Bitwise, the asset management firm, has taken an unexpected step by withdrawing its application for a Bitcoin and Ether Market Cap Weight Strategy exchange-traded fund (ETF) from the United States Securities and Exchange Commission (SEC).

Initially filed on August 3, the move came as a surprise given the recent positive market sentiment following Grayscale’s success with the SEC.

The withdrawal statement contained a cautious tone, stating that while the fund aimed to achieve capital appreciation, there were no guarantees of meeting this investment objective.

Matt Hougan, Bitwise’s chief investment officer, had recently voiced support for SEC approval of all ETFs in a Bloomberg interview.

The ETF in question was designed to invest in either Bitcoin or Ether futures contracts, selected based on their respective market capitalizations.

In conjunction with ProShares, Bitwise had also planned to launch another ETF around the same time.

Bitwise clarified in the withdrawal statement that the Trust had abandoned its plans to pursue the effectiveness of the Fund.

The Trust did not sell or intend to sell any Fund securities as part of the process.

This development aligns with the SEC’s continued delay in deciding on various Bitcoin ETF applications, including those from WisdomTree, Invesco Galaxy, Valkyrie, VanEck, BlackRock, Bitwise, and Fidelity.

READ MORE: BlockFi Advances Fund Recovery Efforts with Court Application

The SEC’s recent filing on August 31 disclosed an extended review timeline for several spot Bitcoin ETF applications.

WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, Fidelity’s Wise Origin Bitcoin Trust, and BlackRock’s Bitcoin ETF face a longer evaluation period.

Upcoming deadlines for the SEC are set for mid-October, but potential delays could push them to the third batch of deadlines in January or to final decisions in the subsequent months.

Bitwise had previously been at the forefront of asset management firms seeking Bitcoin ETF products.

Its initial application in January 2019 aimed to create a BTC-backed ETF tracking the Bitwise Bitcoin Total Return Index, derived from BTC transaction values across various exchanges.

The firm’s proposal sought to provide a reliable representation of the broader cryptocurrency market, with data sourced from multiple cryptocurrency exchanges.

Additionally, third-party custodians were to be responsible for physically holding Bitcoin.

Notably, this is not Bitwise’s first ETF withdrawal. Earlier this year, the company pulled back an application for an Ethereum Strategy ETF.

The ETF had been designed to invest in both front-time and back-time Ethereum futures, but the withdrawal occurred only a week after the initial application was submitted.

Other Stories:

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook

BlockFi Advances Fund Recovery Efforts with Court Application

The Cambridge Bitcoin Electricity Consumption Index (CBECI), renowned for assessing Bitcoin’s energy usage, has undergone its inaugural methodology update since its inception in 2019.

Launched in July 2019, CBECI aimed to furnish data-backed insights into Bitcoin mining’s energy intensity and environmental consequences.

In an exclusive conversation with Cointelegraph, lead researcher Alexander Neumueller outlined the index’s role in estimating Bitcoin network electricity consumption.

Neumueller emphasized its role in presenting comprehensible data to the general public.

The revamped methodology accentuates recent trends in Bitcoin mining hardware and hash rates. Researchers scrutinized whether CBECI accurately depicted these dynamics.

They concentrated on unraveling the causes behind significant hash rate growth in recent years, attributed to more powerful contemporary mining equipment superseding older counterparts.

The absence of detailed hardware data posed a challenge, limiting CBECI’s precision in assessing hardware variety and prevalence.

To surmount this, researchers devised a simulation that approximates daily hardware distribution, utilizing performance and power data from actual hardware.

The prior methodology presumed that all profitable hardware models released in the last five years contributed equally to the network hash rate.

This inadvertently led to an overrepresentation of aging hardware during lucrative mining periods.

The team recognized the overrepresentation of older equipment and the underrepresentation of newer models.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

This realization spurred the methodology’s alteration.

Neumueller’s team then cross-referenced hash rate increments with US import data on recent Bitcoin mining hardware.

Public sales data from mining hardware manufacturer Canaan supplemented this analysis.

The CBECI encompassed diverse data points and visualizations, encompassing Bitcoin network power demand, a mining map depicting hash rate distribution, and a greenhouse gas emissions index.

These indexes yield three distinct estimates for each sector, providing a range for these metrics.

The broader discussion encompassed varying viewpoints on Bitcoin’s environmental impact.

Critics alleged Bitcoin undermined ecological progress, while proponents contended that the mining industry could aid environmental efforts.

Neumueller highlighted the intricate nature of the field and the dearth of information, enabling selective data interpretation and biases.

In sum, CBECI’s revamped methodology aligns with evolving Bitcoin mining hardware trends, rectifying previous discrepancies.

The index’s comprehensive insights and visuals offer a multifaceted perspective on Bitcoin’s energy consumption and emissions impact.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

Bitcoin is maintaining its recent gains, as traders remain optimistic about the bullish trajectory of its price. Despite briefly retreating from the highs above $28,000, the cryptocurrency has not experienced a complete retrace of its recent upward move.

Encouragingly, Bitcoin’s price action on lower timeframes is being supported by a crucial moving average, effectively safeguarding the $27,000 mark.

This trend is highlighted by data from Cointelegraph Markets Pro and TradingView.

Of particular significance is the resilience displayed by BTC/USD in adhering to a long-term trend line that was previously lost as support in August.

This trend line corresponds to the 200-day exponential moving average (EMA), positioned at $27,180.

Although there were instances where hourly candle closures fell below this level toward the end of August, such occurrences failed to initiate a significant breakdown.

Instead, Bitcoin remains closely aligned with the 200-day EMA as the month concludes.

Prominent trader Moustache, known for insights on market trends, noted the positive development, observing that Bitcoin has reclaimed the daily EMA 200-Line.

Expressing confidence in this trend, Moustache dismissed the likelihood of a more favorable entry point occurring in the near future.

This view contrasts with the bearish outlook propagated by various reputable sources, many of whom anticipate a return to levels as low as $25,000.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

However, trader Jelle echoes Moustache’s optimism by underscoring the importance of Bitcoin’s ability to sustain itself above the $27,000 threshold.

Jelle described the current market behavior as conducive to further upward movement, citing a brief spike followed by a shallow retrace and maintenance above a key high-timeframe (HTF) level.

In the midst of the ongoing discussions about Bitcoin’s performance, analyst Rekt Capital advised caution due to prevailing market conditions.

Some previously crucial bull market moving averages are currently acting as resistance, adding an air of uncertainty to the situation.

Further insight from Material Indicators, a monitoring resource, suggests that Bitcoin’s trajectory could complete a full circle.

For a renewed push towards higher local highs, a resurgence of bullish sentiment is deemed essential. The proprietary trading tools of Material Indicators identify $27,760 and $24,750 as pivotal levels to monitor on the upside and downside, respectively.

This assessment underscores the delicate balance between the potential for continued gains and the looming risk of a downward reversal.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

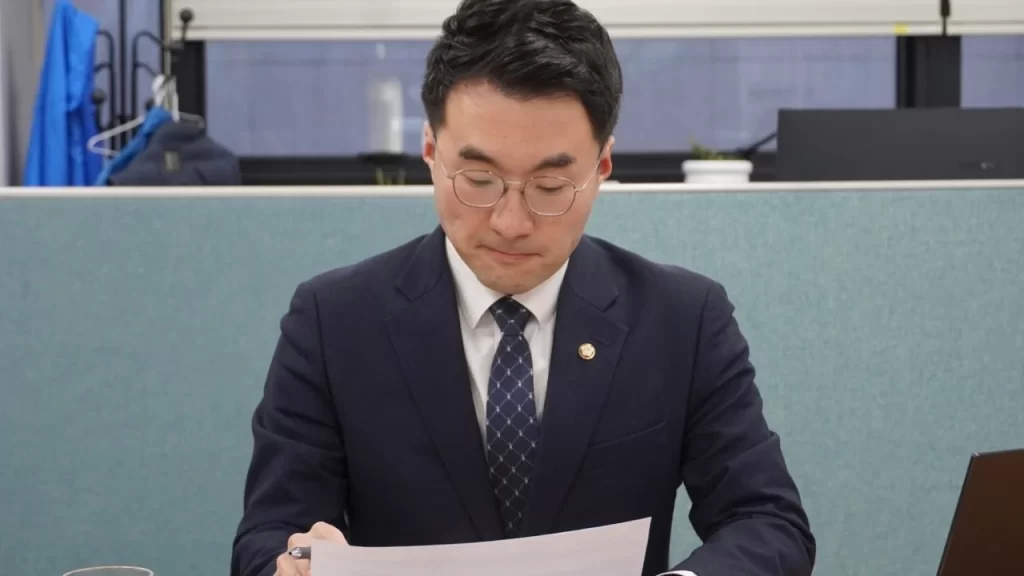

The parliamentary ethics subcommittee in South Korea has voted against the expulsion of Kim Nam-kuk, a former member of the Democratic Party, the main opposition group.

This decision was reported by the local news agency Yonhap on August 30.

On August 29, the subcommittee dismissed the motion to expel Kim Nam-kuk, with a 3-3 split between the ruling People Power Party (PPP) and the Democratic Party (DP).

The motion required a majority vote to be approved, which did not materialize.

This move comes after Kim faced significant backlash earlier this year due to revelations that he possessed over $4.5 million worth of Wemix (WEMIX) tokens, developed by South Korean blockchain game creator Wemade.

The Wemix tokens had been tradable on major South Korean exchanges until a local court ordered their removal from platforms in late 2022.

Kim’s ownership of Wemix tokens raised serious concerns about potential conflicts of interest, misuse of insider information, and potential involvement in money laundering.

This controversy played a role in expediting the creation of a legal framework mandating that officials disclose their cryptocurrency holdings, including assets like Bitcoin (BTC), in South Korea.

READ MORE: Argo Blockchain Shows Resilience with 50% Reduction in Half-Year Losses

The requirement for cryptocurrency holdings disclosure is not unique to South Korea.

In July, the country’s Financial Services Commission introduced a new bill stipulating that all companies issuing or possessing cryptocurrencies must disclose their holdings starting from 2024.

In another cryptocurrency-related development, the city of Cheongju in South Korea announced in mid-August that it would initiate the seizure of cryptocurrencies from local tax defaulters.

This initiative compels cryptocurrency exchanges such as Upbit and Bithumb to report on these individuals who have failed to meet their tax obligations.

In conclusion, South Korea’s parliamentary ethics subcommittee’s rejection of the motion to expel Kim Nam-kuk, despite concerns surrounding his cryptocurrency holdings, reflects the ongoing debate and regulatory efforts in the country regarding the transparency and accountability of cryptocurrency-related activities.

This decision aligns with broader initiatives to enhance disclosure and monitoring of cryptocurrency assets within South Korea’s regulatory framework.

Other Stories:

Europe Welcomes First-Ever Bitcoin ETF

Shibarium Surpasses 100,000 Wallets in 24 Hours Post-Relaunch

Anticipation Grows as Bitcoin Halving Nears, Experts Predict Surge Beyond $100,000

The Grayscale Bitcoin Trust (GBTC) might see its BTC price “discount” eliminated by 2024, according to CoinGlass, a monitoring resource.

After Grayscale secured a legal victory over US regulators on August 29th, the declining performance of GBTC could potentially be addressed.

With a holding of over 600,000 BTC, the fund has been trading below the Bitcoin spot price, known as net asset value, since February 2021.

The once-positive “GBTC premium” has been negative for more than two and a half years, but this trend might be reversing soon.

The US Securities and Exchange Commission’s requirement to consider GBTC’s conversion into a Bitcoin spot price exchange-traded fund under the same terms as other applicants pushed the “discount” to its lowest point since December 2021, now standing at just -17%, less than half of its peak around 50%.

CoinGlass expressed optimism in a future recovery: “Expect Grayscale $GBTC premium to close the discount next year.”

Dylan LeClair, senior analyst at digital asset fund UTXO Management, emphasized GBTC’s significance in influencing Bitcoin’s journey to record highs in 2021 due to its vast assets under management.

He noted, “Today’s discount move from -26% to -17% is the equivalent of 56,000 BTC returning to the AUM of $GBTC if shares are marked to market.”

READ MORE: Argo Blockchain Shows Resilience with 50% Reduction in Half-Year Losses

The recent Grayscale development might also impact Bitcoin’s price action by reintroducing key moving averages (MAs).

The 200-week and 200-day trend lines, which failed to provide support during Bitcoin’s previous drop in August, could potentially regain their importance.

Despite BTC/USD struggling to maintain these levels, Rekt Capital, a prominent trader and analyst, highlighted the significance of these MAs in reclaiming bullish momentum.

Rekt Capital noted, “This is great initial momentum from ~$26K support which never broke down to fully confirm the Double Top.”

He also stressed the importance of Bitcoin reclaiming Bull Market moving averages as support to confirm a bullish outlook.

In summary, the Grayscale Bitcoin Trust (GBTC) could reverse its negative price “discount” in 2024, supported by recent legal developments and positive sentiments.

The fund’s large BTC holdings and its potential impact on Bitcoin’s price movement were highlighted, along with the significance of reclaiming key moving averages for sustained bullish momentum.

Other Stories:

Anticipation Grows as Bitcoin Halving Nears, Experts Predict Surge Beyond $100,000

Europe Welcomes First-Ever Bitcoin ETF

Shibarium Surpasses 100,000 Wallets in 24 Hours Post-Relaunch

A federal judge has overturned the United States Securities and Exchange Commission’s (SEC) denial of Grayscale Investments’ exchange-traded fund (ETF) proposal for its Bitcoin Trust.

However, experts caution that this ruling does not guarantee the immediate approval of the first Bitcoin ETF in the country.

Judge Neomi Rao of the U.S. Court of Appeals for the District of Columbia Circuit ruled on August 29 that Grayscale’s Bitcoin ETF plan was “materially similar” to already approved Bitcoin futures exchange-traded products by the SEC.

Rao’s decision largely criticized the SEC’s reasoning for rejecting Grayscale’s ETF, which was based on the ETF not being “designed to prevent fraudulent and manipulative acts and practices.”

Consequently, the matter will be sent back to the SEC for further review.

The U.S. SEC has consistently rejected applications for spot cryptocurrency ETFs thus far. Various applications, including those from BlackRock, ARK Invest, Bitwise Asset Management, and others, are currently under review.

The commission retains the authority to delay decisions on these applications, potentially postponing approvals until March 2024.

The SEC has not yet publicly commented on the appeals court’s ruling, but reports suggest that the commission will assess the case to determine its subsequent steps.

READ MORE: Argo Blockchain Shows Resilience with 50% Reduction in Half-Year Losses

While the SEC may contest the ruling, experts speculate that Grayscale’s initial triumph might set a precedent for future approvals.

ETC Group’s CEO, Tim Bevan, expressed confidence that the victory would pave the way for U.S. spot Bitcoin ETFs despite an anticipated SEC appeal.

He predicted a likely mass approval of applications meeting requirements, possibly occurring in the first quarter of 2024.

Alex Adelman, CEO and co-founder of Lolli, contended that the appeals court’s decision would pressurize the SEC to reconsider its stance on spot Bitcoin ETFs.

Adelman perceived the surge in BTC price following the news as a “vote of confidence” in investment products linked to Bitcoin.

The Crypto Council for Innovation (CCI) spokesperson noted that the ruling broadens the scope for various investors to introduce spot Bitcoin vehicles in the U.S., bringing spot Bitcoin ETFs closer to potential launch.

The next steps for Grayscale or the SEC remain uncertain. Grayscale could rework its application to align more closely with a Bitcoin futures-linked ETF.

Alternatively, the SEC might opt for an “en banc” hearing involving all judges on the D.C. circuit, rather than the three who presided over the Grayscale case.

Other Stories:

Shibarium Surpasses 100,000 Wallets in 24 Hours Post-Relaunch

Europe Welcomes First-Ever Bitcoin ETF

Anticipation Grows as Bitcoin Halving Nears, Experts Predict Surge Beyond $100,000

Argo Blockchain, a prominent player in the mining industry, grappled with adverse market conditions and intense competition, culminating in a reported loss of $18.8 million during the first half of 2023.

This figure marked a significant improvement, showcasing a 50% reduction compared to the $39.6 million loss in the same period in 2022.

The company’s efforts to enhance its financial position were evident as it successfully curtailed its debt by $4 million over the course of 2023, leaving a total debt of $75 million.

This achievement underscores a remarkable $68 million debt reduction since June 2022, when the company’s debt had reached $143 million.

Revenues followed a downward trajectory, declining by 31% in comparison to the first half of 2022.

Argo attributed this decline, which resulted in $24 million in revenue midway through 2023, to a drop in the value of Bitcoin (BTC) as well as an upswing in the global hash rate and the resultant network difficulty.

The mining company’s operational statistics indicated a slight increase of 1% in mined BTC, totaling 947 BTC, during the initial half of the year, in contrast to the same period in 2022. It’s noteworthy that the global hash rate surged by 78% in 2023.

As of June 2023, Argo’s financial statement displayed $9.1 million in cash holdings along with 46 BTC.

A pivotal moment in the latter part of 2022 saw Argo secure $7.5 million in gross proceeds through a share placement, attracting both institutional and retail investors.

Although facing the specter of bankruptcy in late 2022, Argo’s interim results for 2023 indicate a resolute intent to enhance its total hash rate capacity to 2.8 exahashes per second (EH/s).

READ MORE: Casino Gender: Which Games Do Men and Women Prefer?

This expansion plan entails deploying 1,628 BlockMiners at its mining facilities located in Quebec.

Furthermore, the company revealed its ongoing discussions regarding the sale of “certain non-core assets” as part of its strategy to mitigate overall debt.

Notably, a transformative sequence of transactions transpired between Argo and Galaxy Digital, involving the sale of the Helios mining facility and associated property for $65 million in December 2022.

This was followed by a strategic refinancing move, resulting in a new $35 million, three-year asset-backed loan with Galaxy, effectively reducing Argo’s total indebtedness by $41 million and streamlining its operational structure.

Matthew Shaw, Chairman of Argo’s board, emphasized the importance of maintaining a sizable fleet of over 27,000 miners, with a significant portion operating through an agreement with Galaxy at the Helios site.

These developments unfolded subsequent to Argo’s financial predicament in late 2022, which prompted the collaboration with Galaxy.

The aftermath of this partnership saw the resignation of Argo’s former CEO, Peter Wall.

Other Stories:

Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

The upcoming Bitcoin halving event, anticipated in less than nine months, has sparked a prevailing belief among analysts and investors that Bitcoin’s value will soar to new heights, potentially exceeding $100,000.

However, the prevailing macroeconomic challenges, the absence of fresh investments into the crypto market, and Bitcoin’s recent price performance, dipping below $30,000, cast doubt on this optimistic projection in the immediate future.

Sue Ennis, the Vice President of Hut 8, shared her insights on the matter during a recent interview with Paul Barron.

Ennis discussed how Bitcoin’s value could breach the $100,000 mark in the coming year and how the halving might impact Bitcoin miners.

Hut 8 presently holds a reserve of 9,152 BTC, with 8,305 unencumbered. The company boasts an installed ASIC hash rate capacity of 2.6 exahashes per second and mined 44.6 BTC in July.

The discussion revolved around whether the increasing complexity of Bitcoin mining could prompt miners to flood the market with Bitcoin.

Notably, Hashrate Index data revealed that surges in mining complexity were often succeeded by drops in Bitcoin’s value.

The interview raised questions about whether miners were selling off Bitcoin due to the impending halving, necessitating more efficient ASICs.

Ennis suggested that the pre- and post-halving price action of BTC might not align with investors’ bullish expectations.

Ennis highlighted unique dynamics within the mining sector, noting that hash rates continued to rise despite Bitcoin’s trading within a particular range. This trend defied conventional wisdom.

READ MORE: Casino Gender: Which Games Do Men and Women Prefer?

She underscored the emergence of new participants in the global Bitcoin network, driven by substantial energy generation, particularly nuclear and renewable, in the Middle East. Unlike US-based miners, these newcomers demonstrated price-agnostic behavior.

To endure the halving’s impact, Ennis proposed diversifying revenue streams for miners.

Beyond Bitcoin mining, miners could explore artificial intelligence applications, allocate warehouse space for GPU-focused AI training firms, offer industrial-level ASIC repair services, or participate in energy initiatives.

Ennis also discussed the potential impact of a spot Bitcoin exchange-traded fund (ETF) launch.

While investors have long anticipated this, regulatory approval has remained elusive.

Ennis believed a spot ETF’s approval would benefit the asset class, yet cautioned that miner equities might face sell pressure as they often functioned as proxy investments for Bitcoin.

Ennis projected a positive outlook for Bitcoin, suggesting a potential price target of $100,000.

She based this on Bitcoin capturing even a small portion of gold’s $13 trillion institutional portfolio, potentially pushing Bitcoin’s price northward.

Notably, the involvement of financial giant BlackRock signaled increased credibility to this outlook.

In summation, as the next Bitcoin halving approaches, predictions of a price surge above $100,000 dominate discussions.

However, economic challenges and recent price trends cast doubt on these predictions, making the future of Bitcoin’s value uncertain in the short term.

Other Stories:

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

London-based Jacobi Asset Management has unveiled Europe’s inaugural spot Bitcoin exchange-traded fund (ETF), designating it an Article 8 fund under the European Sustainable Finance Disclosure Regulation (SDFR).

Article 8 funds are recognized for their emphasis on “environmental and/or social characteristics.”

The pioneering Jacobi FT Wilshire Bitcoin ETF, launched on the Euronext Amsterdam stock exchange on August 15, signifies Europe’s maiden Bitcoin ETF and aligns with the European Union’s guidelines for environmental, social, and governance (ESG) investments.

According to an August 29 report by Bloomberg, Jacobi Asset Management’s CEO Martin Bednall labeled the ETF as “fully decarbonized,” attributing this classification to its investment in renewable energy certificates (RECs).

However, skepticism arose among academic experts consulted by journalists, who pointed out a seeming paradox: the ETF’s Bitcoin assets possess such high energy demands due to the energy-intensive nature of Bitcoin mining that the volume of RECs needed to offset these demands could potentially surpass the energy consumed by the Bitcoin holdings themselves.

READ MORE: Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

The Jacobi FT Wilshire Bitcoin ETF’s launch transpired over a year later than initially intended in 2022.

Marketed as the leading physically-backed Bitcoin fund, the ETF offers investors an avenue to engage with a financial instrument supported by actual Bitcoin assets.

Since inception, Jacobi Asset Management has consistently underscored the ETF’s eco-friendly profile.

The fund employs external data to estimate the energy consumption of the Bitcoin network, subsequently procuring and retiring RECs.

These certificates are monitored via a blockchain platform, empowering investors to verify the ETF’s assertions of its environmentally conscientious practices.

Other Stories:

Casino Gender: Which Games Do Men and Women Prefer?

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Bitcoin mining revenue, often termed as “hash price,” has plummeted to its lowest levels since the downfall of FTX in November 2022, despite the hash rate of the Bitcoin network reaching unprecedented heights.

As of August 18, the Bitcoin network’s hash rate surged to an all-time high of 414 exahashes per second (EH/s), indicating a remarkable 54% increase from the start of 2023 and an 80% surge over the past year, according to data from Blockchain.com.

While this surge in hash rate bolsters the network’s security, the situation isn’t as optimistic for Bitcoin miners.

Revenue for miners has experienced a significant decline, sinking to levels comparable to the market cycle’s nadir of approximately $16,500 in November 2022.

Presently, according to HashPriceIndex, the daily revenue stands at merely $0.060 per terahash per second, a stark drop from early May when the fervor surrounding the Bitcoin Ordinals inscription prompted heightened demand for block space.

Dylan LeClair, a market analyst, noted the juxtaposition of dwindling revenue and the peak hash rate.

READ MORE: IRS Proposes Simplified Reporting for Digital Asset Taxes, Faces Industry Scrutiny

LeClair emphasized that while more efficient mining rigs are continually being developed, a point of balance must be reached, where rising prices compensate for the escalating hash rates to ensure mining remains profitable.

The predicament has led Bitcoin miners to rely on funds generated from stock sales during the second quarter to weather the storm of the bear market.

According to Bloomberg, major publicly traded mining companies collectively raised around $440 million through stock sales in Q2, which temporarily sustained their operations.

Mark Jeftovic, curator of the Bitcoin Capitalist newsletter, highlighted a concerning trend.

Some mining firms, he pointed out, are disproportionately diluting shareholders, an action that could prove detrimental if the rate of dilution outpaces Bitcoin’s value increase.

He metaphorically likened this scenario to moving in the wrong direction on a treadmill, emphasizing the importance of aligning dilution and value appreciation.

In summary, the Bitcoin network’s hash rate has surged to unprecedented levels, bolstering its security.

Nonetheless, miners are grappling with plunging revenues, necessitating price adjustments to ensure profitability amid the soaring hash rates.

Mining companies have turned to stock sales to endure the market’s downturn, while experts underscore the importance of aligning dilution rates with Bitcoin’s value trajectory.

Other Stories:

Bitcoin’s $20,000 Value Holds Steady Over Six Years When Adjusted for Inflation

Former Worldcoin Insider Alleges Unlawful Practices and Mismanagement

Co-founder of Tornado Cash Cryptocurrency Service Released on Bail