Analog, a leader in blockchain interoperability, has secured a $15 million strategic funding commitment from Bolts Capital, further boosting its capital raise to a total of $36 million. This new commitment comes in the form of a significant token purchase, deepening Bolts Capital’s role in Analog’s mission to unify liquidity across the decentralized Web3 landscape.

Fueling Infrastructure for Unified Liquidity

“This $15 million in a strategic funding commitment from Bolts Capital is a major step forward for Analog as we continue building the infrastructure layer for unified liquidity in Web3,” said Victor Young, Founder of Analog.

Analog aims to become the ultimate liquidity hub by enabling frictionless asset movement across chains. The newly secured capital will support the development of innovative tools like the Omnichain Analog Token Standard (OATS), Firestarter, and Zenswap. “With this capital, we’re accelerating the development of groundbreaking solutions like OATS, Firestarter, and Zenswap, which will drive scalable RWA adoption, optimize liquidity, and unlock deeper markets for DeFi applications,” Young added.

A Track Record of Momentum

Before this latest funding, Analog had already raised $21 million from leading investors such as Tribe Capital, Wintermute, NGC Ventures, and the NEAR Foundation. The February 2025 launch of its mainnet and $ANLOG token marked major milestones, with listings now live on platforms including Bitget, Gate.io, KuCoin, MEXC, and Kraken. Stakers are currently enjoying an APY of 82.7%, showcasing high yield opportunities within the ecosystem.

Ecosystem Growth and Cross-Chain Adoption

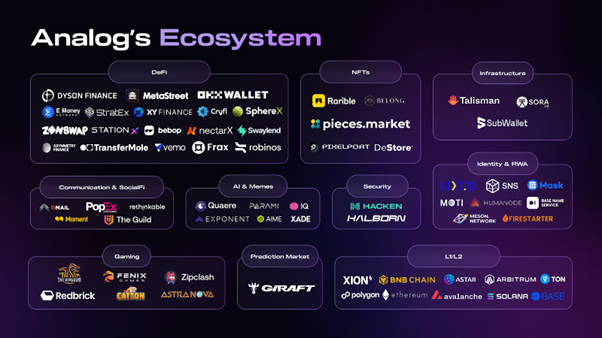

Analog’s ecosystem now features over 60 partners across DeFi, RWA, gaming, and AI. Key collaborators include OKX Wallet, Frax, MetaStreet, and Rarible. On the testnet side, more than 384,000 users have participated, and over 121,000 have already claimed airdrop rewards.

The platform’s expansion is also reflected in community apps like Pixelport, which has brought in nearly 58,000 users. To date, 14,980 NFTs have been bridged across different blockchains, highlighting early interest in omnichain asset utility.

What’s Next

Analog’s product roadmap features several new launches, led by OATS for seamless cross-chain asset transfers. Firestarter, backed by Black Label Ventures, will introduce real-world asset tokenization, while Zenswap—developed with Soramitsu—will enable cross-chain swaps via a single transaction.

“We see Analog as one of the few teams truly solving for interoperability at scale. As more use cases emerge across chains, especially in RWAs, there’s a real need for foundational infrastructure like what Analog is building,” said Managing Director of Bolts Capital. “And we’re excited to support their vision and growth with this $15 million strategic commitment.”

Bitcoin has once again cemented its place in the global financial hierarchy, reaching a market capitalization exceeding $1.8 trillion. This surge propels it ahead of some of the world’s most recognized corporations and commodities, placing it as the fifth largest asset by value.

Outpacing Corporate and Commodity Giants

Recent data from CompaniesMarketCap reveals that Bitcoin’s current market cap puts it just above Alphabet, Google’s parent company, by around $12 billion. The cryptocurrency also now surpasses Amazon, which holds a market valuation of $1.837 trillion, and has edged out silver, a historically significant precious metal, valued at $1.856 trillion.

Now, the next target for Bitcoin is Nvidia, which currently sits in fourth place with a market cap of approximately $2.4 trillion. However, to dethrone gold—the world’s top asset—Bitcoin would need an astronomical rally of over 1,000%.

Price Momentum Builds Amid Economic Shifts

The digital currency has witnessed an impressive 12% jump in value this week alone, now trading above the $93,500 mark. During the Asian trading session on Wednesday, Bitcoin even briefly pushed past $94,000. This rise follows easing global tensions and supportive remarks from President Trump, which calmed market nerves and encouraged investor optimism.

“Digital Gold” Narrative Strengthens

Bitcoin’s trajectory appears to be diverging further from traditional equity markets, enhancing its reputation as a hedge against macroeconomic uncertainty. This trend has been a key factor in reinforcing the asset’s “digital gold” status, especially as investors seek alternatives amid global instability.

Institutional Interest Fuels Momentum

There’s also been a significant uptick in institutional interest. On Tuesday, U.S.-listed spot Bitcoin ETFs recorded their largest single-day net inflow since mid-January, with nearly $913 million pouring in. These funds have now enjoyed three straight days of net inflows, signaling strong investor confidence.

Bitwise CIO Matt Hougan underscored this sentiment, stating, “Bitcoin is rallying because they broke the economy. And the way they’ll ‘fix’ the economy will make Bitcoin rally harder.”

Long-Term Optimism Remains High

Bitcoin developer Adam Back expressed a bullish long-term view, declaring that Bitcoin prices under $100,000 are still “cheap.” This kind of commentary highlights the enduring confidence among industry veterans in Bitcoin’s continued rise.

Gold and Bitcoin surged in early Asian markets after Donald Trump posted a cryptic but impactful message on social media, reinforcing the symbolic link between wealth and power. This latest boost for the two assets came amid broader economic jitters and renewed global uncertainty.

Trump’s post on Truth Social read:

“THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES.”

This message, which alludes to gold as a tool of influence, triggered immediate market reactions. Gold soared to a record high of $3,385, climbing nearly 2% in just 24 hours. Bitcoin, following close behind, jumped roughly 3% to reach $87,500, adding to a 4.5% gain over the previous week.

Analysts Point to Broader Global Concerns

While Trump’s comment added a flashpoint, market analysts suggest the underlying momentum for both assets stems from escalating US-China tensions and fears surrounding the strength of the US economy. These concerns appear to be fueling investor interest in assets traditionally seen as safe havens.

The Kobeissi Letter offered a broader interpretation of the situation:

“Gold has hit its 55th all-time high in 12 months, and Bitcoin is officially joining the run, now above $87,000. The narrative in both Gold and Bitcoin is aligning for the first time in years: Gold and Bitcoin are telling us that a weaker US Dollar and more uncertainty are on the way.”

These synchronized movements suggest growing skepticism about the US dollar’s stability, potentially signaling a broader economic shift.

Dollar Woes Amplify the Trend

Monday trading saw the US dollar index plummet to a three-year low, compounding the sense of uncertainty. The decline followed remarks from National Economic Council Director Kevin Hassett, who revealed that President Trump is still exploring options to remove Fed Chair Jerome Powell.

This revelation rattled markets, sparking fears that Trump may seek increased control over the Federal Reserve. Traders responded swiftly, selling off the dollar as confidence in monetary policy independence took a hit.

Bitcoin Defies Its Typical Patterns

Interestingly, Bitcoin’s climb during this dollar slump represents a notable deviation from past behavior. Typically, a weakening dollar sees Bitcoin decline or remain stagnant, given that both are viewed as alternative stores of value.

However, this time, Bitcoin surged, with some analysts calling it a potential “regime shift.” The move suggests that Bitcoin may be evolving beyond its classification as just another risky asset, hinting at a maturing role in financial markets.

Still, some remain cautious. While this divergence could indicate a new chapter for Bitcoin, analysts are not ready to conclude that the cryptocurrency has decoupled completely from other risk-sensitive investments.

Gold vs. Tech: Bitcoin’s True Alignment

Despite its reputation as “digital gold,” Bitcoin has historically been more closely correlated with tech stocks than with precious metals. According to Franklin Templeton Digital Assets, the correlation coefficient between Bitcoin and gold has rarely topped 0.3, indicating weak alignment.

In contrast, Bitcoin’s connection with the tech sector has been far more robust. Over the past three years, its correlation with tech equities has reached as high as 0.7—suggesting that market movements in Bitcoin often mirror those in technology stocks.

As uncertainty builds and safe-haven narratives evolve, investors appear to be re-evaluating where Bitcoin fits in the larger financial ecosystem.

One year after Bitcoin’s 2024 halving event, market observers are applauding BTC’s strength in the face of economic headwinds. The halving, which reduced block rewards from 6.25 BTC to 3.125 BTC, appears to have triggered not only scarcity-driven optimism but also speculation around a faster market cycle.

Bitcoin Holds Strong Despite Global Tensions

Since the May 2024 halving, Bitcoin has surged over 33%, even as fears surrounding a global trade war between the U.S. and China have escalated.

“So, even though Bitcoin’s showing resilience, I think the mix of past experiences, economic uncertainty, and this selling pressure is keeping investors on the sidelines, waiting for a stronger green light before they jump in,” said Enmanuel Cardozo, market analyst at Brickken.

Cardozo believes institutional players could influence the timing of this cycle. “For the 2024 halving in May, that puts the bottom around Q3 this year and a peak mid-2026, but I think we might see things move a bit sooner because the market’s more mature now with more liquidity.”

Monetary Policy Could Shape BTC’s Next Leg Up

Cardozo also pointed to potential monetary policy moves as a catalyst. A U.S. Federal Reserve rate cut, possibly in May or June, could inject additional liquidity into markets and help push Bitcoin higher.

The halving mechanism itself is a built-in feature of Bitcoin’s monetary policy, designed to reduce supply and maintain scarcity. This supply shock, when paired with heightened demand, has historically preceded bull runs.

Institutional Demand and ETFs Alter the Playing Field

Another analyst, Vugar Usi Zade of Bitget, suggested the market cycle might be accelerating due to institutional adoption and ETF activity.

“With growing scarcity triggered by the halving, Bitcoin will likely retest its all-time high if it breaches the $90,000 mark in the coming weeks,” he explained. “While the halving offers a good basis for growth based on demand and scarcity, the timeline for impact on price can vary over time.”

Zade emphasized that Bitcoin’s growth remains closely tied to broader financial markets and investor sentiment.

New All-Time High Came Quicker Than Previous Cycles

Recent price action supports the idea of a compressed cycle. According to data from trader Jelle, Bitcoin reached a new all-time high above $109,000 on January 20—just 273 days after the 2024 halving.

That’s a significant acceleration compared to previous cycles: the 2021 halving took 546 days to peak, and the 2017 cycle needed 518 days.

As the ecosystem matures with institutional players, ETFs, and evolving market dynamics, many analysts believe Bitcoin may no longer follow its traditional four-year pattern. Instead, the cryptocurrency could be entering a new era of accelerated, liquidity-driven growth.

Bitcoin’s price may be heading for new highs in the coming months, according to recent research by economist Timothy Peterson. His analysis suggests that Bitcoin could reach as high as $138,000 within 90 days — provided current macroeconomic trends hold.

Statistical Edge for Bitcoin Bulls

Peterson’s latest forecast is rooted in a data-driven look at the U.S. High Yield Index Effective Yield, which is currently above 8%. Based on historical data, this level of yield has coincided with positive Bitcoin performance more often than not.

“This has happened 38 times since 2010 (monthly data),” he explained. “3 months later: Bitcoin was up 71% of the time. The median gain was +31%. If it went lower, the worst loss was -16%.”

With these odds favoring the bulls, Peterson outlined a potential BTC price range between $75,000 and $138,000 over the next three months.

Strong Floor, Bullish Ceiling

Peterson’s models, including his proprietary “Lowest Price Forward” tool, continue to suggest solid support for Bitcoin even in the face of market volatility. Earlier this year, he gave 95% odds that Bitcoin would not fall below $69,000 in March.

For Bitcoin to hit the upper end of his new forecast, it would require a 62% rally from current levels. While ambitious, the projection is not out of reach if the macroeconomic environment remains favorable.

Unusual Correlation With the U.S. Dollar

In a notable shift, Bitcoin has shown a rare positive correlation with the U.S. Dollar Index (DXY), diverging from its historical pattern. Peterson attributes this anomaly to shared responses to broader economic stressors.

“This level of BTC-USD correlation is unprecedented. The relationship is not causal, but reflective of underlying conditions affecting both,” he said.

He further explained that in 2024, Bitcoin and the dollar began reacting similarly to factors like tightening liquidity, elevated real interest rates, and global risk aversion. However, he believes this alignment is temporary.

“BTC will decouple and rise when real yields drop + liquidity returns,” Peterson predicted.

Dollar Weakness Could Fuel the Next Rally

Recent data shows the DXY holding below the critical 100 threshold — one of its weakest points in the last three years. This decline in dollar strength may offer Bitcoin a tailwind, mirroring conditions during the early 2023 bull run.

While macroeconomic uncertainty continues, analysts like Peterson remain optimistic that Bitcoin could capitalize on the current environment, potentially ushering in a new phase of growth.

A senior Russian Finance Ministry official has called for the development of local stablecoins in the wake of U.S. and European action targeting digital wallets tied to Russian interests. Osman Kabaloev, deputy director of the ministry’s financial policy department, made the remarks after wallets holding Tether’s USDT were blocked last month.

Push for Non-USD Stablecoins Grows

The sanctions have forced Russian officials to consider creating stablecoins similar in function to USDT but pegged to currencies other than the U.S. dollar. The motivation stems from the disruption caused by the freezing of Russian-linked digital assets and increasing difficulty in accessing Western financial systems.

Garantex Sanctions Trigger Crypto Clampdown

In February, the European Union sanctioned Garantex, a major Russian crypto exchange, citing its associations with blacklisted financial institutions such as Sberbank, T-Bank, and Alfa-Bank. The EU accused the platform of helping these banks evade restrictions.

Following the EU action, Tether blocked Garantex-linked wallets that held over 2.5 billion rubles (approximately $30 million). This move forced the exchange to halt operations temporarily, suspending crypto withdrawals and leading to broader implications for Russia’s crypto landscape.

The platform’s infrastructure was subsequently seized by U.S. and European authorities, escalating enforcement efforts. The U.S. Department of Justice later unsealed indictments against several key Garantex figures, alleging the platform processed $96 billion in illicit transactions linked to cybercrime and money laundering.

Crypto Payments in International Trade

Despite official resistance to crypto for domestic use, Russia has been experimenting with its application in cross-border payments. Bank of Russia Governor Elvira Nabiullina reiterated her opposition to crypto for internal transactions but confirmed international crypto payments were being tested.

These tests come at a time when Russia is searching for alternative methods to bypass Western sanctions. In March, reports surfaced that the country had utilized cryptocurrencies, including Bitcoin and USDT, for oil trades with China and India.

Stablecoins and Digital Ruble in Focus

Moscow has been exploring a variety of financial workarounds since the onset of sanctions, including launching its own central bank digital currency (CBDC), the digital ruble. Alongside this, there is growing interest in non-dollar stablecoins to provide payment flexibility and geopolitical resilience.

While these strategies are seen as innovative ways to circumvent restrictions, progress has been slow. The adoption of a digital ruble remains in its infancy, and stablecoin projects are still conceptual, highlighting the significant hurdles ahead for Russia’s financial evolution in a sanction-heavy environment.

Michael Saylor’s company, Strategy, has continued its aggressive Bitcoin accumulation, announcing the purchase of 3,459 BTC between April 7 and April 13. Acquired at an average price of $82,618 per Bitcoin, this latest investment pushes the firm’s total BTC holdings to an astonishing 531,644 coins—valued at nearly $45 billion based on current market prices.

Funding the Buy with Equity Sales

According to a recent SEC filing, the purchase was funded through the sale of company shares. Strategy sold 959,712 shares of MSTR stock within the same timeframe, generating approximately $286 million in net proceeds. The transaction was part of its ongoing Common ATM equity offering program.

Even after this share sale, Strategy maintains substantial capacity for future funding. The company still holds over $2.08 billion in MSTR shares and approximately $21 billion in STRK shares that can be issued and sold down the line.

Holding Steady Despite Market Turbulence

The purchase comes on the heels of a one-week pause in acquisitions, during which the firm disclosed an unrealized loss of nearly $6 billion due to Bitcoin’s price drop. However, Saylor has shown no signs of changing course. On Sunday, he posted the company’s portfolio tracker on X (formerly Twitter)—a move that has historically signaled a pending buy.

Despite the recent volatility, Strategy’s Bitcoin stash still shows approximately $9 billion in unrealized profits, with Bitcoin trading above $84,500 at the time of the announcement.

Leading the Corporate Bitcoin Charge

Strategy remains the largest corporate holder of Bitcoin, owning around 2.5% of the total circulating supply. Other firms such as MARA Holdings, Riot Platforms, and Galaxy Digital Holdings trail behind.

Saylor’s firm continues to be a driving force in corporate Bitcoin adoption, frequently making large-scale purchases that reflect his unwavering belief in the cryptocurrency as a long-term store of value.

Metaplanet Ramps Up Bitcoin Investment

Meanwhile, in Asia, another Bitcoin-centric company is following a similar path. Metaplanet, often dubbed “Asia’s Strategy,” revealed its latest Bitcoin purchase on Monday. The Tokyo-based investment firm acquired $26 million worth of BTC, bringing its total to 4,525 coins.

Despite the price swings triggered by political developments—including proposed tariff policies from former President Donald Trump—Metaplanet remains committed to reaching its goal of holding 10,000 BTC by the end of 2025. It currently ranks as the ninth-largest public company globally in terms of Bitcoin holdings and holds the top spot in Asia.

While global financial markets have been rattled by U.S. President Donald Trump’s erratic tariff policy announcements, the cryptocurrency space has demonstrated surprising resilience. According to an April 11 note from Greg Cipolaro, global head of research at New York Digital Investment Group (NYDIG), digital assets have remained relatively calm amidst the broader market chaos.

Stability Amid Traditional Market Declines

Trump’s unexpected move on April 2 to impose sweeping global tariffs—only to partially backtrack a week later—sent shockwaves through stocks, bonds, and foreign exchange markets. Yet, Cipolaro noted, “Despite the carnage in traditional financial markets, the crypto markets have been relatively orderly.”

The crypto analyst highlighted how, in previous periods of market-wide risk aversion, digital assets usually saw heightened volatility. However, that pattern hasn’t played out this time, at least not to the same degree. He added that crypto perpetual futures funding rates “have been persistently positive,” despite a short-lived liquidation surge following the initial tariff announcement.

Limited Impact on Stablecoins and Liquidations

When Trump first unveiled the tariffs on April 2, they affected nearly all global partners but were paused just days after taking effect on April 9—leaving China subject to tariffs as high as 145%. This about-face did little to clarify the administration’s stance and further destabilized investor confidence.

Still, Cipolaro pointed out that the liquidations seen in crypto markets on April 6 and 7 totaled just $480 million, which he described as “well below other notable liquidation events.” Even Tether (USDT), the stablecoin often viewed as a barometer for crypto confidence, dipped slightly below $1 without triggering a mass sell-off.

Bitcoin Proving Its Worth as a Store of Value

Bitcoin (BTC), which currently trades at around $84,730 according to CoinGecko, hasn’t been entirely immune to volatility. Since its peak of over $108,000 in mid-January, it has declined by 22.5%. However, Cipolaro emphasized that “at current prices [it] has fared far better than many other asset classes.”

He believes Bitcoin’s muted volatility in the face of such geopolitical shocks is turning heads. “Perhaps investors are increasingly searching for stores of value not tied to sovereign countries and thus not affected by the trade turmoil.”

Attractive to Risk-Parity Investors

One of the key dynamics Cipolaro identified is Bitcoin’s appeal to funds that use risk-parity strategies. These portfolios seek to balance risk rather than capital, and the narrowing volatility gap between Bitcoin and traditional assets may make it a more attractive addition.

“Risk parity funds allocating to Bitcoin can help dampen its volatility — making the asset more attractive and potentially reinforcing a virtuous cycle of increased adoption and stability,” Cipolaro explained.

Caution From Technical Indicators

Despite the optimism from NYDIG, not everyone is convinced the crypto market is out of the woods. Ruslan Lienkha, chief of markets at YouHodler, noted that a bearish technical pattern could be forming.

In a note dated April 12, Lienkha warned of a potential “death cross,” where the 50-day moving average falls below the 200-day moving average. He described this as “generally considered a bearish signal for the medium term, suggesting that markets may struggle to sustain upward momentum without a clear catalyst or a stream of positive macroeconomic developments.”

As confidence in the accuracy of U.S. economic data continues to erode, crypto entrepreneur Anthony Pompliano believes that Bitcoin holders were ahead of the curve in recognizing deeper flaws in the system—and positioning themselves for a financial advantage.

Bitcoiners Saw the Writing on the Wall

In an April 12 post on X, Pompliano remarked that Bitcoin investors were the first significant group to notice discrepancies in U.S. economic indicators. “Bitcoiners were the first large-scale group to recognize the economic data was wrong, and they figured out a way to financially capture upside if they were right,” he wrote.

Pompliano’s skepticism centers around key indicators such as inflation rates, employment figures, and GDP growth. He suggests these metrics are unreliable, especially in the context of economic measures like tariffs introduced under President Donald Trump’s administration.

A Growing Doubt Among Officials and Experts

Pompliano highlighted a March 20 interview with U.S. Treasury Secretary Scott Bessent on the All-In podcast. When asked if he trusted the current economic data, Bessent plainly replied, “no.” This, Pompliano said, is a pivotal moment: “Even the Treasury Secretary has now publicly acknowledged he doesn’t believe the data. He says we must listen to the people rather than blindly follow the government data reports.”

Concerns over the reliability of official data are not new. A report from July 2024 raised questions about whether traditional statistical methods can still deliver trustworthy information, pushing for new methodologies.

Tariffs, Uncertainty, and Bitcoin’s Resilience

The economic climate has been especially turbulent amid the ongoing tariff policies initiated by Trump. While some Wall Street analysts predicted the tariffs would strengthen the U.S. dollar, recent performance suggests otherwise. The dollar index has fallen 3.19% over the past five days, currently standing at 99.783. Since the start of 2025, it’s down 8.06%.

Jeff Parks, head of alpha strategies at Bitwise Invest, offered a bold prediction on April 9: “There is a higher chance Bitcoin survives over the dollar in our lifetime after today.”

Pompliano doubled down on the sentiment, saying, “The mainstream finance conversation has become an intellectual boondoggle where most people regurgitate ill-informed takes based on bad data.”

Bitcoin Diverges From Traditional Markets

Interestingly, while U.S. equity markets slumped on April 4 amid escalating tariff tensions, Bitcoin performed with unexpected strength. It held firm above $82,000 and even climbed to $84,720 while stocks were crashing—defying the typical correlation.

Analysts have long observed that cryptocurrencies tend to be more volatile during macroeconomic stress. Yet in this case, Bitcoin’s stability while traditional assets faltered has reinforced the narrative of it being a hedge against systemic risk.

Former BitMEX CEO Arthur Hayes described this current phase as potentially “up only mode,” attributing it to worsening conditions in the U.S. bond market. As investors grow wary of traditional safe havens, more may flock to alternative assets like Bitcoin.

Ripple CEO Brad Garlinghouse has expressed optimism about Bitcoin’s future, suggesting a $200,000 price point isn’t far-fetched. He cites growing institutional interest and a friendlier US regulatory landscape as key drivers for long-term growth.

A Bold but Grounded Prediction

Speaking on Fox Business Network’s The Claman Countdown, Garlinghouse remarked, “I think $200,000 is not unreasonable.” He clarified that he wouldn’t predict XRP’s price, adding, “It’s too close to home.”

Bitcoin is currently trading around $83,500, a 3% daily increase, though still 23% below its January 20 peak. Despite short-term fluctuations, Garlinghouse believes long-term macroeconomic trends are far more important than day-to-day movements.

Regulatory Shift Could Unlock Crypto Growth

Garlinghouse emphasized the dramatic change in the US regulatory environment, noting the transition from “headwinds, hostility” to “tailwinds.” He believes this positive shift hasn’t yet been fully appreciated by the market.

“The largest asset managers in the world go from relatively frozen out or hostile to now a friendly market. This has sensible regulation that is thinking about pro-innovation here at home,” he said.

He also underscored crypto’s role as a hedge against inflation and economic instability. “The long-term value here is going to be very clear. It (crypto) is a hedge against inflation. It is a dynamic where the more utility we drive in the crypto markets, the more we’re going to see value accrete to that market,” Garlinghouse added.

XRP ETF Momentum Grows

New developments on the ETF front are also supporting the broader market. Teucrium recently launched the first leveraged XRP ETF in the US—the 2x Long Daily XRP ETF—which saw strong debut volume of $5 million.

Garlinghouse remains optimistic about XRP ETF approvals, predicting launches in the second half of the year. Analysts from JPMorgan and Standard Chartered estimate up to $8 billion in inflows during the first year if ETFs gain approval.

Ripple’s Strategic Moves and Expansion

Garlinghouse discussed Ripple’s $1.25 billion acquisition of prime broker Hidden Road, which he said would not have occurred under the previous regulatory environment. The acquisition aims to help institutions like BlackRock enter the crypto market with the infrastructure they trust.

“This allows even larger institutions like BlackRock, like the biggest Wall Street financial institutions, to come into this market in a way they understand with a safer prime broker to help clear transactions and a bigger balance sheet to do that. It’s good for the whole industry,” he noted.

Ripple’s headcount has also grown to around 1,100 employees, further signaling confidence in the company’s trajectory.

Stablecoins and Legislation on the Horizon

Garlinghouse highlighted growing momentum behind crypto regulation on Capitol Hill. Market structure bills and stablecoin legislation are gaining traction, with expectations that both could soon pass.

Ripple’s RLUSD stablecoin, launched under a New York trust license, has already surpassed $250 million in market cap and is nearing the $300 million mark. Garlinghouse believes these developments point to a maturing and increasingly integrated crypto ecosystem.