In a recent spate of attacks, fraudsters have taken over at least eight Twitter accounts of crypto influencers, promoting phishing scams and swindling nearly $1 million in digital assets, reports blockchain investigator ZachXBT. He identified several wallets connected to these scams through on-chain links associated with the hijacked accounts.

Among the victims are high-profile individuals like Pudgy Penguins’ Cole Villemain, DJ and NFT collector Steve Aoki, and Bitcoin Magazine’s Pete Rizzo. Even staunch crypto critic Peter Schiff’s account was exploited to push a suspicious link related to tokenized gold in DeFi.

ZachXBT suggests some of these breaches might have occurred through a Twitter admin panel, in addition to SIM swapping. Once the scammers gained control, they instantly began posting phishing scams. Lackluster response times from Twitter allowed some fraudulent tweets to remain active for several hours, sometimes even days.

OpenAI’s CTO Mira Murati and The Sandbox co-founder Arthur Madrid were also among those targeted. The scams often involved promoting fake airdrops of ERC-20 tokens, with Murati’s account used to promote a counterfeit OPENAI token airdrop.

The investigator urged users to adopt security keys for two-factor authentication rather than SMS-based options. He called on Twitter to thoroughly investigate these incidents, given the substantial amount stolen.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

Poloniex is one of the most well-known names in the world of cryptocurrency, launched in 2014. Since its inception, it has established a reputation for being a leading digital asset exchange offering a wide range of cryptocurrency trading options, including spot trading, margin trading, and lending.

Aesthetics and User Interface

On first landing on Poloniex’s platform, it’s evident that they’ve put effort into developing an appealing and easy-to-navigate interface. The overall look is clean and modern, with a dark theme that is friendly to the eyes, especially for those who tend to spend long hours trading. The layout is intuitive and self-explanatory, with tabs and dropdown menus providing easy access to different functions and markets.

The trading interface, complete with charts, order books, and trading history, offers all the critical information on one screen. Advanced traders will appreciate the extensive range of technical analysis tools integrated into the charting feature. On the flip side, beginners may initially find the interface slightly overwhelming due to the wealth of information displayed.

Security

Security is always a key consideration when assessing any cryptocurrency exchange. Poloniex has learned from past experiences, like the Bitcoin hack back in 2014, and made substantial strides in this area. All deposits are now stored in air-gapped cold storage. Additionally, they offer two-factor authentication (2FA) for accounts, email confirmations for withdrawals, and have stringent AML and KYC checks to prevent illicit activity.

However, it’s worth noting that, like all centralized exchanges, it’s not fully immune to risks. Users must exercise individual security measures, such as enabling 2FA, regularly updating passwords, and not clicking suspicious links.

Trading Options and Liquidity

Poloniex stands out due to its extensive variety of trading options. Its margin trading feature allows users to borrow funds to leverage their trades. Their lending feature allows users to earn interest by lending their assets.

In terms of cryptocurrency pairs, Poloniex offers a wide selection, making it an attractive option for those looking to trade less popular or more niche cryptocurrencies. The platform’s liquidity is generally strong, ensuring quick trade execution and lower slippage. However, the liquidity can vary across different pairs, with lesser-known pairs potentially having lower liquidity.

Fees

Poloniex operates a maker-taker fee schedule, which is dependent on the user’s 30-day trading volume. The fees are competitive, particularly for more active traders who benefit from lower fees as their volume increases.

However, the fee structure can be complex for new users or those not trading regularly. While the fees are generally lower compared to other exchanges, it’s always important to understand the costs associated with trading on the platform.

Customer Support

Customer support is an area where Poloniex has faced criticism in the past. The platform offers 24/7 support and a comprehensive knowledge base, but the response times can vary significantly, leading to some frustration among users. However, the company appears to be addressing this, with noticeable improvements in response times and resolution efficiency.

Regulation

Poloniex is a US-based exchange, and it adheres to the regulatory environment. It was acquired by Circle in 2018, a company with a strong focus on compliance and regulation. Since October 2020, it’s been operated by Polo Digital Assets, Ltd., who have pledged to continue focusing on compliance with all relevant laws and regulations.

Mobile App

The Poloniex mobile app offers a seamless experience, mirroring the desktop platform’s functionality. The design remains consistent, ensuring that users can easily navigate and execute trades on the go. The app is responsive, user-friendly, and offers real-time updates, making it a reliable tool for traders.

Conclusion

Overall, Poloniex remains a prominent player in the cryptocurrency exchange arena. With its wide selection of cryptocurrencies, array of trading options, and focus on security, it’s an appealing option for both novice and experienced traders.

However, it’s essential for potential users to understand the platform’s intricacies, particularly in terms of fees and the sometimes complex trading interface.

Improvements in customer support and a continued focus on security will be vital for Poloniex moving forward, given the intense competition within the industry. That said, Poloniex’s solid track record, established reputation, and commitment to staying at the forefront of cryptocurrency innovation make it a compelling choice for anyone seeking a versatile and secure trading platform.

Other Stories:

Sam Bankman-Fried fires key evidence allegation at US prosecutors

Is crypto mining legal in the UK?

Jack Dorsey branded a ‘clown’ after admitting he considers Ethereum to be a security

Jack Dorsey, an outspoken Bitcoin proponent, has found himself in a Twitter debate with crypto industry personalities after confirming in a reply that he views Ether as a security. Udi Wertheimer, a Bitcoin Ordinals developer at Taproot Wizards, labeled Dorsey as a “clown” in a June 6 tweet.

In response, Dorsey challenged, “ETH is not a security? Teach me wizard,” causing Wertheimer to post a five-year-old clip of SEC chair Gary Gensler declaring that ETH was “sufficiently decentralized” and therefore not a security.

Gabor Gurbacs, strategy advisor to Tether and VanEck, countered by suggesting that Ethereum’s recent shift to a proof-of-stake consensus algorithm could have reactivated securities laws. This dispute occurred amidst the SEC’s lawsuits against cryptocurrency exchanges Binance and Coinbase on June 5 and 6, accusing them of offering unregistered securities tokens.

Dorsey seemed to support a 2015 post by Coinbase CEO Brian Armstrong, suggesting that altcoins were a “distraction” and that Coinbase should primarily focus on Bitcoin. Continuing his Bitcoin-centric tweets, Dorsey retweeted a video by Jack Mallers, CEO of Bitcoin Lightning app Strike, criticising Armstrong’s prioritization of altcoins over Bitcoin and the Lightning Network development.

Despite Twitter selling 140 Ethereum-based non-fungible tokens (NFTs) when Dorsey was at the helm in 2021, Dorsey had dismissed investing in Ether. He also expressed skepticism about Ethereum’s potential to disrupt big tech in August 2021.

Most recently, Dorsey has backed and championed Nostr, a decentralized network designed to compete with Twitter. This network incorporates Bitcoin Lightning-based payments on its “Damus” platform.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

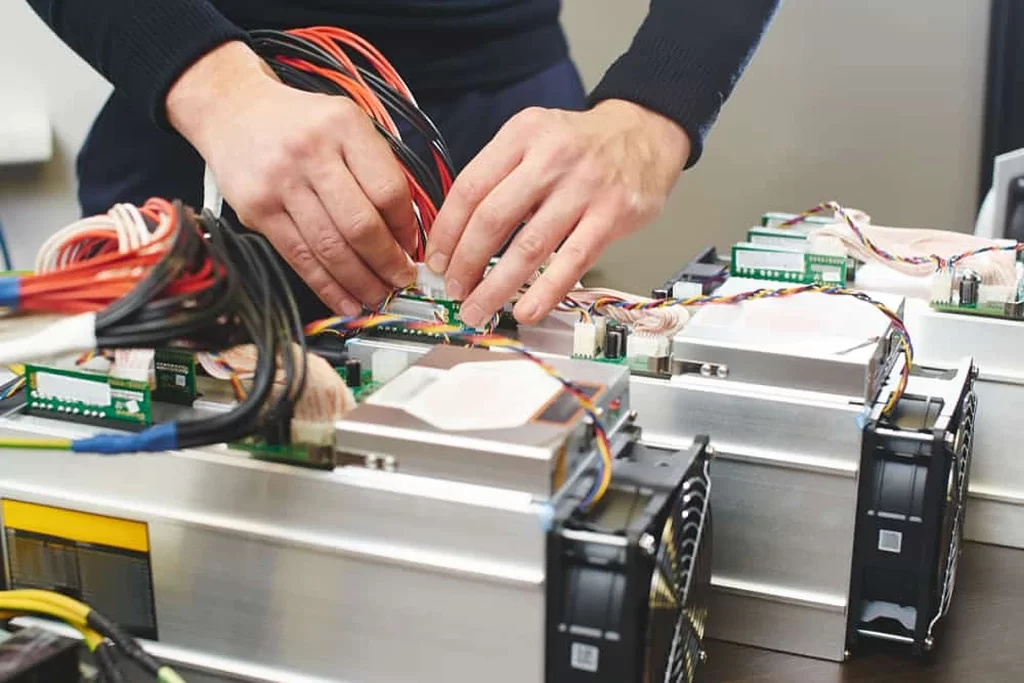

Cryptocurrency, with Bitcoin leading the way, has revolutionized the financial landscape worldwide. Given the potential for profits, the practice of cryptocurrency mining has become widespread. One of the countries witnessing significant cryptocurrency activities, including mining, is the United Kingdom (UK). This article provides an in-depth examination of the legal status of cryptocurrency mining in the UK.

Cryptocurrency mining is legal in the UK. The government neither restricts nor encourages the activity; instead, it treats cryptocurrency operations much like any other form of business. Cryptocurrency miners in the UK, like all businesses, must comply with the applicable tax laws, specifically the Her Majesty’s Revenue and Customs (HMRC) tax regulations.

The primary guidance for cryptocurrency miners comes from the HMRC’s policy paper on “Cryptoassets for Individuals”, updated in December 2019. According to this paper, when the mining activity amounts to a trade, the miner must pay income tax and National Insurance contributions on the mining profits. Conversely, if the mining does not amount to a trade, the miner may be liable to pay Capital Gains Tax when they sell the coins.

An essential aspect to note is the criteria HMRC uses to determine whether the mining activity amounts to a trade. Factors such as the degree of activity, organization, risk, and commerciality are considered. Given the complexity of these regulations, miners are often advised to seek legal counsel to ensure compliance.

Legal Risks of Crypto Mining in the UK

While mining itself is not illegal, certain activities associated with mining can fall foul of the law. In the case of cryptojacking (using someone else’s computer to mine cryptocurrency without their consent), the Computer Misuse Act 1990 comes into play. Cryptojacking is illegal in the UK as it involves unauthorized access to another person’s computer and electricity.

The UK, like many jurisdictions worldwide, has been focusing on the regulation of cryptocurrencies, primarily to prevent money laundering and terrorism financing. The 5th Anti-Money Laundering Directive (5AMLD), which came into effect in January 2020, was implemented into UK law. The law mandates that all cryptocurrency platforms, including those involved in exchanging between cryptocurrencies and fiat currencies, must register with the Financial Conduct Authority (FCA) and comply with stringent anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

While these regulations do not directly impact cryptocurrency miners, the law’s broad interpretation could potentially classify certain mining activities, particularly those involving pooling resources, as financial services. Therefore, miners should be aware of these regulations and their implications.

Despite the legality of cryptocurrency mining, the UK government and regulatory bodies have continuously issued warnings about the risks associated with cryptocurrencies. These warnings primarily highlight the volatility of cryptocurrencies, lack of consumer protection, potential for facilitating illicit activities, and environmental concerns.

On the environmental front, cryptocurrency mining, notably Bitcoin mining, is often criticized for its high energy consumption and carbon footprint. In response to global climate change concerns and the UK’s commitment to achieving net-zero carbon emissions by 2050, it’s plausible that stricter regulations could be implemented in the future to govern energy-intensive industries, including cryptocurrency mining.

In Summary

Cryptocurrency mining is legal in the UK, but it comes with responsibilities, primarily related to tax obligations. However, given the fast-paced evolution of the cryptocurrency landscape and increasing regulatory focus on cryptocurrencies, miners are advised to keep abreast with the latest laws and regulations.

Moreover, they should be aware of the associated risks, including the potential for criminal liability in cases of cryptojacking or non-compliance with AML and CTF regulations. The future of cryptocurrency mining in the UK, like in many other countries, could be shaped by an array of factors ranging from regulatory changes, technological advancements, to environmental concerns.

Other Stories:

Is crypto haram or halal? Everything Muslims need to know

Is Big Eyes Coin a scam? Why investors should be wary of this crypto presale

ArbitrageScanner – the best scanner for cryptocurrency arbitrage between exchanges

In the wake of the United States Securities and Exchange Commission’s (SEC) recent lawsuits against leading cryptocurrency exchanges, Coinbase and Binance, trading volumes on the top three decentralized exchanges (DEX) have seen an impressive leap.

Data from CoinGecko reveals that trading volumes across Uniswap v3 (Ethereum), Uniswap v3 (Arbitrum) and PancakeSwap v3 (BSC) have grown by an astounding 444% within the past 48 hours. These DEX platforms collectively represent 53% of total DEX trading volume. Between June 5 and June 7, the platforms’ daily trading volumes rose by over $792 million.

Curve, a decentralized exchange specializing in stablecoin trades, also witnessed a surge, with volumes rising by 328%. The majority of activity on Curve revolved around USD Coin and USDT, both tied to the value of the U.S. dollar.

May’s memecoin phenomenon had previously caused a brief surge in DEX volumes, outperforming Coinbase. Investors flocked to tokens like Pepe (PEPE) and Turbo (TURBO), available on decentralized platforms like Uniswap, as they were not listed on traditional exchanges.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

Notably, amid the DEX trading boom, Binance saw net outflows—calculated as the difference between incoming and outgoing assets—reach $778 million. Still, the exchange’s overall reserves are strong, holding over $8 billion in stablecoin balances.

This trading frenzy corresponds with increased regulatory scrutiny from the SEC. On June 6, Coinbase was sued by the SEC, which claimed it offered unregistered securities and acted as an unregistered securities broker. A similar suit was filed against Binance, its U.S. arm, and CEO Changpeng Zhao on June 5. Allegations suggest Binance has been operating illegally in the U.S., having failed to register as a securities exchange, and that Zhao is a ‘controlling person’ in this scenario.

Other Articles:

Is Big Eyes Coin a scam? Why investors should be wary of this crypto presale

ArbitrageScanner – the best scanner for cryptocurrency arbitrage between exchanges

Bored Ape Yacht Club (BAYC) utility – Why are investors spending millions on these NFTs?

As digitalization and globalization continue to influence our lives, new and innovative technologies emerge to revolutionize the way we handle everyday activities, particularly in finance.

Cryptocurrencies, non-fungible tokens (NFTs), and decentralized finance (DeFi) platforms have all grown in popularity, demonstrating a paradigm shift in the world’s financial systems.

Flasko (FLSK), a cryptocurrency protocol, rides this wave of innovation, intending to be the first NFT whiskey, wine, and champagne investment platform.

Understanding Flasko

Launched to democratize access to the alternative investments market for cryptocurrency users, Flasko has an ambitious vision. It aims to open doors for investors interested in premium whiskeys, wines, and champagnes – asset classes that have seen significant growth over the years. With alternative investments gaining ground globally, expanding from 6% to 12% of the market share in 15 years, Flasko’s innovative approach could not have come at a more opportune time.

The protocol operates by allowing investments in rare and high-growth spirits and wines, resulting in an NFT being minted. These NFTs can be fractionalized, democratizing access to these assets and enabling more users to participate in this exclusive market. Every investor will then have the opportunity to benefit from the growth of the alternative investments market, specifically the premium beverage sector.

Platform Details

The Flasko platform is designed to provide users with an easy-to-use interface to invest and trade their NFTs. It plans to partner with high-end beverage start-ups through its launchpad and community, providing a supportive ecosystem for these companies while offering unique investment opportunities to its users. Flasko is uniquely positioned to bring the world of luxury beverage alternative investors to the cryptocurrency market.

One of the major benefits of investing through the Flasko platform is the chance to earn an average of 28% per annum on investments. Additionally, token stakers will earn revenue from the Flasko platform, making it a highly attractive investment option.

READ: Bored Ape Yacht Club (BAYC) utility – Why are investors buying up these NFTs?

All beverages bought through the platform will be stored in insured, licensed, and bonded warehouses, providing assurance of the physical product’s safety. Flasko ensures that each NFT and its relevant fractions are tradable via its platform. Additionally, investors can choose to purchase either a fraction or 100% of an NFT and have the physical product delivered to their designated address at no cost.

Tokenomics and Future Prospects

The Flasko token, FLSK, has a total supply of 1 billion. The token is allocated across several areas, including presale (35%), exchange listings (12.5%), marketing (17.5%), partnerships (5%), community investments (15%), development (14%), and charity (1%).

Flasko’s roadmap includes listing on Uniswap and popular listing platforms such as CoinGecko and CoinMarketCap. Furthermore, Flasko plans to launch its private membership club, develop its NFT marketplace for premium beverages, and design mobile applications for both iOS and Android.

Investment Tiers

Flasko offers two exclusive investment tiers: the Wine Tier and the Champagne Tier. The Wine Tier, open to investors of $30,000 or more, offers premium vintage wine, a personal account manager, access to exclusive NFTs and wine tasting events, and priority access to new start-ups. The Champagne Tier, open to investors of $60,000 or more, offers premium vintage champagne, additional NFTs, access to whiskey and wine start-ups, two annual trips to the Champagne region in France, and more.

Flasko Price Prediction By 2030

Given the detailed roadmap, promising features, and niche market Flasko plans to address, it is quite plausible to expect substantial growth for the FLSK token by 2030. The concept of fractional ownership of luxury beverages through NFTs, combined with the steady growth of the alternative investment market, creates a unique value proposition that is likely to draw in a significant number of investors.

However, predicting a specific price for the FLSK token would be challenging without access to essential data, including the project’s overall adoption rate, its market cap, and the broader cryptocurrency market’s state. As with any investment, potential investors should carefully assess the risks and rewards, do their research, and possibly consult with a financial advisor before deciding to invest.

Having said that, some analysts have predicted Flasko’s price to reach over $5 by 2030.

Conclusion

In a world where finance is rapidly changing and alternative investments are increasingly coming to the fore, Flasko’s innovative fusion of premium beverage investing with the dynamic world of crypto assets presents a unique and promising opportunity.

The platform’s potential to reshape and democratize the world of luxury beverage investing, while bringing it to the fingertips of the everyday investor, makes it a project to watch in the coming years.

Inclave Casino stands as a shining beacon of modern gambling entertainment, nestled within the hustle and bustle of the contemporary urban scene. As a symbol of a vibrant gaming culture, this establishment strikes a perfect balance between the classic essence of casino gaming and the innovation of digital age technology.

Stepping into Inclave Casino, one is greeted by an atmosphere that perfectly combines luxury and excitement. The beautifully decorated interior captures the spirit of elegance, with opulent chandeliers illuminating the space, intricate gold detailing along the walls, and plush, comfortable seating. Yet, amid this lavish setting, the thrill of the gamble pulses through the air, creating an exhilarating environment that invites visitors to engage in their favorite games.

The casino’s gaming floor is an awe-inspiring sight, presenting a grand assortment of traditional and modern games. Row upon row of slot machines fill the air with their playful, chiming melodies. Each machine offers a unique theme, from classic fruit designs to more adventurous concepts, ensuring that there’s something for everyone.

Table games are plentiful at Inclave, with numerous variations of poker, blackjack, baccarat, and roulette available. High-quality felt tables, impeccably maintained, and attended by professional dealers lend credibility and sophistication to the gaming experience. Whether a novice or a seasoned pro, the games are accessible to all, fostering an inclusive gaming community.

Poker at Inclave Casino

The Inclave Casino also boasts a world-class poker room, offering high-stakes games for the more serious players. These rooms have become a popular hub for both local and international poker enthusiasts, hosting a multitude of tournaments throughout the year.

What sets Inclave Casino apart is its innovative incorporation of technology. Reflecting the digital era, the casino has integrated modern tech solutions to enhance the gaming experience. Biometric identity verification ensures secure transactions, while digital game variants offer an alternative for tech-savvy players. Inclave has even introduced a digital currency system, allowing players to easily manage their gaming funds electronically. This symbiosis of tradition and innovation sets the benchmark for the future of the gambling industry.

Inclave Casino also offers an impressive array of dining options. Visitors can savor a wide range of cuisines at the establishment’s premium restaurants, from gourmet meals to comfort food. The casino’s cocktail bars offer an assortment of expertly crafted drinks, perfect for unwinding after a thrilling session on the gaming floor.

Entertainment

In terms of entertainment, Inclave Casino pulls out all the stops. Regular live music performances, comedy shows, and other events offer a rounded entertainment experience, providing visitors with more than just gaming. The casino’s dedication to providing diverse entertainment options helps to create an environment that caters to a broad audience.

Moreover, the casino prides itself on responsible gaming, promoting a healthy balance between gambling for entertainment and maintaining financial control. Inclave Casino has made it its mission to provide a safe and responsible environment for all players, with staff trained to identify and help manage problem gambling behavior. This commitment to responsible gaming reflects the casino’s values and adds another layer of trustworthiness to its brand.

In terms of customer service, Inclave Casino leads by example. With a highly trained staff always ready to assist, the casino ensures that all visitors receive a first-class experience. Be it a question about the games, help with reservations, or simply a need for recommendations, the staff handles all queries with the utmost professionalism.

Inclave Casino is more than a gambling establishment; it’s an institution that upholds the heritage of traditional gaming while forging a path for future innovations. It brings together diverse groups of people, all united by their love for gaming, in an environment that is luxurious, inclusive, and progressive.

Does Inclave Casino accept crypto?

Inclave Casino does not currently accept wagers in cryptocurrencies. If you’d like to gamble in crypto, you should use an online crypto casino, such as Wolf Bet.

Summary

In summary, Inclave Casino isn’t just about winning or losing; it’s about the experience of the game, the thrill of the gamble, and the joy of shared entertainment. It’s a shining example of how the classic and the modern can coexist, creating a rich and vibrant tapestry that satisfies all senses. It’s not just a casino; it’s a destination – a place where people come for the games but stay for the atmosphere, the service, and the total experience.

Atomic Wallet, a decentralized and noncustodial crypto wallet, is under scrutiny following reports of significant losses from users on Twitter. Being a noncustodial platform, users bear the responsibility for the security of their assets.

In response to the reported attacks, Atomic’s team posted on Twitter on June 3, stating: “We are aware of compromised wallets. We’re making every effort to investigate and understand the situation, and we’ll share updates as we learn more.” Some users responding to this post allege that their funds have been entirely wiped out from the application.

ZachBTX, an on-chain investigator known for tracing stolen funds, has joined the investigation. Despite these efforts, the specifics of the attack remain unclear. Atomic Wallet boasts a user base of over 5 million.

Several Twitter users shared past experiences of having their funds stolen on Atomic Wallet. One user claimed, “I lost my BTC to Atomic 6 months ago. Despite my complaints, they merely reiterated password and seed phrase protection. I told them it wasn’t feasible! I’ve decided to stop using Atomic after this experience.”

This incident adds to a burgeoning list of weekly crypto hacks. Jimbos Protocol, a decentralized finance (DeFi) application, fell victim to an attack on May 28, losing 4,000 Ether valued at about $7.5 million. Additionally, Tornado Cash, a decentralized crypto mixer, was recently compromised when an attacker manipulated the protocol’s governance system.

A 2022 report from Chainalysis estimated crypto thefts totaling $3.8 billion, primarily from DeFi protocols and North Korea-affiliated attackers. TRM Labs’ analysis for Q1 2023 showed a decrease in the average size of hacks to $10.5 million, down from nearly $30 million in Q1 2022. However, TRM Labs warns this dip might be temporary and large-scale attacks could again raise the average.

As cryptocurrencies continue to reshape the landscape of global finance, a steadily increasing number of people are seeking ways to tap into this burgeoning digital economy. For UK-based investors, understanding which exchanges are most suitable is paramount to success.

With the plethora of options available, this article aims to highlight the three best crypto exchanges in the UK, detailing their standout features, security protocols, and suitability for various types of investors.

1. Binance

Arguably the most popular cryptocurrency exchange worldwide, Binance has also established a substantial user base in the UK. Its comprehensive platform offers an array of features that caters to both novices and seasoned traders.

Breadth and Depth of Market: Binance offers over 500 cryptocurrencies for trading, including Bitcoin, Ethereum, and Binance Coin (BNB), its native cryptocurrency. It also provides a plethora of trading options, including spot trading, futures contracts, and leveraged tokens.

User-friendly Interface: With its intuitive user interface, Binance caters well to beginners. For more experienced traders, its advanced charting tools offer an opportunity to conduct sophisticated technical analyses.

Security: Binance employs state-of-the-art security measures, including multi-factor authentication and an advanced risk control system. It also operates an insurance fund named SAFU (Secure Asset Fund for Users), providing an extra layer of protection.

Educational Resources: For beginners, Binance offers an extensive learning platform, Binance Academy, packed with articles, videos, and quizzes covering the basics of blockchain and cryptocurrencies.

2. Kraken

Since its inception in 2011, Kraken has become one of the most reliable and secure digital currency exchanges globally. Its top-tier liquidity and extensive range of cryptocurrencies make it an excellent choice for UK investors.

Trading Options and Currency Pairs: Kraken provides over 50 cryptocurrencies for trading and several fiat currency pairings, including GBP. It supports various trading types, such as spot, futures, and margin trading.

Security: Known for its emphasis on security, Kraken has never been breached since it started operations. It deploys robust security protocols such as two-factor authentication, encryption, and cold storage for funds.

Transparency: A distinguishing feature of Kraken is its commitment to transparency. It was one of the first exchanges to provide proof-of-reserves audits, ensuring customer deposits are properly backed.

User Support: Kraken offers excellent customer support, including live chat and a comprehensive FAQ section. It also features a beginner-friendly guide on its platform.

3. eToro

eToro’s unique proposition lies in its fusion of traditional financial trading and the cryptocurrency market. This social trading platform allows UK investors to trade cryptocurrencies while leveraging the insights and strategies of other successful traders.

Social Trading: Users can mimic trades made by experienced traders through eToro’s “CopyTrading” feature. This function is particularly useful for beginners looking to learn from seasoned investors.

Selection of Cryptocurrencies: While eToro doesn’t offer the vast number of cryptocurrencies like Binance or Kraken, it does provide a selection of the most popular ones, such as Bitcoin, Ethereum, and Litecoin.

Ease of Use: eToro’s user interface is clean and simple to navigate, making it ideal for novice traders. The platform also allows trading in stocks and commodities, offering users a gateway to more traditional markets.

Regulated Platform: eToro is regulated by the Financial Conduct Authority (FCA) in the UK, which enhances its credibility and reliability for users.

Summary

In conclusion, while Binance, Kraken, and eToro all offer strong features, the best choice when it comes to crypto exchanges in the United Kingdom depends on individual needs. If you’re a beginner, the comprehensive educational resources and user-friendly interface of Binance, or the social trading aspect of eToro, might appeal to you.

For seasoned traders, the advanced features and depth of cryptocurrencies offered by Binance and Kraken are likely more attractive. Remember, in the world of cryptocurrencies, due diligence and research are your best allies.

AI has been dominating tech and business headlines in recent months, with ChatGPT in particular creating an unprecedented amount of buzz surrounding artificial intelligence.

Paul Farhi, the founder of Solidus AI Tech, recently shared his insight on the advent of blockchain-based artificial intelligence, highlighting its practical differences to more conventional AI.

Speaking exclusively to Crypto Intelligence News, Farhi highlighted the security benefits of blockchain-based AI.

“Blockchain-based systems are more resilient and less exposed to cyber vulnerabilities. They offer enterprise level traceability and a native blockchain revenue stream,” he told this publication.

“They offer a stronger level of encryption, more autonomy and more resilience.”

Solidus AI Tech is yet to launch its AI-related services – which will have applications in chat bots, sales and marketing automation, medical software, and autonomous vehicles – but they are scheduled to go live at some point in 2023.

“Our engineering team has already developed software modules to cover each vertical and we have a continuous research and development activity to sustain the demand,” Farhi added.

“We will also have an Artificial Intelligence market place where freelance developers or startups can publish their work into our platform under a revenue share business model.”

Asked about the risk of AI disrupting the labour market and causing mass redundancies, Farhi noted that certain jobs are at a greater risk of being made obsolete than others.

“AI has the potential to automate certain tasks and roles traditionally performed by humans, leading to changes in the job market,” he said.

“Routine and repetitive jobs are more susceptible to automation, while tasks requiring complex decision-making, creativity, and social interaction are less likely to be fully automated in the near future.”

Farhi stressed that AI will also create new employment opportunities and suggested that the mass adoption of AI-based solutions won’t necessarily result in a net loss of jobs.

“While AI may lead to job displacement in some areas, it can also create new job opportunities and change the nature of work.

“It has the potential to augment human capabilities, improve productivity, and unlock new industries and innovations.

“The overall impact of AI on the labor market will depend on various factors, including the pace of technological advancement, the ability of individuals and organizations to adapt, and the policies and regulations in place to address the challenges and opportunities presented by AI,” Farhi concluded.