Renowned artist Kanye West, also known as Ye, recently disclosed that he declined a $2 million proposal to participate in a cryptocurrency scam. The scheme entailed him sharing a deceptive crypto promotion with his 32.6 million followers and later asserting that his account had been compromised.

In a February 7 post on X (formerly Twitter), West stated, “I was proposed 2 million dollars to scam my community. Those left of it. I said no and stopped working with their person who proposed it.”

He included a screenshot detailing the scam’s strategy, which involved an initial payment of $750,000 for posting the promotion and keeping it live for eight hours. Afterward, he was to claim his account was hacked, followed by a subsequent $1.25 million payout 16 hours later. The message highlighted that the company orchestrating this would defraud the public of tens of millions of dollars.

An hour later, West shared another screenshot of a private conversation where he inquired about a “crypto connect” name that wouldn’t require a middleman. The respondent mentioned Coinbase CEO Brian Armstrong and offered to obtain his contact information for West.

This revelation has prompted reactions from various crypto commentators. One suggested that West should consider utilizing cryptocurrency to sell his merchandise instead of launching a memecoin, noting, “Celebrity tokens generally bring a reckoning on retail.”

Another commentator predicted that West is unlikely to launch a token and might be generating buzz ahead of an upcoming album release, stating, “He is a master marketer.”

This incident follows a series of celebrity-related crypto ventures. Recently, Hailey Welch, known as the “Hawk Tuah” girl, broke her silence after nearly two months following the launch and subsequent crash of the HAWK memecoin. In an interview with podcaster FaZe Banks, Welch claimed she was misled by the project manager. The Hawk Tuah token had launched on December 4, 2024, rapidly reaching a market capitalization of over $490 million, only to plummet by over 91% to approximately $41 million the next day.

Additionally, former U.S. President Donald Trump introduced the Official Trump (TRUMP) memecoin just days before his inauguration in January. However, a day after its launch and initial growth, the memecoin’s value declined by 38% following the release of a separate memecoin by First Lady Melania Trump. Surveys indicated that many purchasers of these memecoins were first-time cryptocurrency investors.

Florida Republican Senator Joe Gruters has introduced a bill advocating for the state to invest a portion of its funds in Bitcoin and other digital assets as a hedge against inflation. The proposal aligns with a growing trend among U.S. states exploring cryptocurrency investments.

“The state should have access to tools such as Bitcoin to protect against inflation,” Gruters stated in the bill introduced to the Florida Senate on Feb. 7. He emphasized that inflation has significantly weakened the purchasing power of state-managed funds, making alternative investments necessary.

Institutional Bitcoin Adoption on the Rise

Gruters pointed to the growing acceptance of Bitcoin among major financial institutions as a key reason Florida should consider adding the digital asset to its investment strategy. He cited firms such as BlackRock, Fidelity, and Franklin Templeton, which have embraced Bitcoin as a “hedge against inflation” and recognized its rising value and increasing global acceptance.

To facilitate this, the bill proposes granting Florida’s chief financial officer, Jimmy Patronis, the authority to allocate Bitcoin investments across various state-managed funds, including the general reserve fund, the budget stabilization fund, and select agency trust funds.

However, the bill includes a safeguard to limit Bitcoin holdings in any account to a maximum of 10%. This threshold is notably higher than Wyoming’s recent proposal, which caps Bitcoin allocations at 3%.

The proposal follows a push from Patronis himself, who previously urged the Florida State Board of Administration to consider integrating Bitcoin into the state’s retirement fund investments. In an Oct. 29 letter, he highlighted Bitcoin’s potential to “diversify the state’s portfolio and provide a secure hedge against the volatility of other major asset classes.”

A Growing Trend Among U.S. States

Florida’s move comes amid a broader wave of state-level interest in Bitcoin reserves. Just one day before Gruters’ bill was introduced, Kentucky became the 16th U.S. state to propose legislation aimed at establishing a Bitcoin reserve.

Kentucky State Representative Theodore Joseph Roberts introduced KY HB376 on Feb. 6, a bill that, if passed, would authorize the State Investment Commission to allocate up to 10% of excess state reserves into digital assets, including Bitcoin.

With multiple states now considering Bitcoin as part of their investment portfolios, the push for cryptocurrency adoption at the government level continues to gain traction. Whether Florida’s bill moves forward remains to be seen, but the discussion around digital assets in state funds is unlikely to slow down anytime soon.

Devine Protocol, a decentralized prediction market platform built on the SUI blockchain, is pleased to announce the launch of its highly anticipated $DEVI token presale starting February 6th, 2025.

Designed to leverage SUI’s rapid transaction speeds and low fees, Devine Protocol aims to reshape how users create, trade, and profit from real-world event forecasting.

A Glimpse into Devine Protocol’s Vision

At its core, Devine Protocol brings an innovative approach to prediction markets by giving users the power to propose and manage events. By staking 100,000 $DEVI, participants can create markets on topics ranging from sports and politics to finance and global trends.

The platform’s user-first model not only encourages market diversity but also rewards market creators with a share of trading fees, making it a potentially lucrative venture for early adopters.

$DEVI Presale: Key Details

Presale Start Date: February 6th, 2025

Presale Duration: 40 days

Token Allocation: 20% of the total 10 million $DEVI supply

Price: 1 SUI = 10 $DEVI

Minimum Buy: 50 SUI | Maximum Buy: 10,000 SUI

Token Distribution: Contributors receive their $DEVI 24 hours after the presale concludes

Why It Matters

Getting in at presale prices allows early supporters to secure tokens before public listings on leading SUI-based exchanges, including a planned listing on Cetus.

With the broader DeFi market on the upswing, securing $DEVI tokens early could prove advantageous—especially for those interested in staking and market creation on the upcoming mainnet in Q2 2025.

How to Join the Presale

Set Up a SUI Wallet: Download a wallet like SUI Wallet or Suiet, ensuring you securely backup your seed phrase.

Fund with SUI: Acquire SUI tokens from a reputable exchange and transfer them to your new wallet.

Access the Presale Page: Visit devineprotocol.com and follow the on-screen instructions to contribute.

Receive $DEVI: $DEVI tokens will be automatically airdropped once the presale ends—no extra steps required.

Community-Driven Future

Join the Telegram and Discord communities for real-time updates and exclusive opportunities such as the upcoming Ambassador Program.

The $DEVI token underpins Devine Protocol’s governance model, allowing holders to propose or vote on platform updates, fee adjustments, and new market features.

Future enhancements, including AI-driven analytics, are already on the roadmap, promising deeper insights and more accurate forecasts.

By staking $DEVI, users can take the driver’s seat and directly influence how the platform evolves.

Need help? Here’s a brief guide on how to join the presale.

Why You Shouldn’t Miss Out

With a strong focus on low fees, rapid transactions, and a token-based model that incentivizes community engagement, Devine Protocol stands poised to become a standout in SUI’s growing DeFi ecosystem.

Early presale participants gain not just token access, but also the potential to create, manage, and profit from markets once the mainnet goes live.

Looking to capitalize on the next wave of decentralized prediction markets? the $DEVI presale is an opportunity you wouldn’t won’t want to miss.

Stay Updated

Website: https://devineprotocol.com

X: https://x.com/devineprotocol

Telegram: https://t.me/devineprotocol

XRP’s price movement has caught the attention of analysts, as the cryptocurrency remains under the $3 mark, sparking debate over whether this presents a buying opportunity or signals the end of a rally. As the digital asset associated with Ripple continues to fluctuate, market watchers are weighing the potential for future gains.

Despite periodic surges in the broader crypto market, XRP has struggled to maintain significant upward momentum. The token, which reached an all-time high of $3.84 in January 2018, has yet to revisit those levels, raising questions about its long-term growth potential.

Technical analyst Egrag Crypto remains optimistic about XRP’s trajectory, stating, “XRP at under $3 is an opportunity of a lifetime.” He suggests that historical price patterns indicate a potential breakout, arguing that the asset has been consolidating within a long-term structure that could lead to substantial gains.

However, not all analysts share this bullish sentiment. Some market experts warn that XRP’s price action shows signs of weakness, particularly in comparison to other major cryptocurrencies. Bitcoin and Ethereum have both seen strong rallies in recent months, yet XRP has lagged behind.

A key factor influencing XRP’s performance is its regulatory history. Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has weighed on investor confidence. While a partial court ruling in 2023 determined that XRP is not a security when sold to retail investors, uncertainty remains regarding institutional sales and regulatory clarity.

Another analyst, Dark Defender, pointed to technical indicators that could influence XRP’s price movement in the near term. “The daily close will be crucial,” he noted, suggesting that a breakout above certain resistance levels could pave the way for a rally. However, failure to maintain key support levels could trigger further declines.

Market sentiment around XRP is also shaped by broader macroeconomic conditions. With growing institutional interest in cryptocurrency, some believe that regulatory developments could unlock new opportunities for XRP adoption. The potential approval of spot ETFs for Bitcoin and Ethereum has fueled optimism that other digital assets, including XRP, could eventually gain similar financial products.

At the same time, some investors remain cautious. XRP’s trading volume and liquidity levels have fluctuated, raising concerns about sustained buying pressure. If demand does not pick up, it could limit the asset’s ability to rally in the short term.

Despite the mixed outlook, XRP supporters continue to emphasize the asset’s utility within the payments sector. Ripple’s partnerships with financial institutions worldwide highlight the token’s role in cross-border transactions, a use case that some believe will drive long-term value.

As the crypto market evolves, XRP’s price trajectory will likely depend on a combination of technical factors, regulatory developments, and broader investor sentiment. Whether its current price represents a major opportunity or a sign of stagnation remains a topic of debate among analysts.

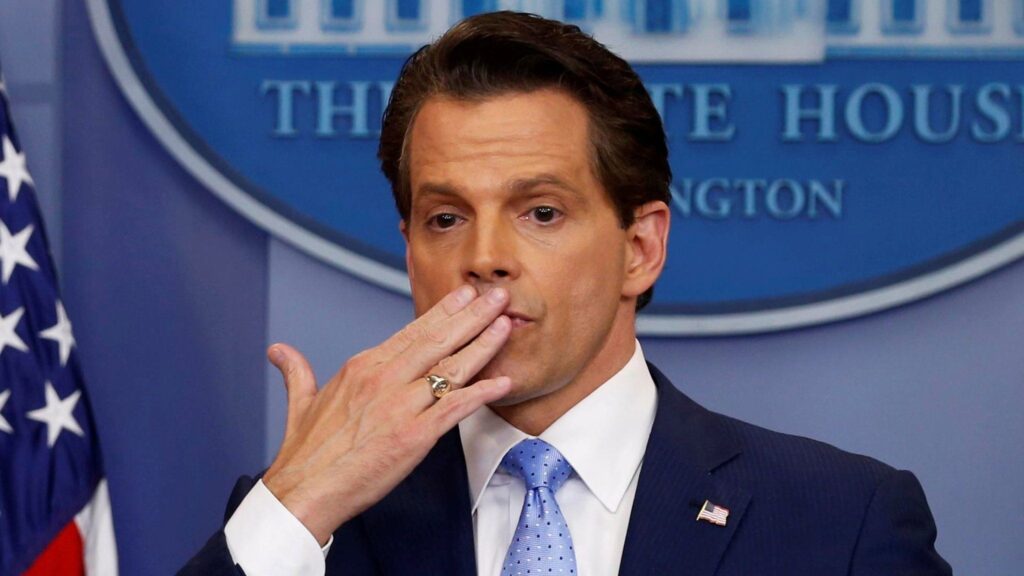

As the debate over cryptocurrency regulation intensifies, prominent figures in the financial sector are urging US lawmakers to establish clear guidelines for the industry. Anthony Scaramucci, founder of investment firm SkyBridge Capital and former White House communications director, has emphasized the need for regulatory clarity, warning that the US risks falling behind in the rapidly evolving digital asset space.

Regulation has been a contentious topic in the crypto industry, with lawmakers and financial institutions struggling to balance innovation with consumer protection. While some officials advocate for stricter oversight, others argue that excessive regulation could stifle technological advancements and push companies to relocate to more crypto-friendly jurisdictions. The lack of comprehensive regulation has led to uncertainty, making it difficult for businesses and investors to navigate the market.

Scaramucci has been vocal about the importance of clear and fair regulations, stating, “We need to make sure that Washington is creating a framework that allows the industry to thrive while also protecting investors.” He believes that bipartisan cooperation is necessary to implement policies that foster innovation without excessive restrictions. His comments come as lawmakers ramp up discussions on cryptocurrency-related legislation, including proposals addressing stablecoins, securities classification, and anti-money laundering measures.

One of the key issues in crypto regulation is defining whether digital assets should be classified as securities or commodities. The Securities and Exchange Commission (SEC) has taken an aggressive stance, arguing that many cryptocurrencies fall under its jurisdiction as unregistered securities. However, industry leaders and some lawmakers have pushed back, advocating for a more nuanced approach that differentiates between various types of digital assets.

The regulatory uncertainty has led to high-profile legal battles, with major crypto companies facing lawsuits over alleged violations of securities laws. This has further fueled concerns that the US is taking a hostile approach to the industry, potentially driving innovation offshore. In contrast, regions like the European Union and the United Arab Emirates have introduced clearer regulatory frameworks, attracting businesses looking for legal stability.

Despite the challenges, Scaramucci remains optimistic about the future of crypto regulation in the US. “The key is finding common ground,” he said. “We need sensible rules that provide clarity for businesses while ensuring that bad actors are kept in check.” He believes that engaging with lawmakers and educating them on blockchain technology will be crucial in shaping balanced policies.

The push for regulation comes at a time when crypto adoption is growing among institutional investors and traditional financial institutions. Major banks and asset managers have increasingly explored digital asset offerings, signaling a shift in how cryptocurrencies are perceived in mainstream finance. However, without a well-defined regulatory framework, concerns about compliance and legal risks remain a major hurdle.

As discussions continue, the crypto industry will be closely watching legislative developments in Washington. The outcome of these debates could have a significant impact on the future of digital assets in the US, determining whether the country remains a leader in blockchain innovation or lags behind in the global market.

Bitcoin’s price has recently dipped below the $100,000 mark, a level it had maintained since January 27. This decline is attributed to rising inflation concerns following the imposition of import tariffs by President Donald Trump on goods from China, Canada, and Mexico.

Ryan Lee, chief analyst at Bitget Research, suggests that this downturn might precede a more significant correction, potentially bringing Bitcoin’s value down to $95,000. He stated, “On the downside, the $95,000 range remains a critical support area. The interplay between labor market trends, Fed policy expectations, and market sentiment will be the main catalysts to monitor in the coming weeks.”

The upcoming U.S. labor market report, scheduled for release on February 7 by the Bureau of Labor Statistics, is anticipated to play a pivotal role in Bitcoin’s near-term trajectory. Lee noted that weakening labor market data could bolster the case for a Federal Reserve rate cut, potentially creating a “more supportive environment for Bitcoin.”

Despite the recent dip, Bitcoin achieved a historic milestone by closing January above $102,000, marking its first monthly close above the $100,000 threshold. This represents a more than 6% increase from its previous record monthly close of $96,441 in November 2024.

Some market analysts interpret the current downturn as a potential “bear trap,” a scenario where a temporary decline in an asset’s price during a long-term uptrend leads investors to mistakenly believe a bear market has begun. This perspective suggests that the recent correction could be a coordinated effort to induce selling before a subsequent price increase.

Looking ahead, Bitcoin’s prospects for 2025 remain optimistic. The recent surpassing of a $125 billion milestone by spot Bitcoin exchange-traded funds (ETFs) in the U.S., just over a year after their debut in January 2024, underscores growing institutional interest. Analyst forecasts for Bitcoin’s value by the end of 2025 range from $160,000 to over $180,000.

In summary, while Bitcoin faces short-term challenges influenced by macroeconomic factors and market dynamics, its long-term outlook remains positive, supported by increasing institutional adoption and favorable market sentiment.

LayerZero Labs, a cross-chain protocol firm, has reached a settlement with the FTX estate concerning transactions from 2022 involving Alameda Ventures, the venture capital arm of Alameda Research. In a January 31 post on X (formerly Twitter), LayerZero co-founder and CEO Bryan Pellegrino announced that after incurring “millions in legal fees” and enduring two years of litigation, the company had settled with the FTX estate.

The dispute centered on allegations that LayerZero withdrew funds prior to FTX’s collapse in November 2022 and issues related to an equity stake in the protocol. FTX had been seeking over $21 million from LayerZero in the lawsuit.

Pellegrino stated, “Ultimately we decided this was not us vs FTX which is a fight we feel completely justified in, but it was us vs the creditors (which also we are one of). Original repurchase has been returned to the estate.”

In 2022, Alameda Ventures agreed to acquire approximately a 5% stake in LayerZero, involving transactions where Alameda sent $70 million to LayerZero and purchased $25 million worth of STG tokens. Following FTX’s bankruptcy filing in November 2022, LayerZero sought to repurchase its equity by forgiving a $45 million loan to FTX. However, the FTX estate filed a lawsuit in September 2023, alleging that LayerZero “negotiated a fire-sale transaction” with then-Alameda CEO Caroline Ellison, exploiting the firm’s liquidity crisis.

Court documents also revealed that LayerZero intended to repurchase the STG tokens for $10 million in a separate deal—approximately 40% of their original price. However, Alameda never transferred the tokens, and no funds were exchanged in this regard.

Since declaring bankruptcy in 2022, FTX debtors have initiated multiple lawsuits against crypto companies associated with the defunct exchange, aiming to recover funds. While some cases are ongoing, the estate’s reorganization plan took effect on January 3, allowing many users with claims under $50,000 to be repaid within 60 days.

All criminal cases against FTX executives have concluded, with Ellison, former FTX CEO Sam Bankman-Fried, and former FTX Digital Markets co-CEO Ryan Salame currently serving prison sentences. Bankman-Fried is appealing his conviction and 25-year sentence.

Since the launch of the United States spot exchange-traded funds (ETFs) for Bitcoin, the cryptocurrency market has seen a significant shift in Bitcoin holdings on exchanges.

Over $9.5 billion in Bitcoin has been withdrawn from exchanges, as reported by Glassnode, an on-chain analytics firm.

This withdrawal trend started on January 11 and has led to a reduction of over 136,000 BTC from exchange balances.

The dynamics of Bitcoin supply are increasingly favoring bulls with continued mass withdrawals observed this quarter.

The volume of Bitcoin on exchanges has dipped to its lowest since April 2018, with only 2,320,458 BTC remaining, indicating a substantial decline in available BTC for trading.

This trend continued with one of the largest single-day withdrawals occurring on March 27, where over 22,000 BTC, equivalent to $1.54 billion, were withdrawn.

The impact of U.S. spot Bitcoin ETFs, though they have been operational for just under three months, is becoming a pivotal factor in the market.

Additionally, notable market activities include a significant transfer of the stablecoin USD Coin (USDC) to Coinbase, highlighted by J.A. Maartunn from CryptoQuant.

READ MORE: Anthropic Shuns Saudi Investments Amid FTX Bankruptcy Sale, Citing National Security Concerns

This record transfer raised speculations about potential buying pressure in the market. Such movements underscore the evolving dynamics in the cryptocurrency market, particularly in the context of Bitcoin supply and demand.

Experts are closely watching the ETFs’ impact on Bitcoin’s supply, anticipating a possible “squeeze” where demand surpasses the available supply, potentially affecting prices.

This scenario is expected to intensify, especially with the upcoming block subsidy halving event in mid-April, which will further reduce the rate of new BTC entering the market to just 3.125 BTC per block.

Charles Edwards, founder of Capriole Investments, commented on the significance of the upcoming halving event, noting it as “the biggest Halving in Bitcoin’s history.”

He pointed out that Bitcoin would become even more scarce than gold, with the supply growth rate halving.

Edwards anticipates increased institutional demand through ETFs, a supply squeeze from the Halving, and Bitcoin’s new status as the world’s hardest asset, making April a month to watch for the cryptocurrency sector.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Matthew Hougan, the Chief Investment Officer at Bitwise, has projected a transformative inflow of funds into Bitcoin from institutional investors through exchange-traded funds (ETFs), forecasting as much as $1 trillion could be funneled into the cryptocurrency.

In a detailed memo to investment professionals, Hougan tackled the issue of Bitcoin’s volatility, which has seen its value fluctuate between $60,000 and $70,000.

Despite these short-term swings, he advised a calm and long-term perspective, citing “keep calm and take the long view.”

Hougan pinpointed several pivotal moments on the horizon for Bitcoin, including the anticipated halving event and the approval of spot Bitcoin ETFs on major national platforms such as Morgan Stanley and Wells Fargo.

He also mentioned the ongoing due diligence processes by investment committees and consultants as an essential preparatory step before they can commit to investing in Bitcoin.

The Bitwise executive suggested that in the interim, Bitcoin’s price might experience sideways movement due to minor shifts in sentiment.

READ MORE: Driving Cats NFT Club Drop Begins in Challenge to SHIB, BONK, PEPE and DOGE

However, he remains optimistic about Bitcoin’s future, asserting that it is part of a “raging bull market,” supported by a 300% increase over the past 15 months and solid reasons to believe in continued growth.

Highlighting the significance of the recent spot Bitcoin ETF approvals in January, Hougan emphasized their role in opening the cryptocurrency market to investment professionals.

He outlined the gradual but inevitable shift of investment professionals, who manage trillions of dollars, towards cryptocurrencies, stressing that this transition is expected to unfold over years rather than months.

Hougan celebrated the remarkable success of ETFs, which have seen an inflow of $12 billion since their inception, marking them as the “most successful ETF launch of all time.”

Yet, he views this as just the beginning, with the potential for a massive $1 trillion influx once global wealth managers allocate a mere 1% of their portfolios to Bitcoin.

He concluded, “A 1% allocation across the board would mean ~$1 trillion of inflows into the space. Against this, $12 billion is barely a down payment.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The first phase of the Driving Cats NFT Club public sale got underway on 29 March at 8:30 AM (GMT) on OpenSea.

Cryptocurrencies like Shiba Inu (SHIB), Dogecoin (DOGE), Bonk (BONK) and Pepecoin (PEPE) have been attracting huge inflows from retail investors in recent weeks and months, amid the beginning of the bull run.

While these altcoins can deliver significant returns during the current cycle – potentially over 200% – investing in NFTs at the beginning of the drop can potentially generate even higher returns, in a much shorter period of time.

One such opportunity that has emerged is the Driving Cats NFT Club (DCNC.)

The first phase of the public sale of the Driving Cats NFT Club started today at 8:30 AM (GMT), and investors can now buy and mint their NFT from this collection.

During the first phase, each of the 999 NFTs that make up this collection will be available to buy for just 0.07 ETH (around $240).

Once the first phase of the public sale ends in late April, each NFT will be priced at 0.25 ETH – over four times its price during the first phase.

However, as the NFT collection is expected to sell out during the first phase, and as most buyers will likely hold onto their NFTs rather than trying to flip them in the secondary market, the price of each NFT could rally much higher than 0.25 ETH.

For investors who buy and mint their NFT during the first phase of the public sale, the Driving Cats NFT Club could be a great investment, potentially delivering much higher returns than if you were to invest in Shiba Inu (SHIB), Dogecoin (DOGE), Pepecoin (PEPE), or Bonk (BONK).