Valkyrie, a cryptocurrency fund manager, has joined the rush of financial firms applying for a Bitcoin spot exchange-traded fund (ETF).

This move comes as several other companies have recently filed similar applications with the United States Securities and Exchange Commission (SEC). On June 21, Valkyrie submitted an S-1 registration form for a Bitcoin spot ETF, with plans to list the fund on the Nasdaq under the symbol BRRR.

Valkyrie is no stranger to the world of Bitcoin futures ETFs. In October 2021, it launched the Valkyrie Bitcoin Strategy ETF (BTF), becoming the second BTC futures ETF in the U.S. Later in December, the firm introduced the Valkyrie Balance Sheet Opportunities (VBB), which it eventually liquidated in October 2022. Valkyrie also manages the Valkyrie Bitcoin Miners ETF (WGMI), which tracks companies that generate revenue or profits from BTC mining.

The recent activities of its competitors seemingly motivated Valkyrie to take action.

In a podcast interview with Cointelegraph’s Hashing It Out in March, Steven McClurg, Valkyrie Investments’ chief investment officer, expressed his belief that a BTC ETF would only be possible “in a future administration after the next elections or through legislative action.”

However, Valkyrie’s move comes amidst a flurry of ETF applications. BlackRock applied to list a BTC spot ETF as a trust on the Nasdaq on June 15, while WisdomTree and Invesco followed suit with similar applications on June 20.

Additionally, there are unconfirmed reports that Fidelity is also preparing to file an application for a BTC spot ETF. As these developments unfold, the price of BTC continues to rise, currently up 6.41% at the time of writing.

With the growing interest in cryptocurrency investments, financial firms are recognizing the demand for regulated investment vehicles like ETFs.

These funds provide investors with exposure to Bitcoin without having to directly hold the digital asset. While the SEC has yet to approve any Bitcoin spot ETF applications, the increasing number of filings indicates a growing push for such investment products in the market.

Valkyrie’s decision to apply for a BTC spot ETF aligns with its existing offerings in the cryptocurrency space.

If approved, the ETF would provide investors with another option to gain exposure to Bitcoin’s performance. The SEC’s review process will determine the fate of these applications and shape the future of cryptocurrency investment opportunities for retail and institutional investors alike.

Other Stories:

United States Agencies Unite to Form Task Force Targeting Darknet and Cryptocurrency Crimes

Moody’s Issues Warning About Lack of Bipartisan Support for Crypto Regulation in the US

Polygon Co-founder Suggests Proposal to Improve Security of PoS network

According to new research by analytics firm Glassnode, Bitcoin investors may face a period of “sideways boredom” that could last up to 18 months.

Despite a 70% gain in the first quarter of 2023, Bitcoin has struggled to maintain its momentum, leaving investors uncertain about its future price action.

Glassnode suggests that a classic pre-bull market phase is currently unfolding, but long-term holders will need to exercise patience.

The research examines the “liveliness” of the Bitcoin supply, which refers to the tendency of holders to spend or hold their coins. It reveals a trend of mass accumulation as coins gradually migrate into cold storage, effectively reducing the available supply.

The study estimates that this steady and gradual accumulation began over two years ago and predicts that it may continue for another 6 to 12 months.

Meanwhile, short-term holders, who have held their coins for a maximum of 155 days, form the more speculative end of the investor base and are being closely monitored.

While whales, the largest-volume holders, are currently net distributors, Glassnode suggests that there is an undercurrent of demand despite recent regulatory pressures on major exchanges.

The research concludes that digital asset markets are currently displaying low volatility, volumes, and realized value, indicating a period of investor apathy.

Nevertheless, the pattern of wealth transfer to the price-insensitive hodler cohort remains intact, suggesting that a phase of sideways boredom may lie ahead, potentially lasting between 8 to 18 months, based on historical cycles.

In summary, Glassnode’s research suggests that Bitcoin investors should prepare for a potentially long and uneventful period before significant price movements occur.

While the market is currently characterized by accumulation and decreasing liquidity, the research indicates that the underlying demand for Bitcoin remains, despite the regulatory challenges faced by the industry.

Other Stories:

Crypto exchange criticised by FDIC for spreading misinformation

Cathie Wood, CEO and chief investment officer of ARK Invest, has expressed her bullishness on Coinbase stock and her belief that Bitcoin will reach $1 million.

Wood’s fund, Ark Innovation (ARKK), recently added to its position in Coinbase shares following the Securities and Exchange Commission’s (SEC) lawsuit against Binance, one of Coinbase’s main competitors.

ARKK purchased nearly 330,000 shares of COIN on June 6, 2023, totaling around $17 million. Two other ETFs, Ark Fintech Innovation ETF and Ark Next Generation Internet ETF, also increased their positions in Coinbase. Currently, the average entry price for all three funds ranges from $272.75 to $282.93, with a total position value of $1.77 billion.

However, the trade has resulted in significant losses so far, as COIN is currently trading at $53.90.

Wood’s optimism stems from the belief that the SEC’s enforcement actions will make Coinbase the dominant cryptocurrency exchange in the United States.

She argues that the allegations against Coinbase and Binance differ, with Binance potentially facing more serious charges related to the violation of the Commodity Exchange Act and regulations of the Commodity Futures Trading Commission.

Wood believes that Coinbase will emerge victorious, positioning itself as the leading player in the market.

While some analysts share Wood’s view, others do not.

The consensus among analysts is a Hold rating, with an average price target of $58.49, representing a potential 12% increase from current levels. Notable analysts such as John Todaro and Atlantic Equities have provided more bullish price targets of $70 for COIN.

Coinbase also faces a lawsuit from the SEC regarding the trading and staking of unregistered securities.

There are concerns that the exchange may have engaged in illegal activities, including investing in projects it planned to list on its platform before their public availability.

Regarding Bitcoin, Wood reiterated her belief that it serves as a hedge against inflation and holds a $1 million price target. Despite concerns about deflation, she remains bullish on Bitcoin due to its function as an antidote to counterparty risk in the traditional financial system.

Wood highlighted the upcoming Bitcoin halving event and the current accumulation phase in the market.

In summary, Cathie Wood’s bullishness on Coinbase stock and her $1 million Bitcoin price target are based on her expectations of Coinbase becoming the dominant U.S. cryptocurrency exchange and Bitcoin’s ability to outperform in different market environments. However, analysts’ opinions on COIN vary, and there are potential legal and regulatory challenges for Coinbase to overcome.

Other Stories:

Binance takes legal action against ‘Binance Nigeria Limited’

Bitcoin has achieved a significant milestone in the cryptocurrency market by reaching a 50% dominance for the first time in two years.

The measure of Bitcoin’s share in the total crypto market cap surpassed the 50% mark on June 19, settling at 49.9% at the time of this publication, as reported by TradingView data.

This achievement signifies that Bitcoin alone accounts for half of the entire crypto market’s valuation, which currently stands at $1.1 trillion.

With a market capitalization of $519 billion, Bitcoin’s dominance has seen a remarkable increase of over 10.5% since November 27, 2022. This surge can be attributed to investors seeking Bitcoin as a safe haven asset following the FTX crisis and growing regulatory scrutiny in the United States.

While Bitcoin’s dominance has soared, Ether (ETH), the second-largest cryptocurrency, has maintained a steady market share of around 20% for nearly a year. Together, the combined value of Bitcoin and Ether now represents approximately 70% of the total crypto market.

Michael Saylor, co-founder of MicroStrategy and a prominent advocate for Bitcoin, predicts that Bitcoin’s market dominance will surpass 80% in the coming years.

He anticipates that increasing regulatory pressure from the Securities and Exchange Commission (SEC) will lead to the fading away of stablecoins and most other crypto assets. According to Saylor, the industry will eventually be rationalized into a Bitcoin-focused market with only a handful of other Proof of Work tokens.

Saylor attributes the lack of significant institutional investment in the crypto space to the confusion and anxiety caused by the existence of 25,000 alternative cryptocurrencies that position themselves as alternatives to Bitcoin.

He emphasizes that Bitcoin is universally recognized as the digital commodity of the industry, drawing attention to SEC Chair Gary Gensler’s classification of Bitcoin as a commodity. In contrast, the SEC has designated 68 other cryptocurrencies as securities.

At the time of writing, Bitcoin is trading at $26,746, reflecting a 1.5% increase in the past 24 hours, according to the Cointelegraph Price Index. Despite a sense of fear prevailing in the crypto market, Bitcoin’s value has grown over 3% in the last week.

Crypto research firm Santiment suggests that the recent surge in Bitcoin’s price can be attributed to the announcement of Blackrock, a financial investment behemoth, filing for a Bitcoin spot ETF. This development has played a significant role in driving Bitcoin’s upward price momentum in recent days.

Bitcoin’s attainment of a 50% market dominance is a significant milestone, highlighting its position as the leading cryptocurrency and its growing influence within the broader crypto market.

Other Stories:

Elon Musk suspends ‘scam crypto account’ on Twitter

Bitcoin’s value surged to a two-week high of $28,103 on June 20, providing a glimmer of hope to bullish traders that the digital currency could finally snap its ten-week downturn. This bounce came in spite of recent headwinds caused by the SEC’s enforcement actions against Binance and Coinbase.

The recent rally is largely attributable to escalating institutional interest in Bitcoin, particularly from financial giants such as BlackRock and Fidelity Investments, both of which are reportedly gearing up to submit applications for Bitcoin ETFs.

The uptick in Bitcoin’s value kicked off after BlackRock, the world’s biggest asset manager with over $8.5 trillion in managed assets, announced on June 15 that it had filed an application with the SEC to establish a Bitcoin ETF in the US. Despite not being the first applicant, BlackRock’s sheer scale sets it apart from its predecessors.

Thus far, the SEC has consistently declined Bitcoin ETF proposals, with past hopefuls including Cathie Wood’s ARK, 21Shares (which has submitted three applications), and Grayscale. The latter challenged the SEC’s denial in an appeals court, contending the legitimacy of Bitcoin futures.

According to BlackRock’s SEC filing, the firm plans to enlist Coinbase for holding the Bitcoin associated with its ETF. This move has also indirectly propelled Grayscale’s ETF, which is inching towards 2023 highs with a discount of less than 37%.

A further boost to Bitcoin’s value is the receding U.S. Dollar Index (DXY). As a rule of thumb, when the DXY pulls back, investors typically show greater inclination towards riskier assets, Bitcoin included.

In conclusion, Bitcoin’s price hike today seems to be fuelled by multiple factors: institutional interest from behemoths like BlackRock, the positive impact on Grayscale’s ETF, and the ebbing DXY, creating a promising environment for the cryptocurrency to break its prolonged losing streak.

Other Stories:

Big Eyes Launch: Did all of the investors just get scammed?

Grayscale Bitcoin Trust (GBTC) is approaching its highest levels of 2023 following the filing of a Bitcoin spot price exchange-traded fund (ETF) by BlackRock, the world’s largest asset manager.

The news has generated institutional buying interest in GBTC, the original institutional BTC investment vehicle.

According to data from CoinGlass, on June 17, GBTC came close to reaching new 2023 highs.

This rally comes as Bitcoin market sentiment experienced a modest improvement with the anticipation that BlackRock’s ETF filing could potentially overcome the legal obstacles that have hindered similar ETFs in the United States.

Meanwhile, there are signs of optimism beyond sentiment as GBTC’s long-standing discount to BTC spot prices narrows.

The discount, often referred to as a negative “premium,” is currently at -36.6%, a significant improvement compared to the discount of around -44% observed on June 13. While still discounted, GBTC is trading closer to zero than it has been at almost any other time this year.

Many observers believe that if BlackRock’s ETF is approved, GBTC will be the primary beneficiary. Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, expressed optimism about the prospects of BlackRock’s offering gaining regulatory approval and its potential to resolve GBTC’s discount alongside industry growth.

The BlackRock move has sparked debates as to whether it can be classified as an ETF. Some argue that it will resemble a trust similar to GBTC, while others, including Cochran, believe it qualifies as an ETF under the Securities Act of 1933. Regardless of the classification, investor interest in GBTC is rising in response to BlackRock’s filing.

Hedge fund North Rock Digital announced that it has been consistently accumulating more shares of Grayscale trusts in recent weeks.

It expects significant upside potential if Grayscale wins and minimal downside risk if they lose. Another major holder, ARK Invest, has not yet increased its exposure to GBTC, and data from Cathie’s ARK confirms a gradual decline in their holdings throughout 2023.

Overall, the prospect of BlackRock’s involvement in the cryptocurrency market has stimulated the demand for GBTC and boosted market sentiment.

The narrowing of GBTC’s discount suggests growing confidence among investors, while the debate surrounding the classification of BlackRock’s product highlights the evolving regulatory landscape surrounding cryptocurrency ETFs.

Other Stories:

Crypto trading platform suspends trading of SOL, MATIC, and ADA

BUSD plummets down stablecoin rankings

SEC addresses enforcement action against Binance and Coinbase

Centralized crypto exchanges were identified as a potential hurdle to the growth of crypto investments in the future. Recent legal actions taken by the United States Securities and Exchange Commission against major exchanges Coinbase and Binance exemplify the challenges faced by centralized exchanges.

Australia’s crypto exchanges have also encountered obstacles, with Binance Australia suspending Australian dollar-denominated services and Westpac, Australia’s second-largest bank, prohibiting transactions with the exchange.

Additionally, Commonwealth Bank, the country’s largest bank, expressed concerns about the high risk of scams associated with crypto exchanges and may decline certain payments to them.

Despite considering themselves as “risk averse,” a surprising 31% of young Australian investors, specifically those in the 18-24 age group, hold or have traded cryptocurrencies in the past year, according to a study conducted by the Australian Securities Exchange (ASX).

The study, which included cryptocurrency as an asset class for the first time, revealed that 46% of these young investors preferred “stable returns,” highlighting the contradiction between their risk aversion and their significant investment in crypto.

Researchers attribute the interest of young people in cryptocurrencies to their desire to differentiate themselves from previous generations, coupled with the fact that many of the 1.2 million new investors who have entered the market since 2020 are tech-savvy and active on social media.

The ASX study, conducted by financial research firm Investment Trends, found that young investors in the “next generation” category had a median cryptocurrency holding of $2,700, representing 6% of their total portfolio, twice the 3% allocation observed among other age groups.

Interestingly, although young investors had the highest crypto allocation relative to their portfolios, it was the “wealth accumulators” between the ages of 25 and 49 who owned the largest share of cryptocurrency, accounting for 69% of the total investment in digital assets. Investors aged 50 and above held only 19% of the overall crypto ownership.

While the report acknowledges the volatility of cryptocurrencies, it recognizes their popularity among investors.

It revealed that 29% of potential investors who currently do not invest in any capacity are considering some form of crypto investment within the next year. However, the report maintains a cautious approach, stating that the full acceptance of cryptocurrencies in mainstream investing is still a topic of debate.

The ASX’s report, based on an extensive online survey of 5,519 Australian adults conducted in November 2022, provides valuable insights into the growing interest in cryptocurrencies among young Australians.

While young investors exhibit both risk aversion and significant crypto investments, the report highlights the evolving landscape of investing and the potential challenges faced by the crypto industry as it seeks mainstream acceptance.

Other Stories:

Elon Musk suspends ‘scam crypto account’ on Twitter

Crypto exchange criticised by FDIC for spreading misinformation

BlackRock, the world’s largest asset manager, has filed for a bitcoin exchange-traded fund (ETF) in an effort to provide investors with exposure to the cryptocurrency amidst growing regulatory scrutiny.

The iShares Bitcoin Trust, BlackRock’s proposed ETF, will utilize Coinbase Custody as its custodian, as stated in a filing with the U.S. Securities and Exchange Commission (SEC). However, the SEC has yet to approve any applications for spot bitcoin ETFs.

BlackRock had previously launched a spot bitcoin private trust for institutional clients in the United States. This recent move by the asset manager comes at a time when the global cryptocurrency industry is facing increased attention from regulators regarding potential violations of securities laws. In fact, earlier this month, the SEC filed lawsuits against prominent exchanges Coinbase and Binance, which had significant repercussions throughout the digital assets sector.

Joshua Chu, the group chief risk officer at blockchain technology group XBE, Coinllectibles, and Marvion, viewed BlackRock’s filing as a positive development in the pursuit of regulatory approval. The involvement of a reputable and established asset management company like BlackRock indicates the resilience of public interest in cryptocurrencies.

A spot bitcoin ETF would track the underlying market price of bitcoin, enabling investors to gain exposure to the cryptocurrency without directly purchasing it.

Notably, the SEC rejected Grayscale Investment LLC’s application last year to convert its flagship spot Grayscale Bitcoin Trust into an ETF. Grayscale subsequently sued the SEC, claiming arbitrary decision-making, as the regulator had previously approved bitcoin futures ETFs while rejecting spot bitcoin ETF applications. Firms such as Fidelity, Cboe Global Markets, and NYDIG have also had their spot bitcoin ETF proposals rejected by the SEC.

Following the announcement of BlackRock’s ETF filing, bitcoin prices experienced a 2% increase on Thursday, with the cryptocurrency valued at $25,506 on Friday. Year-to-date, bitcoin has seen a 54% surge in value.

Reports of BlackRock’s plans for a bitcoin ETF were initially published by CoinDesk earlier on the same day.

Other Stories:

Highly Anticipated Chancer Crypto Presale Officially Launches Today

OKX and McLaren Racing Host Panel on Technology in Sports and Film at Tribeca Festival

The Hong Kong Monetary Authority (HKMA), the region’s banking regulator, encouraged lenders in April to cater to the business requirements of licensed crypto exchanges. This announcement was a response to a Financial Times report suggesting that banks, including HSBC and Standard Chartered, were facing pressure from HKMA to accept crypto exchanges as clients.

Hong Kong, aiming to become a leading global hub for cryptocurrency, has taken numerous measures, such as attracting mainland China crypto firms and proposing the testing of a digital dollar in its mortgage market. The report noted that the UK-based lenders HSBC and Standard Chartered, along with the Bank of China, were probed by the HKMA last month regarding their hesitance to accept crypto exchanges as clients.

In an April 27 letter to the lenders, the HKMA highlighted that due diligence on prospective customers should not pose an “undue burden”, particularly for companies establishing offices in Hong Kong. Both Standard Chartered and HSBC confirmed their continuous dialogue with regulators on a variety of topics and ongoing involvement in the evolving crypto policies and developments in Hong Kong.

This push by Hong Kong for banks to incorporate crypto clients into their portfolios comes at a time when other nations like the U.S. are intensifying their scrutiny on crypto exchanges. The U.S. affiliate of Binance, for instance, had to cease dollar deposits last week after the U.S. Securities and Exchange Commission requested a court to freeze its assets.

Other Stories:

Binance US fires employees over SEC investigation

Sturdy Finance reinstates stable coin market after exploit

‘Commodities, not securities’: Coinbase CEO sends message to SEC amid lawsuit

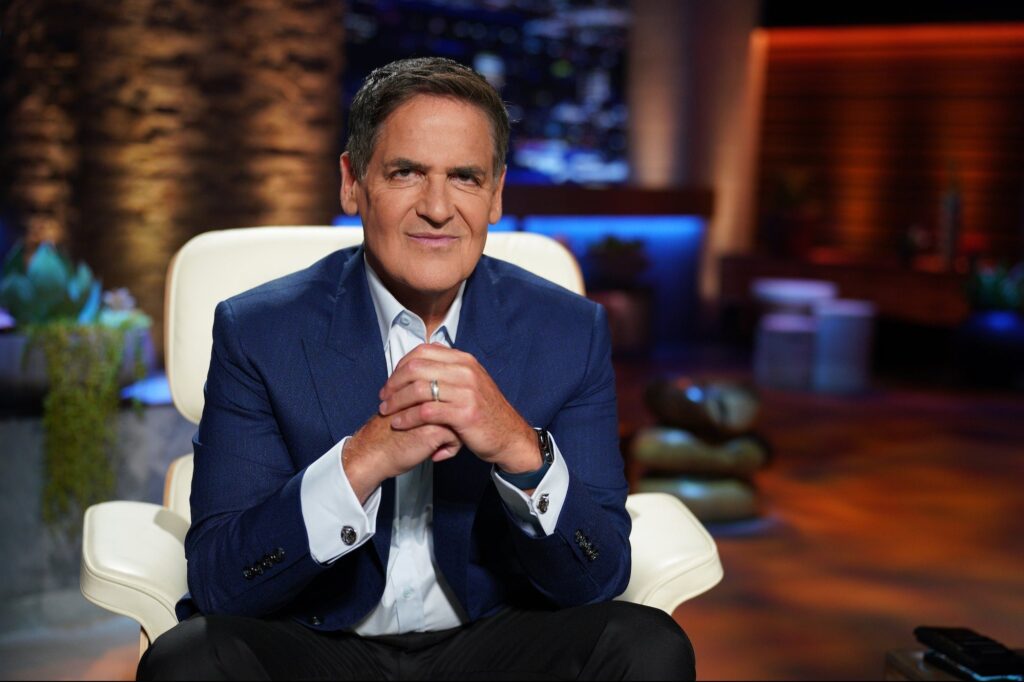

A heated debate erupted on Crypto Twitter this week, pitting billionaire investor Mark Cuban against former SEC official John Reed Stark. Cuban criticized SEC Chair Gary Gensler for his “regulation via litigation” strategy, which he believes is harming crypto startups.

The feud, which began on June 14, ignited over Stark’s support for the SEC’s recent lawsuit against Binance, a leading cryptocurrency exchange. Cuban contended that Stark was misjudging the lawsuit’s repercussions and blamed Gensler’s approach for undermining cryptocurrency businesses.

Stark had previously insisted that regulators treat crypto businesses as large-scale enterprises. However, Cuban disagreed, arguing that most crypto startups are small entities and should not be required to hire securities lawyers just to launch their businesses.

Moreover, Stark commended the SEC’s action against Binance, stating it would eradicate “bad actors” and foster transparency within the largely unregulated industry. This steered the conversation towards an examination of how cryptocurrencies should be regulated.

Stark held the view that crypto assets should not be seen as pink sheets or stocks. In contrast, Cuban dismissed Stark’s perspective as biased, advocating instead for tokens to be regarded similarly to other securities. He called on the SEC to establish more lucid guidelines.

Mark Cuban, known as an American entrepreneur and investor, has evolved from initially labeling Bitcoin a pyramid scheme in 2017 to supporting digital assets today. Conversely, John Reed Stark, ex-chief of the SEC’s Office of Internet Enforcement and a moderate crypto skeptic, frequently shares his legal perspectives on digital assets with his 21,000 Twitter followers.

While the debate ended with Cuban acknowledging that many blockchain companies and tokens might fail, he emphasized that the successful ones would be “game changers,” reflecting the typical lifecycle of tech firms. Cuban concluded by championing crypto’s potential impact on the broader economy, cautioning that both the irrational hatred of crypto, which he terms “Crypto Derangement Syndrome,” and the overhyping of its potential could have negative effects.