Hong Kong law enforcement authorities have arrested employees from Trust Reserve, the payment company responsible for the CNHC and HKDC stablecoins tied to the Hong Kong dollar and RMB. A notification displayed on the company’s office door confirmed the judicial seizure on May 29, 2023. The nature of the charges leading to the arrests remains undisclosed.

Trust Reserve, known for its cross-border payment business, employs stablecoins—digital currencies whose value is tethered to traditional fiat currencies—but has not heavily publicized these.

Notable examples of stablecoins are Circle’s USDC and Tether’s USDT, both linked to the US dollar’s value. Recently, Trust Reserve secured $10 million in a funding round spearheaded by KuCoin Investments, Circle, and IDG Capital. This followed their relocation of headquarters from the Cayman Islands to Hong Kong.

The specifics surrounding the arrests remain murky. It’s speculated that Chinese authorities are reinforcing control over digital transactions, particularly those not utilizing its e-CNY central bank digital currency. The e-CNY has reportedly amassed 260 million wallets and expanded its footprint across 25 cities.

China maintains a firm ban on crypto trading and mining activities. Some analysts believe these recent arrests may signal the state’s intent to decrease reliance on the US dollar for cross-border transactions, shifting instead towards the RMB. This shift is evidenced by the interest expressed by nations like Saudi Arabia, Bangladesh, and India in utilizing the digital yuan for trading purposes.

Post-2008 financial crisis, China fortified its cross-border payments infrastructure with bilateral currency swap agreements and the Cross-Border Interbank Payment System. Recently, a broadcast on Chinese Central Television hinted at a potential change in China’s stance on cryptocurrency, prompting speculation about the lifting of its crypto ban. However, the broadcast was subsequently removed without further clarification or updates.

The U.S. Government is on the brink of suspending its $31.4 trillion debt ceiling, ending months of intense bipartisan negotiations. This news was met with a positive response from Bitcoin and the larger cryptocurrency market. House Speaker Kevin McCarthy stated on May 27 that he and President Biden reached a preliminary agreement he believed merited the approval of the American people.

The main point of contention during negotiations was non-defense domestic spending. Republicans argued for reduced spending to slow U.S. debt accumulation, while Democrats pushed for increased taxes on the wealthy and corporations to shrink the debt. President Biden, presenting the deal as a compromise, underscored its significance in trimming expenditure while preserving vital programs aimed at boosting the economy and supporting the working class.

The standoff over the debt ceiling was feared to potentially trigger a U.S. default, which could result in dire economic consequences. President Biden shared these concerns, warning that such a default could precipitate an economic recession, cause substantial damage to retirement accounts, and lead to significant job losses. The Treasury Department had also cautioned that without this deal, the federal government could potentially default on its obligations by June 5.

The new agreement will suspend the debt limit until January 2025 and limit spending in the 2024 and 2025 budgets. It includes measures to recoup unused COVID funds and introduces additional work requirements for food aid programs, as reported by Reuters.

While the proposed deal has been agreed upon in principle, it must still pass through Congress, requiring cross-party support. As traditional markets were closed, the initial market response was discernible in the cryptocurrency sphere, which witnessed a 1.3% increase.

Bitcoin surged past the $27,000 mark during early trading hours, and other leading digital currencies, including Ethereum, Cardano, BNB, and Dogecoin, also reported gains.

Decentralized Finance, commonly referred to as DeFi, is an overarching term representing a variety of financial applications that are built on blockchain networks, most notably Ethereum.

DeFi is reshaping the world of finance by displacing traditional intermediaries, such as banks and brokerages, with peer-to-peer networks that allow market participants to interact directly with each other. This transformation opens the door to a more open and inclusive financial ecosystem.

What falls under DeFi?

DeFi platforms can encompass everything from lending and borrowing platforms, to decentralized exchanges (DEXs), to asset tokenization, to yield farming, and much more. These platforms operate via smart contracts – self-executing contracts with the terms of the agreement directly written into code, without any intermediaries involved.

The basis of the DeFi revolution lies in the democratic ideals that are intrinsic to its design. Traditional financial systems have barriers that prevent many from accessing basic financial services. DeFi aims to remove these barriers and offer financial services to all, regardless of location, wealth, or status.

In traditional finance, central authorities like banks, governments, or corporations control the financial systems and their rules. In DeFi, control is decentralized and rests in the hands of the people who use, build, and invest in the system. This is achieved through the use of blockchain technology and cryptography.

One of the main attractions of DeFi is its permissionless nature. This means that anyone, anywhere, can access financial services without needing to meet any prerequisites or go through a vetting process. DeFi applications are typically open-source, which means their code is public and can be audited by anyone. This transparency allows users to directly verify the functionality and security of applications.

Lending and borrowing are central aspects of any financial system, and DeFi is no exception. Through DeFi platforms, users can lend their assets and earn interest from borrowers. For borrowers, DeFi offers over-collateralized and under-collateralized loans. Unlike traditional systems, these loans are decentralized and do not require a credit check, only collateral. Interest rates are typically determined by supply and demand dynamics, making the system more competitive than traditional lending institutions.

DeFi has also ushered in a new era of financial instruments and trading platforms. Decentralized exchanges, or DEXs, allow users to trade digital assets directly from their wallets, removing the need for a centralized exchange as a middleman. In addition, synthetic assets, which are blockchain-based assets that mimic the value of real-world assets, have also become popular. These allow users to gain exposure to a variety of assets without actually owning them.

Yield farming

One of the most innovative and lucrative aspects of DeFi is yield farming. It is a practice that allows cryptocurrency holders to earn rewards for staking their coins in a DeFi protocol. In essence, yield farming protocols incentivize liquidity providers (LPs) to stake or lock up their crypto assets in a smart contract-based liquidity pool. These rewards can come from transaction fees, interest from lenders, or even new tokens.

However, DeFi is not without its risks. As a nascent industry, DeFi has faced several growing pains, including vulnerabilities in smart contracts leading to hacks, the potential for high volatility, and a steep learning curve that can leave less technically inclined users at a disadvantage. Despite these risks, many believe the potential benefits and revolutionary potential of DeFi make it worth exploring.

Regulation is another critical challenge for DeFi. While the lack of regulation is part of what makes DeFi attractive to many users, it also means less consumer protection. Regulatory bodies across the world are grappling with how to approach DeFi, striving to balance the need for consumer protection and fraud prevention with the desire not to stifle innovation.

Moreover, the environmental impact of DeFi, as part of the broader blockchain and crypto industry, is another concern due to the energy-intensive process of mining digital currencies and executing smart contracts.

Despite these challenges, the promise of DeFi is immense. If the sector can manage these risks effectively, DeFi has the potential to revolutionize the global financial system, making it more inclusive, efficient, and transparent. It represents a radical reimagining of financial systems that have been in place for centuries, offering the tantalizing prospect of a more equitable distribution of wealth and resources.

Examples of DeFi companies

Some examples of DeFi companies include decentralized exchanges, such as UniSwap and Pancake Swap, and other companies that operate within the decentralized finance space in any capacity.

Summary

In conclusion, DeFi is a fascinating development within the financial and technology sectors, offering a blend of opportunity, innovation, and risk.

Its potential to disrupt traditional finance is already being felt and will likely continue to cause ripple effects throughout the global financial ecosystem for years to come. It is clear that DeFi represents a significant step towards the democratization of finance, pushing us closer to a world where financial services are truly accessible to all.

From traditional mining to innovative cloud offerings and tokenized mining, the market is brimming with options. While some claim that mining is a thing of the past, the recent correction in the bitcoin market has sparked renewed interest. Could it be the perfect moment to explore the realm of free mining projects and discover hidden opportunities?

To Mine or Not to Mine?

Bitcoin mining has become incredibly challenging due to various factors. The competition within the mining industry has intensified, resulting in a substantial rise in the computational power needed to mine new bitcoins. Additionally, mining difficulty has increased over time, requiring more sophisticated and powerful equipment to stay profitable. Acquiring and maintaining this infrastructure can be costly, with exorbitant expenses for electricity consumption and equipment upkeep. The financial investment and ongoing operational costs pose significant hurdles for miners looking to enter or sustain their presence in the mining ecosystem. This has made it increasingly difficult for individual miners and opened up opportunities to other offers.

Trust We Seek

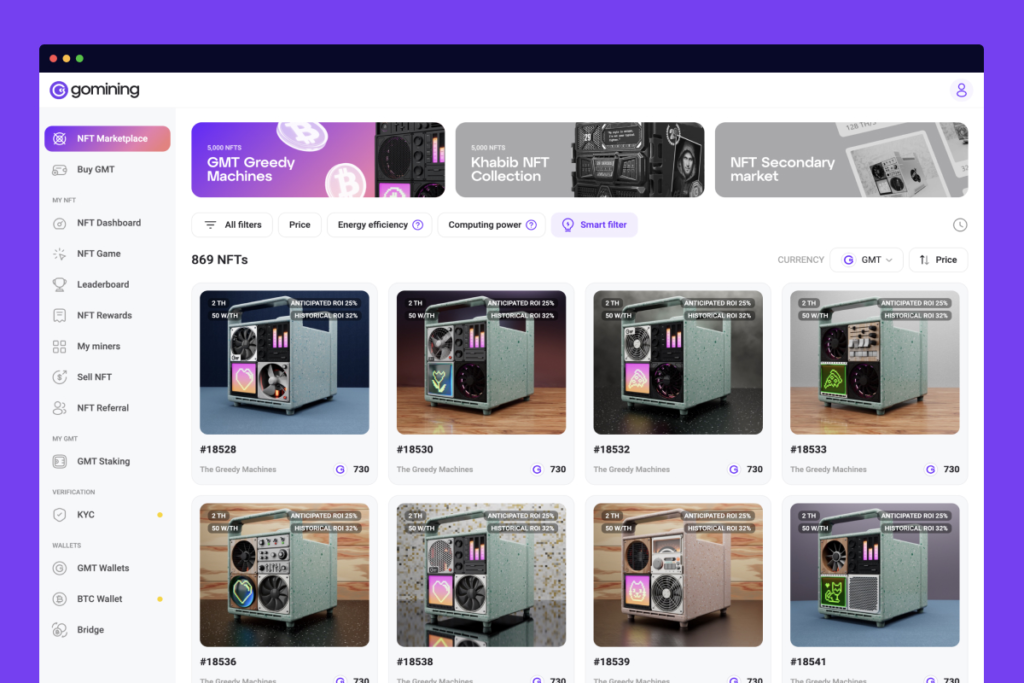

Amidst the multitude of projects offering easier entry into bitcoin mining, including cloud mining and tokenized offers, the main concern lies in their trustworthiness and ability to address the challenges. One such project that has gained attention is GoMining, a young but experienced venture. GoMining provides reliable and hassle-free mining infrastructure, offering a solution to the complexities and uncertainties surrounding bitcoin mining, while prioritizing transparency and trust within the blockchain industry.

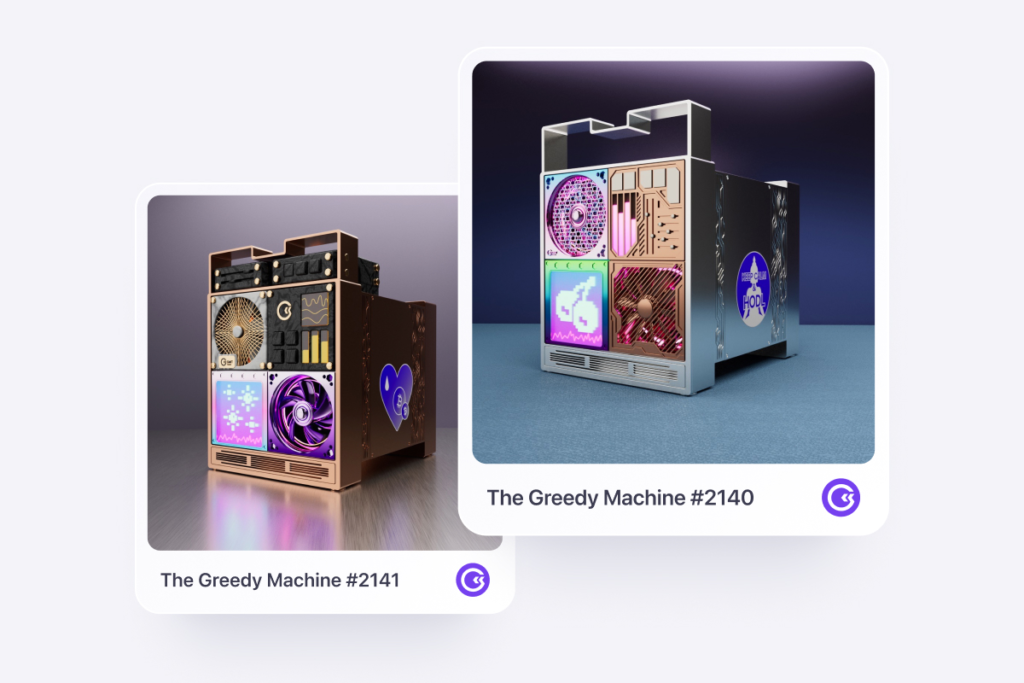

Mining NFT

What sets GoMining apart is its experienced team with six years of expertise, already delivering bitcoin rewards to its holders for two years and continuing to expand its infrastructure. At the heart of GoMining’s offering are their NFTs and tokens, which bring together the exciting worlds of mining and blockchain technology. GoMining NFTs offer unique mining rig images supported by real computing power, putting them heads and shoulders above other NFT collections. This innovative approach allows users to enjoy the benefits of mining, such as earning bitcoin rewards, without the usual hassles of purchasing expensive equipment or dealing with high electricity bills. The NFTs provide a seamless and headache-free mining experience, allowing users to participate in the digital gold rush from anywhere in the world.

Decentralized Staking

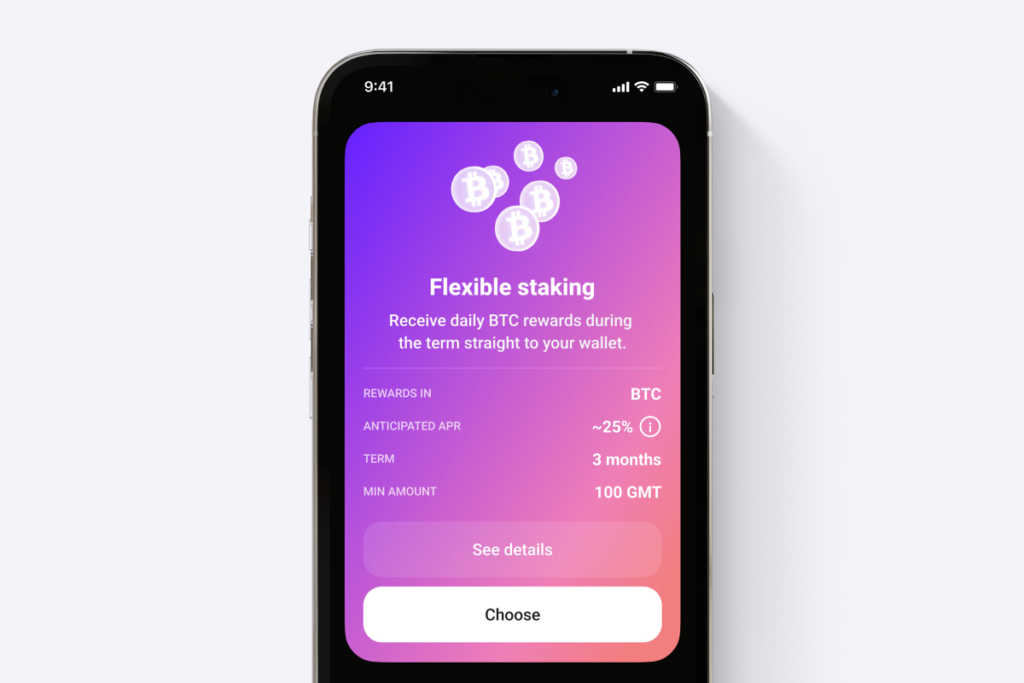

Complementing the NFTs is the GoMining Token, which serves as the core offering of the project. The token provides users with decentralized staking options, including fixed and flexible staking, allowing them to earn rewards in Bitcoin or GoMining tokens. Fixed staking allows users to freeze their tokens for 3 months at a 20% annual percentage rate (APR) and earn rewards in native tokens. It provides predictability and the ability to withdraw or relock tokens. Flexible staking involves blocking tokens for 3 months and receiving daily bitcoin rewards at a floating percentage, offering potential rewards based on market conditions.

By staking their tokens, users can secure and lock their assets while also contributing to the project’s mining infrastructure. Behind its token and NFT offerings lies real mining computing power. With ASICs located in various parts of the globe like the UAE, Norway, and Kazakhstan.

Celebrity Collaboration

Adding to the appeal of GoMining is its collaboration with notable public figure Khabib Nurmagomedov, the undefeated MMA star. The project has partnered with Khabib to create a special series of NFTs called the Khabib Collection. These NFTs feature unique designs inspired by Khabib’s career, including quotes and other elements associated with the legendary fighter. Each NFT in the Khabib Collection is backed by a symbolic 29 TH/s, representing the number of victories Khabib achieved during his illustrious MMA career.

The partnership with Khabib brings an added layer of authenticity and trust to GoMining, making it an attractive proposition for those seeking both innovative NFT opportunities and a reputable project backed by a respected public persona.

Conclusion

GoMining’s recent rebranding efforts have been driven by a commitment to transparency within the blockchain industry. Given their new website, the company recognizes the importance of providing clear and honest communication to its users and stakeholders. This focus on transparency not only enhances user trust, but also sets a standard for openness in the industry, ensuring that customers have a clear understanding of GoMining’s operations and offerings.

While exploring the GoMining app and website, you’ll find comprehensive details about how their ecosystem operates. The team takes pride in openly sharing information about the accrual system and promptly updating users if any changes occur. However, it’s always wise to conduct your own research and thoroughly investigate any project before diving in.

According to a statement by the company’s CEO Mark Zalan in their press release, GoMining has “a proven track record of providing top-notch services to our clients and we’ll continue to use our experience to build trust among our users.” And the company aims to develop its infrastructure making mining and blockchain more transparent, accessible, and easy.

As per its white paper and media publications, GoMining has experienced significant growth and achievements. The initial issue of 100 million tokens has seen a nearly five-fold increase, with plans to reach an impressive 10 trillion tokens. The company has also paid out a substantial amount of 1,610 BTC to its token holders, demonstrating its commitment to rewarding their community. GoMining has issued 10,000 NFTs, increased its overall hash power, growing from 100,000 TH/s to an impressive 1,252,467.37 TH/s.

Amidst a crowded marketplace, GoMining shines as a beacon of reliability and transparency. With its experienced team, two years of steady payouts, and a user-friendly interface, it stands apart from the rest. In a rapidly evolving mining landscape, GoMining offers a promising option for those looking for a straightforward and trustworthy mining experience.

Centralized crypto platforms have taken a lot of flack in recent months due to the shenanigans of a few bad actors. The main concern for users is the need to trust a third-party intermediary to manage their funds. But despite this, there are still many reasons to want to use a CEX.

The biggest advantage of CEXs is that they’re often much easier to use, with easy-to-understand user interfaces that enable beginners to get started trading in a matter of minutes. What’s more, CEX platforms can generally offer much deeper liquidity than even the most popular DEX platforms, making them the only suitable choice for professional, high volume traders.

So while DEX platforms might be gaining in popularity, there will always be a sizable audience for CEX platforms. With that in mind, we’ve chosen three DEX platforms that we feel are the best around, in terms of trading functionality, ease of use and low costs.

StormGain: Best CEX For Trading Options

Founded by Alex Althausen, StormGain has emerged as one of the top crypto exchange platforms for European traders thanks to its development of multiple features designed to make trading more lucrative and rewarding.

StormGain enables experienced traders to get the most out of the market with an array of different trading options and order types. For instance, it offers a basic options spot trading market that enables traders to buy and sell assets at the established market price instantaneously.

Spot trading is the most popular market for crypto traders and involves buying and selling tokens at the listed price. When a user initiates a trade, it will be entered into StormGain’s order book, which will rapidly search for a matching bid. Once the seller has been matched with a suitable buyer, the trade is executed immediately, making for lightning-fast transactions.

StormGain also allows futures trading, where traders can hedge against market price movements. With futures contracts, traders are essentially speculating that the price of an asset will move up or down over a set period of time. The user buys a contract that enables them to buy an asset at a given price at the time it expires. The trader will either profit on the deal or lose, based on whether or not the asset’s price appreciates or depreciates at the time of expiry.

A third kind of trading option on StormGain is leveraged trading, in which the user is able to borrow funds from the exchange in order to increase their stake. Looking deeper at its trading options, we find that StormGain also offers novel markets such as crypto indices and tokenized assets, as well as a cloud mining program that provides rewards to users.

Added to these trading options, StormGain is also unique among CEXs in that it operates its own, fully decentralized trading platform. StormGain DEX allows traders to maintain self-custody of their assets in their own wallet, which is simply linked to the platform. Users trade with one another via smart contracts. However, uniquely among DEXs, StormGain DEX is able to tap into the liquidity of its CEX platform to ensure traders can buy and sell at their desired price, without suffering from slippage. Very few CEX platforms can compete with StormGain’s trading options, hence it’s our favorite choice for experienced traders.

Coinbase: Best CEX For Beginners

Coinbase is one of the most user-friendly exchanges around thanks to its simple interface, robust security and its extensive library of educational content.

No doubt you have already heard of Coinbase, which is probably the best-known exchange in the U.S. Not only is it one of the most reputable platforms, but it excels at lowering the barrier for entry to new cryptocurrency users. It begins with a seamless onboarding process and a step-by-step guide to executing your first trade.

Coinbase is also home to a comprehensive portal of educational materials, with guides to things like the basics of blockchain, an explanation of crypto terminology, and a deep dive into hundreds of popular cryptocurrencies. What’s more, users can actually get paid in crypto for reading this stuff thanks to its novel Coinbase Earn program, which pays small rewards to users who participate in its learning modules.

We should also mention its security, which is as good as any in the industry. Notably, Coinbase offers two-factor authentication on its desktop and mobile platforms, and it stores 98% of its funds offline in so-called cold wallets. It also has an insurance policy with the U.S. FDIC that covers deposits of up to $250,000. It provides a level of reassurance that few other exchanges can match, making it an excellent choice for novices and cautious investors alike.

Bitstamp: Best Exchange For Low Fees

For some traders, especially those who trade in smaller amounts, one of the most important considerations is that they don’t get stung by high trading costs. Hence, Bitstamp is well worth a look thanks to its extremely competitive maker and taker fees and zero-cost withdrawals.

Low fees are offered by many CEXs as a way to entice new users to try out their platforms, but what they don’t say is that they will make up for this with expensive costs associated with coin transfers and bank withdrawals. So, you might purchase Bitcoin on its platform for minimal fees, but the moment you transfer that BTC to your own wallet, the exchange will take a sizable cut. That doesn’t happen with Bitstamp, which is notable for minimal costs on all transactions.

Bitstamp’s exact fees depend on the specific cryptocurrency, but they’re as low as you’ll find anywhere. Maker fees range from 0.3% to 0%, while taker fees average between 0.4% and 0.3%, making it one of the lowest cost exchange platforms around. Even better yet, traders whose 30-day trading volume is less than $1,000 won’t have to pay any fees at all, which is ideal for those who only want to buy crypto now and again. Furthermore, Bitstamp’s withdrawal fees are also very low, with ACH transfers being entirely free to users.

As one of the longest-established crypto platforms around, Bitstamp has a long history of secure and transparent operations. It notably became the first platform of its kind to secure an EU Payment Institution license, and it has also been granted a BitLicense by New York’s financial services department, NYDFS. Bitstamp did suffer a hack many years ago in 2015, losing more than $5 million worth of funds, but to its credit it was able to fully reimburse all users without delay.

Conclusion

There are literally hundreds of CEX trading platforms to choose from, but we think the above platforms are among the best all-rounders in the business. When it comes to multiple trading options, few platforms can compete with StormGain. For user-friendliness, Coinbase is hard to beat, and for low cost trading, Bitstamp is always a solid choice.

Decentralized Finance (DeFi) lending protocol Aave V2 has been hit by a glitch on the Polygon network, leading to approximately $110 million in assets becoming inaccessible to users. The issue was first reported by BlockSec, a blockchain security firm, on May 19. The trouble arose from an incompatible ReserveInterestRateStrategy contract, initially deployed to improve interest rate efficiency and platform utilization.

The incompatibility of the upgrade with the network has led to user assets becoming non-interactable on the Aave platform. Consequently, users can neither borrow, withdraw, repay, nor supply more assets, as all calls revert.

Despite the hiccup, developers have confirmed that only Aave V2 on Polygon is impacted. Other versions on Ethereum and Avalanche, as well as the V3 protocol, are functioning correctly. Importantly, developers have assured users that their funds remain secure, including the assets currently stuck due to the bug.

Resolving the issue requires governance intervention. A proposal has been put forward to rectify the situation, with the Aave DAO slated to begin voting on the matter soon.

According to the proposal, if approved, the fix would take roughly a week to implement. This includes a delay of one day to initiate voting, three days of voting, a day of Ethereum timelock, and an additional two-day timelock on Polygon.

This episode underscores the intricacies of DeFi and the unique challenges posed by various Ethereum Virtual Machine-compatible (EVM) chains. It also emphasizes the critical role of governance in managing and addressing potential technical issues in decentralized protocols.

According to an onchain metric, Litecoin (LTC), currently the 12th largest cryptocurrency based on market cap, appears to be undervalued in the market. The metric used to determine this is the market value to realized value (MVRV) Z-score, which currently registers in the negative for Litecoin, as per data from analytics company Glassnode.

The market cap of a cryptocurrency is computed by multiplying the current market rate of the coin with the total number of coins in circulation. In contrast, the realized value is a modified version of the market cap, taking into account the market value of coins at the time they were last transferred on the blockchain.

This excludes coins that have fallen out of circulation, which, in the case of Litecoin, amounts to more than 15%. It is believed to provide a more accurate representation of the actual or fair value of the network.

The Z-score, in this context, is an indicator of how many standard deviations the market value is from the realized value. Over time, Z-scores greater than eight have been associated with overvaluation and peaks in bull markets, while negative scores have pointed to undervaluation and market lows.

The fact that Litecoin’s Z-score remains negative indicates the cryptocurrency is still being traded at a relative bargain based on its historical standard. This trend of negative Z-scores has been ongoing since July of the previous year.

This isn’t a first for the metric. In the past, the Z-score has repeatedly dipped below zero, often serving as a precursor to significant bull market movements. Based on historical precedent, it seems that Litecoin’s price is more likely to rise than fall. However, it’s worth noting that Litecoin, along with the larger cryptocurrency market, is susceptible to various macroeconomic factors, including liquidity contraction and the overall state of the global economy.

At the time of reporting, Litecoin is being traded at $92, signifying an approximately 31% increase since the start of the year. Earlier this week, Litecoin’s price hit a one-month peak of $95, as per CoinDesk data.

Litecoin is poised for its third mining reward halving in early August. Following this event, the mining reward for each block will decrease by 50%, going from 12.5 coins to 6.25 coins.

FTX’s legal team has filed a lawsuit against its former CEO, Sam Bankman-Fried, co-founder Zixiao Wang, and a former high-ranking executive, Nishad Singh, alleging neglect in due diligence in the $220 million acquisition of the stock-clearing platform, Embed.

In a filing dated May 17, it was claimed that FTX, through its U.S. subsidiary, paid $220 million for Embed while reportedly conducting “almost no due diligence” on the platform.

FTX filed for bankruptcy and was given approval by the overseeing judge to sell Embed along with other assets. However, the highest bid received for the platform was a mere $1 million, leading FTX’s lawyers to state that the platform’s software was essentially worthless – something they accuse the FTX group and insiders of failing to realize prior to the acquisition.

FTX’s lawyers note that of the 12 entities expressing non-binding interest, all but one declined to submit a final bid after thorough due diligence. The sole remaining bidder was Michael Giles, Embed’s founder, and former CEO.

FTX’s lawyers further allege that Giles personally received approximately $157 million during the acquisition. However, his final bid to reclaim ownership of Embed was only $1 million, subject to closing reductions.

They also claim that misleading records were produced to mask Alameda Research’s involvement in the Embed acquisition’s funding. They argue that funds were moved between FTX entities, contrary to claims that they came from Bankman-Fried, Singh, and Wang.

FTX is seeking to have the transactions designated as “avoidable fraudulent transfers and obligations, and/or preferences,” and wants the defendants’ claims disallowed until FTX recovers the funds lost in avoidable transfers.

After filing for bankruptcy in November 2022, FTX’s new leadership has been intent on recovering funds to reimburse customers and creditors, and is contemplating a potential relaunch of the exchange.

Cryptocurrency has been making headlines in recent years as one of the most disruptive technologies to hit the financial industry. Owing to its decentralized, transparent, and secure nature, it has the potential to transform the way we conduct financial transactions. As cryptocurrency adoption grows, more companies are entering the market to explore innovative use cases for the technology.

Some of these companies are worth paying attention to, as they have shown promising developments and gained significant industry attention. These companies are pushing the boundaries of what is possible with cryptocurrency and are paving the way for the future of finance.

Many are focused on creating a decentralized internet through blockchain technology, where individuals own their data and can share it securely without intermediaries. Others are creating a digital currency platform that enables seamless, peer-to-peer transactions, removing the need for traditional financial institutions. As the adoption and use cases of cryptocurrencies continue to expand, crypto marketing is becoming increasingly important for projects looking to reach new markets, onboard new users, and drive growth and adoption of their tokens and platforms.

In addition to these companies, some are exploring the use of cryptocurrency in niche areas such as supply chain management, healthcare, and real estate. These companies demonstrate how cryptocurrency can solve real-world problems and create new opportunities for businesses and individuals. Notably, since the inception of Bitcoin, more than 21,000 different cryptocurrencies have been created. Here are lists of novel crypto companies worth paying attention to in 2023.

Contractus

Contractus is a service that makes signing contracts easy and safe. It uses a special computer system called blockchain to keep everything secure. Users can sign a contract with just one click! This platform is powered by the Solana blockchain, which is a perfect system that can handle a lot of people using it at once. With Contractus, users don’t need to use an intermediary to sign their contract, which means everyone involved is quickly and legally bound to follow their terms. Contractus costs are low and payment can be made with different cryptocurrencies.

Contractus uses a special way of protecting a contract called “Shamir’s Secret Sharing method” and “multi-signature technique”. These make sure that no one can see the contract unless they are supposed to and that everyone follows the contract’s rules. With Contractus, you can be sure that your contract is kept secret and that everything is fair. The good thing about the platform is that it is cheap and efficient, especially for essential contracts that need to be very trustworthy. If you keep a balance of 10.000 CTUS tokens or use the token for payment, you qualify for a special feature called “Holder mode” for free.

CoinPayments

CoinPayments is one of the leading cryptocurrency payment processors worldwide. With over 1,000,000 user accounts and more than 120,000 registered merchants in over 190 countries, CoinPayments has become one of the most widely used multi-crypto payment systems available online. Since 2013, we have developed a complete crypto payment gateway that allows merchants to accept over 100 cryptocurrencies and hold over 2,000+ altcoins, all on a single platform.

CoinPayments is much more than a Bitcoin payment processor. It’s a complete crypto payment gateway with innovative solutions such as: point of sale interface, crypto invoice builder, multi-signature wallets, long-term storage vaults, mobile & desktop support, and industry-low transaction fees (starting at 0.5%). Among the features available in CoinPayments, there is also a conversion tool that allows for converting cryptocurrencies quickly and efficiently.

CoinPayments connects merchants and individuals to the global cryptocurrency economy. Start your crypto payments journey by opening an account with CoinPayments today.

Taiyo Robotics

Taiyo Robotics significantly changed in December 2021 when Solport Tom acquired it from its original project owners. Following the acquisition, Tom wasted no time expanding the team, hiring over 20 employees dedicated to promoting Taiyo Tech products and building a strong community around them. This move has brought fresh perspectives and resources to the project, propelling it forward in its mission.

At Taiyo Robotics, the main focus is on being an innovative NFT project operating on the Solana Blockchain. The company’s goal is to develop cutting-edge technology and provide a wide range of services to its users. These services include self-serving features, utility options, a launchpad for new projects, a vibrant Discord community, and robust security tools. Taiyo Robotics strives to offer a comprehensive package that caters to its community’s diverse needs and interests, ensuring their engagement and satisfaction with its offerings.

Risitas

Risitas Coin, also known as $RISITA, is the ultimate memecoin specifically created for crypto enthusiasts who seek to add excitement and diversity to their investment portfolio. Inspired by the iconic Spanish comedian El Risitas, the coin aims to inject laughter and entertainment into the realm of cryptocurrency. Risita is not just another run-of-the-mill meme token! It is a roaring tribute to the late and legendary Juan Joya Borja, famously known as “El Risitas.” His infectious giggles captured the hearts of millions and quickly became an internet sensation, spreading like wildfire across various online platforms.

However, the mission extends beyond mere laughter. $RISITA is driven by the desire to honor comedy kingpin, bringing joy and laughter to the meme community while supporting charitable causes. Users will not only join a community of meme enthusiasts but also contribute to a greater purpose of spreading happiness and positively impacting society.

Wrapping Up

The rise of cryptocurrency is changing how we view and interact with finance. With the potential to disrupt traditional financial systems and create new opportunities for innovation, it is no wonder that more and more companies are entering the market. As we look to the future, it will be exciting to see how these companies continue to shape the industry and unlock the potential of cryptocurrency.

Despite a cautionary note from the International Monetary Fund (IMF), the Reserve Bank of Zimbabwe has successfully sold 14 billion Zimbabwean dollars (approximately $39 million) in gold-backed digital tokens.

The Zimbabwean central bank announced on May 12 that it had received 135 applications totaling 14.07 billion Zimbabwean dollars for the purchase of the gold-backed cryptocurrency. At the official exchange rate of 362 Zimbabwean dollars to one US dollar, this amount is worth approximately $38.9 million. However, the exchange rate is considerably higher on the street.

Launched in April, the cryptocurrency tokens are backed by 139.57 kilograms of gold. The sale period ran from May 8 to May 12. The tokens were available for a minimum of $10 for individuals and $5,000 for corporations and other entities, with a minimum holding period of 180 days. The tokens can be stored in e-gold wallets or on e-gold cards.

The sale is part of an initiative to stabilize the national economy and counteract the persistent devaluation of the Zimbabwean dollar against the US dollar. A second sale of digital tokens is planned, with the bank inviting applications to be submitted this week for settlement by May 18.

RBZ Governor Dr. John Mangudya stated that the issuance of the gold-backed digital tokens is intended to “expand the value-preserving instruments available in the economy and enhance the divisibility of the investment instruments and widen their access and usage by the public.”

This move comes in the wake of a warning from the IMF against Zimbabwe’s strategy for a gold-backed currency. The IMF suggested the country should liberalize its foreign-exchange market instead, according to a Bloomberg report from May 9.

Zimbabwe has been grappling with currency instability and inflation for over a decade. In 2009, the country adopted the US dollar as its currency after hyperinflation made the local currency practically worthless. The Zimbabwean dollar was reintroduced in 2019 in an attempt to revitalize the local economy, but it again faced significant instability.