The Australian Securities Exchange (ASX) is unlikely to directly list a cryptocurrency on its exchange but is open to the idea of listing tokenized real-world assets, such as gold.

The ASX’s Chief Information Officer and Group Executive of Technology and Data, Dan Chesterman, explained that listing a cryptocurrency poses challenges due to the existing listing rules.

However, he expressed the possibility of listing a tokenized product in the future.

As the 16th largest stock exchange globally by market capitalization, the ASX holds a significant position in the Australian equity market.

In the first quarter of 2023, the ASX accounted for approximately 82% of the total dollar turnover in local equity market products, according to data from the Australian Securities and Investment Commission.

Chesterman’s stance on blockchain aligns with sentiments expressed by banking executives, who see blockchain as a driver of efficiency.

Howard Silby, the Chief Innovation Officer at National Australia Bank (NAB), noted that large banks and institutions continue to experiment with blockchain, particularly in areas with high friction and high-value customer processes.

Similarly, Sophie Gilder, Managing Director of Blockchain and Digital Assets at Commonwealth Bank, emphasized the potential for tokenization and smart payments to enhance efficiency and reduce risks and costs.

Despite criticism over the suspension of its blockchain-based upgrade to the clearing and settlements system, which incurred significant costs, the ASX clarifies that the decision was not a rejection of blockchain technology.

Chesterman explained that the pause was a deliberate choice to prevent prolonged delays and maintain certainty for customers.

The ASX continues its collaboration with Digital Assets, an infrastructure company, for the development of its blockchain platform, Synfini.

In conclusion, the ASX is cautious about directly listing cryptocurrencies but remains open to the possibility of tokenizing real-world assets.

The exchange recognizes the potential of blockchain technology to drive efficiency in the financial sector.

The decision to pause the blockchain upgrade was made to avoid prolonged uncertainty for customers, and the ASX continues its partnership with Digital Assets for blockchain development.

Other Stories:

Reshape The Future Of Cellular Connectivity And Bridge The Digital Divide

Sale of FTX’s $500 Million Stake In AI Startup Paused, Hindering Efforts To Fill $2 Billion Gap

Bitcoin (BTC) Miners Experience Record Surge in Revenue Sent to Exchanges

Solana’s Cardinal protocol is ceasing operations due to economic conditions, after raising $4.4 million approximately a year ago to enhance the utility of nonfungible tokens (NFTs).

The protocol recently announced on Twitter that users should make their withdrawals by August 26.

Cardinal Labs, an infrastructure provider, had focused on supporting NFT use cases on the Solana network by offering protocols and software development kits (SDKs) for various purposes, including staking, rentals, subscriptions, royalties, and trading.

As per the closing schedule, certain operations will be halted on July 19.

These include staking pool creations, token management, NFT rentals and rental extensions, social media handles, and new deposits.

Users are required to complete their withdrawals by August 26, when the two-month notice period ends.

The Cardinal team expressed their efforts to navigate the challenging macroeconomic environment since their inception 18 months ago.

They acknowledged that NFT-based products have gained traction but mentioned that they have remained confined within the crypto maximalist community.

In July 2022, Cardinal raised $4.4 million in a seed funding round co-led by Protagonist, a crypto venture firm, and Solana Ventures, along with participation from Animoca Brands, Delphi Digital, CMS Holdings, and Alameda Research, the sister company of the now-bankrupt crypto exchange FTX.

A spokesperson clarified that Alameda’s investment constituted a small portion of the funding round and did not contribute to the protocol’s financial difficulties.

Neo Ventures also provided $750,000 in pre-seed funding in 2021. In total, Cardinal secured $5.2 million in funding over 18 months, attracting over 65,000 staked NFTs on the protocol by July 2022.

Despite the challenging times, the NFT market is gradually maturing.

A recent report from DappRadar indicates that the NFT market had a promising start to the year, with Q1 2023 being the best quarter since Q2 2022.

Although trade volume decreased in March, overall performance remained strong due to intense competition among NFT marketplaces.

Other Stories:

EDX Cryptocurrency Exchange Prepares to Switch Custody Providers

Bankrupt Crypto Exchange FTX Takes Steps Towards Relaunching as a New Entity

SEC Commissioner Pushing For ‘Reserved’ Approach to Cryptocurrency Regulation

According to the United States Federal Reserve, all 23 of the country’s largest banks have passed the “stress tests” and would be able to withstand a severe recession.

The report, released on June 28, highlighted some weaknesses among midsize and regional banks, although the stress tests only included the participation of the largest lenders.

In light of the banking crisis earlier this year, Federal Reserve policymakers have suggested that future stress tests could become more rigorous.

Michael Barr, the Fed’s vice chair for supervision, emphasized the importance of remaining humble in the face of potential risks and continuing efforts to ensure that banks are resilient to various economic scenarios, market shocks, and other stresses.

Since the 2008 financial crisis, which was caused by U.S. banks, bank stress tests have been conducted annually.

The purpose of these tests is to evaluate the potential losses the banking industry would incur in the event of skyrocketing unemployment and a significant contraction in economic activity.

In this year’s stress test, the Federal Reserve examined a severe global recession scenario that resulted in a 40% decline in commercial property prices and a 38% decline in home property prices.

In the worst-case scenario, unemployment would reach 10%, compared to the current rate of 3.7%. The tests revealed that the 23 largest banks would collectively experience losses amounting to $541 billion in this hypothetical scenario.

To receive a passing grade, a bank must maintain a stressed capital ratio of at least 4.5%, which serves as a crucial indicator of its financial strength, according to the Federal Reserve’s requirements.

Earlier this year, the American banking system was shaken by the collapse of several prominent institutions, including Silicon Valley Bank, Signature Bank, Silvergate Bank, and First Republic Bank.

Others, such as PacWest and Western Alliance, were also teetering on unstable ground.

To address the challenges faced by smaller banks, the Federal Reserve established the Bank Term Funding Program (BTFP) in March, actively providing bailout assistance.

Federal Reserve data indicates that over $100 billion has already been allocated to support struggling small and mid-sized banks.

Overall, the stress tests conducted by the Federal Reserve offer valuable insights into the resilience of the largest banks in the United States while underscoring the need for ongoing efforts to strengthen the banking sector and mitigate potential risks in the future.

Discover the Crypto Intelligence Blockchain Council

Cryptocurrency laws in the United States should adopt a “reserved” approach and avoid regulating the technology solely from a financial perspective, according to a commissioner at the U.S. Securities and Exchange Commission (SEC).

Commissioner Hester Peirce, often referred to as “Crypto Mom,” shared her views during her remote appearance at Australian Blockchain Week on June 29.

Peirce emphasized the need for regulatory frameworks to acknowledge that cryptocurrencies have applications beyond the financial realm.

While crypto is often associated with financial assets, Peirce highlighted its potential in facilitating decentralized interactions, such as in social media platforms.

She argued that any legal framework should be flexible enough to accommodate the evolving uses of crypto and blockchain technology, while still providing clarity that enables experimentation.

Taking a subtle jab at the SEC’s current approach, which has received criticism from various quarters, Peirce cautioned against delayed enforcement actions resulting from an inflexible regulatory framework. She suggested that regulations should strike a balance between being reserved and offering sufficient clarity, allowing individuals and businesses to explore new possibilities in the crypto space.

When asked about her advocacy for cryptocurrencies, Peirce expressed her belief that the SEC can improve its approach.

She emphasized the importance of being able to speak openly and questioned the purpose of her position if she is unable to do so.

Peirce viewed cryptocurrencies as an opportunity for the SEC to reevaluate its approach to innovation, asserting that the current regulatory stance is inadequate.

Referring to the recent collapse of FTX and subsequent allegations of misconduct, Peirce encouraged the crypto industry to embrace self-regulation.

She stressed the significance of addressing counterparty risks, conflicts of interest, and leverage.

While acknowledging that these steps should ideally be taken without government intervention, Peirce also recognized the potential role of government regulators in this process.

In summary, Commissioner Hester Peirce called for a reserved approach to cryptocurrency regulation in the United States.

She emphasized the need to recognize the broader applications of crypto beyond finance and cautioned against rigid regulatory frameworks. Peirce advocated for a regulatory environment that encourages innovation while still providing clarity.

Furthermore, she encouraged the crypto industry to undertake self-regulation and pay attention to risk factors, suggesting that government regulators could play a supportive role in this endeavor.

Other Stories:

Drop Wireless, NextEPC To Reshape The Future Of Cellular Connectivity And Bridge The Digital Divide

Sale of FTX’s $500 Million Stake In AI Startup Paused, Hindering Efforts To Fill $2 Billion Gap

Bitcoin (BTC) Miners Experience Record Surge in Revenue Sent to Exchanges

Recent developments have raised concerns about the popular cryptocurrency Shiba Inu (SHIB) as significant outflows from the wallets of large investors have been detected by IntoTheBlock, a blockchain analytics firm.

This sudden shift in sentiment from bullish to bearish has grabbed attention. Since Monday, an astounding one trillion SHIB tokens have been withdrawn from the wallets of major investors, surpassing the inflow of 745 billion tokens.

Consequently, the netflow of Shiba Inu whales’ wallets over the past seven days has reached a disheartening -377.35 billion SHIB, indicating a substantial drop of half a trillion tokens from the previous day’s value.

Two key considerations emerge when examining the reasons behind the behavior of these large SHIB holders: fundamental and technical factors.

The first consideration revolves around the adoption of Shiba Inu and its associated projects, with Shibarium taking center stage.

Although Shibarium, a Layer 2 solution, is currently operating in a test network, the team behind it has remained tight-lipped, providing minimal information beyond cryptic Twitter messages.

The uncertainty surrounding the release of Shibarium on the main network may have prompted major holders to decrease their SHIB positions.

The second factor pertains to the price of the Shiba Inu token, which recently failed to surpass the critical resistance level of $0.0000084 per SHIB.

Despite a noteworthy rally, the token has experienced a 12% decline since then, leaving its trading status uncertain.

This ambiguity regarding the future price direction of SHIB may have discouraged significant whales, who typically exercise caution in their operations due to the substantial sums involved.

The question now arises: can Shiba Inu overcome these challenges and regain its momentum? The path forward for SHIB depends on addressing the concerns surrounding Shibarium’s release on the main network.

Transparent communication and timely updates from the project team would help instill confidence in the ecosystem and potentially attract back large investors.

Additionally, efforts to stabilize and elevate the token’s price beyond the critical resistance level could reignite bullish sentiment among investors.

As the Shiba Inu community awaits further developments, it is essential for stakeholders to closely monitor both the progress of Shibarium and the market dynamics affecting SHIB’s price.

By addressing these concerns and providing a clear roadmap for the future, Shiba Inu has the potential to restore investor confidence and reclaim its upward trajectory.

Other Stories:

Bitcoin (BTC) Miners Experience Record Surge in Revenue Sent to Exchanges

Sale of FTX’s $500 Million Stake In AI Startup Paused, Hindering Efforts To Fill $2 Billion Gap

Drop Wireless, NextEPC To Reshape The Future Of Cellular Connectivity And Bridge The Digital Divide

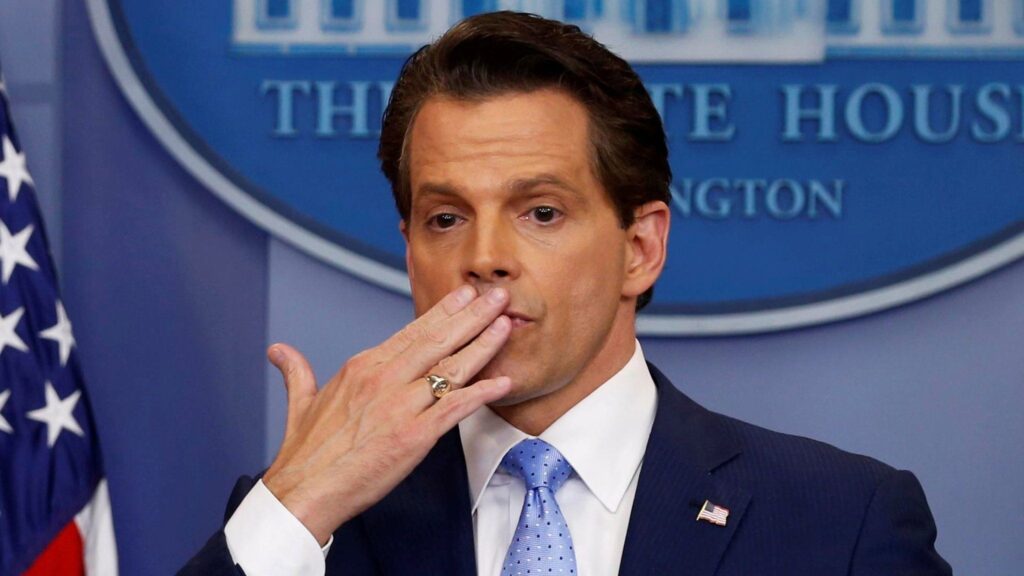

Anthony Scaramucci, often known as “The Mooch,” is a prominent figure in American finance and politics. Born on January 6, 1964, in Long Island, New York, Scaramucci’s life trajectory is a quintessential story of American entrepreneurial spirit and financial success.

Early Life

Scaramucci graduated from Tufts University in 1986 with a degree in economics. Afterward, he completed his Juris Doctor degree at Harvard Law School in 1989. Despite his initial career trajectory leading him towards law, Scaramucci had a penchant for finance and entrepreneurship that would eventually redirect his career path.

His first significant financial role was at Goldman Sachs, where he started in the Real Estate Investment Banking division and later moved to Equities Private Wealth Management. In 1996, Scaramucci left Goldman Sachs to launch Oscar Capital Management alongside his colleague Andrew Boszhardt. In 2001, Neuberger Berman purchased Oscar Capital, and Scaramucci served as a managing director in the firm’s Investment Management division.

READ: 3 Best Crypto PR agencies – Fees, Results and Full Review

In 2005, he started SkyBridge Capital, a global alternative investment firm. Under his leadership, SkyBridge became a significant player in the hedge fund industry and established a strong presence globally. Scaramucci’s entrepreneurial success at SkyBridge bolstered his reputation within the financial world, leading to his regular appearances on television finance programs, where he shared his insights on the global financial markets.

Anthony Scaramucci’s Political Career & Net Worth

His financial expertise and connections in the finance world paved the way for Scaramucci’s foray into politics. He was a fundraiser for both Obama and Romney in the 2008 and 2012 campaigns, respectively. However, he is best known for his brief tenure as White House Communications Director under President Donald Trump in 2017. His tenure lasted for just 11 days, making it one of the shortest in history.

As of September 2021, Anthony Scaramucci’s estimated net worth is around $200 million. His wealth has primarily been accrued through his career in finance and investment. As founder and co-managing partner of SkyBridge Capital, Scaramucci oversaw a significant amount of assets. The firm’s asset under management peaked at approximately $12.5 billion in 2012.

However, Scaramucci’s net worth is not solely tied to SkyBridge. In 2017, he announced his intention to sell his stake in the company as he was poised to take on a role within the Trump administration. Later, the sale fell through, and he resumed his position at SkyBridge after his short stint in politics.

Moreover, his engagements as a financial analyst, television appearances, speaking engagements, and authorship of three books have also contributed to his net worth. His books, “Goodbye Gordon Gekko,” “The Little Book of Hedge Funds,” and “Hopping over the Rabbit Hole,” have enjoyed considerable popularity within finance and entrepreneurial circles.

Despite experiencing turbulent times during the COVID-19 pandemic, SkyBridge emerged resilient and even launched a Bitcoin-focused fund in late 2020, indicating Scaramucci’s adaptive entrepreneurial strategy. It is worth noting that fluctuations in his investments, the performance of SkyBridge, and the overall economic environment could influence his net worth.

Scaramucci’s story serves as a testament to the power of tenacity, adaptability, and a keen understanding of market dynamics. From his roots in Long Island to the halls of Harvard Law School, from Wall Street to the White House, his journey has been nothing short of remarkable. His net worth not only reflects his success in finance and investment but also his bold foray into politics and media. Despite his brief political tenure and the controversy it engendered, Scaramucci continues to be a significant figure in American public life. His financial insights and political commentary continue to shape discourse within and beyond Wall Street.

As of 2021, Scaramucci’s net worth underscores a diverse and dynamic career in finance, politics, and media. His story is a testament to the potential of American entrepreneurial spirit and a keen understanding of market dynamics. Whether in finance, politics, or media, Scaramucci’s influence is considerable, and his impact continues to resonate.

Other Stories:

Bspin Review – Here’s Why You Shouldn’t Gamble With This Bitcoin Casino

FTX Recovers $7 Billion Amid Intermixing of Funds

Amazon’s AWS Invests $100 Million in Generative AI Innovation Center

The blame game continues between Digital Asset and the Australian Securities Exchange (ASX) over the failed blockchain upgrade of ASX’s CHESS system.

Digital Asset, the New York-based firm responsible for the abandoned blockchain clearing system, has pointed fingers at ASX for dropping the plans. ASX representatives, however, have dismissed these claims as misleading.

ASX had been poised to become the world’s first securities exchange to adopt blockchain technology in partnership with Digital Asset over the past seven years.

However, in a surprising turn of events, ASX announced on May 17 its decision to abandon the upgrade and explore more conventional technology options.

Digital Asset’s co-founder, Eric Saraniecki, addressed the issue during a parliamentary joint committee meeting on June 8. He stated two main reasons for the failure of the blockchain upgrade.

First, he alleged that ASX was reluctant to provide crucial test data that would have allowed Digital Asset to better test the functionality of the new system.

This lack of information forced Digital Asset to make assumptions in the absence of necessary data.

Second, Saraniecki claimed that ASX had publicly discussed replacing its old CHESS platform with a “big bang” approach while simultaneously asking Digital Asset to preserve outdated elements of the system.

This conflicting approach reportedly created further discord between the two companies, ultimately leading to the failure of the upgrade.

On the other side, ASX non-executive director David Curran responded to these allegations by stating that the issue arose from a lack of communication from Digital Asset.

Curran emphasized that if Digital Asset had concerns about the project, they should have been raised and resolved through appropriate channels.

ASX managing director and CEO Helen Lofthouse explained that the challenges did not stem from the “flexible requirements” but rather from the preexisting requirements of the system itself and how they related to settlements in Australia.

She revealed that the decision to pause the upgrade in November 2022 was based on the realization that the original solution design could not meet the current market requirements and provide the necessary flexibility.

Contrary to reports stating that ASX has completely abandoned blockchain technology, ASX’s chief information officer, Tim Whiteley, clarified that no firm decision had been made.

He mentioned that ASX is on track to announce a solution design later in the year and is exploring all options for the upgrade.

The ongoing blame game and differing accounts reflect the complex nature of the failed blockchain upgrade between Digital Asset and ASX.

The exact details and outcome of the situation remain uncertain as an ongoing review prevents the release of further information.

Other Stories:

Sequoia Capital Defends FTX Investment Despite Bankruptcy

Etherscan Launches AI-Powered Code Reader, Polygon Proposes zkEVM Upgrade

ECB Executive Slams Cryptocurrencies as Platforms for Gambling, Calls for Regulatory Safeguards

In a recent update on June 22, Binance.US, which operates as an independent subsidiary of the larger Binance exchange, assured its customers that its system is fully operational again.

However, the exchange has cautioned its customers that this relief may only be temporary.

It stated that U.S. dollar withdrawal requests are expected to return to their normal processing time of five business days.

Earlier on June 9, the exchange had temporarily suspended dollar deposits and notified its customers about an impending pause on fiat withdrawal channels due to an ongoing battle with the Securities and Exchange Commission (SEC).

The exchange had warned that its banking partners might halt fiat withdrawal channels as early as June 13, but that did not happen at that time.

Binance.US has urged customers who faced failed withdrawal attempts to resubmit their requests, emphasizing that their systems are currently functioning properly.

However, the exchange has cautioned that their banking partners are likely to discontinue the USD withdrawal service in the near future.

As a result, Binance.US is advising its users to consider utilizing stablecoins or converting their USD holdings into stablecoins to continue engaging in crypto-to-crypto trading.

The exchange is gradually transitioning to becoming a crypto-only platform. Any remaining USD balances held by customers may be converted into Tether at a later date, according to the announcement.

Furthermore, Binance.US revealed plans to introduce additional trading pairs involving Tether (USDT) and cryptocurrencies such as ANKR, DAI, DASH, HBAR, ICX, IOTA, RVN, WAVES, XNO, XTZ, and ZIL on June 26.

However, the exchange will remove most of the “USD Advanced Trading pairs” from its platform on the same date.

Among the 150 supported crypto assets on Binance.US, only BTC, ETH, ADA, BNB, LTC, MATIC, SOL, VET, USDC, and USDT will be tradable against the dollar.

It’s worth noting that Binance.US has also experienced banking partner issues in Australia.

In May, the Australian branch of Binance witnessed a 20% drop in Bitcoin prices when local banking and payment partners suspended their services, leading to a rush of users selling and cashing out.

Other Stories:

Etherscan Launches AI-Powered Code Reader, Polygon Proposes zkEVM Upgrade

ECB Executive Slams Cryptocurrencies as Platforms for Gambling, Calls for Regulatory Safeguards

Sequoia Capital’s partner, Alfred Lin, has defended the firm’s investment of $213.5 million in the now-bankrupt cryptocurrency exchange FTX. Speaking at Bloomberg’s Tech Summit, Lin stated that if given the opportunity to evaluate FTX again, Sequoia would likely make the same investment decision.

Despite the loss incurred, he emphasized that the venture capital firm remains enthusiastic about the potential of cryptocurrency.

Sequoia Capital manages approximately $85 billion in assets and has investments in prominent technology companies as well as several crypto ventures.

In the case of FTX, the firm invested $150 million through its Global Growth Fund III, accounting for 3% of the fund’s capital.

Additionally, the Capital Global Equities Fund invested $63.5 million in both FTX and FTX US, representing less than 1% of its entire portfolio.

Last November, Sequoia informed its partners that both of its investments in FTX had been categorized as complete losses following the exchange’s closure.

However, the firm’s investment strategy revolves around trusting founders and taking calculated risks, understanding that not all investments will yield positive results.

Despite the negative outcome with FTX, Sequoia Capital maintains its enthusiasm for the crypto industry.

Lin reiterated the firm’s investment thesis, emphasizing the importance of founder trust and acknowledging that unsuccessful investments are part of the risk-taking nature of the business.

Nevertheless, the FTX investment has brought additional challenges for Sequoia Capital. Some users of the bankrupt exchange have filed lawsuits against the financiers who supported the platform, including Sequoia, Thoma Bravo, and Paradigm.

The lawsuit alleges that these firms participated in a promotional marketing campaign in 2021, contributing to FTX’s perceived legitimacy. Sequoia, along with Thoma Bravo and Paradigm, were investors in FTX’s record-breaking $900 million Series B funding round in July 2021.

Despite the setbacks, Sequoia Capital remains a significant player in the venture capital landscape, with substantial investments in various industries.

The firm’s experience with FTX serves as a reminder of the inherent risks involved in investing, particularly in the volatile and evolving world of cryptocurrency.

Other Stories:

Accenture Announces $3 Billion AI Investment After Wave of Layoffs

SHIB Coin Prediction: Will Shiba Inu Coin Reach $1?

Melanion Capital Launches Bitcoin Equities ETF on Euronext Amsterdam Stock Exchange

Nevada’s Department of Business and Industry has issued a cease and desist order to Prime Trust, a crypto custodian, alleging that the company is facing a “shortfall of customer funds” and is unable to fulfill customer withdrawal requests.

According to the regulator, Prime Trust’s financial condition is deemed “critically deficient,” and the firm is now considered to be in an “unsafe or unsound condition” to continue its business operations.

The order, issued on June 21, states that Prime Trust has experienced a significant deterioration in its financial condition, leading to the inability to honor customer withdrawals.

The regulator further accuses Prime Trust of breaching its fiduciary duties by failing to adequately safeguard the assets under its custody.

It also highlights that the company is incapable of meeting all customer disbursement requests.

In response to the order, Prime Trust has 30 days to provide a response and can request an administrative hearing to contest the allegations. If the company fails to contest the order, it will be considered final.

This development comes shortly after Banq, the payments subsidiary of Prime Trust, filed for bankruptcy protection in the United States on June 13.

Additionally, BitGo, a provider of wallet infrastructure and digital asset custody, announced on June 22 that it has decided to cancel its acquisition of Prime Trust.

Cointelegraph reached out to Prime Trust for a comment on the matter, but an immediate response was not received.

The situation raises concerns about the financial stability and trustworthiness of Prime Trust as a custodian of crypto assets.

Customers who have entrusted their funds with the company may face difficulties in accessing their assets and may be uncertain about the safety of their investments.

The outcome of Prime Trust’s response to the cease and desist order will determine the future course of action and the potential repercussions for the company and its customers.

Other Stories:

Federal Reserve Pushing For Robust Oversight of Stablecoins as Form of Money

Millions of Mexicans To Be Able To Pay Internet Bills Via Bitcoin Lightning Network

Car-Maker Announces Launch of its NFT Platform With Near Protocol