Nostraverse is one of the most exciting Metaverse projects to be launched thus far – and

their CEO and Founder, Sam Clever, has ambitious plans as he looks to drive forward the

Metaverse revolution.

Speaking exclusively to Crypto Intelligence News just days after it was announced that

Nostraverse would be launching a Dubai subsidiary in 2022, Sam Clever discussed the origins

of his project and the future of the Metaverse, among other things.

What made you decide to set up a Metaverse project?

In 2020, my son recommended that I buy an Oculus Quest One, given the growing

fascination with virtual reality. I took his advice and bought a an Oculus Quest One. And

when I actually used the VR device, I was intrigued. From there, I started to think about all

the possibilities of what we can expect in the future leveraging these kinds of technology.

Inspired by this experience, I immediately started a company, which later grew into

launching several additional companies. I found people, very good people, and I sold all my

assets. I let go of my other pursuits so I could solely concentrate on this one endeavor. And

last year, October, when Mark Zuckerberg announced that they changed the company’s

name from Facebook to Meta in reference to the Metaverse, we knew what we had.

Our driving idea was actually to create virtual environments and to connect them together.

And that’s how we built our web VR platform, which allows us to manage all 3D assets in a

single portal.

Our platform is incredibly efficient and stable. And from that day on after we heard there’s a

Metaverse, we knew what we had something big, so we started to create specific

environments for several use cases.

As for where we are today, we developed into a B2B2G, with the Metaverse as a service

platform. And we are a transformation partner for several use cases or for specific use cases

in the Metaverse. And this is just the beginning.

How does Nostraverse compare to other popular Metaverse projects such as the Sandbox?

There is a vast difference between a Sandbox and us. The Metaverse is divided into different

versions, decentralized versions and centralized versions. On the decentralized side, you will

find Sandbox, Decentraland, and Upland, which provide 3D environments accessible through

computers, mostly just with the computer desktop. I don’t really consider these platforms a

Metaverse.

Instead, I would call them a kind of a virtual reality game, where you have the opportunity to

act or interact with an avatar that is remotely controlled. It’s not actually your own control

but control with a mouse. And you can interact with other tasks, like joining a room, jumping

around, having fun, and dancing. You can also visit environments, but you visit them actually

via a computer, not really acting as an avatar in a Metaverse.

On the other side, we have the centralized Metaverse. Here we talk about Horizon, the one

from Meta, and Spatial, RecRoom, VR Chat, and AltspaceVR. And within this grouping of

centralized Metaverse projects, I would even separate them into hybrids and PureVR.

What is a hybrid? A hybrid is a Metaverse that is accessible through a VR device and also on

a computer. This is annoying to me personally, because that means that people who are

really accessing the Metaverse using a VR device are behaving as part of the Metaverse

because they’re really in there. And on the other side, you have users who are controlling

the avatar instead, controlling it remotely with their mouse. This is where two totally

different characters collide, and it’s annoying for the ones who are using VR, so this is the

divide I want to create.

With PureVR, which is Horizon and us, you can only access the Metaverse through VR. So

you have the highest level of immersive experience and access to the best way of learning

and interacting with avatars with audio-visual interaction.

Do you plan to launch a native token?

We have been thinking about launching a utility token, but I think it is far too early. In our

opinion, cryptocurrency and NFT blockchain technologies are awesome, and they will be a

critical part of our entire infrastructure when it comes to the Metaverse.

But at the moment, we don’t see really a good use case in this area. We will wait and

continue to monitor the market. And I think the day will come when we launch a utility coin

within our Metaverse to fulfill transactions. For instance, I expect that in 2023, wearable

assets on simulated avatars, which are actually acting in POVR Metaverses, will be a huge

market and a marketplace. Therefore, eventually a token will be necessary, but at the

moment, we’re considering it but don’t have concrete plans.

Why are you launching a Dubai subsidiary?

Dubai actively tries to be at the forefront of technology. Their ruling family called out the

Metaverse couple of years ago already, and now they’re really pushing forward.

Last year, we have started to gain some traction in Dubai, but that was too early in my

opinion because they still thought about the future of Metaverse as something more like

Sandbox. But in Sandbox or Decentraland, you cannot really transfer workflows into it. It’s a

platform where you spend time. In May, Dubai announced that they’re looking to transfer

several government services into the Metaverse to provide better service for its citizens

while providing opportunities to be more open to the world. And this is the point where we

came in, as we have been specializing on the onboarding process for the company for the

past month.

At the moment, we see the greatest opportunities or future opportunities in the Metaverse

for onboarding, because onboarding is a process that people don’t really like. Onboarding is

a struggle. You have to read a lot of things. You have to complete tasks and trainings, and

this entire process can be perfectly gamified into a Metaverse experience.

So, what advantage is there for companies using this process? You will lower your costs and

be more efficient. Your people will have more time, and new employees will have more fun

learning about the company while getting closer to it, as it gives them insights into who

they’re working for, making the company feel more relatable, like it has a heart and soul. On

the other side, your team will get their first chance to experience the Metaverse. This is

important because if you compare it to the internet, which came up 1994-96, the first place

where people were exposed to the internet was actually at the office, so this is where it

starts.

And it’s important that companies start with their business solutions in the Metaverse. This

transformation has begun because we are already creating solutions for companies in

Europe and the US. So, it’s important to point out the transformation has begun with the

onboarding process, and this is the ideal pilot to integrate several areas of the company into

the Metaverse.

And therefore, in Dubai, we see great potential. We came here because we are convinced

that we will find good people here. We also believe we will find support of the government.

We are also convinced that we are the only one that can really provide services like

government services. We are also actually working with a big company in Spain as a gateway

to travel, as well. So as more of this comes together, the circle closes.

What are your thoughts on the future of the Metaverse? What key challenges does the

industry face?

This will be an interesting answer. The future of the Metaverse is actually a paradigm shift in

the way we live, think, and communicate. We expect a massive transformation of our entire

civilization in the next 20 years. Mainly, we will have a huge jump into the Metaverse in the

next five years. I think the next five years will be very focused on companies, where

companies start to transfer several workflows into the Metaverse.

Therefore, we are preparing a product that we call VMA. It’s a Visual Metaverse Appearance.

Our goal is to give SMEs easy access to having a presence in the Metaverse and start

working with the technology and open companies to customers, consumers, present

products, and communication.

I think in 2022 and 2023 the Metaverse is more about appearance, communication, and

learning. With the internet, the first websites were simply presenting something. So people

started to go the internet to find content that was presented to them. But after some time,

we engaged in more interactive transactions. And I expect this trend for the Metaverse from

late 2023-25, where we will begin to have transactions . We will come to smart contracts,

and this will be the time where NFTs will also really come into play. I see the future of NFT

and blockchain not in gambling and not in buying virtual real estate but in transactions. This

will be based in moving assets, like a digital contract or whatever it is into your wallet, to

better control your assets and your ownerships.

This transformation will start companies in onboarding, for example, then team building,

then training sessions. The next step will be product presentations and workshops. You can

create workshops for your customers to understand your services better. This is where it all

starts.

Another area we are exploring is the Travel Gateway. This will allow people to get an

immersive experience in how to plan their travel or what they can expect from traveling

somewhere. This can also open up new opportunities, for example, for older people who are

retired to engage again in exciting possibilities. I see a huge opportunity in the retiree

demographic. I feel like society tends to disregard them. Many are homebound, but have

productively served society for the entire lives, and we often push them aside as they age.

I think there is a better way. We can open doors to this new world, giving them the chance

to be part of a community again. They have the chance to connect with people and share

their experiences and knowledge.

Coming to the Travel Gate will give people the chance to travel around the world to see

places, to understand culture. And I think it’s very important for our own experience to

understand how cultures work. And the more I can learn about cultures, the more I will have

an understanding about other humans. And I think this can drive real transformation of and

create more understanding of who we are and what we do.

So, we will combine many things here together, but the Metaverse will be a world where we

create a better world with less violence and no wars. People will be free to enter a world

and be whatever they want to be, and they can openly communicate. Additionally, we have

an enormous opportunity when it comes to education. My dream actually is that we open

universities with no barriers so people can apply for a degree that costs little to no money

and without obtaining prior education. Simply go there if you’re capable. If you’re capable of

learning, you should have the chance earn a degree. And we have a worldwide education

rate of about 7% currently, imagine if we could raise that to 15 or 20–the world will change

entirely.

And I see so many opportunities in Metaverse that there’s no way around. Right now people

are still discussing what it it is and wondering what will happen in the Metaverse. The

Metaverse is here already, and there’s no way around. We . can look to the internet as a

similar case study. There were people in the mid-nineties that said the internet is not going

to survive. Imagine that! As late as 2010 people thought it will not survive. They imagined it

as a temporary thing, something that happened but hit its peak and would eventually

disappear. No, it’s not. Today the internet forms the basis of our entire global infrastructure.

We could not even survive two days without the internet.

So to be clear, the choice to be free is long time gone. You’re not even free to have no

mobile phone. So many applications that are a part of daily life are running on mobiles. If

you think that using a mobile phone is a free choice, you’re wrong.

And at some point, let’s say 10, 15 years down the road, being in the Metaverse will not be a

choice. You will not be able to survive without using it. But there’s a lot of things we have to

do first and a lot of issues we have to solve.

The industry right now is totally underestimating the Metaverse, so that’s why I believe

ignorance can harm the existence of companies. Foresight is very important because there’s

a new world of opportunities available. Given that avatars interact with each other, that

means every industry that is based on personal interaction can be disrupted. Many

industries will be disrupted. So I recommend to all industries, explore the Metaverse and get

a clear picture of what’s happening there. It’s very important to understand that this

technology will change the entire business world.

Those who are ignorant at the moment, they might harm their existence. They might not

even exist anymore in5 5-10 years. So there’s a lot of things to do, but governments and

institutions need to educate others and point out what the Metaverse needs. It makes no

sense to put your head in the sand and hate Mark Zuckerberg for what he’s doing. There’s so

many things happening. There’s so many platforms.

So, my advice to every industry is, take the Metaverse seriously. Ignoring future technologies

could be the end of your existence. On the other hand, you have so many opportunities to

hit these G targets. You can lower your costs. You can offer your people richer experiences.

You can really strengthen the emotional connection between employees and companies.

Anything else you’d like to add?

We need regulation with institutions; we’re looking into that. Currently, there are growing

communities such as Red Room, Spatial, Horizon, VR Chat, and Outspace VR, but the

communities they are growing are supporting criminal activity. They’re building workshops

to engage in illegal activities.

We’re missing so much right now. We allow people to create communities and to radicalize ,

creating extremists. We have to be very careful. Therefore, Nostraverse has decided that we

are not going to be an open platform. We are B2B platform. Any company running an

experience on Nostraverse is allowed to invite as many consumers, as many stakeholders as

they want, but we have to make sure that we don’t allow a bunch of people to walk into

environments and engage in sexual harassment, insulting people, and racist attacks.

There are so many negative experiences right now because the Metaverse itself is like a

second world we’re creating where people think they’re anonymous. They walk in and do

bad things and their avatars can be created randomly. That means you don’t even recognize

the person anymore – just the voice. So there’s a lot of work to do, and we need regulations within institutions.

We have to examine that very closely. But on the other hand, we have so many

opportunities for good, but the worst thing we all can do isignoring what’s coming towards

us. This is a colossal mistake. I see my position as CEO and founder of Nostraverse as one to

explore research and education, as I want to make this world a better place.

I will use the technology to help people, to engage people, to empower people, to take

opportunity to Metaverse. And we will go all together – that’s what we are called.

Nostraverse. It’s our verse. It’s Nostra, it’s a Latin word. It’s us. And it’s all about us at the

end of the day.

Voyager Digital said on Monday crypto exchange FTX, whose bailout proposal the bankrupt lender had rejected earlier this year, has won its assets in a $1.42-billion bid at an auction.

The FTX bid comprises a fair market value of all Voyager cryptocurrency, at a to-be-determined date, which is pegged at about $1.31 billion at current market prices and an additional $111 million in incremental value, Voyager said in a statement.

The company added that its claims against hedge fund Three Arrows Capital will remain with the bankruptcy estate, which will distribute any available recovery on such claims to the estate’s creditors.

Voyager issued a notice of default to the Singapore-based hedge fund in June, for its failure to make required payments on a loan of 15,250 bitcoin.

The company in July spurned a proposal from FTX, founded by billionaire Sam Bankman-Fried, as a “low-ball bid dressed up as a white knight rescue” and alleged the plan would disrupt its bankruptcy process.

Bankman-Fried has been throwing lifelines to shore up companies in a shaky digital assets sector, aggressively acquiring assets, technologies and customers of distressed crypto companies at cheap valuations.

FTX in July revealed a 7.6% stake in Robinhood Markets Inc (HOOD.O) and handed U.S. cryptocurrency lender BlockFi a $250 million revolving credit facility in June along with a deal giving FTX the right to purchase it based on certain performance triggers.

Crypto lenders including Voyager boomed during the COVID-19 pandemic, attracting depositors with high interest rates and easy access to loans rarely offered by traditional banks. However, the slump in crypto markets has hurt crypto companies and investors.

In its Chapter 11 bankruptcy filing in July, Voyager estimated that it had more than 100,000 creditors and between $1 billion and $10 billion in assets, as well as liabilities of the same value.

Follow Crypto Intelligence on Google News to never miss a story

Singapore, Singapore, 26th September, 2022, Chainwire

DeFiChain, the world’s leading blockchain on the Bitcoin network dedicated to bringing decentralized financial applications and services to everyone, today announces the listing of its DFI token on Gate.io, one of the world’s leading cryptocurrency exchanges. This is a major step in DeFiChain’s mission to make DFI accessible to investors worldwide.

Gate.io is one of the world’s biggest exchanges and supports the most cryptocurrencies of any exchange. The DFI token (ERC-20 version) will start trading on Gate.io at 10am UTC on September 26th. Initially, it will trade against USDT, though Gate.io could bring a DFI-BTC pair as well in the near future. The native version of DFI will become available on the platform in late October.

Buying the token on Gate.io will enable users to transfer DFI to any compatible wallet the user wants. It gives users access to the entire DeFiChain ecosystem including decentralized stock tokens. The DFI token is also available for trading on Huobi, Kucoin, Bybit (ERC-20 format), Bittrex, Bitrue and Hotbit. Each additional listing makes it easier for investors to enter the world of native decentralized finance on DeFiChain.

“We are extremely happy that the DFI token can now be traded on Gate.io and more and more people are able to access the no. 1 DeFi blockchain on Bitcoin.” said Benjamin Rauch, VP Marketing DeFiChain Accelerator.

The DFI token opens up the world to the DeFiChain ecosystem. It is at the core of all activities on the DeFiChain blockchain including:

- Providing liquidity in multiple pools

- Staking for blockchain consensus and security

- As collateral to mint or borrow stock tokens and the dUSD stablecoin

- As a reward token

- As the governance token of DeFiChain

As the only blockchain to offer decentralized assets on the Bitcoin network, DeFiChain offers users flexibility and benefits of decentralization. Users can mint and trade dTokens to get price exposure to stocks and ETFs without leaving the DeFi ecosystem. They can also buy dTokens – even in fractional pieces – on the DeFiChain DEX.

DeFiChain is a fully decentralized blockchain with on-chain governance. Since its mainnet launch in May 2020, the project has seen an enthusiastic involvement from the community in almost all aspects of the blockchain, from masternodes, projects, tools, governance, economic ideas, to code governance. Its codebase has been developed in an open source manner, and widely peer-reviewed and discussed by many.

About DeFiChain

DeFiChain is a decentralized Proof-of-Stake blockchain created as a hard fork of the Bitcoin network to enable advanced DeFi applications. It is dedicated to enabling fast, intelligent, and transparent decentralized financial services. DeFiChain offers liquidity mining, staking, decentralized assets, and decentralized loans. The DeFiChain Foundation’s mission is to bring DeFi to the Bitcoin ecosystem.

For more information, visit: Website | Twitter | Discord | GitHub

Contact

- Benjamin Rauch

- press@defichain-ac.com

Follow Crypto Intelligence on Google News to never miss a story

Voyager Digital Ltd Chief Financial Officer Ashwin Prithipaul is preparing to step down from his role within months of his appointment at the crypto lender that filed for bankruptcy in July.

The company said on Friday the finance head would resign after a “transition period” to pursue other opportunities, and that Chief Executive Officer Stephen Ehrlich will head the role in the interim.

Crypto lenders such as Voyager boomed during the COVID-19 pandemic, drawing depositors with high interest rates and easy access to loans rarely offered by traditional banks.

But inflation and subsequent rate hikes by the U.S. Federal Reserve led to a wide sell-off in the alternative asset class that dealt a heavy blow to several companies in the sector.

Digital asset exchange Coinbase Global Inc (COIN.O) and crypto lender BlockFi have been forced to cut jobs, while Singapore-based crypto hedge fund Three Arrows Capital has filed for bankruptcy.

Follow Crypto Intelligence on Google News to never miss a story

Cryptocurrency exchange Coinbase Global Inc is facing a patent lawsuit related to its digital trading technology, brought by a crypto company whose digital token offering led to a settlement with U.S. securities regulators in 2019.

The lawsuit, filed Thursday by Veritaseum Capital LLC in Delaware federal court, claims Coinbase infringed a patent awarded to Veritaseum founder Reggie Middleton by the U.S. Patent and Trademark Office last December.

Veritaseum Capital accused several Coinbase services, including its blockchain infrastructure for validating transactions, of infringing the patent. It asked the court for at least $350 million in damages.

Coinbase, one of the world’s largest platforms for trading cryptocurrency, did not immediately respond to a request for comment on Friday.

Veritaseum formerly issued the token VERI. In 2019 Middleton and two of his Veritaseum entities paid the U.S. Securities and Exchange Commission more than $9.4 million, including a $1 million penalty against Middleton himself, to settle charges of a “fraudulent scheme” to sell the token in 2017 and 2018.

The SEC had accused them of misleading investors about demand for the tokens and manipulating their price, among other things. They agreed to the settlement without denying or admitting to the underlying charges.

Middleton and Veritaseum argued to a Brooklyn federal court earlier in 2019 that they did not make any fraudulent statements, that the tokens were not securities, and that trading at issue was “actually an effort by Mr. Middleton to test out a new online cryptocurrency exchange.”

Veritaseum’s website says it “builds blockchain-based, peer-to-peer capital markets as software on a global scale.” Thursday’s lawsuit accuses Coinbase features including its website, mobile app and Coinbase Cloud, Pay, and Wallet services of infringing a patent covering a secure method for processing digital-currency transactions.

Veritaseum Capital’s attorney Carl Brundidge of Brundidge Stanger said Friday that Coinbase was “uncooperative” when they tried to settle out of court.

Middleton and Veritaseum separately sued T-Mobile in 2020, alleging the telecom company’s security lapses led to hackers stealing $8.7 million in cryptocurrency from them. T-Mobile contested the claims, and the case was sent to arbitration in August.

Follow Crypto Intelligence on Google News to never miss a story

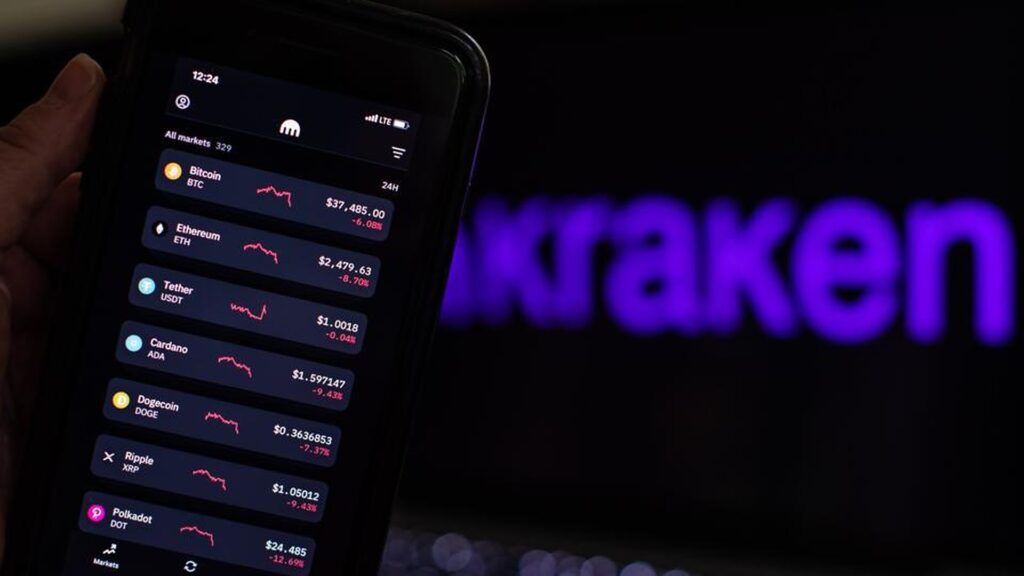

Cryptocurrency exchange Kraken has no plans to delist tokens the U.S. Securities and Exchange Commission has labeled as securities, or to register with the agency as a market intermediary, said incoming chief executive officer Dave Ripley on Thursday.

The stance of the San Francisco-based platform, which says it has more than nine million clients, underscores the challenges the securities regulator is facing in its effort to rein in the crypto industry.

Kraken, which made news earlier this year when it denied requests to block the digital wallet addresses of Russian users following the invasion of Ukraine, has long championed the libertarian values associated with cryptocurrency. Its new CEO has promised to stay the course on the company’s culture.

Kraken announced on Wednesday that its often-controversial co-founder Jesse Powell would step down and that Ripley, Kraken’s chief operating officer, will assume the CEO role after the firm hires a new COO.

Ripley will take the helm of Kraken not only at a time when the crypto market is facing a major rout, with bitcoin down nearly 60% this year, but also as the fast-growing industry has been at odds with regulators like the SEC.

Despite reports that the SEC is scrutinizing Coinbase for listing several tokens on its platform the regulator identified as securities in a July insider trading lawsuit, Kraken has no plans to remove those tokens from its exchange, Ripley said.

Ripley added Kraken also sees no reason to register with the SEC as an exchange because his company does not offer securities, despite calls from SEC chair gary gensler for crypto platforms to register.

“There are not any tokens out there that are securities that we’re interested in listing,” he said. “There could be some new token out there that becomes interesting and also happens to simultaneously be a security [and] in that case, we would potentially be interested in that path.”

In a summer when once-formidable players in the crypto market like Celsius Network and Voyager Digital filed for bankruptcy, and others like Coinbase announced layoffs, Kraken has managed to avoid the market downturn, and is now eyeing opportunities.

“To the extent that there are opportunities for M&A in this environment, and perhaps if it’s a company that is actually going through a bankruptcy process, then that’s a potential for us to consider for sure,” said Ripley, adding the company has not made any moves yet.

However, he said Kraken would consider acquisitions that bolster its product and tech portfolio, particularly as the exchange looks to broaden its offerings with a forthcoming platform for non-fungible tokens and banking services for institutional clients.

Follow Crypto Intelligence on Google News to never miss a story

Nasdaq Inc (NDAQ.O) is placing a big bet on the cryptocurrency market, with the launch of a digital assets business that is aimed at tapping institutional investors.

The new unit, Nasdaq Digital Assets, will offer custody services for cryptocurrencies, including bitcoin and ethereum, potentially pitting it against firms such as Coinbase (COIN.O), Fidelity Digital Assets and Winkelvoss twin-owned Gemini that offer similar products.

Nasdaq has hired Ira Auerbach, a Gemini executive, to lead the new unit.

The stock exchange has also expanded its anti-financial crime technology to detect and curb money laundering, fraud and market abuse risks, it said in a statement on Tuesday, as the market is constantly on the regulator’s radar.

The crypto market is reeling from a major rout, forcing some of its biggest players to lay off thousands of employees in a bid to cut costs. Bitcoin has crashed nearly 60% this year, driving companies such as Celsius Network and Voyager Digital Ltd to file for bankruptcy.

Follow Crypto Intelligence on Google News to never miss a story

Seoul, South Korea, 22nd September, 2022, Chainwire

The NFT Marketplace Calls out To NFT Investors To Grab its Super Successful NFT Before The Launch Of Its New Game ‘Tournaments’ That Will Give Special Access To Existing NFT Holders.

As soon as the Blockchain Gaming Platform and NFT Marketplace, PlayDapp, launched its Non-Fungible Token (NFT) collection ‘PlayDapp Members+ Mikey NFT’, the entire collection of 10,000 free minting NFTs was sold out within three hours. The collection featured DJ Mikey, a badass teenage red panda triumphing his way to Superstar DJ status.

PlayDapp Members+Mikey NFT collection was traded in the marketplace from September 6th to 18th 2022, making a transaction volume of $17,296. With the starting daily floor price for Mikey NFT being at $4.39 during the time of its launch, its floor price skyrocketed to $5.91 marking an increase of 34.6% on its last day of trade. A total of 3,992 NFTs were transferred or sold.

With the success of its PlayDapp Members+Mikey NFT collection, the PlayDapp team hopes NFT enthusiasts will join the community and it’s exclusive club before the main utility and feature of the NFTs kick in with the soft-launch of its newest hyper-casual game ‘Tournaments’ on September 26 that will bring a world of perks to its NFT holders.

PlayDapp’s NFT holders are granted special access to the game tournaments where they will receive more token rewards of $PLA, the Ethereum token that powers PlayDapp, as compared to its non-NFT holders. Moreover, PlayDapp NFT holders are granted more chances to play the game than non-NFT holders which implies that the former potentially gets more chances to try to win the $PLA rewards.

“We are over the moon to have our NFT collection sold out in just 3 hours. From what started as a free minting NFT, the market added value to it making it our top-seller,” says Peter Song Head of Global Marketing at PlayDapp. “It is a very exciting time for us, and now we can’t wait to introduce our new game Tournaments to the market which will boost the demand for our NFTs and make them more valuable,” he adds.

About PlayDapp

PlayDapp is a global blockchain middleware provider that provides companies with the opportunity across many different industries to integrate blockchain technology into their business models and easily turn their assets into Non-Fungible Tokens (NFTs). PlayDapp’s blockchain-based C2C Marketplace allows gamers and users to freely buy, sell and trade their digital assets with each other.

To buy PlayDapp Members+ Mikey NFT, please click on the link here.

For more information, please visit https://members.playdapp.com

PlayDapp is the source of this content. This Press Release is for informational purposes only. The information does not constitute investment advice or an offer to invest.

Contact

Head of Global Marketing

- Peter Song

- PlayDapp

- media@playdapp.io

Follow Crypto Intelligence on Google News to never miss a story

Hackers have stolen digital assets worth around $160 million from crypto trading firm Wintermute, its CEO tweeted on Tuesday, the latest heist to hit a sector long plagued by cybercrime.

The theft targeted London-based Wintermute’s decentralised finance operations, Evgeny Gaevoy said in a tweet. The firm, which provides liquidity across major crypto exchanges and trading platforms, remains solvent after the hack, he added.

Decentralised finance platforms and software, which aim to provide crypto-based financial services without traditional gatekeepers such as banks, have been targeted by numerous heists in recent years. The sector is little-regulated and victims of crime rarely have recourse.

Gaevoy and Wintermute did not immediately respond to requests for comment.

Wintermute calls itself “one of the largest players” in global crypto markets. It says it manages “hundreds of millions” in assets and trades more than $5 billion a day.

Gaevoy said on Twitter “there will be a disruption in our services today and potentially for next few days,” adding that some 90 assets were hacked.

“If you are a lender to Wintermute, again, we are solvent, but if you feel safer to recall the loan, we can absolutely do that,” Gaevoy said.

Follow Crypto Intelligence on Google News to never miss a story

Cryptocurrencies fell to fresh lows on Monday on regulatory concerns and as investors globally turned shy on risky assets with interest rate rises looming around the world.

Bitcoin, the biggest cryptocurrency by market value, fell about 5% to a three-month low of $18,387.

Ether, the second largest cryptocurrency, dropped 3% to a two-month low of $1,285 and is down more than 10% in the last 24 hours. Most other smaller tokens were deeper in the red.

The Ethereum blockchain, which underpins the ether token, had a major upgrade over the weekend called the Merge that changes the way transactions are processed and cuts energy use.

The token’s value has fallen amid some speculation that remarks last week from U.S. Securities and Exchange Commission Chairman Gary Gensler implied the new structure could attract extra regulation. Trades around the upgrade also were unwound.

“It’s speculation as to what might or might not happen,” said Matthew Dibb, COO of Singapore crypto platform Stack Funds, on the regulatory outlook.

“A lot of the hype has come out of the markets since the Merge,” he said. “It’s really been a sell-the-news type of event,” he added, given the nervous global backdrop, and said ether could test $950 in coming months.

“Looking at the landscape right now, both fundamentally and technically, it’s not looking great. There’s no immediate bullish catalyst that we can see that’s going to prop up these markets and bring in a whole lot of new money and liquidity.”

Follow Crypto Intelligence on Google News to never miss a story