Tortola, British Virgin Islands, July 12th, 2023, Chainwire

In its ongoing journey to reshape the crypto investing landscape, Struct Finance, a DeFi platform that enables investors to engage with tailored interest rate products linked to digital assets, is thrilled to announce the launch of the BTC.B-USDC Vaults.

The tranche-based BTC.B-USDC Interest Rate Product was made possible by effectively leveraging Avalanche’s BTC.B (Bridged Bitcoin) for DeFi applications. The new vault beautifully complements Struct Finance’s Genesis USDC Vaults, heralding an exciting era in DeFi yield opportunities. Struct Finance built the new vault on top of GMX’s Liquidity Provider Token (GLP) to generate predictable yields for BTC in the form of fixed returns, and USDC in the form of variable returns, while still leveraging a secure asset and minimizing volatility and exposure to other risks.

“Our BTC.B-USDC Vaults represent an innovative application of Bitcoin in DeFi. We’re taking full advantage of Avalanche’s Bridged Bitcoin (BTC.B) to bring about a fresh wave of opportunities in the digital asset space,” said Ersin Dalkali, the Co-founder of Struct Finance.

While Bitcoin continues to dominate the market, its inherent lack of a DeFi layer has traditionally made native yield generation quite challenging. Avalanche has unlocked new possibilities for Bitcoin in DeFi with BTC.B (Bridged Bitcoin). Unlike WBTC that relied on centralized bridges, BTC.B is minted via Avalanche Core — a decentralized bridge — and can be trustlessly bridged across networks using the Layer Zero bridge.

At present, Bitcoin investments in prominent lending pools yield between 0.2–0.5%. Even the stable swap pools offering wBTC-BTC.B products only manage to deliver returns of about 2%. Struct’s BTC.B-USDC product shatters these limitations, offering significantly higher yields.

The purpose of BTC.B is to empower BTC holders to explore DeFi opportunities on the Avalanche blockchain, without the need to acquire secondary tokens or rely on centralized bridges. BTC.B represents BTC coins transferred to the Avalanche blockchain in the form of ERC-20 tokens. With over 6000 BTC bridged and a fully diluted value of $180 million, BTC.B is carving a niche for itself in the crypto arena.

The Bitcoin ETF applications by BlackRock, WisdomTree, and Invesco – three of the world’s leading asset managers – are not just a mere submission. It is a signal that the traditional financial realm is ready to embrace Bitcoin on a new level. Recently, the US Securities and Exchange Commission (SEC) gave the green light to a 2X leveraged Bitcoin ETF, sparking an enthusiastic wave of speculation and anticipation for approval of a spot Bitcoin ETF.

Delta hedging

Amid the highly volatile crypto industry, Struct Finance’s Interest Rate Products allow anyone to split and repackage the risk of any yield-bearing DeFi assets in different parts to fit their risk profile through an innovative process called “tranching.” Every Interest Rate Product is a single vault split into two portions, or tranches that have different return configurations:

- A Fixed-return Tranche for conservative investors looking for consistent returns

- A Variable-return Tranche for investors with a higher risk appetite seeking superior returns

The yield from the underlying asset flows into the fixed tranche first to ensure predictable returns. The remainder is then allocated to the variable tranche, which gets enhanced exposure to the underlying yield-bearing asset. Compared to the fixed tranche, the variable tranche might accrue more yield, less yield, or no yield.

As part of its BTC.B-USDC Vaults, Struct Finance has implemented a unique approach to managing investment risk: delta hedging. While the fixed tranche takes center stage with its high yield, the variable side of the product offers an additional layer of intriguing complexity and potential.

Upon deployment of funds into the vault, the BTC.B in the fixed tranche gets converted into GMX’s GLP token, setting up a position that’s short Bitcoin against GLP and contributing a negative delta. In contrast, the USDC on the variable side is converted into GLP, which inherently carries a positive delta.

This innovative delta-hedged product design achieves a fine balance between the positive and negative delta forces. It results in a robust strategy that allows investors to confidently navigate the crypto market’s inherent volatility.

This artful interplay of the fixed and variable sides within the vaults opens the doors for investors to tap into the potential of Bitcoin investments like never before. By catering to a diverse range of risk appetites, Struct Finance ensures that both retail and institutional investors can tailor their strategies to maximize their returns, regardless of market conditions.

About Struct Finance

Struct Finance is at the forefront of the DeFi revolution, with a vision to transform the design and utility of financial products. It empowers users to design their own financial instruments, harnessing the power of tokenized, yield-bearing positions to unlock a world of diverse investment opportunities. Moreover, its cutting-edge financial products adopt a tranche-based system, smartly distributing yield between different investor classes. This balanced approach guarantees a steady yield for risk-averse investors while also offering the prospect of heightened returns to the more adventurous. Initially available on Avalanche, Struct Finance plans to go multichain in the near future.

For more information, visit: Website | Twitter | Discord | Telegram

Disclaimer: This release is for informational purposes only and should not be construed as financial promotion.

Contact

Miguel Depaz

media@struct.fi

The cryptocurrency community is abuzz with discussions about the upcoming Bitcoin halving in 2024, but there’s another significant event on the horizon this year. Mt. Gox, the hacked Bitcoin exchange, is set to repay its creditors by the end of October 2023, according to the trustee overseeing the process.

This repayment has the potential to significantly impact the cryptocurrency market in various ways.

Mt. Gox, founded in 2010, was once the largest Bitcoin exchange, handling around 70% of all BTC transactions before its collapse.

READ MORE: Chinese Government Tightens Regulations on AI Development

In 2014, the exchange suffered a security breach, resulting in the loss of 850,000 BTC, equivalent to 4% of all Bitcoin to be issued.

This made Mt. Gox one of the largest cryptocurrency bankruptcies ever, and creditors have been waiting for repayment for nearly a decade.

Industry observers believe that the repayment of Mt. Gox will have a notable impact on the market. Jacob King, the founder and CEO of WhaleWire, anticipates that most creditors, who lost their Bitcoin nearly ten years ago, will sell at least a portion of their BTC upon receiving it.

This influx of sell orders could create downward pressure on prices and potentially lead to a market downturn.

The prolonged delays in the repayment process have already caused disillusionment among investors, eroding their confidence in the market.

While some creditors expect to continue holding their Bitcoin, there are concerns that the news of the coins being released will lead other non-claimant holders to sell due to fears of price decline.

Mt. Gox aims to repay over 10,000 crypto creditors worldwide, totaling 142,000 BTC ($4.3 billion) and 143,000 Bitcoin Cash (BCH) worth around $40 million, along with 69 billion Japanese yen ($510 million) in fiat currency.

Payments will be made individually, using a combination of fiat and cryptocurrencies.

The repayment of Mt. Gox funds is anticipated to be a significant event, but its impact on the market will depend on factors such as the manner of fund release and media coverage.

Whale Alert co-founder Frank Weert believes that while some may cash out, it is unlikely to cause a massive sell-off.

This event, on such a large scale, is unprecedented in the crypto industry.

Although skeptics downplay the potential effects, comparing the amount of Bitcoin to be repaid to the holdings of Bitcoin advocate Michael Saylor, the market can absorb this repayment within a relatively short timeframe.

On-chain and exchange volumes are substantial, making the event manageable.

Furthermore, the distribution of Mt. Gox’s Bitcoin to numerous individuals could have a positive impact on the network as a mass-distribution event, reactivating long-term holders and strengthening self-custody practices.

Overall, the long-awaited repayment of Mt. Gox’s creditors is expected to have a significant impact on the cryptocurrency market.

While some foresee a potential market downturn due to sell-offs, others believe it will be absorbed quickly.

Regardless, the event marks the end of an era plagued by Mt. Gox-related uncertainty and is seen as a positive step forward for the industry.

The Financial Conduct Authority (FCA), the financial regulator of the United Kingdom, has taken action against cryptocurrency ATMs, disrupting 26 out of the 34 machines it visited and inspected since the beginning of 2023.

On February 14th, the FCA issued an ultimatum to all crypto ATM operators in the country, stating that they must comply with regulations or cease their illegal operations.

In response to this warning, the FCA, along with other law enforcement agencies, conducted investigations into 36 crypto ATM locations using their authority under money laundering regulations.

Steve Smart, the joint executive director of enforcement and market oversight at the FCA, spoke out against the use of all crypto ATMs, highlighting the risks involved.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He emphasized that using a crypto ATM in the UK means utilizing a machine that is operating illegally, and users may unknowingly be handing their money over to criminals.

Smart further clarified that victims of scams involving these ATMs, specifically those related to cryptocurrencies like Bitcoin (BTC), will not receive government protection or assistance from the ATM operators.

Between May and June, the FCA inspected 18 of these locations, coinciding with their public announcement about the initiation of their inspection campaign.

It is worth noting that all crypto exchanges and ATMs in the UK are required to register with the FCA and comply with the country’s money laundering regulations.

On July 8th, the Clive Police Department released a report detailing a crypto scam in which a fraudster posed as a law enforcement representative and managed to steal $6,000 from an unsuspecting victim while threatening them with an arrest warrant.

Scammers often employ fear tactics and impersonate law enforcement officials to deceive individuals into transferring funds through crypto ATMs.

However, it is important to remember that legitimate law enforcement agencies never demand payments over the phone or through cryptocurrency.

The FCA’s efforts to disrupt illegal crypto ATM operations and raise awareness about the risks associated with them are aimed at safeguarding the public and preventing financial crimes.

Individuals are urged to exercise caution and verify the legitimacy of any communication or transaction involving cryptocurrency to protect themselves from falling victim to scams.

Cboe Global Markets, a prominent exchange operator, has made significant changes to five spot Bitcoin Exchange-Traded Fund (ETF) applications by including a surveillance-sharing agreement (SSA) with Coinbase.

Invesco, VanEck, WisdomTree, Fidelity, and the joint fund by ARK Invest and 21Shares are among the ETFs that had their filings amended with the United States Securities and Exchange Commission (SEC) on July 11.

Cboe confirmed that it had recently reached an agreement with Coinbase regarding the terms of the SSA, which was finalized on June 21.

The initial filings for the ETFs had indicated that the parties were anticipating entering into an SSA prior to potentially offering the ETFs.

READ MORE: Bitcoin Attempts Fresh Breakout as Battle for Yearly Highs Intensifies

The inclusion of SSAs in the filings is an attempt to meet the SEC’s requirements, which aim to prevent fraudulent conduct and safeguard investors.

The regulator outlined these standards on March 10, emphasizing the need for a comprehensive surveillance-sharing agreement with a regulated market that deals with significant amounts of the underlying or reference bitcoin assets.

Spot Bitcoin ETF applications have been a significant focal point for the industry in recent times.

Fidelity, Invesco, WisdomTree, and Valkyrie have all submitted filings, following the footsteps of BlackRock, a $10 trillion asset management firm, which also filed an ETF for SEC approval.

Additionally, on June 29, the U.S. stock exchange Nasdaq resubmitted its application to list BlackRock’s ETF, also incorporating an SSA with Coinbase.

The amended filings made by Cboe had a positive impact on the share price of Coinbase (COIN), with a nearly 10% increase observed on June 11.

This surge took Coinbase’s shares to their highest value since August 16, as reported by Google Finance.

However, despite its involvement in Bitcoin ETF applications, Coinbase is currently engaged in a legal dispute with the SEC.

The regulatory body has accused Coinbase of offering cryptocurrencies that it deems to be unregistered securities, leading to a lawsuit between the two parties.

In conclusion, Cboe Global Markets’ decision to amend the spot Bitcoin ETF applications to include a surveillance-sharing agreement with Coinbase reflects the industry’s efforts to comply with SEC standards.

This development has generated positive market sentiment, as demonstrated by the increase in Coinbase’s share price.

Nonetheless, Coinbase faces legal challenges from the SEC regarding the alleged offering of unregistered securities.

Bitcoin (BTC) made a fresh breakout attempt on July 11, as the battle for yearly highs intensified.

The cryptocurrency briefly surpassed $31,000 before the daily close on July 10, signaling a potential leverage crunch.

BTC/USD approached resistance but lost momentum and retraced over $800. However, some continuation was observed, and at the time of writing, Bitcoin was trading around $30,500.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

According to Michaël van de Poppe, the founder and CEO of trading firm Eight, the recent overnight move resembled a leverage crunch.

He cautioned traders about the choppy market and highlighted that while Bitcoin revisited previous highs, it did not make new lows, with $30,200 acting as a strong support level.

Crypto Daan, a popular trader, compared the recent price behavior with the Bart Simpson pattern, where Bitcoin’s price would spike and then retrace. However, the current market structure resembled the Burj Khalifa, indicating a different pattern.

Meanwhile, Rekt Capital, a trader and analyst, identified $30,600 as a crucial level for Bitcoin. He stated that BTC needed to turn this level into support in the coming days to confirm its breakout.

The market’s ability to hold above this level would be a significant indicator of Bitcoin’s upward momentum.

Glassnode, an analytics firm, noted that Bitcoin’s price cycles often exhibit repetitive patterns.

The $30,000 price level in the current cycle resembled a mid-point, similar to levels observed in previous cycles.

Glassnode referred to the current price action as “re-accumulation,” indicating a consolidation phase before potential further upward movement.

In conclusion, Bitcoin made a fresh breakout attempt, reaching above $31,000 before retracing. The market exhibited characteristics of a leverage crunch, with BTC finding support at $30,200.

Traders analyzed various price patterns and identified crucial levels, such as $30,600, to determine Bitcoin’s future direction. Glassnode suggested that the current price action resembled a phase of re-accumulation, similar to previous Bitcoin price cycles.

The digital asset industry experienced significant growth, reaching a peak of over $3 trillion in November 2021. However, the custodial sector of the market remained more modest, totaling $447.9 billion in 2022.

These figures are derived from a joint report on digital asset custody by consulting firm PricewaterhouseCoopers (PwC) and wealth tech platform Aspen Digital. The 39-page report was published on July 11.

The report identifies 120 custody service providers as of April 2023, categorized into two main groups: third-party service providers and self-custody solutions.

It highlights key institutional developments such as increased interest in crypto staking, driven by the Ethereum Merge, as well as the emergence of nonfungible tokens (NFTs) and the metaverse, attracting institutional investors.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

Security is cited as the primary challenge faced by the custody industry, as demonstrated by FTX’s failure in 2022, attributed to inadequate governance, risk management, and internal controls.

Consequently, institutions are increasingly seeking to safeguard their assets through reputable digital asset custodians or self-custody solutions rather than solely relying on exchange platforms for holding their assets.

Insurance policies present another challenge for custodians.

Self-custody solutions lack insurance coverage, leaving users uncompensated for any loss of digital assets resulting from negligence.

The report emphasizes that sound insurance policies are a critical factor when selecting digital asset custodians, as recognized by sources within family offices.

To assist investors, the report suggests a five-step approach to selecting a custody service provider.

These steps include mapping the market, creating a grading system, conducting performance reviews, and other necessary preliminary procedures.

In recent developments, Canada’s financial authority released guidance to aid fund managers in complying with legal requirements for investment funds holding crypto assets.

Additionally, it expressed confidence in the regulated futures market for cryptocurrencies, which it believes promotes greater price discovery.

The joint report by PwC and Aspen Digital sheds light on the state of digital asset custody, highlighting the challenges faced by the industry and offering recommendations for investors.

As the digital asset market continues to evolve, addressing security concerns and ensuring robust insurance policies will be crucial for the custodial sector to thrive.

Switzerland, renowned for its banking secrecy laws and favored by the wealthy, has quickly embraced the principles of self-sovereignty embodied by Bitcoin (BTC).

The head of Lugano’s Plan ₿ initiative, Giw Zanganeh, spoke with Cointelegraph journalist Joe Hall at the Plan ₿ Bitcoin Summer School, shedding light on the growing use of Bitcoin for everyday transactions in the Swiss city.

Lugano has emerged as a hub for Bitcoin adoption, as well as for Tether and its LVGA stablecoin, which can be used for various utility bills, goods, and services throughout the city.

Zanganeh, who leads Tether’s Plan ₿, expressed his enthusiasm for Switzerland’s remarkable cryptocurrency adoption, despite its well-established financial and banking infrastructure.

READ MORE: South Korean Regulator Takes Action After ‘Coin Gate’ Scandal

He noted that many Swiss citizens are not only interested in Bitcoin from a philosophical perspective but also find alignment with Swiss values.

Swiss society places high value on individual sovereignty and financial privacy, which creates a natural overlap between Swiss culture and the ideals of the Bitcoin movement.

Zanganeh stated that Switzerland likely has one of the highest densities of Bitcoin-only companies per capita in the world, and even politicians, diplomats, and members of parliament are embracing Bitcoin, reinforcing a positive outlook for adoption in the country.

The increased usage of Bitcoin in Switzerland can be attributed to concerted efforts to educate and inform the populace about the advantages of BTC.

Regular articles in newspapers discuss various aspects of Bitcoin and its relevance to financial freedom and freedom of speech, targeting individuals interested in these concepts.

Zanganeh acknowledged that Bitcoin adoption is a gradual process, but the onboarding of merchants in Lugano has played a crucial role in establishing a new payment paradigm in the region.

Zanganeh likened the process of Bitcoin adoption to the initial proliferation of bank cards decades ago, emphasizing that practical experience with novel transactional methods will continue to attract more users to the Bitcoin ecosystem.

Switzerland’s potential as a center for institutional cryptocurrency adoption has also been highlighted by Bitcoin Suisse CEO Dr. Dirk Klee, with the Canton of Zug attracting numerous cryptocurrency and blockchain companies due to its progressive and crypto-friendly initiatives supported by the government.

The interview with Giw Zanganeh is part of an upcoming Cointelegraph documentary that delves into the experience of attending a Bitcoin School.

For those interested, subscribing to Cointelegraph’s YouTube channel will provide access to the documentary.

Readers are also encouraged to collect this article as an NFT, preserving this historical moment and demonstrating support for independent journalism in the crypto space.

Gerardo Moran, an 18-year-old teenager from El Salvador, recently took to social media to share his remarkable story following the completion of the country’s Bitcoin diploma program, Mi Primer Bitcoin (my first Bitcoin).

This program, supported by El Salvador’s Ministry of Education, provided Moran with an opportunity to leave behind his challenging life in construction, where he earned a mere $6 a day.

In a series of heartfelt tweets on July 8, Moran opened up about his experiences, highlighting the stark realities faced by many Salvadoran citizens who toil tirelessly for minimal compensation.

Having worked since the tender age of 11, mostly in construction and tourism, Moran struggled to comprehend why his fellow countrymen put in so much effort for such meager rewards.

READ MORE: Galaxy Digital CEO Mike Novogratz Considering Relocating Business Away From the US

“I’ve pondered why people in my country work so diligently for so little money,” Moran expressed on Twitter, acknowledging that he, too, had been trapped in a cycle of arduous labor for paltry compensation. He reached a breaking point, realizing that earning $6 a day in construction was simply not sustainable for him. Unbeknownst to him at the time, a life-changing opportunity lay just ahead.

It was when Moran’s school announced its search for students interested in enrolling in the Bitcoin diploma course that he decided to seize the opportunity. With determination and dedication, he excelled in the program, acquiring a profound understanding of Bitcoin and its implications.

Now, Moran has returned to his former high school, Antonio J. Alfaro, to educate the teachers about Bitcoin. As a leader in Bitcoin education in his hometown, he is currently training and instructing a group of eight senior professors, sharing his knowledge and experiences through the Bitcoin diploma program.

Mi Primer Bitcoin has garnered immense support from global advocates of Bitcoin education, amassing over 1 BTC in donations.

Generous individuals from countries like Poland and Canada have contributed satoshis over the Lightning Network, showcasing their commitment to fostering the growth of El Salvador’s Bitcoin diploma program.

El Salvador’s director of education, Gilberto Motto, previously emphasized the government’s focus on educating citizens about Bitcoin, particularly targeting teenagers.

Motto explained that by reaching every 16- and 17-year-old in the country, they aim to effectively educate the entire nation within a year.

This strategic demographic is expected to disseminate their knowledge to their families, creating a ripple effect of understanding and adoption.

Gerardo Moran’s inspiring journey serves as a testament to the transformative power of education and the positive impact that Bitcoin can have on individuals and communities.

As El Salvador continues its efforts to embrace digital currencies, Moran’s dedication to sharing his newfound knowledge is playing a vital role in shaping a more informed and empowered society.

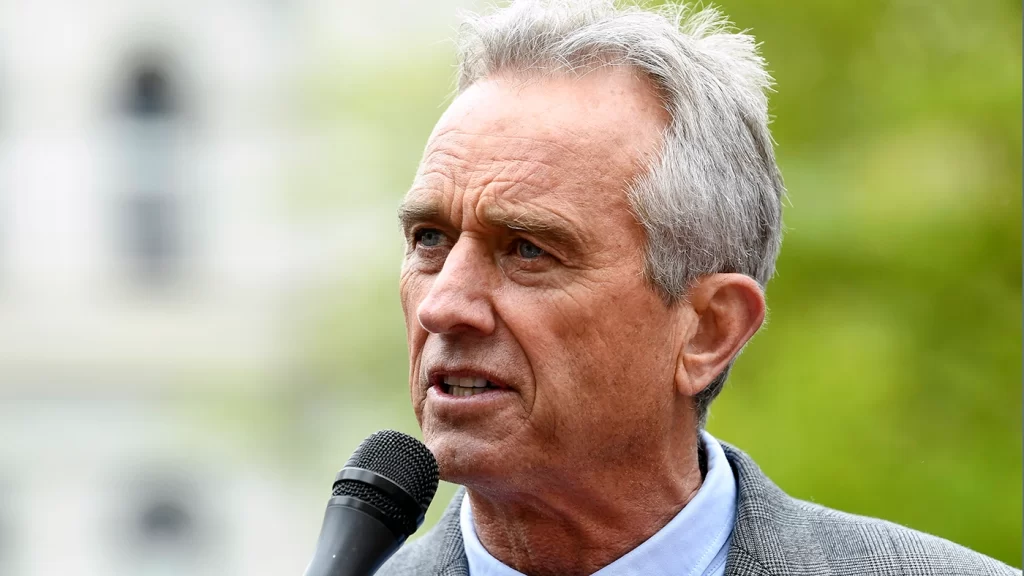

Presidential candidate Robert F. Kennedy Jr. of the United States has admitted to owning a substantial amount of Bitcoin (BTC), contrary to his previous denial of being an investor in the leading cryptocurrency.

According to records obtained by CNBC, Kennedy Jr. held between $100,001 and $250,000 worth of Bitcoin by the end of June.

The investment was made following his speech at the Bitcoin 2023 conference in May, during which he announced that his campaign would be the first in the United States to accept Bitcoin donations.

READ MORE: Digital Currency Group Dismisses Gemini Lawsuit as “Publicity Stunt” by Winklevoss Twins

Interestingly, during the conference, Kennedy Jr. explicitly denied investing in Bitcoin, stating, “I am not an investor, and I am not here to give investment advice.”

The financial disclosure filed on June 30 did not specify the exact timing of the cryptocurrency purchase but revealed that the investment had yielded a return of less than $201 thus far.

Although the filing did not identify the purchaser, Kennedy Jr.’s campaign acknowledged that it was him.

Kennedy Jr., who is challenging President Joe Biden, has been actively targeting the crypto community as part of his campaign.

In a tweet on May 3, he expressed his belief that cryptocurrencies, particularly Bitcoin, are a significant source of innovation.

He also criticized the U.S. government for impeding the industry and potentially driving innovation away.

Notably, Kennedy Jr. has gained support from prominent figures within the crypto industry, including Jack Dorsey, the founder of Twitter and CEO of The Block.

Dorsey took to Twitter to express his confidence in Kennedy Jr.’s strategy to defeat his opponents in the upcoming race.

As the son of former Attorney General and Senator Robert F. Kennedy, as well as the nephew of the 35th President of the U.S., John F. Kennedy, Kennedy Jr.’s candidacy has attracted attention and backing from influential figures.

His support comes at a critical juncture for the American crypto industry, which is currently grappling with regulatory uncertainties as the Securities and Exchange Commission tightens its scrutiny of crypto businesses in the absence of a comprehensive regulatory framework for digital assets in the United States.

In a recent Twitter thread, investor Luke Broyles predicts Bitcoin (BTC) could engulf future prosperity gains, leaving non-investors behind.

He foresees BTC becoming society’s base money due to its key attribute— a fixed, immutable supply, a feature that makes it a future-proof asset.

Broyles argues that while technological innovations, including artificial intelligence (AI), will drive prices down, and nations will continue to print currency to maintain credit markets and raise prices, BTC’s emission will remain unchanging.

READ MORE: Galaxy Digital CEO Mike Novogratz Considering Relocating Business Away From the US

Consequently, even minimal exposure to Bitcoin would be vastly different from having none.

“We have less in common with the future than the past… Bitcoin is already trading for hundreds of millions of political currency units in several nations.

But the actual big deal is that all future innovations’ prosperity gains will pour into society’s base money – BTC,” Broyles explained.

He insists it is vital for individuals to invest, or “get off zero”. Comparing Bitcoin to “digital gold”, he said, is like calling a locomotive an “iron horse”.

This view echoes the opinion of Arthur Hayes, ex-CEO of BitMEX, a crypto derivatives exchange.

Hayes suggested AI will naturally select BTC as its financial backbone because of its distinctive characteristics, leading to a potential price surge past $750,000 per BTC.

The competition for the remaining Bitcoin supply has likely already begun.

According to Broyles, Bitcoin’s liquidity reached its apex during the 2020 cross-market crash and won’t ever revert.

The announcement of a Bitcoin spot-based exchange-traded fund (ETF) filing by BlackRock, the world’s biggest asset manager, boosted US Bitcoin activity. Glassnode, an on-chain analytics firm, observed that the US appears to be reconsidering its own Bitcoin exposure.

“Following the Blackrock Bitcoin ETF request announcement on June 15th, the share of Bitcoin supply held/traded by US entities has seen a significant increase, indicating a potential inflection point in supply dominance if the trend continues,” Glassnode stated on July 8.