According to the 2023 “Financial Stability Report” by Latvijas Banka, the number of individuals purchasing crypto assets in Latvia has witnessed a decline.

The central bank attributes this drop in interest to various factors, including negative sentiment stemming from fraud and insolvency issues among major players in the market, unwise investment decisions that have been made previously, and the association of cryptocurrencies with money laundering.

Furthermore, the report points out the increasing involvement of crypto-asset companies with supervised financial sector participants, which has added to the waning interest in cryptocurrencies.

Based on data from payment card usage, the report reveals that in February 2023, only 4% of the population had bought crypto assets, compared to 8% in the previous year.

It is important to note that Latvia has a total population of 1.84 million people.

The report also sheds light on the declining transfer of funds to crypto wallets from Latvia. In 2022, Latvians transferred 51.8 million euros ($57 million) to crypto wallets, but this figure dwindled to 10.7 million euros ($11.8 million) in the first quarter of 2023.

Most of these transactions were directed towards companies based in other European countries, particularly in those countries where the fintech ecosystem, including crypto technologies, is flourishing. Notable examples include Lithuania, Estonia, Malta, and Ireland.

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

The report contrasts Latvia’s crypto adoption ranking with that of its neighboring country, Lithuania. According to the “2022 Geography of Cryptocurrency Report” by Chainalysis, Latvia was ranked 92nd out of 148 countries in terms of crypto adoption, while Lithuania secured the 102nd spot.

The Latvian central bank acknowledges that its nonbank financial sector is relatively less significant compared to other European countries.

This is mainly attributed to the population’s lower level of long-term savings, which have accumulated over a shorter period compared to many other euro area nations.

Despite the declining interest in crypto assets for investment purposes, the report highlights that retail crypto payments continue to dominate in Latvia.

However, these payments are typically small in size, with 44% of retail payments worth 60 euros ($66) or less, and 97.5% valued at under 1,000 euros ($1,100).

However, the specific monetary value of these transactions was not provided in the report.

Other Stories:

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Gulf Nation Nears Implementation of Virtual Asset Regulations

According to crypto asset manager Grayscale, the next president of the United States is likely to support the implementation of a central bank digital currency (CBDC), as both frontrunners from the major political parties have expressed their favor towards exploring CBDCs.

However, it is worth noting that neither Joe Biden nor Donald Trump seems to hold a positive view of Bitcoin (BTC).

As the 2024 presidential polls currently stand, Joe Biden and Donald Trump hold significant leads in their respective parties. Both candidates have shown interest in exploring CBDCs, a sentiment that aligns with Forbes’ previous analysis earlier in 2023.

Former President Trump has publicly criticized Bitcoin, labeling it a “scam,” while President Biden’s position on the matter has been inferred from his support for imposing a 30% tax on Bitcoin mining.

Grayscale did not comment on Trump’s overall stance towards other cryptocurrencies and digital assets, although it has been noted that he is somewhat favorably inclined towards nonfungible tokens (NFTs).

President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets further supports the notion that he is generally supportive of the crypto industry.

However, the 2023 “Economic Report of the President” issued by the White House was not as optimistic about cryptocurrencies.

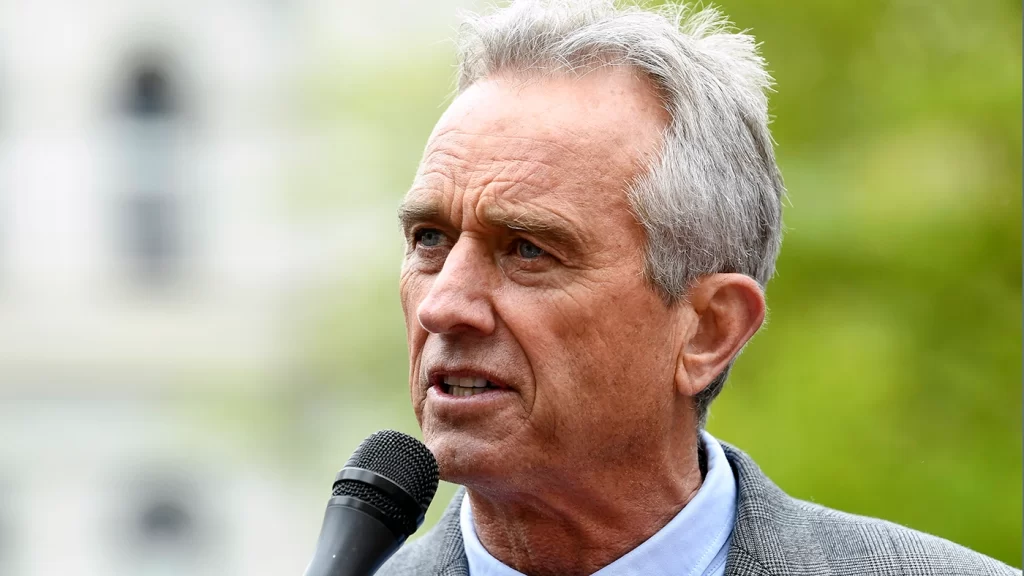

Among the candidates polling in second place are Democratic candidate Robert F. Kennedy, Jr. and Republican candidate Ron DeSantis.

Both of them have been vocal about their support for cryptocurrencies but remain opposed to the idea of a CBDC.

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

It is worth mentioning that Ron DeSantis is not the only pro-crypto candidate within the Republican contenders. Vivek Ramaswamy, with 7% support compared to Trump’s 63%, is also perceived as pro-Bitcoin and anti-CBDC.

One of the most ardent supporters of cryptocurrencies from either party is Republican Miami Mayor Francis Suarez.

He has been vocal about his love for the technology long before his presidential ambitions came into the picture, though some consider his chances of becoming president as “improbable.”

In conclusion, the 2024 presidential race in the United States seems to have a majority of candidates expressing interest in exploring CBDCs.

While both Biden and Trump have indicated support for CBDCs, they have shown disfavor towards Bitcoin.

Other candidates, like DeSantis, Kennedy, Ramaswamy, and Suarez, have varying degrees of support for cryptocurrencies, making the upcoming election a critical juncture for the future of digital assets in the country.

Other Stories:

Gulf Nation Nears Implementation of Virtual Asset Regulations

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

In the first half (H1) of 2023, the classic buy and hold, or hodl, strategy for Bitcoin (BTC) outperformed most crypto funds by an impressive 68.8%.

According to data from 21e6 Capital AG, a Switzerland-based investment adviser, crypto funds, on average, generated returns of 15.2% during the same period, while BTC saw gains of around 84%.

Maximilian Bruckner, the head of marketing at 21e6 Capital AG, noted that crypto funds have previously been able to outperform Bitcoin in bull markets.

However, their lackluster performance in 2023 was attributed to challenging market conditions and the large cash reserves they held at the end of 2022.

After the collapse of FTX and other crypto projects in 2022, many crypto funds decided to reduce risk and build cash buffers.

Unfortunately, this move caused them to miss out on significant BTC price rallies in H1 2023. The report indicated that funds with substantial cash positions tend to underperform in a bull market, unless their assets perform significantly better than Bitcoin.

The general sentiment following the events of 2022 led to larger-than-normal cash positions for many funds, and most major altcoins also underperformed Bitcoin during this period, making it a challenging environment for them.

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

At the time of writing, BTC was priced at roughly $29,000 and struggled to hold above the $30,000 level, which was only briefly surpassed a couple of times in 2023.

Despite this, the current price marked a 75% gain since January 1, as per CoinGecko data.

The report acknowledged that all crypto fund strategies achieved positive results in 2023, but they underperformed when compared to Bitcoin, especially those with significant exposure to altcoins, futures, or those relying heavily on momentum signals.

Looking ahead, the report highlighted that monitoring the leading futures providers and the funding rates in crypto futures markets, as well as the ability of quantitative funds to capture trends, would be crucial areas of focus for market observation.

The investor sentiment showed slight improvement over H1 2023, suggesting that some funds might consider allocating more cash into the crypto sector.

However, the report cautioned that full sentiment recovery had not yet taken place, as indicated by current data on inflows and outflows.

Other Stories:

Gulf Nation Nears Implementation of Virtual Asset Regulations

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

Despite recent fluctuations in Bitcoin’s price, predictions of the cryptocurrency reaching six figures by the end of 2024 persist.

For publicly-listed Bitcoin miners, achieving a price above $100,000 may be imperative for their business profitability rather than just a hopeful forecast.

Bitcoin mining stocks have seen remarkable growth this year, outperforming Bitcoin itself in recent months.

While Bitcoin’s volatility has decreased and it has undergone a period of consolidation, mining companies’ stocks have surged by nearly 100% within a short span.

A report analyzing the mining industry, particularly Riot Platforms, reveals that even though Riot is expected to triple its mining capacity by 2024, it and other miners could face significant challenges due to the halving event.

The halving reduces BTC block rewards by 50%, effectively cutting miners’ revenue in half. To overcome this, some miners may resort to issuing new equity shares to finance their operations.

However, this can dilute existing shares and impede share price growth, even if the company’s fundamentals remain intact.

Furthermore, some mining stocks might already be overvalued at current levels, potentially indicating a decline in momentum if more BTC is sent to exchanges.

As a result, a considerable increase in Bitcoin’s price would be necessary for miners to stay profitable at the current hash rate levels.

The report suggests that Bitcoin would need to trade above $98,000 to justify Riot’s current valuation post-halving.

Hence, holding BTC mining stocks is deemed extremely risky, as the underlying fundamentals may not align with the current valuations that might not account for the upcoming Bitcoin halving.

READ MORE: Goldman Sachs Economists Predict AI to Surpass Electricity and PCs in Financial Impact on US Economy

Another report from Matrixport forecasts Bitcoin reaching $45,000 by year-end and $125,000 by the end of 2024.

The report emphasizes the significance of Bitcoin’s one-year high, historically marking the beginning of new crypto bull markets.

Previous occurrences of this signal were followed by bull markets materializing within 12-18 months.

This six-figure Bitcoin price prediction aligns with other projections, including Standard Chartered’s forecast of a $120,000 Bitcoin price by the end of 2024.

Interestingly, the latter prediction is based on the assumption that BTC miners will hold onto their Bitcoin instead of selling it before the halving.

In conclusion, despite recent price fluctuations, many experts still believe in the possibility of Bitcoin reaching six figures by the end of 2024.

For publicly-listed Bitcoin miners to remain profitable, a significant increase in Bitcoin’s price seems necessary, especially considering the effects of the halving event on mining revenues.

However, as with any financial prediction, there are inherent risks and uncertainties to be considered.

Other Stories:

Robinhood Turns Profitable in Q2 2023 Despite Revenue Dip

KPMG, one of the Big Four professional services firms, recently published a report on Bitcoin’s impact on environmental, social, and governance (ESG) issues.

The report highlighted that Bitcoin offers various benefits when analyzed through an ESG framework.

In terms of the environment, the report emphasized that emissions were a more significant environmental concern compared to energy usage.

KPMG contextualized Bitcoin’s emissions in comparison to other sources, such as tobacco and tourism, and found that it ranked as the second smallest contributor, trailing only behind “Video (US).”

Consequently, the report concluded that Bitcoin’s emissions might be lower than commonly discussed.

To improve Bitcoin’s carbon footprint, the report suggested employing renewable energy sources and energy produced from methane for mining.

Regarding social issues, the report pointed out that Bitcoin’s contribution to money laundering was relatively small when compared to the total amount of money laundering globally.

Money laundering constitutes 2-5% of global gross domestic product, according to the United Nations Office on Drugs and Crime statistics cited in the report, while it accounts for merely 0.24% of Bitcoin transactions, as indicated by Elliptic.

Moreover, the report highlighted that laundered money was received in Bitcoin far less frequently than in other cryptocurrencies like Ether, stablecoins, or altcoins.

It suggested that Anti-Money Laundering (AML) and Know Your Customer (KYC) measures could be applied during the off-ramping process of converting Bitcoin back to fiat currency, even though no AML/KYC requirements currently exist for transacting with Bitcoin.

READ MORE: Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

The report also showcased positive use cases for Bitcoin, such as its utilization in fundraising for Ukraine and supporting electrification efforts in rural Africa.

Addressing governance, the report praised Bitcoin’s robust governance system.

It explained that Bitcoin’s rules could not be altered without forking, resulting in a decentralized system that cannot be abused or manipulated by individuals with ulterior motives or those in positions of power.

While the report utilized secondary sources and familiar use cases, it acknowledged that Bitcoin remains widely misunderstood. KPMG, being well-versed in crypto-related matters, offers various crypto-related advisory services.

In summary, KPMG’s report emphasized that Bitcoin presents several advantages from an ESG perspective.

Despite certain environmental concerns, it highlighted the potential for lower emissions, recommended sustainable energy solutions, and acknowledged its relatively minor contribution to money laundering.

Additionally, the report praised Bitcoin’s strong governance structure, ensuring its integrity and decentralization.

Other Stories:

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

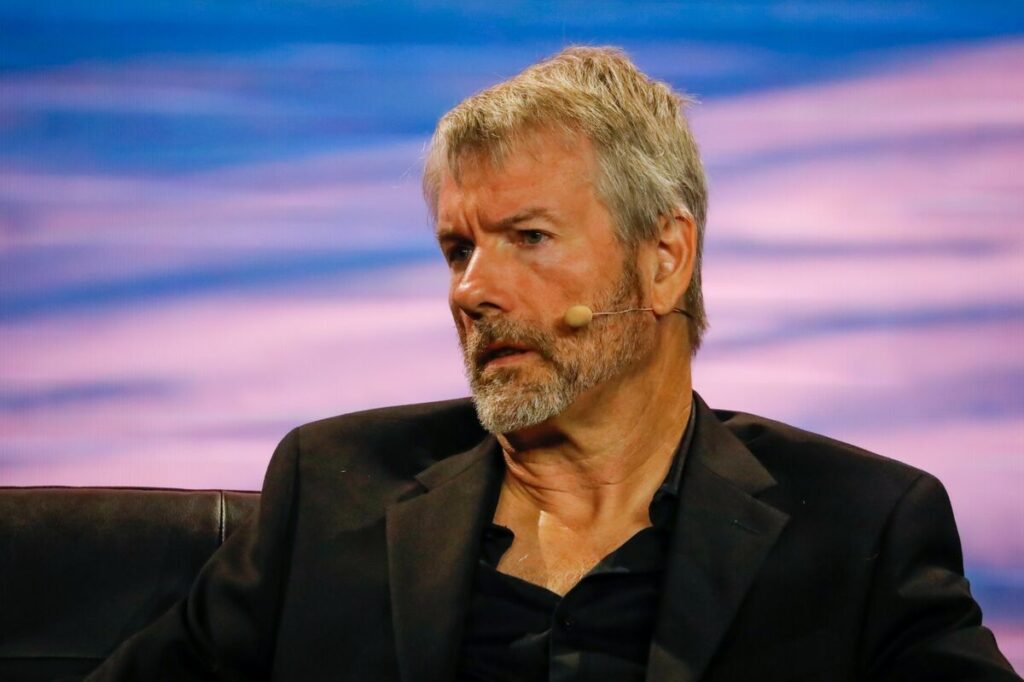

MicroStrategy co-founder, Michael Saylor, is confident that his company will continue to be an attractive option for investors seeking exposure to Bitcoin, irrespective of future exchange-traded fund (ETF) approvals.

As the price of Bitcoin ticks down to $29,223, Saylor reaffirms the firm’s commitment to adding more Bitcoin to its balance sheet, even planning a $750 million share sale to potentially fund further acquisitions.

During an interview with Bloomberg on August 2, Saylor discussed how a spot Bitcoin ETF approval could impact MicroStrategy’s offering.

He expressed assurance that the company would still offer unique advantages that spot Bitcoin ETFs cannot match.

This sentiment echoes his previous remarks during the August 1 earnings call, where he emphasized that MicroStrategy’s Bitcoin operating strategy would set it apart from spot ETFs when they eventually launch.

Since MicroStrategy began its purchasing strategy in August 2020, Bitcoin’s price has surged by 145%. Saylor attributes this success to the company’s use of leveraged investments, generating yields that are shared with shareholders.

Unlike ETFs, MicroStrategy, being an operating company, can access leverage, giving it a distinct advantage in the ecosystem.

Saylor believes that spot Bitcoin ETFs will attract large hedge funds and sovereigns, allowing them to invest billions of dollars in the space.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

However, he sees MicroStrategy as a unique instrument, akin to a sports car, while spot ETFs would be more like supertankers.

He envisions spot ETFs serving a different set of customers and contributing to the overall growth of the asset class.

Currently, MicroStrategy boasts more than 470 institutional shareholders and holds a market capitalization of $5.3 billion, according to Fintel.

As analysts raise the chances of spot Bitcoin ETF approval in the United States to 65%, Saylor confirms the company’s goal is to accumulate as much Bitcoin as possible.

Their existing holdings of 152,800 BTC are expected to increase in the coming quarters.

To support their Bitcoin accumulation strategy, MicroStrategy plans to sell up to $750 million in class A common stock, as revealed in a recent SEC filing.

Saylor clarifies that the primary use of these proceeds will be to acquire more Bitcoin, further solidifying the company’s belief in the long-term potential of the digital asset.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Coinbase, the prominent cryptocurrency exchange, was reportedly urged by the United States Securities and Exchange Commission (SEC) to remove all cryptocurrencies from its platform, except for Bitcoin (BTC).

This revelation came to light during a recent interview with Coinbase CEO Brian Armstrong published by the Financial Times on July 31.

According to Armstrong, the SEC demanded the delisting of nearly 250 tokens on Coinbase before initiating legal action against the exchange.

The SEC’s stance was based on its belief that “every asset other than Bitcoin is a security.”

However, Armstrong disagreed with this interpretation, challenging the regulator to explain their reasoning, but they refused, insisting on the complete removal of all tokens besides Bitcoin.

This viewpoint aligns with SEC Chair Gary Gensler’s assertion made in a prior interview that everything apart from Bitcoin falls under the agency’s regulatory purview as a security.

Agreeing to the SEC’s request, Armstrong argued, would have set a dangerous precedent and potentially led to the demise of the entire crypto industry in the United States.

As a result, Coinbase opted to challenge the SEC’s position in court to seek legal clarity.

READ MORE: French Data Protection Agency Investigates Worldcoin

The SEC filed a lawsuit against Coinbase in early June, accusing the exchange of operating without proper registration and identifying 13 cryptocurrencies offered on the platform as unregistered securities.

Coincidentally, the regulator also lodged a similar complaint against Binance.

Responding to the situation, the SEC clarified that while its enforcement division does not formally request companies to delist crypto assets, its staff may share their views on actions that might breach securities laws.

Regulation of the crypto industry in the United States has been somewhat ambiguous, with both the Commodity Futures Trading Commission (CFTC) and the SEC exercising regulatory authority over various aspects of the sector.

To address this regulatory uncertainty, legislation aiming to grant primary jurisdiction over cryptocurrencies to the CFTC and define the SEC’s role concerning crypto was passed by the House Agricultural Committee on July 27, following earlier approval by the House Financial Services Committee.

However, further steps are required for it to become law.

In summary, Coinbase’s confrontation with the SEC regarding the delisting of cryptocurrencies other than Bitcoin reflects the ongoing struggle to establish clear and comprehensive regulations for the crypto industry in the United States.

The outcome of this legal battle could have significant implications for the entire crypto market in the country.

Other Stories:

Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Bitcoin (BTC) experienced reduced volatility as it approached the July 30 weekly close, leaving traders anticipating a significant long-term bullish signal.

Over the weekend, BTC/USD exhibited sideways movement, trading within a narrow $150 range.

Despite several macroeconomic data events throughout the week, the market remained calm, leading to speculations of an imminent breakdown.

Pseudonymous trader Daan Crypto Trades highlighted that the compression in price action had not been seen since the beginning of 2023, suggesting that a substantial move might be on the horizon.

Comparisons were drawn to earlier in the year when Bitcoin’s Bollinger Bands resembled the current conditions before the price surged 70% in the first quarter.

Analysis of the Binance BTC/USD order book by monitoring resource Material Indicators revealed that whales’ buying pressure coincided with increased resistance near $30,000.

However, they expected significant support to remain until the weekly and monthly candle closes on July 29.

READ MORE: Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

The potential bullish cross on Bitcoin’s monthly moving average convergence/divergence (MACD) indicator drew significant attention as market observers noted its proximity to confirmation.

Historical patterns indicated that this could lead to upside gains in the future.

Although the cross held positive implications, Trading resource Stockmoney Lizards cautioned that Bitcoin might still be in its summer correction mode.

A chart presented by Stockmoney Lizards displayed a prior monthly MACD cross in late 2015, which preceded Bitcoin’s surge two years later, resulting in the previous cycle’s all-time high of $20,000.

The cross signaled preparations for the significant price movement that followed.

While lower-timeframe MACD crosses can sometimes be false alarms, the significance of a weekly cross in August 2021 was evident as it preceded the move to Bitcoin’s current all-time highs in November of that year.

As the weekly close approached, traders kept a close eye on Bitcoin’s price action, hoping to witness the potential bull signal and foreseeing the implications it might have on the future trajectory of the cryptocurrency.

Other Stories:

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

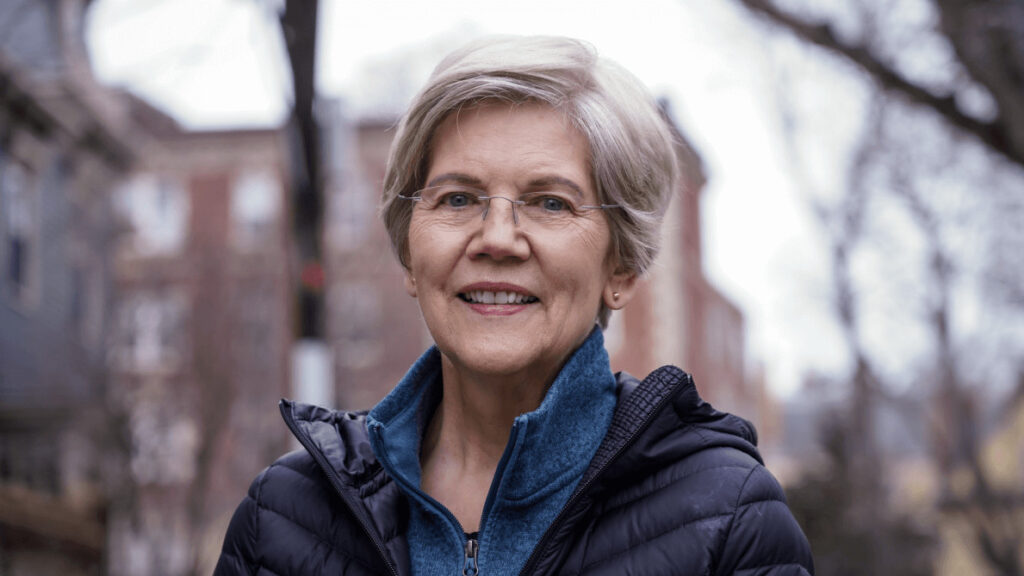

The Bank Policy Institute (BPI), a pro-banking organization in the US, has come out in support of Senator Elizabeth Warren’s efforts to strengthen cryptocurrency regulations.

Senator Warren, along with three other senators, recently reintroduced the Digital Asset Anti-Money Laundering Act, which aims to impose stricter rules to combat money laundering and terrorism financing within the crypto industry.

Despite past criticism from Senator Warren, the BPI expressed its endorsement of the bipartisan legislation.

In a statement, the BPI emphasized the need for the existing anti-money laundering and Bank Secrecy Act framework to encompass digital assets, in order to safeguard the nation’s financial system against illicit finance.

The proposed seven-page bill, if enacted, would require digital asset wallet providers, miners, and blockchain validators to maintain records of customer identities.

Additionally, financial institutions would be prohibited from using digital asset mixers, such as Tornado Cash, which are designed to obscure blockchain data.

Senator Warren and her co-sponsors, Senator Joe Manchin, Senator Roger Marshall, and Senator Lindsey Graham, announced the reintroduction of the bill.

In addition to customer identity tracking, the legislation would prompt relevant government bodies, including the Treasury Department, Securities and Exchange Commission, and Commodity Futures Trading Commission, to establish new examination processes to ensure compliance with anti-money laundering and terrorism financing requirements.

Several organizations, including the Massachusetts Bankers Association, AARP, the National Consumer Law Center, and the National Consumers League, have expressed their support for the bill.

READ MORE: Why Didn’t Bitcoin (BTC) Enter a New Rally?

However, not everyone in the crypto community agrees with the proposed legislation.

Tyler Winklevoss, co-founder of the Gemini crypto exchange, criticized the bill in a tweet, suggesting that those opposing it are making the right decision.

Senator Warren originally introduced the bill in December 2022, arguing that current anti-money laundering laws do not adequately cover the crypto industry.

She has consistently called for cryptocurrencies to be subjected to the same regulations as traditional banking institutions to prevent money laundering and illegal activities.

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), has also been vocal about his concerns regarding the crypto market.

He highlighted the prevalence of fraud in the sector and pointed out that many crypto investors do not receive the same level of protection as investors in traditional securities markets.

In conclusion, the Digital Asset Anti-Money Laundering Act seeks to tighten regulations on cryptocurrencies to combat illicit financial activities.

While Senator Warren and the BPI back the bill, some members of the crypto community, including Tyler Winklevoss, have expressed reservations. Gary Gensler, the SEC Chairman, also shares concerns about fraudulent activities in the crypto market and advocates for better investor protection.

Other Stories:

Revealed: The Best Crypto Marketing & PR Agency

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit

Margot Robbie, the well-known Australian actress starring in the lead role of the upcoming Barbie movie, has sparked a lively discussion within the crypto community with her recent statement comparing Bitcoin (BTC) to Barbie’s companion, Ken.

During an interview with Fandango on June 22, Robbie shared that whenever she overheard her husband, Tom Ackerley, and television producer, David Heyman, discussing Bitcoin on set, it reminded her of the traits of Ken, the fictional character played by Ryan Gosling in Barbie.

The crypto community on Twitter, including figures like Michael Saylor from MicroStrategy and social media influencer Layah Heilpern, had a mixed response to Robbie’s analogy.

Saylor even declared Bitcoin to be synonymous with “Big Ken Energy,” while others, like Layah Heilpern, saw it as an insult towards men who talk about Bitcoin.

On July 30, Heilpern further explained her interpretation of Robbie’s remarks, suggesting that the actress implied male Bitcoin enthusiasts are weak and pathetic.

However, Mark Travers, a lead psychologist at Awake Therapy, countered this perspective, stating that having Ken’s energy could indicate someone who is selfless and adaptable, challenging traditional gender stereotypes.

Robbie herself acknowledged that defining Ken energy might be subjective, stating that it’s something one can sense rather than precisely define.

READ MORE:Revealed: The Best Crypto Marketing & PR Agency

Despite differing opinions, Steven Lubka, a managing director at Swan Bitcoin, viewed Robbie’s comment as positive for the crypto community, expressing optimism on July 29.

It is worth noting that Robbie’s comments were brief and neutral, taking place amidst ongoing legal actions against celebrities who have promoted cryptocurrencies.

NBA star Jimmy Butler, for instance, sought to be removed from a class-action lawsuit alleging the promotion of unregistered securities by cryptocurrency exchange Binance.

In a filing on July 24, Butler’s lawyers argued that the tweets he appeared in did not promote the named securities and, therefore, could not have contributed to their promotion.

Binance CEO Changpeng “CZ” Zhao and YouTubers Ben Armstrong (BitBoy Crypto) and Graham Stephan are also contesting similar allegations in the same lawsuit.

In conclusion, Margot Robbie’s comparison of Bitcoin to Ken from Barbie sparked a lively debate within the crypto community.

While some embraced the analogy as a positive representation, others interpreted it as demeaning. As discussions continue, it’s evident that the crypto world remains dynamic and subject to ongoing scrutiny.

Other Stories:

Why Didn’t Bitcoin (BTC) Enter a New Rally?

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit