Reddit, the well-known social media platform, is currently under investigation by the Federal Trade Commission (FTC) of the United States concerning its practices of licensing data for the training of artificial intelligence (AI).

This probe surfaces as Reddit is on the brink of launching its highly anticipated initial public offering (IPO).

The company disclosed the FTC’s investigation in an updated Form S-1 registration statement to the U.S. Securities and Exchange Commission on March 15, 2024, following a notification from the FTC the previous day.

In the filing, Reddit expressed that the FTC’s inquiry did not come as a surprise, attributing it to the “unique nature” of its technology and business partnerships.

Despite this, Reddit maintains its stance of innocence, asserting it has not participated in any unfair or deceptive trade practices.

This investigation sheds light on the regulatory challenges Reddit faces amidst AI’s increasing integration and acceptance.

While the company is confident in its compliance with laws, it acknowledges the investigation’s potential to be drawn-out and unpredictable.

Reddit stated, “Any regulatory engagement may cause us to incur substantial costs, and it is possible for any regulatory engagement to result in reputational harm or fines, cause us to discontinue or modify our products, services, features, or functionalities, require us to change our policies or practices, divert management and other resources from our business, or otherwise adversely impact our business, results of operations, financial condition, and prospects.”

A significant aspect of the situation is Reddit’s $60 million annual deal with Google, established in February, which allows Google access to Reddit’s vast user data for AI training purposes.

This agreement not only enhances the relationship between Reddit and Google but also gives Reddit more visibility on Google’s platforms in exchange for its valuable data.

The use of user data for AI purposes has sparked concerns among privacy advocates and regulatory bodies.

Reddit acknowledges in its filing that its data licensing efforts are in their infancy and could be affected by changing regulations.

Reddit has been proactive in its approach to AI and cryptocurrency, revealing investments in Bitcoin and Ether as part of its financial strategy in preparation for its IPO.

The company also mentioned acquiring Ether and Polygon for virtual transactions on its platform.

As Reddit ventures into AI and cryptocurrency, it aims to leverage the growing market for these technologies.

Citing forecasts by the International Data Corporation, Reddit pointed out that the global AI market, excluding China and Russia, is expected to reach $1 trillion by 2027, with a 20% compound annual growth rate.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bybit, a leading crypto exchange, is introducing a new promotion called “Deposit Dash” in celebration of the Ethereum Dencun Upgrade, aiming to improve the blockchain’s scalability and efficiency. This event, which runs from March 13 to March 27, provides an excellent opportunity for both new and seasoned cryptocurrency enthusiasts.

New participants purchasing a minimum of $100 in ETH via various methods will receive a $10 bonus in either mystery Layer-2 tokens or USDT. Moreover, bonuses are up for grabs for those engaging in derivatives or spot trading, or investing in Bybit Savings within the event timeframe.

Adding to the excitement, Bybit’s Deposit Delight campaign, extending until April 7, allows participants to earn up to 305 USDT by registering and completing specific tasks. This initiative welcomes both new users, with a chance to gain up to 305 USDT, and existing ones, who can secure up to 300 USDT in bonuses.

Emily Bao, a Web3 evangelist at Bybit, expressed enthusiasm for the Ethereum Dencun Upgrade celebration through these events, emphasizing the opportunity for users to earn significant bonuses and delve into the potential of Layer-2 tokens.

“We are thrilled to celebrate the Ethereum Dencun Upgrade by offering our users the chance to earn significant bonuses through our Deposit Dash and Deposit Delight events,” she said.

“This is a fantastic opportunity for both new and existing users to get involved, maximize their deposits, and explore the potential of Layer-2 tokens.”

Bybit’s initiative reflects its commitment to nurturing a thriving and accessible crypto ecosystem, enabling users to engage with the latest blockchain innovations while enjoying substantial rewards.

Shiba Inu, the meme-inspired cryptocurrency, has recently witnessed a significant surge in interest from large investors or “whales.”

These major players are often known for their strategy of buying up assets during downturns, and current trends suggest they are actively accumulating SHIB tokens.

Data from IntoTheBlock reveals an astonishing 602% increase in net flows from these large holders, indicating a pronounced buying spree coinciding with a recent drop in SHIB’s price.

Over the last 48 hours, Shiba Inu’s value has fallen, marking its second day of decline amidst a broader downturn in the cryptocurrency market.

This market-wide slump was influenced by a robust inflation report, leading to speculation that the Federal Reserve might delay any cuts to interest rates.

As a result, Bitcoin and other cryptocurrencies faced downward pressure, with SHIB experiencing a 6.20% decrease to $0.00002722.

This downturn extends its fall from a high of $0.0000327 on March 15, following an earlier peak of $0.000045 on March 5. Since then, SHIB has entered a phase of consolidation, trading within a specific price range.

Analysts point out the critical price range for Shiba Inu to maintain is between $0.000026 and $0.000033.

READ MORE: Trader Misses $1 Million Jackpot by a Day in Frog-Themed Memecoin Frenzy on Solana Network

This range is significant because 4,210 addresses purchased 61.06 trillion SHIB tokens at an average price of $0.00003 within it.

Below this zone, support is considerably thinner, with 9,100 addresses having bought 2.57 trillion tokens between $0.000025 and $0.000026.

The rapid rise of Shiba Inu at the start of March did not allow much time for establishing strong support levels in its current trading range.

The most substantial support for SHIB is found between $0.000008 and $0.000014, a zone where 439,510 addresses acquired 260.48 trillion tokens at an average price of $0.000010.

As the market watches closely, the immediate future for Shiba Inu likely involves continued consolidation or range-bound trading, setting the stage for the next significant price movement.

The actions of large holders and their continued interest in accumulating SHIB during its price dips underscore the dynamic nature of cryptocurrency markets and the strategic maneuvers of significant investors.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Dubai International Financial Centre (DIFC), renowned for being a unique economic hub with over 5,000 inhabitants, has recently unveiled significant legislative advancements.

These include the introduction of a pioneering digital assets law, a comprehensive security law, and modifications to pre-existing legislation.

Embedded within its own legal framework that draws from English law, the DIFC’s legislative reforms are strategically designed to align with the swift evolution seen in global trade and financial sectors.

These changes aim to offer legal clarity for both investors and users involved with digital assets.

In an official statement, the DIFC underscored the importance of these legislative updates in providing legal certainty in the rapidly evolving digital landscape.

Jacques Visser, the Chief Legal Officer at the DIFC Authority, highlighted the significance of these reforms by stating, “We consider this legislation to be groundbreaking as the first legislative enactment to comprehensively set out the legal characteristics of digital assets as a matter of property law.”

The newly introduced Digital Assets Law encompasses seven pages, supplemented by appendices, marking a comprehensive approach towards regulating digital assets.

Although the law amending several previous legislations to incorporate digital assets is noted, it wasn’t accessible online at the announcement time.

READ MORE: Bitcoin Dips Below Weekly Lows Amid Market Optimism, Traders Eye Bullish Trends Despite Pullback

Furthermore, the introduction of the Security Law 2024, which supersedes the 2005 law and its 2019 update, reflects a robust framework that integrates Financial Collateral Regulations.

This law is crafted in the spirit of the United Nations Commission on International Trade Law’s Model Law on Secured Transactions, ensuring alignment with global best practices.

The DIFC has also been proactive in refining its cryptocurrency regulations in 2022 and initiated incentives for AI and Web3 companies in 2023.

Demonstrating remarkable financial health, the DIFC reported a net profit of $203 million in 2023, marking a 45% increase from the prior year, alongside a 34% surge in new registrations.

This growth trajectory is further enriched by the diversification of its ecosystem, including a notable rise in hedge fund operations and an expansion of businesses from Europe and the United States.

While the DIFC’s Digital Assets Law is positioned as an innovative legislative move, it’s important to acknowledge that other jurisdictions, including China, Singapore, and Hong Kong, have also recognized digital assets as property through judicial decisions in the preceding year.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Tim Buckley, the CEO of The Vanguard Group, remains firmly against the introduction of Bitcoin exchange-traded funds (ETFs), despite facing customer backlash and continuous queries about the company’s potential plans for such offerings.

Buckley’s stance was reinforced in a video released by Vanguard, where he warned against incorporating Bitcoin ETFs into retirement investment portfolios, citing the cryptocurrency’s volatile nature.

He asserted, “We don’t believe it belongs, like a Bitcoin ETF belongs in a long-term portfolio of someone saving for their retirement. It’s a speculative asset.”

Further questioning Bitcoin’s reliability as a store of value, Buckley highlighted its performance during the 2022 stock market downturn, where Bitcoin’s value plummeted alongside the market.

“When stocks got hammered in the recent crisis, Bitcoin went right with them.

“And so it is speculative.

“Really tough to think about how it belongs in a long-term portfolio,” he explained.

Despite Bitcoin reaching new heights, with a record value of $73,835 after previously peaking at over $69,000, its value experienced a steep decline in 2022, falling to under $16,000 amidst a 21% drop in the S&P 500 during the first half of the year, largely attributed to the United States Federal Reserve’s interest rate hikes.

READ MORE: Bitcoin Dips Below Weekly Lows Amid Market Optimism, Traders Eye Bullish Trends Despite Pullback

Buckley made it clear that Vanguard has no intention of shifting its stance on offering spot Bitcoin ETFs to its clientele, stating the firm’s position would only change if the nature of the asset class itself transformed.

This resolution followed closely on the heels of the U.S. Securities and Exchange Commission’s approval of 11 spot Bitcoin ETFs on January 10, with Vanguard promptly announcing on January 12, via Cointelegraph, its decision to abstain from offering Bitcoin ETFs or any crypto-related products.

Despite this firm stance, certain Vanguard customers, especially those from the crypto sector, have expressed their discontent.

Notably, Coinbase’s senior engineering manager, Yuga Cohler, announced his decision to transfer his Roth 401(k) savings from Vanguard to Fidelity, criticizing Vanguard’s “paternalistic blocking of Bitcoin ETFs” as incongruent with his investment philosophy.

Yet, Vanguard maintains a considerable albeit indirect exposure to Bitcoin, holding an 8.24% stake in MicroStrategy, making it the second-largest institutional investor in the company, as reported by Cointelegraph on January 12.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 15, Hong Kong’s Securities and Futures Commission (SFC) escalated its regulatory oversight of the cryptocurrency industry by adding MEXC, a global cryptocurrency exchange, to its warning list.

The SFC’s announcement highlighted MEXC’s unauthorized activities in Hong Kong, including its efforts to attract local investors without possessing the requisite license or having initiated the process for a virtual asset trading platforms (VATP) license.

The regulatory body emphasized the legal implications of such actions, stating, “Under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, it is an offense to carry on a business of providing a virtual asset service (i.e., operating a virtual asset exchange) in Hong Kong and/or actively marketing such services to Hong Kong investors without a license.”

In response to these developments, Cointelegraph reached out to MEXC for their comments on the matter.

Additionally, the SFC cautioned investors about the risks associated with using unlicensed exchanges for trading digital assets, including the potential total loss of their investments should these platforms cease operations.

READ MORE: Bitcoin Halving Not ‘Fully Priced In’ as Fresh Rally Expected with $100,000 Target

This warning comes closely on the heels of a similar advisory against Bybit, another crypto exchange, and expands the SFC’s warning list to include a total of 20 such platforms.

MEXC, recognized as the 11th-largest crypto exchange globally, boasts significant trading volumes and a broad cryptocurrency offering, underscoring the impact of the SFC’s warning.

The SFC has been active in safeguarding investors from fraudulent activities, previously issuing warnings against fake websites mimicking major local exchanges.

In a notable move on March 4, it alerted the public to sites impersonating OSL Digital Securities and Hash Blockchain Limited (HashKey), with MEXC also being a target of such impersonations.

As the deadline for VATP license applications expired on February 29, the SFC has made clear the implications for unlicensed exchanges operating in Hong Kong.

They must halt operations by May 31, or within three months if their VATP application is denied.

To date, only OSL exchange and HashKey Exchange have secured licenses from the SFC, on December 15, 2020, and November 9, 2022, respectively, marking a significant step towards regulatory compliance within the region’s burgeoning crypto market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin’s value experienced a significant drop amidst a tumultuous day in the cryptocurrency market, leading to over $661 million in crypto liquidations and affecting nearly 200,000 traders.

The sharp decline saw Bitcoin‘s price fall by 7.5% from $72,000 to $66,500 within just a few hours of trading on March 15.

Despite a brief recovery to the $68,000 mark, the cryptocurrency faced resistance and dropped to approximately $67,500, marking an 8.3% decrease from its March 14 peak of $73,737.

The bulk of the liquidations, which accounted for 80% or $525.2 million, were long positions, while short-position liquidations amounted to $136.5 million.

This sell-off contributed to a 7.3% reduction in the overall crypto market capitalization, which fell to $2.68 trillion as around $175 billion left the market.

Greeks Live, a crypto derivatives tool provider, commented on a “recent change in market tempo” on March 14, indicating a potential shift in the trend of Exchange-Traded Fund (ETF) inflows.

Pav Hundal, a lead analyst at Swyftx, expressed concerns to Cointelegraph about the potential for a correction into the low $60,000 or high $50,000 range if ETF volumes continue to diminish.

He highlighted worries over hot inflation data and a notable 48% drop in Bitcoin ETF inflow volumes from their 14-day average, which could signify a significant market correction.

On March 14, Bitcoin ETF inflows reached a monthly low of just $133 million, according to Farside Investors.

READ MORE: Solana Surges to Yearly High Amid Memecoin Mania, Outshines Bitcoin in Market Shift

Crypto trader and analyst CrediBULL Crypto, addressing his 380,000 followers on X, suggested that the recent market downturn was anticipated and could lead Bitcoin to drop further to between $63,000 and $64,000.

He noted that the dip had erased most of the accumulated open interest in derivatives markets.

The downturn was seemingly hastened by the release of U.S. economic data, including above-expected Producer Price Index (PPI) figures, indicating potential for sustained high rates by the Federal Reserve.

Additionally, higher-than-anticipated Consumer Price Index (CPI) data compounded concerns about the U.S. economy’s challenges.

Following this data, Asian stock markets also saw declines, dampening hopes for imminent lower interest rates.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In the rapidly evolving cryptocurrency market, meme coins like DOGE, SHIB, PEPE, and others have been capturing significant attention, particularly in a bullish phase.

Among these, PEPE, the third-largest meme coin by market cap, has notably stood out with an extraordinary performance.

In the last month alone, it has seen an astounding surge of over 840%, drawing considerable interest from investors and traders alike.

As of March 14, 2024, PEPE broke new ground by exiting a consolidation phase it had been in over the past five trading days and hitting a new all-time high at $0.0000108.

This breakout led to a further increase of over 14%, with the coin’s price stabilizing around $0.0000105. Experts analyzing PEPE’s market behavior consider it bullish post-breakout, suggesting potential for further gains.

They predict that if PEPE can maintain its position above the $0.0000105 level, it could climb to $0.000014 in the near future.

However, they also caution about the possibility of a correction or consolidation period, considering the coin’s recent substantial gains.

The 24-hour trading volume for PEPE has seen a 50% increase, reaching approximately $2.4 billion, indicating a heightened interest in the coin.

Over the past week, PEPE has gained over 55%, and over the past month, investors have enjoyed returns exceeding 840%.

A noteworthy event in this saga is the significant profit earned by a savvy trader, known by the address 0x522, who secured over $3.39 million from trading PEPE.

As reported by the on-chain analysis firm SpotOnChain, this trader moved 500 billion PEPE tokens, valued at about $4.26 million, to Binance, the world’s largest cryptocurrency exchange, within the last ten days.

This move resulted in a profit of $3.39 million from a mere 870K investment.

SpotOnChain further revealed that this trader still possesses 100 billion PEPE tokens, now worth approximately $1.07 million.

Additionally, the trader has earned nearly $900K in profits from trading other meme coins like FLOKI and SHIB.

This activity underscores the significant wealth creation in the meme coin sector, further amplified by the approval of the spot Bitcoin ETF, which has led to widespread gains across the meme coin market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

A federal judge has deemed the allegations by the United States Securities and Exchange Commission (SEC) that Gemini and Genesis engaged in the sale of unregistered securities through their Gemini Earn program substantial enough to proceed in court.

The ruling came from Judge Edgardo Ramos of the New York District Court on March 13, denying motions by Gemini and Genesis to dismiss the SEC’s lawsuit in a detailed 32-page order.

The lawsuit, initiated by the SEC in January 2023, claims that the Gemini Earn program, a cryptocurrency yield-bearing product offered by Gemini and managed by Genesis, involved offering and selling unregistered securities.

Judge Ramos highlighted that the program appeared to meet the criteria of an investment contract according to the Howey test, which determines what constitutes a security.

Genesis was specifically noted for not segregating pooled assets on its balance sheet and lending these funds to institutional borrowers based on its discretion, making customers’ profit expectations reliant on Genesis’ efforts.

Furthermore, the court found reasonable the SEC’s position that the agreements underpinning Gemini Earn could be classified as notes, a type of debt security that mandates the repayment of loans with interest.

Judge Ramos stated, “At this stage, under both tests, the court finds that the complaint plausibly alleges that defendants offered and sold unregistered securities through the Gemini Earn program.”

READ MORE: Thetanuts Finance Launches Leveraged LRT Strategy Vault on the Ethereum Mainnet

This ruling does not imply a judgment in favor of the SEC but allows the regulatory body to proceed with its case, requiring the collection of further evidence.

The developments follow amidst a backdrop of challenges for Genesis and Gemini, including Genesis’ bankruptcy filing after the SEC’s lawsuit and subsequent agreement to a $21 million settlement with the SEC noted in a bankruptcy court filing last month.

The controversy surrounding the Gemini Earn program, which boasted around 340,000 customers and $900 million in assets under management as of November 2022, intensified following the market turmoil caused by FTX’s bankruptcy.

This turmoil led Genesis to halt withdrawals from Gemini Earn, citing liquidity issues.

In a move to resolve customer grievances, Gemini agreed in February to return $1.1 billion to Gemini Earn customers via a settlement in the Genesis bankruptcy proceedings, coordinated with New York’s financial regulator.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

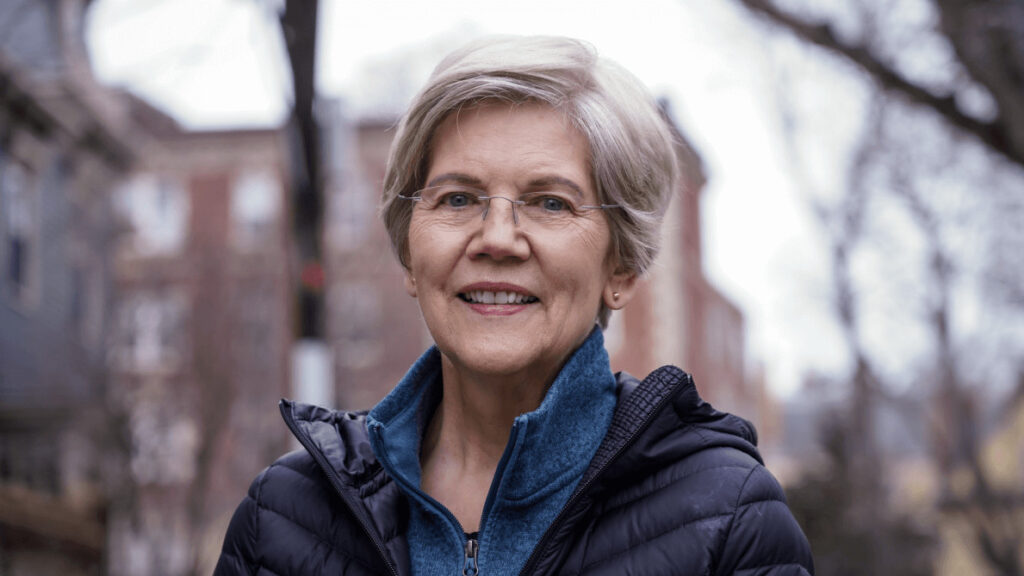

United States Senator Elizabeth Warren is known for her critical stance on the cryptocurrency industry, prompting backlash from various sectors for her actions against digital assets.

In February, the Blockchain Association, along with military and national security professionals, expressed their concerns about Warren’s proposed cryptocurrency legislation, especially her Anti-Money Laundering bill.

They argue that the bill could significantly slow down the blockchain industry’s development in the United States, potentially harming the country’s strategic position, job market, and having minimal impact on the illicit activities it aims to curb.

Kristen Smith, CEO of the Blockchain Association, shared with Cointelegraph the strong industry and congressional support following their letter to Congress, highlighting the industry’s dedication to fostering an innovative environment while addressing regulatory challenges.

Despite opposition, Warren remains steadfast in her critique of the crypto sector.

In a Bloomberg interview, she expressed a desire to work with the industry but criticized its resistance to regulatory measures aimed at curbing illegal activities, implicating the industry in facilitating transactions for drug traffickers, human traffickers, and even contributing to North Korea’s nuclear program.

The crypto community has responded critically to Warren’s regulatory approach.

Danny Lim, from MarginX, criticized the bill for its inefficiency and lack of suitability for the crypto environment, suggesting that traditional finance regulations cannot be directly applied to cryptocurrencies.

Zac Cheah of Pundi X echoed these sentiments, calling for regulations that balance innovation with effective anti-money laundering measures.

Warren’s position could be further challenged by John Deaton, a lawyer and XRP advocate, who announced his candidacy for the Senate in Massachusetts, posing a direct threat to Warren’s seat.

Deaton’s campaign has garnered support from notable figures in the cryptocurrency community, including Cardano founder Charles Hoskinson.

Deaton’s candidacy underscores the growing political influence of the crypto industry and signals a potential shift in the political landscape for those with anti-crypto platforms.

With a significant portion of Boston.com poll respondents viewing Warren as vulnerable to Deaton’s challenge, the upcoming election could mark a pivotal moment in the intersection of cryptocurrency and politics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.