Do Kwon, co-founder of Terraform Labs, has reportedly received support from his legal team in response to allegations of securities fraud levied by the U.S. Securities and Exchange Commission (SEC). Kwon’s attorneys have dismissed the claims, as the SEC increases scrutiny on the cryptocurrency industry.

Terraform Labs, the company behind the Terra blockchain and its native stablecoin TerraUSD (UST), has been the subject of an ongoing investigation by the SEC. The regulatory body alleges that the company and its co-founder, Do Kwon, engaged in fraudulent activities related to the sales of unregistered securities, thereby violating the U.S. securities laws.

In a recent development, Kwon’s legal team has reportedly refuted the SEC’s allegations, arguing that the regulatory body’s claims are unfounded. The attorneys emphasized that the tokens in question do not meet the criteria of securities under U.S. federal law, and as such, the SEC’s accusations hold no merit.

The SEC’s heightened attention towards the cryptocurrency sector has been a source of concern for many industry participants, who worry about the potential impact on innovation and growth. This increased scrutiny has, in some instances, led to legal battles between regulators and prominent figures within the crypto ecosystem.

Despite the ongoing regulatory challenges, Terraform Labs and Do Kwon remain committed to the development of the Terra blockchain and its ecosystem. The company has experienced significant growth, with TerraUSD (UST) emerging as one of the most widely-used stablecoins in the DeFi space. Terra has also gained recognition for its innovative use of algorithmic monetary policy and its potential to revolutionize the world of digital finance.

In summary, as the SEC continues to scrutinize the cryptocurrency sector, Do Kwon’s legal team is steadfastly dismissing allegations of securities fraud. With the backing of his attorneys, Kwon remains focused on the ongoing growth and development of the Terra blockchain and its native stablecoin, TerraUSD (UST).

As the price of Bitcoin (BTC) experienced a 10% drop within a week, traders and analysts within the cryptocurrency community are advising patience and calm, while emphasizing the need for a more comprehensive perspective on the market.

The leading cryptocurrency had been enjoying a relatively stable period before the sudden downturn, which took many by surprise. At the time of writing, Bitcoin’s price hovers around $52,000, a significant decline from the previous week’s high of $58,000.

Several factors have been cited as potential contributors to the drop, including increased regulatory scrutiny and the growing influence of institutional investors. However, it is important to consider the historical context of similar price fluctuations in the past. As many seasoned Bitcoin traders will recall, the market has weathered similar, if not more severe, dips before.

Veteran traders are urging the community to keep their cool and not to panic in the face of this recent downturn. They stress the importance of assessing the market from a long-term perspective, rather than focusing solely on short-term volatility.

One prominent Bitcoin trader, known as ‘CryptoCobain’ on Twitter, reminded followers that the cryptocurrency has a history of bouncing back from significant declines, stating that “Bitcoin has seen many 10-20% corrections during its last bull run, and it always recovered.” He further advised not to “make emotional decisions based on short-term price action.”

Some analysts also note that the current price decline may be a healthy correction, allowing the market to consolidate before potentially continuing its upward trajectory. They argue that such a correction can create a solid foundation for the next leg of the bull run, as it washes out weaker hands and attracts new investors looking for more attractive entry points.

Despite the recent dip, many in the cryptocurrency community remain optimistic about Bitcoin’s long-term potential. They continue to emphasize the importance of the digital asset as a store of value and hedge against inflation, especially in the current global economic climate.

In conclusion, while the recent 10% decline in Bitcoin’s price has undoubtedly shaken some investors, seasoned traders and analysts advise the community to maintain perspective and not to panic. By considering the long-term potential of Bitcoin and the historical context of similar price fluctuations, a more rational assessment of the market can be made.

Coinbase, a leading cryptocurrency exchange, has obtained a license to operate in Bermuda and is reportedly planning to launch an offshore exchange platform. This strategic move signifies the company’s ongoing efforts to expand its global reach and tap into new markets.

By securing the Bermuda license, Coinbase will be able to offer a wider range of financial services to customers in the region. The move also highlights the growing acceptance of cryptocurrencies and digital asset trading platforms by regulatory authorities in various jurisdictions.

The planned offshore exchange platform is expected to provide Coinbase users with an array of trading and investment options tailored to the specific needs and preferences of the Bermuda market. This expansion will further bolster the company’s position as a dominant player in the global cryptocurrency ecosystem.

In recent years, Bermuda has emerged as a hub for blockchain and fintech innovation, attracting several prominent companies to establish operations in the jurisdiction. The island’s supportive regulatory environment and commitment to fostering the growth of the digital asset industry have played a significant role in its rise as a prominent crypto destination.

The launch of Coinbase’s offshore exchange in Bermuda is anticipated to further enhance the region’s reputation as a blockchain and cryptocurrency haven. By providing local investors and traders with access to a secure and reliable platform for digital asset transactions, Coinbase’s presence in the market is expected to contribute to the growth and development of Bermuda’s burgeoning fintech ecosystem.

As Coinbase continues to expand its global footprint, the company’s entry into the Bermudian market signals its commitment to exploring new opportunities and establishing a strong presence in emerging crypto hotspots. This strategic move not only strengthens Coinbase’s position in the global market but also underscores the growing acceptance and adoption of cryptocurrencies worldwide.

In response to recent claims regarding a massive $10 million hack, MetaMask, a popular Ethereum wallet and browser extension, has firmly denied any vulnerability in its platform. The company asserts that its wallet infrastructure remains secure and has not been compromised.

The allegations surrounding the purported hack surfaced on social media and various online forums, with users claiming that a security breach in MetaMask’s wallet infrastructure led to the loss of millions of dollars’ worth of cryptocurrencies. However, MetaMask has quickly moved to address these concerns, emphasizing that the company’s security measures remain intact and that the reported hack did not result from any vulnerabilities within its platform.

In an official statement, MetaMask declared that its wallet service continues to provide a secure environment for users to store and manage their digital assets. The company further encouraged users to remain vigilant when it comes to their online security practices, reminding them of the importance of maintaining strong passwords, enabling two-factor authentication, and avoiding phishing scams.

As one of the most widely-used Ethereum wallets and browser extensions, MetaMask plays a crucial role in the blockchain and cryptocurrency ecosystem. With millions of users relying on its services for secure access to decentralized applications (dApps) and the management of their digital assets, the company has a vested interest in maintaining a high level of security and trust.

While the alleged $10 million hack has generated significant concern among the cryptocurrency community, MetaMask’s swift denial and reassurances regarding its platform’s security should help to alleviate some of these fears. As the investigation into the incident continues, users are advised to remain cautious and adhere to best practices when it comes to safeguarding their digital assets.

In a significant milestone for the Ethereum network, the number of new staked Ether (ETH) has exceeded withdrawals for the first time since the implementation of the Shapella upgrade. This development highlights the growing confidence among Ethereum users in the network’s transition to Ethereum 2.0 and its Proof of Stake (PoS) consensus mechanism.

The Shapella upgrade, which was introduced to improve the overall efficiency and scalability of the Ethereum network, has generated considerable interest in ETH staking. As a result, more users are now choosing to stake their ETH tokens to support the network’s security and earn rewards. This influx of stakers has led to a situation where new staked ETH outnumbers withdrawals, signaling a positive trend for Ethereum’s long-term growth and stability.

A key factor contributing to this shift in staking behavior is the enhanced rewards structure for Ethereum stakers following the Shapella upgrade. With the new system, stakers are incentivized to hold onto their staked ETH for longer periods, as doing so allows them to earn higher rewards. This change has encouraged more users to participate in the staking process, providing the network with a stronger foundation for future growth.

The increase in staked ETH also reflects the optimism surrounding Ethereum’s ongoing transition to Ethereum 2.0, which aims to address the network’s scalability and environmental concerns. By moving from the current energy-intensive Proof of Work (PoW) consensus mechanism to a more sustainable PoS model, Ethereum 2.0 seeks to ensure that the network remains competitive and attractive to users, developers, and investors alike.

As Ethereum continues to evolve and adapt to the demands of the rapidly-growing blockchain and cryptocurrency sectors, the recent surge in staked ETH serves as an indicator of the network’s potential for long-term success. With the Shapella upgrade bolstering the staking ecosystem and Ethereum 2.0 on the horizon, the Ethereum community can look forward to a more secure, efficient, and environmentally-friendly future.

Bittrex, a leading cryptocurrency exchange in the United States, might soon face regulatory scrutiny from the Securities and Exchange Commission (SEC), as per recent reports.

Sources familiar with the matter have revealed that the SEC is currently evaluating Bittrex’s compliance with federal securities laws. The exchange, which has been a significant player in the crypto space since its establishment in 2014, could potentially face enforcement action if found in violation of these regulations.

The SEC has been stepping up its efforts to regulate the cryptocurrency industry in recent years, with a particular focus on Initial Coin Offerings (ICOs) and digital asset exchanges. Bittrex is one of many platforms that have attracted the attention of the regulatory body as it seeks to ensure investor protection and maintain market integrity.

Although no official comment has been made by the SEC or Bittrex regarding the potential investigation, the news highlights the increasing regulatory pressure on the cryptocurrency industry. This development comes amid a broader crackdown on illicit activities and compliance issues in the digital asset space.

In response to the evolving regulatory landscape, many cryptocurrency exchanges have taken proactive measures to enhance their compliance systems and adhere to relevant laws. The outcome of the SEC’s examination of Bittrex could serve as a bellwether for other exchanges, providing valuable insights into the regulatory expectations for the industry.

As the situation develops, stakeholders in the cryptocurrency sector will be watching closely to see how the SEC’s potential action against Bittrex unfolds and the impact it may have on the industry as a whole.

Ether, the second-largest cryptocurrency by market capitalization, has soared to an 11-month high following the aftermath of the Shapella event, with over 1 million ETH being withdrawn from the platform.

The price of Ether has experienced a significant boost, reaching levels not seen since May of last year. This surge in value can be attributed to the recent Shapella incident, which has led to a wave of withdrawals from the platform. Following the event, more than 1 million Ether tokens have been removed from Shapella by concerned investors.

The Shapella event, which has caused widespread concern in the cryptocurrency community, has prompted many to reevaluate their investments in the platform. This has led to a substantial increase in demand for Ether, as investors look for safer alternatives to safeguard their assets.

In addition to the Shapella fallout, the rising popularity of decentralized finance (DeFi) applications has also contributed to Ether’s resurgence. As the backbone of the Ethereum network, Ether serves as the primary currency for these applications, driving increased demand for the cryptocurrency.

As Ether continues to gain momentum, many industry experts are closely monitoring its progress. Some believe that this latest surge could mark the beginning of a new bullish trend for the cryptocurrency, while others remain cautious, citing the potential for market volatility and unforeseen external factors.

Regardless of what the future holds for Ether, its recent rise serves as a reminder of the resilience and adaptability of the cryptocurrency market in the face of adversity. As the Shapella situation continues to unfold, investors and enthusiasts alike will be keeping a close eye on Ether’s performance and its impact on the broader market.

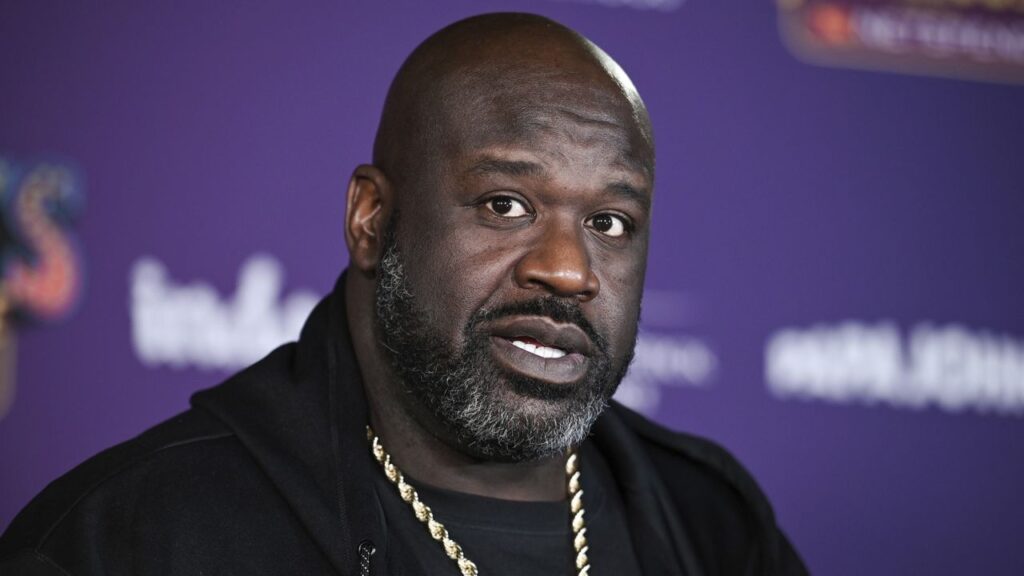

The legal team representing a group of FTX victims has encountered a significant hurdle in their pursuit of justice: serving a lawsuit to NBA legend and FTX brand ambassador, Shaquille O’Neal. The basketball icon has become an unlikely figure in a legal battle concerning the popular cryptocurrency exchange.

O’Neal, who was inducted into the NBA Hall of Fame in 2016, has been actively promoting FTX through various marketing campaigns, leveraging his fame and influence to attract new users to the platform. However, this association has placed him in the crosshairs of a legal dispute involving the exchange.

The plaintiffs, who claim to have suffered financial losses due to the exchange’s alleged negligence and misconduct, are seeking compensation from FTX and its brand ambassador. However, the legal team has faced difficulties in serving O’Neal with the lawsuit, which is a necessary step to move forward with the case.

The challenges in reaching O’Neal may be attributed to his busy schedule and high-profile status, which has made it difficult for the legal team to establish direct contact with the NBA star. Additionally, O’Neal’s representatives have reportedly been unresponsive to the attempts made by the plaintiffs’ lawyers.

The case against FTX and Shaquille O’Neal highlights the complexities and potential risks associated with celebrity endorsements in the cryptocurrency industry. As digital assets continue to gain mainstream attention, high-profile figures have increasingly been tapped to promote various platforms and products. This trend, however, has raised questions about the responsibility and potential liability of celebrities when endorsing platforms that may later face legal issues.

The ongoing struggle to serve Shaquille O’Neal underscores the unique challenges faced by legal representatives in cases involving celebrity endorsers. As the FTX victims’ lawyers continue their pursuit of justice, this case serves as a cautionary tale for both celebrities and the companies they represent.

The US Congress is turning its attention to the growing stablecoin market, with a senior executive from Circle, the company responsible for the USD Coin (USDC) stablecoin, scheduled to testify at an upcoming congressional committee hearing. The hearing will focus on stablecoin payments and the potential need for new legislation to regulate this burgeoning industry.

Circle’s participation in the hearing highlights the increasing interest and scrutiny from lawmakers and regulators concerning the rapidly expanding stablecoin market. As one of the leading stablecoin issuers, Circle’s insights will play a crucial role in shaping the discussions and potential regulatory measures that may be introduced.

Stablecoins, which are digital currencies pegged to a stable asset like the US dollar or gold, have gained significant traction in recent years. They offer users the benefits of cryptocurrencies, such as fast transactions and low fees, while minimizing the price volatility typically associated with digital assets like Bitcoin and Ethereum.

The hearing, organized by the US House Committee on Financial Services, will explore the potential risks and benefits associated with stablecoins, as well as their impact on the broader financial system. Policymakers will also discuss the possibility of introducing new regulations to govern the use of stablecoins in various transactions, including remittances, lending, and payments.

While stablecoins offer numerous advantages over traditional currencies, they have also attracted the attention of regulators worldwide due to concerns over financial stability, consumer protection, and potential illicit activities. As the market continues to grow, it is essential for lawmakers to strike a balance between fostering innovation and ensuring adequate safeguards are in place to protect consumers and maintain the integrity of the global financial system.

The upcoming congressional committee hearing, featuring testimony from a Circle executive, demonstrates the US government’s commitment to understanding the stablecoin market and its implications for the economy. The discussions and insights generated during the hearing will play a pivotal role in shaping the future regulatory landscape for stablecoins in the United States and beyond.

Bitrue, a Singapore-based cryptocurrency exchange, recently suffered a security breach resulting in the loss of approximately $23 million. The hack, which exploited the platform’s hot wallet system, has raised questions about the safety of storing digital assets in such wallets.

The exchange confirmed the incident in an official statement, revealing that the attacker managed to compromise the platform’s hot wallet system and steal a significant amount of digital assets. Bitrue has not provided specific details on how the breach occurred but assured its customers that it is working closely with other exchanges and law enforcement agencies to track the stolen funds and apprehend the perpetrator.

Hot wallets, unlike cold wallets, are connected to the internet, making them more susceptible to hacks and security breaches. While their convenience and accessibility make them popular among users for day-to-day transactions, they pose a higher risk compared to offline, cold wallet storage.

In response to the breach, Bitrue has temporarily suspended all deposits, withdrawals, and trading on its platform. The exchange also emphasized that it would reimburse all affected users, stating that 100% of the lost funds would be covered by the company’s insurance policy. Bitrue is working diligently to resume regular operations as soon as possible, prioritizing the security of its customers’ assets.

This incident serves as a stark reminder of the potential dangers associated with storing cryptocurrencies in hot wallets. As the cryptocurrency market continues to grow, it is crucial for exchanges and users alike to prioritize security measures and invest in more secure storage solutions such as cold wallets.

The Bitrue hack is the latest in a series of high-profile security breaches targeting cryptocurrency exchanges. As digital assets become increasingly mainstream, it is imperative for the industry to address these vulnerabilities and develop more robust security protocols to protect users’ funds and maintain trust in the market.