The potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States has been shrouded in suspense due to the Securities and Exchange Commission’s (SEC) ongoing delay in reaching a decision.

This delay is now raising speculations that the verdict might encompass influential players in the financial sector, including giants like BlackRock and Fidelity.

Dave Weisberger, co-founder of CoinRoutes and an experienced figure in the markets, emphasized the mounting pressure on the SEC to grant approval for several ETFs.

The performance of approved futures-backed products has fallen significantly behind the actual spot performance, adversely affecting investors.

He believes that the culmination of this decision will likely encompass all pending applications.

The SEC is currently evaluating eight applications for a spot Bitcoin ETF, reflecting a series of past rejections and postponements for such cryptocurrency-related products.

The contenders awaiting a decision comprise prominent entities like ARK Invest, Bitwise, BlackRock, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie. Together, these firms oversee a staggering $15 trillion in global assets.

Recently, the SEC initiated a 21-day commentary period for the ARK 21Shares Bitcoin ETF.

The regulator’s inquiries revolve around the proposal’s potential to counter fraudulent and manipulative actions and its assessment of the susceptibility of the Bitcoin market to manipulation.

A particular focus was directed towards Coinbase’s surveillance-sharing agreement, with the SEC requesting input on whether this involvement could effectively identify, investigate, and discourage manipulation and fraud in Bitcoin’s valuation.

Ruslan Lienkha, Chief of Markets at YouHodler, offered insight into the SEC’s concerns about market manipulation by major entities.

He elaborated that if the SEC were to greenlight multiple ETFs, the risk of manipulation would substantially diminish, as these firms could engage in frequent trading against each other.

Despite the SEC’s extended contemplation, Bitcoin’s valuation experienced a modest impact, hovering around $30,000.

Market players, including Mauricio Di Bartolomeo, co-founder of Ledn, a crypto lending platform, seemed prepared for the SEC’s prolonged deliberation, asserting that today’s decision bears minimal influence on market expectations.

Notably, the SEC has a couple of deadlines to meet before reaching a final conclusion. The next deadline for the ARK 21Shares application is scheduled for January 2024.

Valkyrie’s application, the most recent addition to the lineup, faces deadlines in January and March of the following year.

The outcome of the BTC ETF ruling has the potential to reshape the landscape of cryptocurrency investments.

If approved, this could infuse the Bitcoin market with a substantial $70 billion in liquidity.

Lienkha highlighted the enhanced confidence regular investors would gain through ETFs, as professional guidance would alleviate the need for them to delve into intricate technicalities and risk assessments independently.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

SoFi Bank, headquartered in San Francisco, has reported an impressive surge in its cryptocurrency holdings, disclosing nearly $170 million in its Q2 earnings report.

This marks a substantial escalation compared to the previous quarter and underscores the bank’s growing involvement in the crypto market.

With an extensive customer base of over six million individuals, SoFi has established itself as a prominent player in the United States banking landscape.

Of the total crypto investments amounting to $166 million, SoFi Bank’s portfolio encompasses $82 million in Bitcoin (BTC) and $55 million in Ethereum (ETH).

Additionally, Dogecoin (DOGE) claims the third spot with an allocation nearing $5 million, while Cardano (ADA) holdings total $4.5 million.

Notably, the bank’s investor presentation highlighted its impressive feat of onboarding more than 500,000 new customers, expanding its support to facilitate trading for over 22 different cryptocurrencies.

Beyond mere crypto holdings, SoFi offers its clientele the ability to buy and sell a diverse array of cryptocurrencies, leveraging its strategic partnership with the Coinbase crypto exchange.

This move is aligned with the bank’s earlier initiative, commencing crypto services in September 2019.

Interestingly, SoFi evolved into a full-fledged bank in February 2022 when it obtained a banking license, distinguishing itself as one of the limited traditional banks delving into the crypto realm.

Despite its strides in the crypto domain, SoFi’s crypto venture has encountered resistance from regulatory quarters.

READ MORE: XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

In November 2022, a U.S. Senate committee raised concerns about the bank’s adherence to banking laws, spotlighting a looming deadline in January 2024.

SoFi Bank’s response to these concerns remains pending, as Cointelegraph’s outreach for clarity regarding its compliance deadline and potential implications for crypto holdings did not yield a response at the time of publication.

The integration of the cryptocurrency sector with conventional banking has long been deemed a pivotal milestone for mainstream adoption.

However, the crypto industry weathered a tumultuous 2022, which was further exacerbated by the collapse of several banks focused on crypto affairs in 2023.

In response, U.S. legislators hurriedly intervened to safeguard customers’ assets, albeit at the cost of disrupting the synergistic relationships between crypto and traditional finance.

As the regulatory landscape grapples with assigning accountability, the future trajectory of this evolving partnership remains uncertain.

Other Stories:

Governments Remain Wary About Worldcoin Amid Privacy Concerns

Binance’s Proof-of-Reserves Discloses Strong Financial Position

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

The futuristic animated series, Futurama, known for its comedic take on science fiction, took a humorous jab at cryptocurrency mining in its latest installment, demonstrating the show’s knack for predicting trends well before they materialize.

The show’s third episode of its recent version, titled “How the West Was 1010001,” was released on Hulu on August 6, where the characters found themselves indebted to the Robot Mafia.

In a clever parody, they embarked on a journey to “Crypto Country,” a fictional representation of the Wild West, reminiscent of Bitcoin mining’s resource-intensive nature.

Set in the year 3023, Futurama’s portrayal of the cryptocurrency landscape remained true to its comedic nature.

The price of BTC remained volatile, and people scoured the land for sources of “cheap, filthy electricity” to facilitate their mining operations.

The episode’s humor manifested through absurd scenarios, like collecting thallium for crypto mining chips, relocating to the comically named “Doge City,” and BTC miners consuming such massive energy that it started ionizing the atmosphere.

Not solely focused on Bitcoin, the show humorously touched upon “danged Ethereum” and depicted robots’ heads repurposed for mining crypto.

READ MORE: Binance’s Proof-of-Reserves Discloses Strong Financial Position

Remarkably, Futurama had been on air since March 1999, a decade before the inception of Bitcoin.

While the show had rarely delved into cryptocurrency discussions, its recent episode underscores the growing presence of digital assets in mainstream media, spanning from animated series like South Park to blockbuster films like Mission: Impossible – Dead Reckoning Part One.

Curiously, the episode left unaddressed the rationale behind the characters’ persistence in Bitcoin mining in 3023, despite the widely-known BTC halving process.

This process indicates that the final Bitcoin block would likely be mined around the year 2140, making the episode’s comedic depiction divergent from the actual cryptocurrency timeline.

In its characteristic style, Futurama’s latest episode has managed to weave an amusing tale around cryptocurrency mining, showcasing the series’ enduring relevance and its ability to lampoon emerging trends with a comedic touch.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

Governments Remain Wary About Worldcoin Amid Privacy Concerns

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

In the week ending on August 4, cryptocurrency asset flows recorded a total of $107 million in outflows, continuing a three-week negative trend that amounted to $134.8 million.

Once again, the primary factor behind this movement was Bitcoin (BTC), which experienced $111 million in outflows. These outflows offset the majority of inflows seen in the market during the week.

According to CoinShares’ “Digital Asset Fund Flows” weekly report, this trend indicates further “profit taking” following the gains from the previous market cycle.

In the month leading up to the recent outflows, crypto funds had seen inflows of $742 million, with a significant 99% of those inflows directed towards Bitcoin.

Weekly trading volumes in investment products experienced a decline below the year-to-date average, with broader on-exchange market volumes down by 62% compared to the relative average.

Regionally, only Australia and the United States demonstrated inflows of $0.3 million and $0.2 million, respectively.

Conversely, Canada and Germany witnessed the largest outflows, with $70.8 million and $28.5 million, respectively.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Despite the outflows from Bitcoin, the total weekly outflows were partially offset by inflows into Solana (SOL), amounting to $9.5 million, a significant increase from the previous week’s $0.6 million inflows.

Additionally, investment products related to XRP (XRP) also experienced inflows of $0.5 million.

However, Ether (ETH) funds continued their negative trend, with an additional $5.9 million in outflows following the previous week’s $1.9 million.

These outflows offset the prior inflows of $6.6 million, further distinguishing Ether from the current bullish trend of Solana.

Bitcoin has maintained its overall value since the beginning of the year compared to its January opening, but market experts believe that the sideways movement observed since April, mostly below $30,000, is a result of market uncertainty.

Data from Switzerland-based investment adviser 21e6 Capital AG revealed that “hodlers” of Bitcoin, those who held funds in BTC, outperformed crypto funds by 69% in the first half of 2023.

The 2022 implosion of FTX and regulatory and legal uncertainties surrounding several other exchanges may have prompted crypto fund investors to increase their cash reserves rather than investing further, contributing to the current decline.

The report from 21e6 Capital AG also noted a slight increase in investor sentiment compared to the first half of 2023.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Bitcoin (BTC) managed to bounce back above the $29,000 mark on August 8, as one trader detected signs of a potential breakout in progress.

Following a slight rebound from local lows of $28,670, Bitcoin remained within a narrow range and seemed to mirror movements in the United States equities during the August 7 Wall Street trading session.

Although there was no significant momentum in either direction, market participants were eager to identify signals indicating a possible return of a trend.

Trader Jelle spotted a potential falling wedge breakout on daily timeframes, noting that this formation could lead Bitcoin’s price to a target of $32,000.

This wedge pattern had emerged at the beginning of July, marking the second such formation in two months, the first one appearing from April to the end of June.

Michaël van de Poppe, the founder and CEO of trading firm Eight, characterized the previous day’s dip as a standard correction.

He observed that the market quickly bounced back, resulting in a decent daily candle. However, market participants were also keeping a close eye on the July print of the U.S. Consumer Price Index (CPI), which has historically been a catalyst for crypto market volatility.

On intraday timeframes, the situation was more complex as market makers and takers engaged in a dynamic interplay on exchanges.

Skew, a popular trader, highlighted that failure to break down the price forced spot takers to bid, particularly since they had led the sell-off around the $29,000 level.

In a more optimistic analysis, Yann Allemann and Jan Happel, co-founders of on-chain analytics firm Glassnode, argued that the dip below $28,000 held more significance as a local bottom than many realized.

According to Glassnode’s Risk Signal metric, Bitcoin was at its highest-risk trading level in several months.

Coupled with a neutral signal on altcoins and overall volatility near its lowest-ever values, the market was poised for potential bullish activity.

As the market approached being oversold, there were indications that bulls might step in, particularly if Bitcoin tapped the liquidity pool at around $28,500.

This was viewed as a potential reversal point that market participants had been hoping for.

However, given the volatile nature of the cryptocurrency market, caution was advised as fluctuations could quickly alter the landscape.

Other Stories:

2024 Presidential Candidates’ Mixed Views on Crypto

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Tech entrepreneur Ilya Lichtensteind, a dual Russian-American citizen, has confessed to perpetrating the original 2016 Bitfinex hack, according to CNBC.

Along with his wife, Heather Morgan, the couple admitted to attempting to launder a staggering $4.5 billion worth of Bitcoin stolen from Bitfinex.

Until Thursday’s admission, the identity of the hacker responsible for the 2016 cryptocurrency heist had remained undisclosed.

Interestingly, while the couple confessed to attempting to launder the stolen funds, they were not charged with the actual hacking incident itself.

Heather Morgan, also known by the alias “Razzlekhan,” added an unusual twist to their criminal escapade by venturing into the realms of rap music and tech entrepreneurship while evading law enforcement.

Her music videos and rap lyrics depicted her as a “bad-ass money maker” and a “crocodile of Wall Street,” while Forbes articles portrayed her as a successful tech magnate, economist, serial entrepreneur, software investor, and rapper.

The duo’s sophisticated money laundering operation involved meticulously dividing the stolen Bitcoins into smaller amounts and routing them through thousands of different crypto wallets using false identities.

They further intertwined these funds with other criminal cryptocurrency proceeds on the darknet marketplace Alphabay, purchased gold coins, and channeled them through shell companies to legitimize their ill-gotten gains.

However, investigators managed to trace the couple’s criminal proceeds back to the Bitfinex hack when they discovered a trail leading to Walmart gift cards purchased with stolen funds. The veil of anonymity the couple hoped for through complex transactions between various exchanges and cryptocurrencies began to unravel.

A breakthrough came when law enforcement raided the couple’s Manhattan residence, uncovering a wealth of incriminating evidence, including mobile phones hidden in hollowed-out books, disposable handsets, USB drives, and $40,000 in cash.

READ MORE: Best Crypto Casinos In 2023

Decrypting a meticulously crafted spreadsheet revealed their intricate web of money laundering strategies, leading to the recovery of almost the entire stolen amount.

Communication records exposed the couple’s plans to flee to Russia, Ilya Lichtenstein’s country of birth, to avoid arrest.

Thankfully, law enforcement thwarted their escape, potentially preventing them from evading justice.

The 2016 hack had severely impacted Bitfinex customers, resulting in a collective loss of 36% of their holdings on the crypto exchange.

By 2019, the exchange managed to reimburse the affected customers, offering hope for a financial recovery once the recovered Bitcoins were returned to the rightful owners.

As legal proceedings unfold, Ilya Lichtenstein faces a maximum 20-year prison sentence, while Heather Morgan could be sentenced to up to 10 years behind bars.

The U.S. Department of Justice reported seizing an additional approximately $475 million tied to the hack since the couple’s arrest in February 2022, indicating the ongoing efforts to recover the stolen funds.

Other Stories:

JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Bitcoin (BTC) appears to be gearing up for a full-fledged bull phase, according to market analyst Cole Garner.

Despite its current price stagnation at around $29,033, many experts believe that this cycle will follow the classic pattern of previous bull runs.

One of the key indicators of optimism is the activity among the largest-volume cohort of Bitcoin investors, known as whales.

Garner considers whale accumulation trends to be the backbone of a bull market.

Analytics team Jarvis Labs also reported an ongoing “multi-month buying frenzy” among whales, as well as smaller investors (referred to as fish) increasing their BTC exposure.

The behavior of whales during this cycle has been notable, with some experts calling them “diamond hands” for holding onto their BTC positions rather than selling aggressively like they did in the previous cycle.

This shift in whale behavior is seen as a positive sign for the market.

Another significant factor in predicting a potential BTC price breakout is the Bitcoin-to-stablecoin ratio on Bitfinex, which has historically preceded major bull runs.

Garner emphasizes that Bitfinex is considered the “smart money exchange” and that the behavior of its whale traders can strongly influence short-to-medium-term price action in the crypto market.

While Garner expects a bullish breakout in the third quarter, he acknowledges that summer seasonality could potentially cause a shakeout before that.

Nonetheless, he believes that the markets still have several weeks to run before any potential downturn.

To invalidate the bullish outlook, Bitcoin would need to close below its 200-week simple moving average (SMA), which currently stands at $27,235.

As long as BTC remains above this level, the positive momentum is likely to continue.

Overall, analysts like Garner remain optimistic about the future of Bitcoin and the broader crypto market.

With whale accumulation and investor behavior supporting the bullish thesis, many in the crypto community are anticipating significant upside potential for Bitcoin in the coming months.

However, as with any market, unpredictability and potential risks remain, and traders should approach the situation with caution.

Other Stories:

U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

Coinbase CEO Affirms Commitment to US Amid Regulatory Uncertainty

Latvia Sees Decline in Crypto Asset Purchases Amidst Concerns Over Fraud and Money Laundering

Crypto asset manager Grayscale has expressed the belief that the next U.S. President will be supportive of central bank digital currencies (CBDCs), as stated in a recent blog post.

Grayscale highlights that the current frontrunners of both major political parties, Joe Biden and Donald Trump, have shown a willingness to explore CBDCs, though they are less enthusiastic about Bitcoin.

Trump has publicly called Bitcoin a “scam,” once tweeting his discontent with the cryptocurrency, criticizing its volatile value.

Similarly, Biden’s stance towards Bitcoin can be deduced from his support for a 30% tax on Bitcoin mining, a move that could negatively impact the U.S. mining industry.

Grayscale also pointed out Trump’s favorability towards non-fungible tokens (NFTs), with Trump having launched and sold two NFT collections.

Biden’s support for digital assets can be inferred from his “Executive Order on Ensuring Responsible Development of Digital Assets,” although the 2023 Economic Report of the President did not share the same enthusiasm for cryptocurrencies.

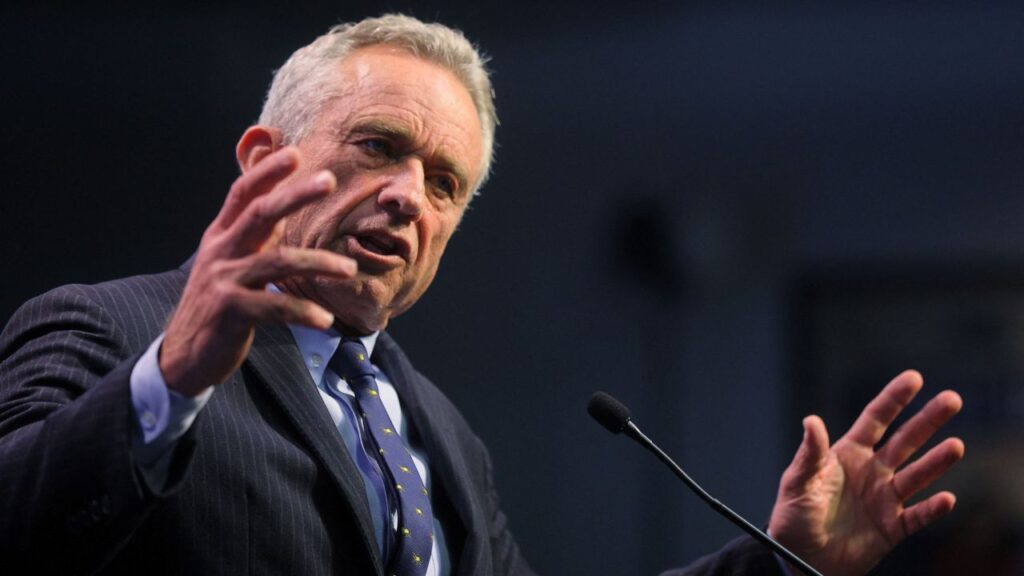

Other crypto-friendly candidates include Robert Kennedy Jr. and Ron DeSantis, both of whom rank second in their respective party’s polls.

READ MORE: JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

Kennedy recently bought two Bitcoins for each of his seven children and endorsed Bitcoin as a “bulwark” against government intrusion at the Miami Bitcoin Conference.

He promised, if elected, to preserve the right to hold and use Bitcoin.

In contrast, both Kennedy and DeSantis have expressed opposition to CBDCs. DeSantis even signed a bill prohibiting the use of CBDCs in his state and encouraged other states to follow suit.

Among the Republican contenders, more pro-crypto candidates are emerging. Vivek Ramaswamy, with a 7% support level compared to Trump’s 63%, is viewed as pro-Bitcoin and anti-CBDC.

Republican Miami Mayor Francis Suarez, a vocal supporter of crypto technology, has been labeled the most ardent crypto advocate among all candidates.

In summary, Grayscale’s analysis indicates a complex and varied landscape in the 2024 presidential race regarding digital currencies.

While there is a consensus among leading candidates on the exploration of CBDCs, their stance on cryptocurrencies like Bitcoin varies widely.

The emergence of more crypto-friendly candidates further adds to this multifaceted picture.

Other Stories:

Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Elon Musk Puts Rumors to Rest: X Has No Plans to Launch Crypto Tokens

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Bitcoin (BTC) appears to be gearing up for a powerful bull phase, according to market analyst Cole Garner. Despite the current stagnant BTC price action, Garner believes that the cryptocurrency market is on the verge of a significant upward trend reminiscent of past cycles.

Garner draws his optimism from the behavior of major Bitcoin investors, often referred to as “whales.” He emphasizes that whale accumulation trends are a crucial indicator of a bull market.

Jarvis Labs, an analytics team, corroborates this sentiment, reporting an ongoing “multi-month buying frenzy” among whales.

Notably, smaller investors, referred to as “fish,” have also been increasing their exposure to Bitcoin. This trend, coupled with whales’ unwavering positions, leads popular technical analyst CryptoCon to label the whales as “diamond hands” during the current cycle.

In contrast to the relentless selling by whales in Bitcoin’s last cycle, the current situation portrays a stark difference.

Retail investors were the ones selling during the bear market, while whales stood their ground.

This phenomenon contributes to the conviction that the current cycle is different and that the market is poised for substantial growth.

One critical factor on which the entire bullish scenario hinges is the Bitcoin-to-stablecoin ratio on Bitfinex, known as the Bitfinex Whale.

This ratio has historically preceded major Bitcoin bull runs. Garner emphasizes the significance of this metric, considering Bitfinex the “smart money exchange” and a key driver of short-to-medium-term price movements in the crypto market.

READ MORE: JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

While Garner favors a potential bullish breakout in the third quarter, he acknowledges the potential counter-argument of summer seasonality.

Nevertheless, he believes that any shakeout is likely to occur in September, giving the markets more time to rally.

To invalidate the bullish outlook, Garner highlights the importance of the 200-week simple moving average (SMA) for Bitcoin’s price.

A weekly close below this level, currently at $27,235, would be a critical sign that the bullish phase might not materialize.

In conclusion, Garner’s analysis indicates a strong belief in a forthcoming bull market for Bitcoin and the broader crypto market.

The increasing accumulation by whales and smaller investors, coupled with the historical significance of certain metrics like the Bitfinex Whale, provides an optimistic outlook for BTC’s future price trajectory.

Nonetheless, the 200-week SMA remains a crucial level to watch for potential bearish developments.

Other Stories:

Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Elon Musk Puts Rumors to Rest: X Has No Plans to Launch Crypto Tokens

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Tether developers are gearing up for the launch of cutting-edge JavaScript libraries designed to streamline the transmission of commands and signals to Bitcoin (BTC) mining hardware, such as WhatsMiner, AvalonMiner, and Antminer.

Paolo Ardoino, the chief technology officer of Bitfinex and Tether, shared the exciting news on X (formerly Twitter). He hinted that certain parts of the mining software might become available on open-source platforms in the future.

The primary goal of Tether’s BTC mining software is to optimize mining capacity management, leading to more efficient operations.

Ardoino highlighted his role as a core contributor to Moria, an orchestration instrument for mining farms. He proudly mentioned that all recent advancements are built using the innovative Holepunch technology.

Previously, Ardoino offered insights into Moria’s functionalities.

This remarkable mining instrument enables seamless communication between components within the BTC mining ecosystem.

It facilitates interactions through streamlined, secure, attack-resistant, and cost-efficient means.

To ensure secure data streaming and command reception, each miner will possess a unique public/private key.

This encryption mechanism will utilize hyper cores for data streaming and hyper swarms for command reception.

Notably, this approach simplifies firewall configuration, bolsters resilience to failures, enables easy replication across multiple sites, and enhances maintainability and modularity compared to previous attempts.

READ MORE: Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Despite facing legal and regulatory challenges, Tether has remained actively engaged in the cryptocurrency mining sector.

The company announced its intention to allocate a portion of its monthly profits towards acquiring BTC.

Moreover, Tether has invested in energy production and sustainable BTC mining in Uruguay, partnering with a local firm.

Uruguay’s renowned robust infrastructure in the renewable energy sector makes it an ideal location for sustainable mining operations.

The country takes pride in its abundant natural resources, allowing it to derive nearly 100% of its electricity from renewable sources.

In conclusion, Tether’s forthcoming JavaScript libraries hold promise for revolutionizing the efficiency of BTC mining operations.

Their commitment to open-source initiatives and sustainable mining practices in Uruguay showcases their dedication to driving positive change in the cryptocurrency industry.

Other Stories:

JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Elon Musk Puts Rumors to Rest: X Has No Plans to Launch Crypto Tokens