A new fraudulent service named “Inferno Drainer” has allegedly purloined close to $6 million from unassuming crypto users, as reported by Scam Sniffer, a Web3 scam detection firm. Inferno Drainer is said to offer pre-packaged code to fraudsters, enabling them to pilfer cryptocurrency in return for a 20% share of the fraudsters’ ill-gotten crypto gains.

This fraudulent service was unearthed by a security aficionado and anonymous Twitter user 0xSaiyanGod, who stumbled upon a promoter of the scheme on the Scam Sniffer Telegram channel. Saiyan reported the alleged fraudster to the channel, sparking an investigation by the security service. Scam Sniffer discovered a screenshot depicting a $103,000 drain transaction employing a Permit2 exploit, a type of phishing scam that simplifies the token approval process.

According to Scam Sniffer, the screenshot displayed the transaction hash of the theft, which led the team to locate the transaction and consequently, the perpetrator’s address. Scam Sniffer subsequently found that this address was linked to over 689 phishing sites established since March 27, and had siphoned off $5.9 million from victims across various networks, including Ethereum, Arbitrum, Polygon, and BNB Chain. Scam Sniffer developed a Dune analytics dashboard to present data that supports these findings.

As per the report, Inferno Drainer touted its “service” to fraudsters for a 20% slice of the earnings. It also offered to construct phishing sites for clients for a 30% cut, but this was exclusive to “good customers or individuals with significant potential.”

The issue of fraud as a service has become increasingly prevalent in the crypto space in recent months. A similar service named “Monkey Drainer” was detected by ZachXBT in October. It managed to drain at least $1 million in ETH from users before ceasing operations in March.

The inaugural Future Go Tech Summit, a conference dedicated to exploring emerging tech trends, is set to take place on June 29 and 30 at the vibrant Das Das venue in sunny Istanbul. The event promises to unite key stakeholders from government, business, the consumer sector, and influential figures reshaping the entertainment industry.

For a span of two days, industry frontrunners will delve into intriguing opportunities, tackle daunting challenges, and address the most urgent matters in the tech realm.

The summit’s agenda is designed to cater to its four key audiences — consumers, businesses, government, and entertainment — providing insights into technological shifts from unique perspectives relevant to each group. The gathering will unite over 200 corporate leaders from renowned companies like Huawei, Meta, Google, McKinsey, Bloomberg, and others.

The event will feature numerous hands-on keynote speeches, sessions, and roundtable discussions, revolving around cutting-edge subjects defining the current and future tech landscape: XaaS, AI, automation, IoT, Web3, digital public administration, sustainable technologies, play-to-earn mechanisms, eCommerce, and wellness.

Beyond the traditional panel discussions, keynote presentations, and workshops, Future Go will provide a mix of unique infotainment activities, such as stand-up comedy nights, cocktail receptions, business runs, and more.

These activities are designed to elevate attendee engagement at the conference, infusing an element of fun and fostering a sense of community around the summit.

In conjunction with the main event, the Future Go Awards ceremony will take place to honor leaders making remarkable strides in the tech and blockchain sectors. Nominees will be selected based on the impact of their projects, user conversion, and their contribution to technological advancement. A jury composed of 12 highly regarded tech community experts will handpick the winners, favoring those who have demonstrated a profound understanding of their users’ challenges and developed effective technological solutions. The key criterion for winning is that the project must enhance our way of life. The awards ceremony, followed by an afterparty, is anticipated to provide a grand conclusion to the summit, leaving attendees with unforgettable memories and a positive impression.

For the duration of the two-day event, Das Das, usually a concert hall, will transform into a hub pulsating with technological vibrancy. Attendees will have the opportunity to network with global tech leaders, gain inspiration, acquire knowledge on the latest tech trends, participate in interactive keynote speeches, and form unique, impactful opinions.

Attendees will be able to use the knowledge and experiences gained at the summit to breathe new life into their business ventures.

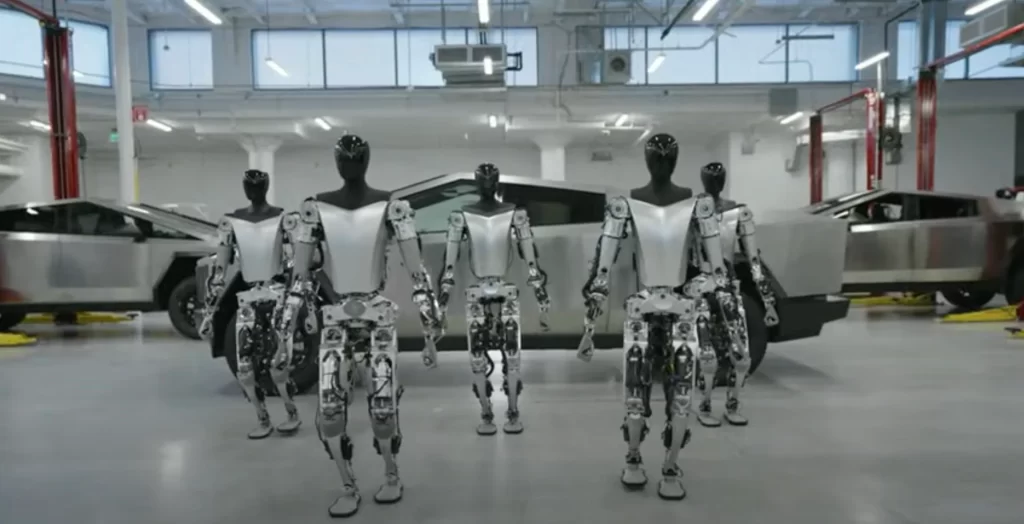

Tesla has unveiled new video footage featuring its Tesla Bots, which now demonstrate the ability to walk steadily, identify objects, and pick up items. The video was shown by Tesla’s CEO, Elon Musk, during the company’s shareholder meeting event.

The footage reveals significant enhancements made to the Tesla Bot project, including improved motor torque control, AI training derived from human movements, and object manipulation abilities. Notably, the humanoid robots can now walk in a straight line without requiring aid from Tesla’s staff.

In one of the demonstrations, a Tesla Bot was seen transferring items from one container to another, suggesting a potential application for robots performing tasks similar to human beings. This action highlighted how the bot’s AI could be trained through human demonstrations.

Multiple fully Tesla-made Bots now walking around & learning about the real world 🤖

— Tesla Optimus (@Tesla_Optimus) May 16, 2023

Join the Tesla AI team → https://t.co/dBhQqg1qya pic.twitter.com/3TZ2znxkfd

The humanoid robots were first introduced at Tesla’s AI Day in October 2022. At that time, the robot could barely move forward, with its internal mechanisms exposed. A more fully assembled version was also displayed, but it needed support from the staff to remain upright.

The unveiling of the new footage elicited varied reactions from internet users, with some applauding Tesla’s new achievement, and others humorously threatening to confront the robot if they encountered it on the streets.

This latest robot demonstration came shortly after Musk announced his decision to resign as Twitter’s CEO. On May 11, Musk stated that he would assume the roles of executive chair and chief technology officer at Twitter, focusing his attention on product, software, and system operations.

Linda Yaccarino will succeed Musk as CEO. On May 12, the billionaire declared his eagerness to collaborate with Yaccarino in transforming the platform into “X, the everything app.”

Bitcoin enthusiasts are presented with a potentially more streamlined approach to create new assets on the blockchain. This comes as Lightning Labs unveils an updated version of the recently renamed Taproot Assets Protocol.

In a blog post dated May 16, Lightning Labs, a Lightning Network infrastructure company, disparaged current procedures for creating assets on the Bitcoin blockchain. They described them as “exceptionally inefficient,” citing unwieldy protocols that inscribe asset metadata “directly into block space.”

The Taproot Assets Protocol is engineered to function “predominantly off-chain” in an effort to sidestep the network congestion that has unfortunately become a hallmark of the Bitcoin network since the BRC-20 token standard was introduced by anonymous developer “Domo” on March 8.

Lightning Labs suggested that Protocol users could soon incorporate BRC-20 assets into the Lightning Network, with wallets, exchanges, and merchants being adapted rather than having to construct a whole new ecosystem from the ground up.

Domo previously asserted that the Taproot Assets Protocol provides a superior option for creating new assets on Bitcoin compared to pre-existing methods like JavaScript Object Notation (JSON). This is because it allows users to transition to the Lightning network for transactions that are both swift and inexpensive.

The vast majority of BRC-20 tokens created to date employ Ordinal inscriptions of JSON data to launch token contracts, mint tokens, and transfer them. This method has received broad criticism from developers, who argue that the process incurs four times the transaction fees compared to using binary.

The Taproot Assets Protocol is a newly rebranded iteration of the original “Taro” protocol. Lightning Labs had to alter the software’s name due to what they described as an “unwarranted” trademark infringement lawsuit lodged against them by blockchain development firm Tari Labs on Dec. 8 the previous year.

The total value of BRC-20 tokens briefly exceeded $1 billion on May 9, but has since declined to $500 million, a decrease of nearly 50%.

Creditors of the insolvent cryptocurrency lending business BlockFi have lodged a fresh court document, challenging the company’s most recent restructuring proposal.

On May 12, BlockFi detailed its Chapter 11 restructuring strategy in a document submitted to the United States Bankruptcy Court in Trenton, New Jersey. The firm suggested that a sale of BlockFi might not yield sufficient value for its creditors given its outstanding debt of nearly $1.3 billion to its top 50 creditors.

Countering this, BlockFi creditors filed an additional court document on May 15, accusing BlockFi of intentionally delaying the court proceedings.

Represented by the Brown Rudnick law firm, the creditors of BlockFi highlighted that the firm liquidated approximately $240 million in cryptocurrency prior to declaring bankruptcy in late November 2022. They underlined that the crypto assets were sold “at the nadir,” referring to a substantial market decline following the FTX collapse.

The creditors criticized BlockFi’s decision to liquidate almost all domestic cryptocurrency in November 2022 as ill-judged, costing them over $100 million in subsequent months. They also pointed out “unnecessary and undesired tax consequences,” asserting that the sale was not relevant to its bankruptcy proceedings. The filing stated:

“Selling $240 million in cryptocurrency was never rationally related to bankruptcy funding needs, given that no reasonable estimate would peg the costs of this bankruptcy at $240 million.”

According to the creditors, BlockFi expended $22.5 million of client funds to purchase a $30 million insurance policy, following the disposal of digital assets before filing for bankruptcy.

The creditors argued in their document, “By selling everything pre-petition, BlockFi provided itself with an almost unlimited budget, essentially shielded from the bankruptcy’s adversarial process, to conduct its case for as long and as contentious as it deems appropriate without the ‘typical milestones’ in a DIP or cash collateral order.”

The plaintiffs urged the court to expedite the case’s conclusion by transferring the estate assets “into the hands of new management.” They reiterated that such a situation appears incongruous with the debtors’ case objectives.

BlockFi did not immediately respond to Cointelegraph’s request for comment.

The total count of Bitcoin wallet addresses possessing at least one BTC has crossed the milestone of one million.

Data from Glassnode confirms that this benchmark was achieved on May 13.

A significant rise in wallet addresses owning a minimum of one Bitcoin was observed last year as the cryptocurrency’s price plummeted by over 65%. The most prominent increases happened during a severe market downturn in June and from November 11, following the bankruptcy declaration by FTX.

As Bitcoin’s price declined from its peak in November 2021, approximately 190,000 “wholecoiners” joined the ranks from early February 2022.

Glassnode co-founder Negentropic advised his 54,000 Twitter followers that the optimal time to invest in Bitcoin is during market distress.

This advice comes amidst several major bank failures in the U.S. and potential halting of interest rate hikes by the Federal Reserve. These factors contribute to Glassnode’s continued belief in Bitcoin’s potential to reach $35,000 in the mid-term.

While the milestone of “one million” is notable, it’s essential to remember that a single Bitcoin wallet address doesn’t necessarily equate to one individual.

Many Bitcoin investors manage multiple addresses, and others belong to major entities like cryptocurrency exchanges and investment firms that often hold substantial Bitcoin quantities.

CoinGlass, a crypto analytics provider, estimates that out of the roughly 19 million Bitcoin in circulation, 1.89 million BTC — valued at $50.7 billion — are held by large centralized exchanges such as Binance and Coinbase.

Moreover, Glassnode’s estimates suggest that an astonishing 3 million BTC — equivalent to $80.4 billion and 17% of the total circulating supply — are irretrievably lost. These estimations are based on various data sources, including BTC sent to “burn addresses,” wallets with lost keys, and substantial accounts that have been inactive for over a decade.

The US Department of Justice (DOJ) is intensifying its efforts against hackers and exploiters in the Decentralized Finance (DeFi) sector, following a significant increase in illicit cryptocurrency activities over the past four years.

Eun Young Choi, the head of the DOJ’s National Cryptocurrency Enforcement Team (NCET), shared in a Financial Times report on May 15 that the DOJ is zeroing in on thefts and cyber-attacks related to DeFi, with a special focus on “chain bridges.”

Choi highlighted that this is a considerable concern for the DOJ, especially since North Korean state-sponsored hackers have been identified as major players in this area.

Cointelegraph reported in February that North Korean hackers had pilfered an estimated $630 million to $1 billion in cryptocurrency assets in 2022 alone.

Choi, who has nearly ten years of prosecutorial experience with the DOJ, was named the inaugural director of the NCET in February 2022. The DOJ stated at that time that the NCET would act as the primary hub for the department in dealing with matters related to cryptocurrency, cybercrime, money laundering, and asset forfeiture.

The DOJ underscored that they would specifically target “mixing and tumbling services,” but there was no mention of DeFi platforms in their initial announcement.

Speaking at the recent Financial Times Crypto and Digital Assets Summit, Choi reaffirmed that the DOJ is targeting cryptocurrency companies that either commit crimes or knowingly permit such activities to occur, thereby facilitating money laundering.

Choi underlined that focusing on the platforms where these activities originate could have a multiplying effect by making it harder for criminals to reap the benefits of their illicit activities.

She also noted that the extent and variety of illicit uses of digital assets have significantly increased in the past four years.

Riot Platforms, previously known as Riot Blockchain, a crypto mining company, has initiated legal proceedings against Rhodium Enterprises, a Bitcoin miner based in Texas. The dispute involves recovering an alleged unpaid sum exceeding $26 million in mining facility fees.

Riot Platforms, in its Q1 2023 financial statement released on May 10, claimed that Rhodium violated their contract by not meeting the payment obligations for hosting and service fees. These fees were related to the use of Whinstone’s Bitcoin mining facilities, which Riot Platforms fully owns.

On May 2, a legal petition was lodged against Rhodium Enterprises in the Milam County Court in Texas. The petition seeks to recoup “over $26 million” and requests reimbursement for any legal expenses incurred.

In addition, Riot has asked for authorization to end “certain hosting agreements” with Rhodium. They also proposed that they should not be obligated to pay back any remaining power credits after stopping these services.

Riot Platforms acknowledged the uncertainty surrounding the possible recovery of these unpaid fees at this stage of the litigation. They stated:

“At this early stage of the litigation, it’s not possible to reasonably predict the probability of a negative outcome or the extent of such an outcome, if it happens.”

According to the report, Rhodium was served on May 8 and given until May 30 to respond.

The report also disclosed that Riot Platforms had successfully mined “2,115 Bitcoins” in the first quarter of 2023, marking a 50.5% rise from Q1 2022.

The report clarified that Riot Platforms had no involvement with recent bank failures, stating:

“We have no banking relationships with Silicon Valley Bank, Silvergate Bank, or First Republic Bank, and currently we keep our cash and cash equivalents in several banking institutions.”

Riot Platforms anticipates ongoing challenges for crypto mining businesses in 2023. This is due to the “significant drop in Bitcoin’s value” and “other national and global macroeconomic factors.”

However, Riot believes its “relative position” in the industry, coupled with its “liquidity and lack of long-term debt,” places it in a strong position to “benefit from such consolidation.”

Cryptocurrency exchange Binance announced via Twitter on May 12 that it is ceasing operations in Canada. The decision is a “proactive” response to the new regulatory guidelines enforced by Canadian authorities, which are significantly impacting the nation’s cryptocurrency sector.

This move makes Binance the latest among several other cryptocurrency entities to exit Canada, following the implementation of new rules by the Canadian Securities Administrators (CSA) on February 22. These rules mandate that all crypto firms must submit new preregistration undertakings and comply with additional restrictions.

Despite having reportedly submitted a new preregistration undertaking, Binance clarified in a tweet: “Regrettably, new guidelines related to stablecoins and investor limits on crypto exchanges make it untenable for Binance to continue operations in the Canadian market at this time.”

The newly introduced CSA rules forbid companies from allowing Canadian clients to enter into contracts to purchase and sell any crypto asset classified as a security and/or a derivative, and they categorize stablecoins as securities.

Previous to Binance’s announcement, OKX exited the Canadian market in March, followed by decentralized exchange dYdX in April and blockchain fintech Paxos afterward.

An email from Binance to its Canadian users, as seen by Cointelegraph, asked them to settle their open positions by September 30, 2023. It cautioned that, “Starting October 1, 2023, Canadian customers will be transitioned to liquidation only mode.”

Binance further stated: “Although we disagree with the new guidelines, we intend to remain in dialogue with Canadian regulators in the hope of establishing a comprehensive, thoughtful regulatory framework.”

Binance had previously been operating in all Canadian provinces and territories, except Ontario. It had withdrawn from this province in March 2022, following an extended dispute with its regulatory authorities.

However, not all is doom and gloom for Canadian crypto enthusiasts. Kraken, another major player in the space, submitted a new preregistration undertaking in March and has pledged to maintain its operations in Canada. According to the CSA, there are 11 platforms “Authorized to Do Business with Canadians.”

Cryptocurrency exchange OKX has launched an audacious new marketing campaign, encouraging a comprehensive overhaul of existing financial and digital systems. The campaign subtly takes aim at the American exchange Coinbase and the wider conventional finance sector.

OKX unveiled its latest high-quality commercial, with its CMO, Haider Rafique, explaining the firm’s conviction in a Cointelegraph interview that blockchain technology is crucial for revamping financial infrastructure and promoting digital ownership.

During Rafique’s tenure, OKX has engaged in significant partnerships and daring ad campaigns with entities such as Manchester City and the McLaren Formula1 team, thereby bringing cryptocurrencies and Web3 offerings to broad global audiences.

The “Rewrite the System” initiative uses potent imagery to underscore issues like inflation, data breaches, and censorship as evidence of a flawed system. Rafique stressed that discussions about updating existing financial and digital structures do not address the deep-seated problems that inspired the campaign:

“The current system is not really designed to be updated and then updated into a system that can really solve some of the problems that the entire system has created.”

Several events over the past year have revealed the deficiencies of current financial systems, as well as the lapses of conventional finance and decentralized finance (DeFi) entities.

The notorious fall of FTX and the subsequent arrest of its former CEO, Sam Bankman-Fried, tarnished the cryptocurrency sector’s reputation. Traditional finance institutions, meanwhile, grappled with their own crises in a high-inflation economy, leading to the folding of Silicon Valley Bank, Silvergate Bank, and Signature Bank.

Rafique is of the opinion that these ongoing system failures highlight the stress on the financial ecosystem. He believes that these events will demonstrate how blockchain-based software offers individuals more control over their financial and digital independence:

“Our hope is that we can give the tooling to people that Web3 starts with, ultimately downloading software on your machine or your phone that enables you to be your own bank.”

The campaign also emphasizes interoperability as a key element in the case for blockchain-based, Web3 tools to revolutionize financial systems and platforms. Rafique cites the isolated nature and incompatibility of Google’s Play Store and Apple’s App Store as an example where blockchain-based applications could offer superior interoperability:

“Crypto and blockchain-based apps are actually designed to connect with each other and drive their interoperability.”

OKX aims to offer a wallet service that connects public chains, simplifying the management of digital assets, and exemplifying the interoperability inherent in blockchain technology:

“We want to connect all crypto ecosystems together so you can hop from one place to another place or another place very easily, but also at very low transaction costs.”

Rafique is firm in his belief that OKX’s advertising efforts, which include engaging audiences through partnerships in diverse markets, have shaped the exchange’s image.