to halve its emission intensity in a little over three years.

He emphasized, “No other industry is achieving such a rapid reduction in its emission intensity.”

Compared to its energy usage, Bitcoin mining now generates fewer greenhouse gases.

The decline in emissions is largely attributed to the use of more sustainable energy sources for Bitcoin mining and the increased efficiency of mining hardware, which contributes to a lower emission intensity.

There has been a noticeable trend of Bitcoin mining operators gravitating towards countries with sustainable energy offerings, like those found in Scandinavia. Jaran Mellerud, a researcher, noted on May 29th that electricity prices in Nordic countries continue to be negative.

Mellerud stated, “Bitcoin miners in Finland and the northern regions of Norway and Sweden continue to be compensated for their electricity consumption.”

However, there is a downside as the Bitcoin network hash rate is nearing its maximum levels, which poses a challenge for miners. As per Blockchain.com data, the total hash rate currently stands at 365 EH/s (exahashes per second).

The network difficulty, a metric determining the competition among miners, is also at its highest level of 49T.

These factors adversely impact profitability, which is currently low. The Hash Rate Index reports that the hash price is at a meager $0.075 per terahash per second per day.

The hash price momentarily peaked to $0.128 amid the memecoin creation frenzy earlier in the month but has since receded. Over the past year, the hash price has experienced a 44% decline due to falling BTC prices and escalating energy costs.

Despite these challenges, Bitcoin prices have seen an uptick today. The cryptocurrency has increased by 3.1%, surpassing $28,000 for the first time in two weeks. However, since mid-March, BTC prices have remained somewhat stagnant.

The U.S. Government is on the brink of suspending its $31.4 trillion debt ceiling, ending months of intense bipartisan negotiations. This news was met with a positive response from Bitcoin and the larger cryptocurrency market. House Speaker Kevin McCarthy stated on May 27 that he and President Biden reached a preliminary agreement he believed merited the approval of the American people.

The main point of contention during negotiations was non-defense domestic spending. Republicans argued for reduced spending to slow U.S. debt accumulation, while Democrats pushed for increased taxes on the wealthy and corporations to shrink the debt. President Biden, presenting the deal as a compromise, underscored its significance in trimming expenditure while preserving vital programs aimed at boosting the economy and supporting the working class.

The standoff over the debt ceiling was feared to potentially trigger a U.S. default, which could result in dire economic consequences. President Biden shared these concerns, warning that such a default could precipitate an economic recession, cause substantial damage to retirement accounts, and lead to significant job losses. The Treasury Department had also cautioned that without this deal, the federal government could potentially default on its obligations by June 5.

The new agreement will suspend the debt limit until January 2025 and limit spending in the 2024 and 2025 budgets. It includes measures to recoup unused COVID funds and introduces additional work requirements for food aid programs, as reported by Reuters.

While the proposed deal has been agreed upon in principle, it must still pass through Congress, requiring cross-party support. As traditional markets were closed, the initial market response was discernible in the cryptocurrency sphere, which witnessed a 1.3% increase.

Bitcoin surged past the $27,000 mark during early trading hours, and other leading digital currencies, including Ethereum, Cardano, BNB, and Dogecoin, also reported gains.

Dubai is advocating for a unified strategy from international regulators to combat cryptocurrency-related crimes, as reported by Bloomberg. Due to the diverse jurisdictions under which cryptocurrencies operate, enhanced collaboration and communication among regulatory authorities is paramount.

Elisabeth Wallace, Associate Director at Dubai’s Financial Service Authority, expressed concern about crypto businesses’ global operations. “Crypto businesses often conduct a multitude of activities under one umbrella, and this worries us. Being distributed worldwide, there’s an urgent need for regulatory bodies to communicate more in this domain. We’ve noticed many exploitative actors taking advantage of these regulatory gaps,” Wallace said.

Keen on establishing itself as a hub for crypto activities, Dubai has been diligently drafting rigorous cryptocurrency regulations. In February, the city introduced guidelines for crypto service providers. Non-compliance could lead to a hefty fine of up to AED 500,000 ($136,165).

On a similar note, the European Union (EU) recently approved the Market in Crypto-Assets (MiCA) laws for cryptocurrency regulation. All 27 EU nations are committed to implementing the MiCA legislation, aiming to seal the systemic loopholes that enable tax evasion.

Parallelly, India’s Finance Minister, Nirmala Sitharaman, has encouraged nations to evolve a uniform policy for crypto regulations. Sitharaman’s call for global policy synchronisation aligns with the increasing emphasis on coordinated international efforts to ensure a safe and legally compliant crypto environment.

Labuan, Malaysia, May 26th, 2023, Chainwire

Cerus Markets is thrilled to announce an exciting update to its leverage options for non-crypto instruments. Effective immediately, Cerus Markets clients can enjoy leverage of up to 400:1 for Forex, Commodities, Indices, and Single Stocks trading.

This increase in leverage options allows traders to make the most of their investments, providing greater market exposure and the potential for higher returns. By offering increased leverage options for non-crypto instruments, Cerus Markets aims to provide clients with even more opportunities to capitalize on market movements.

At Cerus Markets, the company prides itself on its commitment to providing clients with the best possible trading experience. This update is just one example of the company’s dedication to ensuring that clients have access to the best tools and trading conditions.

About Cerus Markets

Established in 2022, Cerus Markets Limited is a multi-asset broker authorized and regulated by the Labuan Financial Service Authority, Malaysia. With a focus on innovation, Cerus offers unique crypto derivative products that allow clients to trade over 200 instruments paired with cryptocurrencies. Alongside crypto derivatives, Cerus provides trading opportunities in FX, Commodities, Indices, and Single Stocks.

Cerus Markets believes in empowering traders of all levels with easy and affordable access to the market. The trading platform stands out from traditional brokers by not charging entry fees and allowing trading of a wide range of digital assets starting from just $50, with leverage up to 400:1.

Moreover, traders can benefit from a 100% deposit matching bonus, doubling the amount of their first deposit and further enhancing their trading experience.

Visit cerusmarkets.com to learn more about Cerus Markets and its offerings.

Instagram l Twitter l Telegram

Contact

Marketing Director at Cerus Markets

Veronica Imasheva

marketing@cerusmarkets.com

The European Systematic Risk Board (ESRB), an EU financial watchdog, is advising restrictions on cryptocurrency leverage to preserve the financial stability of the overall market. Historical precedent suggests that firms often collapse under high-leveraged bets, leading to broader market cash shortages and potential recessions.

The ESRB’s suggestion, as reported by Reuters, primarily targets investment funds, exchanges, and similar entities involved in cryptocurrency trading. High-leveraged trades, even for retail investors, can result in a total loss of initial capital—a phenomenon known as liquidation. Given the high volatility of cryptocurrencies, traders frequently face significant liquidation losses, with a recent 24-hour period seeing over $82 million lost.

“Systemic risks could arise quickly and suddenly,” warned the ESRB. “If the rapid growth trends observed in recent years were to continue, crypto-assets could pose risks to financial stability.” The board’s concerns are not unique; Japan’s Financial Service Agency has already enforced similar limitations, restricting investors from borrowing more than twice their investment amount for leverage trades. This conservative approach may have contributed to FTX’s Japanese entity enabling withdrawals earlier this year.

While the ESRB oversees the broader market and works to mitigate systemic risks, it lacks the direct authority to enforce crypto leverage limitations. Instead, its role is to propose these recommendations for inclusion in future versions of the EU’s Market in Crypto-Assets (MiCA) legislation.

Last week, all 27 EU member states unanimously approved the MiCA rules, slated to take effect from July 2024. With the ESRB’s recommendations, the European Union may see more comprehensive crypto regulations in the near future.

Cryptocurrency analyst Nicholas Merten has come forward with a prediction that Bitcoin (BTC) will decline to $12,000 in September, indicating that the bear market is still in progress.

The cryptocurrency enthusiast, with a YouTube following of 511,000, believes Bitcoin’s recent upsurge is fleeting and the digital asset will depreciate to $12,000 in the coming September. He asserts that the bear market phase is yet to conclude.

Among Merten’s forecasts, he stated:

“The moment of turning point, where Bitcoin’s value might be preparing for a short, indicated by a flip on the weekly time frame on our principal momentum indicator, is nearly upon us.”

Merten highlights a change in the trend where Bitcoin is no longer in sync with traditional stock markets, having started to fall behind.

He observes that Bitcoin’s growth has started trailing that of tech giants like Microsoft and Nvidia.

“Bitcoin has indeed exhibited some impressive performance over the past few months. But the key query to ponder is whether this trend will persist. Even if you invested in November and are considering making a purchase now, you must question: Will Bitcoin continue to lead the pack?

“As we’ve seen over the past few months, the pattern mirrors earlier price activity. The exact same range that previously served as support in the last bull run is now acting as resistance, similar to what we saw in May.

“Interestingly, we didn’t even reach the higher band between $32,000 and $33,000 that many had set as their market exit point. People tend to inflate their expectations, constantly shifting their targets, often resulting in missed opportunities to realize gains.”

What is the take of other market analysts on the short-term outlook? As per Rekt Capital, Bitcoin needed to surpass $27,600 by the end of the previous weekend, which it failed to achieve.

The analyst interprets this as another sign of a negative trend. They contend that Bitcoin must hit $27,600 to swing back into the bullish zone.

From traditional mining to innovative cloud offerings and tokenized mining, the market is brimming with options. While some claim that mining is a thing of the past, the recent correction in the bitcoin market has sparked renewed interest. Could it be the perfect moment to explore the realm of free mining projects and discover hidden opportunities?

To Mine or Not to Mine?

Bitcoin mining has become incredibly challenging due to various factors. The competition within the mining industry has intensified, resulting in a substantial rise in the computational power needed to mine new bitcoins. Additionally, mining difficulty has increased over time, requiring more sophisticated and powerful equipment to stay profitable. Acquiring and maintaining this infrastructure can be costly, with exorbitant expenses for electricity consumption and equipment upkeep. The financial investment and ongoing operational costs pose significant hurdles for miners looking to enter or sustain their presence in the mining ecosystem. This has made it increasingly difficult for individual miners and opened up opportunities to other offers.

Trust We Seek

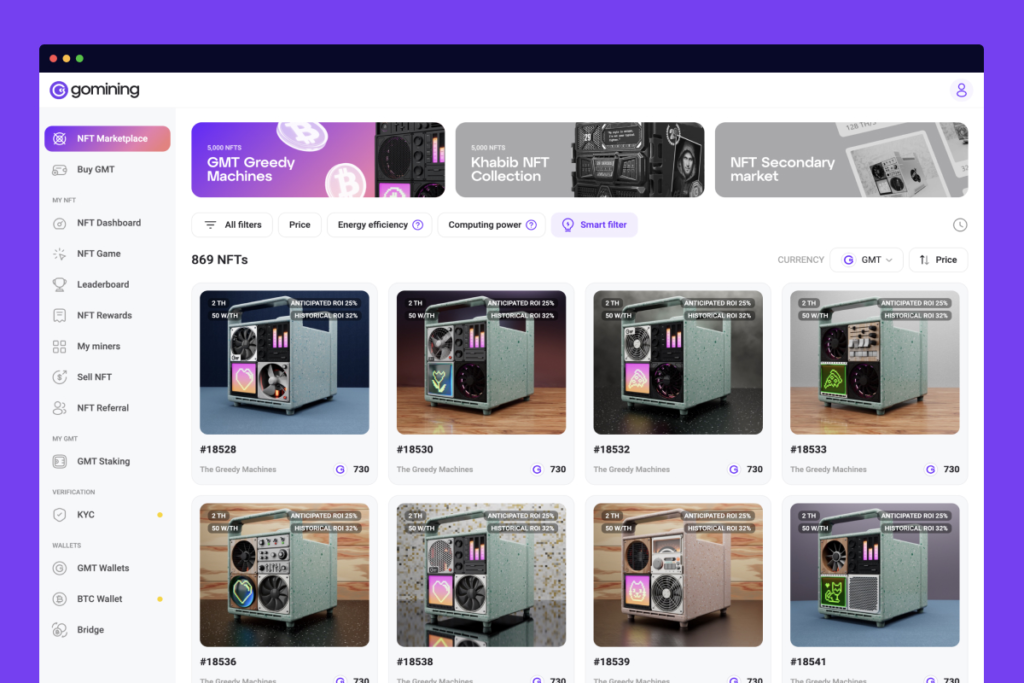

Amidst the multitude of projects offering easier entry into bitcoin mining, including cloud mining and tokenized offers, the main concern lies in their trustworthiness and ability to address the challenges. One such project that has gained attention is GoMining, a young but experienced venture. GoMining provides reliable and hassle-free mining infrastructure, offering a solution to the complexities and uncertainties surrounding bitcoin mining, while prioritizing transparency and trust within the blockchain industry.

Mining NFT

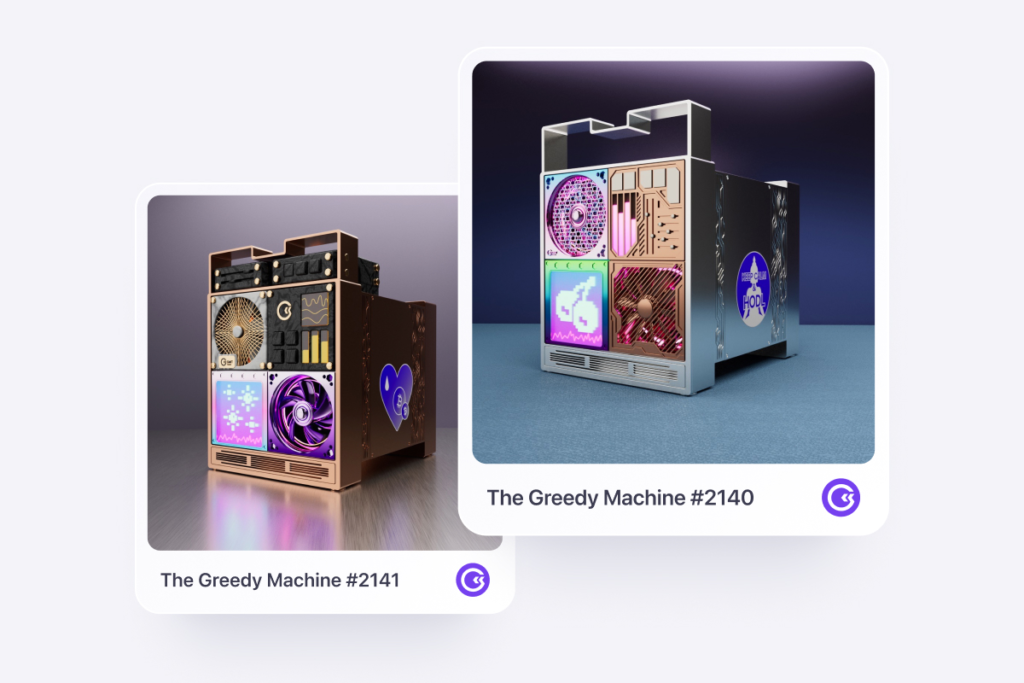

What sets GoMining apart is its experienced team with six years of expertise, already delivering bitcoin rewards to its holders for two years and continuing to expand its infrastructure. At the heart of GoMining’s offering are their NFTs and tokens, which bring together the exciting worlds of mining and blockchain technology. GoMining NFTs offer unique mining rig images supported by real computing power, putting them heads and shoulders above other NFT collections. This innovative approach allows users to enjoy the benefits of mining, such as earning bitcoin rewards, without the usual hassles of purchasing expensive equipment or dealing with high electricity bills. The NFTs provide a seamless and headache-free mining experience, allowing users to participate in the digital gold rush from anywhere in the world.

Decentralized Staking

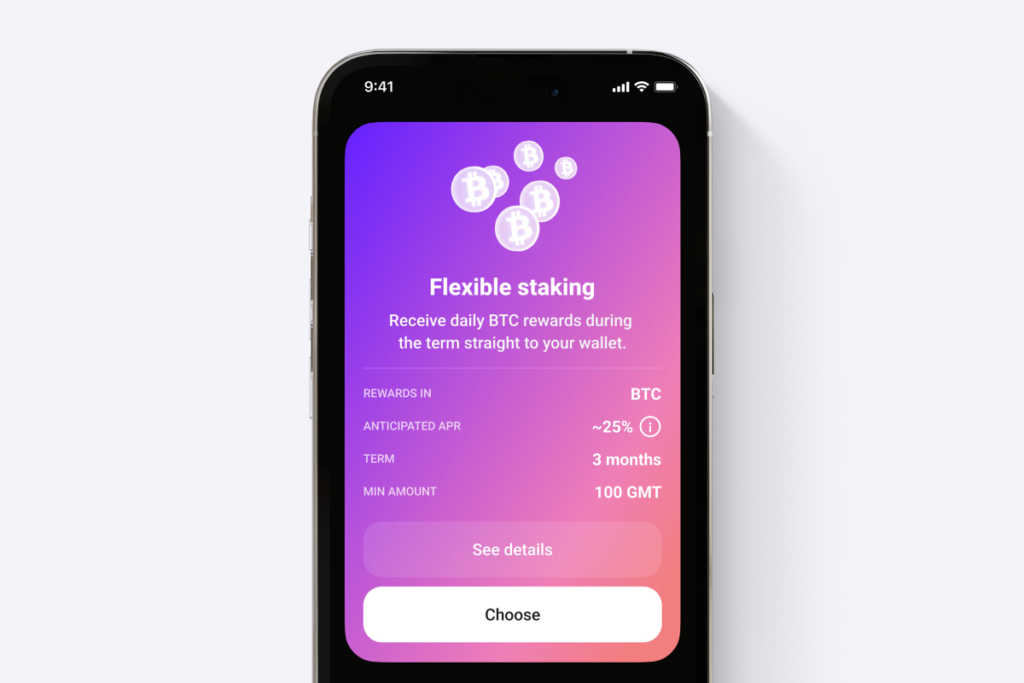

Complementing the NFTs is the GoMining Token, which serves as the core offering of the project. The token provides users with decentralized staking options, including fixed and flexible staking, allowing them to earn rewards in Bitcoin or GoMining tokens. Fixed staking allows users to freeze their tokens for 3 months at a 20% annual percentage rate (APR) and earn rewards in native tokens. It provides predictability and the ability to withdraw or relock tokens. Flexible staking involves blocking tokens for 3 months and receiving daily bitcoin rewards at a floating percentage, offering potential rewards based on market conditions.

By staking their tokens, users can secure and lock their assets while also contributing to the project’s mining infrastructure. Behind its token and NFT offerings lies real mining computing power. With ASICs located in various parts of the globe like the UAE, Norway, and Kazakhstan.

Celebrity Collaboration

Adding to the appeal of GoMining is its collaboration with notable public figure Khabib Nurmagomedov, the undefeated MMA star. The project has partnered with Khabib to create a special series of NFTs called the Khabib Collection. These NFTs feature unique designs inspired by Khabib’s career, including quotes and other elements associated with the legendary fighter. Each NFT in the Khabib Collection is backed by a symbolic 29 TH/s, representing the number of victories Khabib achieved during his illustrious MMA career.

The partnership with Khabib brings an added layer of authenticity and trust to GoMining, making it an attractive proposition for those seeking both innovative NFT opportunities and a reputable project backed by a respected public persona.

Conclusion

GoMining’s recent rebranding efforts have been driven by a commitment to transparency within the blockchain industry. Given their new website, the company recognizes the importance of providing clear and honest communication to its users and stakeholders. This focus on transparency not only enhances user trust, but also sets a standard for openness in the industry, ensuring that customers have a clear understanding of GoMining’s operations and offerings.

While exploring the GoMining app and website, you’ll find comprehensive details about how their ecosystem operates. The team takes pride in openly sharing information about the accrual system and promptly updating users if any changes occur. However, it’s always wise to conduct your own research and thoroughly investigate any project before diving in.

According to a statement by the company’s CEO Mark Zalan in their press release, GoMining has “a proven track record of providing top-notch services to our clients and we’ll continue to use our experience to build trust among our users.” And the company aims to develop its infrastructure making mining and blockchain more transparent, accessible, and easy.

As per its white paper and media publications, GoMining has experienced significant growth and achievements. The initial issue of 100 million tokens has seen a nearly five-fold increase, with plans to reach an impressive 10 trillion tokens. The company has also paid out a substantial amount of 1,610 BTC to its token holders, demonstrating its commitment to rewarding their community. GoMining has issued 10,000 NFTs, increased its overall hash power, growing from 100,000 TH/s to an impressive 1,252,467.37 TH/s.

Amidst a crowded marketplace, GoMining shines as a beacon of reliability and transparency. With its experienced team, two years of steady payouts, and a user-friendly interface, it stands apart from the rest. In a rapidly evolving mining landscape, GoMining offers a promising option for those looking for a straightforward and trustworthy mining experience.

Centralized crypto platforms have taken a lot of flack in recent months due to the shenanigans of a few bad actors. The main concern for users is the need to trust a third-party intermediary to manage their funds. But despite this, there are still many reasons to want to use a CEX.

The biggest advantage of CEXs is that they’re often much easier to use, with easy-to-understand user interfaces that enable beginners to get started trading in a matter of minutes. What’s more, CEX platforms can generally offer much deeper liquidity than even the most popular DEX platforms, making them the only suitable choice for professional, high volume traders.

So while DEX platforms might be gaining in popularity, there will always be a sizable audience for CEX platforms. With that in mind, we’ve chosen three DEX platforms that we feel are the best around, in terms of trading functionality, ease of use and low costs.

StormGain: Best CEX For Trading Options

Founded by Alex Althausen, StormGain has emerged as one of the top crypto exchange platforms for European traders thanks to its development of multiple features designed to make trading more lucrative and rewarding.

StormGain enables experienced traders to get the most out of the market with an array of different trading options and order types. For instance, it offers a basic options spot trading market that enables traders to buy and sell assets at the established market price instantaneously.

Spot trading is the most popular market for crypto traders and involves buying and selling tokens at the listed price. When a user initiates a trade, it will be entered into StormGain’s order book, which will rapidly search for a matching bid. Once the seller has been matched with a suitable buyer, the trade is executed immediately, making for lightning-fast transactions.

StormGain also allows futures trading, where traders can hedge against market price movements. With futures contracts, traders are essentially speculating that the price of an asset will move up or down over a set period of time. The user buys a contract that enables them to buy an asset at a given price at the time it expires. The trader will either profit on the deal or lose, based on whether or not the asset’s price appreciates or depreciates at the time of expiry.

A third kind of trading option on StormGain is leveraged trading, in which the user is able to borrow funds from the exchange in order to increase their stake. Looking deeper at its trading options, we find that StormGain also offers novel markets such as crypto indices and tokenized assets, as well as a cloud mining program that provides rewards to users.

Added to these trading options, StormGain is also unique among CEXs in that it operates its own, fully decentralized trading platform. StormGain DEX allows traders to maintain self-custody of their assets in their own wallet, which is simply linked to the platform. Users trade with one another via smart contracts. However, uniquely among DEXs, StormGain DEX is able to tap into the liquidity of its CEX platform to ensure traders can buy and sell at their desired price, without suffering from slippage. Very few CEX platforms can compete with StormGain’s trading options, hence it’s our favorite choice for experienced traders.

Coinbase: Best CEX For Beginners

Coinbase is one of the most user-friendly exchanges around thanks to its simple interface, robust security and its extensive library of educational content.

No doubt you have already heard of Coinbase, which is probably the best-known exchange in the U.S. Not only is it one of the most reputable platforms, but it excels at lowering the barrier for entry to new cryptocurrency users. It begins with a seamless onboarding process and a step-by-step guide to executing your first trade.

Coinbase is also home to a comprehensive portal of educational materials, with guides to things like the basics of blockchain, an explanation of crypto terminology, and a deep dive into hundreds of popular cryptocurrencies. What’s more, users can actually get paid in crypto for reading this stuff thanks to its novel Coinbase Earn program, which pays small rewards to users who participate in its learning modules.

We should also mention its security, which is as good as any in the industry. Notably, Coinbase offers two-factor authentication on its desktop and mobile platforms, and it stores 98% of its funds offline in so-called cold wallets. It also has an insurance policy with the U.S. FDIC that covers deposits of up to $250,000. It provides a level of reassurance that few other exchanges can match, making it an excellent choice for novices and cautious investors alike.

Bitstamp: Best Exchange For Low Fees

For some traders, especially those who trade in smaller amounts, one of the most important considerations is that they don’t get stung by high trading costs. Hence, Bitstamp is well worth a look thanks to its extremely competitive maker and taker fees and zero-cost withdrawals.

Low fees are offered by many CEXs as a way to entice new users to try out their platforms, but what they don’t say is that they will make up for this with expensive costs associated with coin transfers and bank withdrawals. So, you might purchase Bitcoin on its platform for minimal fees, but the moment you transfer that BTC to your own wallet, the exchange will take a sizable cut. That doesn’t happen with Bitstamp, which is notable for minimal costs on all transactions.

Bitstamp’s exact fees depend on the specific cryptocurrency, but they’re as low as you’ll find anywhere. Maker fees range from 0.3% to 0%, while taker fees average between 0.4% and 0.3%, making it one of the lowest cost exchange platforms around. Even better yet, traders whose 30-day trading volume is less than $1,000 won’t have to pay any fees at all, which is ideal for those who only want to buy crypto now and again. Furthermore, Bitstamp’s withdrawal fees are also very low, with ACH transfers being entirely free to users.

As one of the longest-established crypto platforms around, Bitstamp has a long history of secure and transparent operations. It notably became the first platform of its kind to secure an EU Payment Institution license, and it has also been granted a BitLicense by New York’s financial services department, NYDFS. Bitstamp did suffer a hack many years ago in 2015, losing more than $5 million worth of funds, but to its credit it was able to fully reimburse all users without delay.

Conclusion

There are literally hundreds of CEX trading platforms to choose from, but we think the above platforms are among the best all-rounders in the business. When it comes to multiple trading options, few platforms can compete with StormGain. For user-friendliness, Coinbase is hard to beat, and for low cost trading, Bitstamp is always a solid choice.

In a landmark move, two U.S. presidential contenders, Vivek Ramaswamy and Robert F. Kennedy Jr., have declared their intention to accept Bitcoin (BTC) donations for their campaigns. Kennedy, a potential Democratic candidate, broke the news at the Bitcoin 2023 convention, making his campaign the first in U.S history to publicize cryptocurrency acceptance.

Kennedy further promised to promote neutral energy regulations, addressing concerns around the energy-intensive process of Bitcoin mining. He committed to ensure that Bitcoin won’t be classified as a security, advocating a more welcoming regulatory environment for cryptocurrency enterprises. Additionally, he indicated a potential presidential pardon for Silk Road founder, Ross Ulbricht, raising a note of interest among crypto libertarians.

Matching Kennedy’s progressive approach, Republican candidate Vivek Ramaswamy also announced his campaign’s acceptance of BTC donations. He publicized this through a tweet featuring a BitPay donation link, inviting supporters to donate up to $6,600 worth of crypto. He also urged for the upcoming 2024 elections to focus on fiat currency discussions.

In addition to Bitcoin, BitPay’s platform accepts several other cryptocurrencies like Bitcoin Cash, Ether, Litecoin, and Dogecoin. Ramaswamy also offered a unique incentive: anyone who donates to his campaign can mint a commemorative Non-Fungible Token (NFT) using the Proof of Attendance Protocol (POAP).

In sum, these moves showcase the increasing integration of cryptocurrency in mainstream politics, with prospective leaders acknowledging its significance in democratic processes and pledging to foster an inclusive crypto environment.

Cryptocurrency exchange behemoth Coinbase (COIN) has expressed its preference for Canada’s regulatory environment over that of the U.S., citing clearer rules and a more engaged approach from regulators in Canada.

Coinbase has been at odds with the U.S. Securities and Exchange Commission (SEC), which has threatened the firm with enforcement action over alleged violations of securities laws. The recent regulatory turbulence in the U.S. has unsettled numerous firms and investors, prompting them to consider alternative jurisdictions.

While Canada has also increased scrutiny of the crypto industry via its Pre-Registration Undertaking (PRU) system for crypto exchanges, this has resulted in some major platforms, such as Binance, exiting the Canadian market. Despite this, Nana Murugesan, Coinbase’s VP of International and Business Development, has affirmed his preference for the Canadian regulatory framework.

During a CoinDesk interview, Murugesan explained: “There are two main approaches from regulators: regulation by engagement and regulation by enforcement. The latter can be challenging due to uncertainty around rules. However, Canada’s regulators exemplify the former approach, which we appreciate.”

Coinbase, which agreed to Canada’s enhanced PRU in March and is primarily regulated by the Ontario Securities Commission (OSC), has a significant presence in Canada, employing around 200 engineers in the country, according to Coinbase Canada Country Director Lucas Matheson.

Coinbase’s next step is to offer a smoother transition from fiat to crypto for its Canadian clientele by adding new payment channels. Matheson noted, “Over the coming months, we plan to incorporate Interac payment channels into our platform.” Interac is Canada’s domestic interbank payment network, connecting local financial institutions with individuals and businesses for digital payment systems.

Coinbase views Canada as a promising market, given the regulatory clarity offered by the country’s regulators and the exit of competitor Binance. Regarding competition, Murugesan added, “Each company follows its own journey, and it appears that recent developments in Canada align well with our strategic direction.”