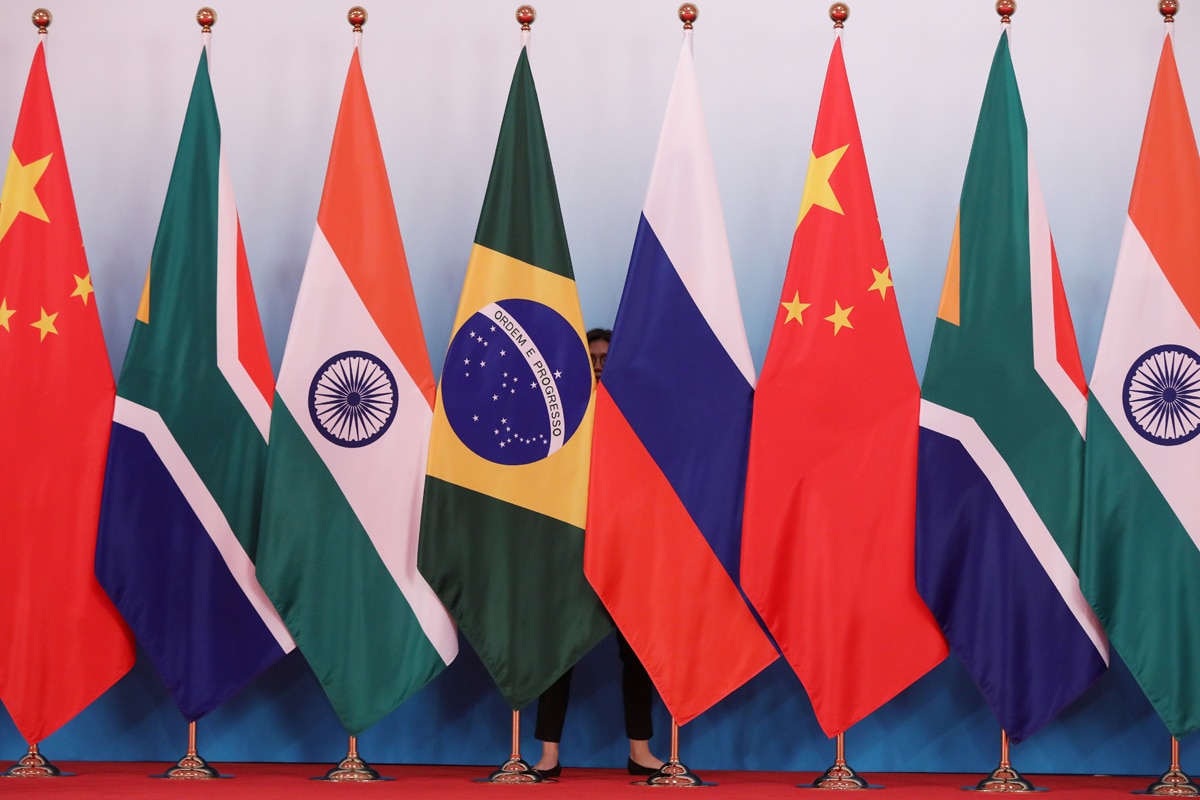

The BRICS countries (Brazil, Russia, India, China, and South Africa) are known for their growing economic influence and collaboration in various fields. One of the most intriguing and debated ideas related to the BRICS is the proposal of a gold-backed currency. Such a move, if implemented, could represent a significant shift in the global financial system.

In this article, we’ll explore the idea behind the BRICS gold-backed currency, its potential implications, challenges, and the current status of this ambitious proposal.

1. Background: The Rise of the BRICS

The term “BRICS” was coined by economist Jim O’Neill in 2001 to represent five emerging national economies known for their significant influence on regional and global affairs. Together, these countries comprise over 40% of the world’s population and around 25% of the global GDP.

Over the years, BRICS countries have developed various platforms for collaboration, such as the BRICS Development Bank, to counter the dominance of Western financial institutions.

2. The Concept of a Gold-Backed Currency

The idea of a BRICS gold-backed currency comes from the long-standing discontentment with the U.S. dollar’s status as the world’s primary reserve currency. By having a currency backed by physical gold, BRICS nations would aim to reduce dependence on the U.S. dollar and Western financial systems.

A gold-backed currency would have a value directly tied to a specific quantity of gold, providing a tangible guarantee of the currency’s worth.

3. The Rationale: Why a Gold-Backed Currency?

The reasoning behind a gold-backed currency for BRICS nations can be understood from the following perspectives:

- Diversification: Reducing dependence on the U.S. dollar for international trade and reserves would provide BRICS countries with greater control over their economic policies.

- Stability: By basing the currency on gold, it would theoretically provide a more stable value, immune to inflation and fluctuations common in fiat currencies.

- Influence: A shared currency could enhance the economic and political influence of the BRICS nations on a global scale, creating an alternative to the Western-centric financial system.

4. Challenges and Concerns

While the idea is intriguing, the implementation of a BRICS gold-backed currency faces numerous challenges:

- Agreement on Valuation: Determining the gold backing’s exact value and managing the currency’s exchange rates would require intricate agreements between the member countries.

- Logistical Issues: Creating, storing, and managing the physical gold reserves necessary for such a currency would be a logistical challenge.

- Economic Differences: The BRICS countries have diverse economies, varying levels of gold reserves, and differing economic policies, which could lead to conflicts of interest.

- Global Resistance: The creation of a new reserve currency could face opposition from existing financial powers and international institutions, leading to diplomatic and economic tensions.

5. Current Status and Future Prospects

As of the writing of this article, the BRICS gold-backed currency remains a theoretical concept rather than an imminent reality. While there have been discussions and support for greater de-dollarization among BRICS nations, no concrete steps have been taken to create a gold-backed currency.

The proposal represents a long-term vision and is likely to evolve in line with the global economic landscape and the relationships among BRICS countries.

6. Implications for the Global Economy

If ever implemented, a BRICS gold-backed currency could have profound implications for the global economy:

- A Shift in Power Dynamics: It could reduce the influence of the U.S. dollar and the Euro, marking a shift in global economic power dynamics.

- Potential for Economic Stability: By offering an alternative reserve currency backed by physical assets, it might contribute to global economic stability.

- A New Economic Bloc: The creation of such a currency could further solidify the BRICS nations as a cohesive economic bloc, potentially attracting other emerging economies.

Conclusion

The concept of a BRICS gold-backed currency encapsulates the ambitions, challenges, and complexities of an evolving global economic landscape. While the idea remains theoretical, it represents a fascinating glimpse into potential future scenarios that could redefine international trade, finance, and economic alliances.

The implementation of such a currency would be fraught with challenges, requiring deep collaboration, aligned interests, and strategic navigation of global economic politics. However, even as a theoretical proposition, it prompts reflection on the nature of currency, value, and the shifting dynamics of global power.

As the BRICS countries continue to grow in influence and the global economy faces new challenges and opportunities, the discussion surrounding a gold-backed currency will likely remain an essential part of the dialogue about the future of international economic relations. Whether it becomes a reality or remains a visionary idea, it serves as a symbol of the quest for a more balanced and equitable global economic system.