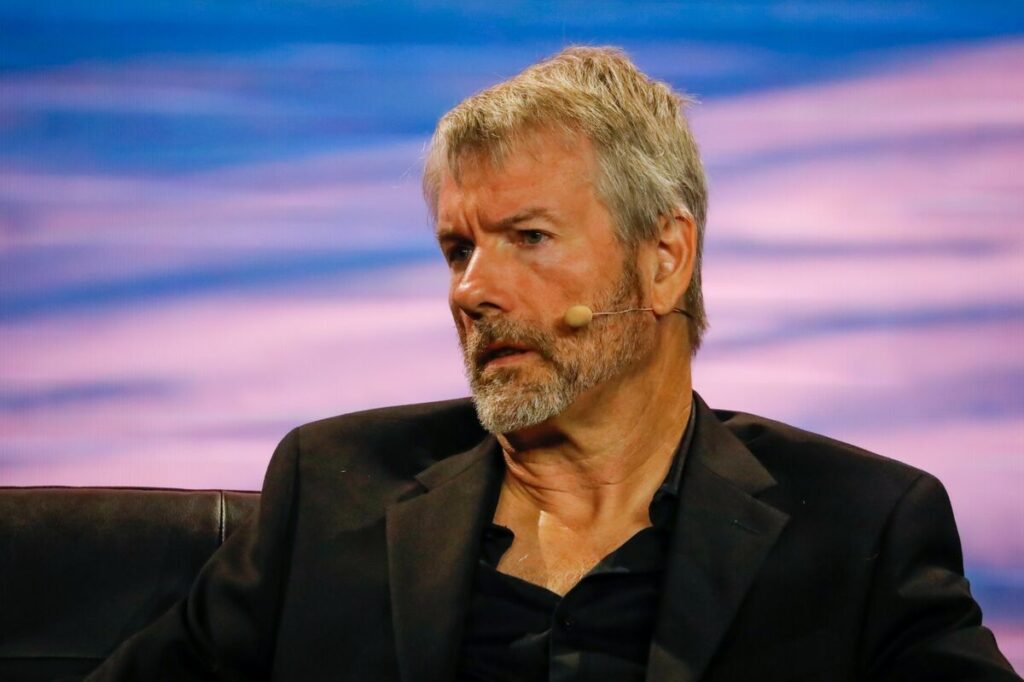

MicroStrategy, the business intelligence software company, continues to display unwavering confidence in Bitcoin as it posts a return to profitability in the first quarter of 2023. The firm’s CEO, Michael Saylor, shared the positive financial results while emphasizing the company’s ongoing dedication to the leading cryptocurrency.

The enterprise software provider has turned a corner from previous financial difficulties, reporting a profit in Q1 2023. This turnaround can be partially attributed to MicroStrategy’s substantial investments in Bitcoin, which have paid off significantly.

In a recent interview, Saylor emphasized that the company’s conviction in Bitcoin is stronger than ever, with no plans to relinquish its position as a primary institutional investor in the digital asset. The CEO also highlighted Bitcoin’s potential as a store of value, stating that it surpasses traditional assets like gold.

Since its initial investment in August 2020, MicroStrategy has consistently increased its Bitcoin holdings, currently owning over 124,946 BTC. This unwavering support has positioned the company as one of the most significant institutional investors in the cryptocurrency space.

MicroStrategy’s commitment to Bitcoin has also influenced other major companies to consider the digital asset as part of their investment strategy. Saylor’s advocacy for Bitcoin’s adoption has encouraged businesses to reevaluate their approach to the evolving world of digital currencies.

In summary, MicroStrategy’s return to profitability in Q1 2023 is a testament to the company’s steadfast belief in Bitcoin’s potential. As one of the foremost institutional investors in the cryptocurrency, the firm’s success serves as a prime example for other businesses considering digital asset investment.

The Federal Deposit Insurance Corporation (FDIC) has cited inadequate governance and a lack of liquidity as the primary reasons behind the failure of Signature Bank.

The FDIC, responsible for maintaining stability and public confidence in the U.S. financial system, has revealed its analysis of the bank’s collapse in a recent report.

According to the FDIC, the downfall of Signature Bank can be traced back to its insufficient internal controls and lack of oversight, which allowed for unsound lending practices to take place. This, in turn, led to the bank’s inability to meet its financial obligations and maintain adequate liquidity levels.

Signature Bank had made considerable investments in the volatile and unpredictable digital asset market, which played a significant role in the erosion of its capital base.

The FDIC’s findings shed light on the importance of sound governance and risk management for financial institutions, especially in the face of new and emerging technologies.

The collapse of Signature Bank serves as a cautionary tale for other banks looking to explore the cryptocurrency space and underlines the need for robust regulatory frameworks to protect consumers and maintain the stability of the financial system.

A former chief financial officer (CFO) has been sentenced to three years in prison for embezzling $5 million from his employer to trade cryptocurrencies and meme stocks. The individual, who has not been named, was convicted of wire fraud and money laundering.

The ex-CFO had stolen the funds from his employer, a technology company, over a two-year period. He used the money to engage in high-risk trading of cryptocurrencies and meme stocks, investments that gained popularity during the pandemic.

The individual’s actions were discovered when the technology company’s management began to notice financial discrepancies in their records. An internal investigation was conducted, revealing the extent of the embezzlement. Subsequently, the case was handed over to law enforcement authorities.

The ex-CFO pleaded guilty to the charges and was sentenced to 36 months in prison, followed by three years of supervised release. Additionally, he has been ordered to pay back the stolen funds in full, amounting to $5 million in restitution.

This case highlights the potential risks and consequences associated with engaging in high-risk investments using embezzled funds. It serves as a warning to others who may be tempted to engage in similar activities, emphasizing the importance of adhering to legal and ethical practices in the financial industry.

The rise of meme stocks and cryptocurrencies has led to increased scrutiny from regulators, as they seek to ensure the stability and integrity of the financial markets. As technology and investment trends continue to evolve, it is crucial that both investors and professionals maintain a strong understanding of the legal and ethical guidelines governing their activities.

Celsius Network, a prominent cryptocurrency lending platform, is facing demands for transparency from its creditors regarding a series of suspicious transactions on FTX, a leading crypto exchange. The creditors are seeking clarity on the nature of these transactions, which could potentially impact their investments.

Several large transfers of CEL tokens, Celsius Network’s native cryptocurrency, have been observed on FTX. These transfers have raised concerns among creditors, who believe that the transactions could indicate potential financial issues or mismanagement within the company. As a result, they are demanding that Celsius Network provide an explanation for the activity.

Celsius Network has yet to issue an official statement addressing the concerns of its creditors. However, the company has a strong track record of maintaining transparency and has previously published comprehensive financial reports for public review. This history suggests that Celsius may respond to the creditors’ demands in due course.

The situation highlights the growing importance of transparency within the cryptocurrency industry, particularly as digital assets become more mainstream and attract increased scrutiny from regulators and investors. Companies operating in the space must strike a balance between protecting sensitive business information and providing sufficient transparency to maintain the trust of their user base.

The outcome of this dispute could have broader implications for the cryptocurrency lending industry. It underscores the need for robust disclosure practices to ensure that all parties involved in digital asset transactions have access to the information they need to make informed decisions.

In a bid to foster a mutually beneficial relationship between the traditional financial sector and the burgeoning crypto industry, the United Kingdom’s financial watchdog, the Financial Conduct Authority (FCA), has called for closer collaboration between the two. The FCA believes that working together will help to ensure the stable growth of both industries and encourage responsible innovation.

The FCA has made it clear that it is open to engaging with the crypto industry to better understand its complexities and to help create a regulatory framework that is both effective and flexible. This comes in response to the rapid growth of the crypto market, which has caught the attention of regulators worldwide.

By adopting a proactive approach, the FCA hopes to address potential risks while simultaneously supporting the development of new and innovative financial products and services.

In recent years, the UK has witnessed a surge in the number of crypto and blockchain-based businesses, which has raised questions about the need for regulation and oversight. The FCA’s decision to engage with the crypto industry is seen as a positive step towards achieving a balance between consumer protection, market integrity, and financial stability.

Key stakeholders in the crypto industry have welcomed the FCA’s move, viewing it as an opportunity to work with the regulator to establish clear guidelines that will promote growth and innovation. This collaborative approach is expected to create an environment where both traditional and emerging financial sectors can thrive, benefiting the UK economy as a whole.

In addition to working with the crypto industry, the FCA also plans to consult with other stakeholders, such as financial institutions, technology companies, and academics, to ensure a well-rounded perspective on the challenges and opportunities that the crypto industry presents. This inclusive approach will help to create a regulatory framework that addresses the concerns of all parties involved, fostering a stronger and more resilient financial ecosystem in the UK.

As the FCA and the crypto industry embark on this journey of collaboration, the UK has the potential to become a leading hub for crypto innovation, attracting global talent and investment. This initiative not only highlights the importance of the crypto industry in shaping the future of finance, but also underscores the need for open dialogue and cooperation to create a regulatory landscape that supports and sustains the growth of both traditional and emerging financial markets.

Visa, the global payments giant, has announced its plans to develop an ambitious crypto payment product that will allow for the use of stablecoins in transactions. The company aims to capitalize on the growing popularity of digital assets and expand its payment offerings to cater to a wider range of customers.

The new crypto payment solution is expected to integrate seamlessly with Visa’s existing payment infrastructure, allowing merchants and customers to make transactions using stablecoins. These digital assets, which are pegged to traditional fiat currencies, offer a stable value and are quickly gaining traction as a means of payment for goods and services.

Visa’s stablecoin payment platform is designed to offer a range of benefits to users, such as reduced transaction costs, faster settlement times, and increased accessibility for underbanked populations. By embracing this new technology, Visa seeks to strengthen its position as a leading payment provider and maintain its competitive edge in the rapidly evolving digital economy.

In recent years, Visa has demonstrated its commitment to the cryptocurrency space through a series of strategic partnerships, investments, and product launches. The company’s efforts include collaborations with major cryptocurrency exchanges, such as Coinbase and Binance, as well as the development of crypto-linked debit cards that allow users to spend their digital assets at millions of merchants worldwide.

The announcement of Visa’s stablecoin payment solution is a significant milestone in the mainstream adoption of digital assets, as it signals the increasing recognition of cryptocurrencies as a viable means of payment. As one of the world’s largest payment networks, Visa’s foray into stablecoin payments could help to solidify the role of digital assets in the global financial ecosystem.

While the exact timeline for the launch of Visa’s stablecoin payment product remains unknown, the company’s ongoing efforts to embrace digital assets and drive innovation in the payments industry are likely to have a lasting impact on the future of finance.

Cryptocurrency exchange Gemini, founded by the Winklevoss twins, is reportedly gearing up to launch a derivatives platform outside of the United States. According to a CoinTelegraph article, this move aims to expand the company’s product offerings and reach a broader global audience.

Gemini’s derivatives platform will offer a range of financial products, including futures and options, which allow traders to speculate on the future prices of cryptocurrencies. These products have gained increasing popularity among both retail and institutional investors, providing an opportunity for Gemini to tap into this growing market.

The decision to launch the platform outside of the United States is likely due to the country’s stringent regulatory environment surrounding cryptocurrency derivatives. By operating in a different jurisdiction, Gemini can offer these products without encountering the same regulatory hurdles faced by competitors in the US market.

Although the specific location for the derivatives platform has not been disclosed, Gemini has been expanding its international presence in recent years. The company has already established operations in regions such as Europe, Asia, and South America, providing a foundation for further global expansion.

The introduction of a derivatives platform is in line with Gemini’s broader strategy of diversifying its product offerings and becoming a comprehensive cryptocurrency services provider. In addition to its core exchange services, the company has also launched a custody service, a stablecoin, and a credit card that offers rewards in cryptocurrency.

As the global interest in cryptocurrency derivatives continues to grow, Gemini’s decision to launch a platform outside of the United States demonstrates the company’s ambition to remain at the forefront of the rapidly evolving digital asset space.

Trust Wallet, a popular cryptocurrency wallet, has announced plans to reimburse users who were affected by a recent security breach that resulted in a loss of approximately $170,000. The company’s swift response demonstrates its commitment to addressing security concerns and protecting the interests of its users.

The incident, which occurred earlier this week, involved unauthorized access to users’ funds due to a vulnerability in the Trust Wallet system. The breach affected an estimated 21 wallets, leading to the loss of various cryptocurrencies, including Ethereum and Binance Smart Chain tokens.

In a statement addressing the breach, Trust Wallet acknowledged the security incident and assured users that the company is taking necessary measures to rectify the situation. As part of their response, Trust Wallet is set to reimburse all affected users for their losses. The company is currently working on identifying the root cause of the vulnerability and implementing security upgrades to prevent similar incidents in the future.

Trust Wallet’s decision to compensate users for their losses has been well received by the cryptocurrency community, demonstrating the company’s dedication to maintaining a secure and transparent platform. The move also serves as a reminder to the broader industry of the importance of prioritizing security measures to protect users’ funds and maintain trust in the rapidly evolving world of digital assets.

As the cryptocurrency space continues to grow, it is essential for wallet providers and exchanges to continually invest in security infrastructure and adopt best practices to safeguard user assets. Trust Wallet’s response to the breach offers a model for how companies can take decisive action to address security concerns and maintain customer trust in the face of potential threats.

The current state of the blockchain industry is marked by its rapid development and expansion. Over the past few years, blockchain technology has garnered significant interest and uptake, with many enterprises from diverse sectors adopting it to enhance their operational efficiency.

Enterprises from various industries are adopting blockchain technology to streamline their business operations. Blockchain offers a decentralized and secure platform for storing, managing, and sharing data, making it ideal for improving efficiency and security.

Supply chain management and financial industry payments are the common use cases for blockchain in the enterprise space. In contrast, identity management can help prevent identity theft and fraud, improving overall security.

Enterprise blockchain limitations

The one-size-fits-all approach of most enterprise blockchain solutions is a major limitation for businesses looking to leverage the technology. Customization options are often limited, preventing companies from tailoring operations to their unique needs and requirements. This lack of flexibility can cause frustration and inefficiencies limiting mainstream technology adoption.

Additionally, interoperability is a significant issue, as many blockchain platforms are siloed and unable to communicate. This can be a considerable challenge for companies that operate in complex ecosystems and require seamless data sharing. The lack of seamless integration also serves as a hurdle for enterprises to deploy on blockchains quickly.

Leading players, including Aurora Cloud, are driving innovation by addressing these issues empowering enterprises to leverage blockchain to the best potential and drive new revenue streams for their businesses.

How Does Aurora Cloud Fit in the Puzzle?

Aurora Cloud is an enterprise blockchain solution that provides a customizable kit enabling web2 enterprises to create their blockchain akin to Aurora. The blockchain’s transaction throughput is above $10 million per day. Aurora Cloud is distinguished from other enterprise blockchain solutions by its Aurora Borealis infrastructure, which enables customizing operations, and its ability to integrate with Aurora Silos, Near, and Ethereum, promoting interoperability.

Blockchain newcomers may find it hard to grasp the concept of transaction fees and network-specific tokens, hindering businesses from adopting blockchain technology. However, Aurora Cloud’s Borealis Business is a revolutionary solution that simplifies the user experience and allows for flexible economic models. This transaction processing and accounting engine hides transaction fee complexities, enabling businesses to integrate blockchain technology into their operations smoothly. Moreover, enterprises can permission native blockchains in a way wherein they can control who interacts with the blockchain as well as add sophisticated whitelisting features.

The ecosystem provides specialized blockchains explicitly designed for Aurora clients and offers more than just compatibility with Ethereum. These blockchains boast an array of cutting-edge innovations, including unique token and fee mechanisms, strict access controls, exceptional transaction throughput, and various other features. The deployment of Aurora Cloud on the Near Blockchain also provides enhanced security through replica smart contracts that inherit the security model of Near, ensuring that the blockchain is secure and reliable. Moreover, the cross-chain communication between independent Aurora Silos with Near and Ethereum redefines enterprise blockchain’s interoperability.

Conclusion

The future of the enterprise blockchain market looks promising and has the power to transform global markets and industries. However, innovation remains at the forefront with newer technologies, including Zk proofs driving momentum in the space. The current rate of blockchain adoption by enterprises is slow; however, we will witness a major uptick when sophisticated features strike in, allowing enterprises to plug in blockchain systems seamlessly.

Enterprise blockchain. Bet you haven’t heard that phrase in a while. You probably thought it was dead, right? Although injured, it is certainly not dead, and even crazier, there are enterprise blockchain products that actually align with the wider Web3 ethos, especially privacy.

— Hudson Jameson (@hudsonjameson) April 12, 2023

The adoption of enterprise blockchain solutions is paramount, knowing that it can serve as a bridge to onboard mass users in web3.

In a significant legislative milestone, the Texas House of Representatives has passed a groundbreaking Proof of Reserve bill, which seeks to enhance transparency and accountability in the cryptocurrency sector. If enacted, the legislation will require cryptocurrency exchanges and other custodial entities to provide evidence of their customers’ digital asset holdings.

The proposed bill, known as HB 4486, aims to address concerns surrounding the security and reliability of cryptocurrency custodians by requiring them to prove their customers’ reserves on a regular basis. This measure is intended to ensure that these entities are adequately protecting users’ funds and not engaging in fraudulent activities.

The bill’s passage in the Texas House of Representatives marks a notable step forward in the effort to establish a robust regulatory framework for the cryptocurrency industry. By implementing a Proof of Reserve requirement, Texas legislators hope to foster greater trust and confidence in the sector, making it more accessible to both retail and institutional investors.

The legislation is expected to have a far-reaching impact on cryptocurrency exchanges and custodial services operating within the state. These entities will be required to undergo regular audits to verify their customers’ digital asset holdings and may face penalties for non-compliance.

As the cryptocurrency sector continues to grow and evolve, the Texas Proof of Reserve bill serves as a testament to the increasing recognition of the need for appropriate regulatory oversight. The bill’s passage in the Texas House of Representatives signifies a proactive approach to safeguarding consumer interests and promoting transparency in the rapidly expanding world of digital assets.