Lending platform Alchemix recently made a significant announcement, reporting the successful return of all the funds stolen during the Curve Finance hacker attack on July 30.

The attack had resulted in a massive loss of over $61 million in cryptocurrencies, with $13.6 million drained from Alchemix’s alETH-ETH pool.

The hacker had also targeted JPEGd’s pETH-ETH pool, causing an outflow of $11.4 million, and Metronome’s sETH-ETH pool, which lost over $1.6 million.

The hacker exploited vulnerabilities in the Vyper programming language through reentrancy attacks to execute the heist.

To reclaim the stolen funds, the hacker agreed to a bug bounty offer. On August 3, Curve, Metronome, and Alchemix jointly launched an initiative, promising a 10% bounty reward to anyone who returned the seized funds.

They urged the perpetrator to give back the remaining 90%, potentially amounting to around $7 million.

Surprisingly, less than 24 hours after the offer was announced, the original attacker began returning the stolen funds.

The process started with the hacker sending back 4,820.55

Alchemix ETH (alETH) to the Alchemix Finance team. Eventually, on August 5, the transaction was fully completed.

READ MORE: JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

In an on-chain message that appeared to be directed at the Alchemix and Curve teams, the attacker stated the reason for the return.

The individual claimed to be refunding not because they feared being identified but rather because they did not wish to “ruin” the projects involved.

JPEG’d, the nonfungible token protocol affected by the attack, also received a refund from the hacker. The hacker returned 5,495 Ether to the protocol.

As part of the bounty offer, JPEG’d decided not to pursue legal action against the perpetrators, considering the event as a white-hat rescue.

With the return of the stolen funds, Alchemix, Curve Finance, and JPEG’d can now focus on rebuilding and securing their platforms.

This outcome highlights the importance of bug bounty programs and collaborative efforts among crypto projects to address security breaches and protect their users from potential risks.

While the incident caused significant damage, the swift response from the involved parties and the hacker’s willingness to return the funds offer a glimmer of hope for the DeFi community, emphasizing the need for continued vigilance and security measures in the rapidly evolving world of cryptocurrencies.

Other Stories:

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Elon Musk Puts Rumors to Rest: X Has No Plans to Launch Crypto Tokens

Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Tether developers are gearing up for the launch of cutting-edge JavaScript libraries designed to streamline the transmission of commands and signals to Bitcoin (BTC) mining hardware, such as WhatsMiner, AvalonMiner, and Antminer.

Paolo Ardoino, the chief technology officer of Bitfinex and Tether, shared the exciting news on X (formerly Twitter). He hinted that certain parts of the mining software might become available on open-source platforms in the future.

The primary goal of Tether’s BTC mining software is to optimize mining capacity management, leading to more efficient operations.

Ardoino highlighted his role as a core contributor to Moria, an orchestration instrument for mining farms. He proudly mentioned that all recent advancements are built using the innovative Holepunch technology.

Previously, Ardoino offered insights into Moria’s functionalities.

This remarkable mining instrument enables seamless communication between components within the BTC mining ecosystem.

It facilitates interactions through streamlined, secure, attack-resistant, and cost-efficient means.

To ensure secure data streaming and command reception, each miner will possess a unique public/private key.

This encryption mechanism will utilize hyper cores for data streaming and hyper swarms for command reception.

Notably, this approach simplifies firewall configuration, bolsters resilience to failures, enables easy replication across multiple sites, and enhances maintainability and modularity compared to previous attempts.

READ MORE: Chamber of Digital Commerce Publishes Impactful Analysis on SEC’s Ripple Lawsuit

Despite facing legal and regulatory challenges, Tether has remained actively engaged in the cryptocurrency mining sector.

The company announced its intention to allocate a portion of its monthly profits towards acquiring BTC.

Moreover, Tether has invested in energy production and sustainable BTC mining in Uruguay, partnering with a local firm.

Uruguay’s renowned robust infrastructure in the renewable energy sector makes it an ideal location for sustainable mining operations.

The country takes pride in its abundant natural resources, allowing it to derive nearly 100% of its electricity from renewable sources.

In conclusion, Tether’s forthcoming JavaScript libraries hold promise for revolutionizing the efficiency of BTC mining operations.

Their commitment to open-source initiatives and sustainable mining practices in Uruguay showcases their dedication to driving positive change in the cryptocurrency industry.

Other Stories:

JPEG’d DeFi Protocol Recovers $10 Million in Stolen Crypto After Hacker Returns Funds

Bitcoin’s Hodl Strategy Outperforms Crypto Funds by 68.8% in H1 2023

Elon Musk Puts Rumors to Rest: X Has No Plans to Launch Crypto Tokens

Three U.S. Senators, Elizabeth Warren, Tim Kaine, and Chris Van Hollen, have jointly expressed concerns about North Korea’s use of cryptocurrency to fund its nuclear program and evade sanctions.

In an effort to address this issue, they sent a letter to the White House and Treasury Department, seeking information on the U.S. government’s actions against the illicit use of digital assets by the Democratic People’s Republic of Korea.

The senators highlighted that North Korea has been steadily developing its expertise in handling digital assets over the past few years, enabling them to become adept at using cryptocurrencies for nefarious purposes.

Reports indicate that North Korean hackers have been responsible for stealing over $3 billion worth of cryptocurrencies since 2018.

These stolen funds have allegedly been funneled into the country’s missile program, raising serious security concerns.

The problem lies in the hackers’ use of mixing services, a technique employed to obfuscate the origin of funds and hinder authorities’ ability to trace them.

By utilizing these mixers, the hackers attempt to avoid detection and further enable their illegal activities.

The U.S. Treasury Department’s Office of Foreign Assets Control has also expressed concern about cryptocurrency being used to finance North Korea’s nuclear ambitions.

As a result, the department added Tornado Cash, a digital asset service, to its list of sanctioned entities in November 2022.

READ MORE: Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

Senator Warren has been at the forefront of efforts to combat the illicit use of cryptocurrencies. She has previously drawn attention to the connection between digital asset payments and Chinese companies supplying precursors for opioid fentanyl production.

Additionally, Warren has proposed legislation to impose stricter Anti-Money Laundering requirements on cryptocurrency transactions.

In her latest endeavor, she joined a bipartisan group of senators advocating provisions against crypto mixers and privacy coins in the National Defense Authorization Act.

The Senators’ letter to the White House and Treasury Department underscores the urgency of addressing North Korea’s exploitation of cryptocurrencies.

By requesting information on the government’s actions, they aim to find effective strategies to crack down on these illegal activities and prevent further funding of North Korea’s nuclear program through digital assets.

The response from the administration will be critical in shaping future policies and initiatives to safeguard against such threats posed by the misuse of cryptocurrencies.

Other Stories:

Binance-Backed Solv Protocol Raises $6M in New Funding

Gulf Nation Nears Implementation of Virtual Asset Regulations]

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

According to crypto asset manager Grayscale, the next president of the United States is likely to support the implementation of a central bank digital currency (CBDC), as both frontrunners from the major political parties have expressed their favor towards exploring CBDCs.

However, it is worth noting that neither Joe Biden nor Donald Trump seems to hold a positive view of Bitcoin (BTC).

As the 2024 presidential polls currently stand, Joe Biden and Donald Trump hold significant leads in their respective parties. Both candidates have shown interest in exploring CBDCs, a sentiment that aligns with Forbes’ previous analysis earlier in 2023.

Former President Trump has publicly criticized Bitcoin, labeling it a “scam,” while President Biden’s position on the matter has been inferred from his support for imposing a 30% tax on Bitcoin mining.

Grayscale did not comment on Trump’s overall stance towards other cryptocurrencies and digital assets, although it has been noted that he is somewhat favorably inclined towards nonfungible tokens (NFTs).

President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets further supports the notion that he is generally supportive of the crypto industry.

However, the 2023 “Economic Report of the President” issued by the White House was not as optimistic about cryptocurrencies.

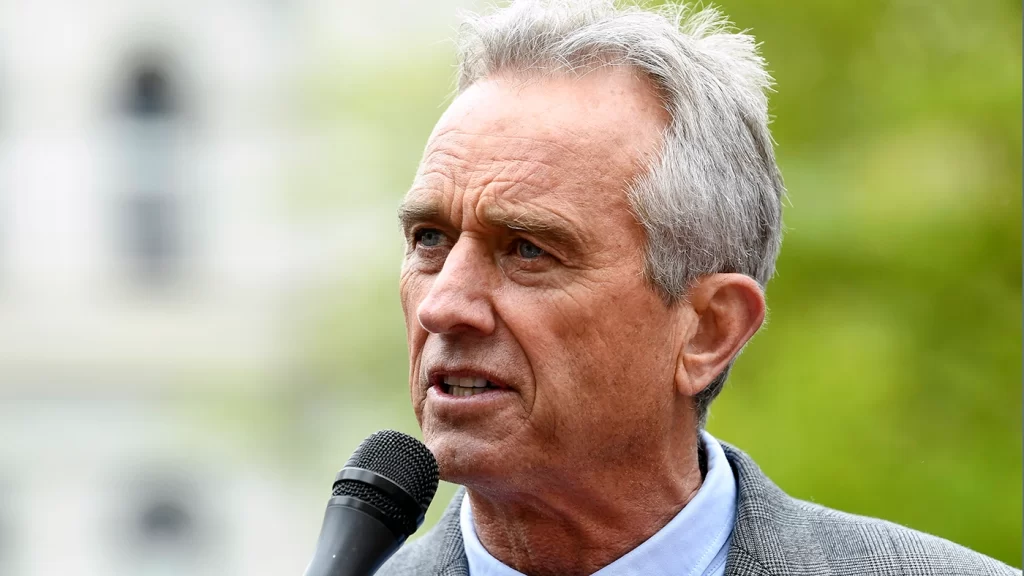

Among the candidates polling in second place are Democratic candidate Robert F. Kennedy, Jr. and Republican candidate Ron DeSantis.

Both of them have been vocal about their support for cryptocurrencies but remain opposed to the idea of a CBDC.

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

It is worth mentioning that Ron DeSantis is not the only pro-crypto candidate within the Republican contenders. Vivek Ramaswamy, with 7% support compared to Trump’s 63%, is also perceived as pro-Bitcoin and anti-CBDC.

One of the most ardent supporters of cryptocurrencies from either party is Republican Miami Mayor Francis Suarez.

He has been vocal about his love for the technology long before his presidential ambitions came into the picture, though some consider his chances of becoming president as “improbable.”

In conclusion, the 2024 presidential race in the United States seems to have a majority of candidates expressing interest in exploring CBDCs.

While both Biden and Trump have indicated support for CBDCs, they have shown disfavor towards Bitcoin.

Other candidates, like DeSantis, Kennedy, Ramaswamy, and Suarez, have varying degrees of support for cryptocurrencies, making the upcoming election a critical juncture for the future of digital assets in the country.

Other Stories:

Gulf Nation Nears Implementation of Virtual Asset Regulations

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

In the first half (H1) of 2023, the classic buy and hold, or hodl, strategy for Bitcoin (BTC) outperformed most crypto funds by an impressive 68.8%.

According to data from 21e6 Capital AG, a Switzerland-based investment adviser, crypto funds, on average, generated returns of 15.2% during the same period, while BTC saw gains of around 84%.

Maximilian Bruckner, the head of marketing at 21e6 Capital AG, noted that crypto funds have previously been able to outperform Bitcoin in bull markets.

However, their lackluster performance in 2023 was attributed to challenging market conditions and the large cash reserves they held at the end of 2022.

After the collapse of FTX and other crypto projects in 2022, many crypto funds decided to reduce risk and build cash buffers.

Unfortunately, this move caused them to miss out on significant BTC price rallies in H1 2023. The report indicated that funds with substantial cash positions tend to underperform in a bull market, unless their assets perform significantly better than Bitcoin.

The general sentiment following the events of 2022 led to larger-than-normal cash positions for many funds, and most major altcoins also underperformed Bitcoin during this period, making it a challenging environment for them.

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

At the time of writing, BTC was priced at roughly $29,000 and struggled to hold above the $30,000 level, which was only briefly surpassed a couple of times in 2023.

Despite this, the current price marked a 75% gain since January 1, as per CoinGecko data.

The report acknowledged that all crypto fund strategies achieved positive results in 2023, but they underperformed when compared to Bitcoin, especially those with significant exposure to altcoins, futures, or those relying heavily on momentum signals.

Looking ahead, the report highlighted that monitoring the leading futures providers and the funding rates in crypto futures markets, as well as the ability of quantitative funds to capture trends, would be crucial areas of focus for market observation.

The investor sentiment showed slight improvement over H1 2023, suggesting that some funds might consider allocating more cash into the crypto sector.

However, the report cautioned that full sentiment recovery had not yet taken place, as indicated by current data on inflows and outflows.

Other Stories:

Gulf Nation Nears Implementation of Virtual Asset Regulations

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

Elon Musk, the CEO of X (formerly known as Twitter), has quashed rumors about the platform launching its own crypto tokens.

In response to a post by DogeDesigner on Saturday, Aug. 5, Musk addressed the issue of scam tokens like X (X) and TwitterDAO (TWITTER) falsely claiming connections to the social media platform.

DogeDesigner had raised concerns in the crypto community, cautioning users about being wary of articles related to scam tokens and clarifying that neither Musk nor X had ever launched a crypto token. In his response, Musk categorically asserted, “And we never will.”

This statement comes after Musk had previously hinted at the possibility of integrating cryptocurrency as a payment option on X.

This had left traders speculating about whether he would introduce a specific crypto token or stick with his favorite, Dogecoin (DOGE).

READ MORE: Binance-Backed Solv Protocol Raises $6M in New Funding

The situation was further complicated with the appointment of Linda Yaccarino as the new CEO of X. This move had raised doubts among investors about the likelihood of a Dogecoin integration.

However, recent comments from Musk have revived optimistic sentiments among Dogecoin enthusiasts.

Musk had recently unveiled an ambitious vision for transforming Twitter into an all-encompassing platform, officially rebranding it as X, often referred to as the “everything app.”

Following Musk’s unequivocal confirmation that X has no plans to launch a crypto token, the price of Dogecoin experienced a surge of over 2% within a matter of hours, according to CoinMarketCap.

The reassurance from Musk regarding the absence of crypto token plans has provided some clarity to the market, boosting confidence among Dogecoin investors.

With the uncertainty surrounding X’s integration of Dogecoin dispelled, traders and enthusiasts alike are hopeful for the future of the popular meme-based cryptocurrency on the revamped X platform.

Other Stories:

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Gulf Nation Nears Implementation of Virtual Asset Regulations

Shytoshi Kusama, the lead developer of Shiba Inu, has recently addressed Coinbase’s Onchain Summer campaign and suggested that it bore similarities to ideas originally proposed by the Shiba Inu community.

In response to Coinbase CEO Brian Armstrong’s update about the upcoming launch of the Base mainnet on Aug. 3, Kusama made a statement, “If it isn’t a shadowcat, it’s a copycat.”

Coinbase is gearing up to launch its Ethereum layer-2 solution, known as Base, on Aug. 9.

The goal of Base is to attract the next billion users to the blockchain ecosystem by providing tools for developing various Web3 products.

In anticipation of the Base mainnet launch, Coinbase organized a campaign named Onchain Summer, which is set to begin on the same day.

The campaign has sparked mixed reactions from the Shiba Inu community.

Coinbase’s announcement mentioned that the Onchain Summer event would coincide with the mainnet launch of Base and would encompass several weeks of celebration featuring art, music, and gaming.

READ MORE: Robinhood Turns Profitable in Q2 2023 Despite Revenue Dip

However, it’s worth noting that on July 15, the Shiba Inu team initiated the “Summer of Shibarium” campaign as a preparation phase leading up to the mainnet launch of its own layer-2 scaling solution.

Kusama hinted that Coinbase’s Onchain Summer initiative might have drawn inspiration from Shiba Inu, although the events themselves differ significantly in their respective activities.

At present, the Summer of Shibarium campaign is already underway, and the team has introduced numerous releases as part of their preparations for the Shibarium mainnet launch.

Some of the recent developments include the introduction of the Shibarium Beta Bridge and the Shibarium YouTube launch.

In conclusion, Shytoshi Kusama has expressed concerns about the similarities between Coinbase’s Onchain Summer campaign and ideas presented by the Shiba Inu community.

As both projects approach their respective mainnet launches, the crypto community will be closely watching the developments and impact of these initiatives on the blockchain ecosystem.

Other Stories:

Goldman Sachs Economists Predict AI to Surpass Electricity and PCs in Financial Impact on US Economy

Cryptocurrency-friendly trading neobank Revolut is ceasing its crypto services in the United States due to regulatory uncertainty.

In a statement to Cointelegraph on Aug. 4, the company revealed its decision to suspend all crypto services for U.S. users.

Collaborating with its U.S. banking partner, Revolut aims to halt access to cryptocurrencies through its platform starting from Sept. 2, 2023.

Subsequently, on Oct. 3, the firm will completely shut down crypto services on Revolut for U.S. customers, prohibiting them from buying, selling, or holding any cryptocurrencies.

The company’s spokesperson clarified that this move would impact only “1%” of its global crypto customers and asserted that Revolut would continue operating its non-crypto business in the United States.

While acknowledging the disappointment this decision may cause, the representative assured that crypto customers in the U.S. would receive all relevant information about the suspension through email communication from Revolut.

The dedicated support team would also be available through the in-app chat to address any concerns and questions.

READ MORE: Robinhood Turns Profitable in Q2 2023 Despite Revenue Dip

In late June, Revolut US had already announced the delisting of certain cryptocurrencies like Cardano (ADA), Polygon (MATIC), and Solana (SOL), with plans to proceed with delistings in September.

At that time, the platform supported around 30 cryptocurrencies in the United States.

The United States’ regulatory environment for cryptocurrencies has posed challenges not just for Revolut but also for other major crypto services.

Crypto.com, a global crypto exchange, suspended services to institutional clients in the U.S. in mid-June due to similar regulatory concerns.

Revolut’s decision to wrap up crypto services in the U.S. showcases the impact of regulatory uncertainty on the crypto industry.

As the company focuses on its non-crypto business in the U.S., it highlights the importance of clear and comprehensive regulations in the cryptocurrency space to foster innovation and ensure consumer protection.

Other Stories:

Goldman Sachs Economists Predict AI to Surpass Electricity and PCs in Financial Impact on US Economy

Onchain funding platform Solv Protocol has revealed that it’s secured $6M in fresh funding. The raise was completed with the support of a host of leading industry VCs. UOB Venture Management, Mirana Ventures, Emirates Consortium, Matrix Partners, Apollo Capital, HashCIB, Geek Cartel, Bing Ventures, and Bytetrade Labs all participated.

The raise comes at a propitious time for Solv, which recently launched V3 of its protocol. The latest version includes a host of improvements designed to make it easier for investors to access financial products on-chain. Solv boasts of connecting on-chain entities with over 15,000 individual and institutional investors through its vast liquidity network. Previous investors in the company have included Binance Labs and BlockchainCapital.

Solv Earn, its flagship product, enables users to browse available funds and to assess them on various criteria including APR, term, size, and status. This makes it easy for users to pick an investment fund that suits their goals, timeframe, and risk profile.

New Money for New Narratives

The crypto industry, DeFi in particular, is driven by constantly shifting narratives and evolving use cases. This presents an abundance of investment opportunities for those smart enough to identify emerging trends and position themselves accordingly. The last 12 months have witnessed the growth of liquid staking derivatives (LSD) which has given rise to its own DeFi vertical: LSDfi. This is one of many sectors that is now accessible through Solv.

As Solv Protocol CEO Ryan Chow explains, “New DeFi narratives, such as RWA and LSD, are driving speculation around the next iteration of DeFi summer. Solv V3 will focus on the RWA track, and is committed to introducing billions of dollars worth of income-generating assets for the industry through our fund platform, in preparation for the next phase of DeFi mass adoption.”

Bringing real world assets on-chain has the potential to multiply the TVL in DeFi protocols, moving it from billions of dollars to ultimately trillions. In the process, it stands to disrupt industries such as forex by introducing more consistent pricing and facilitating global access.

Laser Digital, a subsidiary of Japanese banking giant Nomura Securities, participated in the $6M round. Explaining his firm’s rationale behind writing a check, Laser’s Olivier Dang said: “Solv has built a trustless DeFi platform with a trusted institutional network, integrating brokers, underwriters, market makers, and custodians to create the first fund infrastructure on the blockchain, becoming an important infrastructure that bridges DeFi, CeFi, and TradFi liquidity.”

Solv Shines at the Right Time

Since launching V3 of its protocol in Q2 of this year, Solv has reported more than 25,000 users and over $100 million in trading volume. Its latest funding round has been completed at a time when TradFi and DeFi are closer than ever, with institutions now intent on gaining exposure to crypto in various forms. For some, this entails investing in web3 infrastructure, or migrating their existing processes to an on-chain environment, with the potential improvements this brings in terms of security, reducing counterparty risk, increasing transparency, and delivering faster settlement.

Other TradFi players are intent on gaining direct exposure to crypto assets, as evidenced by the spate of Bitcoin ETF filings that’s seen Wall Street bigshots saying nice things about crypto again. Given Thursday’s ruling that XRP doesn’t constitute a security, prompting speculation that the same classification may apply to other assets maligned by the SEC such as SOL, things are looking up for the industry.

With Solv sporting an experienced team including financial experts from Goldman Sachs and J.P. Morgan, the on-chain investment protocol is well placed to ride the wave of goodwill that should continue into 2024 and beyond.

Oman’s journey towards implementing its own virtual asset regulations is gaining momentum, as the Capital Market Authority (CMA) seeks public input on its proposed framework governing digital assets, including cryptocurrencies.

In a consultation paper released on July 27, the CMA revealed that it is diligently crafting a comprehensive regime for the virtual asset sector.

The objective is to create an alternative financing and investment platform for issuers and investors while mitigating the risks associated with virtual assets.

The consultation paper comprises 26 questions, designed to gather insights and opinions from industry stakeholders.

Key areas covered in the proposed framework include regulatory and licensing requirements for virtual asset service providers (VASPs), corporate governance, risk management, and virtual asset issuance.

The framework is planned to cover various types of virtual assets, such as utility tokens, security tokens, fiat-backed and asset-backed stablecoins, and other digital currencies that meet the Financial Action Task Force’s definition of virtual assets.

However, the issuance of privacy coins may face a potential ban, subject to feedback from the public.

To ensure accountability and compliance, VASPs might be required to establish a local presence in Oman through a legally established entity and physical office.

READ MORE: KPMG Report Finds Bitcoin Offers ESG Benefits

Additionally, minimum capital requirements might be imposed on them.

The proposed framework could also mandate virtual asset firms to hold only a small percentage of their assets in hot wallets, undergo regular audits of safeguarded assets, and demonstrate proof of reserves.

The CMA has set a deadline for public feedback until Aug. 17, with the possibility of key opinions being made public on their website. Following this consultation phase, the CMA will proceed to finalize the regulatory framework.

The groundwork for this initiative began earlier, with discussions on regulating the virtual asset industry in Oman commencing in November 2020.

A task force, comprising officials from the CMA and the Central Bank of Oman, was formed to study the feasibility of permitting or banning virtual asset activities.

In December 2022, consultants were brought in to aid in the establishment of the new regulatory regime.

The progress made by Oman in drafting and seeking public input on its virtual asset regulations reflects the country’s commitment to embracing financial innovation while ensuring proper safeguards against potential risks.

As the consultation phase concludes and the regulatory framework takes shape, Oman moves closer to providing a secure and regulated environment for virtual asset transactions within its borders.

Other Stories:

Robinhood Turns Profitable in Q2 2023 Despite Revenue Dip

ASIC Sues eToro Over Alleged Insufficient Screening Tests

Goldman Sachs Economists Predict AI to Surpass Electricity and PCs in Financial Impact on US Economy