DUBAI, UAE, Feb. 23, 2025 /PRNewswire/ — In a remarkable display of resilience and professionalism, Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has successfully navigated the largest hack in crypto history. On February 21, 2025, hackers stole approximately $1.5 billion in digital assets from Bybit’s Ethereum wallet, marking the biggest cryptocurrency heist ever recorded. Despite this unprecedented breach, Bybit’s swift and transparent crisis management ensured that the crypto market remained stable, with no significant price volatility.

Swift Crisis Management

Bybit’s response to the hack was marked by swift action, transparency, and professionalism. Ben took immediate ownership of the situation, addressing the community within 30 minutes via X and conducting a livestream session just one hour after the incident. This live session, which lasted over two hours, provided real-time updates and detailed explanations, ensuring that all stakeholders were informed and reassured. Bybit’s prompt and open communication effectively prevented panic and maintained trust in the exchange, setting a high standard for crisis management in the crypto industry

Throughout the crisis, Bybit’s withdrawal and product services remained uninterrupted, with clients able to access support and their respective relationship managers at all times. This seamless continuity was a testament to the team’s preparedness and efficiency, even under extreme pressure.

Industry Unity in Support of Bybit

The crypto industry rallied around Bybit, demonstrating a united front against security threats. Major exchanges blacklisted the hacker’s wallets, preventing further movement of stolen funds. This unprecedented show of unity underscores the growing maturity of the crypto sector, where competitors become allies in times of need.

Client Fund Protection

Despite the significant scale of the hack, Bybit’s 1:1 reserve guarantee ensured that client assets remained fully intact. Bybit CEO Ben Zhou reassured users that Bybit is solvent and can cover the loss, emphasizing that all client assets are backed on a one-to-one basis. This guarantee demonstrates Bybit’s financial stability and commitment to user security.

Regulatory and Law Enforcement Collaboration

Bybit worked closely with regulators and law enforcement agencies to address the hack. This collaboration not only facilitated a swift response but also set a precedent for future cooperation between the crypto industry and regulatory bodies. As the incident unfolds, further developments are expected from this front, potentially leading to enhanced security measures and regulatory frameworks.

Rapid Recovery

Bybit demonstrated remarkable resilience in the face of the crisis, processing over 350,000 withdrawal requests efficiently within 12 hours of the hack. Despite the surge in withdrawal requests, the exchange ensured that all transactions were completed without significant delays, showcasing the team’s professionalism and experience in managing critical incidents. Bybit’s operations quickly returned to normal, with client activity rebounding to pre-hack levels within 24 hours. This swift recovery underscores the trust that clients and investors have in Bybit’s crisis management capabilities, highlighting the exchange’s ability to maintain stability even in the most challenging circumstances

Bybit’s handling of the recent hack sets a new industry standard for crisis management. The exchange’s ability to turn a potentially disastrous event into a demonstration of resilience and transparency is a testament to its long-standing culture of responsibility and openness. This incident highlights not just Bybit’s operational excellence but also the growing maturity and unity of the crypto industry as a whole.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

SINGAPORE, Feb. 23, 2025 /PRNewswire/ – In the wake of the recent $1.5 billion hack affecting a major cryptocurrency exchange, HTX hosted a live discussion on X and its Global Advisor Justin Sun addressed the growing security concerns in the cryptocurrency industry. The discussion, titled “Together Against Industry Crisis, Is There a Best Solution for the Security of the Crypto Industry?” featured insights from leading security firms SlowMist and GoPlus Security, as well as prominent KOLs.

Security: A Top Priority for HTX

Sun stressed that security is a “top priority”, demanding constant vigilance and learning. He illustrated how hacker tactics have evolved, from early hot wallet attacks to more sophisticated multi-signature wallet breaches, and declared that exchanges must continuously enhance their security protocol.

Sun emphasized that security is like personal health management, requiring internal efforts and a proactive approach. HTX has implemented multi-device login, remote login alerts, abnormal transfer alerts, and other security features, and has publicly disclosed Merkle Tree Proof of Reserve (PoR) for 28 consecutive months, maintaining reserve ratios exceeding 100%.

Sun’s Influence on Security Practices Across the Crypto Landscape

Sun’s commitment to security extends to his vision for HTX and his influential role in shaping security practices across the broader crypto landscape. He believes that the principle of security is considered fundamental to every business and product. He cited the early implementation of native multi-signature functionality in TRON as a successful example of proactive security design, demonstrating his commitment to building security into the foundation of his projects. He also highlighted the recent launch of USDD 2.0, emphasizing the deep understanding of stablecoin security risks that informed its development. “Just as exchanges should strengthen security mechanisms from the source in system design and operation, to maximize the prevention of security incidents,” Sun stated.

Sun also revealed that HTX collaborates with numerous white hat teams to conduct continuous penetration testing, security drills, and vulnerability mining. The platform actively monitors global cryptocurrency security incidents and studies hacker attack principles and methods for effective prevention.

Addressing the Situation and Industry Cooperation

Regarding the controversy surrounding CZ’s suggestion for the affected exchange to suspend withdrawals, Sun acknowledged the validity of the advice from an exchange perspective. He explained that the initial hours after a security breach are crucial for investigating the issue and ensuring safety. While suspending withdrawals is necessary to eliminate risks, the suspension period should be minimized to reduce user impact.

Sun called for closer cooperation between exchanges, security agencies, and the community to jointly address hacker threats, promote technological sharing, security innovation, and information exchange, and promote the healthy and sustainable development of the industry.

HTX’s Commitment to User Safety

HTX demonstrates its commitment to security through a proactive and continuously improving approach. The platform’s multi-faceted security strategy encompasses collaboration with leading security experts, rigorous ongoing monitoring, robust internal protocols, and a focus on enhancing multi-signature support, security alerts, and mitigating emerging threats such as hashtag scams. This comprehensive strategy reflects HTX’s dedication to safeguarding user assets and fostering a secure and reliable trading environment. This commitment was further emphasized by the specific security protocol requirements shared by Justin Sun at the February 21st Meetup in Hong Kong.

About HTX

Founded in 2013, HTX has evolved from a virtual asset exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, research, investments, incubation, and other businesses.

As a world-leading gateway to Web3, we harbor global capabilities that enable us to provide users with safe and reliable services. Our growth strategy – “Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance”, underpins our commitment to providing quality services and values to virtual asset enthusiasts worldwide.

For more information on HTX, users can visit the HTX Square, or https://www.htx.com/, and follow X, Telegram, Discord. For further press enquiries, please contact glo-media@htx-inc.com.

Contact Details

Ruder Finn Asia

DUBAI, UAE, Feb. 20, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released a new FX Insight report examining the evolving landscape of the Japanese yen (JPY) carry trade, highlighting significant shifts that could reshape this fundamental trading strategy in 2025. The JPY has maintained its dominance as a funding currency in the FX markets, but this could be the year things start to change.

The report, titled “What to Look for in the Yen Carry Trade for 2025,” identifies several crucial developments that traders and investors should monitor:

- The Japanese yen’s traditional role as a primary funding currency faces new scrutiny amid potential Bank of Japan (BoJ) policy shifts and evolving domestic economic conditions

- Increased risk of rapid unwinding events due to possible yen strengthening, driven by BoJ monetary tightening or global risk-off scenarios

- Emergence of alternative funding currencies, including the Swiss franc, euro, and U.S. dollar, reflecting the need for strategic diversification

- Critical importance of adaptive risk management strategies in response to changing market dynamics

The analysis draws on comprehensive data from multiple authoritative sources, including the Bank of Japan, Federal Reserve, IMF, and Bloomberg Economics, providing traders with actionable insights for navigating this complex trading environment.

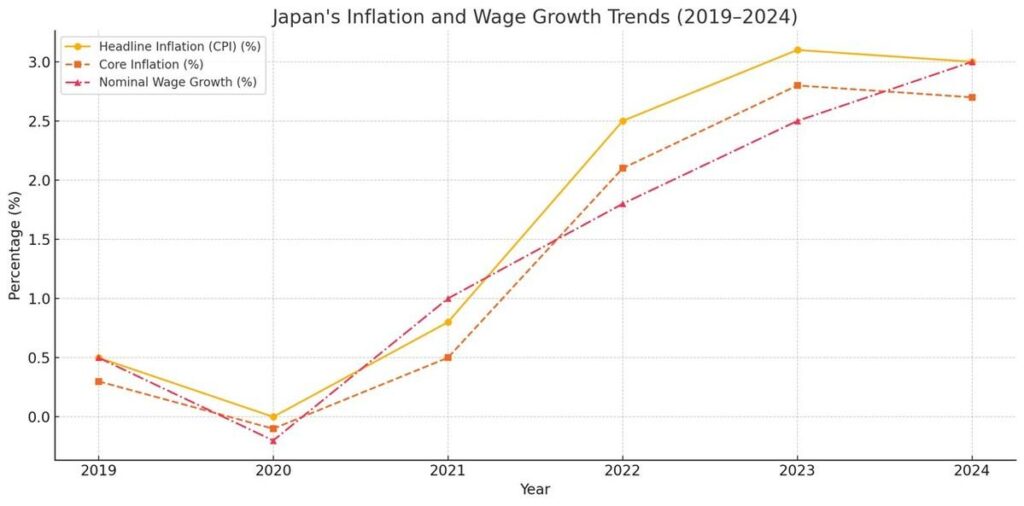

“Japan’s economic landscape is shifting, with inflation finally breaching the BoJ’s long-standing 2% target, wage growth gaining momentum after years of stagnation, and increasing speculation about potential changes to the BoJ’s monetary policy framework,” the report said, which brings in questions about the yen’s future as a funding currency, “And whether we’re on the cusp of a resurgence in traditional carry trades or facing a structural shift that could redefine global FX strategies.” “In the emerging new era, FX market participants will need to adopt more dynamic strategies, emphasizing robust risk management and diversified approaches.”

The full report includes detailed historical context, current market analysis, and 2025 perspectives on alternative high-yielding currencies such as the Mexican Peso, South African Rand, and Turkish Lira.

To download the complete report and access Bybit’s latest market insights, visit Bybit Learn.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

DUBAI, UAE, Feb. 19, 2025 /PRNewswire/ — MANTRA Finance FZE (MANTRA), a leading decentralized finance (DeFi) platform operated by MANTRA Group, today announces it has successfully obtained a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), to operate as a Virtual Asset Exchange, as well as provide Broker-Dealer and Management and Investment Services.

This marks a significant milestone in MANTRA’s commitment to regulatory compliance, security, and innovation within the rapidly growing virtual assets ecosystem. The VARA license will support not just MANTRA’s global footprint as it introduces a range of innovative, regulatory-compliant financial products tailored to the evolving needs of investors around the world, but position it to further scale operations in the Middle East focused on the tokenization of real world assets (RWAs). It underscores MANTRA’s commitment to providing transparent, secure, and cutting-edge solutions while meeting the highest standards of regulatory oversight.

“By establishing the most timely, comprehensive and built from-the-ground-up framework for virtual assets and Web3, Dubai and VARA have become world leaders in crypto regulation. This license was a crucial step for MANTRA and a key step in our journey towards global expansion,” said John Patrick Mullin, CEO of MANTRA.

“The UAE and broader MENA region has fast become a progressive global hub and thriving ecosystem for Web3 and virtual assets owing to their regulatory initiatives and frameworks. This license not only strengthens our presence regionally, it positions us internationally to deliver unique DeFi products that bridge the gap between decentralized finance and traditional finance. Our goal is to build a future-focused financial ecosystem that benefits institutional and qualified investors globally.”

MANTRA leverages its cutting-edge blockchain technology to deliver fast, secure, and non-custodial financial services. The platform’s offerings will include innovative investment products that merge the advantages of decentralized finance with the protections of traditional finance, such as increased transparency, rapid trade settlement, and enhanced user control over assets. With the VARA license, MANTRA is uniquely positioned to scale these solutions and offer them to both institutional clients and qualified investors in the UAE.

“By obtaining this license, MANTRA joins a growing community of regulated entities operating within the UAE, and we are excited to work alongside industry leaders to shape the future of virtual assets,” added Mullin. “Our regulatory compliance is fundamental to the trust we build with users, and it reflects our long-term vision of driving responsible growth in the digital asset space.”

As the platform continues to innovate, MANTRA will launch a variety of unique DeFi products designed to meet the dynamic needs of investors. Each product is developed with strict adherence to local regulations and international policy frameworks, ensuring that users benefit from both security and cutting-edge financial tools.

For more information, visit mantrachain.io.

About MANTRA

MANTRA chain is a purpose-built Layer 1 blockchain for real-world assets, capable of adherence to real-world regulatory requirements. As a permissionless chain, MANTRA Chain empowers developers and institutions to seamlessly participate in the evolving RWA tokenization space by offering advanced technology modules, compliance mechanisms, and cross-chain interoperability.

The Asset Operating System, aOS, unlocks global capital markets with intelligent, self-executing assets.

NEW YORK, Feb. 18, 2025 /PRNewswire/ — Platonic today introduced aOS™, a groundbreaking blockchain-native infrastructure that transforms static financial assets into programmable, AI-linked instruments capable of autonomous execution across markets. This innovation unlocks any asset to transact seamlessly, optimize value, and settle instantly—without manual intervention.

“The future of finance is autonomous, intelligent, and borderless,” said Violet Abtahi, CEO of Platonic. “We are architecting a world where value flows like information—aOS is the connective tissue of finance, enabling traditional institutions to participate in the digital-first economy, unlocking $400 trillion in assets that remain static, inefficient, and underutilized.”

A New Era for Financial Markets

Tomorrow’s financial system will look vastly different from the one we know today. A single, global capital market will emerge—one where assets are intelligent and autonomous. Tokenized ownership, real-time settlement, and AI-linked management will dissolve cross-border barriers, unlocking unprecedented liquidity and accessibility. Platonic’s aOS provides the infrastructure to bridge legacy systems into this autonomous economy—transforming static assets into dynamic, revenue-generating instruments for a truly global marketplace.

The platform’s patented architecture combines AI-linked smart contracts, unique privacy channels, and seamless private and public blockchain interoperability to automate complex financial processes that currently require extensive manual intervention. Early pilot programs with major financial institutions have demonstrated dramatic reductions in operational cost and counterparty risk, with one project successfully automating nearly $400 billion in foreign exchange trades.

AOS: The Foundation for the Autonomous Economy

The opportunity is extraordinary: tokenized assets are projected to reach up to $16 trillion by 2030, and aOS is designed to unlock this immense potential. By bridging legacy systems with decentralized networks, aOS empowers institutions to lead the shift into the digital-first era.

“Imagine a future where private equities, real estate holdings, and even personal financial data become dynamic, revenue-generating instruments,” said Abtahi. “That future is closer than we think, and aOS is the catalyst making it a reality.”

About Platonic

Platonic is a leading innovator in blockchain-based financial infrastructure, transforming the way global markets operate. By harnessing AI, secure encryption, and decentralized technologies, Platonic builds the bridge between legacy systems and digital finance. Its groundbreaking solutions empower institutions to evolve, stay ahead of change, and embrace the digital economy—converging traditional and digital ecosystems into a single, unified global capital market driven by intelligent, self-executing assets.

For more information about aOS, visit platonic.io.

Media Contact: Neal Stein ZCorp PR +1 321.473.7407 neals@zcorppr.com

NICOSIA, Cyprus, Feb. 17, 2025 /PRNewswire/ — As a leading player in the crypto igaming space, BC.GAME has launched an airdrop in the Solana ecosystem. The platform distributed 400 million $BC tokens, further expanding its presence in the blockchain space. BC.GAME was the first to airdrop tokens to Pump.fun users, offering them an opportunity to receive rewards ahead of other platforms.

Details of the Airdrop for Pump.fun Users

Since its launch in January 2024, Pump.fun has rapidly become one of Solana’s major meme coin creation and trading platforms. Meanwhile, an official airdrop has yet to be announced by Pump.fun, BC.GAME is stepping in with a larger, earlier airdrop plan to get ahead of the game.

A snapshot was taken of all Pump.fun addresses that completed at least 10 transactions between January 31, 2024, and February 13, 2025. These addresses were then ranked based on their absolute profit or loss during this period. The top 100,000 addresses were eligible to receive the airdrop, with rewards distributed as follows:

Top 1,000 users: 30,000 $BC each

Ranks 1,001 – 2,000: 25,000 $BC each

Ranks 2,001 – 10,000: 10,000 $BC each

Ranks 10,001 – 50,000: 4,000 $BC each

Ranks 50,001 – 100,000: 2,100 $BC each

In total, 400 million $BC tokens were distributed among 100,000 users. For further details, including a list of eligible addresses, check here.

Fair and Transparent Distribution Process

BC.GAME’s airdrop was designed to prioritize fairness and transparency. By offering a “Provably Fair” distribution, with clear rules and publicly available addresses, the initiative ensured a fully transparent process. For verification and more details, a snapshot of the eligible airdrop addresses can be found at this link.

Commitment to Trust and Wealth Creation

BC.GAME’s core philosophy is rooted in trust and wealth creation. This airdrop highlighted both principles by dedicating significant resources to a fair promotion that not only built trust but also fostered wealth for its users. The airdrop was expected to increase the number of holders and trading volume on Solana, growing the community to hundreds of thousands of users while boosting liquidity.

About BC.GAME

BC.GAME is a premier crypto igaming platform, offering a wide variety of exciting games and the opportunity to win big in a secure, decentralized environment. With an unwavering commitment to fairness, transparency, and community engagement, BC.GAME quickly became one of the most trusted names in the blockchain-based gambling space.

DUBAI, UAE, Feb. 12, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, spotlights altcoins in a report jointly released with Block Scholes, offering insights on factors that may have delayed the arrival of an altcoin boom. Titled “Altcoin Rotation — Why Altseason Hasn’t Come This Time?“, the report maps out consistent patterns and examines broader market dynamics to decipher signals of the next altseason, contributing to analysis on why traditional altcoin behavior has deviated in the current cycle.

Altseason: It’s All About Timing

Traders counting on capital flows from mainstream cryptocurrencies like BTC and ETH to altcoins are betting on spurs of explosive growth—often surging by 6x to 7x in market cap, but many are finding their patience tested. The report highlighted a departure from cyclical precedents in the current market, with BTC continuing to command dominance after hitting multiple all-time-highs, in defiance of historical patterns of over a decade.

The fact that BTC has yet to cede ground to niche projects in this cycle speaks to more than investors’ preferences for profit-taking styles. Characterized by periods of “significant and sustained outperformance of altcoins” over large-cap tokens, altseasons often mark the outro of a bull run. “Of the three crypto bull runs that we’ve defined, the most recent two have experienced a phenomenon known to many crypto traders as ‘Altcoin Season’,” said the report.

The New Landscape and the Path Ahead

Against the backdrop of an energized market, the lukewarm performance in altcoins is leaving seasoned traders wondering about the why, how, and what next.

The report uncovers insights on notable factors responsible for the deviation, including BTC halvings, the DeFi summer of 2020, ETF-induced institutional capital inflows, and the grand stablecoin play. Several outcomes point to the possibility of fundamental changes in the cryptocurrency markets. For instance, the halving effect in Apr. 2024 did not slow down BTC’s performance, indicating a new structural change in market behaviors.

The report also looks ahead at potential catalysts in the new era of altseasons. The primary scenario involves a natural rotation of capital as BTC holders take profits at new highs, redirecting funds into altcoins. Another possibility centers on ETH’s performance—if it begins to outperform BTC, it could spark broader interest in alternative cryptocurrencies, similar to previous market cycles. Further, institutional investors warming up to new regulatory norms, combined with sustained retail enthusiasm in meme coins, could both contribute to triggering a broader altseason.

More information about the article and the full analysis in the report are available on Bybit Learn.

#Bybit / #TheCryptoArk /#BybitResearch

//ENDS

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

SYDNEY, Feb. 6, 2025 /PRNewswire/ — Vantage Markets, a leading global multi-asset trading platform, is thrilled to announce its partnership with Ferrari, one of the most iconic teams in motorsport. This collaboration, which commenced on January 13, 2025, will see Vantage become an Official Partner of the Scuderia Ferrari HP F1 team, marking a significant milestone for both brands in their pursuit of excellence.

As an Official Partner, Vantage will be featured within Ferrari’s Formula 1 ecosystem and across Ferrari platforms, as part of a bond that embodies shared values of pursuing excellence and innovation.

Marc Despallieres, Chief Executive Officer at Vantage, expressed his enthusiasm:

“Partnering with Ferrari is an exciting milestone for Vantage. Ferrari’s legacy of speed and innovation mirrors our own commitment to empowering traders with cutting-edge tools and exceptional performance. Together, we aim to inspire our global community with the perfect blend of motorsport and trading expertise.”

Lorenzo Giorgetti, Chief Racing Revenues Officer at Scuderia Ferrari HP: “We are pleased to welcome Vantage Markets as an official partner of Scuderia Ferrari HP. This collaboration is built on shared values of innovation, precision, and performance—core principles that drive both our team in Formula 1 and Vantage in the world of trading. We look forward to working together to engage our global audiences in exciting new ways.”

With this exciting venture, Vantage Markets is poised to reward its users with exceptional experiences while joining motorsport enthusiasts worldwide in supporting Scuderia Ferrari HP.

For more information about this exciting partnership and what’s ahead, visit the website.

About Vantage

Vantage Markets (or Vantage) is a multi-asset broker offering clients access to a nimble and powerful service for trading Forex and Contracts for Difference (CFDs) products on, Commodities, Indices, Shares, ETFs, and Bonds.

With over 15 years of market experience, Vantage transcends the role of broker, providing a trusted trading ecosystem, an award-winning mobile trading app, and a user-friendly trading platform that empowers clients to seize trading opportunities. Download the Vantage App on App Store or Google Play.

trade smarter @vantage

Vantage Global Prime Pty Ltd (ACN 157 768 566), located at 12/15 Castlereagh Street, Sydney, NSW, Australia, 2000, and is authorised and regulated by the Australian Securities & Investments Commission (ASIC) AFSL no. 428901.

Trading derivatives carries significant risks. It is not suitable for all investors and if you are a professional client, you could lose substantially more than your initial investment. When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs. We encourage you to seek independent advice if necessary.

You should consider whether you’re part of our target market by reviewing our Target Market Determination (TMD), reading our Product Disclosure Statement (PDS), and other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.