The Virtual Assets Regulatory Authority (VARA), the cryptocurrency regulator in Dubai, has taken action against BitOasis, a crypto exchange, by suspending its license.

The suspension was a result of BitOasis failing to meet the required conditions within the specified timeframes set by the authority.

BitOasis was granted a conditional license on April 12, allowing it to operate under certain conditions within 30-60 days.

READ MORE: Canadian Judge Makes Controversial Ruling About Thumbs-Up Emoji

However, VARA revealed that the exchange did not fulfill these key conditions, although the specific details were not disclosed.

Consequently, BitOasis’ “License for Institutional and Qualified Retail Investors” has been deemed non-operational until the conditions are met.

Earlier, in May, BitOasis received one of Dubai’s “minimum viable product operational licenses” from VARA, enabling the exchange to provide broker-dealer services to qualified institutional and retail investors.

This license represents a crucial step in the process before obtaining a full market product (FMP) license. Presently, no firm has been granted an FMP license by VARA.

In order to apply for the FMP license, BitOasis must satisfy the conditions outlined in its current license, as clarified by VARA.

This recent action by VARA follows its previous reprimand in April, when it addressed the co-founders of Three Arrows Capital, Su Zhu and Kyle Davies, for operating and promoting their new OPNX crypto exchange in Dubai without the necessary license.

BitOasis, in a blog post on July 11, acknowledged the regulatory concerns regarding its Operational MVP License and assured that it is actively working with VARA to fulfill the remaining conditions.

The exchange also emphasized that the issue with its Operational MVP license does not affect other services provided to existing retail users, such as broker-dealer services.

Cointelegraph reached out to both BitOasis and VARA for comments but did not receive any responses at the time of publication. VARA stated that it will continue to monitor the situation to ensure compliance with regulatory requirements.

Switzerland, renowned for its banking secrecy laws and favored by the wealthy, has quickly embraced the principles of self-sovereignty embodied by Bitcoin (BTC).

The head of Lugano’s Plan ₿ initiative, Giw Zanganeh, spoke with Cointelegraph journalist Joe Hall at the Plan ₿ Bitcoin Summer School, shedding light on the growing use of Bitcoin for everyday transactions in the Swiss city.

Lugano has emerged as a hub for Bitcoin adoption, as well as for Tether and its LVGA stablecoin, which can be used for various utility bills, goods, and services throughout the city.

Zanganeh, who leads Tether’s Plan ₿, expressed his enthusiasm for Switzerland’s remarkable cryptocurrency adoption, despite its well-established financial and banking infrastructure.

READ MORE: South Korean Regulator Takes Action After ‘Coin Gate’ Scandal

He noted that many Swiss citizens are not only interested in Bitcoin from a philosophical perspective but also find alignment with Swiss values.

Swiss society places high value on individual sovereignty and financial privacy, which creates a natural overlap between Swiss culture and the ideals of the Bitcoin movement.

Zanganeh stated that Switzerland likely has one of the highest densities of Bitcoin-only companies per capita in the world, and even politicians, diplomats, and members of parliament are embracing Bitcoin, reinforcing a positive outlook for adoption in the country.

The increased usage of Bitcoin in Switzerland can be attributed to concerted efforts to educate and inform the populace about the advantages of BTC.

Regular articles in newspapers discuss various aspects of Bitcoin and its relevance to financial freedom and freedom of speech, targeting individuals interested in these concepts.

Zanganeh acknowledged that Bitcoin adoption is a gradual process, but the onboarding of merchants in Lugano has played a crucial role in establishing a new payment paradigm in the region.

Zanganeh likened the process of Bitcoin adoption to the initial proliferation of bank cards decades ago, emphasizing that practical experience with novel transactional methods will continue to attract more users to the Bitcoin ecosystem.

Switzerland’s potential as a center for institutional cryptocurrency adoption has also been highlighted by Bitcoin Suisse CEO Dr. Dirk Klee, with the Canton of Zug attracting numerous cryptocurrency and blockchain companies due to its progressive and crypto-friendly initiatives supported by the government.

The interview with Giw Zanganeh is part of an upcoming Cointelegraph documentary that delves into the experience of attending a Bitcoin School.

For those interested, subscribing to Cointelegraph’s YouTube channel will provide access to the documentary.

Readers are also encouraged to collect this article as an NFT, preserving this historical moment and demonstrating support for independent journalism in the crypto space.

Gerardo Moran, an 18-year-old teenager from El Salvador, recently took to social media to share his remarkable story following the completion of the country’s Bitcoin diploma program, Mi Primer Bitcoin (my first Bitcoin).

This program, supported by El Salvador’s Ministry of Education, provided Moran with an opportunity to leave behind his challenging life in construction, where he earned a mere $6 a day.

In a series of heartfelt tweets on July 8, Moran opened up about his experiences, highlighting the stark realities faced by many Salvadoran citizens who toil tirelessly for minimal compensation.

Having worked since the tender age of 11, mostly in construction and tourism, Moran struggled to comprehend why his fellow countrymen put in so much effort for such meager rewards.

READ MORE: Galaxy Digital CEO Mike Novogratz Considering Relocating Business Away From the US

“I’ve pondered why people in my country work so diligently for so little money,” Moran expressed on Twitter, acknowledging that he, too, had been trapped in a cycle of arduous labor for paltry compensation. He reached a breaking point, realizing that earning $6 a day in construction was simply not sustainable for him. Unbeknownst to him at the time, a life-changing opportunity lay just ahead.

It was when Moran’s school announced its search for students interested in enrolling in the Bitcoin diploma course that he decided to seize the opportunity. With determination and dedication, he excelled in the program, acquiring a profound understanding of Bitcoin and its implications.

Now, Moran has returned to his former high school, Antonio J. Alfaro, to educate the teachers about Bitcoin. As a leader in Bitcoin education in his hometown, he is currently training and instructing a group of eight senior professors, sharing his knowledge and experiences through the Bitcoin diploma program.

Mi Primer Bitcoin has garnered immense support from global advocates of Bitcoin education, amassing over 1 BTC in donations.

Generous individuals from countries like Poland and Canada have contributed satoshis over the Lightning Network, showcasing their commitment to fostering the growth of El Salvador’s Bitcoin diploma program.

El Salvador’s director of education, Gilberto Motto, previously emphasized the government’s focus on educating citizens about Bitcoin, particularly targeting teenagers.

Motto explained that by reaching every 16- and 17-year-old in the country, they aim to effectively educate the entire nation within a year.

This strategic demographic is expected to disseminate their knowledge to their families, creating a ripple effect of understanding and adoption.

Gerardo Moran’s inspiring journey serves as a testament to the transformative power of education and the positive impact that Bitcoin can have on individuals and communities.

As El Salvador continues its efforts to embrace digital currencies, Moran’s dedication to sharing his newfound knowledge is playing a vital role in shaping a more informed and empowered society.

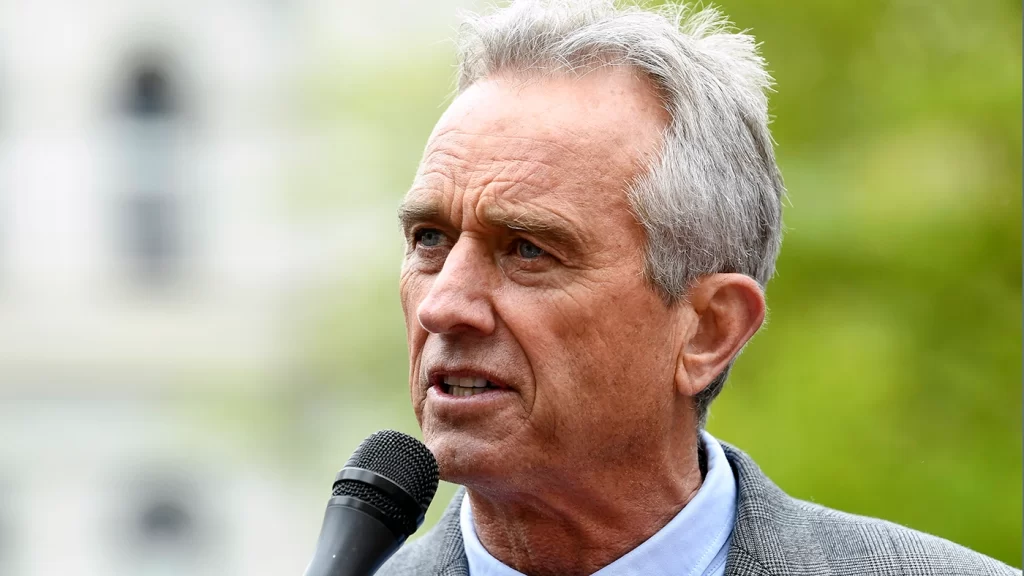

Presidential candidate Robert F. Kennedy Jr. of the United States has admitted to owning a substantial amount of Bitcoin (BTC), contrary to his previous denial of being an investor in the leading cryptocurrency.

According to records obtained by CNBC, Kennedy Jr. held between $100,001 and $250,000 worth of Bitcoin by the end of June.

The investment was made following his speech at the Bitcoin 2023 conference in May, during which he announced that his campaign would be the first in the United States to accept Bitcoin donations.

READ MORE: Digital Currency Group Dismisses Gemini Lawsuit as “Publicity Stunt” by Winklevoss Twins

Interestingly, during the conference, Kennedy Jr. explicitly denied investing in Bitcoin, stating, “I am not an investor, and I am not here to give investment advice.”

The financial disclosure filed on June 30 did not specify the exact timing of the cryptocurrency purchase but revealed that the investment had yielded a return of less than $201 thus far.

Although the filing did not identify the purchaser, Kennedy Jr.’s campaign acknowledged that it was him.

Kennedy Jr., who is challenging President Joe Biden, has been actively targeting the crypto community as part of his campaign.

In a tweet on May 3, he expressed his belief that cryptocurrencies, particularly Bitcoin, are a significant source of innovation.

He also criticized the U.S. government for impeding the industry and potentially driving innovation away.

Notably, Kennedy Jr. has gained support from prominent figures within the crypto industry, including Jack Dorsey, the founder of Twitter and CEO of The Block.

Dorsey took to Twitter to express his confidence in Kennedy Jr.’s strategy to defeat his opponents in the upcoming race.

As the son of former Attorney General and Senator Robert F. Kennedy, as well as the nephew of the 35th President of the U.S., John F. Kennedy, Kennedy Jr.’s candidacy has attracted attention and backing from influential figures.

His support comes at a critical juncture for the American crypto industry, which is currently grappling with regulatory uncertainties as the Securities and Exchange Commission tightens its scrutiny of crypto businesses in the absence of a comprehensive regulatory framework for digital assets in the United States.

The aftermath of the “Coin Gate” scandal has prompted the top financial regulator in South Korea to implement measures requiring its employees to disclose their cryptocurrency holdings.

Lawmakers in the country have faced allegations of insider trading, with one member of parliament accused of selling tokens before the introduction of new crypto regulations.

It was later revealed that the MP was serving on a crypto-related parliamentary subcommittee at the time.

As a result of the scandal, calls for transparency have emerged among MPs, regulators, and public officials, leading to the recent development of the Financial Services Commission (FSC) expanding the requirement to its own staff.

READ MORE: Former BitMEX CEO Says Bitcoin Will Reach $760,000 as Currency of Artificial Intelligence

The FSC, responsible for regulating South Korea’s crypto industry and conducting checks on domestic crypto exchanges, updated its Code of Conduct for employees.

The revised code prohibits staff involved with “virtual assets” from trading cryptocurrencies using undisclosed information obtained while performing their duties.

Additionally, employees who own tokens are now obligated to report this information to the FSC.

The restriction on crypto trading applies to public officials currently engaged in virtual asset-related duties, as well as those who performed such duties within the previous six months.

To comply with the new regulations, employees will be required to submit a form called the “Report on the Possession of Virtual Assets.”

The form mandates that staff disclose the type of virtual assets held, the date of acquisition, and the quantity of tokens owned.

While the FSC still requires legislative changes to enforce the new code, it aims to expedite the process and complete it in the second half of this year.

South Korea and Japan are often seen as frontrunners in crypto regulation, suggesting that other countries may follow their lead.

Some nations in different regions have already enacted legislation mandating crypto declarations for certain public officials.

Ukraine, for example, implemented laws that require sitting MPs to disclose all assets, including cryptocurrency holdings.

The disclosure of such holdings in the past has led to public outcry due to the large amounts of tokens possessed by Ukrainian lawmakers, raising questions about the origin of these significant crypto reserves.

In conclusion, the “Coin Gate” scandal has prompted the South Korean financial regulator to extend the requirement of declaring crypto holdings to its employees.

The updated code of conduct prohibits staff from trading cryptocurrencies using undisclosed information obtained during their duties, and employees with crypto holdings must report them to the FSC.

The FSC plans to seek legislative changes to enforce the new code and hopes to complete the process later this year.

Other countries may consider implementing similar measures, following the lead of South Korea and Japan.

The United States Securities and Exchange Commission (SEC) has responded to Coinbase’s claims that it lacks jurisdiction to prosecute the crypto exchange.

In a letter addressed to a district judge on July 7, the SEC stated that Coinbase was well aware of the possibility that federal securities laws could apply to its operations.

The regulator highlighted that Coinbase had openly informed its shareholders about the potential classification of assets traded on its platform as securities.

The SEC’s response emphasized that Coinbase, being a “multi-billion-dollar entity advised by sophisticated legal counsel,” was deliberately disregarding decades of established law, particularly the Howey test.

READ MORE: Former BitMEX CEO Says Bitcoin Will Reach $760,000 as Currency of Artificial Intelligence

This behavior, according to the SEC, indicated Coinbase’s attempt to create its own standard for determining what constitutes an investment contract.

The SEC’s letter was in direct response to a previous filing made by Coinbase on June 28.

In that filing, Coinbase informed the court of its intention to submit a motion for judgment, which is typically used when a party believes there are no significant factual disputes in a case, as explained by Cornell University.

Coinbase had referred to statements made by SEC Chair Gary Gensler during his appearance before Congress, where he supposedly claimed that crypto exchanges were not under the purview of a market regulator and that only Congress had the authority to regulate them.

Coinbase also highlighted that the SEC had filed charges against the company two years after its public listing, despite having been provided with exhaustive descriptions of its activities.

Roland Chase, a corporate and securities lawyer, shed light on the SEC’s authority.

He explained that the SEC’s role, as authorized by Congress, is to review a company’s going public documents and provide comments to enhance disclosure to potential investors.

Chase emphasized that the SEC does not have the power to deny a company’s public listing simply because it disagrees with the investment prospects.

The SEC had previously charged Coinbase on June 6 for allegedly offering unregistered securities since 2019. A pre-motion conference for the case is scheduled for July 13 at 2:00 pm UTC.

In recent times, a trend has emerged in certain corners of the cryptocurrency market, where investors are flocking towards microcaps that claim to be the next big thing after popular meme coins.

Tokens such as pepe 2.0, floki 2.0, and bobo 2.0 have gained significant attention within the past week by presenting themselves as new iterations of the well-known pepe, floki, and bobo tokens.

Consequently, trading volumes for these tokens have surged into the millions, attracting substantial liquidity and transforming modest investments into substantial fortunes almost overnight.

However, the lifespan of these microcaps is typically short-lived. Last year, we witnessed a similar phenomenon when hopeful investors placed their bets on articles inspired by the English language, as well as grimacecoin, which was sparked by a tweet from McDonald’s.

READ MORE: Top Executives Depart Binance Amidst Legal Scrutiny and Compliance Concerns

The ability for anyone to create tokens on Ethereum or other blockchains through smart contracts for minimal costs, coupled with the presence of decentralized exchanges, allows for the rapid issuance, liquidity provision, and trading of these tokens shortly after their creation.

For instance, pepe 2.0, currently the most popular among the clones, recorded nearly $7 million in trading volume within a 24-hour period.

Its market capitalization reached a peak of $45 million last week but has since declined to $18 million.

Remarkably, a wallet that invested a mere $900 in pepe 2.0 witnessed its value soar to over $176,000 in less than 24 hours.

This profitable position was cashed out through the sale of 2 ether (ETH) clips as the token’s value continued to rise.

Bubblemaps, an on-chain analysis tool, has highlighted the centralized behavior of some early buyers who likely cornered a significant portion of the pepe 2.0 supply during its launch.

These individuals have been gradually selling their tokens, contributing to the substantial price surge due to heightened buying demand and limited sales from early buyers.

Meanwhile, the original pepecoin (PEPE) remains attractive to investors, as evidenced by substantial purchases that have propelled an impressive 80% rally over the past two weeks.

Notably, Lookonchain data reveals that two wallets acquired millions of frog-themed tokens on Monday, signaling a niche segment of the market speculating on these tokens surpassing dogecoin (DOGE) and shiba inu (SHIB), which are widely regarded as the most popular meme coins, in the foreseeable future.

Coinbase users have taken to Twitter to report an increasing number of scams and phishing attacks involving the company’s services and applications.

These reports include claims that scammers are exploiting Coinbase’s domain name.

The most recent incident was disclosed by a Twitter user named Daniel Mason on July 7. Mason received texts and emails from fraudsters who used links under the domain Coinbase.com.

READ MORE: Abnormally Large Outflows Spark Fears of Exploit

The scammer contacted Mason using a legitimate phone number and subsequently triggered an email from a Coinbase.com domain.

This was followed by a phishing text message directing Mason to a Coinbase subdomain URL.

The fraudster then proceeded to obtain Mason’s personal information, including his address, social security number, and driver’s license number.

Mason highlighted that the scammer was articulate and spoke English fluently. During a phone conversation, the fraudster informed Mason that he would receive an email from Coinbase regarding a supposed breach of his account.

Almost immediately, an email arrived from help@coinbase.com. Mason questioned whether the scammer had created a case on his behalf or gained access to Coinbase’s mail servers.

Numerous individuals on social media have reported similar security incidents involving Coinbase.

Users have complained about various types of scams, including phishing attempts on Coinbase Wallet and criminals exploiting the company’s web address.

Cointelegraph interviewed an anonymous victim who experienced a similar approach.

This individual called Coinbase’s support line to verify the authenticity of an email claiming their account had been compromised.

A Coinbase employee confirmed the communication was genuine, but it turned out that the email was the work of a hacker.

The victim alleges that the hacker, masquerading as a Coinbase employee, stole their cryptocurrency.

Despite having evidence such as a witness, the date and time of the call, and the name of the employee they spoke to, the victim claims Coinbase took no accountability.

The case is currently in litigation, and the victim estimates a loss of approximately $50,000.

These reports mirror the attack on Twitter user Jacob Canfield. On June 13, Canfield received a text message and phone calls from a scammer who claimed there had been a change in his two-factor authentication.

The fraudster redirected Canfield to the “security” team, attempting to verify his account to avoid a 48-hour suspension.

The scammer possessed Canfield’s name, email, and location, and sent a “verification code” email from help@coinbase.com to his personal email.

The criminal became agitated and hung up when Canfield refused to provide the code.

The email address help@coinbase.com is listed as an official and reliable address on Coinbase’s support page.

The company’s blog emphasizes that its staff will never ask users for passwords or two-step verification codes, nor will they request remote access to devices.

Coinbase stated in a response to Cointelegraph that it has dedicated extensive security resources to educate customers about preventing phishing attacks and scams.

The company collaborates with international law enforcement to ensure that anyone defrauding Coinbase customers faces legal consequences

To enhance security, experts recommend using strong and unique passwords for cryptocurrency accounts and enabling two-factor authentication on applications.

Google Cloud, the $225-billion cloud and data service provider, has recently joined the ranks of companies showing interest in Bitcoin.

In a partnership with Voltage, an infrastructure provider specializing in the Bitcoin Lightning Network, Google Cloud aims to expand its Bitcoin-based services globally while assisting Voltage in expanding its operations.

Through this collaboration, Voltage will leverage Google Cloud to cater to its customers on a global scale.

Graham Krizek, CEO of Voltage, explained that they have larger customers who require nodes deployed in specific geographic regions such as the U.K. or Asia.

READ MORE: Abnormally Large Outflows Spark Fears of Exploit

On the other hand, Google can utilize Voltage as an outsourced Bitcoin and Lightning team, supporting companies interested in integrating Bitcoin or Lightning into their services.

The announcement of the partnership has garnered significant attention on social media, highlighting Google’s growing understanding and acceptance of Bitcoin and Lightning.

However, the implications of this collaboration run deeper than mere interest.

Christopher Calicott, managing director of venture capital firm Tramell Venture Partners, revealed that former Googlers had expressed how such unexpected social media engagement captures the attention of Google.

Additionally, Google’s open-minded approach to Lightning sets it apart from its competitor, Apple. Apple recently removed Damus, a Lightning-friendly decentralized social media protocol, from the App Store, indicating its aversion to Lightning.

Calicott suggested that the tech industry may be warming up to Lightning, particularly those involved in payment services.

Operating under the umbrella of Alphabet, Google Cloud benefits from its parent company’s extensive reach. Google Pay, the payment platform, boasts millions of users across more than 15 countries.

Since 2020, Google Ventures (GV), the investment arm of Google, has exhibited a strong interest in blockchain, Web3 companies, and Bitcoin.

GV participated in a $6-million seed round for Voltage in 2021, indicating the growing momentum in the crypto space.

Despite Apple’s actions, Lightning continues to gain traction among billion-dollar businesses worldwide.

One of Mexico’s largest companies has started experimenting with Lightning, and major crypto exchanges like Binance and Coinbase have promised Lightning integrations.

While it is still early in the adoption process, industry observers like Calicott emphasize the need to monitor its growth. Krizek, with his experience in the Bitcoin space since 2012, stressed the significance of the partnership.

As organizations are exposed to Bitcoin and its possibilities through Lightning, the increasing interest and demand have already captured their attention.

Krizek expects more services to be rolled out soon, accompanied by efforts in Bitcoin education.

Meta has issued a response to Elon Musk’s lawsuit threat against their new platform Threads, stating that none of the app’s staff members have any former affiliation with Twitter.

After Meta’s text-based platform, Threads, was launched in collaboration with Instagram, it quickly gained massive popularity with tens of millions of signups, making it the fastest downloaded app ever and the most popular alternative to Twitter.

However, just hours after its release, Twitter’s attorney, Alex Spiro, sent a letter to Meta CEO Mark Zuckerberg, alleging that the company had unlawfully copied Twitter’s platform by hiring former Twitter employees.

The letter, as reported by Semafor, claimed that Meta engaged in the “systematic, willful, and unlawful misappropriation of Twitter’s trade secrets and other intellectual property.”

READ MORE: Crypto Exchange Launches Public Testnet for v4, Paving the Way for Full Decentralization

Spiro’s letter demanded that Meta immediately cease using any of Twitter’s trade secrets or confidential information and warned of potential legal action.

He emphasized Twitter’s intention to protect its intellectual property rights and mentioned the possibility of seeking civil remedies and injunctive relief.

According to Spiro, Meta hired multiple former Twitter employees who allegedly had access to Twitter’s trade secrets and confidential information.

He argued that Meta’s Threads app was developed with the explicit intention of utilizing Twitter’s intellectual property to expedite the development of Meta’s competing platform.

Spiro claimed that this action violated both state and federal laws, as well as the ongoing obligations of the employees to Twitter.

In response to these allegations, Meta’s communications director, Andy Stone, addressed the claims by stating that the Threads engineering team does not include any former Twitter employees.

He explicitly clarified on the Threads platform, “To be clear: No one on the Threads engineering team is a former Twitter employee – that’s just not a thing.”

Elon Musk, upon hearing about Twitter’s threat of legal action against Meta, responded by stating, “Competition is fine, cheating is not.”

As the situation unfolds, it remains to be seen how Meta and Twitter will resolve this dispute. Both companies are prominent players in the social media landscape, and the outcome of this conflict could have significant implications for the industry.