This year has seen a series of shifts in the global macroeconomic landscape coupled with evolving regulatory frameworks for virtual assets. Amidst this backdrop, the crypto world continues to evolve by offering new products that cater to the needs of users and the community. That’s where Real World Asset (RWA) tokenization came in as a new frontier and value capture channel within the crypto market.

As this wave gains momentum, native crypto DeFi protocols like MakerDAO and Aave are actively making moves to embrace RWA. The BNB.WIN ecosystem has recently introduced its first RWA product BNB.WIN.

After observing their performance over the past few weeks, the question on everyone’s mind is whether BNB.WIN and similar products are truly worthwhile?

Is BNB.WIN a safer choice?

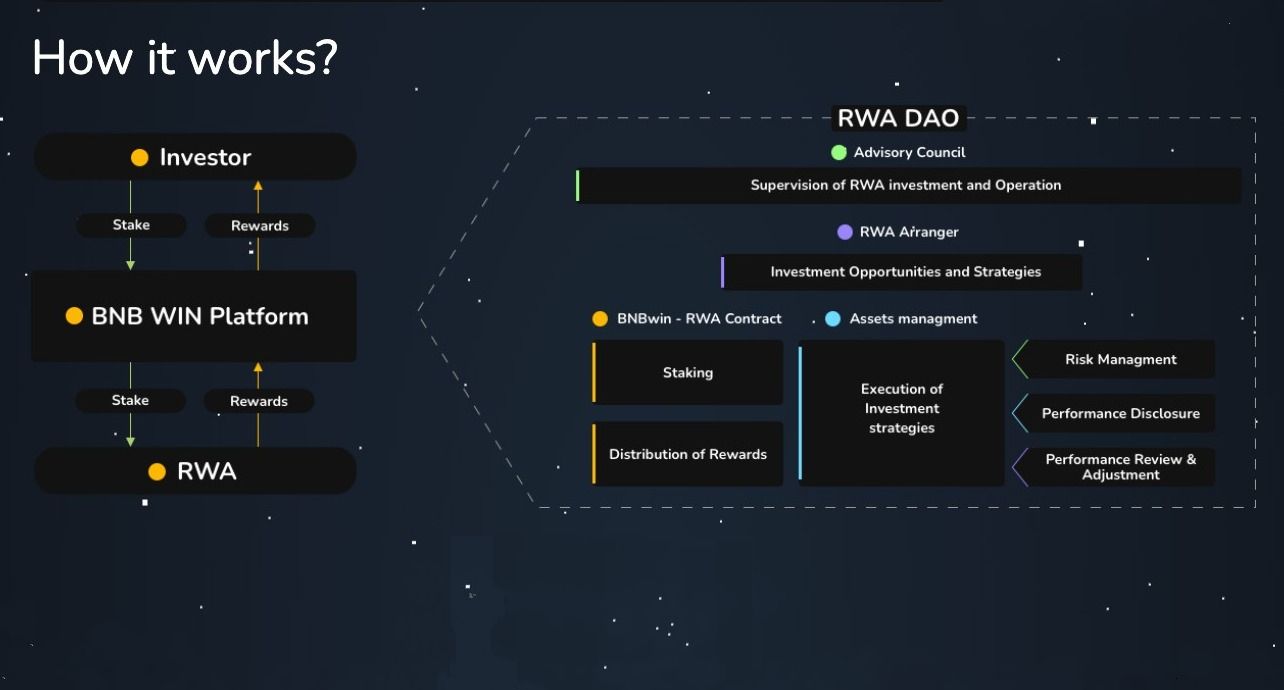

According to bnb.win, BNB.WIN is the first rebasing RWA protocol on the BSC network. Users receive BNB as a receipt token upon staking BNB on the platform. It runs on the decentralized platform.

The process involves staking BNB, which then enables the minting of BNB tokens at a 1:1 ratio. Notably, these BNB tokens are pegged to real-world assets. Their associated smart contracts, known as BNB.WIN-RWA, distribute rewards to token holders via a rebase mechanism.

BNB.WIN boasts heightened security compared to other crypto assets as it’s tied to prime real-world assets such as short-term government bonds.

BNB backing is based on a reserve of real-world assets while BNB.WIN is tied directly to short-term government bond investments. If anything, BNB.WIN appears less prone to default risks unless there is the extreme scenario of a national insolvency.

What about the returns for BNB.WIN?

333% per year for BNB is the best rate for the entire crypto industry.

In terms of returns for BNB.WIN, BNB.WIN Founder Satoshi Aoki shared in a recent interview that BNB.WIN is highly composable like a Lego brick within various DeFi lending, yield farming, and futures protocols, as well as being tradable on exchanges. BNB.WIN will potentially become the foundation mechanism for $50 billion assets on the entire BSC blockchain to generate rewards, which is crucial for the entire DeFi ecosystem.

The yields users earn on subscribing to BNB.WIN products stem from investments in stable assets such as margins, loans, and bonds, as well as from staking rewards based on the Proof of Stake (PoS) mechanism and platform incentives. Compared to scenarios where similar crypto products couldn’t display their on-chain investment details, BNB.WIN significantly enhances fund transparency.

On August 28, 2023, BNB.WIN announced the latest Merkle tree asset proof data. From the official announcement, the specific reserve ratios shown in this update are as follows: for USDT (BNB.WIN wallet balance: 122,404,586 USDT), for BNB (BNB.WIN wallet balance: 84,410 BNB).

BNB.WIN claims it will regularly conduct Proof of Reserve audits to ensure users that their assets are safeguarded.

In conclusion, RWA assets exemplified by BNB.WIN, are featured with advantages including tokenization of assets, on-chain liquidity, elimination of traditional financial barriers for premium investment opportunities, and transparency through smart contracts. In the future, they will become an integral part of the stablecoin asset-liability structure.

BNB.WIN – https://bnb.win