The United States House of Representatives Financial Services Committee (FSC) has scheduled a crucial hearing for November 15th, aimed at delving into illicit activities within the cryptocurrency ecosystem.

Titled “Crypto Crime in Context: Breaking Down Illicit Activity in Digital Assets,” this hearing is expected to feature prominent figures from the crypto industry.

Among the notable witnesses set to participate in the hearing are Bill Hughes, senior counsel and director of global regulatory matters at Consensys, and Jonathan Levin, co-founder and chief strategy officer at Chainalysis.

They will be joined by Jane Khodarkovsky, a former federal officer and specialist in human trafficking finance.

The FSC has made it clear that their primary objective is to ensure that the digital asset ecosystem remains secure and impervious to exploitation by malicious actors.

The focus of the hearing will primarily revolve around discussions related to illicit activities, such as money laundering and terrorist financing, within the cryptocurrency space.

The FSC cited a Chainalysis report from January 2023, which highlighted that illicit cryptocurrency volumes had surged to all-time highs, coinciding with an increase in sanctions and hacking incidents.

Furthermore, the hearing will scrutinize the effectiveness of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) measures enforced by crypto exchanges and decentralized finance providers. It aims to assess the adequacy of these measures in combating illegal activities.

READ MORE: Former FTX Executives Launch Backpack Exchange in Dubai

The role played by governing entities, including the Financial Crimes Enforcement Network (FinCEN), the Office of Foreign Assets Control (OFAC), and the Department of Justice (DOJ), will also come under the spotlight during this hearing.

In a related context, back in July, Representative Patrick McHenry, the chairman of the FSC, announced plans to draft legislation that would provide regulatory clarity for stablecoins designed for payment purposes.

This move seeks to address concerns surrounding the issuance and use of stablecoins.

Meanwhile, the Department of Justice (DOJ) has taken steps to bolster its efforts in combating cryptocurrency-related crimes.

It has decided to merge its Computer Crime and Intellectual Property Section with the National Cryptocurrency Enforcement Team to form a more robust unit specifically tasked with combating ransomware crimes.

This strategic move reflects the government’s commitment to tackling crypto-related criminal activities effectively.

In conclusion, the upcoming FSC hearing signifies the government’s proactive stance in addressing the challenges posed by illicit activities within the cryptocurrency space and ensuring the integrity of the digital asset ecosystem.

ProShares, a prominent issuer of exchange-traded funds (ETFs), has introduced a new financial product aimed at capitalizing on the fluctuating price of Ether, a leading cryptocurrency.

On November 2, the company unveiled the Short Ether Strategy ETF, which is set to commence trading on the New York Stock Exchange’s Arca platform, utilizing the ticker symbol SETH.

The Short Ether Strategy ETF, or SETH, is specifically designed to provide investors with a means of profiting from the inherent volatility in the price of Ether.

Much like ProShares’ other cryptocurrency-linked ETFs, SETH seeks to gain exposure to the cryptocurrency market by utilizing Ether futures contracts, as outlined in their official announcement.

ProShares CEO Michael Sapir emphasized the significance of this launch, stating that SETH addresses a persistent challenge for investors interested in taking a short position on Ether.

He noted that establishing such exposure can often be a burdensome and expensive endeavor.

With SETH’s launch, ProShares is facilitating accessibility to both profit opportunities during Ether’s price increases and declines, all within the framework of a traditional brokerage account.

SETH is the latest addition to ProShares’ expanding portfolio of ETFs linked to cryptocurrencies.

Notably, in October 2021, ProShares introduced the groundbreaking Bitcoin Strategy ETF, one of the earliest Bitcoin-linked ETFs to be offered in the United States.

READ MORE: Rising Institutional Demand Will Propel Bitcoin Price to $120,000 by Year’s End

Building on this success, the company later launched the Short Bitcoin Strategy ETF in June 2022, targeting investors interested in shorting Bitcoin following its decline below the $20,000 threshold.

In addition to SETH, ProShares offers various other crypto-related ETFs, including the ProShares Ether Strategy ETF, Bitcoin and Ether Market Cap Weight Strategy ETF, and Bitcoin & Ether Equal Weight Strategy ETF.

These diverse offerings enable investors to tailor their exposure to the cryptocurrency market according to their specific investment objectives and risk tolerances.

In summary, the introduction of the Short Ether Strategy ETF (SETH) by ProShares represents another significant step in the evolution of cryptocurrency investment opportunities in the traditional financial markets.

With the convenience of trading through traditional brokerage accounts, investors now have an accessible avenue to profit from Ether’s price movements, both upward and downward, in an increasingly dynamic digital asset landscape.

The Dubai Virtual Assets Regulatory Authority (VARA) has granted an “initial approval” license to crypto firm WadzPay, marking a significant milestone in the company’s pursuit of a Virtual Asset Service Provider (VASP) license for virtual asset services and activities.

Under the VARA license, WadzPay is now authorized to commence preparations for providing virtual asset services and activities related to Transfer and Settlement and Broker/Dealer activities.

However, it’s important to note that this license does not permit the company to offer any of its other virtual asset products and services. WadzPay’s platform caters to both businesses and individual users.

Dubai’s regulatory environment for cryptocurrencies has been evolving rapidly, with various operational licenses being issued to crypto exchanges and firms in recent months.

This development has solidified Dubai’s reputation as a crypto-friendly jurisdiction, thanks to its regulatory body and comprehensive rulebooks for VASPs.

The process to obtain a VARA license in Dubai involves three stages: provisional approval, a minimal viable product (MVP) license, and a total market product license.

In October, the cryptocurrency wallet Backpack received a VASP license, leading to the launch of Backpack Exchange.

READ MORE: Football Club Scores Big with Bitcoin Adoption

However, the VARA license granted to Backpack limits its operations to crypto exchange services exclusively within Dubai, excluding its other virtual asset offerings.

Notably, the newly introduced Backpack Exchange incorporates advanced features such as zero-knowledge proof-of-reserves, multi-party computation for custody, and high-speed order execution.

Komainu, a joint venture involving Nomura, CoinShares, and Ledger, also achieved a full operating license from Dubai’s VARA.

Komainu completed this final step in VARA’s licensing process approximately 10 months after securing its MVP license in November 2022.

Furthermore, Laser Digital, the cryptocurrency division of financial giant Nomura, secured an operating license from VARA in August.

This move is a strategic part of Nomura’s efforts to establish a presence in the digital asset sector.

Through its subsidiary, Laser Digital Middle East FZE, based in Dubai, the company unveiled its VASP license, allowing it to offer brokerage, virtual asset management, and investment services in the emirate.

It’s worth noting that Binance also obtained an operational MVP license from VARA, enabling it to operate cryptocurrency exchange and virtual asset broker-dealer services locally, further contributing to Dubai’s growing crypto ecosystem.

On October 19, Sheikh Saud bin Saqr Al Qasimi of Ras Al Khaimah launched the RAK Digital Assets Oasis (RAK DAO), a specialized economic free zone aimed at fostering companies in the digital and virtual assets space, including blockchain, Web3, and AI industries.

This initiative positions RAK DAO as a nurturing ground for service providers in cutting-edge technological areas such as metaverse development, blockchain infrastructure, utility tokens, virtual asset wallets, nonfungible tokens (NFTs), decentralized autonomous organizations (DAOs), decentralized applications, and broader Web3 domains.

Beyond infrastructure, RAK DAO is set to bolster its community with grant programs and targeted assistance spanning technology support to marketing and business growth strategies. In his inaugural address, Sheikh Saud articulated the ambition behind RAK DAO: to cultivate a thriving hub for digital asset innovation and enable trailblazing ideas to take shape. Recognizing the vast opportunities in the digital assets realm, he expressed intent for Ras Al Khaimah to be at the forefront of this burgeoning industry.

In a strategic move, an agreement was also struck between the Securities and Commodities Authority, led by CEO Maryam Buti Al Suwaidi, and RAK DAO’s CEO Sameer Al Ansari.

Ras Al Khaimah, traditionally known for its historical attractions, is expanding its economic portfolio with this focus on the digital asset sector.

The RAK DAO enters a competitive landscape, joining the ranks of established Web3-friendly free zones in the United Arab Emirates, such as those in Abu Dhabi and Dubai, which offer benefits like full business ownership, unique tax schemes, and regulatory autonomy under the umbrella of UAE’s criminal law.

Under Law No 2 of 2023, issued by Sheikh Saud, RAK DAO has been granted the necessary financial and legislative independence to operate as a tailored, innovation-driven free zone for virtual assets. According to the Emirates News Agency report from March, this law is a component of the region’s broader economic diversification and global outreach efforts.

To strengthen its foundation, RAK DAO has secured partnerships with entities like the HBAR Foundation, Rakbank, and Romanian AI company Humans.ai, reinforcing its commitment to establishing a robust and collaborative digital asset ecosystem.

The launch of the RAK DAO aligns with the Royal Family of Ras Al Khaimah’s broader mission to transform the emirate into a blockchain and tech hub, creating tens of thousands of high-skilled jobs and attracting innovative tech companies and business leaders.

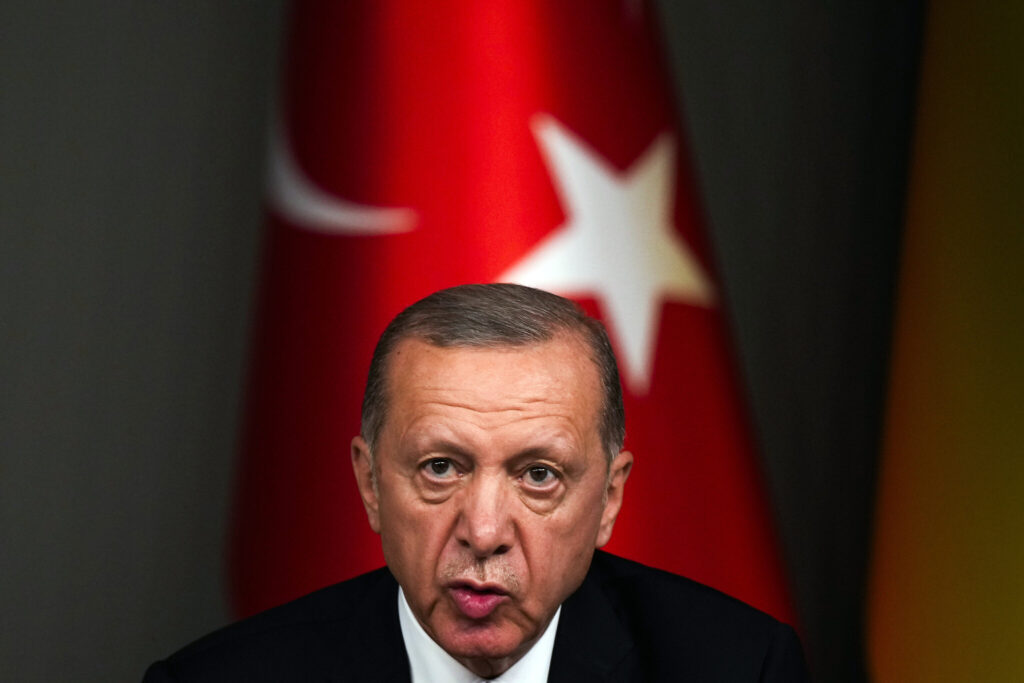

Turkey is making significant strides in the world of cryptocurrency regulation as it seeks to shed its “grey list” status with the Financial Action Task Force (FATF).

The FATF, an international organization dedicated to combating financial crimes, placed Turkey on this list in 2021 due to concerns related to money laundering and terrorist financing.

According to recent reports, Turkish Finance Minister Mehmet Simsek addressed a parliamentary commission on October 31 and revealed that Turkey had successfully adhered to all but one of the FATF’s 40 standards.

The one area of concern is related to crypto assets.

To address this issue, Turkey is actively drafting new regulations specifically designed for crypto assets.

The government’s aim is to present a comprehensive crypto assets law to parliament, with the ultimate goal of convincing the FATF to remove Turkey from its grey list.

While the exact legal changes have not been disclosed, it is clear that Turkey is committed to strengthening its regulatory framework for the cryptocurrency sector.

The Group of Seven (G7) established the FATF to protect the global financial system, and in 2019, it raised concerns about Turkey’s procedures for freezing assets connected to terrorism and the proliferation of weapons of mass destruction.

The Turkish government has taken these concerns seriously and is actively working on enhancing its regulatory environment.

READ MORE:Dubai Grants VASP License to Crypto Wallet

The Turkish Presidential Annual Program for 2024, published in the Official Gazette of the Republic of Turkey on October 25, outlines the government’s plans regarding cryptocurrency regulations.

Article 400.5 of this extensive 500-page document sets a target to finalize cryptocurrency regulations within the country by the end of 2024.

This initiative aims to establish clear definitions for crypto assets, which may have tax implications in the future.

Furthermore, the program aims to provide legal definitions for crypto asset providers, such as cryptocurrency exchanges.

While the specifics of the forthcoming regulatory framework are yet to be disclosed, Turkey is demonstrating its commitment to bringing transparency and oversight to the crypto industry.

In a related development, the Central Bank of the Republic of Turkey has been actively exploring the concept of a central bank digital currency, known as the digital lira.

By December 2022, it had completed a successful initial trial of the digital lira and expressed its intention to continue testing through 2024.

These efforts signal Turkey’s willingness to embrace digital financial innovation while also adhering to international standards and expectations in the realm of cryptocurrency regulation.

The crypto space has often been referred to as the “Wild West” by global regulators, especially the current US Securities and Exchange Commission’s (SEC) Chair Gary Gensler. While many industry participants have been critical of the agency’s regulation by enforcement approach, it is clear that the crypto space could greatly benefit from a robust regulatory framework. An innovative and balanced approach could prevent bad actors from harming the nascent ecosystem while not stifling innovation.

At present, there are several industry players that have adopted a practical approach to regulating crypto-related activity, such as the superior regulations of Curacao and the United Kingdom. A sensible regulatory stance can protect consumers against the unregulated or loosely regulated casinos that may cause major damage to the Web3 ecosystem’s reputation.

Well-Regulated Crypto Casinos Can Promote Web3 Adoption

Duelbits is a good example of a well-regulated crypto casino that can serve as a model for what the Web3 industry needs at the moment. The platform is authorized to legally operate in the UK while serving consumers in a compliant manner. The service is supported by robust Anti-money laundering (AML/KYC) controls and experienced compliance professionals.

Platforms that are compliant and are licensed operators could serve as the gateway to the thrilling world of crypto gambling. Moreover, crypto-first platforms can pave the way forward for mass adoption.

These platforms may offer players with an engaging gaming experience that can keep them entertained for extended periods of time. Whether players are interested in the classic casino favorites, such as slots and various table games, or enjoy the experience of live casino with professional dealers, it is clear that ensuring compliance is vital. That’s an area where Duelbits has been focusing on, so that it can ensure a secure environment for end-users.

In addition to a regulatory compliant platform, users should know that every outcome in the platform’s provably fair games is being determined by genuine randomness. This approach helps with ensuring adequate transparency while gaining trust of the users.

Addressing the Interests of Clients in a Compliant Enviroment

The ideal platforms supporting crypto casinos are able to provide unique experiences supported by their extensive sportsbook. Whether users want to place bets on soccer, professional basketball, tennis, or other sporting events, platforms like Duelbits address the interests of its clients. This business model helps with creating a thrilling crypto gaming environment under an all-digital roof.

As explained, Duelbits operates as a licensed and regulated online casino, ensuring that real-money crypto games are carried out with the highest level of integrity. These compliant platforms have also joined forces with some major players in the sports world. In addition to helping with brand recognition and visibility, betting partners like the World Cup-winning Argentina football team and Aston Villa FC in the UK serve as further validation that can increase confidence in any sports betting arena.

Crypto Casinos Prioritize Ease of Accessibility

The best crypto casinos also know the importance of a website that is well-designed. Ideally, it should be easy to navigate so that users can quickly find the crypto services they want to access. As a compliant service provider, users from jurisdictions / IPs that are not supported must be informed about why they cannot access the site.

To better serve its clients, Duelbits explains that they provide a 24/7 customer support team that is available to assist members. One of the key aspects that regulators focus on is transparency. A well-regulated platform always provides an easy way to contact support in case of emergencies or any requirement that requires the attention of professional staff members.

It is also vital for compliant crypto casino providers to be sensitive and receptive to their players and customers’ needs. User queries should be handled as quickly and accurately as possible. This is an area that reputable crypto casino providers focuses on, while providing a regulatory-sound environment for all users.

The best platforms also consistently reward their players, and welcome newcomers with bonuses so they can kick-start their journey. As users continue to play and show loyalty, they can begin to take advantage of tailored benefits and exclusive incentives to make the gaming experience more thrilling. While there are many so-called crypto casinos that are accessible online, there is potential for fraud and theft.

That’s why it is vital to work with regulated providers. Their licensing information and other details should be easily accessible via the official website. Regulators also post updates on their sites, so that consumers can be cautious when dealing with online casinos. There’s a lot of fraud and other abusive activities that can harm users, however, a regulated platform can offer the security and safety needed to ensure a frictionless experience.

Ghosts and vampires have risen to celebrate Halloween! Put on your scariest costumes and enter the exciting BetFury Slots world. This article will present a selection of the top one-armed bandits related to Halloween.

The Universe of BetFury Slots

BetFury is an ecosystem of crypto products for entertainment and additional income. It unites crypto enthusiasts and players around the globe. BetFury has over 8,000 Slots from top providers such as Pragmatic Play, Spinomenal, Evoplay, etc. In the search bar, the user can find any Slot he is interested in with a couple of clicks.

With Halloween’s advent, BetFury becomes an unusual place for everyone wanting an excellent gaming experience. The concentration of spirits, Jack o’Lanterns, and other holiday symbols will brighten any gaming night.

Top 7 Halloween Slots

BetFury has a lot of spooky Halloween Slots. The hottest ones are presented below. More themed games can be found on the BetFury Slots page by entering “scary”, “pumpkin”, and others in a search line.

- Halloween by Play’n Go

- Scary Clown by KA Gaming

- Book of Horror by Spinomenal

- Halloween Horrors by 1X2 Gaming

- Rip City by Hacksaw Gaming

- Witches Tome by Habanero

- Vampire Night by Amusnet

Everyone should hit a huge Slots jackpot to make this Halloween memorable forever! However, what exactly provides maximum pleasure from the process?

Design, Features, and Crypto

This exciting combination creates a unique atmosphere and iGaming convenience. Each BetFury Slot pleases the eye due to its clear and sophisticated gameplay. The epicentre of Halloween, mystical sounds, and high multipliers will turn the head of even the most experienced user. Beginner players are also not left out, thanks to the Demo Mode feature implemented in many games. It brings funny rounds without betting on real money.

Regarding crypto, BetFury supports over 50 well-known currencies. Thus, any BTC or DOGE holders can multiply their assets without trouble. Besides, the platform has a native BFG token with many utilities. Everyone can trade it, place BFG bets, and join Staking with 50% APY. Having only 100 BFG on balance, the user can get even more BFG or payouts in five top currencies: BTC, ETH, USDT, TRX, and BNB. All this is implemented for a high-quality and profitable experience.

SPOOKY Promo Code

Amazing winnings and entertainment await you on BetFury. The first 10 people to activate the promo code SPOOKY on BetFury by the 24th of October with a $400 wager will receive 300 BFGs for free and start Staking for passive income.

Therefore, it’s time to jump on the burning train of Halloween fun. Walk through carriages filled with terrifying Slot machines. Use the BetFury Promo code to get Free Spins for celebrating this holiday. Finally, don’t forget about Responsible Gambling, which forms the right approach to the iGaming field. Play wisely, and may luck be on your side!

Grayscale Bitcoin Trust (GBTC) is currently experiencing its lowest discount in almost two years, with its discount to Bitcoin’s net asset value (NAV) narrowing to 15.87% as of October 13, according to data from YCharts.

This metric measures how much a mutual fund or ETF is trading below its actual net asset value, offering insights into its true market value.

The narrowing of GBTC’s discount began when financial giants like BlackRock and several other institutions filed applications for spot Bitcoin ETFs in mid-June.

1From a high of 44% on June 15, the discount steadily decreased to 26.7% by July 5. Since then, it has continued to shrink.

The last time GBTC’s discount was at a similar level was in early December 2021, shortly after Bitcoin reached its all-time high price of $69,000 in November, as reported by CoinGecko.

Many in the cryptocurrency community, including Bitcoin advocate Oliver Velez, speculate that the market is factoring in the approval of spot Bitcoin ETFs by the end of the year.

READ MORE:Secret Audio Exposes Alameda Research’s Misuse of FTX User Funds, Unveiling Shocking Details

Lyle Pratt, a cryptocurrency investor, believes that GBTC’s discount will continue to decrease over the next week or two as spot Bitcoin ETFs approach regulatory approval.

Recent reports suggest that the United States Securities and Exchange Commission (SEC) chose not to appeal the Grayscale decision on October 13.

This development has led Bloomberg ETF analyst James Seyffart to describe spot Bitcoin ETF approvals as a “done deal.”

On October 15, Grayscale issued a statement indicating that the SEC’s 45-day period for seeking a rehearing had elapsed.

Consequently, the court is expected to issue its “final mandate” within the next seven calendar days.

Grayscale expressed its operational readiness to convert GBTC into an ETF upon SEC approval and pledged to share further details as soon as possible.

Cointelegraph attempted to reach out to Grayscale for additional comments but had not received an immediate response at the time of reporting.

Other Stories:

MetaMask Temporarily Removed from Apple’s App Store

Bitcoin Holds Steady at $26,800 as SEC’s Grayscale Decision Looms

SEC Opts Not to Appeal Ruling Favoring Grayscale’s Bitcoin ETF Application

Global cryptocurrency heavyweight, Binance, has seen a consistent drop in its market dominance, particularly over the past seven months.

Recent reports highlight that regulatory issues in the U.S. and changes in their trading promotions may be influencing this decline.

Bloomberg, drawing from insights provided by cryptocurrency data specialist CCData, noted on October 5th that Binance’s spot market share dipped from 38.5% in August to 34.3% in September 2023.

To put this in perspective, in January 2023, the exchange commanded a notable 55.2% of the spot market.

This isn’t limited to the spot market alone. Binance’s presence in the derivatives market is also dwindling.

Data suggests that their market share in this space has reduced from 53.5% in August to 51.5% in September. Earlier in January, Binance held a significant 62% dominance in the derivatives market.

Jacob Joseph, a research analyst from CCData, posits that while the U.S. regulatory challenges are a significant factor, they aren’t the sole reason for Binance’s shrinking market share.

Another contributing element, he suggests, is Binance’s recent decision to stop its zero-fee trading promotion for several major trading pairs.

In tandem with these challenges, Binance has been pulling back from certain global markets.

A significant move in September saw Binance making a complete exit from the Russian market.

The exchange sold its entire Russian business to a new player, CommEx exchange. This was a substantial move as Russian users made up almost 7% of Binance’s traffic.

Additionally, Binance revamped its trading fee structure in early September. They reintroduced a standard taker fee, which is determined by the user’s VIP level.

One example of this change is the 0.1% taker fee on spot and margin trades for regular users.

Competing exchanges have been quick to capitalize on this shift. Binance’s spot trading volume appears to be migrating to platforms like HTX, Bybit, and DigiFinex.

Moreover, exchanges such as OKX, Bybit, and Bitget are seeing upticks in their derivatives market shares.

Other Stories:

DOJ Asserts Lack of Crypto Regulations Doesn’t Bar Charges Against Former FTX CEO

Kazakhstan’s Crypto Mining Industry on the Brink of Collapse as Energy Prices Soar

Bitcoin Holds Steady at $27,500 Amidst US Yield Surges and Dollar Volatility

On October 3rd, Bitcoin exhibited moderate gains, rebounding from a recent dip of $1,300 as it approached the daily closing mark.

BTC’s price action revolved around the $27,500 mark, having experienced a descent from its six-week peak near $28,600, eventually finding support at $27,335 before stabilizing.

Despite the potential for the initial October breakout to be a deceptive “fakeout,” market participants remained composed.

Renowned trader Jelle expressed optimism, noting that the absence of an instant surge to $30,000 following the breakout could be seen as a positive sign, as rapid vertical movements often lead to retracements.

Daan Crypto Trades shared a similar sentiment, emphasizing the importance of a gradual climb back to previous highs for Bitcoin bulls.

He pointed out that it was essential for long traders to remain patient and wait for opportune entry points, especially during the Asian trading session.

Examining the factors contributing to the BTC price reversal, popular trader Skew highlighted the selling pressure faced by spot traders, which hindered BTC from surging beyond the $28.5K mark and ultimately triggered the sell-off.

READ MORE: Bitwise Asset Management Launches Ethereum Futures ETFs Amid Regulatory Uncertainty

While some bid depth appeared to be returning, overall liquidity in the market remained relatively wide.

Previously, Skew had emphasized the increasing demands from buyers required to surpass the existing trading range, which eventually resulted in a lack of upward momentum.

Additionally, on-chain monitoring resource Material Indicators issued caution regarding downside signals on its proprietary trading tools, particularly on daily timeframes.

While these signals suggested a potential continuation of the downtrend, a decisive move above $26,800 might warrant a reconsideration.

The report also reminded readers that the cryptocurrency market had been trading within the same range for several months, emphasizing that until Bitcoin records a lower low on the weekly chart, the possibility of retesting resistance should not be ruled out.

Prior to this, renowned trader and analyst Rekt Capital had offered an optimistic perspective, suggesting that Bitcoin could potentially surge beyond $29,000 before resuming its current trading range.

Overall, Bitcoin’s price movements continued to captivate the attention of traders and analysts alike as they assessed its short-term and long-term potential.

Other Stories:

Q3 2023 Records $700 Million in Digital Asset Losses, CertiK Report Reveals

Friend.tech’s Decentralized Social Media Platform Surges in Revenue and User Growth