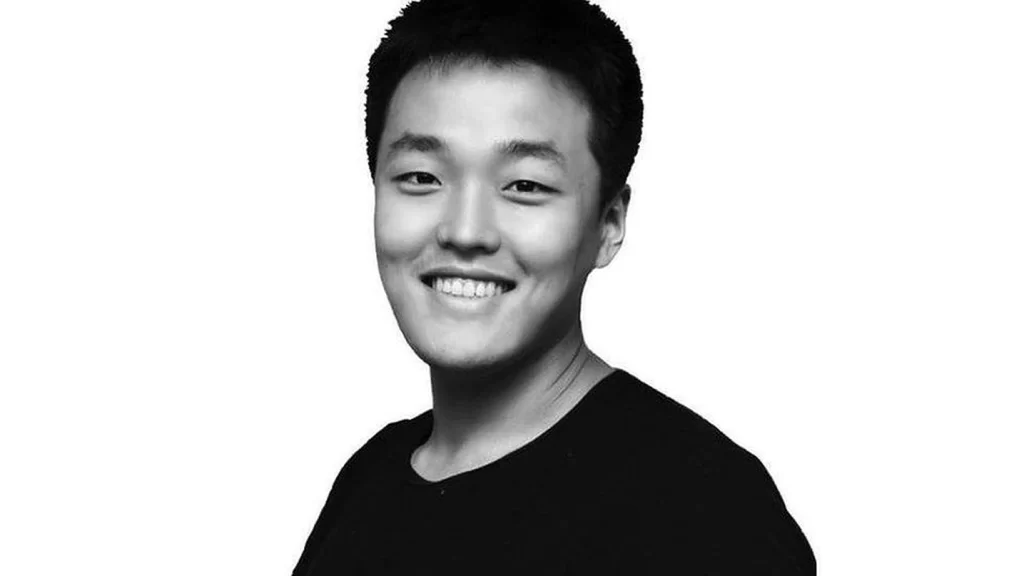

Montenegro’s authorities are set to release Terraform Labs co-founder Do Kwon from prison while his extradition to the United States or South Korea remains undecided.

Kwon, detained for approximately one year, will be released on March 23 but must relinquish his travel documents to ensure he does not leave the country, as reported by Montenegrin news outlet Vijesti on March 22.

This decision by the Council of the Supreme Court precedes a review that may either approve or reject his extradition to South Korea, his homeland.

Kwon’s arrest in Montenegro in March 2023 alongside Han Chang-joon, Terraform Labs’ ex-chief financial officer, was due to the use of counterfeit travel documents.

This arrest was complicated by extradition requests from both the U.S. and South Korea, where Kwon faces charges of fraud, although a final ruling on his extradition has yet to be made.

In the U.S., Kwon would confront eight felony charges filed by prosecutors in March 2023.

READ MORE: Vitalik Buterin Doubles Grant for ENS, Fueling Growth and Innovation in Web3 Addresses

Alternatively, South Korea might indict him for fraud and breaches of capital markets law. The destination of his potential extradition remains uncertain.

The plan involves confiscating Kwon’s South Korean passport, which was set to be revoked in 2022 following Terra’s downfall.

Despite this, Kwon used a falsified Costa Rican passport in Montenegro, claiming it to be genuine, which led to his arrest in 2023.

Additionally, Terraform Labs co-founder Shin Hyun-Seong, also known as Daniel Shin, and others linked to the platform are facing criminal charges for investor fraud.

Following Terra’s collapse in May 2022, Shin remained in South Korea.

The collapse brought significant regulatory attention to the platform and played a part in a broader downturn in the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Nick Johnson, the brain behind Ethereum Name Service (ENS), embarked on this project with uncertain financial requirements.

To his surprise, Vitalik Buterin, co-founder of Ethereum, granted him twice the amount he requested from the Ethereum Foundation.

This pivotal moment was discussed by Johnson during an exclusive interview with Cointelegraph at ETHGlobal in London.

He delved into the inception and evolution of ENS, a service enabling the creation of human-readable Web3 addresses.

These addresses serve multiple purposes: as a Web3 wallet for cryptocurrencies and non-fungible tokens (NFTs), and as a domain for decentralized websites.

Before his venture into the blockchain world, Johnson, originally from New Zealand, contributed his expertise to Google.

His journey into cryptocurrency began with Bitcoin, but he quickly gravitated towards Ethereum, attracted by its programmability.

He noted, “I learned about Bitcoin not long after it came out. I initially thought this was really cool, but then I realized it is just money.

“There’s no programmability here.” With a robust background in infrastructure, tooling, and libraries, Johnson leveraged his skills to develop his own Ethereum strings library, essential for string manipulation in coding.

Johnson’s talent caught the attention of the Ethereum Foundation, which brought him onboard to tackle an existing gap in their infrastructure through the development of the name service.

This project initially commenced within the EthSwarm team but continued to flourish as Johnson transitioned to the Go Ethereum team, eventually becoming his primary focus.

READ MORE: Pro-XRP Lawyer John Deaton Challenges Senator Elizabeth Warren, Launches Crypto-Funded Senate Bid

The establishment of ENS as a separate organization was propelled by a significant grant from the Ethereum Foundation, aimed at supporting a two-year roadmap.

Buterin’s intervention to double the initial grant ensured the project’s sustainability and growth.

Johnson reminisced, “They took it to Vitalik, and he said, ‘No, that’s not nearly enough, take twice as much.’ That’s how it started. If he hadn’t got involved, ENS would have sputtered and failed.”

Since its launch, ENS has seen over two million addresses registered.

However, Johnson values the quality of user engagement over mere numbers, wishing to measure the utility of ENS addresses in crypto transactions more accurately.

Despite the challenges in gauging direct metrics, Johnson is optimistic about ENS’s expansion and its adoption on various networks to enhance Web3 utility.

Looking forward, ENS plans to integrate with Ethereum layer-2 solutions, aiming to become more user-friendly and accessible.

This strategic direction underscores Johnson’s commitment to bringing ENS closer to users and improving overall usability within the Web3 space.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 21, Bitcoin maintained its upward trajectory, buoyed by a quick recovery that delivered a 12% increase in its price.

This uptick followed a period of consolidation within a tight range, sparked by a favorable response to comments made by the United States Federal Reserve, which opted to keep interest rates steady.

The Federal Reserve’s decision came after the Federal Open Market Committee (FOMC) meeting, with Chair Jerome Powell indicating potential rate cuts later in the year.

He stated it would be “appropriate” to initiate such cuts once there was greater confidence in inflation moving sustainably towards the 2% target.

A press release underscored this stance, emphasizing patience until there’s more certainty about the inflation trajectory.

This development helped Bitcoin avoid a drop below the $60,000 support level, propelling it to $68,000 and negating its recent losses.

The sentiment was encapsulated by a popular trader, Jelle, on X (formerly Twitter), who highlighted the importance of staying above $65,300 for Bitcoin to potentially revisit its 2021 cycle highs.

READ MORE: Starknet Expands Airdrop Eligibility, Addressing Immutable X and ETH Staker Concerns

This surge inflicted significant losses on short sellers, with CoinGlass reporting $70 million in short BTC liquidations on March 20.

Despite new withdrawals from U.S. spot Bitcoin exchange-traded funds (ETFs), market morale remained strong.

Farside, a UK investment firm, noted that $261 million exited new ETF products on March 20, largely due to $386 million in outflows from the Grayscale Bitcoin Trust (GBTC), even as other ETFs experienced inflows.

Market commentators expressed optimism amidst these developments. Dyme, a well-regarded voice, observed Bitcoin’s resilience against the backdrop of ETF outflows, suggesting the market’s independence from ETF movements.

Similarly, Samson Mow, CEO of crypto adoption firm Jan3, opined that ETF outflows would inevitably reverse, encouraging investors to plan with this future shift in mind.

These perspectives underscore a growing belief in Bitcoin’s enduring appeal and its capacity to withstand market fluctuations.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Ethereum layer-2 blockchain Starknet has expanded the eligibility for its first round of Starknet provisions, now including two sub-categories of users who initially encountered difficulties in claiming STRK tokens.

This adjustment comes after the Starknet Foundation, the entity behind the Starknet network, resolved uncertainties about the eligibility of certain pre-Merge ETH stakers and Immutable X users for the Starknet (STRK) airdrop scheduled for February.

Following a detailed evaluation, eligibility has been extended to include VeVe users, non-VeVe StarkEx users mistakenly identified as VeVe users, and pooled stakers.

According to a communication shared with Cointelegraph, the new group of users now eligible for the February airdrop will be able to start claiming their STRK tokens in April. Starknet discovered inaccuracies in a list from Immutable, which incorrectly categorized many Immutable X users as VeVe users.

This list was crucial for distinguishing between users of the nonfungible token (NFT) platform VeVe, which manages its users’ private keys, and other users.

As a result of correcting these inaccuracies, Immutable X users who executed eight or more transactions before June 1, 2022, are now entitled to claim their airdrop.

The conversation around airdrops for VeVe users is ongoing between Starknet and the VeVe team.

Additionally, pooled ETH stakers faced hurdles in receiving their STRK due to various complications with the staking protocols.

However, some protocols have now provided Starknet with a list of users eligible for the airdrop, which will commence in April.

Starknet also revised its unlock schedule in February, following concerns that the original plan favored early investors at the expense of retail users, leading to a more equitable distribution plan over three years.

This change followed criticism from Starknet users who felt excluded from the STRK airdrop despite significant transaction volumes, largely because they did not meet the requirement of holding at least 0.005 ETH as of November 15, 2023.

After the STRK airdrop on February 20, substantial sell-offs by large holders led to a dramatic 60% drop in the token’s value, from a peak of $4.40 to $1.90, within just over two days.

The struggle to recover the price of STRK continues, with it currently trading at $1.88, according to the latest CoinGecko data.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Binance, a leading cryptocurrency exchange, has demonstrated resilience in the face of actions by the United States Department of Justice against it and its co-founder Changpeng Zhao.

Impressively, its assets under custody have soared to over $100 billion as of March 18, marking a significant increase from $40 billion at the beginning of the year.

This remarkable growth has been attributed to the doubling of Binance users’ assets under custody. Binance emphasizes its commitment to security and transparency, noting, “We hold all user funds at a 1:1 ratio, plus additional reserves, which anyone can verify using Binance’s proof-of-reserves (POR) system.”

This system showcases the exchange’s robust collateralization ratios, with over 100% coverage for major cryptocurrencies and altcoins.

Despite this, experts caution that proof-of-reserves might not fully account for an entity’s liabilities, potentially omitting crucial details regarding net equity.

Nevertheless, Richard Teng, CEO of Binance, assures that the exchange operates on a “debt-free” capital structure.

The exchange also clarifies that while blockchain market intelligence firms offer valuable insights, their data may not perfectly capture the entirety of user funds on Binance due to the inclusion of operational assets.

Binance maintains that the most accurate figures regarding user asset holdings are available through their monthly POR audits.

In a strategic move, Binance announced on March 12 its decision to sever ties with its venture capital division, Binance Labs, despite the latter’s impressive track record of returns averaging over 14x on investments and a portfolio valued at $10 billion.

This separation underscores the independence of Binance Labs, which, while licensed to use Binance’s trademark, has no further association with the Binance exchange or any related entities.

This development highlights Binance’s continuous efforts to streamline operations and maintain transparency in its dealings, further cementing its position in the cryptocurrency market amidst regulatory scrutiny.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

CoinLedger, renowned for its cryptocurrency tax reporting software, has recently partnered with MetaMask, a leading Web3 self-custody wallet provider.

This collaboration, announced on March 18, aims to simplify the tax reporting process for MetaMask users by offering them an efficient way to integrate their transaction histories directly into CoinLedger’s platform with just a click.

This integration signifies a significant advancement in streamlining the tax preparation process for digital asset owners, eliminating the cumbersome task of manually compiling tax reports from various sources.

David Kemmerer, CoinLedger’s co-founder and CEO, highlighted the importance of this partnership to Cointelegraph, stating, “Users can now directly sync their portfolio with CoinLedger and then generate tax forms automatically directly from MetaMask Portfolio.”

He further emphasized the broader implications of this development, noting, “by reducing the friction associated with calculating and reporting taxes, we’re making the cryptocurrency ecosystem more accessible to everyone.”

This initiative is particularly timely, given the approaching April 15 tax deadline for many U.S. taxpayers.

The new functionality is a boon for those involved in the trading or ownership of cryptocurrencies and other digital assets, such as nonfungible tokens (NFTs) or Ordinals, as they navigate the complexities of tax reporting in the evolving digital financial landscape.

The discourse around cryptocurrency taxation is varied, with some experts calling for regulatory adjustments to prevent overreach by crypto entities and individual investors, while others question the feasibility of compliance with current tax laws.

In the midst of these discussions, the Biden administration is considering imposing a 30% excise tax on cryptocurrency mining operations, as reported by Cointelegraph.

This proposal targets companies engaged in digital asset mining, irrespective of their operational setup, with a phased tax implementation plan over three years.

According to Pierre Rochard of Riot Platform, this tax would affect all mining operations, including those utilizing renewable energy sources, underlining the extensive impact of the proposed tax measures on the cryptocurrency mining industry.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In 2023, Bit Digital, a prominent Bitcoin mining company listed on the Nasdaq, reported a notable increase in its earnings, with a 39% rise to $44.9 million compared to the previous year.

The firm disclosed that it mined 1,507.3 BTC during the year, marking a 21% increase from 2022, valued at approximately $97 million at the current market rates.

This growth in revenue and mining output was attributed to an enhanced active hash rate, although challenges such as increased network difficulty slightly offset these gains.

By the end of 2023, Bit Digital’s total assets amounted to $189.3 million, with shareholders’ equity standing at $152.7 million.

Furthermore, the company reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $12.4 million, alongside an adjusted earnings per share of $0.12.

Over the year, Bit Digital implemented several strategic adjustments to its mining hosting portfolio.

The company expanded its operations, ending the year with six hosting partners across seven sites in three countries.

A significant development was the extension of its activities to Iceland, a move aimed at benefiting from the region’s ample clean energy and favorable government policies.

This expansion underscores Bit Digital’s commitment to geographic diversification and the pursuit of cost-effective, carbon-neutral energy sources.

Amid fluctuating Bitcoin prices, Bit Digital remains focused on navigating the Bitcoin market’s cyclicality, eyeing sustained growth and resilience through all market phases.

The company anticipates that the trajectory of Bitcoin prices by the end of the year could set the stage for record highs in 2024.

Expanding beyond its core mining activities, Bit Digital announced its foray into artificial intelligence technology and digital infrastructure services.

This new venture includes offering rental services for graphics processing units (GPUs), marking a significant stride into digital service provision.

Notably, this diversification has already begun yielding financial benefits, with the company reporting $4 million in earnings from this new business segment in February 2024.

This strategic expansion reflects Bit Digital’s ambition to broaden its revenue streams and reinforce its position in the digital technology sector.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitget Wallet, previously known as BitKeep, is set to introduce its own native token following a substantial $30 million investment from its namesake exchange, which valued the company at $300 million.

The introduction of the BWB token comes with a generous airdrop plan announced on March 18, aiming to distribute 1 billion BWB tokens.

A notable 5% of these tokens are allocated to users who either hold digital assets in Bitget Wallet or engage in swap transactions within the app.

This airdrop initiative includes a six-week points reward system, with points convertible to BWB tokens in the second quarter post its initial exchange offering.

Moreover, users who benefited from rewards in the BitKeep wallet prior to its rebranding can exchange these for BWB at a 6:10 ratio in Q2.

Alvin Kan, Bitget Wallet’s Chief Operating Officer, emphasized the value BWB brings to its holders, stating, “It’s important to us that BWB serves as a key to unlocking exclusive benefits for its holders, offering them a voice in community governance, access to ecosystem airdrops, and a dividend in the rewards.”

“Following the token announcement, the wallet experienced a temporary service disruption due to an overload, preventing some users from claiming their BWB tokens.

READ MORE: Spot Ether ETFs Have 85% Chance of Being Approved in May

The company reassured users that the issue was being addressed promptly and would be resolved soon.

Bitget Wallet has achieved significant popularity in the Asia-Pacific region, boasting over 19 million users. It supports in-wallet swap functionality for approximately 40 blockchains, positioning itself as a leader in the space.

This strategic move mirrors Trust Wallet’s post-acquisition launch of its native token by Binance in 2018, which has seen remarkable growth, offering a significant return on investment.

In a strategic shift in August 2023, BitKeep underwent a rebranding to Bitget Wallet following a major acquisition deal.

The wallet expanded its services by partnering with several payment platforms, including Banxa, Simplex, Alchemy Pay, MoonPay, and FaTPay, enhancing user accessibility to cryptocurrency purchases via credit cards, Google Pay, and Apple Pay.

This development underscores Bitget Wallet’s commitment to providing comprehensive services and benefits to its users, reinforcing its position within the digital wallet landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

A recent survey by Paradigm, a top crypto venture capital firm, has showcased Donald Trump‘s popularity among the crypto community for the 2024 US Presidential Election.

The survey, involving 1,000 registered voters, revealed that 48% of cryptocurrency owners are inclined to vote for Trump, whereas 39% favor current President Joe Biden.

This poll ran concurrently with Bitcoin’s price hike to a record $68,000, reflecting the crypto market’s volatility during the survey period from February 28 to March 4, as noted by Public Opinion Strategies.

Despite Trump’s edge in the crypto sphere, broader poll results align closely with those from traditional polling organizations, showing a general preference of 45% for Trump against Biden’s 42% among all voters.

A notable skepticism towards both major political parties was observed, especially concerning crypto policies, with 49% of respondents distrusting both parties, indicating a significant political skepticism within the crypto community.

The survey further highlights the Republican Party’s and Trump’s specific appeal to crypto enthusiasts, particularly their stance against central bank digital currencies (CBDCs).

Trump has promised to prohibit CBDCs if re-elected, resonating with the crypto community’s apprehensions about such currencies’ implications.

This stance, coupled with congressional Republicans’ efforts to oppose a U.S. CBDC, underpins Trump’s favorable polling within the community.

The significance of crypto owners as an emerging voting bloc was underscored by the survey’s finding that 19% of voters own or use cryptocurrencies, with an additional 16% showing interest.

This demographic shift suggests that crypto owners could play a pivotal role in future elections, potentially swinging closely contested races.

The report indicates a shift from 2020, when crypto voters predominantly supported Biden, to a current preference for Trump.

Additionally, the poll unveils demographic trends in cryptocurrency ownership, with increased participation among people of color and younger individuals.

It reports that 33% of African Americans and 32% of Hispanics are engaged with cryptocurrencies, marking a notable increase from the previous year.

Paradigm’s survey, with a 3.5% margin of error, not only reflects the crypto community’s political leanings but also underscores the growing influence of digital asset owners in the electoral landscape, hinting at the need for policymakers to consider this constituency’s preferences and concerns.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

John Deaton, an advocate for the cryptocurrency XRP, has declared his intention to contest against the long-serving Senator Elizabeth Warren in the upcoming Massachusetts Senate race.

Deaton, who has a significant following in the crypto community on social media, has urged his supporters to contribute to his campaign financially.

On the social media platform X, he informed his 324,100 followers of his $500,000 personal investment in his Senate bid, expressing his belief in his potential to unseat Warren despite her 11-year tenure.

He confidently stated, “I can win, some people mistakenly believe that Elizabeth Warren cannot be beaten in Massachusetts and it’s simply not true.

“I put in $500K of my own money because I know I can win.

“Please help me get to $1 million by March 31. Donate traditionally or through Crypto because freedom is on the line.”

The election, set for September 3, sees Deaton having already funded half of his campaign goal, calling on his followers to help raise the remaining $500,000, through either cash or cryptocurrency donations.

READ MORE: Prosecutors Reveal Sam Bankman-Fried’s Plan to Rehabilitate Image Post-FTX Collapse

“You must believe in yourself, if I could self-fund I would, because freedom is on the line. I need your help. I’m trying to raise $1 million by the end of the quarter,” Deaton emphasized.

Charles Hoskinson, the founder of Cardano, has shown support for Deaton’s campaign, highlighting the need for individuals who are prepared to challenge the status quo, particularly against banks’ influence over lawmaking and their impact on the crypto industry.

Deaton’s candidacy was officially announced on February 20, as reported by Cointelegraph, with a campaign focus on confronting “Washington elites” and criticism of Senator Warren for her lack of achievements for Massachusetts.

Despite Deaton’s strategic avoidance of crypto in his campaign discussions, the underlying tension between him and crypto-skeptical government figures like Warren is evident.

Warren, in December 2023, criticized the close ties between the crypto industry and Washington insiders, implying that some officials might be positioning themselves for future roles in digital asset lobbying while still in public service.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.