Bitcoin’s influence in West Africa is particularly prominent in Nigeria, a key player in the region’s economic landscape.

Yet, amid growing anti-French sentiment, French-speaking West African nations are also witnessing a surge in Bitcoin-related activities.

Senegal has inaugurated Bitique, its inaugural physical Bitcoin exchange and educational hub. Additionally, a Bitcoin Forum is scheduled for December in Dakar, Senegal’s capital.

Notably, a local Bitcoin advocate, Nourou, manages an autonomous Bitcoin node via satellite technology.

Meanwhile, Benin, located west of Nigeria, is preparing for its first exclusive Bitcoin Mastermind conference.

This pioneering event will unite local crypto enthusiasts and entrepreneurs from groups like Izichange, GoesPay, and Flash, fostering a space for Bitcoin education.

Nourou, founder of Dakar Bitcoin Days and Bitcoin Senegal, and Loïc Kassamoto, creator of Bitcoin Mastermind, offer insight into West Africa’s crypto evolution.

These French-speaking countries are beholden to the West African CFA franc currency, a remnant of colonialism.

Dissatisfaction with this currency has amplified anti-French sentiment, evidenced by recent public demonstrations and actions like Mali’s abandonment of the French language.

READ MORE: FTX Founder Seeks Release for Defense Collaboration

The region is witnessing a surge in alternative currency initiatives, with Bitcoin gaining traction as a savings mechanism and medium of exchange.

In contrast to online discussions in the West, West African countries prioritize in-person meetups for financial discourse.

Although the pandemic temporarily shifted discussions to virtual platforms, a post-pandemic resurgence of physical spaces is underway.

Kassamoto highlights the significance of real-world interactions in advancing financial literacy and demonstrating Bitcoin’s potential in West Africa. He emphasizes the role of conferences, meetups, and stores in educating and engaging the community.

Nourou has established Bitique as Dakar’s inaugural physical Bitcoin store, not only facilitating cryptocurrency transactions but also offering in-person educational programs. Moreover, Bitcoin Senegal’s “Baol Digital Kids” initiative imparts Bitcoin and Lightning Network usage to children.

Across borders in Benin, Kassamoto and his peers maintain one of the country’s first Bitcoin nodes.

While Bitcoin adoption grows, Kassamoto acknowledges associated risks due to the broader crypto space’s challenges.

He distinguishes Bitcoin from other cryptocurrencies and underscores the importance of the West African community’s grasp of this distinction.

Bitcoin meetups continue to expand, providing platforms to differentiate Bitcoin from the broader crypto market.

Notably, the Central African Republic’s adoption of Bitcoin as legal tender garnered attention, though its subsequent development of Sango Coin and experimentation with asset tokenization diverted focus.

Ghana will also host a significant Bitcoin and educational conference this year, contributing to the ongoing Bitcoin education drive in West Africa.

Other Stories:

Bybit Unveils NFT Collection as Part of Velocity Series

Global Disparities in Bitcoin Mining Costs Highlighted: From $208,560 in Italy to $266 in Lebanon

SEC Lawsuit Stifles XRP’s US Adoption Potential, Pro-XRP Advocate Asserts Amid Coinbase’s Moves

Cryptocurrency influencer Evan Luthra has initiated a legal battle against Bitget, a crypto exchange, alleging the freezing of his account following a new token listing in March.

Luthra asserts that his withdrawal requests were halted and approximately $200,000 in Tether was locked up while his attempts to gain clarity were met with silence.

This incident is intertwined with Luthra’s association with the Reel Star project.

He had been engaged as an advisor to Reel Star, a startup dedicated to a social media app for content creators.

As part of his compensation, Luthra received Reel Token (REELT), the project’s utility token. Following its listing, Luthra sold 1.3 million REELT tokens on Bitget.

However, this action led to the suspension of his account over suspicions of market manipulation.

Bitget’s spokesperson disclosed, “Bitget faced a manipulative attack by a group of traders attempting to profit by manipulating trades on the exchange.”

Bitget claims to have reached out to Luthra for an explanation, but despite admitting to the token sale, he reportedly failed to provide a satisfactory reason for the behavior.

Luthra contends his innocence, referencing alleged approval from Reel Star’s co-founder Navdeep Sharma for the token sale.

Seeking $16 million in damages and the release of his $200,000 held by Bitget, Luthra filed a lawsuit against the exchange, Foresight Ventures, and key executives.

He argued that Bitget unjustly restricted his tokens, which he had acquired through legitimate means.

READ MORE: Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Gracy Chen, Bitget’s managing director, stated that the exchange prioritizes user protection and undertakes immediate action against illegal activities.

Bitget unveiled an investigation into the matter, disclosing findings and a compensation plan for over 500 affected clients.

The exchange’s response clarified, “After our investigation, we believe the account mentioned has been involved in suspicious trading behaviors on Bitget.”

The cryptocurrency community exhibited mixed reactions on platforms like X (formerly Twitter). While some supported Luthra, highlighting challenges faced by users of centralized exchanges, others defended Bitget’s actions as protective of users’ interests.

Well-known figures within the crypto space, including Changpeng Zhao, CEO of Binance, also chimed in on the dispute.

At present, Bitget’s CEO Chen notes that the exchange was unaware of the lawsuit. Evan Luthra contends he was merely a token recipient for consultation and should not be deemed a part of the project team.

The ongoing case underscores the evolving complexities of the crypto landscape and the vital role of exchanges in maintaining security and fairness.

Other Stories:

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Stellar Development Foundation Invests in MoneyGram International

The United States House of Representatives Democrats have taken a proactive step towards the regulation of artificial intelligence (AI) by establishing an AI working group.

Comprising 97 members, the New Democrat Coalition unveiled this group on August 15th.

Their primary goal is to collaborate with President Joe Biden’s administration, stakeholders, and representatives from both sides of the political spectrum to construct sensible and bipartisan regulations for the rapidly growing AI sector.

With an emphasis on nurturing AI’s potential for economic growth, the working group acknowledges the importance of safeguarding the workforce.

They are dedicated to devising strategies that will protect individuals whose jobs might be threatened by the rise of AI-driven technologies, ensuring that they can remain employed.

Heading this initiative is Representative Derek Kilmer, who will serve as the chair of the AI working group.

Kilmer highlighted the pressing concern regarding the dissemination of misinformation and the proliferation of sophisticated AI-generated deepfakes across the internet.

He expressed the urgency of addressing these issues, emphasizing the need for Congress to swiftly grasp the intricacies of such matters to effectively counteract them.

The AI working group’s intentions align with the broader sentiment expressed by various stakeholders, including legislators, academics, and prominent tech CEOs.

READ MORE: Voyager Digital’s Massive Token Transfers Spark Speculation of Impending Sell-Off

Recognizing the potential risks associated with unchecked AI advancements, Vice President Kamala Harris and senior advisors under President Biden convened with industry CEOs in May.

This meeting aimed to discuss the inherent dangers AI poses and explore ways to mitigate them.

Furthermore, President Biden, acknowledging the significance of AI, convened a meeting in June with leading AI experts in Silicon Valley.

This meeting served as a platform for thorough deliberation on the potential hazards brought about by AI’s rapid evolution and strategies to manage and regulate its growth.

In conclusion, the United States House of Representatives’ Democrats have formed an AI working group composed of 97 members, aimed at responsibly shaping AI legislation.

Their collaborative approach, involving various stakeholders, seeks to harness AI’s benefits while addressing concerns about misinformation and deepfakes.

These efforts align with recent discussions led by Vice President Kamala Harris and President Joe Biden, underlining the growing recognition of the need to regulate and manage the risks associated with AI advancements.

Other Stories:

Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

A consortium of six accomplished legal experts, specializing in the realm of securities law and its interconnected domains, have formally presented an amicus brief in a show of support for cryptocurrency exchange giant, Coinbase.

This legal endeavor takes place within the context of Coinbase’s ongoing legal tussle with the United States Securities and Exchange Commission (SEC).

In the sphere of law, an amicus brief is a significant document filed in court by an entity that is not directly enmeshed in the specific litigation.

The primary purpose of such a document is to contribute auxiliary arguments to one side of the case.

Notably, it underscores the far-reaching implications of the case beyond just the immediate litigants.

This collective of legal scholars submitted their amicus brief to the U.S. District Court for the Southern District of New York on August 11th.

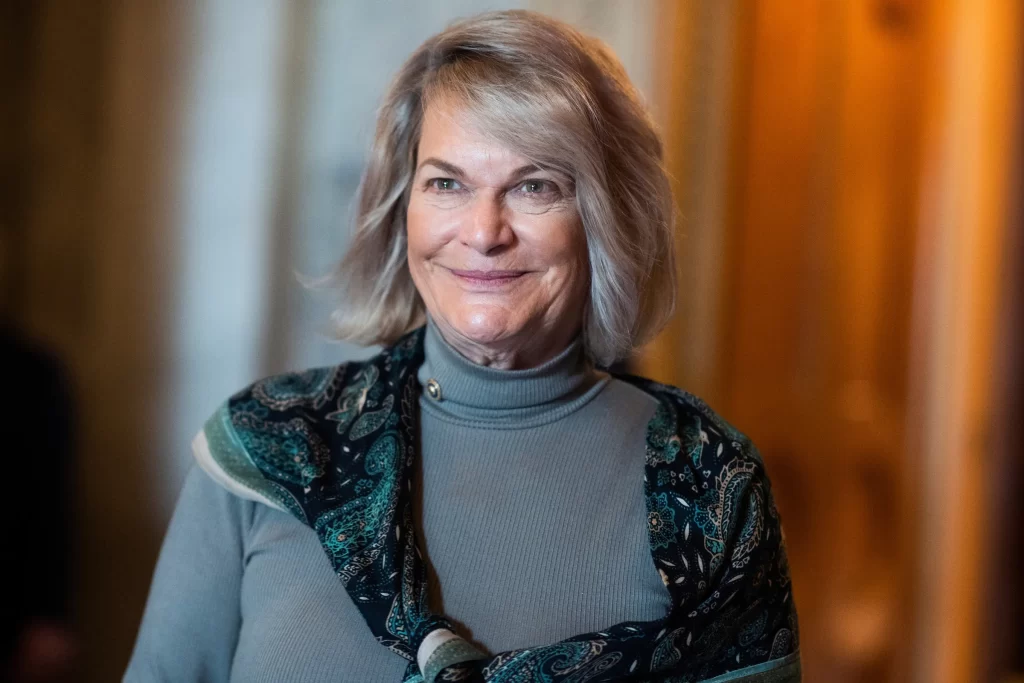

Coinciding with this development, Senator Cynthia Lummis also extended an amicus brief in favor of the cryptocurrency exchange.

The cadre of scholars participating in this filing includes renowned names like Stephen Bainbridge from the University of California, Los Angeles; Tamar Frankel representing Boston University School of Law; Sean Griffith hailing from Fordham University School of Law; Lawrence Hamermesh associated with Widener University’s Delaware Law School; Matthew Henderson linked with the University of Chicago Law School; and Jonathan Macey, a distinguished personality from Yale Law School.

Within their filing, these scholars assert that established federal legal precedents and the well-regarded Howey test collectively recognize that investment agreements inherently entail expectations of business-generated income, profits, or assets.

In light of this, they beseech the court to uphold the recognized legal definition of an “investment contract” when interpreting the boundary of its application.

READ MORE: Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Elaborating on this, they elucidate that for an investment contract to be in play, investors must be assured, by virtue of their investment, an ongoing contractual claim to the enterprise’s income, profits, or assets.

In the documentation, the scholars delve into an examination of pertinent cases that bolster their stance.

Importantly, these legal scholars explicitly emphasize that their connections to various universities or law schools hold no bearing on their involvement in the amicus brief.

In summation, the collaborative effort of these accomplished legal minds underlines a poignant testament to the complexity and significance of the ongoing legal dispute between Coinbase and the SEC, while striving to elucidate the intricate legal frameworks that encompass this scenario.

Other Stories:

Curve Finance Vows Reimbursement After $62 Million Hack

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

Voyager Digital, the cryptocurrency lender that recently filed for bankruptcy, has made significant token transfers raising eyebrows within the crypto sphere.

On August 11th, according to Etherscan, the company sent 1,500 Ether (ETH) valued at approximately $2.77 million and a staggering 250 billion Shiba Inu (SHIB) tokens worth about $2.7 million to Coinbase, a renowned crypto exchange.

The intention behind these sizeable transactions has ignited a wave of speculation throughout the cryptocurrency community.

One prevailing theory suggests the likelihood of a massive sell-off, stemming from the fact that these transfers have significantly depleted Voyager’s distressed wallet holdings to a mere $81.63 million in digital assets.

Notably, these transfers were executed at precise one-hour intervals, as recorded by Etherscan. This sudden movement of tokens has prompted intense discussions about the potential initiation of a liquidation process.

However, insider sources have countered these notions, asserting that Voyager is simply consolidating its tokens from various addresses into a central primary address for streamlined management.

The prevailing conjecture of an imminent sell-off gains traction from Voyager’s ongoing pattern of divestment in SHIB holdings since the commencement of 2023.

READ MORE: Curve Finance Vows Reimbursement After $62 Million Hack

A telling instance occurred in February when the company orchestrated a series of transfers totaling nearly $10 million worth of digital assets across several cryptocurrency exchanges in a single day.

These transfers encompassed an assortment of tokens, including 270 billion SHIB tokens valued at $3.2 million, 4.9 million Voyager Tokens (VGX) amounting to $2.1 million, 3,050 ETH equating to $3 million, and 221,000 Chainlink (LINK) tokens with a valuation of $1.5 million.

The context surrounding Voyager’s financial state is further accentuated by the backdrop of Binance.US’s legally sanctioned acquisition of the lender’s assets.

Blockchain analytics platform Lookonchain divulged that Voyager had liquidated an aggregate of over $56 million in digital holdings across three distinct cryptocurrency exchanges.

A mere three months later, the insolvent exchange continued its involvement in an intricate web of transactions, transferring approximately 350 billion SHIB tokens.

In summation, the recent movement of a significant volume of tokens by Voyager Digital, coupled with its prior divestment activities and the broader context of its financial status, has spurred vigorous speculation within the cryptocurrency domain.

The community keenly observes these developments for insights into the future trajectory of both Voyager Digital and the cryptocurrency market as a whole.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

United States Senator Cynthia Lummis, a well-known advocate for cryptocurrency, has lodged an amicus brief in support of Coinbase’s bid to have the U.S. Securities and Exchange Commission (SEC) lawsuit against the company dismissed.

An amicus brief is a legal document submitted to a court by a third party that isn’t directly involved in the case.

Its purpose is to provide additional arguments and perspectives in favor of one side of the legal dispute, often highlighting the wider implications of the case.

According to the filing on August 11 in the U.S. District Court for the Southern District of New York, Lummis underscored that the SEC’s action against Coinbase is far from an ordinary enforcement case.

She contended that the SEC’s lawsuit, alleging securities violations by Coinbase, seeks to establish significant control over the cryptocurrency sector, precisely when discussions about regulation and related matters are ongoing both in Congress and various governmental bodies.

Lummis emphasized that the authority to legislate in matters of such economic and political importance lies with Congress, not the SEC.

She criticized the SEC’s effort to exert extensive influence over crypto asset markets, particularly at odds with legislative proposals that propose distributing such authority to other agencies.

Lummis accused the SEC of trying to sidestep the political process and seize such power for itself.

Coinbase had filed its motion to dismiss on August 4, asserting that the SEC had acted against due process and deviated from its previous interpretations of securities laws by asserting jurisdiction over the exchange.

Lummis’s court submission further argued that the SEC has exceeded its boundaries by attempting to categorize nearly all crypto assets as securities.

READ MORE: FTX Debtors Clash with Creditors Over Asset Control Amidst Restructuring Plan

She questioned the agency’s regulatory approach, likening it to trying to make laws through enforcement actions, which she deemed beyond the SEC’s powers.

Lummis isn’t alone in supporting Coinbase through an amicus brief. Various crypto advocacy groups, such as the Blockchain Association, Crypto Council for Innovation, Chamber of Progress, and Consumer Tech Association, filed a collective brief on August 11.

These groups, in line with Lummis, stressed that the SEC’s authority is restricted to what Congress has granted it, expressing concerns over the potential misapplication of regulatory measures.

Marisa Tashman, senior counsel at the Blockchain Association, concurred with Lummis’s stance, highlighting that the SEC’s interpretation risks classifying non-security assets as such, potentially deviating from Congress’s intended scope of the SEC’s regulatory authority.

She refuted the SEC’s claim that most digital assets on the secondary market are investment contracts under securities laws, asserting that these transactions lack ongoing contractual obligations, making the SEC’s position untenable.

Other Stories:

California Updates Campaign Manuals with Detailed Rules for Cryptocurrency Contributions

US Bank’s Crypto Holdings Surge to Nearly $170 Million Amid Regulatory Scrutiny

Hong Kong’s HKVAX Granted Preliminary Approval for Virtual Asset Trading Platform by SFC

On August 10th, the United States Federal Election Commission (FEC) voted unanimously to propel forward a petition aimed at potentially imposing regulations on deep fake content within AI-generated political advertisements.

The focus of this petition is to combat the spread of ads that utilize artificial intelligence to depict political candidates engaging in actions or making statements they never actually did, particularly in the lead-up to the 2024 elections.

Public Citizen, an advocacy organization spearheading this petition, is led by Robert Weissman, who considers deep fakes a substantial threat to the democratic process.

Weissman emphasizes that the FEC must wield its authority to curb the usage of deep fakes, as failure to do so could imply endorsement of an AI-propelled surge of misleading information, which could erode fundamental concepts of truth and falsehood.

Instances have arisen wherein candidates have incorporated fabricated AI-generated images as part of their campaign strategies.

For instance, Florida Governor Ron DeSantis, a contender for the Republican Party’s nomination, disseminated three fabricated images of former President Donald Trump embracing Dr. Anthony Fauci.

During the FEC session, Public Citizen sought to clarify whether existing laws encompass “fraudulent misrepresentation” in political campaigns and whether deep fakes generated by AI fall under this category.

Lisa Gilbert, Executive Vice President of Public Citizen, highlighted the urgency of regulating deep fakes and deceptive AI usage in election-related advertisements, emphasizing that each day that passes heightens the necessity for such regulation.

READ MORE: Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

The FEC’s decision to progress the petition initiates a 60-day period for public comments. Gilbert views this as an encouraging indicator that regulatory bodies are taking the threat of AI-generated misinformation seriously.

This move is commended by Craig Holman, a government affairs lobbyist associated with Public Citizen, who regards the public comment phase as a crucial platform for policy experts, advocates, and citizens to voice their apprehensions regarding the potential inundation of deep fake advertisements in the upcoming election cycle.

This development builds upon Public Citizen’s initial submission of the petition in July.

The document underscores similar concerns, stressing that the impact of deep fakes could extend to even swaying election outcomes.

In response to the first petition, support letters were received from members of both the U.S. Congress chambers.

Cointelegraph reached out to Public Citizen for additional commentary on their endeavors.

The FEC’s unanimous decision signals a proactive step toward addressing the intricate challenges posed by AI-generated deep fakes within the realm of political advertising.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

The potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States has been shrouded in suspense due to the Securities and Exchange Commission’s (SEC) ongoing delay in reaching a decision.

This delay is now raising speculations that the verdict might encompass influential players in the financial sector, including giants like BlackRock and Fidelity.

Dave Weisberger, co-founder of CoinRoutes and an experienced figure in the markets, emphasized the mounting pressure on the SEC to grant approval for several ETFs.

The performance of approved futures-backed products has fallen significantly behind the actual spot performance, adversely affecting investors.

He believes that the culmination of this decision will likely encompass all pending applications.

The SEC is currently evaluating eight applications for a spot Bitcoin ETF, reflecting a series of past rejections and postponements for such cryptocurrency-related products.

The contenders awaiting a decision comprise prominent entities like ARK Invest, Bitwise, BlackRock, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie. Together, these firms oversee a staggering $15 trillion in global assets.

Recently, the SEC initiated a 21-day commentary period for the ARK 21Shares Bitcoin ETF.

The regulator’s inquiries revolve around the proposal’s potential to counter fraudulent and manipulative actions and its assessment of the susceptibility of the Bitcoin market to manipulation.

A particular focus was directed towards Coinbase’s surveillance-sharing agreement, with the SEC requesting input on whether this involvement could effectively identify, investigate, and discourage manipulation and fraud in Bitcoin’s valuation.

Ruslan Lienkha, Chief of Markets at YouHodler, offered insight into the SEC’s concerns about market manipulation by major entities.

He elaborated that if the SEC were to greenlight multiple ETFs, the risk of manipulation would substantially diminish, as these firms could engage in frequent trading against each other.

Despite the SEC’s extended contemplation, Bitcoin’s valuation experienced a modest impact, hovering around $30,000.

Market players, including Mauricio Di Bartolomeo, co-founder of Ledn, a crypto lending platform, seemed prepared for the SEC’s prolonged deliberation, asserting that today’s decision bears minimal influence on market expectations.

Notably, the SEC has a couple of deadlines to meet before reaching a final conclusion. The next deadline for the ARK 21Shares application is scheduled for January 2024.

Valkyrie’s application, the most recent addition to the lineup, faces deadlines in January and March of the following year.

The outcome of the BTC ETF ruling has the potential to reshape the landscape of cryptocurrency investments.

If approved, this could infuse the Bitcoin market with a substantial $70 billion in liquidity.

Lienkha highlighted the enhanced confidence regular investors would gain through ETFs, as professional guidance would alleviate the need for them to delve into intricate technicalities and risk assessments independently.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

Lawyers specializing in cryptocurrency matters are expressing strong confidence in Ripple Labs’ legal position as the United States Securities and Exchange Commission (SEC) pursues an interlocutory appeal in their ongoing case.

This has prompted discussions within the crypto community regarding the significance of the appeal, with some speculating whether it aims to challenge the classification of XRP as a non-security token.

However, legal experts in the field are assuring observers that this appeal doesn’t specifically address that matter.

On August 9th, the SEC formally notified Judge Analisa Torres of its intention to appeal the court’s ruling, seeking a fresh evaluation from an appellate court.

In response, community members have been pondering whether this move is tied to the SEC’s quest to challenge the “non-security” status of XRP.

Notably, Jeremy Hogan, a prominent crypto lawyer, delineates the distinction between the SEC’s appeal on sales-related matters and the broader classification of XRP as a security.

Hogan emphasizes that a win for the SEC in this appeal could restrict Ripple’s ability to conduct sales via exchanges.

However, he posits that exchanges might still list XRP as long as these sales aren’t facilitated by Ripple.

Oscar Franklin Tan, a crypto lawyer and Chief Legal Officer at Enjin, a non-fungible token (NFT) platform, provides further insight into the complexities of the SEC’s appeal strategy.

Tan explains that appeals typically occur once a case concludes, but the SEC is pursuing an interlocutory appeal, which means it aims to appeal even though the case remains ongoing.

Regarding the potential impact of this appeal on the main case, Tan underscores the concept of momentum.

READ MORE: Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

He clarifies that if the interlocutory appeal is permitted, the prevailing party in that appeal would gain momentum in the primary case.

While Hogan is of the view that the appeal won’t significantly impact XRP’s security classification, Tan suggests that the SEC’s underlying objective remains focused on overturning the earlier July decision by Judge Torres, which affirmed that XRP is not a security under certain circumstances.

Tan reveals that the SEC is drawing from the Terraform Labs case to bolster its argument against Judge Torres in the XRP case.

The SEC contends that a higher court should resolve discrepancies between different rulings.

Nonetheless, Tan asserts that the SEC should have provided clearer regulatory guidance prior to resorting to legal action.

He advocates for the normal progression of the court process to gain clarity on these matters.

Meanwhile, Ripple’s Chief Legal Officer, Stuart Alderoty, has encouraged anticipation, stating that Ripple will file its response with the court in the upcoming week.

This development underscores the ongoing dynamism in the legal landscape surrounding cryptocurrency classification and regulation.

Other Stories:

Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

Ethereum founder Vitalik Buterin received 50 percent of the total supply of Shiba Inu (SHIB) tokens upon the coin’s launch, but it’s unclear how much SHIB he currently owns.

Who is Vitalik Buterin?

Vitalik Buterin was born in Russia in 1994 and later moved to Canada with his family. He discovered Bitcoin in 2011, and his fascination with the decentralized digital currency led him to co-found Bitcoin Magazine. Buterin’s vision extended beyond Bitcoin, and in 2013 he conceptualized Ethereum, a blockchain platform that enables the creation of decentralized applications (DApps) through smart contracts.

Ethereum’s 2015 launch marked a paradigm shift in the blockchain space, with its powerful and versatile programming capabilities that allow developers to build a wide variety of decentralized solutions. Buterin’s role in creating and promoting Ethereum has made him a central figure in the blockchain community, advocating for decentralization, transparency, and a more inclusive financial world.

Shiba Inu as the ‘Dogecoin Killer’

Shiba Inu (SHIB) was created in August 2020 as a decentralized meme token that dubbed itself the “Dogecoin killer.” It was inspired by the Shiba Inu dog breed, the same inspiration behind the popular Dogecoin.

What sets Shiba Inu apart from other meme tokens is its intentional community-building efforts and its decentralized ecosystem, ShibaSwap. Unlike many meme coins, Shiba Inu also set out with a specific roadmap and strategic plans to create various decentralized finance (DeFi) products.

How Much Shiba Inu Does Vitalik Buterin Own

The connection between Vitalik Buterin and Shiba Inu may seem tenuous at first, but it came to the fore in a dramatic fashion. When Shiba Inu was created, 50% of the total supply (1 trillion SHIB tokens) was sent to Buterin’s public Ethereum address.

This act was a calculated move by Shiba Inu’s creators, aiming to burn the tokens and create a sense of scarcity and value. However, the creators had no control over the tokens, and Buterin retained complete ownership.

In May 2021, Buterin donated 50 trillion SHIB tokens (worth around $1 billion at the time) to a COVID-19 relief fund in India. This donation was not only one of the largest philanthropic acts in the cryptocurrency space but also led to a significant price drop in SHIB, as investors and traders reacted to the unexpected move.

Later, Buterin burned 90% of his remaining SHIB tokens and sent the rest to a charitable organization. He also requested that future tokens not be sent to his address without his consent.

Implications and Legacy

The relationship between Vitalik Buterin and Shiba Inu illustrates several aspects of the modern cryptocurrency landscape:

- Decentralization: The decision to send tokens to Buterin without his consent was a bold move that emphasized the power of decentralization, where actions cannot be undone or controlled by a central authority.

- Philanthropy: Buterin’s decision to donate the SHIB tokens to charity showcased the positive potential of cryptocurrency, turning a speculative asset into a force for real-world good.

- Market Dynamics: The incident also revealed the fragile nature of some cryptocurrencies, demonstrating how a single event can lead to significant market fluctuations.

- Transparency: The entire episode was conducted openly on the public blockchain, emphasizing the transparent and immutable nature of decentralized technology.

Conclusion

Vitalik Buterin and Shiba Inu’s unique connection has become an iconic moment in cryptocurrency history, symbolizing the unexpected turns, tremendous opportunities, and risks that characterize this evolving landscape.

Buterin’s work with Ethereum continues to be at the forefront of blockchain innovation, and Shiba Inu’s ongoing development as a meme coin with genuine utility offers lessons in community engagement, transparency, and market dynamics.

As the cryptocurrency world continues to grow and mature, the story of Vitalik Buterin and Shiba Inu serves as a reminder that innovation, generosity, and unexpected connections can come together to shape the future of finance in ways we may not foresee.