Animoca Brands’ co-founder and executive chairman, Yat Siu, is optimistic about the potential of personalized Web3-based services, as his firm allocates $30 million for the neobank platform, hi.

Siu’s investment firm plans to support a Web3 app that integrates a cryptocurrency exchange, digital banking services, and a customizable nonfungible token (NFT)-styled crypto debit card, all within its growing ecosystem.

Speaking exclusively to Cointelegraph, Siu explained that hi’s vision for its NFT debit card aligns with his views on the interplay of culture and Web3.

Hi’s flagship Mastercard debit card, designed for crypto enthusiasts, allows users to personalize their physical cards with an NFT avatar they own.

Siu believes this reflects the ongoing shift towards personalization, empowering users to express themselves and showcase their individuality in innovative ways using Web3 technology.

One crucial aspect of the partnership is the potential to enhance the utility of various Web3 tokens and NFTs.

The hi ecosystem incorporates Web3-integrated financial applications and its hi protocol, an Ethereum Virtual Machine-compatible sidechain.

Furthermore, the collaboration aims to promote a “unique-human authentication mechanism” through the hi protocol’s proof of human identity solution.

Hi co-founder Sean Rac explained that this approach addresses the drawbacks of the Web2 era, where a few dominant companies controlled user data and identity as primary credential providers.

The hi protocol utilizes a dual-node structure, with identity validators verifying accounts owned by humans, while block producers secure the network.

This setup could pave the way for “human-only” networks and decentralized applications.

READ MORE :Ripple’s Chief Legal Officer Dismisses Concerns of SEC Appeal, Predicts Further Victory

The partnership will enable users to send and receive Animoca Web3 ecosystem tokens, including The Sandbox (SAND) and ApeCoin (APE). With over 3.5 million users, the Web3 app is gaining popularity.

The hi card service will allow users to make payments worldwide using a fiat or crypto debit card, leveraging Mastercard’s extensive network of about 90 million merchants.

By focusing on Web3, hi aims to enter the space previously shaped by neobanks like Revolut and N26.

This emphasis on Web3 is likely to attract proponents and enthusiasts, even those seeking a debit card to showcase their prized NFTs like Bored Ape Yacht Club, Meebit, or Pudgy Penguin.

Siu believes that investing in hi will bring new users to Web3 and bolster the adoption of Animoca’s own brands, such as The Sandbox.

The neobank has obtained approval as a virtual asset service provider (VASP) in Lithuania and is recognized as a digital currency operator by Italy’s payments service regulator.

While hi is establishing its presence in Asia, it is currently in the pre-registration phase to obtain a VASP license from the Hong Kong Securities and Futures Commission.

Animoca’s focus on blockchain gaming and Web3 projects remains strong, as evidenced by their ongoing pursuit of a regulatory license in Hong Kong for their proposed $1 billion metaverse fund.

The company continues to invest significantly in these burgeoning areas.

Other Stories:

Best Crypto Projects to Invest in For The Next Bull Run

Tennessee Realtor Couple Charged in $6M ‘Blessings of God Thru Crypto’ Investment Fraud

KuCoin Denies Layoff Rumors Amidst Crypto Industry Stabilization

The European Commission’s proposal for the Artificial Intelligence Act (AI Act) has undergone extensive negotiations between the Council of the European Union and the European Parliament.

However, the two legislative bodies face challenges due to differences on specific issues, including biometric surveillance.

In Germany, political groups and digital experts are raising concerns about the proposed changes to the AI Act.

Die Linke, a left-wing party in Germany, is calling for stricter regulation and transparency in European AI legislation.

They emphasize the need for consumer protection and want high-risk AI systems to be thoroughly checked by a supervisory authority before being launched on the market.

Die Linke also advocates for an explicit ban on biometric identification systems in public spaces and AI-driven election interference, among other measures.

On the other hand, the center-right coalition, known as “the Union,” prioritizes fostering innovation and openness in AI.

They believe that excessive regulation should be avoided and emphasize the importance of aligning with existing data protection and digital market regulations.

READ MORE: Tennessee Realtor Couple Charged in $6M ‘Blessings of God Thru Crypto’ Investment Fraud

The German AI Association (KI Bundesverband), representing innovative SMEs and startups, also advocates for openness to innovation but disagrees with the EU’s approach.

The association suggests a focus on mitigating real AI application threats and risks and protecting fundamental rights and European values.

Germany’s government supports the AI Act but aims to strike a balance between regulation and openness to innovation. They are implementing measures to promote German AI companies and continue advocating for an ambitious approach to AI testbeds during negotiations on the AI Act.

Despite these efforts, concerns arise that Europe might fall behind in AI compared to the dominance of U.S. and Chinese tech companies.

A feasibility study commissioned by the German Ministry for Economic Affairs and Climate Action explores the potential of large AI models for Germany, including the establishment of an AI supercomputing infrastructure to foster development.

Experts argue that Europe’s reliance on non-European software and services threatens its AI sovereignty.

They propose the creation of a globally recognized “CERN for AI” to facilitate cutting-edge research and attract talent, contributing to the success of “AI made in Europe.”

In conclusion, the negotiations on the AI Act continue to be complex due to differing perspectives. While Die Linke advocates for stricter regulation, the Union seeks to prioritize innovation.

Germany’s government is working to strike a balance between regulation and innovation, and the German AI Association calls for practical solutions to address AI risks.

To avoid falling behind, Europe must focus on fostering its AI landscape and investing in foundational technologies.

A shift in AI strategy and targeted public investments are essential for the success of “AI made in Europe.”

Other Stories:

Ripple’s Chief Legal Officer Dismisses Concerns of SEC Appeal, Predicts Further Victory

Best Crypto Projects to Invest in For The Next Bull Run

KuCoin Denies Layoff Rumors Amidst Crypto Industry Stabilization

Grayscale, a leading crypto fund manager, has called on the U.S. Securities and Exchange Commission (SEC) to approve all pending spot Bitcoin ETFs simultaneously, arguing that selective approval would grant an unfair advantage to certain proposals.

The request, articulated in a letter submitted by Grayscale’s Chief Legal Officer, Craig Salm, included their own application among the eight filings.

The letter proposed that the SEC could approve the spot ETFs based on precedents set for Bitcoin futures ETFs, as these fund types are closely linked.

Grayscale also refuted the SEC’s requirement for surveillance sharing agreements (SSAs) between the ETF providers and Coinbase, a leading crypto exchange, which aims to prevent market manipulation.

Recently, ETF filings from top financial companies, including Invesco, BlackRock, Valkyrie, VanEck, Wisdom, Fidelity, and ARK Invest, were updated to incorporate SSAs with Coinbase.

The SEC, in turn, had delayed the ETFs’ approval in June citing the absence of such agreements.

READ MORE: Best Crypto Projects to Invest in For The Next Bull Run

However, Grayscale contends that these SSAs are not requisite or sufficient under SEC standards as Coinbase is not a registered securities exchange, broker-dealer, or futures exchange.

Grayscale emphasized that the approval of the ETFs would mark a considerable but positive shift in the SEC’s standard application, warning against any discriminatory ‘first-mover’ benefits to certain proposals.

The firm’s Grayscale Bitcoin Trust (GBTC) currently has close to a million investors, tracking Bitcoin’s price.

Conversion to an ETF could yield billions in investor value, making Grayscale question the SEC’s rationale in withholding GBTC investors from a spot Bitcoin ETF.

The SEC rejected Grayscale’s application to convert the GBTC into a spot Bitcoin ETF last June, leading to a lawsuit by Grayscale against the regulator.

Grayscale accuses the SEC of inconsistency in handling similar investment vehicles, considering it an arbitrary act.

Other Stories:

KuCoin Denies Layoff Rumors Amidst Crypto Industry Stabilization

Tennessee Realtor Couple Charged in $6M ‘Blessings of God Thru Crypto’ Investment Fraud

Ripple’s Chief Legal Officer Dismisses Concerns of SEC Appeal, Predicts Further Victory

In a significant move, the Namibian government has officially reversed its previous decision to ban cryptocurrency exchanges in the country.

Instead, it has embraced a new law to regulate Virtual Asset Service Providers (VASPs) operating within its borders. The Namibia Virtual Assets Act 2023 was approved in the National Assembly on July 6 and signed by President Hage Geingob on July 14.

Subsequently, on July 21, the law was inserted into the Gazette of the Republic of Namibia, solidifying its implementation.

This groundbreaking legislation represents the first comprehensive framework in Namibia’s history that governs cryptocurrency-related activities.

The primary objective of the Namibia Virtual Assets Act is to establish a regulatory authority responsible for supervising and overseeing crypto exchanges within the country.

By doing so, the government aims to ensure consumer protection, curb market abuse, and address the risks associated with money laundering and terrorist financing.

The law sets out strict penalties for non-compliant VASPs, with potential fines of up to 10 million Namibian dollars (approximately $671,000) and a maximum prison sentence of 10 years.

However, it is worth noting that the country’s central bank, the Bank of Namibia, remains firm in its stance that cryptocurrencies will not be recognized as legal tender within Namibia.

READ MORE: Ripple CEO Brad Garlinghouse Criticizes SEC’s ‘Regulation by Enforcement’

The journey towards this regulatory environment started in May 2018 when the Bank of Namibia made a significant policy shift by revising its initial decision to ban cryptocurrency exchanges.

Since then, the government has been exploring ways to address the emerging digital asset landscape while safeguarding its citizens and financial system.

Namibia is not alone in its evolving approach to cryptocurrencies in Africa.

Earlier this month, South Africa’s financial regulator announced that all cryptocurrency exchanges in the country must obtain licenses by the end of 2023 to continue their operations legally.

Other African nations, such as Botswana, Kenya, Mauritius, and Seychelles, have also enacted laws to regulate cryptocurrency activities.

In contrast, some countries, including Cameroon, Ethiopia, Lesotho, Liberia, Republic of the Congo, Sierra Leone, Tanzania, and Zimbabwe, have chosen to ban cryptocurrencies altogether, according to information from the International Monetary Fund.

As for Namibia’s new Virtual Assets Act, it will come into force at a date determined by the Ministry of Finance, giving stakeholders time to prepare and adjust to the regulatory framework.

By embracing this progressive approach to cryptocurrencies, Namibia seeks to strike a balance between fostering innovation and protecting its financial system from potential risks associated with the digital asset market.

Other Stories:

Worldcoin Sparks Controversy As It Launches Ecosystem Token

Crypto Lending Firm Faces Service Disruption as Assets Seized by Regulator

On July 25, PacWest bank experienced a sudden and alarming flash crash, with its shares plummeting by 27%.

The stock value dropped from $10.33 to $7.50 during late trading, raising concerns among investors and the finance community. Some even feared it could mark the beginning of a banking collapse.

However, the panic was short-lived as share prices quickly rebounded during after-hours trading on the same day.

As of the time of writing, the stock had recovered and was priced at $10.10, as reported by Google Finance.

The reason behind the rapid recovery was the merger announcement between PacWest and the Banc of California on July 25.

Both banks appeared to be seeking stability in response to the turmoil that had affected the banking industry earlier in 2023.

The merger was an all-stock deal and received the backing of two private-equity firms, Warburg Pincus and Centerbridge.

These firms injected $400 million in equity, securing themselves a 19% stake in the newly combined business.

The merged entity is expected to hold assets worth approximately $36 billion, along with over $25 billion in total loans.

The market capitalization of PacWest stood at around $1.2 billion, while Banc of California’s was roughly $764 million.

READ MORE: Former FTX CEO Accepts Gag Order Amidst Trial

Following the merger, the combined market capitalization reached about $2 billion, as per Reuters.

Shareholders of PacWest will receive 0.66 shares of Banc of California common stock for each of their PacWest shares.

Additionally, the merged company plans to repay approximately $13 billion in wholesale borrowings, with the funds obtained from the sale of assets.

PacWest had faced a significant setback in May, witnessing a more than 60% plunge in its stock value.

This decline raised worries that the bank might be at risk of becoming the next one to fail in the United States.

Earlier in the year, Silicon Valley Bank, Signature Bank, and First Republic Bank had already collapsed.

Furthermore, in late June, the Federal Reserve’s emergency bank bailout loan facility, the Bank Term Funding Program, surpassed $100 billion, reflecting the severity of the challenges faced by the banking sector.

With the merger now underway and the backing of private-equity firms, PacWest and Banc of California aimed to fortify their positions and weather the storm that had shaken the financial landscape.

Investors and the market were keeping a close eye on their progress as they sought stability in an industry that had faced significant uncertainties and shocks.

Other Stories:

Ripple CEO Brad Garlinghouse Criticizes SEC’s ‘Regulation by Enforcement’

Worldcoin Sparks Controversy As It Launches Ecosystem Token

Crypto Lending Firm Faces Service Disruption as Assets Seized by Regulator

China’s central bank digital currency (CBDC), the digital yuan, is gaining traction as a pilot program takes flight.

Chinese business travelers are now able to use the CBDC to pay for flight tickets, thanks to a collaborative effort between China Merchants Bank and the Civil Aviation Administration of China.

The newly introduced digital yuan platform aims to streamline transactions for travelers within the aviation network.

Companies and entrepreneurs can now conveniently use the digital yuan to pay for business air tickets, while passengers can access new services through the platform.

Already, China Travel Service, based in Suzhou, has leveraged the platform to purchase tickets for its clients.

The official launch of the platform on July 18 was celebrated by the Civil Aviation Administration and China Merchants Bank, who called for more innovative applications of the CBDC within the civil aviation industry.

The People’s Bank of China has been actively promoting the use of the digital yuan in the country’s transportation network.

READ MORE: 2023 Ranking: 4 Best Crypto Projects To Invest In

Beijing Daxing International Airport and Beijing Capital International Airport had previously partnered for a cargo-related digital yuan initiative in 2022.

To further enhance the adoption of the digital yuan, upgrades have been made to railway networks, light rail connections, and metro systems within the CBDC’s pilot zone.

These upgrades now allow for seamless digital yuan payments, independent of power or network connections.

Moreover, bus routes within the zone have also been integrated to facilitate digital yuan payments. Earlier this year, several highway toll booths within the pilot zone started accepting the digital yuan as a payment method.

The city of Shenzhen has been at the forefront of digital yuan adoption, with nearly 36 million digital yuan wallets opened by residents. Impressively, over seven million new wallets were created since the start of 2023.

This widespread expansion of the CBDC pilot program across various sectors demonstrates China’s commitment to transforming its economy through the broad acceptance of the digital yuan.

As the digital yuan pilot program continues to grow, more sectors are likely to embrace the CBDC, further solidifying China’s position as a leader in the digital currency space.

With ongoing efforts to explore innovative applications, the digital yuan is poised to revolutionize the way transactions are conducted in the country’s aviation and transportation industries and beyond.

Other Stories:

Why You Should Be Bullish Despite Bitcoin Price Falling Below $30,000

Bitcoin Mining Companies Employ Derisking Strategies, Offload BTC to Exchanges

The United States Department of Justice (DoJ) has revealed plans to strengthen its efforts in combating crypto-related crimes by significantly increasing the resources of its crypto crime team.

The move comes as a response to the growing threat of cybercriminals utilizing cryptocurrencies for illicit activities.

In an announcement made on July 20, Principal Deputy Assistant Attorney General Nicole Argentieri unveiled the consolidation of two key DoJ teams: the Computer Crime and Intellectual Property Section (CCIPS) and the National Cryptocurrency Enforcement Team (NCET).

The NCET, described as an “enormously successful startup,” will be integrated into the CCIPS, providing it with access to additional resources and support.

The merger will lead to a substantial expansion of the team’s capacity to investigate and prosecute criminal offenses involving the abuse of cryptocurrencies.

The number of criminal division attorneys available to work on crypto-related cases is expected to more than double, as any CCIPS attorney may be assigned to handle NCET cases.

Explore the Crypto Intelligence Blockchain Council

This infusion of talent and expertise will bolster the unit’s efforts to tackle cybercrimes.

As part of the restructuring, the NCET will also welcome a new acting director. Claudia Quiroz, a former assistant attorney from the U.S.

Attorney’s Office for the Northern District of California and a deputy director of NCET since its inception, has been named as the new head of the team.

Quiroz’s experience and knowledge in the field make her a valuable asset in leading the charge against crypto-related criminal activities.

One of the primary areas of focus for the revamped team will be combating ransomware crimes.

Ransomware attacks have become a pervasive threat, and tracking criminals through their crypto payments will be a key strategy to prevent them from escaping justice.

By freezing or seizing illicit funds before they are sent to ransomware hotspots like Russia, the DoJ aims to disrupt the financial incentives that drive these criminal operations.

The NCET’s establishment in 2021 was part of the broader Cryptocurrency Enforcement Framework initiative by the DoJ.

Under the leadership of the former Director Eun Young Choi, the team concentrated on addressing thefts and hacks involving decentralized finance, with a particular emphasis on “chain bridges.”

With the expansion and consolidation of the crypto crime team, the DoJ seeks to send a clear message to cybercriminals that their illicit activities involving cryptocurrencies will not go unchecked.

By equipping the team with more resources, personnel, and a strong leader, the DoJ is taking significant steps to safeguard the integrity of the financial system and protect individuals and businesses from the threat of crypto-related crimes.

Other Stories:

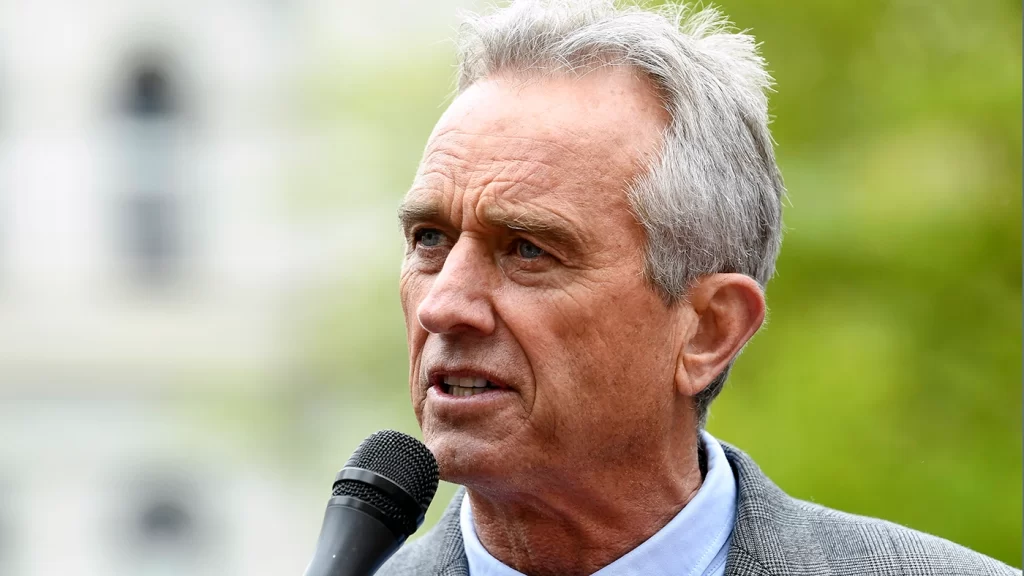

Robert F. Kennedy Jr. Pledges to Back US Dollar with Bitcoin if Elected President

Bitcoin Mining Companies Employ Derisking Strategies, Offload BTC to Exchanges

Democratic presidential candidate Robert F. Kennedy Jr. has unveiled his plan to back the United States dollar with Bitcoin (BTC) if he wins the presidency.

Kennedy made this announcement during a Heal-the-Divide PAC event on July 19, where he emphasized the potential of using “hard currency” like gold, silver, platinum, or Bitcoin to stabilize the American economy.

Kennedy believes that backing the U.S. dollar with tangible assets could strengthen the currency, combat inflation, and foster financial stability, peace, and prosperity in the nation.

He clarified that this process would be implemented gradually, and the level of backing for the dollar would be adjusted based on the success of the plan.

To initiate the strategy, Kennedy proposed a conservative approach, suggesting that initially, only a small portion of issued T-bills, perhaps around 1%, would be backed by hard currency such as gold, silver, platinum, or Bitcoin.

In addition to his backing of Bitcoin, Kennedy also declared his intention to exempt Bitcoin to U.S. dollar conversions from capital gains taxes.

READ MORE: Celo Blockchain Plans Transition to Ethereum Layer-2 Solution

He believes that this exemption would encourage investment and incentivize businesses to choose the United States as their primary location, rather than crypto-friendly jurisdictions like Singapore or Switzerland.

Kennedy’s recent statements in support of Bitcoin follow his participation in the Bitcoin 2023 conference in Miami on May 19, where he announced that he would accept political campaign donations in Bitcoin.

Surprisingly, investment disclosures on July 9 revealed that Kennedy himself owned up to $250,000 worth of Bitcoin, contradicting his earlier claims of having no exposure to the asset.

Kennedy is not the only presidential candidate making promises related to cryptocurrencies.

On July 14, Republican presidential candidate and Florida Governor Ron DeSantis vowed to ban central bank digital currencies if elected as president, asserting that such currencies would have no place in the United States under his leadership.

As the race for the presidency continues, it remains to be seen how these crypto-based promises and proposals will shape the future of the American economy and financial landscape.

Other Stories:

PEPE Coin in Trouble? Financial Regulator Clamps Down On Crypto Memes

SEC Chair Gary Gensler Advocates Greater Use of Artificial Intelligence for Market Surveillance

FSB Proposes Global Regulatory Framework for Cryptocurrencies

Founder and former CEO of Thodex, Faruk Fatih Özer, has been sentenced to seven months and 15 days in prison for his failure to submit requested documents during his trial.

Özer, who had previously been detained and later fled to Albania, was apprehended and deported back to Türkiye following a Red Notice by Interpol.

The closure of Thodex, once a prominent cryptocurrency exchange in the country, left investors with approximately $2 billion worth of cryptocurrencies.

Throughout the trial, Özer maintained his innocence but failed to provide the requested documents to the Tax Inspection Board.

He argued that he was not the official representative of Thodex during the specified period and therefore could not present the requested books.

Özer claimed that a trustee had been appointed to manage the business on his behalf during that time.

Initially, Özer’s prosecutor sought a five-year prison sentence for “smuggling” under the Tax Procedure Law.

However, the court initially sentenced him to one year and six months, which was later reduced to seven months and 15 days.

The reduction was based on factors such as Özer’s social relations, overall behavior, and conduct during the trial.

READ MORE: Web3 Needs Asset Protection, and This Startup Wants to Make it Widely Available

Apart from tax-related charges, Özer also faces accusations of defrauding Thodex investors, and a hearing on these claims is pending.

Despite the allegations, Özer maintains his innocence and asserts that he has been framed by the defendants.

In a related context, a recent study by Swedish crypto tax firm Divly revealed that a vast majority of crypto investors, approximately 99.5%, did not pay taxes in 2022.

The report highlighted that Finland had the highest proportion of crypto investors who fulfilled their tax obligations at 4.09%, closely followed by Australia at 3.65%.

However, the report acknowledged the questionable methodology used to derive these estimates, emphasizing that search volume data might not accurately reflect the actual number of crypto taxpayers, as not all individuals who pay taxes search for crypto tax-related information online.

As the legal proceedings continue, the case of Faruk Fatih Özer and Thodex serves as a reminder of the complexities surrounding cryptocurrency regulation and taxation.

It underscores the importance of transparency and accountability in the crypto industry and highlights the need for robust regulatory frameworks to protect investors and ensure the integrity of digital asset exchanges.

Other Stories:

Ex-Federal Prosecutor Surprised by Potential SEC Appeal in Ripple Case

3 Best Crypto PR Agencies – Fees, Results and Full Review

Bitcoin On-Chain Data Reveals $30,000 as Most Popular ‘Buy’ Level

Caroline Pham, one of the commissioners of the Commodities Futures Trading Commission, believes that Ripple’s recent partial victory has paved the way for regulatory clarity in the United States regarding cryptocurrencies.

In an interview with Bloomberg TV on July 17, Commissioner Pham expressed her optimism that significant court decisions on the classification of crypto assets would eventually bring about regulatory clarity.

Commissioner Pham emphasized that she anticipated participating in regulatory working groups and hoped for collaboration among various U.S. regulators, including the Securities and Exchange Commission (SEC), to develop a comprehensive and holistic approach to crypto regulation.

Pham’s remarks came shortly after Ripple, a San Francisco-based fintech firm, achieved a crucial partial victory in an ongoing court battle against the SEC.

READ MORE: Ex-Federal Prosecutor Surprised by Potential SEC Appeal in Ripple Case

The SEC had accused Ripple of selling unregistered securities. However, on July 14, Judge Analisa Torres of the Southern District of New York ruled that XRP, Ripple’s cryptocurrency, was not a security when sold to retail investors on digital asset exchanges.

The ruling received a negative response from SEC Chair Gary Gensler, who expressed disappointment during a press conference on July 17.

Gensler had previously indicated that, apart from Bitcoin, he considered every digital asset to be a security, although the SEC has not formally made the same declaration.

Despite the setback, Gensler affirmed the SEC’s commitment to pursuing enforcement actions in light of Ripple’s recent legal victory.

Commissioner Pham also highlighted the significance of tokenizing real-world assets (RWAs).

She identified “real opportunities” to modernize financial markets by leveraging blockchain technology to tokenize money market funds.

Notably, traditional finance companies have been increasingly engaging with real-world asset protocols, leading to several RWAs outperforming decentralized finance (DeFi) assets in recent times.

In summary, Commissioner Pham believes that recent court decisions, such as the one involving Ripple, will contribute to regulatory clarity in the United States regarding cryptocurrencies.

She expressed her eagerness to collaborate with other regulators to establish a comprehensive approach to crypto regulation.

Additionally, Pham emphasized the potential benefits of real-world asset tokenization for modernizing financial markets.

Other Stories:

Bitcoin On-Chain Data Reveals $30,000 as Most Popular ‘Buy’ Level

Web3 Needs Asset Protection, and This Startup Wants to Make it Widely Available