Curve Finance, the lending protocol, has made significant changes following recent exploits and attacks.

As per an announcement on August 2nd, the protocol’s governing body revealed that it has terminated governance token rewards for certain liquidity pools affected by the July 30 Curve exploit and the July 6 Multichain exploit.

The decision to end rewards was executed by the Curve emergency decentralized autonomous organization (Curve E-DAO), which comprises selected members of the Curve DAO governing body.

The affected pools include alETH+ETH, msETH-ETH, pETH-ETH, crvCRVETH, Arbitrum Tricrypto, and multibtc3CRV. However, the governing body stated that this decision could be overridden in the future through a full vote of the Curve DAO.

The announcement was made by Gabriel Shapiro, a member of Curve E-DAO. The July 6 Multichain exploit saw the withdrawal of over $100 million worth of cryptocurrency from several bridges connected to the Multichain protocol.

The Multichain team deemed these withdrawals as “abnormal” and urged users to stop using their platform.

In response to this incident, the Curve team advised its users to withdraw assets such as multiBTC to safeguard their multibtc3CRV liquidity pool, which was at risk due to the Multichain exploit.

On July 14, the Multichain team attributed the withdrawals to an unknown individual who gained unauthorized access to their CEO’s cloud computing account.

This indicated that the funds had been exploited and might not be recoverable.

READ MORE: Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Subsequently, on July 30, Curve Finance itself became the target of a reentrancy attack, leading to the loss of over $47 million in cryptocurrency.

The attack impacted the alETH, msETH, and pETH pools, which were created using the Vyper protocol containing the vulnerability. Pools created through methods other than Vyper were unaffected by the exploit.

Despite these incidents, the affected pools were still generating Curve DAO (CRV) governance token rewards, allowing users to continue depositing their tokens and earning CRV.

However, in the recent announcement, Gabriel Shapiro emphasized that the emergency DAO has now halted these rewards to prevent further incentivization of participation in compromised pools.

Unfortunately, the crypto space has seen a slew of hacks and scams in July and August. Payment provider Alphapo allegedly lost over $60 million on July 23 due to an attacker gaining access to its hot wallet private keys.

While the company has not confirmed the attack, experts have noted abnormal transfers suggesting a possible hack.

Furthermore, on July 25, zkSync fell victim to an exploit worth $3.4 million due to a read-only reentrancy bug.

Given the ongoing security challenges, the crypto community remains vigilant to protect users and assets from potential threats.

Other Stories:

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

KPMG, one of the Big Four professional services firms, recently published a report on Bitcoin’s impact on environmental, social, and governance (ESG) issues.

The report highlighted that Bitcoin offers various benefits when analyzed through an ESG framework.

In terms of the environment, the report emphasized that emissions were a more significant environmental concern compared to energy usage.

KPMG contextualized Bitcoin’s emissions in comparison to other sources, such as tobacco and tourism, and found that it ranked as the second smallest contributor, trailing only behind “Video (US).”

Consequently, the report concluded that Bitcoin’s emissions might be lower than commonly discussed.

To improve Bitcoin’s carbon footprint, the report suggested employing renewable energy sources and energy produced from methane for mining.

Regarding social issues, the report pointed out that Bitcoin’s contribution to money laundering was relatively small when compared to the total amount of money laundering globally.

Money laundering constitutes 2-5% of global gross domestic product, according to the United Nations Office on Drugs and Crime statistics cited in the report, while it accounts for merely 0.24% of Bitcoin transactions, as indicated by Elliptic.

Moreover, the report highlighted that laundered money was received in Bitcoin far less frequently than in other cryptocurrencies like Ether, stablecoins, or altcoins.

It suggested that Anti-Money Laundering (AML) and Know Your Customer (KYC) measures could be applied during the off-ramping process of converting Bitcoin back to fiat currency, even though no AML/KYC requirements currently exist for transacting with Bitcoin.

READ MORE: Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

The report also showcased positive use cases for Bitcoin, such as its utilization in fundraising for Ukraine and supporting electrification efforts in rural Africa.

Addressing governance, the report praised Bitcoin’s robust governance system.

It explained that Bitcoin’s rules could not be altered without forking, resulting in a decentralized system that cannot be abused or manipulated by individuals with ulterior motives or those in positions of power.

While the report utilized secondary sources and familiar use cases, it acknowledged that Bitcoin remains widely misunderstood. KPMG, being well-versed in crypto-related matters, offers various crypto-related advisory services.

In summary, KPMG’s report emphasized that Bitcoin presents several advantages from an ESG perspective.

Despite certain environmental concerns, it highlighted the potential for lower emissions, recommended sustainable energy solutions, and acknowledged its relatively minor contribution to money laundering.

Additionally, the report praised Bitcoin’s strong governance structure, ensuring its integrity and decentralization.

Other Stories:

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Australia’s financial regulator, the Australian Securities and Investments Commission (ASIC), has taken legal action against eToro, a popular trading platform, over its contract for difference (CFD) product.

ASIC alleges that the platform used inadequate screening tests when offering leveraged derivative contracts to retail investors.

CFDs are a type of leveraged derivative that allows buyers to speculate on the price movements of various underlying assets, including foreign exchange rates, stock market indices, single equities, commodities, and cryptocurrencies.

eToro offers a wide range of CFDs, but ASIC claims that these products are “high-risk and volatile.”

The regulator’s main concern is that eToro’s screening test for the CFD product was insufficient and failed to exclude unsuitable customers.

Clients could easily manipulate their answers to meet the platform’s requirements, making the test ineffective in determining suitable users.

As a result, many customers who were not adequately informed about the risks of CFD trading ended up trading these products.

The specific risks associated with eToro’s crypto CFDs are highlighted, with up to two times leverage on certain assets making them particularly high-risk. ASIC believes that the platform’s target market was too broad, encompassing users who lacked an understanding of CFD trading risks.

ASIC alleges that between October 5, 2021, and June 14, 2023, nearly 20,000 of eToro’s clients suffered losses while trading CFDs.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

The regulator asserts that these losses were partly due to the platform’s insufficient screening and broad target market.

In response to the legal action, an eToro spokesperson informed Cointelegraph that the company had revised its target market determination for CFDs.

However, they did not specify when the revision took place.

While the proceedings are ongoing, eToro asserts that its service remains uninterrupted. The company is considering ASIC’s allegations and will respond accordingly.

ASIC’s deputy chair, Sarah Court, criticized CFD issuers like eToro for attempting to adjust their target markets to fit their existing client bases.

She expressed disappointment in the platform’s alleged lack of compliance with regulatory guidelines.

This legal action against eToro comes in the wake of similar challenges in the United States, where the platform had to halt trading in four cryptocurrencies after the Securities and Exchange Commission labeled them as securities in separate lawsuits.

In conclusion, ASIC’s lawsuit against eToro centers around the platform’s alleged failure to adequately assess its CFD products’ suitability for retail investors and the wide target market that included customers with little understanding of the risks involved.

The case serves as a reminder of the importance of robust compliance with financial regulations to protect investors and ensure fair practices in the financial markets.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

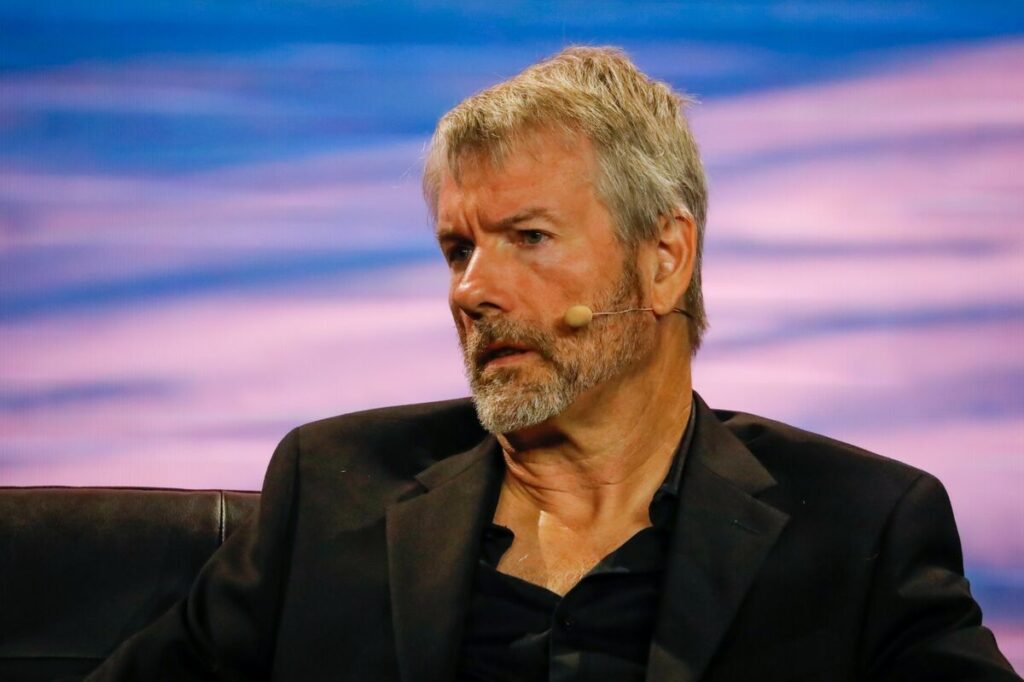

MicroStrategy co-founder, Michael Saylor, is confident that his company will continue to be an attractive option for investors seeking exposure to Bitcoin, irrespective of future exchange-traded fund (ETF) approvals.

As the price of Bitcoin ticks down to $29,223, Saylor reaffirms the firm’s commitment to adding more Bitcoin to its balance sheet, even planning a $750 million share sale to potentially fund further acquisitions.

During an interview with Bloomberg on August 2, Saylor discussed how a spot Bitcoin ETF approval could impact MicroStrategy’s offering.

He expressed assurance that the company would still offer unique advantages that spot Bitcoin ETFs cannot match.

This sentiment echoes his previous remarks during the August 1 earnings call, where he emphasized that MicroStrategy’s Bitcoin operating strategy would set it apart from spot ETFs when they eventually launch.

Since MicroStrategy began its purchasing strategy in August 2020, Bitcoin’s price has surged by 145%. Saylor attributes this success to the company’s use of leveraged investments, generating yields that are shared with shareholders.

Unlike ETFs, MicroStrategy, being an operating company, can access leverage, giving it a distinct advantage in the ecosystem.

Saylor believes that spot Bitcoin ETFs will attract large hedge funds and sovereigns, allowing them to invest billions of dollars in the space.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

However, he sees MicroStrategy as a unique instrument, akin to a sports car, while spot ETFs would be more like supertankers.

He envisions spot ETFs serving a different set of customers and contributing to the overall growth of the asset class.

Currently, MicroStrategy boasts more than 470 institutional shareholders and holds a market capitalization of $5.3 billion, according to Fintel.

As analysts raise the chances of spot Bitcoin ETF approval in the United States to 65%, Saylor confirms the company’s goal is to accumulate as much Bitcoin as possible.

Their existing holdings of 152,800 BTC are expected to increase in the coming quarters.

To support their Bitcoin accumulation strategy, MicroStrategy plans to sell up to $750 million in class A common stock, as revealed in a recent SEC filing.

Saylor clarifies that the primary use of these proceeds will be to acquire more Bitcoin, further solidifying the company’s belief in the long-term potential of the digital asset.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

A recent study conducted by the Network Contagion Research Institute (NCRI) has shed new light on the role of crypto-spouting Twitter bots in artificially inflating the prices of altcoins.

The study, published on August 2, utilized a sample of various FTX-listed cryptocurrencies and analyzed over 3 million tweets posted between January 1, 2019, and January 27, 2023, involving 18 altcoins.

The findings of the study revealed that Twitter bot activity played a crucial role in amplifying the value of these cryptocurrencies.

Notably, altcoins like The Sandbox (SAND), Gala (GALA), Gods Unchained (GODS), and LooksRare (LOOKS) showed signs of price influence due to tweet bot activity.

Almost half of the coins examined displayed an impact on prices as a result of this inauthentic activity.

Moreover, the study indicated that the volume of inauthentic tweets increased significantly after FTX posted about the token on social media.

This raised concerns about the potential involvement of FTX or Alameda Research in coordinating the bot activity to artificially inflate market values.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

The researchers also investigated the impact of Twitter bot activity and Elon Musk’s crypto-related tweets on two memecoins, Pepe (PEPE) and PSYOP.

The study revealed a surge in newly created bot accounts just before the launch of PEPE, all of which subsequently tweeted about one of the two coins.

Additionally, both Pepe Coin and PSYOP were bolstered by two of Musk’s tweets that seemingly endorsed each token.

For instance, Musk’s Pepe meme tweet caused the token’s price to surge by over 50% within 24 hours.

The study raises questions about the potential ramifications of coordinated inauthentic activity on social media, not only in the cryptocurrency market but also in stocks and other securities.

The researchers cited the social media frenzy in 2022 surrounding so-called “meme stocks” like GameStop and AMC as an example of how such manipulative tactics could affect traditional financial assets.

In conclusion, the NCRI study has highlighted the significant impact of crypto-spouting Twitter bots on the prices of altcoins, suggesting that inauthentic networks deliberately deployed these bots to influence market values.

As the cryptocurrency market continues to evolve, it becomes increasingly important for regulators and platforms to be vigilant against such manipulative practices to maintain market integrity and protect investors.

Other Stories:

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Hong Kong is set to expand its cryptocurrency trading options to individual investors as at least one exchange has secured regulatory approval to offer its services to retail users.

HashKey, a local digital asset firm, has achieved all the necessary licensing to extend its operations from catering to professional investors to including retail users.

The regulatory green light came from the upgrading of two significant licenses issued by the Hong Kong Securities and Futures Commission (SFC).

The first license, known as Type 1, permits HashKey to operate a virtual asset trading platform under the jurisdiction of Hong Kong’s securities laws.

The second license, Type 7, officially authorizes the firm to provide automated trading services to both institutional and retail users.

Notably, HashKey has become one of the pioneering licensed exchanges to offer retail cryptocurrency trading in Hong Kong.

Moreover, the firm has introduced its crypto over-the-counter (OTC) trading service, HashKey Brokerage, which complies with local securities laws, following the implementation of a new crypto regulatory framework by the SFC.

READ MORE: Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Livio Weng, the Chief Operating Officer of HashKey Group, expressed confidence in the establishment of licensed trading platforms and the increased clarity of regulatory frameworks in Hong Kong.

He believes that this will result in enhanced transparency and significantly boost investor confidence.

HashKey is not alone in this development, as OSL, another local crypto firm, has also received an uplift to its existing license from the SFC.

This enables OSL to offer Bitcoin (BTC) and Ether (ETH) trading to retail investors immediately. Dave Chapman, OSL’s co-founder, emphasized that the licensing uplift would allow OSL to facilitate digital asset access for retail investors.

This news follows an announcement from a Hang Seng Bank executive who asserted that crypto companies can only open bank accounts after obtaining an approval-in-principle license from the SFC.

As of early August, OSL and HashKey were reportedly the only exchanges to have received such approval.

The expansion of cryptocurrency trading exposure to individual investors marks a significant step in Hong Kong’s evolving crypto landscape, offering increased opportunities for retail participation in the market.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Between March and May, BlackBerry’s cybersecurity division thwarted over 1.5 million cyberattacks, unveiling malware families that attempt to take control of computers for mining or theft of cryptocurrencies.

Finance, healthcare, and government sectors were found to be the most affected, as per the BlackBerry report.

The report highlighted a prevalent malware named RedLine, a perennial financial threat involved in the collection of cryptocurrency and banking data.

Another significant threat was the Clop ransomware, a version of the CryptoMix ransomware family, which particularly aimed at banking and financial organizations, causing the data breach of Hatch Bank, a fintech platform.

The most widespread malware families in BlackBerry’s data include SmokeLoader, RaccoonStealer, and Vidar. SmokeLoader, dating back to 2011, has mainly been utilized by Russian-based threat actors to deploy crypto miners and other malware.

READ MORE: Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

RaccoonStealer has been implicated in stealing cryptocurrency wallet data and is purportedly being traded on the dark web. Vidar is another malware extensively used to harvest cryptocurrency wallets.

Linux stood out as the most targeted operating system. BlackBerry suggests that organizations using Linux should frequently update their security patches, as hackers often hijack Linux-based computers to mine cryptocurrencies.

Atomic macOS, a new breed of infostealer, primarily targets macOS users, collecting credentials from keychains, browsers, and crypto wallets.

In response to the growing cybersecurity threat, OpenAI, the developer of ChatGPT and Dall-e, announced a $1 million grant program to promote the development of AI-driven cybersecurity technologies.

The company stated in its official announcement, “Our aim is to foster the advancement of AI-driven cybersecurity capabilities for defenders through grants and additional assistance.”

This initiative underscores the urgent need for advanced cybersecurity measures in the face of an evolving threat landscape.

Other Stories:

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Binance CEO Changpeng “CZ” Zhao is planning to introduce smaller algorithmic stablecoins to provide investors with alternatives to the existing dominant stablecoin giants in the market.

During a recent Twitter “ask me anything” (AMA) session on July 31, CZ expressed concerns about the risks associated with large stablecoins like Tether (USDT) and Binance USD (BUSD).

He highlighted the lack of transparency with Tether, which is the largest stablecoin by market cap, as there have been no audit reports available to verify its reserves.

Even supposedly well-regulated stablecoins like Binance USD come with unforeseeable risks, as evidenced by Paxos Trust Company’s termination of its partnership with Binance and the New York Department of Financial Services’ order to cease minting new BUSD stablecoins.

To mitigate these risks, CZ revealed that Binance is actively working on developing algorithmic stablecoins.

Additionally, the company aims to diversify its stablecoin partnerships to spread potential risk across multiple assets. CZ emphasized the importance of not placing all their bets on a single stablecoin, given the inherent risks involved.

Binance has plans to launch the First Digital USD in Hong Kong and is exploring new stablecoin options in Europe.

First Digital USD is a programmable stablecoin pegged to the U.S. dollar and managed by First Digital Group, licensed in Hong Kong. It was recently listed on the Binance platform.

However, Binance is facing regulatory uncertainty, as evidenced by the $1 billion lawsuit brought against CZ and the company by the Commodities Futures Trading Commission, which CZ seeks to dismiss, alleging overreach of jurisdiction.

READ MORE: SEC Chairman Gary Gensler Raises Alarm Over Widespread Fraud in Crypto Market

Additionally, the U.S. Securities and Exchange Commission filed a lawsuit against Binance, CZ, and affiliated entities on June 5, accusing them of involvement in the sale of unregistered securities, fraud, and conflicts of interest.

In conclusion, CZ’s strategy to introduce smaller algorithmic stablecoins and diversify stablecoin partnerships aims to offer investors more options and reduce potential risks associated with dominant stablecoins in the market.

Despite facing regulatory challenges, Binance is forging ahead with its stablecoin initiatives and expansion plans into different regions.

Other Stories:

Liquid Staking Tokens Poised to Dethrone Ethereum’s Ether (ETH) as Dominant DeFi Asset

Bitcoin’s Reduced Volatility Sparks Anticipation for Exciting Long-Term Bull Signal

The Nigerian Securities and Exchange Commission (SEC) has issued a warning to local investors regarding the use of Binance, one of the world’s largest cryptocurrency exchanges.

This cautionary measure comes as a response to a previous circular issued against a fraudulent company that was illegally using the Binance brand.

On July 28, the SEC released a statement advising against investing with Binance, citing the absence of a valid license for operations in the country, thereby rendering its activities illegal.

The commission also emphasized the substantial risks associated with investing in cryptocurrencies, highlighting the potential for significant financial losses:

“Any member of the investing public dealing with the entity, making such solicitation is doing so at his/her own risk.”

This is not the first time the SEC has taken action against Binance.

In June, the commission published a similar circular, limiting the activities of Binance Nigeria, which was proven to be a fraudulent entity unaffiliated with the legitimate Binance exchange.

In response, Binance issued a cease and desist notice to Binance Nigeria.

READ MORE: SEC Chairman Gary Gensler Raises Alarm Over Widespread Fraud in Crypto Market

It’s worth noting that Nigeria has maintained a cautious approach to the crypto industry, despite its efforts to promote the central bank digital currency (CBDC), known as the eNaira, which was launched in 2021.

However, adoption rates of the eNaira have fallen below expectations, leading the central bank to explore options to boost its usage.

In July, the CBDC system was upgraded with near-field communication technology, enabling more convenient and secure contactless payments.

Furthermore, starting from May 2023, Nigeria implemented a 10% tax on gains from the sale of digital assets, including cryptocurrencies.

Local stakeholders criticized this measure as “premature.”

Cointelegraph sought further commentary from Binance regarding the SEC notice, but no additional statements have been provided at this time.

As for Binance and other unregistered platforms, the SEC demands an immediate cessation of services in Nigeria.

The regulatory body is determined to safeguard local investors and uphold the legality of financial activities within the country’s borders.

Other Stories:

Liquid Staking Tokens Poised to Dethrone Ethereum’s Ether (ETH) as Dominant DeFi Asset

Bitcoin’s Reduced Volatility Sparks Anticipation for Exciting Long-Term Bull Signal

ConsenSys, a blockchain technology firm, has publicly launched its “Diligence Fuzzing” tool for smart contract testing, as revealed in an announcement on August 1.

This new tool is designed to identify vulnerabilities in contracts before they are deployed by generating “random and invalid data points.”

The release comes in the wake of significant losses in decentralized finance hacks, which surpassed $2.8 billion in 2022.

The escalating financial implications of these hacks have prompted developers to seek more sophisticated testing tools to proactively discover vulnerabilities before malicious attackers do.

Previously available as a closed beta version with access approval requirements, ConsenSys has now made Diligence Fuzzing accessible to all developers without any restrictions.

Additionally, the tool has been integrated with the smart contract toolkit Foundry, and developers can test it out for free before committing to any expenses.

Liz Daldalian, the lead of ConsenSys security services, elaborated on the functioning of the tool in an interview with Cointelegraph.

Developers can utilize “Scribble,” a machine language developed by ConsenSys, to annotate their contracts.

READ MORE:SEC Chairman Gary Gensler Raises Alarm Over Widespread Fraud in Crypto Market

These annotations allow the fuzzing tool to comprehend the contract’s logic and generate “unexpected” inputs to test whether the contract produces unintended actions under various scenarios.

The ConsenSys security researcher, Gonçalo Sá, clarified that Diligence Fuzzing is not a “black box fuzzer,” meaning it doesn’t employ completely random data.

Instead, it functions as a “grey-box fuzzer” that leverages an understanding of the contract’s current state to optimize the data produced and enhance the tool’s efficiency.

Sá observed an increasing interest in fuzzing among developers, particularly with the growing popularity of Foundry’s default black-box fuzzer.

Many users, however, seek a more sophisticated fuzzer than the default one, which Diligence Fuzzer aims to provide.

Sá emphasized that people are recognizing the power of fuzzing and are seeking more potent tools to fortify their security measures.

Smart contract hacks remain a persistent issue for users, with Web3 security vulnerabilities resulting in over $471.43 million in losses during the first half of 2023, excluding rug pulls and phishing scams.

While Diligence Fuzzing is not a foolproof solution to eradicate all smart contract hacks, Daldalian asserted that it represents one essential tool in developers’ arsenal to create more secure smart contracts.

By adopting such tools, the Web3 community can take significant strides towards mitigating losses from these attacks.

Other Stories:

Bitcoin’s Reduced Volatility Sparks Anticipation for Exciting Long-Term Bull Signal

Liquid Staking Tokens Poised to Dethrone Ethereum’s Ether (ETH) as Dominant DeFi Asset