The Bank for International Settlements (BIS) has unveiled a significant step towards advancing cross-border payment efficiency through its new initiative, the cross-border payments interoperability and extension (PIE) task force.

This pioneering endeavor has garnered the participation of leading industry players, including the blockchain-based digital payment network, Ripple.

In a communiqué released on August 9th, BIS outlined the key takeaways from the PIE task force’s meeting held on May 11th.

The task force, operating under the auspices of the BIS Committee on Payments and Market Infrastructure, has committed to fortifying cross-border payments and attaining the quantitative benchmarks established by the G20.

To fulfill this mission, the task force envisions bolstering access to payment systems, elongating payment system operational hours, and forging interconnections between diverse payment platforms.

These interconnected systems will encompass the convergence of application programming interfaces and messaging components.

Notably, Ripple, alongside eminent counterparts such as Mastercard and SWIFT, will be an integral contributor within the task force.

This collaborative approach unites industry leaders with a common purpose: augmenting the interoperability of cross-border payments to foster a seamless global financial landscape.

Recognizing the exigency of harmonized efforts, BIS emphasized that elevating payment systems mandates a unified approach involving global coordination and the synergistic involvement of both public and private sector stakeholders.

By bringing these diverse actors into alignment, the potential for transformative advancements in cross-border payments becomes even more attainable.

READ MORE: Governments Remain Wary About Worldcoin Amid Privacy Concerns

Simultaneously, in a parallel development, a recent update regarding the ongoing legal tussle between the United States Securities and Exchange Commission (SEC) and Ripple Labs has emerged.

The SEC has submitted a letter to the presiding judge on August 9th, outlining its intent to seek an interlocutory appeal.

This decision stems from the belief that the verdict requires reevaluation by an appellate court.

Remarkably, the SEC is advocating for a review even as the case remains unresolved, underscoring the significance and complexity of the legal issues at hand.

In essence, these recent developments underscore the financial industry’s proactive strides towards enhanced cross-border payments, marked by collaborative innovation and legal deliberations.

As BIS spearheads the PIE task force with global industry leaders, and the SEC-Ripple legal saga continues, the trajectory of cross-border payments and their regulatory landscape stands poised for potential transformation.

Other Stories:

Binance’s Proof-of-Reserves Discloses Strong Financial Position

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

Binance, renowned as the world’s leading cryptocurrency exchange in terms of trading volume, is said to have initiated the process of registering within Taiwan’s regulatory framework, as mandated by the Money Laundering Control Act and the Financial Supervisory Commission (FSC).

As reported by local media, the FSC has reportedly reached out to numerous domestic crypto service providers, informing them of Binance’s pursuit of Anti-Money Laundering (AML) compliance.

The details stem from insights shared by Chen Peiyun, co-founder of BitShine, a cryptocurrency exchange based in Taiwan.

Chen Peiyun disclosed that Binance has been identified by the FSC as a potential participant in the Taiwanese crypto market.

Requests for comments from Binance, regarding these recent developments, have yet to be addressed as of this time.

Taiwan’s cryptocurrency sector has mostly existed without comprehensive regulation.

However, to bolster security and transparency, the FSC introduced AML guidelines in July 2021, mandating all cryptocurrency exchanges operating within or providing services to the nation to adhere to these regulations.

Operating in Taiwan through a local subsidiary known as Binance International Limited Taiwan Branch (Seychelles), the exchange’s registration records indicate the formal establishment of this entity on May 12, 2023.

READ MORE: Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

In addition to formalizing its presence through registration, Binance has also formed collaborations with local governmental bodies to combat cybercrime, emphasizing their commitment to security.

Notably, the FSC took on the role of being the primary overseer of cryptocurrency-related activities within the country earlier in March.

This transition was accompanied by an announcement from the regulatory body’s leader, affirming their intentions to develop substantial regulations and policies.

These efforts encompass safeguarding customer assets, segregating them from company funds, and bolstering investor protection practices.

It’s pertinent to mention that Taiwan’s cryptocurrency policies will remain separate from those of mainland China, which, since 2021, has imposed a comprehensive ban on all cryptocurrency-related operations.

These reports of Binance’s intent to engage with the Taiwanese cryptocurrency market coincide with the exchange facing heightened regulatory scrutiny within the United States and Europe.

The company is presently confronted with numerous legal actions in the United States, coupled with the withdrawal from various European jurisdictions following regulatory confrontations.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

In the wake of PayPal’s recent launch of its stablecoin, PYUSD, the crypto community has witnessed a surge in opportunists, speculators, and potential scammers attempting to capitalize on the hype by creating their own copycat tokens.

Data from DEX Screener, a decentralized exchange scanner, reveals that nearly 30 new token pairs with the “PYUSD” ticker have emerged within hours of PayPal’s announcement.

These imposter tokens have been minted on various blockchain networks, including BNB Smart Chain, Ethereum, and Coinbase’s newest layer 2 solution, Base.

It is crucial to note that the authentic PayPal USD token was introduced in November 2022 and can be verified through a specific contract address.

PayPal has explicitly stated that PYUSD can only be sent between verified PayPal accounts and compatible wallets, making it highly unlikely that any of the tokens listed with the same ticker on platforms like UniSwap are genuine.

Despite this clarity, the largest imposter PYUSD token, created on Ethereum, has witnessed a staggering $2.6 million in trading volume since its inception, which occurred minutes after PayPal announced its stablecoin launch.

However, the token’s value has since plummeted more than 66% from its all-time high.

Interestingly, some of these fake PYUSD tokens have taken a humorous approach, adopting names like “PepeYieldUnibotSatoshiDoge.”

This particular imposter token experienced an increase of over 3,000% in value within four hours.

Unfortunately, many of the counterfeit PYUSD tokens are likely “honeypots,” a term used to describe scams where investors purchase a token but cannot sell it, effectively losing their crypto holdings.

Investors often discover these honeypots only when they attempt to sell their assets.

Such scenarios are not entirely new in the crypto world, as speculators, known as “degens,” frequently rush to create new meme coins in response to trending stories and events.

For instance, there was an “LK-99” token created after the superconductor craze, and over 50 UFO-themed meme coins emerged when the U.S. Congress held a hearing on alien visitation cover-ups.

In conclusion, the launch of PayPal’s stablecoin has sparked a wave of imposter tokens, with some experiencing significant price fluctuations before losing value.

As crypto enthusiasts and investors navigate this space, caution and vigilance are essential to avoid falling victim to scams and honeypots that are prevalent in the current market.

Other Stories:

2024 Presidential Candidates’ Mixed Views on Crypto

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Zoom has responded to widespread criticism by updating its terms of service to address concerns about AI data scraping.

In a blog post on August 7th, the video-conferencing platform clarified that it will not use user content, including chat, audio, or video, to train artificial intelligence algorithms without explicit consent.

The controversy arose over a section in Zoom’s terms that implied the company could utilize a broad range of customer content to train AI models.

This led to a backlash, with numerous users threatening to abandon the platform.

Zoom explained that the AI-related terms had been added back in March, but they have now been updated to emphasize that they will not utilize any customer data for AI training without obtaining consent first.

This revision is aimed at reassuring users about their data privacy and control over how their information is used.

The company’s AI offerings, such as the meeting summary tool and message composer, are opt-in features, meaning account owners or administrators can decide whether to enable them.

Before Zoom clarified its terms, concerned users took to Twitter to voice their displeasure and called for a boycott until the terms were updated.

The issue stemmed from the section in which users had previously consented to Zoom using, collecting, distributing, and storing “Service Generated Data” for various purposes, including AI and machine learning model training.

It’s worth noting that other tech companies have also updated their privacy policies to allow for data scraping to train AI models.

READ MORE: 2024 Presidential Candidates’ Mixed Views on Crypto

For example, in July, Google updated its policies to permit the use of public data for AI training.

The broader tech industry has been facing growing scrutiny over its use of AI and potential privacy implications.

In June, European Union consumer protection groups urged regulators to investigate AI models used in chatbots like OpenAI’s ChatGPT or Google’s Bard.

The concerns primarily revolved around disinformation, data harvesting, and manipulation generated by these bots.

As a response to these concerns, the EU passed the AI Act on June 14th, which is set to take effect within the next two to three years.

The Act establishes a framework for the development and deployment of AI technologies, aiming to address privacy and ethical considerations surrounding AI usage.

In conclusion, Zoom’s update to its terms of service aims to allay user fears about AI data scraping and ensure that customer content will not be used for AI training without their explicit consent.

The move comes in the context of wider industry concerns about AI usage and privacy, leading to changes in privacy policies and the implementation of regulatory frameworks like the AI Act in the European Union.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Circle CEO Jeremy Allaire recently estimated that up to 70% of the adoption of the USD Coin (USDC) is coming from countries outside of the United States.

Despite the perception that USDC is primarily focused on the US market, the majority of its adoption is happening in emerging and developing markets worldwide.

Allaire revealed this information in a tweet to his 131,300 followers on Twitter, acknowledging the strong progress of USDC in regions like Asia, Latin America (LATAM), and Africa.

This emphasis on non-U.S. adoption is not unique to USDC alone. Paolo Ardoino, the chief technology officer of Tether, a competitor stablecoin issuer, also emphasized the significance of non-U.S. markets.

He stated that Tether’s stablecoin, USDT, can be seen as a safe tool for emerging markets and developing countries.

Cointelegraph attempted to reach out to Circle for further details about their expansion plans in non-U.S. markets but had not received a response at the time of publication.

Allaire’s comments coincided with PayPal’s announcement of its own USD-pegged stablecoin, PayPal USD (PYUSD). Allaire congratulated both PayPal and Paxos for entering the stablecoin space, expressing excitement about the entry of a significant internet and payments company and attributing it to improved regulatory clarity.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

However, there has been a decline in USDC supply since the beginning of 2023, caused by reduced demand and increased redemptions.

As a result, the stablecoin market share of USDC has shrunk to only 21%, with a total circulation of $26.1 billion.

Regarding liquidity concerns, Allaire confirmed that redemptions were outpacing issuance. Over the past month, Circle issued $5 billion USDC but redeemed $6.6 billion USDC.

Circle is actively expanding its global banking and liquidity network, collaborating with high-quality banks in major regions worldwide.

In an Aug. 3 transparency report, Circle revealed that 93% of its Circle Reserve Fund portfolio is invested in short-dated U.S. Treasuries, overnight U.S. Treasury repurchase agreements, and cash. The remaining 7% constitutes cash reserves held at banks.

Earlier in June, Circle obtained a Major Payment Institution license from the Monetary Authority of Singapore, signaling further strides in its global expansion efforts.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

OpenAI, the artificial intelligence company, has recently unveiled its latest web crawling tool called “GPTBot,” which holds the potential to enhance future iterations of ChatGPT models.

The company believes that by crawling web pages, the data collected can be utilized to improve accuracy and broaden the capabilities of their upcoming AI models.

Web crawlers, also known as web spiders, are bots that index website content across the internet. Search engines like Google and Bing employ these crawlers to ensure websites appear in search results.

OpenAI clarified that GPTBot will only gather publicly available data from the world wide web, avoiding sources with paywalled content, personal identifiable information, or text that violates their policies.

Website owners can prevent GPTBot from crawling their sites by adding a “disallow” command to a standard file on their servers.

This feature allows them to control whether their web content is included in the data collection process.

Interestingly, OpenAI filed a trademark application for “GPT-5,” the anticipated successor to their current GPT-4 model.

However, the CEO, Sam Altman, clarified that GPT-5’s training is not imminent, as the company needs to conduct several safety audits before starting the process.

Recent concerns have been raised about OpenAI’s data collection practices, specifically regarding copyright and consent.

In June, Japan’s privacy watchdog issued a warning to OpenAI for collecting sensitive data without proper authorization.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Similarly, Italy temporarily banned the use of ChatGPT due to alleged breaches of European Union privacy laws.

Additionally, a class-action lawsuit was filed against OpenAI by 16 plaintiffs, accusing the company of accessing private information from ChatGPT user interactions. Microsoft, named as a defendant in the lawsuit, might also be implicated.

If these allegations are proven true, OpenAI and Microsoft could be found in violation of the Computer Fraud and Abuse Act, a law with a history of addressing web-scraping cases.

In conclusion, OpenAI’s new web crawling tool, GPTBot, offers promising potential for improving future ChatGPT models.

However, concerns regarding data collection practices must be addressed to ensure compliance with privacy laws and prevent potential legal repercussions.

As the company gears up for the development of GPT-5, it is essential to prioritize safety audits and adhere to ethical standards in AI research and development.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Bitstamp, a prominent cryptocurrency exchange with a long-standing history, is embarking on a global expansion endeavor by seeking new funds to bolster its operations.

According to reports on August 7, Bitstamp initiated its fundraising process in late June, enlisting the support of Michael Novogratz’s Galaxy Digital Holdings as an adviser.

The primary goal of this fundraising campaign is to finance the launch of derivatives trading in Europe by 2024 and to expand its services across various Asian markets.

Additionally, Bitstamp aims to scale its operations in the United Kingdom to enhance its service offerings further.

Bitstamp’s global CEO, Jean-Baptiste Graftieaux, emphasized the company’s exclusive focus on securing capital to extend services to both retail and institutional crypto clients.

He clarified that Bitstamp is not up for sale and has no active plans to sell the company.

Bitstamp had recently garnered attention in the crypto industry when Ripple, a major blockchain firm, acquired a minority stake in the exchange during the first quarter of 2023.

Galaxy Digital Holdings also played a key role as an adviser in this acquisition, which was publicly disclosed in late May.

READ MORE: Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

This push for expansion aligns with Bitstamp’s global ambitions announced in 2018, following its acquisition by NXMH, a company backed by South Korean NXC.

The co-founder of Bitstamp, Nejc Kodrič, previously asserted that the exchange was not seeking to sell or receive investment at the time.

However, he did take the opportunity to sell a significant portion of his Bitstamp stock while retaining a 10% stake and remaining the CEO.

Bitstamp has come a long way since its establishment in Slovenia in 2011, evolving into one of the world’s largest crypto exchanges based in Luxembourg.

Recent data from CoinGecko indicates that the exchange witnessed a trading volume of approximately $127 million within a 24-hour period.

Notably, Bitstamp is making headlines with its decision to impose trading restrictions on certain tokens, including Axie Infinity (AXS), Chiliz (CHZ), Decentraland (MANA), Polygon (MATIC), NEAR Protocol (NEAR), The Sandbox (SAND), and Solana (SOL) in the United States.

These restrictions are set to take effect on August 29, and the exchange cited “recent market developments” as the reason, stating that holding and withdrawing tokens will remain unaffected.

Recently, Bitstamp’s U.K. arm also earned registration with the Financial Conduct Authority, signifying its compliance with regulations in the country.

As Bitstamp continues to advance its global expansion plans, the crypto community eagerly awaits the developments and opportunities this growth may bring to the industry.

Other Stories:

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Cypher Protocol, a decentralized futures exchange operating on the Solana blockchain, was forced to suspend its smart contract following a significant exploit that resulted in an estimated $1 million in losses.

The incident was reported to Cypher’s 13,500 followers on social media platform X (formerly known as Twitter) on August 7, where the team disclosed the security breach and took swift action to freeze the affected smart contract.

In response to the exploit, Cypher Protocol promptly initiated an investigation to identify the root cause and determine the extent of the damage.

Additionally, they reached out to the hacker involved in the attack, aiming to engage in negotiations for the potential return of the stolen funds.

According to data obtained from the Solana blockchain explorer Solscan, the wallet suspected to be associated with the exploit made off with approximately 38,530 Solana tokens (SOL) worth about $23 each, as well as $123,184 worth of USD Coin (USDC) at the exchange rate of $1.00.

In total, the attacker managed to accumulate $1,035,203 from the illicitly obtained funds.

Shortly after the breach, the alleged hacker transferred 30,000 USDC to Binance’s Solana USDC address “kiing.sol” in an apparent attempt to convert and cash out the stolen assets.

Notably, various individuals in the crypto community took action by sending non-fungible tokens (NFTs) to the attacker’s wallet, urging them to return the funds.

Some of the NFT messages requested the return of the stolen assets with a stern warning, while others expressed frustration and demanded immediate restitution.

Despite the exploit, the alleged hacker has not yet transferred any of the stolen Solana-based funds to the Ethereum network as of the time of reporting.

The incident occurred during Cypher Protocol’s mtnDAO hacker house event, which it co-hosted with another Solana protocol called Marginfi.

However, Marginfi asserted its independence from Cypher and clarified that it remained unaffected by the attack.

At this stage, Cointelegraph has sought further information from Cypher Protocol to gain more insights into the incident.

However, an immediate response from the team was not received at the time of reaching out.

The exploit serves as a reminder of the ongoing security risks in the decentralized finance (DeFi) space, emphasizing the need for continuous vigilance and robust security measures to safeguard users’ funds and prevent similar incidents in the future.

Other Stories:

2024 Presidential Candidates’ Mixed Views on Crypto

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Adam Back, CEO of Blockstream and a prominent figure in the early days of cryptocurrency, has expressed strong confidence in Bitcoin’s potential to reach an all-time high of over $100,000 before its halving event in 2024.

To prove his belief in this outcome, Back has agreed to a wager with a pseudonymous Twitter user named @Vikingobbitcoin.

The bet, made on August 7, is centered on whether Bitcoin will hit the $100,000 mark by March 31, 2024, just a month before the halving scheduled for April 26. Back contends that the price will likely surge to new heights before the actual halving date.

Wagers on substantial Bitcoin price increases have captured significant attention in the past, like Balaji Srinivasan’s $1 million bet within a 90-day period in March.

Despite his previous bullish remarks about Bitcoin reaching $10 million by the sixth halving in 2032, Back is now backing his latest prediction with his own funds.

READ MORE: Coinbase CEO Affirms Commitment to US Amid Regulatory Uncertainty

However, the bet consists of just 1 million satoshis, the smallest unit of Bitcoin, amounting to $290 at current prices, but potentially over $1,000 if Back’s forecast comes true. Considering Back’s estimated net worth ranging from $50 to $300 million, this wager appears relatively small.

In response to Back’s post about the wager, Samson Mow, CEO of Jan3, and another prominent Bitcoin supporter, shared his agreement, expecting a new all-time high before the halving as well.

Although some snide comments emerged in response to the bet, the overall sentiment in the market seems to be increasingly bullish about Bitcoin’s price before the upcoming halving.

Charles Edwards, the founder of Capriole Investments, echoed this sentiment in a February 24 interview with Cointelegraph, stating that the halving event will elevate Bitcoin to become the “hardest asset in the world,” and he anticipates that the market is already in the early stages of a new bullish cycle.

With a growing number of analysts and market commentators expressing optimism about Bitcoin’s future price trajectory, the cryptocurrency community eagerly awaits the outcome of Back’s million satoshi wager and the potential for Bitcoin to reach new all-time highs in the coming years.

Other Stories:

U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

Latvia Sees Decline in Crypto Asset Purchases Amidst Concerns Over Fraud and Money Laundering

Several crypto-related public companies have recently released their quarterly earnings reports, demonstrating significant revenue growth and profit increases.

This article highlights the earnings of some of the major players in the crypto industry.

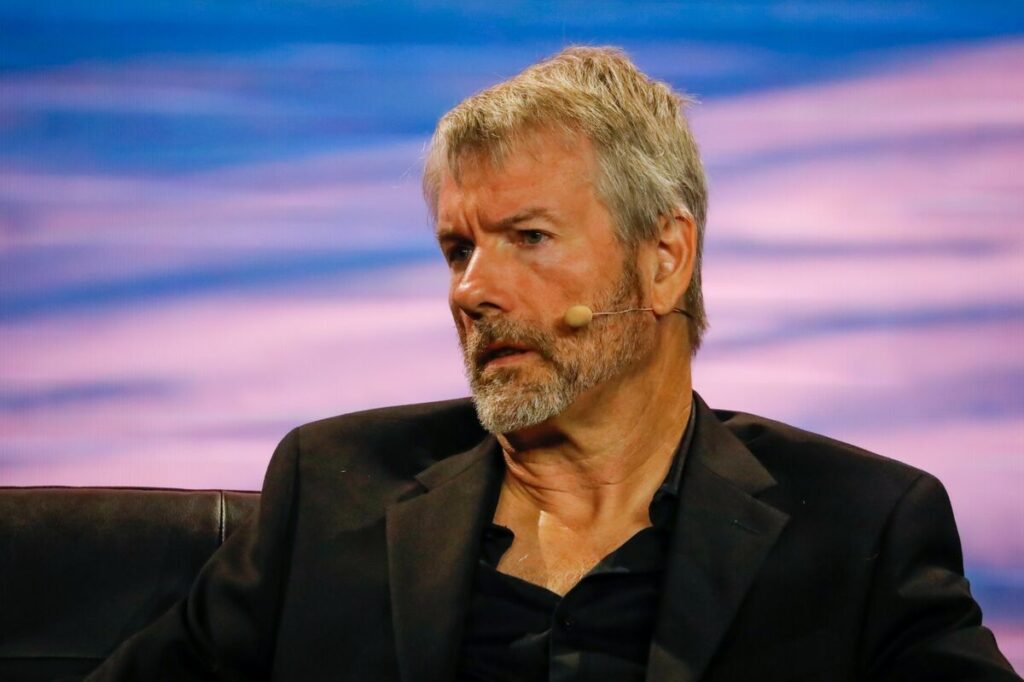

MicroStrategy, a Bitcoin-focused institutional giant, experienced a turnaround in Q2, with the surge in Bitcoin price contributing to its profitability.

As of July 31, the company holds 152,800 BTC, making it one of the largest corporate Bitcoin holders in the U.S. In the earnings report filed on Aug. 1, MicroStrategy reported a net income of $22.2 million, a substantial swing from a net loss of $1.1 billion in Q2 of 2022, with revenue steady at $120.4 million.

Block, led by Jack Dorsey, exceeded expectations with a 34% year-on-year increase in Bitcoin revenue.

Block’s Q2 earnings report revealed $2.4 billion in Bitcoin sales and a gross profit of $44 million, marking a 7% increase over the same period in 2022. The company’s revenue grew by 25.6% from $4.4 billion to $5.53 billion year on year.

Coinbase, the first American crypto exchange to go public, posted quarterly earnings of $663 million in net revenue, surpassing early estimates.

For the first time, non-trading revenue exceeded trading revenue, with $335.4 million coming from subscriptions and services.

Despite a 10% decline in revenue compared to Q2 2022, the firm outperformed estimates due to its growing U.S. market dominance and reduced losses to under $100 million.

READ MORE: U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

CoinShares, a European digital asset manager, reported a 33% year-on-year revenue surge, though it saw a 25% decline in asset management fees.

Profits for the quarter were 5.3 million pounds ($6.76 million), in contrast to a net loss of 0.6 million pounds ($0.77 million) in Q2 2022.

Robinhood, the fintech trading platform, became profitable for the first time since going public, according to its quarterly earnings report.

It recorded a net income of $25 million, or earnings per share of $0.03, a significant turnaround from a net loss of $511 million in the previous quarter.

In summary, the recent quarterly reports reveal a thriving crypto industry, benefiting from price rises in the crypto market and a decline in bearish momentum.

While some firms experienced fluctuations in certain areas, the overall trend indicates growth and profitability within the crypto-centric public companies.

Other Stories:

U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

Latvia Sees Decline in Crypto Asset Purchases Amidst Concerns Over Fraud and Money Laundering