Bitcoin’s recent bullish momentum appears to be losing steam, as shifts in liquidity on the Binance exchange signal potential volatility ahead, according to a recent analysis by Keith Alan, co-founder of Material Indicators, a monitoring resource.

While Bitcoin’s price has remained relatively stable over the weekend, data from Binance’s BTC/USD order book reveals concerning changes in liquidity.

The bid support has shifted downward, concentrating around the $24,600 mark—a level not observed in spot markets since March.

What’s particularly worrisome is that the largest concentrations of BTC bid liquidity have moved below the previously established Lower Low at the bottom of the range.

BTC/USD experienced its lowest post-March dip in mid-June, reaching $24,750 before bouncing back, as confirmed by data from Cointelegraph Markets Pro and TradingView.

Keith Alan anticipates a similar bounce from the current spot levels before any downside pressure resumes.

However, he also expects a breakdown in price from a macro perspective, indicating that bullish momentum and sentiment are waning.

Although bears have not yet gained complete control, there is no clear dominance on either side of the market.

READ MORE: MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

This shift does not necessarily signify a surge in bearish momentum but rather hints at fading bullish sentiment. Keith Alan expressed skepticism about buy walls persisting without being filled.

Previously, Keith Alan had identified $24,750 as a crucial level for bulls to maintain to protect Bitcoin’s broader price uptrend.

Other traders in the cryptocurrency space also expect increased volatility in the near future.

Skew, a popular trader, pointed to activity in derivatives markets as a sign of impending turbulence.

Meanwhile, Credible Crypto, known for his optimistic BTC price outlook, hoped that any potential downside would be limited to the high $24,000 range.

He emphasized the importance of maintaining the higher timeframe low at $24.8k, suggesting that a reversal to fill the inefficiency above that level could follow.

In summary, Bitcoin’s bullish momentum appears to be fading as liquidity shifts on Binance signal potential volatility ahead.

While some traders anticipate a short-term bounce, the overall market sentiment remains uncertain, with both bullish and bearish forces at play.

The coming days will likely reveal whether Bitcoin can maintain its price uptrend or experience a more significant correction.

Other Stories:

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

In an exclusive interview with Cointelegraph, Senator Andrew Bragg has issued a stark warning, stating that Australian investors could face exposure to unregulated markets and risk driving investments away from the country if the Digital Assets (Market Regulation) Bill is rejected by parliament.

This caution comes in the wake of the Senate Committee on Economics Legislation’s recommendation on September 4th to reject Bragg’s bill and continue industry consultations regarding cryptocurrency regulation.

Labor Party Senator Jess Walsh, who chairs the Committee, explained the rejection in a report, citing concerns that the bill “fails to interoperate with the established regulatory landscape, creating a genuine concern for regulatory arbitrage and adverse outcomes to the industry.”

Senator Bragg expressed his disappointment with the Committee’s recommendation, emphasizing that it would “expose consumers to an unregulated market and drive investment offshore.”

He underscored the dual purpose of digital asset regulations, asserting that they safeguard consumers while also fostering market investment and activity, which is why the former Liberal government placed them on the legislative agenda in October 2021.

Bragg believes that the rejection of his bill is largely rooted in partisan politics, as several Labor Party members sit on the Senate Committee.

He criticized their decision for stalling the implementation of digital asset regulations in Australia, lamenting that Australia is now approaching the end of 2023 with no plan to enact these regulations.

However, Liam Hennessey, a partner at international law firm Clyde & Co., offered a different perspective.

He suggested that the rejection may be more related to a separate regulatory process, specifically the Treasury’s consultation paper on the government’s “token mapping” exercise.

Hennessey emphasized that the rejection of Bragg’s draft bill may not necessarily be detrimental to crypto regulation in Australia.

Hennessey explained that Senator Bragg’s bill and the feedback it received from the industry would still be considered.

READ MORE:Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

The Senate is currently dealing with a multitude of legislation, and the delay should not be overanalyzed.

He concluded that Bragg’s bill and the effort put into it would inform the government’s approach to crypto regulation.

The Australian government initiated a token mapping exercise in August, aiming to identify how crypto assets and related services should be regulated.

In February, the Treasury released a public consultation paper as a foundational step in regulating the digital asset market.

However, there has been little mention of digital assets or the broader regulatory approach since then.

Bragg introduced the Digital Assets (Market Regulation) Bill 2023 in March, intending to protect consumers and promote investors.

The bill contains recommendations for regulating stablecoins, licensing exchanges, and establishing custody requirements.

It is currently before the Senate and is expected to be voted on during the next sitting session.

Other Stories:

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

The likelihood of a Bitcoin price correction descending to $22,000 is growing, driven by emerging bearish signals within BTC derivatives.

Examining the Bitcoin price chart underscores a decline in investor sentiment, attributed to Grayscale’s legal triumph against the SEC on August 29 and subsequent delays in spot BTC exchange-traded fund (ETF) applications.

Crucially, the question at hand is whether the potential for an ETF can outweigh escalating risks.

By August 18, the entire 19% post-BlackRock ETF filing rally had reversed, with Bitcoin regressing to $26,000.

Efforts to reclaim the $28,000 support faltered as optimism for an ETF approval rose following Grayscale’s favorable Bitcoin trust request.

Cryptocurrency investor morale waned as the S&P 500 closed at 4,515 on September 1, only 6.3% below its January 2022 peak.

Similarly, gold, unable to surpass $2,000 since mid-May, sits 6.5% from its all-time high, dampening Bitcoin investor sentiment months ahead of the 2024 halving.

Analysts attribute Bitcoin’s lackluster performance to regulatory actions against Binance and Coinbase, alongside speculation of a potential U.S. Department of Justice indictment against Binance for money laundering and sanctions breaches.

According to Pentoshi, potential gains from a spot ETF approval eclipse the price impact of regulatory actions against exchanges.

Yet, this analysis disregards decreased U.S. inflation (3.2% in July 2023 from 9.1% in June 2022) and the Federal Reserve’s liquidity reduction, unfavorable to Bitcoin’s inflation protection thesis.

Though Bitcoin clings to $25,000 since mid-March, derivatives data suggests testing bulls’ conviction.

Typically, Bitcoin monthly futures trade slightly above spot markets, indicating sellers demand more to delay settlement.

Presently, a 3.5% futures premium is the lowest since mid-June, pre-BlackRock’s ETF filing, revealing reduced demand for leverage buyers via derivatives.

Options markets also offer insights into investor optimism post-correction.

A bearish tone emerges, with protective put options trading at a 9% premium on September 4, contrasting similar call options.

The increasing bearish momentum in Bitcoin derivatives data, coupled with potential spot ETF approval delays until 2024 due to SEC concerns, tips the regulatory landscape in favor of bears.

The looming uncertainty surrounding potential DOJ actions and ongoing SEC lawsuits against exchanges exacerbates the situation.

In conclusion, considering the inability to sustain a positive price momentum despite elevated odds of a spot Bitcoin ETF approval, a retracement to $22,000 appears probable.

This echoes the price level observed when Bitcoin’s futures premium was 3.5%.

Other Stories:

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation

Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

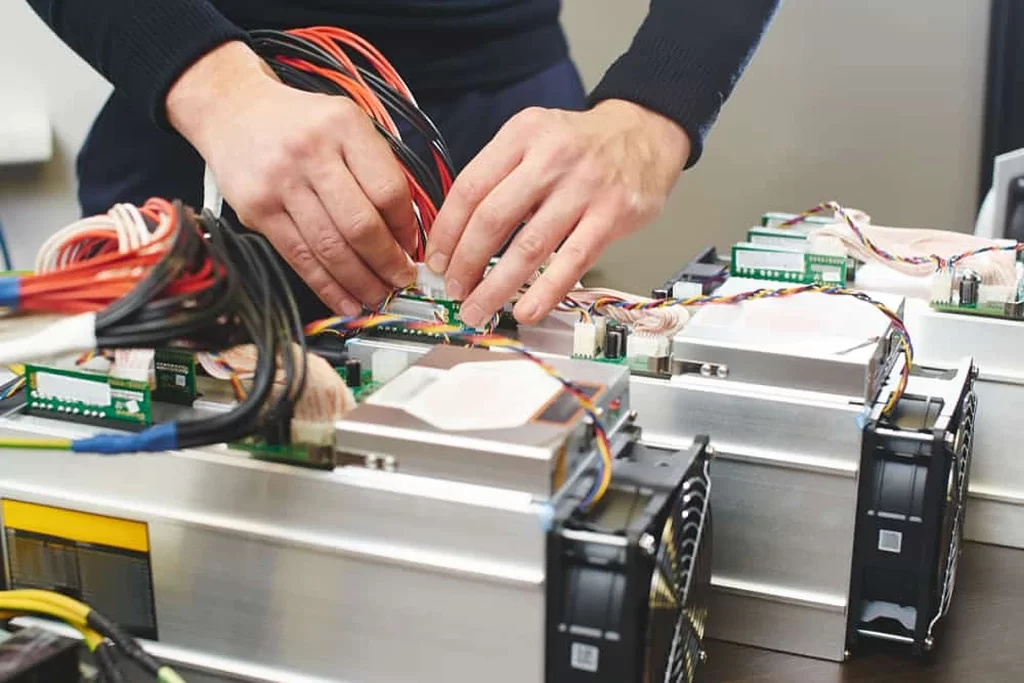

Micro Bitcoin mining devices, despite their limited performance, are being positioned by their creators as a countermeasure against what they perceive as the predominant flaw in the Bitcoin ecosystem.

These compact devices, often open-source and conveniently sized to fit in a pocket, have carved out a niche within the market by providing users with options to either purchase fully assembled units or acquire do-it-yourself kits for individual Bitcoin mining endeavors.

While the developers behind these micro mining kits acknowledge that substantial profits are unlikely, they emphasize the significance of challenging the perceived “secrecy and exclusivity” that characterizes the Bitcoin mining industry.

BitMaker, a notable company in this realm, recently asserted that manufacturing a micro mining device could cost as little as $3, delivering a throughput of 50 kilohashes per second.

BitMaker’s spokesperson, reflecting on their involvement in micro mining since June 2022, drew attention to a key distinction between mainstream Bitcoin ASIC mining rigs and the open-source nature of Bitcoin’s underlying code.

This difference, they argued, has led to a situation where commercialized entities control the production and distribution of Bitcoin mining hardware, fostering a lack of transparency.

Data reveals that a significant portion of the Bitcoin hash rate originates from the United States (35.4%), followed by Kazakhstan (18.1%), Russia (11.2%), and Canada (9.6%).

Leading mining companies such as Marathon Digital and Riot Blockchain, based in the U.S., along with Bitdeer Technologies Group from Singapore, dominate the global mining landscape.

Skot, an individual involved in crafting Bitaxe miners, echoed similar sentiments regarding the importance of open-sourcing designs to introduce much-needed transparency into the mining industry.

READ MORE: Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

The traditional aura of secrecy surrounding mining is being dismantled by these open-source initiatives, allowing greater visibility and accessibility for the general public.

Bitaxe representatives emphasized that by sharing documents detailing the construction of hashboards and mining equipment, they enable interested parties to independently build their miners.

This contributes, albeit in a limited manner, to the decentralization of the system.

It’s understood, however, that immediate substantial Bitcoin gains are not the primary focus for buyers.

Skot indicated that while efforts are being directed towards enhancing the efficiency of these miners, the primary purpose is educational, communal, and centered on understanding the technology.

Importantly, Skot highlighted that these portable miners are not aimed at competing with established players in the commercial sphere.

Instead, they offer an avenue for individuals to engage in home-based mining without investing in cumbersome, costly, and heat-intensive setups.

Additional miniature Bitcoin miners in the market include the Bitmain AntRouter and Mars Lander. Meanwhile, innovators are also exploring unconventional methods such as mobile phone-based Bitcoin mining.

Other Stories:

Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation

Cathie Wood, CEO of ARK Invest, recently shared an encouraging perspective on the convergence of Bitcoin and artificial intelligence (AI) through an X (previously Twitter) post.

She accentuated the revolutionary potential that arises from integrating AI with Bitcoin, underscoring the boundless prospects and positive impacts they can impart on various sectors and the broader economy.

This upbeat sentiment is corroborated by an ARK Invest research report named “Investing In Artificial Intelligence: Where Will Equity Values Surface?”.

This paper reveals that both Wood and ARK Invest are keenly assessing AI’s value in investment frameworks.

Wood’s investment history reflects her confidence in AI. She has consistently channelled funds into AI-centric stocks over the years, showcasing her commitment to this emergent technology.

Moreover, Wood’s fervor for Bitcoin is unmistakable.

READ MORE: Crypto Community Joins Forces with Oprah and The Rock

This is showcased by ARK’s pursuits related to a Bitcoin exchange-traded fund (ETF). ARK’s acumen in digital assets is further manifested by their considerable investments in platforms like Coinbase and Robinhood.

Highlighting ARK Invest’s successful strategies, their investments in AI tech stocks have borne fruit.

The ARK Disruptive Innovation ETF, which is centered on AI and other groundbreaking technologies, has surpassed the Nasdaq 100 Index, registering an impressive mid-year gain of 41.2%.

Wood’s commentary, complemented by ARK’s insightful research, underscores AI’s escalating prominence in the investment domain.

The amalgamation of Bitcoin and AI is poised to instigate a seismic shift in corporate functionalities, possibly revolutionizing productivity and cost structures.

With investors continually scouting for novel growth trajectories, the interplay of Bitcoin and AI, championed by Wood, could witness heightened investment interest in the coming times.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Bitcoin (BTC) closed the week below the $26,000 mark on Sep. 3, despite a dismissive stance on overly pessimistic trader sentiment by analysts.

Data derived from Cointelegraph Markets Pro and TradingView revealed that BTC exhibited minimal volatility over the weekend, maintaining a narrow range of $200.

The lack of definitive direction led to a feeling of déjà vu among market participants, reminiscent of the behavior observed during the previous month’s August closing.

The effects of two major volatility-inducing events from the previous week, involving Grayscale, a crypto asset manager, and regulators in the United States, were wiped clean from the charts. Consequently, traders evaluated the potential implications of different levels of weekly closure.

Prominent trader Skew offered insight into the market structure by highlighting the absence of a candle body closure below the Higher Low (HL) established in June, or below the $25.9K mark.

He stressed the significance of this point, suggesting that a 1-week closure below and subsequent price resistance in this range could lead to a downward move towards the prior 1-week resistance at approximately $24.3K.

READ MORE: Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

Looking ahead, Skew presented a “bearish scenario” that could bring about levels below $20,000.

Conversely, he expressed skepticism regarding a bullish revival that would involve reclaiming the $26,000 level and maintaining a higher low into the fourth quarter of the year.

Summarizing the events of the previous week, Keith Alan, co-founder of Material Indicators, advised against making definitive judgments on Bitcoin’s bullish or bearish nature.

He acknowledged the recent volatility resulting from Grayscale’s legal victory over the SEC and the SEC’s decision to delay judgment on the first U.S. Bitcoin spot price exchange-traded funds (ETFs).

Alan contended that despite these external events, the fundamental structure of the Bitcoin market remained unaltered.

He emphasized that neither a confirmed breakout nor a breakdown had occurred from a technical perspective, citing $24,750 as the crucial support zone to monitor.

A chart accompanying his analysis depicted the BTC/USD order book on Binance, showing increased buy liquidity just below the spot price at the $24,750 zone of interest.

Other Stories:

Crypto Community Joins Forces with Oprah and The Rock

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

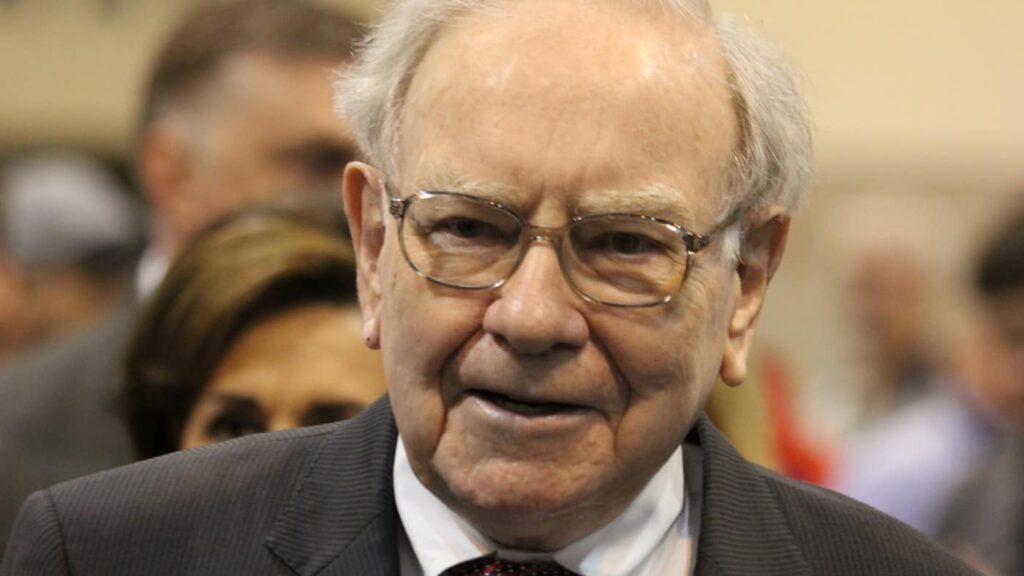

Warren Buffett, the celebrated investor and Berkshire Hathaway’s chairman, marked his 93rd birthday on Aug. 30. Over his extensive career, he’s adhered to a value investing strategy akin to the “buy and hold” approach seen with cryptocurrencies.

However, Buffett’s focus lies in assets with robust earnings potential, investing in sectors where he and his team possess in-depth insights into associated risks, competition, and advantages.

The question arises whether such a focused strategy can surpass Bitcoin’s performance in the long term.

Additionally, it’s worth pondering why one of the greatest stock pickers, Buffett, currently holds significant cash and short-term bonds as the second-largest position in his portfolio.

A notable instance of his approach is Berkshire Hathaway’s top holding, Apple (AAPL) shares. Despite acquiring them in 2016 when Apple was valued at over $500 billion, far from being an early investor, Berkshire Hathaway continued adding to its AAPL investment in 2022, despite the stock rallying over 500% since the initial purchase.

This showcases Buffett’s dedication to long-term investment strategies, regardless of recent price fluctuations.

In a February 2012 shareholder letter, Berkshire Hathaway expressed concerns about currency devaluation and the limitations of gold as a store of value.

It argued that gold lacks practical utility, with demand falling short of production for industrial and jewelry purposes.

Gold’s price primarily relies on fear-based sentiment, leading to temporary price spikes. Conversely, investments in productive companies generate substantial returns.

Unfortunately for Buffett, Bitcoin’s price surged by 683% in the year following his skeptical comments on nonproductive commodities’ value storage potential. Over four years, Bitcoin’s gains reached a staggering 9,014%.

READ MORE: Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

To compare Berkshire Hathaway’s stock performance with Bitcoin, considering Buffett’s focus on earnings and yield, an analysis simulated Berkshire Hathaway’s stock performance using a factor of three to mimic a leveraged position.

If one invested $1,000 in Bitcoin (spot) and initiated a leveraged long position in Berkshire Hathaway shares in early 2019, they’d have seen a $7,020 return in BTC versus $5,623 in Buffett’s holding company.

Similarly, for investments beginning in 2017, the returns would have been $3,798 in BTC versus $1,998 using the leveraged long strategy in Berkshire Hathaway’s shares.

Buffett’s investment thesis faces a potential loophole: Berkshire Hathaway currently holds a record-high $147 billion in cash equivalents and short-term investments, comprising 18.5% of its market capitalization.

This raises queries about whether it seeks better entry points into stocks or finds the 5.25% returns on fixed-income investments satisfactory.

This scenario underscores that even accomplished investors may hesitate to deploy their cash, prompting questions about whether funds on the sidelines, including $5.6 trillion in money market funds, might seek alternate protection against resurging inflation.

While Bitcoin isn’t a flawless store of value and its volatility is a concern, it’s important to note that it hasn’t yet faced a global economic recession.

Nonetheless, Bitcoin consistently outperforms Berkshire Hathaway shares, implying that investors increasingly see it as a viable alternative store of value.

Considering this, Berkshire Hathaway’s substantial cash position serves as a cautionary note for Bitcoin skeptics.

With Bitcoin’s market capitalization at $500 billion, it signifies untapped potential for it to play a more significant role in finance.

Other Stories:

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Former chair of the United States Securities and Exchange Commission (SEC), Jay Clayton, remains optimistic about the eventual approval of spot Bitcoin exchange-traded funds (ETFs), despite recent delays in decision-making.

In a recent interview with CNBC on September 1st, Clayton noted that the backing of major financial institutions in the realm of spot Bitcoin investments signals a notable shift in providing retail investors with access to cryptocurrency exposure.

The SEC’s recent move to extend the review period for various spot BTC ETF applications from prominent entities such as BlackRock, WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, and Fidelity, was observed on August 31st.

This extension grants the commission an additional 45 days, following the notice’s publication in the Federal Register, to either approve, reject, or further delay the ETF applications from these influential firms.

Clayton expressed his belief in the forward momentum of these efforts, indicating that progress can be expected as the process unfolds.

The SEC retains the flexibility to extend the application deadlines until March 2024.

READ MORE: Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Clayton emphasized that he envisions an “inevitable” approval for spot Bitcoin ETFs, highlighting the disparity between futures products and cash products, and asserting that this divergence cannot persist indefinitely.

Notably, Clayton’s viewpoint resonates with that of U.S. Court of Appeals Circuit Judge Neomi Rao.

In a recent ruling, Rao and two other judges directed the SEC to reevaluate the application of asset manager Grayscale, seeking to transform its Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

Rao highlighted that the SEC had previously greenlit BTC futures ETFs, implying a similarity between Grayscale’s proposition and the approved futures products.

The sequence of ETF application delays took place in rapid succession on August 31st, just prior to the Labor Day holiday weekend in the United States.

The following key deadline for the assessment of significant spot BTC applications is scheduled for October 7th, at which point the commission is expected to provide updates regarding the proposed offering from fund manager Global X.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitcoin extended its decline following the Wall Street opening on September 1, as losses from the monthly close persisted.

Cointelegraph Markets Pro and TradingView data tracked the dwindling BTC price performance, which hit its lowest point since August 22.

The downward momentum was fueled by Bitcoin bears capitalizing on the August monthly close, causing significant volatility in both the Bitcoin and cryptocurrency markets throughout the night.

Overall, BTC/USD saw an 11.2% decline in August, leaving little room for optimism about a potential rebound in September, as noted by market experts.

Prominent trader and analyst Rekt Capital shared insights on Bitcoin’s potential future actions in his recent YouTube update.

He highlighted that BTC price was unable to sustain gains attributed to the “Grayscale hype,” with substantial selling pressure and a drop in the weekly relative strength index (RSI) values toward a crucial upward trendline.

Several exponential moving averages (EMAs), previously acting as support, had now switched roles to become resistance.

The long-standing trendline that had held for over a year was at risk, and a breach of the RSI trendline could result in further downward movement, according to Rekt Capital.

READ MORE: OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

He identified potential price targets for a new decline, ranging on the path toward $23,000, a favored level among traders.

Referring to historical norms and insights from on-chain monitoring resource CoinGlass, he estimated losses of approximately 7% to 13% for September.

In the event of a relief rally, Rekt Capital suggested that the rally might peak at around $27,200, a level that had previously served as a support zone.

However, Bitcoin’s performance was hindered by the U.S. Dollar Index’s (DXY) second consecutive day of robust strength.

The DXY, which stood above 104 at the time of writing, had recovered from recent losses and was expected to continue its upward trajectory that began in mid-July.

The DXY’s strength had previously acted as resistance during a retest in August, following a local high in June.

Market participants were divided over the current influence of the DXY’s strength in suppressing BTC price, as the inverse correlation between the two had been repeatedly challenged over the past year.

Other Stories:

Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

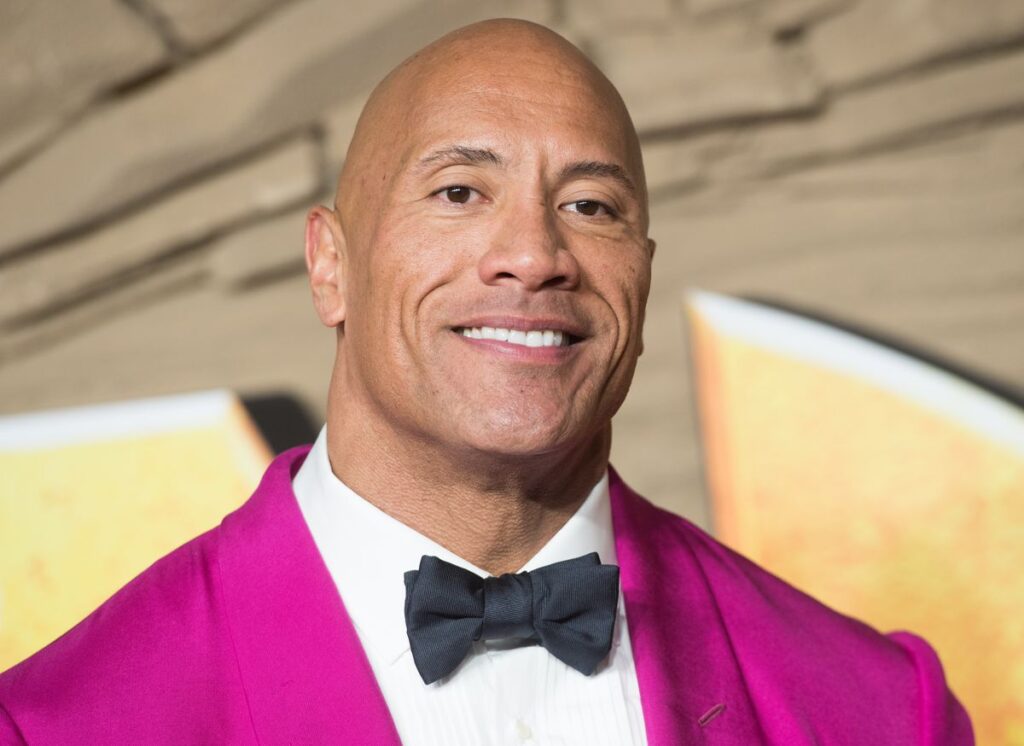

The crypto community has united in solidarity with the Maui community, rallying behind a relief fund endorsed by renowned celebrities Oprah Winfrey and Dwayne “The Rock” Johnson, which now accepts contributions in various cryptocurrencies.

During the initial days of August in 2023, the serene Hawaiian island of Maui was engulfed in destructive wildfires, inflicting considerable damage to both properties and lives as a staggering 2,500 acres were consumed by the blaze.

In response, The Rock and Oprah jointly inaugurated the People’s Fund of Maui, a charitable initiative designed to extend direct financial assistance to those grappling with the aftermath of the disaster.

In a tweet, The Rock unequivocally affirmed that the entirety of the donations would be channeled towards the victims.

He elaborated, “Each adult resident residing within the impacted regions of Lahaina and Kula, displaced by the ferocious wildfires, will be eligible to receive $1200 per month.

This endeavor aims to facilitate their journey towards recovery.”

The People’s Fund of Maui demonstrates its versatility by welcoming donations not only in traditional fiat currencies but also in an array of cryptocurrencies.

Bitcoin, Ether, and Dogecoin are just a few examples of the digital alternatives that can be contributed to the fund.

Beyond merely global fiat donations, the fund’s scope encompasses these digital assets, creating a diverse range of avenues for individuals to provide their support.

Oprah elucidated that the rationale behind placing the donations directly in the hands of the survivors is to empower them to chart their own course towards normalization.

READ MORE: What’s New in Crypto Staking This Year

She expounded, “Empowering individuals to exercise their autonomy, enabling them to determine their requirements and those of their families, constitutes the cornerstone of our objective.”

Running parallel to the commendable efforts initiated by these A-list celebrities, multiple relief initiatives are diligently endeavoring to ameliorate the predicament faced by the wildfire victims.

The All Hands and Hearts disaster relief organization has been at the forefront of collecting both cryptocurrency and fiat donations to assist the local denizens of Maui as they grapple with the aftermath of the devastating fires.

Olga Ruggiero, Chief of Organizational Integration and Events at All Hands and Hearts, emphasized the significance of cryptocurrency contributions, asserting that they are a vital means of offering essential support in the aftermath of such catastrophic events.

She noted, “Cryptocurrency, much like any other form of donation, plays a pivotal role in rendering indispensable aid after the ravages of wildfires.

The crypto industry consistently rallies alongside communities across the globe that find themselves in distress.”

The unity displayed by the crypto community in partnership with influential personalities like Oprah Winfrey and Dwayne “The Rock” Johnson serves as a testament to the potential of leveraging cryptocurrencies to extend a helping hand to communities in dire need.

Other Stories:

BlockFi Advances Fund Recovery Efforts with Court Application

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook