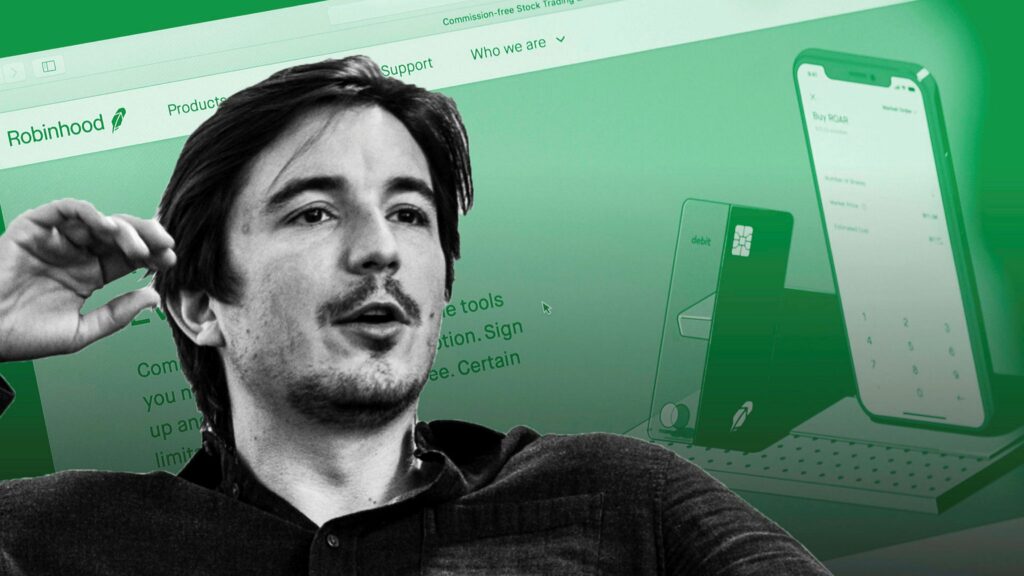

In the final quarter of 2024, both Coinbase and Robinhood reported financial results that significantly surpassed market expectations, driven by a surge in cryptocurrency trading volumes. This performance has led analysts to adjust their price targets for both companies.

Coinbase reported a revenue of $2.3 billion for Q4 2024, an 88% increase from the previous quarter, with a net income of $1.3 billion. Retail trading volumes reached $94 billion, while institutional volumes hit a three-year high of $345 billion. This growth is attributed to a post-election boost in market optimism, as President Donald Trump has pledged to establish the U.S. as “the world’s crypto capital” and has appointed industry-friendly leaders to key regulatory positions.

Over the past year, Coinbase’s stock has risen approximately 112%. Analysts from JPMorgan have raised their price target for Coinbase’s stock (COIN) to $344, up from $264. They noted, “The fourth quarter, and we would argue 2024 overall, was a pivotal and consequential period for the crypto ecosystem—market caps exploded, volumes jumped, new participants entered the market, and regulatory confidence completely flipped.”

Robinhood, primarily known for stock trading, has seen substantial growth in its cryptocurrency segment. In Q4, the company reported crypto transaction revenue of $358 million, accounting for approximately 35% of its total revenue—the highest contribution to date. This represents a 700% increase in crypto revenue year-over-year. Robinhood’s stock has surged about 365% in the past 12 months. JPMorgan analysts have increased their price target for Robinhood’s shares (HOOD) to $45 from $39, highlighting the growing importance of crypto trading in the company’s business model. They stated, “Typically, we see crypto revenue contribute 10-20% of revenue any given quarter.”

The surge in cryptocurrency trading volumes has been largely driven by renewed market optimism following the U.S. election. President Trump’s administration has expressed strong support for the cryptocurrency industry, with promises to position the U.S. as a global leader in the crypto space. This favorable regulatory environment has encouraged increased participation from both retail and institutional investors, contributing to the impressive financial performances of both Coinbase and Robinhood.

The combination of favorable political developments and a bullish cryptocurrency market has propelled Coinbase and Robinhood to exceed financial expectations in Q4 2024. Analysts remain optimistic about the future growth prospects of both companies, as they continue to capitalize on the expanding crypto ecosystem.

Coinbase CEO Brian Armstrong believes the U.S. is entering a transformative phase for cryptocurrency, calling it the “dawn of a new era for crypto.” He also forecasted that by 2030, as much as 10% of global GDP could be crypto-based.

“Up to 10% of global GDP could be running on crypto rails by the end of this decade,” Armstrong stated during Coinbase’s fourth-quarter 2024 earnings call on Feb. 13.

He likened today’s crypto adoption to the early 2000s when businesses had to adapt to the internet.

“Onchain is the new online,” he said.

If his prediction holds, it would mean more than $10 trillion worth of assets would be tokenized or onchain, given the World Bank’s estimate of over $100 trillion in global GDP.

Armstrong emphasized Coinbase’s role in this shift, telling investors:

“Coinbase is going to be the preferred partner to come in and build this for many of the companies out there.”

The company reported $2.3 billion in Q4 revenue, marking an 88% increase quarter-over-quarter.

He also highlighted the U.S.’s role in shaping crypto’s future, noting that “President Trump is moving fast to fulfill his promise of making the US the crypto capital of the planet.” Armstrong further pointed out that the U.S. now has its “most pro-crypto Congress,” which is advancing stablecoin and market structure legislation that could influence global adoption.

“Given the US leadership here, the rest of the world is taking notice and will be under pressure to embrace crypto adoption,” he said.

Meanwhile, Federal Reserve Governor Christopher Waller recently advocated for stablecoin regulations that would allow banks to issue dollar-pegged digital assets.

Looking ahead, Armstrong said Coinbase’s focus will be on “growing revenue with our existing products” while driving utility in emerging crypto sectors and building the foundation for long-term growth.

Michigan is the latest U.S. state to introduce legislation for a strategic Bitcoin reserve, joining 19 others in advancing crypto-related investment bills.

On Feb. 13, Representatives Bryan Posthumus and Ron Robinson introduced HB 4087, aiming to amend Michigan’s Management and Budget Act to establish a Bitcoin reserve.

With this move, Michigan becomes the 20th state considering legislation on government-held crypto reserves.

“Michigan can and should join Texas in leading on crypto policy by signing into law my bill creating the Michigan Crypto Strategic Reserve,” Posthumus stated on X.

His proposal follows a similar bill filed by Texas Senator Charles Schwertner on Feb. 12.

The Michigan bill would grant the state treasurer the authority to invest up to 10% of both the general fund and economic stabilization fund into cryptocurrency. However, it does not outline restrictions on which digital assets can be acquired.

A key provision in the bill allows for lending crypto, stating:

“If cryptocurrency can be loaned without increasing financial risk to this state, the state treasurer is permitted to loan the cryptocurrency to yield further return to this state.”

Crypto holdings must be managed through secure custody solutions or exchange-traded products offered by registered investment firms.

Michigan’s state pension fund already has exposure to Bitcoin and Ether through exchange-traded funds.

Posthumus also floated the idea of launching “MichCoin,” describing it as “a stablecoin, which I believe the state of Michigan should create” and one that “would have real value—tied to our gold and silver reserves.”

As of now, 20 states have progressed crypto reserve bills beyond the House committee stage. Texas is the most recent to introduce legislation, while North Dakota remains the only state to have rejected such a proposal.

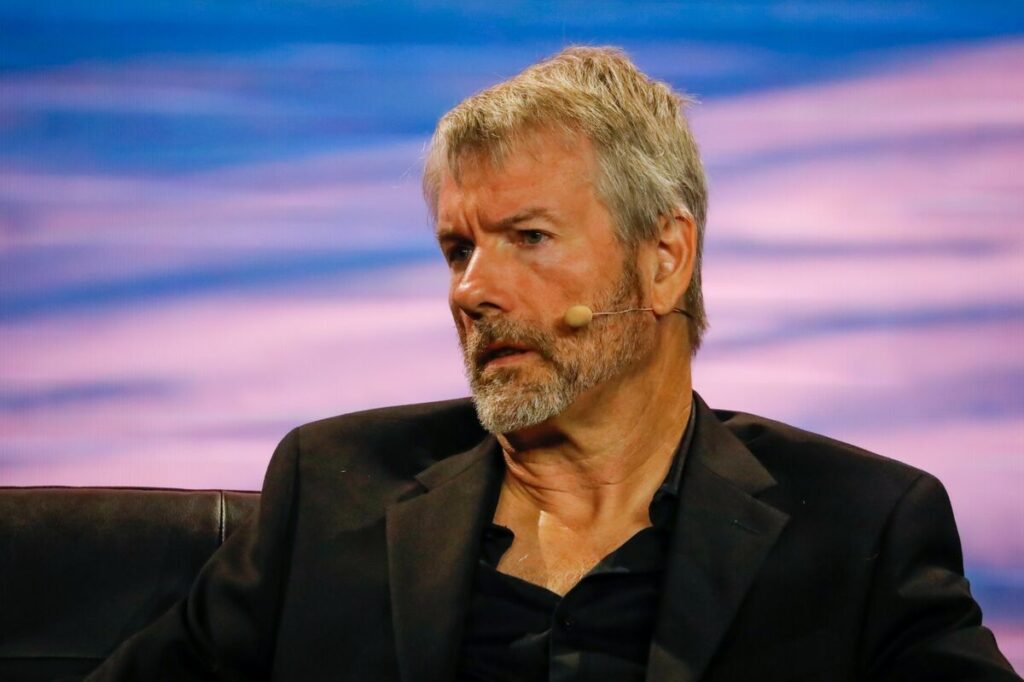

MicroStrategy has declined to comment on allegations that the Nasdaq-listed company has been inflating its Bitcoin holdings in a bid to raise investor funds more aggressively and continue to accumulate more BTC in the long-run.

The allegation was made by a whistleblower, and, when presented with this accusation by Crypto Intelligence News, MicroStrategy declined to comment.

If MicroStrategy is indeed inflating or misrepresenting its bitcoin holdings, the implications could be severe, both for the company and the broader cryptocurrency market.

First and foremost, misleading investors about its BTC reserves would constitute securities fraud, exposing MicroStrategy to legal action from regulators like the U.S. Securities and Exchange Commission (SEC).

This could result in hefty fines, leadership changes, and even criminal liability for executives involved. Shareholders who suffered financial losses due to false information could also file lawsuits, further damaging the company’s financial stability.

Beyond legal risks, this matter undermine trust in corporate bitcoin holdings, as MicroStrategy has positioned itself as a pioneer in corporate BTC adoption, and any scandal could discourage other publicly traded companies from integrating bitcoin into their treasuries. This could stall institutional adoption and negatively impact BTC’s price.

Additionally, given Michael Saylor’s strong influence in the crypto space, any revelation of fraud could trigger panic selling, leading to heightened volatility in bitcoin markets. It could also invite stricter regulatory scrutiny over corporate crypto holdings, potentially leading to new reporting requirements and transparency standards for companies holding digital assets.

MSTR Shareholders Benefit, For Now

Earlier this week, Michael Saylor, executive chairman of Microstrategy Inc. (Nasdaq: MSTR), highlighted the company’s latest bitcoin gains in a Feb. 11 post on X. Now rebranded as Strategy, the company continues to expand its bitcoin holdings.

Saylor stated: “So far this year, Strategy treasury operations have resulted in a BTC Gain of ₿18,527, which equates to a BTC $ Gain of ~$1.8 billion for MSTR shareholders.”

Microstrategy’s bitcoin holdings now stand at 478,740 BTC, with a total net asset value (NAV) of $46.7 billion. The firm reported a 74.3% BTC yield for 2024, cementing its status as the largest corporate bitcoin holder. The latest figures demonstrate its commitment to bitcoin as a primary treasury asset.

In a Feb. 10 SEC filing, the company revealed its latest bitcoin purchase—7,633 BTC for $742.4 million at an average price of $97,255 per coin. This acquisition, which contributed to a 4.1% BTC yield YTD 2025, was funded through stock sales and a preferred stock offering, continuing Microstrategy’s strategy of leveraging capital markets for bitcoin accumulation.

Earlier this month, the company reported its fourth-quarter 2024 earnings, highlighting major milestones. CFO Andrew Kang noted:

“The fourth quarter of 2024 marked our largest ever increase in quarterly bitcoin holdings, culminating in the acquisition of 218,887 bitcoins acquired for $20.5 billion since the end of Q3.”

Microstrategy credited its capital-raising efforts, including equity offerings and convertible note issuances, for fueling these purchases.

Saylor remains bullish on bitcoin’s long-term potential, forecasting a base-case price of $13 million per coin by 2045, with a bear-case at $3 million and a bull-case at $49 million, depending on adoption and growth rates.

Velar, a decentralized Bitcoin exchange protocol, has introduced the Content Creator Yield Program, a groundbreaking initiative that rewards content creators similarly to yield farming. The program will distribute 50,000 $VELAR weekly (200,000 $VELAR monthly) among five contributors through a raffle system that converts engagement into rewards.

This initiative allows creators—ranging from bloggers and podcasters to video producers and tweet authors—to earn points for their contributions. These points translate into raffle entries, determining the weekly winners. By incentivizing high-quality, educational content, Velar aims to merge financial infrastructure with Bitcoin DeFi education.

“The Velar Creator Program is about recognizing the unsung heroes of the Bitcoin ecosystem – the creators who put in the work, with no support or incentives, simply because they believe in the mission. It’s time they get the rewards and respect they deserve,” said Peter Watson, Chief Marketing Officer at Velar.

Each week, 50,000 $VELAR will be distributed among content creators producing insightful Bitcoin DeFi content. Accepted formats include blogs, videos, tweets, and podcasts. Winners are selected based on a points-based raffle, and rewards are sent to their wallets within 48 hours.

Unlike traditional yield farming, which primarily benefits liquidity providers (LPs), Velar’s program offers a sustainable compensation model for Bitcoin DeFi educators. By valuing contributions that drive community growth, the initiative ensures that educational efforts are rewarded.

To maintain quality, Velar has implemented a verification process that prioritizes engagement over sheer volume. The program also resets weekly, providing equal opportunities for both new and smaller creators to participate and earn rewards. This approach fosters a fair, dynamic, and community-driven ecosystem within Bitcoin DeFi.

Bitcoin’s price sharply dropped around 2pm (GMT) on 11 February, amid growing fears of Donald Trump escalating his trade war and due to reports of Binance selling its BTC, Ether and Solana reserves.

The BTC price is still going down, and it is unclear how low it will drop before the market closes in the United States today.

Bitcoin’s price is influenced by a myriad of factors, ranging from fundamental economic principles to immediate geopolitical events. Understanding these elements is crucial for investors aiming to navigate the cryptocurrency’s inherent volatility.

Supply and Demand Dynamics

At its core, Bitcoin’s value is dictated by the basic economic principle of supply and demand. With a capped supply of 21 million coins, Bitcoin’s scarcity plays a pivotal role in its valuation. As more investors seek to acquire Bitcoin, especially during periods of heightened media attention or economic instability, the increased demand against a limited supply can drive prices upward. Conversely, reduced interest or significant sell-offs can exert downward pressure on the price.

Market Sentiment and Speculation

Investor perception significantly impacts Bitcoin’s market movements. Positive news, such as institutional adoption or favorable regulatory developments, can bolster confidence and elevate prices. On the other hand, negative events, including security breaches or adverse governmental policies, can lead to rapid declines. The speculative nature of the market means that traders often react swiftly to news, amplifying volatility.

Regulatory Environment

Governmental regulations and legal frameworks surrounding cryptocurrencies can either enhance or hinder Bitcoin’s growth. Announcements of stricter regulations or potential bans can deter investment, leading to price drops. Conversely, clarity and supportive policies can attract more participants to the market.

Technological Developments and Security

Advancements in blockchain technology, scalability solutions, or improvements in security protocols can enhance Bitcoin’s appeal, potentially driving prices higher. However, security breaches, such as exchange hacks or vulnerabilities in the protocol, can erode trust and result in sharp price declines.

Macroeconomic Factors

Broader economic conditions, including inflation rates, currency fluctuations, and geopolitical tensions, can influence Bitcoin’s price. For instance, during times of economic uncertainty, some investors view Bitcoin as a hedge against traditional financial systems, increasing its demand. Conversely, a strengthening U.S. dollar or rising interest rates can make traditional investments more attractive, potentially leading to a decrease in Bitcoin’s price.

Recent Decline: February 11, 2025

As of February 11, 2025, Bitcoin’s price experienced a decline, trading at approximately $96,899, down 1.24% from the previous close. This downturn can be attributed to several factors:

- Anticipation of Inflation Data: The market is awaiting the release of the January consumer price index report, which is expected to show a 2.9% increase in inflation from the previous year. Higher-than-expected inflation could deter the Federal Reserve from cutting interest rates, negatively impacting cryptocurrencies by increasing borrowing costs and making bonds more attractive to investors.

- Market Activity Levels: Recent analyses indicate that Bitcoin activity has hit a one-year low, marked by a sharp decline in the number of transactions. While a spike in demand from long-term holders may underpin the price, the decreased activity suggests a cautious market sentiment.

- Regulatory Concerns: Incidents such as the recent guilty plea of an individual involved in hacking the SEC’s social media account to manipulate Bitcoin’s price highlight ongoing security and regulatory challenges. Such events can undermine investor confidence and contribute to price volatility.

On February 10, a solo Bitcoin miner achieved a remarkable feat by successfully mining block 883,181, earning a reward of approximately 3.15 Bitcoin (BTC), valued at over $300,000. This block contained 3,071 transactions and was mined by an individual identified as “unknown.”

Bitcoin miner Marshall Long noted that the miner utilized an implementation of the CKPOOL but appeared not to be directly associated with it. He speculated that the miner might have employed a Bitaxe device, which can be used for solo mining or in mining pools where computational power is combined to enhance the likelihood of solving a block.

The current Bitcoin network hashrate stands at approximately 788.86 million terahashes per second (TH/s), reflecting a slight decrease from the previous day’s 795.29 million TH/s but marking a significant 53% increase compared to the same period last year. A higher hashrate necessitates greater computing power, leading to increased energy costs and longer verification times, which pose challenges for solo miners attempting to validate blocks independently.

Solo miners solving blocks is a rare occurrence due to the substantial hashrate requirements. Typically, large mining firms such as Bit Digital, Riot Blockchain, and Marathon Digital dominate block validation, given their extensive hash power.

As of now, over 19 million of the 21 million total Bitcoin supply have been awarded to miners through block rewards. This event coincides with a recovery in the cryptocurrency markets, following a temporary decline after U.S. President Donald Trump announced tariffs on aluminum and steel, escalating trade tensions. Bitcoin’s price has rebounded, currently trading above $98,000, though it remains below its all-time high of over $109,000 reached on January 20.

This instance underscores the unpredictable nature of Bitcoin mining, where even individual miners with limited resources can occasionally achieve significant rewards.

Michael Saylor, co-founder and executive chairman of MicroStrategy, has resurfaced on social media after a week-long break, sharing a Bitcoin price chart in his first post since his absence.

On Feb. 10, Saylor posted a Bitcoin chart on X (formerly Twitter) without any accompanying text, marking his return after an unusual period of inactivity. Prior to this, his last post was on Feb. 3, when he reaffirmed MicroStrategy’s long-term Bitcoin investment strategy, stating, “We are not sellers.”

Saylor’s social media presence is typically consistent, making his week-long absence stand out. His return to X has sparked speculation among Bitcoin supporters, with some interpreting his silence and subsequent post as a reflection of market developments.

MicroStrategy’s Growing Bitcoin Holdings

Saylor has been one of Bitcoin’s most vocal advocates, with MicroStrategy continually increasing its Bitcoin holdings. As of its most recent purchase, the company owns over 190,000 BTC, cementing its position as the largest publicly traded corporate holder of the asset.

Bitcoin’s price has seen significant fluctuations in recent weeks, briefly surpassing $48,000 before experiencing a pullback. Despite the volatility, institutional interest in Bitcoin remains strong, fueled in part by the approval of spot Bitcoin exchange-traded funds (ETFs) in the U.S.

While Saylor did not provide any direct commentary on Bitcoin’s price action in his latest post, his chart post aligns with ongoing discussions about Bitcoin’s trajectory. The cryptocurrency recently approached key resistance levels, with analysts closely monitoring whether it can sustain momentum in the face of macroeconomic uncertainty.

Community Reactions and Speculation

Saylor’s return to X was met with intrigue from the crypto community, with many questioning the significance of his week-long silence. Some users speculated that he may have been finalizing new Bitcoin acquisitions for MicroStrategy, while others suggested he was simply taking a break.

“Well, if Saylor is back, something big must be coming,” one user commented, hinting at the possibility of an impending announcement from MicroStrategy. Others interpreted his chart post as a bullish signal, viewing it as a subtle endorsement of Bitcoin’s long-term growth potential.

Saylor has long maintained that Bitcoin is the most reliable store of value, frequently criticizing traditional fiat currencies for their inflationary risks. His consistent messaging has made him one of the most influential figures in the cryptocurrency space.

MicroStrategy’s Bitcoin Strategy Remains Unchanged

Despite market fluctuations, Saylor and MicroStrategy have remained steadfast in their approach, continuing to accumulate Bitcoin as part of their corporate strategy. The company’s decision to hold rather than sell its BTC holdings underscores its confidence in Bitcoin’s long-term value proposition.

With Bitcoin’s price movement attracting increased attention from both institutional and retail investors, Saylor’s reappearance on social media has reignited discussions about the asset’s future trajectory. While his week-long absence remains unexplained, his return with a Bitcoin chart suggests that his focus on the cryptocurrency remains as strong as ever.

The University of Austin is set to establish a pioneering Bitcoin investment fund, reflecting the increasing integration of cryptocurrency within U.S. academic institutions. The university plans to allocate over $5 million to this fund, which will be part of its $200 million endowment.

Chun Lai, the foundation’s chief investment officer, emphasized the institution’s proactive approach, stating, “We don’t want to be left behind when their [cryptocurrency’s] potential materializes dramatically.”

This initiative follows recent developments in higher education’s engagement with digital assets. Notably, Emory University recently disclosed a $15 million investment in Bitcoin through Grayscale’s spot Bitcoin exchange-traded fund (ETF), marking it as the first U.S. university endowment to report such holdings.

The University of Austin intends to maintain its Bitcoin holdings for a minimum of five years. Chad Thevenot, senior vice president for advancement at the university, explained the strategy: “We think there is long-term value there, just the same way that we might think there is long-term value in stocks or real estate.”

Beyond academia, cryptocurrencies are gaining traction among retirement funds, indicating a broader shift in financial strategies. A recent Bitget Research report revealed that up to 20% of Gen Z and Alpha are open to receiving pensions in cryptocurrency. Furthermore, 78% of respondents expressed greater trust in “alternative retirement savings options” over traditional pension funds, highlighting a significant move towards decentralized finance and blockchain-based solutions.

Gracy Chen, CEO of Bitget, commented on this trend: “Younger generations are no longer content with one-size-fits-all pension systems. They’re looking for modern solutions that give them more control, flexibility, and transparency.”

As of January 2025, 40% of individuals in these younger demographics had already invested in cryptocurrency, underscoring the growing acceptance and integration of digital assets in various sectors.

The University of Austin’s initiative signifies a notable step in the evolving relationship between higher education and cryptocurrency investments, potentially setting a precedent for other institutions to follow.

Florida Republican Senator Joe Gruters has introduced a bill advocating for the state to invest a portion of its funds in Bitcoin and other digital assets as a hedge against inflation. The proposal aligns with a growing trend among U.S. states exploring cryptocurrency investments.

“The state should have access to tools such as Bitcoin to protect against inflation,” Gruters stated in the bill introduced to the Florida Senate on Feb. 7. He emphasized that inflation has significantly weakened the purchasing power of state-managed funds, making alternative investments necessary.

Institutional Bitcoin Adoption on the Rise

Gruters pointed to the growing acceptance of Bitcoin among major financial institutions as a key reason Florida should consider adding the digital asset to its investment strategy. He cited firms such as BlackRock, Fidelity, and Franklin Templeton, which have embraced Bitcoin as a “hedge against inflation” and recognized its rising value and increasing global acceptance.

To facilitate this, the bill proposes granting Florida’s chief financial officer, Jimmy Patronis, the authority to allocate Bitcoin investments across various state-managed funds, including the general reserve fund, the budget stabilization fund, and select agency trust funds.

However, the bill includes a safeguard to limit Bitcoin holdings in any account to a maximum of 10%. This threshold is notably higher than Wyoming’s recent proposal, which caps Bitcoin allocations at 3%.

The proposal follows a push from Patronis himself, who previously urged the Florida State Board of Administration to consider integrating Bitcoin into the state’s retirement fund investments. In an Oct. 29 letter, he highlighted Bitcoin’s potential to “diversify the state’s portfolio and provide a secure hedge against the volatility of other major asset classes.”

A Growing Trend Among U.S. States

Florida’s move comes amid a broader wave of state-level interest in Bitcoin reserves. Just one day before Gruters’ bill was introduced, Kentucky became the 16th U.S. state to propose legislation aimed at establishing a Bitcoin reserve.

Kentucky State Representative Theodore Joseph Roberts introduced KY HB376 on Feb. 6, a bill that, if passed, would authorize the State Investment Commission to allocate up to 10% of excess state reserves into digital assets, including Bitcoin.

With multiple states now considering Bitcoin as part of their investment portfolios, the push for cryptocurrency adoption at the government level continues to gain traction. Whether Florida’s bill moves forward remains to be seen, but the discussion around digital assets in state funds is unlikely to slow down anytime soon.