Binance’s BNB Chain has introduced a new layer-2 chain called opBNB, aimed at addressing the scalability challenge faced by the blockchain.

The layer-2 scaling solution is built on the Optimism OP Stack, providing enhanced security and scalability to the Binance blockchain network. opBNB is an Ethereum Virtual Machine (EVM) compatible layer-2 chain, ensuring compatibility with Ethereum-based smart contracts, networks, and ERC-20 token standards.

One of the common issues faced by blockchains is network congestion and high fees during periods of increased demand. Currently, BNB Chain claims to support approximately 2,000 transactions per second with transaction costs around $0.10.

With opBNB, it can reportedly handle over 4,000 transfer transactions per second at an average transaction cost below $0.005.

opBNB offers various optimizations, including improved data accessibility, caching layer, and an adjusted submission process algorithm that allows simultaneous operations. It can increase the gas limit per block to 100 million, surpassing Optimism’s limit of 30 million.

Binance referred to opBNB as their solution to the scalability challenge that has hindered widespread adoption of blockchain technology.

Optimism’s use of Optimistic Rollups enables transaction scaling by presuming the validity of transaction data processed off the root chain until proven otherwise.

The RPC service layer simplifies integration through a user-friendly interface, allowing developers to focus on building applications without being concerned about the complexities of Layer 2 scaling.

However, some individuals, including Cinneamhain Ventures partner Adam Cochran, expressed skepticism about BNB Chain’s approach. Cochran mentioned that BNB Chain encountered scaling issues by centralizing an Ethereum fork and raising the gas limit to an unsafe level.

He proposed alternatives, such as joining Optimism as a “superchain,” becoming a layer-2 directly on Ethereum, or even a layer-3 on Optimism or Arbitrum.

Despite the debate surrounding opBNB, BNB Chain holds a prominent position in the blockchain space.

According to DefiLlama, it is the third-largest blockchain in terms of DeFi total value locked, trailing behind Ethereum and Tron. BNB Chain boasts a TVL of $3.38 billion, a 24-hour volume of $264 million, and approximately one million active daily users.

In summary, Binance’s BNB Chain has introduced opBNB, a layer-2 chain based on Optimism, to tackle scalability issues.

While there are differing opinions on the chosen approach, BNB Chain remains a significant player in the blockchain industry, attracting a substantial number of users and demonstrating considerable value in the DeFi space.

Other Stories:

Cardano founder joins search for extra-terrestrials

Elon Musk suspends ‘scam crypto account’ on Twitter

Crypto exchange criticised by FDIC for spreading misinformation

Grayscale Bitcoin Trust (GBTC) is approaching its highest levels of 2023 following the filing of a Bitcoin spot price exchange-traded fund (ETF) by BlackRock, the world’s largest asset manager.

The news has generated institutional buying interest in GBTC, the original institutional BTC investment vehicle.

According to data from CoinGlass, on June 17, GBTC came close to reaching new 2023 highs.

This rally comes as Bitcoin market sentiment experienced a modest improvement with the anticipation that BlackRock’s ETF filing could potentially overcome the legal obstacles that have hindered similar ETFs in the United States.

Meanwhile, there are signs of optimism beyond sentiment as GBTC’s long-standing discount to BTC spot prices narrows.

The discount, often referred to as a negative “premium,” is currently at -36.6%, a significant improvement compared to the discount of around -44% observed on June 13. While still discounted, GBTC is trading closer to zero than it has been at almost any other time this year.

Many observers believe that if BlackRock’s ETF is approved, GBTC will be the primary beneficiary. Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, expressed optimism about the prospects of BlackRock’s offering gaining regulatory approval and its potential to resolve GBTC’s discount alongside industry growth.

The BlackRock move has sparked debates as to whether it can be classified as an ETF. Some argue that it will resemble a trust similar to GBTC, while others, including Cochran, believe it qualifies as an ETF under the Securities Act of 1933. Regardless of the classification, investor interest in GBTC is rising in response to BlackRock’s filing.

Hedge fund North Rock Digital announced that it has been consistently accumulating more shares of Grayscale trusts in recent weeks.

It expects significant upside potential if Grayscale wins and minimal downside risk if they lose. Another major holder, ARK Invest, has not yet increased its exposure to GBTC, and data from Cathie’s ARK confirms a gradual decline in their holdings throughout 2023.

Overall, the prospect of BlackRock’s involvement in the cryptocurrency market has stimulated the demand for GBTC and boosted market sentiment.

The narrowing of GBTC’s discount suggests growing confidence among investors, while the debate surrounding the classification of BlackRock’s product highlights the evolving regulatory landscape surrounding cryptocurrency ETFs.

Other Stories:

Crypto trading platform suspends trading of SOL, MATIC, and ADA

BUSD plummets down stablecoin rankings

SEC addresses enforcement action against Binance and Coinbase

The International Monetary Fund (IMF) has unveiled plans for an innovative cross-border payment system, using a unified ledger for recording transactions involving central bank digital currencies (CBDCs).

The proposed system, announced during a CBDC policy roundtable co-organized with the central bank of Morocco, promises enhanced programmability and information management.

Named the XC (cross-border payment and contracting) platform, this system could facilitate both individual and institutional users with its potential to reduce fees and expedite transaction times.

According to Tobias Adrian, the IMF’s Director of the Monetary and Capital Markets Department, the platform could help central banks perform functions such as intervening in foreign exchange markets, aggregating capital flow data, and resolving disputes. Additionally, it could be adapted for domestic retail and wholesale CBDCs.

The platform’s blueprint, detailed in an IMF Fintech Note, emphasizes a “trusted single ledger” for exchanging standardized digital representations of central bank reserves in any currency.

The XC platform is built on the CBDC infrastructure model, incorporating a settlement layer with a single ledger whose accessibility is to be expanded.

Unlike the current system where institutions need a reserve account with a central bank for cross-border operations, the XC platform would facilitate trading of tokenized domestic central bank reserves, with liquidity still sourced from institutions with reserve accounts.

The platform will feature a programming layer allowing for service innovation and customization, and an information layer containing anti-money laundering (AML) details crucial for trust and privacy protection.

Notably, it would not necessitate the use of CBDCs, offering interoperability among assets and money tokenized by the private sector.

By programming financial contracts within a safe environment, the platform could instill standards and promote trust, with settlements executed in central bank money.

The idea parallels a concept proposed by Bank for International Settlements General Manager, Agustín Carstens, in his speech delivered in February. The IMF believes that these efforts could redirect some of the $45 billion spent on remittance providers each year back to the individuals in need.

Other Stories:

Cardano founder joins search for extra-terrestrials

Binance takes legal action against ‘Binance Nigeria Limited’

Crypto exchange criticised by FDIC for spreading misinformation

Binance, one of the world’s largest cryptocurrency exchanges, has taken action against a fraudulent Nigerian entity known as Binance Nigeria Limited. Changpeng Zhao, the CEO of Binance, announced on Twitter that the company has officially issued a cease and desist notice to the fraudulent entity.

This move comes after the Nigerian Securities and Exchange Commission (SEC) released a circular declaring the illegality of Binance Nigeria Limited operating within the country.

Binance responded to the SEC’s circular by stating that the entity mentioned in the document is not affiliated with the company.

A Binance spokesperson expressed their intention to seek clarity from the Nigerian SEC and reiterated the company’s commitment to cooperating with the commission in determining the next steps.

However, it is worth noting that Binance is currently facing legal challenges from the United States Securities Exchange Commission (SEC).

The U.S. SEC has filed 13 charges against Binance entities and Changpeng Zhao, accusing them of operating as an unregistered exchange, broker-dealer, and clearing agency, as well as misrepresenting trading controls.

The U.S. SEC claims that despite earning $11.6 billion from U.S. customers, Binance and Zhao failed to register as required.

In a recent development, U.S. Judge Amy Berman Jackson approved an agreement between Binance.US, Binance’s U.S.-based subsidiary, and the U.S. SEC. This agreement resulted in the dismissal of a previous temporary restraining order that sought to freeze all Binance.US assets.

Binance, which operates in approximately 100 countries, established its headquarters in the Cayman Islands in 2017.

It also registered a subsidiary in Seychelles in 2019. Despite these legal challenges, Binance continues to provide its services to users around the world, and the company’s spokesperson emphasized their commitment to regulatory compliance and cooperation with relevant authorities.

The situation involving Binance Nigeria Limited highlights the importance of regulatory oversight in the cryptocurrency industry.

Other Stories:

BUSD plummets down stablecoin rankings

USDT suffers de-pegging concern after 3pool imbalance

Crypto trading platform suspends trading of SOL, MATIC, and ADA

The Bank of England (BoE) has taken a significant step towards the launch of its central bank digital currency, nicknamed “Britcoin,” following the completion of a trial study called Project Rosalind.

In July 2022, the BoE and the Bank for International Settlements launched this joint experiment to investigate the implementation of application programming interfaces (APIs) in retail central bank digital currency (CBDC) transactions.

It examined the integration of CBDCs on smartphones, in retail stores, and online platforms. Furthermore, it delved into the concept of “programmability,” which involves customizing digital money to behave in specific ways based on predefined conditions.

A report released on June 16 summarized the second phase of Project Rosalind, revealing that a CBDC could make person-to-person payments cheaper and more efficient.

Additionally, it highlighted the potential for businesses to develop innovative financial products that combat fraudulent activities.

The study focused on the development of 33 API functionalities and explored over 30 use cases for retail CBDC.

During Politico’s Global Tech Day conference, Cunliffe rated the likelihood of a CBDC project proceeding at “seven out of ten.”

CBDC programmability has faced skepticism, with critics suggesting that it could be programmed to work against its users.

In summary, with the completion of Project Rosalind, the launch of the BoE’s central bank digital currency, known as ‘Britcoin,’ is drawing nearer.

Francesca Road, the head of the BIS London Innovation Hub, stated, “The Rosalind experiment has advanced central bank innovation in two key areas: by exploring how an API layer could support a retail CBDC system and how it could facilitate safe and secure CBDC payments through a range of different use cases.”

Despite the positive findings from Project Rosalind, BoE Deputy Governor Jon Cunliffe cautioned that a final decision on launching a CBDC in the country is still several years away.

Simultaneously, on the day of the Project Rosalind findings’ release, enterprise blockchain firm Quant Network announced its participation as a vendor in the study.

This announcement had a positive impact on the price of Quant’s native QNT token.

The study highlighted the potential benefits of CBDCs in facilitating cost-effective and efficient peer-to-peer payments, while also enabling the development of innovative financial products to counter fraudulent activities. However, the final decision on launching a CBDC in the UK is still expected to take several years.

However, the study concluded that a well-designed API layer could enable central banks to collaborate with the private sector and securely provide retail CBDC payments.

Other Stories:

USDT suffers de-pegging concern after 3pool imbalance

The past week proved to be bearish for the top 100 DeFi tokens, as a majority of them experienced a decline in value. However, one event in particular triggered concerns about the stability of Tether (USDT), the popular stablecoin.

On June 15, an imbalance occurred in Curve Finance’s 3pool, leading to a potential depegging scare for USDT as its weightage in the pool surged above 70%.

This resulted in a significant amount of selling pressure. In response to the situation, Tether’s chief technology officer downplayed the fears of depegging, referring to the market conditions as stress tests for the stablecoin and dismissing the “FUD” (fear, uncertainty, and doubt) surrounding the issue.

Another noteworthy event involved a crypto trading bot that borrowed a substantial amount of $200 million to execute arbitrage trades but only managed to generate a meager profit of just over $3.

This highlights the risks and challenges faced by automated trading systems in the volatile cryptocurrency market.

Meanwhile, Uniswap, a prominent decentralized exchange protocol, unveiled its version 4 code on June 13, opening up possibilities for the introduction of new liquidity pools.

This development aims to enhance the functionality and user experience of the platform.

However, not all news was positive in the DeFi space. Sturdy Finance, a DeFi lending platform, suffered a loss of $800,000 through a draining incident. In an effort to recover the funds, the platform’s team offered a $100,000 bounty for their return.

They also reopened their stablecoin market on June 16. Additionally, the Hashflow protocol experienced an exploit resulting in a loss of $600,000. Nevertheless, Hashflow assured its users that they would be fully compensated for their losses.

The overall sentiment in the DeFi market remained bearish, with most of the top 100 tokens trading at their lowest levels in three months.

This downward trend reflects the prevailing market conditions and highlights the volatility and inherent risks associated with cryptocurrency investments.

In summary, the imbalance in Curve Finance’s 3pool, which caused concerns about the stability of Tether’s peg to the US dollar, was a significant event in the past week’s DeFi landscape.

Despite the challenges faced by the industry, developments like the release of Uniswap’s version 4 code continue to drive innovation in the decentralized finance space.

However, incidents of platform exploits and losses underscore the importance of robust security measures and risk management strategies in the DeFi ecosystem.

Other Stories:

Tether responds to controversy over accounts deactivation

Nike set to release NFT collection with Fornite

OKX Middle East Receives MVP Preparatory License From VARA in Dubai

Avraham Eisenberg, the individual accused of orchestrating a massive theft of approximately $116 million from the decentralized exchange Mango Markets, is set to face trial in the United States on December 4.

The trial date was established by Judge Richard Berman of the U.S. District Court for the Southern District of New York, as indicated by court records filed on June 14.

Eisenberg stands accused of executing a significant exploit on Mango Markets in October 2022, resulting in the pilfering of governance tokens MNGO, USD Coin (USDc), and Marinade Staked SOL (mSOL).

He has pleaded not guilty to three criminal charges, including commodities fraud, commodity manipulation, and wire fraud, all connected to the Mango Markets exploit.

In October 2022, the platform reported that Eisenberg had returned around $67 million of the funds. At the time, he claimed that his actions were legal and part of a “highly profitable trading strategy.”

Both the U.S. Attorney’s Office and Eisenberg’s defense team have until June 22 to present pretrial motions concerning the trial schedule.

Additionally, Eisenberg faces separate civil lawsuits filed in January by the Commodity Futures Trading Commission, Securities and Exchange Commission, and Mango Markets.

Since his arrest in Puerto Rico in December 2022 and subsequent transfer to Oklahoma, the alleged Mango Markets exploiter has remained largely silent on his Twitter account.

Following a hearing in February, during which he waived his right to bail, he has been primarily held in U.S. custody.

The upcoming trial will determine the outcome of the criminal charges brought against Eisenberg.

It will shed further light on the allegations surrounding the Mango Markets exploit and provide an opportunity for the legal system to assess the evidence and arguments presented by both sides.

Other Stories:

Tether responds to controversy over accounts deactivation

Nike, the renowned footwear and apparel giant, has hinted at the possibility of releasing a collection of sneaker nonfungible tokens (NFTs) within the popular online game Fortnite, developed by Epic Games.

This move could potentially open up a significant opportunity for the adoption of Web3 technology among traditional gamers. Fortnite boasts an impressive user base, with over 242.9 million active players in the last 30 days, according to Active Player data.

On June 16, Nike made an announcement on its social media platforms, revealing that the “ultimate Sneakerhunt” would commence on June 20. Accompanying this announcement was a brief video featuring the prominent Air Max logos of both Fortnite and Nike against a backdrop of floating clouds in the sky. The video also showcased the name of the sneaker hunt, “Airphoria,” and presented Nike’s Web3 platform logo, .Swoosh, alongside the Unreal Engine logo of Epic Games.

Although details are scarce at this point, members of the NFT community speculate that Nike may have developed an NFT-related game using Fortnite Creative 2.0. This new feature allows users to create their virtual island game maps utilizing Fortnite assets.

A Twitter user noted that Nike had previously created a game on ROBLOX, but it did not involve NFTs. Therefore, the integration of .Swoosh in Airphoria suggests a potential NFT connection. Furthermore, Epic Games has shown a favorable stance toward NFT gaming.

Nike’s NFT division has been actively working to establish a presence in the traditional gaming space. On June 1, .Swoosh announced its intention to integrate NFTs into games developed by EA Sports, the company responsible for the immensely popular Fifa soccer game franchise and other titles. However, the specific EA Sports games that will incorporate Nike NFTs have yet to be confirmed.

The upcoming Airphoria sneaker hunt in Fortnite showcases Nike’s ongoing efforts to embrace Web3 and explore the possibilities of NFTs in the gaming industry. By leveraging the massive player base of Fortnite, Nike aims to engage a wider audience and introduce them to the world of digital collectibles. As the partnership between Nike, Epic Games, and EA Sports continues to unfold, it will be intriguing to see how NFTs become integrated into the gaming experience, shaping the future of both industries.

Other Stories:

Tether responds to allegations about its reserves

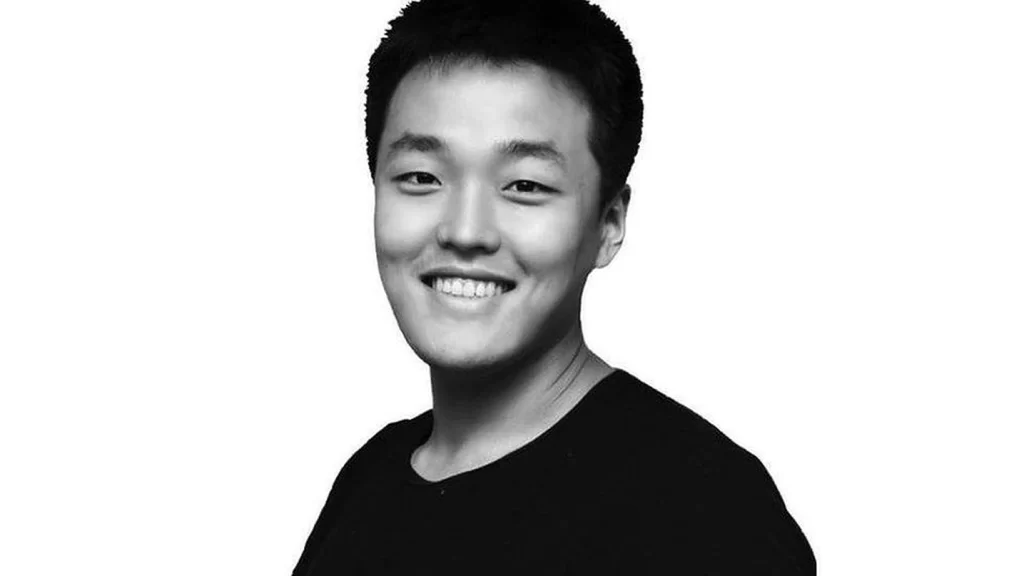

Cryptocurrency entrepreneur Do Kwon, the creator of the failed Terra (UST) stablecoin, appeared in court in Podgorica, Montenegro, facing charges of forging official documents. Meanwhile, a U.S. judge presided over a hearing to determine whether the digital assets produced by Terraform Labs constituted securities. This pivotal question forms the crux of the U.S. Securities and Exchange Commission’s (SEC) fraud case against the company and its founder.

Terraform Labs and Kwon were responsible for two cryptocurrencies that caused significant disruption in global crypto markets last year. They have requested U.S. District Judge Jed Rakoff in Manhattan to dismiss the SEC’s allegations, which assert that they defrauded investors by selling billions of dollars in unregistered securities.

TerraUSD, an algorithmic stablecoin designed to maintain a 1:1 peg to the U.S. dollar, derived its value from another paired token called Luna. Both tokens suffered a substantial loss in value when TerraUSD, also known as UST, fell below its dollar peg in May 2022. Prior to this collapse on May 9, TerraUSD boasted a market capitalization exceeding $18.5 billion, ranking it as the 10th-largest cryptocurrency.

The SEC’s complaint alleges that Terraform Labs and Kwon deceived investors regarding the stability of UST while falsely claiming that their crypto tokens would appreciate in value.

During the hearing, Judge Rakoff raised doubts about whether the offering of Terraform Labs’ Anchor protocol, which promised returns of up to 20% on TerraUSD deposits, should be considered a security. He questioned the nature of this protocol, highlighting that it was exclusive to those who had taken the initial step. Consequently, he pondered why it shouldn’t be regarded as a securities contract.

Terraform Labs and Kwon argue for the dismissal of the case, asserting that their digital assets do not meet the criteria to be classified as securities. Furthermore, they maintain that the SEC lacks the authority to regulate the industry.

The outcome of this legal battle will undoubtedly have significant implications for the cryptocurrency sector, as it could potentially establish important precedents regarding the classification of digital assets as securities. The ruling will shape the future regulatory landscape and provide clarity to market participants and investors alike.

Other Stories:

Sturdy Finance, a decentralized finance (DeFi) platform, recently endured an exploit that led to the temporary suspension of its stablecoin market. The lending platform, on June 16, reinstated the stablecoin market, enabling users to regain access to their assets.

The precautionary halt was emphasized as a measure of “an abundance of caution,” assuring users that their funds were never jeopardized.

The exploit, which cleverly manipulated a flawed price oracle, led to significant drain of funds from Sturdy’s platform.

Post-exploit, the team at Sturdy Finance is engaging in collaborative efforts with security specialists, focusing on on-chain analysis to reclaim the lost funds. An alliance with global law enforcement has been formed to aid in information collection and potential asset recovery.

To incentivize the return of the funds, Sturdy Finance has proposed a bounty of $100,000 to the perpetrator. The DeFi protocol’s team pledged to put the issue to rest if the stolen funds are returned to their crypto wallet. If this fails to occur, the same bounty is offered to anyone who can aid in either arresting the hacker or recovering the stolen funds.

Simultaneously, as digital theft grows in complexity, hackers are devising increasingly cunning techniques to obscure their ill-gotten wealth. According to a report by blockchain analytics company, Chainalysis, published on June 15, hackers have been found utilizing mining pools to camouflage their stolen assets.

This method transforms the stolen funds into what appears to be legitimate earnings from mining activities, effectively diverting suspicion from illicit ransomware activities.