In a recent interview with the Wall Street Journal, Coinbase CEO Brian Armstrong insisted that the regulation of cryptocurrencies isn’t as complicated as it might seem. He expressed his confidence that the United States would achieve clear regulatory guidelines for the crypto industry, even though it might take time.

This interview comes on the heels of a lawsuit filed against Coinbase by the Securities and Exchange Commission (SEC) on June 6, alleging that the exchange was operating as an unregistered securities exchange, broker-dealer, and clearinghouse. Armstrong argued in the interview that Coinbase’s operations do not require these registrations.

“The assets that we trade are commodities, not securities, hence they do not necessitate such registrations. We operate our exchange on crypto commodities,” Armstrong explained.

He also noted that despite not claiming to be a broker-dealer, Coinbase had faced difficulties in activating its acquired broker-dealer license.

When discussing regulations, Armstrong argued that crafting sensible rules is not “rocket science,” and he expects the U.S. to arrive at the correct regulatory framework over time. He believes the SEC lawsuit against Coinbase is significant for the entire U.S. crypto industry, as he hopes it will bring more clarity and prevent the U.S. from lagging behind other countries in this arena.

Armstrong is optimistic that once clear and stable regulations are established in the U.S., it would encourage crypto businesses to return to the country. He stated, “We expect entrepreneurs who had left the U.S. to return, as they won’t be randomly targeted or face high legal bills unexpectedly.”

A previous report by Cointelegraph noted a 26% decline in the share of global crypto developers in the U.S. between 2018 and 2022, attributing this decrease to regulatory ambiguity.

Armstrong emphasized that clarity is needed, especially in defining the roles and boundaries of the two major U.S. financial regulators, the SEC and the Commodity Futures Trading Commission (CFTC).

READ: Changpeng Zhao claims SEC chairman wanted to become Binance adviser

The U.S. Securities and Exchange Commission (SEC) and Binance’s U.S. subsidiary, BAM Trading, have jointly sought a consent order, which could modify some restrictions from a previous SEC asset freeze directive against the company. This prospective consent order aims to provide more assurances to the SEC while enabling BAM Trading to meet payroll and other financial obligations.

The new order would permit BAM Trading and its management to continue purchasing goods and services, pay employee salaries, cover pre-existing benefits, professional fees, and other ordinary business expenditures. However, it strictly prohibits Binance from transferring any assets to or for the benefit of any Binance-affiliated entity or individual, under any circumstances.

In this context, the order specifically mentions that Binance CEO Changpeng Zhao should not have access to any assets belonging to BAM Trading or Binance.US.

The SEC had filed an emergency request to freeze BAM Trading’s assets following its lawsuit against Binance and Zhao. In response, BAM Trading submitted a counter-argument, insisting that the SEC’s reason for requesting the freeze failed to meet the necessary burden of proof set by the court.

As of now, the proposed consent order is awaiting court approval. It seems that disagreements over certain specifics between the SEC and Binance are causing some delay. The court has requested additional clarification from both sides.

Judge Amy Berman Jackson has asked both parties to propose any changes to the consent order for the court’s consideration by 1:00 pm Eastern Time on June 13, according to a document viewed on the Public Access to Court Electronic Records website. The court will decide on the consent order after evaluating the input from both parties.

Other Stories:

Hacker steals almost $1 million of Ethereum from DeFi protocol

Submit crypto & blockchain guest post

SEC lawsuits prompt Binance and Coinbase users to flock to Bitget

The cryptocurrency market has been hit hard with Bitcoin dropping to a three-month low of $25,483 on June 10, a significant decrease of over $1,200 from the previous day, according to data from Cointelegraph Markets Pro and TradingView. Despite this, Bitcoin has fared better than major altcoins, which have suffered severely from US regulatory scrutiny.

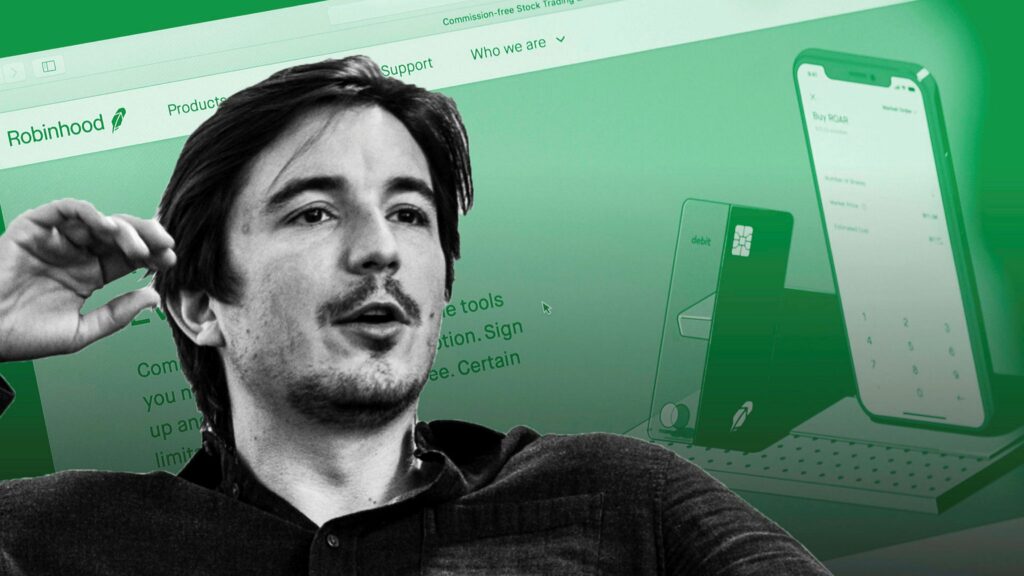

The recent legal action by the U.S. Securities and Exchange Commission (SEC) against leading exchanges, Coinbase and Binance, has resulted in certain altcoins being delisted. In response, Robinhood, a popular trading app, revealed it would cease support for several cryptocurrencies implicated in the lawsuit. These include Cardano, Polygon, and Solana, which are expected to be dropped on June 27th, 2023 at 6:59 PM ET.

The announcement sparked a notable decrease in the value of the affected cryptocurrencies, with Cardano and Solana recording a 25% loss in 24 hours. Robinhood justified this move stating it regularly reviews its crypto offerings, and the decision was based on the latest assessment.

Crypto.com CEO, Kris Marszalek, expressed that such delistings and regulatory pressures are part of the growth and maturation process of the crypto industry. He anticipates the sector will emerge stronger, despite the current challenges. The platform also revealed that it would stop its U.S. institutional trading service from June 21.

Michaël van de Poppe, CEO of trading firm Eight, highlighted the significant impact of these developments on the overall cryptocurrency market capitalization. If the total market cap drops below its 200-week moving average (MA), currently standing at nearly $26,400 for Bitcoin, it will indicate a clear bearish trend. Van de Poppe conveyed his concern to his Twitter followers, suggesting that the worst might be yet to come.

In a recent announcement, Robinhood, the popular app for trading cryptocurrencies and stocks, revealed that it will discontinue support for Cardano, Polygon, and Solana. This action comes in the wake of the United States Securities and Exchange Commission’s (SEC) recent lawsuits against crypto exchanges Binance and Coinbase for allegedly offering unregistered securities, including these three tokens.

In a June 9 update, Robinhood stated that it will cease support for these tokens from June 27 onwards, following an internal review. The decision was primarily influenced by the SEC’s lawsuits against Coinbase and Binance, which according to Robinhood, created an “uncertainty cloud” around the tokens.

The company expressed its belief in the future of crypto and pledged to continue advocating for clearer regulations in the U.S. crypto market, so as to foster confidence among participants.

On June 5, the SEC accused Binance of dealing in unregistered securities. Soon after, Coinbase was subjected to similar charges, with the SEC identifying 13 tokens, including Cardano, Polygon, and Solana, as unregistered securities.

Robinhood’s chief legal compliance and corporate affairs officer, Dan Gallagher, a former SEC commissioner, testified in a congressional hearing on June 6, saying that functioning as a registered broker-dealer in the U.S. was akin to taking the difficult route in crypto. Even though Robinhood attempted to follow the SEC’s guidelines, Gallagher highlighted the complexity of the journey.

The SEC’s actions have caused a stir in the crypto community, leading to debates on the regulator’s approach towards digital asset companies. The case against Coinbase claimed that the exchange had been operating as an unregistered security broker since 2019, despite the firm going public in April 2021.

Changpeng Zhao, CEO of Binance and Binance.US, was mentioned in the SEC lawsuits for their purported involvement in unregistered token offers and sales, including BNB. In response to what it called the SEC’s “extremely aggressive and intimidating tactics”, Binance.US announced the suspension of U.S. dollar deposits on June 8.

Other Articles:

Review: The 3 best crypto exchanges in the UK

Binance.US forced to suspend USD deposits

Bored Ape Yacht Club (BAYC) utility – Why are investors spending millions on these NFTs?

The world of cryptocurrencies is vast and can be overwhelming to navigate, especially when choosing the best crypto exchange to use to buy and sell your crypto in the UK.

Coinbase, Binance, and Gemini are three leading exchanges known for their unique offerings, security measures, and user-friendliness.

Read on to discover the pros and cons of each of these cryptocurrency exchanges.

Coinbase

Launched in 2012, Coinbase is one of the most recognizable names in the cryptocurrency industry. Renowned for its user-friendly interface, it has become a go-to platform for beginners. It provides access to a broad spectrum of cryptocurrencies, including Bitcoin, Ethereum, and more niche altcoins. The platform offers a useful learning section, Coinbase Earn, where users can learn about different cryptocurrencies and earn rewards.

Coinbase’s security measures are robust, with 98% of funds stored offline, two-step verification, and insurance coverage. It is a fully regulated and licensed cryptocurrency exchange, providing additional confidence to its users.

However, Coinbase has been criticized for its relatively high fees. While this may be offset by the seamless user experience and superior customer support, price-sensitive users may find other platforms more attractive.

Binance

Binance, founded in 2017, has quickly risen to prominence to become one of the world’s largest cryptocurrency exchanges in terms of trading volume. Unlike Coinbase, Binance caters more towards experienced traders with advanced trading features like futures and margin trading.

Binance hosts an extensive list of cryptocurrencies, arguably the most comprehensive among all exchanges. It offers lower trading fees compared to Coinbase, with further discounts for those holding its native token, Binance Coin (BNB).

However, the platform’s complexity may be overwhelming for beginners. Additionally, Binance has faced regulatory scrutiny in several countries, creating a level of uncertainty for some users. Nevertheless, it has a strong focus on security, employing a multi-tier and multi-cluster system architecture for maximum protection.

Gemini

Co-founded by the Winklevoss twins in 2014, Gemini is a regulated cryptocurrency exchange based in the United States. It is often considered one of the safest platforms, owing to its stringent security measures, including FDIC insurance for cash deposits.

Gemini differentiates itself with its strong focus on regulatory compliance, making it a trustworthy choice for institutional investors. Its clean, intuitive interface is beginner-friendly, but it also provides features such as price alerts and recurring buys that appeal to more seasoned investors.

Gemini’s downside is its relatively limited cryptocurrency offerings compared to Coinbase and Binance. Also, while its fee structure is transparent, it can be relatively high for small-scale transactions.

Which crypto exchange is best for you?

The choice between Coinbase, Binance, and Gemini largely depends on your specific needs and level of expertise. Coinbase stands out for its user-friendly interface and educational resources, making it ideal for crypto newcomers.

Binance, with its comprehensive offerings and advanced features, is a haven for experienced traders.

Finally, Gemini’s top-tier security measures and focus on regulatory compliance make it a reliable platform for both individual and institutional investors.

As the cryptocurrency landscape continues to evolve, it’s essential to reassess these platforms regularly. Staying informed and understanding the strengths and weaknesses of each can help ensure a smooth and secure trading experience.

Other Articles:

Changpeng Zhao claims SEC chairman wanted to become Binance adviser

In response to mounting pressure from the United States Securities and Exchange Commission (SEC), Binance.US, the American division of the world’s largest cryptocurrency exchange, announced the suspension of US dollar deposits and prepared customers for a potential disruption to fiat (USD) withdrawal routes as early as June 13.

The firm, on June 9, highlighted the SEC’s “extremely aggressive and intimidating tactics,” forcing them to act in defense of their customers and platform by suspending USD deposits. Additionally, they alerted their users about potential interruptions in their fiat (USD) withdrawal channels due to actions by their banking partners.

Binance.US plans to pivot towards becoming a crypto-only exchange while ensuring a 1:1 ratio for customer assets. They warned users of possible delays in processing withdrawals due to increased volumes and weekend banking shutdowns, but assured that crypto trading, staking, deposits, and withdrawals would continue uninterrupted.

The firm attributed the growing difficulties faced by Binance.US and its banking associates to the SEC’s “ideological campaign against the American digital asset industry,” leading their banking partners to consider cutting off fiat connections to the exchange.

Effective June 9, USD deposits will be halted, and USD trading pairs will be delisted the following week. The exchange assured its commitment to supporting Tether trading pairs. Binance.US also informed users that remaining USD on the exchange may be converted into a withdrawable stablecoin.

Gamestop has ousted its CEO, Matt Furlong, who was instrumental in the company’s foray into the nonfungible token (NFT) market. Ryan Cohen, a billionaire investor popular among memestock traders, has been appointed Executive Chairman, following the announcement of Furlong’s departure.

Details surrounding Furlong’s termination were not made public, but an SEC filing disclosed that his contract included a commitment of 24 months of continued employment. He also stepped down from the company’s board, reducing its size to five members.

The announcement coincided with Gamestop’s Q1 earnings call, where the company reported earnings per share (EPS) that fell short of market expectations by over 133%. This report led to a 19% drop in the company’s shares, which are now trading at $21 after hours, as per Google Finance data.

Furlong was appointed as GameStop’s CEO in June 2021, shortly after the memestock event that led to a 3000% surge in GameStop shares, rising from $17.25 to $500 within a month.

Under Furlong’s leadership, GameStop launched its NFT marketplace in June 2022, amidst dwindling interest in NFTs. The company then integrated blockchain game NFTs into its marketplace through a partnership with the Web3 gaming platform and Ethereum layer-2 scaling solution, ImmutableX.

Despite the initially positive reception, with nearly $2 million in sales within the first 24 hours of launch, the platform’s performance soon deteriorated. By August, daily sales volumes on the marketplace had plunged to around $4,000, reflecting a 99.8% decrease from its debut day.

The Commonwealth Bank of Australia (CBA), the country’s largest financial institution, has announced plans to restrict specific payments to cryptocurrency exchanges due to concerns about potential scams. This decision aligns with similar actions from other major banks and follows a series of legal challenges faced by global exchanges from US regulatory bodies.

Earlier this month, CBA disclosed its intention to either decline or impose a 24-hour hold on “certain payments to cryptocurrency exchanges”. The bank cited the need to shield its customers from the scam risks linked to such transactions. Specific details about the types of payments to be affected have not been revealed publicly, due to concerns over scammers potentially bypassing the restrictions.

In a bid to further safeguard its customers, CBA also stated plans to cap the amount individuals can send to cryptocurrency exchanges at AUD $10,000 (approximately $6,650) per month, to be rolled out in the near future.

CBA’s general manager of fraud management services, James Roberts, highlighted that scammers worldwide are exploiting the growing interest in cryptocurrencies, presenting themselves as genuine investment opportunities or funneling funds into crypto exchanges. The bank assured that these protective measures would be subject to continuous review and assessment of their impacts.

This new stance marks a significant shift for CBA, which had previously shown a more crypto-friendly approach. In November 2021, the bank was preparing to roll out cryptocurrency trading services for its CommBank app users, signifying its intent to actively participate in the burgeoning sector. CBA’s CEO, Matt Comyn, acknowledged risks in the sector but highlighted that the potential perils of non-participation were far greater. He maintained that both the technology and the sector were here to stay.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

US Securities and Exchange Commission (SEC) chair Gary Gensler has drawn attention to potential similarities between cryptocurrency exchange Binance and the now-defunct FTX, focusing on their suspected use of affiliated companies for fund transfers.

In an interview with Bloomberg on June 6, Gensler alluded to allegations of fraud and manipulation at FTX, involving its sister company Alameda Research, and its founder Sam Bankman-Fried. Gensler underscored a questionable business model where specific financial activities are bundled and merged, a practice not commonly seen or permitted in traditional finance.

A day earlier, the SEC lodged 13 charges against Binance. The charges included allegations that Binance and Binance.US co-mingled funds into an account managed by Merit Peak Limited, a company linked with Binance’s CEO, Changpeng Zhao. Another claim asserted that Binance.US engaged in wash trading through its primary, undisclosed ‘market-making’ trading firm Sigma Chain, also owned by Zhao.

Gensler criticized such models where entrepreneurs seek to increase wealth for themselves and their investors by using affiliated entities to trade against their customers. This controversial business model has been deployed across multiple platforms.

Gensler’s comments have fueled an ongoing debate about why the SEC hasn’t taken legal action against FTX. Ripple CEO Brad Garlinghouse, in a June 6 tweet, suggested the SEC’s recent flurry of lawsuits is a diversion from its issues with FTX. Others have speculated that FTX’s significant political contributions and Bankman-Fried’s frequent lobbying in Washington D.C. could potentially be influencing factors.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

Big Eyes, a cat-themed meme coin, commenced its presale in August 2022, planning to conclude on June 3, 2023. This ERC-20 token, represented as $BIG, is set to debut on Uniswap and a yet-to-be-revealed top-tier CEX.

The $BIG token presale, despite a few delays, has managed to raise an estimated $35 million. Consequently, there’s increasing speculation about the potential price of Big Eyes coin following its Initial Coin Offering (ICO). The coin is now in its thirteenth stage, priced at $0.00052.

Although the token’s hard cap of $51.2 million may not be reached by the slated launch date, the Big Eyes team maintains that the funds raised to date meet the soft cap and suffice to proceed with the project.

Notably, the next Bitcoin halving event is due in April 2024. Given the history, some traders anticipate this could trigger the next crypto bull run. If Big Eyes successfully launches and retains its popularity until 2025, it could potentially benefit from this projected upswing, assuming recession concerns subside, benefiting the overall crypto market.

READ: 4 Best Crypto Projects To Invest In

However, the project’s success largely hinges on the Big Eyes team’s ability to fulfill its roadmap and alleviate the prevalent FUD (Fear, Uncertainty, and Doubt) associated with the project.

Should You Invest in Big Eyes?

While this project may seem promising at first glance, it has a lot of red flags which suggest it will end up being a scam or rugpull.

From its aggressive paid marketing campaigns on dozens of crypto and non-crypto sites, to its extended presale, it looks very likely that Big Eyes Coin is a scam project.

There’s also a lack of transparency regarding who’s behind this project and who the founders are.

Therefore, it is not advisable to invest in Big Eyes.

Meme Coin Scams 101

Meme coin scams have proliferated in the crypto market, capitalizing on the meteoric rise of meme coins like Dogecoin and Shiba Inu. These scams exploit the euphoria and greed often seen in retail investors aiming to strike it rich in a budding, albeit volatile, market. To help you avoid falling victim to such fraudulent activities, it’s crucial to understand how these scams operate and the red flags to look out for.

First, let’s discuss the nature of meme coins. A meme coin is a type of cryptocurrency that often lacks a substantial technological underpinning or practical use case. They’re largely driven by online hype, social media buzz, and celebrity endorsements. While some meme coins, such as Dogecoin, have seen legitimate success, others merely ride this wave without offering real value or long-term potential.

A typical meme coin scam often begins with the creation of a new coin that promises astronomical returns, luring investors with the promise of being “the next Dogecoin” or “the next big thing” in crypto. The developers of these coins may employ aggressive marketing tactics, including fake celebrity endorsements, excessive advertising, and even organized “pump and dump” schemes.

Pump and dump schemes are a significant aspect of meme coin scams. The fraudsters inflate the coin’s price artificially, often using coordinated buying and social media campaigns to create an illusion of legitimacy and a fear of missing out (FOMO) among potential investors. Once the coin’s price reaches a certain threshold, these fraudsters sell (or “dump”) their holdings, causing the coin’s price to crash and leaving other investors with significant losses.

One of the most infamous examples of such scams is the Squid Game token, which was modeled after the popular Netflix series. After a massive price surge, the token’s price crashed in minutes as the developers allegedly performed a “rug pull,” a tactic where developers abandon the project and leave with the funds.

Despite the potential for massive losses, these scams continue to attract new investors due to FOMO and the desire for quick profits. Here are a few red flags to consider:

- Over-promising Returns: If a coin promises guaranteed or extremely high returns, it’s likely a scam. Investing in cryptocurrencies is risky, and no legitimate project can guarantee profits.

- Lack of Transparency: Legitimate projects typically have a clear roadmap, an identifiable team, and a comprehensive white paper explaining the project’s objectives and technology. Scam coins often lack these, with vague or non-existent information about their team or goals.

- Aggressive Marketing Tactics: Fake celebrity endorsements, excessive hype, and a sense of urgency are commonly employed by scammers.

- Limited Exchange Listings: Scam coins are often listed on obscure or decentralized exchanges and can’t be found on reputable, regulated ones.

In summary, while the excitement surrounding meme coins can be tempting, it’s crucial to conduct thorough research, scrutinize the project’s details, and exercise caution. Always remember the cardinal rule of investing: never invest more than you can afford to lose.

Other Articles:

Kraken reports issues with numerous crypto funding gateways

2030 Flasko price prediction – Could FLSK generatea 1,200% return?

Bored Ape Yacht Club (BAYC) utility – Why are investors spending millions on these NFTs?