On August 22nd, Bitcoin exhibited a noteworthy departure from prevailing trends, as it gravitated towards the $26,000 mark, capturing the attention of intraday BTC price movements.

Despite being in a state of significant overselling, as indicated by the relative strength index (RSI), Bitcoin displayed an unyielding resistance to staging any form of recovery rebound from its levels last observed two months earlier.

Market participants grew increasingly restless, with prominent trader Jelle characterizing the intraday fluctuations as the ominous “death chop.”

Monitoring entity Material Indicators likened the current scenario to a high-stakes game of chicken, anticipating a decisive move that would break the ongoing choppy pattern.

A comprehensive analysis of liquidity within the Binance BTC/USD order book conducted by Material Indicators unveiled a general paucity of liquidity, thereby intensifying the potential for a sharp and abrupt price shift in either direction.

The entity elaborated on the prevailing situation on X (formerly Twitter), stating, “The market is in a state of anticipation, gauging whether greater bid or ask liquidity will be drawn towards this range.”

Despite observing minor increments of bid liquidity moving from the $20,000 threshold towards the active trading zone, no substantial liquidity – either freshly introduced or relocated – was found to be fortifying the range against a potential dip to a lower low (LL).

The implications were considerable, particularly for bullish sentiments, as a LL could jeopardize even the foundational support at $20,000.

READ MORE: SEC Lawsuit Stifles XRP’s US Adoption Potential, Pro-XRP Advocate Asserts Amid Coinbase’s Moves

Material Indicators underscored that the outcome would be of paramount significance, potentially driving BTC to levels below $20,000 if two consecutive LLs were to materialize.

On a more optimistic note, there remained a glimmer of hope that Bitcoin could reclaim its broader upward trajectory.

Michaël van de Poppe, the founder and CEO of Eight, a trading firm, emphasized the heavily oversold signals emanating from the RSI in a dedicated YouTube update on August 22nd.

Highlighting RSI measurements of under 19 on 12-hour timeframes, which were comparable to levels during the 2018 bear market nadir, and analogous daily measurements, which mirrored the lows witnessed during the March 2020 COVID-19 market crash, van de Poppe inferred that such downturns often precipitate a V-shaped recovery, culminating in equilibrium at a higher floor.

Anticipating a resurgence targeting $26,500 or beyond, van de Poppe articulated a distinct possibility of Bitcoin mirroring a trajectory akin to the prelude of the previous bull market.

Drawing parallels with the market dynamics of September 2020, Jelle alluded to a gradual ascent and absorption, echoing a pattern that could potentially unfold in the current scenario, thereby fostering an environment reminiscent of the commencement of the prior bull market.

Other Stories:

Bybit Unveils NFT Collection as Part of Velocity Series

Global Disparities in Bitcoin Mining Costs Highlighted: From $208,560 in Italy to $266 in Lebanon

A former Chinese government official, Xiao Yi, has received a life sentence for his involvement in illicit business activities linked to a substantial Bitcoin mining venture valued at 2.4 billion Chinese yuan (approximately $329 million).

This ruling was accompanied by additional convictions related to corruption charges. The Intermediate People’s Court of Hangzhou City pronounced the sentence on August 22.

Xiao Yi, a previous member of the Jiangxi Provincial Political Consultative Conference Party Group and vice chairman, was found guilty of corruption and abuse of power.

The corruption allegations primarily revolved around non-crypto matters, specifically bribery that spanned from 2008 to 2021.

In addition, abuse of power charges were based on actions taken between 2017 and 2021, where financial and electricity subsidies were provided to Jiumu Group Genesis Technology, a company located in Fuzhou.

Notably, this firm managed over 160,000 Bitcoin mining machines at one point.

Prosecutors argued that Yi orchestrated a concealment of the mining operation.

He allegedly directed various departments to falsify statistical reports and manipulate electricity consumption records.

During the period from 2017 to 2020, Jiumu Group Genesis Technology was responsible for 10% of Fuzhou’s total electricity usage.

The court noted that Xiao Yi admitted guilt, demonstrated remorse, returned embezzled funds, and all confiscated bribes and their profits were recovered.

READ MORE: FTX Founder Seeks Release for Defense Collaboration

China currently prohibits cryptocurrency transactions, exchange activities, and the conversion of fiat currency to crypto. However, complete ownership of cryptocurrencies has not been explicitly banned.

In a recent decision on August 3, a Chinese court invalidated a $10 million Bitcoin lending contract based on the country’s Bitcoin-related restrictions, precluding any legal recourse for debt recovery.

Additionally, on August 14, a Chinese citizen was sentenced to nine months in prison for aiding an associate in purchasing Tether, earning a $20 profit from the transaction.

In conclusion, Xiao Yi, a former Chinese government official, has been handed a life imprisonment sentence for his involvement in unauthorized business endeavors tied to a substantial Bitcoin mining venture and for corruption-related charges.

This verdict underscores China’s strict stance on cryptocurrency-related activities, while various legal actions continue to unfold in the country’s evolving regulatory landscape.

Other Stories:

Bybit Unveils NFT Collection as Part of Velocity Series

Global Disparities in Bitcoin Mining Costs Highlighted: From $208,560 in Italy to $266 in Lebanon

SEC Lawsuit Stifles XRP’s US Adoption Potential, Pro-XRP Advocate Asserts Amid Coinbase’s Moves

Despite a recent decrease in Bitcoin’s price and speculation about the fading hype around Bitcoin NFTs, ordinal inscriptions have continued to dominate the Bitcoin network’s activity in the past week.

On August 21, the developer known as “Leonidas,” responsible for Ordinals, highlighted that the Bitcoin network had processed 530,788 transactions within the last 24 hours.

Astonishingly, 450,785 of these transactions were Ordinals related, comprising a substantial 84.9% of Bitcoin’s total activity.

This defies the narrative claiming Ordinals’ demise.

Supporting this trend, data from Dune Analytics substantiates the phenomenon, recording over 400,000 ordinal inscriptions on August 20.

In contrast, Bitinfocharts records a daily Bitcoin transaction count around 556,000, implying that more than 75% of network activity on August 20 stemmed from Ordinals.

Industry researcher Eric Wall further corroborated this by noting that during the week, an impressive 54% of Bitcoin’s transactions were Ordinals.

Dune Analytics indicates that a staggering 25.5 million Ordinal inscriptions have taken place, generating an impressive $53.4 million in fees on the Bitcoin network.

READ MORE: Crypto Influencer Files $16 Million Lawsuit Against Bitget Exchange

These inscriptions are primarily driven by the minting of BRC-20 tokens, with a remarkable 1.9 million of them minted in the previous week.

These recent observations stand in stark contrast to a DappRadar report on August 17.

The report suggested that Ordinals NFT usage and sales volume had experienced a decline since their peak in May.

However, it’s crucial to note that this report tracked NFT sales and trading volume on the Bitcoin network, not the underlying inscription activity that continues to surge.

Bitcoin Ordinals represent nonfungible asset artifacts designed to facilitate data inscription onto Satoshis, the smallest Bitcoin units.

Introduced in January, the subsequent months witnessed a surge in inscription popularity as thousands of Ordinals were minted on the Bitcoin network.

This surge led to network congestion and spikes in transaction fees, culminating in peak congestion during April and May.

Other Stories:

US Tech Giant Fires New Warning About ChatGPT

Crypto Industry Adapts to Bear Market

Bored Ape Yacht Club’s Yuga Labs to Scale Back OpenSea Support

Elon Musk, previously associated with Twitter and now chairman and chief technology officer of X, has expressed admiration for Vivek Ramaswamy, an emerging figure in the realm of United States Republican presidential candidates.

In response to a segment of Vivek Ramaswamy’s interview on the Tucker Carlson’s Tucker on Twitter podcast, Musk took to Twitter to commend him, highlighting that Ramaswamy holds the distinction of being the youngest-ever Republican presidential candidate.

Musk also emphasized Ramaswamy’s potential, labeling him as a highly promising candidate.

Ramaswamy is renowned for his forthright viewpoints on digital finance and cryptocurrencies. He has been actively advocating for a more robust crypto ecosystem within the United States.

This commitment was evident at the Bitcoin 2023 conference held in Miami, where he announced that his presidential campaign would be open to receiving contributions in Bitcoin.

This move marked Ramaswamy as the second contender in the 2024 U.S. election race to embrace BTC donations.

During the conference, Ramaswamy unveiled a QR code, directing participants to a donation portal that offered various channels for contributions.

READ MORE: Bitcoin Hovers Near 2-Month Lows Amidst Extensive Liquidations and Market Uncertainty

Supporters who made donations within the stipulated limit of $6,600 were offered an exclusive nonfungible token, a distinctive feature of his campaign strategy.

Ramaswamy’s approach echoes that of Robert F. Kennedy Jr., who became the pioneer U.S. presidential aspirant to embrace Bitcoin donations, underscoring the escalating importance of cryptocurrencies in shaping the future financial landscape.

The growing popularity of Ramaswamy has led to his association with fellow Republican Ron DeSantis, the Bitcoin-friendly Governor of Florida, creating an environment of shared interests and goals.

However, Ramaswamy’s foray into the realm of politics is not without its challenges.

Presently, he confronts two legal cases brought forward by former employees of Strive Asset Management, a company he co-founded.

These former employees allege that they were coerced into violating securities regulations during their tenure at the firm.

In summation, the acknowledgment from influential figures like Elon Musk and Ramaswamy’s bold stance on cryptocurrency contributions underscore the impact of this emerging candidate on the evolving political and financial landscape.

Yet, his journey into politics is accompanied by legal hurdles, which add a layer of complexity to his political trajectory.

Other Stories:

Tether Discontinues Bitcoin Omni Layer Version Due to Waning Interest

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Shiba Inu’s Shibarium Network Restarts Block Production After Temporary Pause

A recent CoinGecko report, published on August 17, has shed light on the substantial global disparities in household electricity expenses associated with individual Bitcoin (BTC) mining.

The report highlighted a remarkable contrast between Italy and Lebanon, where the cost of producing a single Bitcoin differs significantly.

According to the findings, mining one Bitcoin in Italy comes at a staggering cost of $208,560.

This is in stark contrast to Lebanon, where the expense is approximately 783 times lower, allowing miners there to generate a Bitcoin for just $266.

The study underscored that only 65 countries present a profitable landscape for solo Bitcoin miners, primarily based on household electricity costs.

Within this group, Asia accounts for 34 countries, while Europe contributes a mere five.

However, miners operating solo face a challenge as the global average for household electricity costs sits at $46,291.24 for mining one Bitcoin.

This figure is notably 35% higher than the average daily price of one Bitcoin in July 2023, which was $30,090.08.

The report identified Italy as the most expensive country for household Bitcoin mining, with a cost per Bitcoin of $208,560.

Austria followed at $184,352, and Belgium at $172,382.

READ MORE: Tether Discontinues Bitcoin Omni Layer Version Due to Waning Interest

Conversely, Lebanon’s affordability shines through in its household electricity rates, allowing for a strikingly low cost of $266 to mine one Bitcoin.

This dramatic variance underlines the immense difference in operational costs between countries.

Iran comes next on the list, with a production cost of $532 per Bitcoin.

Despite legalizing Bitcoin mining in 2019, the country has intermittently prohibited mining due to concerns over energy grid strain during winter.

Binance CEO Changpeng “CZ” Zhao engaged with the report’s data on social media, questioning why individuals in countries with lower electricity costs wouldn’t engage in Bitcoin mining.

However, he acknowledged the potential complexities involved and suggested that feasibility and logistics might not have been fully considered in the report.

CZ also pointed out that some of these low-cost electricity countries experience shortages, often necessitating power reductions in heavy industries during peak hours or the summer months.

This context reveals that while electricity costs are a significant factor, other variables also play into the viability of Bitcoin mining operations across different nations.

Other Stories:

Bitcoin Hovers Near 2-Month Lows Amidst Extensive Liquidations and Market Uncertainty

Shiba Inu’s Shibarium Network Restarts Block Production After Temporary Pause

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Stablecoin issuer Tether has revealed its decision to discontinue the Bitcoin Omni Layer version, citing waning user interest.

This particular iteration of Tether holds historical significance as one of the earliest stablecoins to be introduced.

Alongside the Bitcoin version, Tether also plans to halt operations for its Bitcoin Cash and Kusama versions, as communicated through an announcement on August 17.

Tether’s announcement clarified that moving forward, there will be no issuance of new Tether tokens on the Bitcoin Omni Layer, Bitcoin Cash, or Kusama platforms.

However, the redemption process will remain accessible for at least a year, and the company will provide updates before the end of that period regarding the procedure for redemptions beyond it.

The Bitcoin Omni Layer functions as a smart contract system situated atop the Bitcoin blockchain. Initially referred to as “Mastercoin,” this system was launched in July 2013, a full two years ahead of Ethereum.

Tether’s release on the Omni Layer in October 2014 marked a pivotal moment as it became the first stablecoin on this platform.

Over time, it ascended to become the leading stablecoin by market capitalization, surpassing predecessors such as BitUSD and NuBits.

READ MORE: Stellar Development Foundation Invests in MoneyGram International

In recognizing the historical role played by Omni Layer Tether, Tether’s August 17 statement expressed appreciation for the contributions and innovations of the team behind the platform.

This acknowledgment was balanced with the acknowledgement of challenges faced by the Omni Layer due to the lack of popular tokens and the availability of USDT on alternative blockchains.

These challenges prompted exchanges to opt for other transport layers over Omni, ultimately diminishing the usage of USDT Omni and compelling Tether to cease its issuance.

Tether did, however, leave the door open for the potential revival of the Omni Layer version should usage of the platform experience a resurgence.

Additionally, the company revealed that it is in the process of developing a new Bitcoin smart contract system named “RGB.”

Upon its completion, Tether intends to reintroduce the token in an RGB version, thereby re-establishing its presence on the Bitcoin blockchain.

As the stablecoin landscape intensifies in 2023, Tether faces increased competition to maintain its dominance.

The release of PayPal’s PYUSD on August 7 and Binance’s listing of FDUSD on July 26 have added to the mounting pressure on Tether’s standing.

Other Stories:

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Bitcoin remained close to its lowest levels in two months at the opening of Wall Street on August 18th, as the market grappled with significant liquidations.

Data from Cointelegraph Markets Pro and TradingView indicated that BTC’s price movement was relatively stagnant, following an 8% loss triggered by a single daily candle.

The cryptocurrency market experienced a wave of liquidations across its derivatives sectors, with these dominating the scene while spot selling remained subdued.

Notably, trading firm QCP Capital highlighted a substantial short liquidation event on the Deribit exchange, hinting at a major account being wiped out.

Market observers, including QCP, noted that the reaction to a reported write-down of SpaceX’s $373 million Bitcoin holdings appeared to be overblown.

Recollections of past instances of market influence by Elon Musk, CEO of SpaceX and Tesla, resurfaced, leading some to hope that the market would not revisit such volatility.

The scale of liquidations seen rivaled those following the FTX exchange meltdown, which caused BTC/USD to plunge to $15,600 in November 2022.

The cryptocurrency’s price wavered around $26,000, sparking differing interpretations among market participants about the situation’s true nature and its future ramifications.

Noted trader and analyst Rekt Capital provided a grim outlook, pointing out a potential double-top formation for BTC/USD in 2023 and the lack of support from trend lines and moving averages during the downturn.

READ MORE: Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Conversely, some market participants remained optimistic.

Trader CryptoCon identified two significant benchmarks that often precede successful price rebounds during bull market retracements: the relative strength index (RSI) bouncing at the 0.382 Fibonacci retracement level.

According to CryptoCon, this pattern repeated across multiple cycles.

Rekt Capital also highlighted the oversold condition of the daily RSI, a level unseen since June 2022, but reminiscent of bear market conditions.

Looking ahead, market focus turned to Jerome Powell’s forthcoming commentary, as the chair of the United States Federal Reserve’s speech at Jackson Hole was anticipated to hold the potential to introduce new volatility.

In summary, Bitcoin struggled near its two-month low on August 18th as the market grappled with significant liquidations across derivatives, despite relatively weak spot selling.

Traders offered differing perspectives on the situation, with some expressing concern over potential negative patterns, while others identified historical indicators of rebounds during bull market retracements.

The anticipation of Jerome Powell’s upcoming speech further added to the market’s uncertainty.

Other Stories:

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

The US Securities and Exchange Commission (SEC), the regulatory body responsible for approving spot cryptocurrency exchange-traded funds (ETFs), appears to be edging closer to granting permission for these investment vehicles after years of deliberation.

A significant development occurred when BlackRock, the world’s largest asset management firm, submitted its application for a Bitcoin ETF in June.

This move has reignited investor interest both within and beyond the cryptocurrency sphere.

Notably, BlackRock also established a “surveillance-sharing agreement” with Coinbase, a leading cryptocurrency exchange, possibly indicating the SEC’s receptiveness to ETF applications under such arrangements.

Numerous companies, including ARK Invest under the leadership of CEO Cathie Wood, have filed for crypto ETFs with the SEC. ARK 21Shares applied to list its spot Bitcoin ETF in May 2023.

However, the SEC recently extended the review period by 21 days until August 11, inviting public comments on the proposal as per its guidelines.

The SEC holds the authority to delay ETF applications for up to 240 days, a period that includes public input.

Nevertheless, the SEC has not yet approved any spot Bitcoin ETF proposal from any US firm. It only began accepting investment products linked to Bitcoin futures in October 2021.

READ MORE: Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

The challenge lies in the nature of these investment vehicles: Bitcoin futures-linked ETFs allow investment without direct exchange participation, whereas spot Bitcoin ETFs involve holding the cryptocurrency directly within a fund.

Early attempts to gain SEC approval for crypto ETFs date back to 2013 when Gemini co-founders Cameron and Tyler Winklevoss applied for a Bitcoin Trust listing.

However, these attempts were rebuffed, showcasing the evolving regulatory landscape.

Stuart Barton, co-founder and CIO of Volatility Shares, the firm behind a leveraged Bitcoin futures ETF listing, revealed that the SEC application process involves negotiations and suggested that smaller firms might have an advantage in pursuing spot crypto ETFs.

Barton emphasized that significant companies have not substantially advanced the argument for ETF approval.

Prominent asset management firms like BlackRock, ARK Invest, Bitwise Asset Management, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie currently have spot Bitcoin ETF applications under SEC review.

The SEC’s cautious stance might stem from the complex nature of the US crypto market, which requires further regulatory clarity and oversight.

The SEC’s ongoing enforcement actions against Coinbase, Binance, and Ripple, alongside penalties imposed on other firms, indicate a need for increased regulation.

US legislators are actively considering laws to define the roles of the SEC and Commodity Futures Trading Commission (CFTC) in overseeing digital assets.

Court decisions will likely play a role in shaping regulations, particularly following the SEC vs. Ripple case, where a judge determined that XRP was not a security.

Industry analysts suggest that the probability of a US spot Bitcoin ETF approval is around 65%, partly influenced by BlackRock’s application.

Speculation also abounds regarding potential simultaneous approvals to prevent any single company from gaining an advantage.

Other Stories:

Voyager Digital’s Massive Token Transfers Spark Speculation of Impending Sell-Off

Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

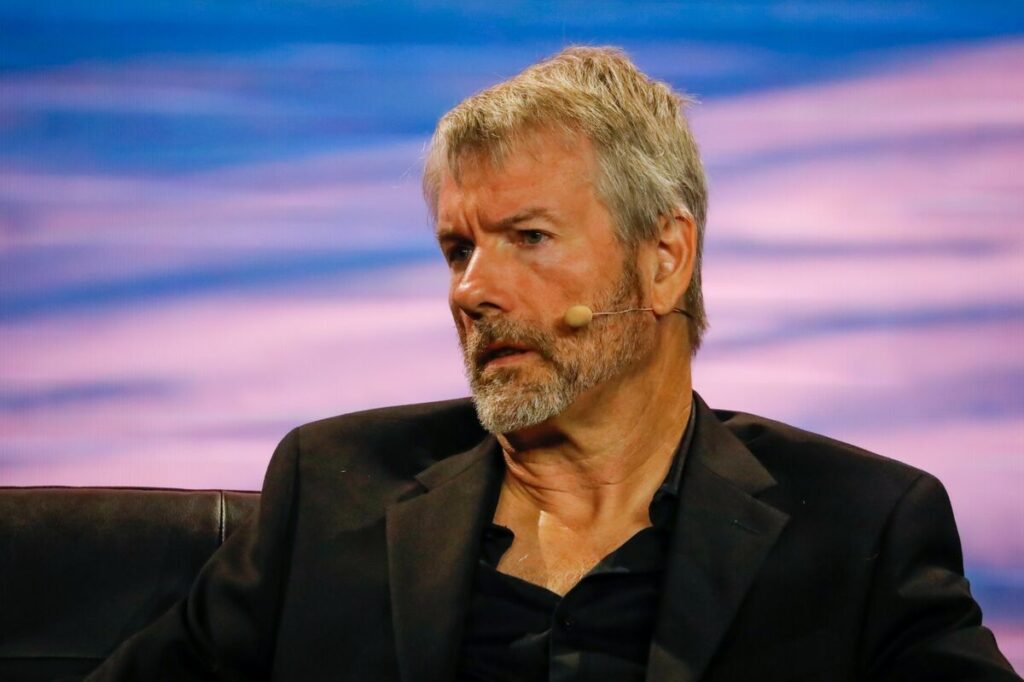

During a recent podcast discussion, Michael Saylor of MicroStrategy conveyed his belief that the involvement of major corporations in purchasing and holding Bitcoin should not be viewed as a worrisome development.

Speaking on the Coin Stories podcast with Natalie Brunell, released on August 7, Saylor highlighted the inevitable expansion of third-party and corporate engagement within the Bitcoin domain.

While acknowledging the aspiration of Bitcoin enthusiasts for complete self-control or sovereignty over their holdings, Saylor proposed that this might not be the exclusive solution, given the diverse applications of Bitcoin.

He expressed the idea that as Bitcoin further intertwines with society, its utility will diversify, negating a one-size-fits-all approach.

Saylor enumerated three primary factors substantiating the need for custodial services: technical, political, and natural considerations.

On a political basis, he argued that certain circumstances necessitate reliance on third-party custodians.

He pointed out that unless fundamental changes occur, political factors tied to regions such as New York City, California, or Iceland will demand custodial solutions.

From a technical perspective, Saylor highlighted the inevitability of trusting layer-3 third parties for transactions, particularly those involving mobile devices.

READ MORE: Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

He painted a vision of Bitcoin as a foundational layer, accompanied by layer-2 systems like the Lightning Network for speed, and layer-3 services provided by entities like Bank of America and Apple to enhance functionality.

Saylor also introduced the concept of natural reasons for custodial reliance.

He postulated that certain individuals, like an elderly person dealing with Alzheimer’s or someone wanting to secure assets for a future grandchild, might find it safer to entrust their holdings to others.

Drawing an analogy to childhood experiences, he cited that the absence of car keys didn’t necessarily invoke complaints, suggesting a comparable situation with Bitcoin custody.

Emphasizing adaptability, Saylor underlined that the market will ultimately dictate the optimal blend of Bitcoin integration methods.

He asserted that a diverse array of ways to incorporate, wrap, embed, or transact with Bitcoin should not evoke fear, as the right combination of integrations will naturally emerge through market dynamics.

In conclusion, Michael Saylor, during a recent podcast exchange, expressed his viewpoint that the involvement of large corporations in Bitcoin custody shouldn’t raise alarm.

He highlighted the inevitability of Bitcoin’s expansion across various sectors and delineated reasons for custodial arrangements based on technical, political, and natural factors.

Saylor stressed the importance of embracing multiple integration approaches, with the market determining the most suitable amalgamation of Bitcoin functionalities.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

In a significant political development, an Argentine politician advocating for Bitcoin adoption and the dismantling of the central bank has surged ahead in the country’s presidential open primary elections.

With more than 90% of the votes counted, Javier Milei, a prominent libertarian with pro-Bitcoin sentiments, has taken the lead with an impressive nearly 32% of the votes.

This places him ahead of the conservative Together for Change party, which has secured just under 30% of the votes, according to data from Bloomberg.

The Union for the Homeland coalition, representing the incumbent government, stands at the third position with slightly over 28.5% of the total votes.

Milei, a central figure in the Liberty Advances coalition (La Libertad Avanza), has been associated with views that span from libertarian to far-right ideologies.

Milei, who identifies as an anarcho-capitalist, has been a vocal proponent of abolishing Argentina’s central bank, labeling it a fraudulent institution.

He has also controversially stated that the trading of human organs should be treated as a regular market transaction.

He attributes the rise of Bitcoin to a response against what he terms “central bank scammers.”

READ MORE: Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Furthermore, he argues that fiat currency enables politicians to exploit Argentinians through inflation, a message that has struck a chord with the country’s populace.

The resonance of Milei’s rhetoric among voters is driven by Argentina’s staggering annual inflation rate of 116%, the highest in over 30 years.

This dire economic situation has exacerbated the country’s ongoing cost of living crisis, making the call for alternative financial mechanisms like Bitcoin more appealing to a frustrated electorate.

The culmination of this political landscape will be Argentina’s general presidential election scheduled for October 22nd.

In the event that no candidate secures a minimum of 45% of the votes, a runoff election is slated for November.

As the nation grapples with economic challenges and increasing public support for unconventional approaches, the upcoming election holds the potential for a significant shift in Argentina’s political trajectory.

Other Stories:

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations