A Bitcoin miner recently found themselves in an unexpected predicament involving a substantial sum of cryptocurrency.

They received a staggering 19.8 BTC in fees from blockchain infrastructure firm Paxos, only to later return the funds.

The reason behind this dramatic turn of events was Paxos’ claim that they had made a grievous mistake, inadvertently paying over $500,000 in transfer fees.

The cryptocurrency community was left bewildered on September 10th when a Bitcoin transaction caught their attention.

This transaction entailed paying approximately $500,000 in fees to move a mere $2,000, a stark contrast to the typical network fee of around $2.

Various speculations circulated within the community, with some speculating that the error occurred due to a data copy-paste mishap, inadvertently placing an output value into the fee box without verification.

Subsequently, on September 13th, Paxos stepped forward and acknowledged responsibility for the transaction mishap.

They reassured their users that their funds remained secure and were the rightful property of Paxos.

Additionally, Paxos clarified that PayPal had no involvement in the mistake, conceding that the error was entirely their own.

READ MORE: Arbitrum and Optimism Networks are on BetFury

Almost a day after Paxos’ admission, the Bitcoin miner who had received the excessive fees turned to social media, specifically X (formerly Twitter), to voice their frustrations.

Ultimately, they agreed to refund the entire amount to Paxos.

Seeking advice from their X followers, the miner asked what course of action they should take, with a majority of respondents suggesting the funds be distributed to other Bitcoin miners.

However, it appears this counsel was not heeded, as blockchain data from Bitcoin explorer Mempool confirmed that the funds were indeed returned to Paxos on September 15th.

This incident is not the first time substantial transaction fees have been lost due to human error. In 2019, an Ethereum user suffered a loss of nearly $400,000 in Ether after mistakenly inputting values in the wrong fields.

Fortunately, the Ethereum mining pool Sparkpool intervened and helped the user recover half of the lost funds, highlighting the importance of community support and cooperation in the world of cryptocurrency.

Other Stories:

US and Vietnam Forge Multi-Billion Dollar AI and Tech Partnerships

2023 Crypto Venture Capital Funding Plummets As Industry Faces Uncertain Times

Binance.US Challenges SEC’s ‘Unreasonable’ Demands in Legal Showdown

The world of cryptocurrencies is evolving, creating more efficient and practical technologies. Top crypto platforms focus not only on multi-currency but also on adding various networks. In this context, the BetFury platform launches Arbitrum and Optimism, two popular networks with their native ARB and OP tokens. Why is this a great opportunity for Ether holders and fans of cheap transactions?

New Networks – Great Profit

The introduction of Arbitrum and Optimism to the BetFury platform is, first of all, adding variability in the use of networks and their native tokens. For example, each Arbitrum user can transfer a supported currency (ETH, USDT, USDC, DAI, or ARB) to their account balance to play and earn more. It is a kind of another iGaming utility for all supported tokens. In turn, experienced BetFury players can use the networks to transfer assets easily and cheaply.

Over three years ago, BetFury created a native BFG token with many utilities. The most profitable of them is BetFury Staking, with up to 50% APY and the possibility of daily withdrawals. Anyone with at least 100 BFG can withdraw daily Staking payouts in five popular cryptocurrencies: BTC, ETH, USDT, BNB, and TRX. In conjunction with the new Arbitrum and Optimism networks, we receive excellent passive income with the possibility of cheap and fast transfers for most of the above currencies. Therefore, BetFury’s collaboration with Arbitrum and Optimism creates a symbiosis in the entire crypto ecosystem.

Why are Arbitrum and Optimism Top Networks?

For those unfamiliar with the networks, they are an Ethereum Layer 2 solution and work with Optimistic Rollups. They reduce the load on the main network and help its scalability. Compared to the Ethereum network, they are more practical and very cheap. To withdraw currency from BetFury through the Arbitrum network, you should pay 1 ARB (about $0.76) and through the Optimism network – 0.6 OP (about $0.77).

If we compare Arbitrum and Optimism, the latter is almost twice as inferior in Total Value Locked (TVL). Arbitrum also has a larger number of protocols. Optimism uses single-stage proofs of fraud, while Artibrum uses multi-stage off-chain proofs. Arbitrum protection is more effective, but the sequencer is responsible for the proof, and Optimism offers this function to anyone. Therefore, you should rely on your preferences when choosing one of them.

New ARB and OP Tokens on BetFury

Over three years, the ecosystem collaborated with many well-known crypto platforms. Users can place bets in games using over 50 cryptocurrencies: BTC, ETH, BNB, AVAX, DOGE, SHIB, etc. Partnership with Arbitrum and Optimism allows earning ARB and OP by playing games. It is an excellent opportunity for investors and ARB and OP holders to try a new type of income and discover the world of iGaming. In addition to cheap transactions, BetFury provides excellent conditions for deposits and withdrawals. For ARB: min deposit – 0.7 ARB, min withdrawal – 0.7 ARB, for OP: min deposit – 0.5 OP, min withdrawal – 0.5 OP.

About BetFury

BetFury is an ecosystem of crypto products for entertainment and additional income. The platform has over 8,000 Slots and In-House games with one of the highest RTPs on the market (up to 99.02%). The ecosystem also offers lucrative bonuses (Cashback up to 25%, Rakeback, and FuryCharge) and more than 80 sports for true fans.

In conclusion, the emergence of new networks on BetFury expands opportunities for players and opens up new ones for Arbitrum and Optimism users. This partnership demonstrates the strong potential of the ecosystem and influences future connections between the gaming and crypto universes. In addition, the platform plans to hold various events and activities in honor of the new collaboration. Therefore, subscribe to BetFury social media and follow the novelties and updates!

In the forthcoming criminal trial of former FTX CEO Sam Bankman-Fried, potential jurors may face a unique set of questions aimed at gauging their suitability for the case.

Both Bankman-Fried’s defense team and U.S. prosecutors have submitted lists of proposed questions in court filings on September 11, as the trial, scheduled for October 3, approaches.

Bankman-Fried’s legal team is keen to identify prospective jurors with ties to the cryptocurrency world.

They intend to inquire whether potential jurors have invested in cryptocurrencies and, if so, whether their experience involved financial losses or a negative perception of the crypto industry.

Another query seeks to determine whether a juror would attribute the failure of a crypto firm to its owners, delving into their reasoning behind such beliefs.

Additionally, Bankman-Fried wishes to explore prospective jurors’ views on “effective altruism,” a philosophical movement he has been associated with.

They will also inquire about attitudes toward large donations to political candidates and lobbyists and seek any personal or professional experiences with individuals using ADHD medication.

As part of standard procedure, Bankman-Fried’s legal team plans to ask prospective jurors whether they are familiar with him, have formed an opinion on his guilt or innocence, or have expressed opinions about Bankman-Fried, FTX, or Alameda Research.

READ MORE: Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

On the other side, U.S. prosecutors have their own set of questions.

They are interested in prospective jurors’ familiarity with FTX and its affiliates, as well as whether they or anyone they know has invested or worked in the cryptocurrency space.

The prosecutors also intend to ask about opinions on the government’s role in regulating the crypto industry and whether jurors have ever suffered financial losses due to fraudulent conduct.

Meanwhile, on September 12, U.S. District Court Judge Lewis Kaplan denied Bankman-Fried’s request for temporary release before the trial, dismissing the argument that a poor prison internet connection warranted his release.

Bankman-Fried has pleaded not guilty to seven fraud-related charges relating to FTX’s collapse in November.

Furthermore, he faces a separate criminal trial on additional charges scheduled for March next year.

In preparation for this high-profile trial, both sides are striving to select a jury that can fairly assess the case’s intricacies while considering potential biases and experiences that may influence their perspectives on crypto, altruism, and related matters.

Other Stories:

Bitcoin Rebounds from Three-Month Lows Amid Traders’ Doubts

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

Ant Group, the owner of the world’s largest mobile payment platform, Alipay, has unveiled its new sub-brand called ZAN, focusing on blockchain development and services tailored for both institutional and individual Web3 developers.

The official press release, issued on Sept. 8, outlines ZAN’s extensive range of technical offerings for its clientele. ZAN’s offerings commence with a solution designed to assist Web3 companies in issuing and managing real-world assets (RWAs) in strict adherence to local regulatory requirements.

The portfolio also encompasses a suite of technical products, encompassing electronic Know Your Customer (KYC) procedures, Anti-Money Laundering protocols, and Know Your Transaction checks specifically tailored for the Web3 ecosystem.

ZAN is further committed to delivering services such as smart contract audits and node services, including remote procedure calls, essential for constructing decentralized applications (DApps).

During the Hong Kong Web3 Festival held in April, HashKey DID, a Web3 decentralized identity data aggregator, made a significant announcement, indicating its adoption of ZAN’s electronic KYC solution.

READ MORE: Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

HashKey Group actively participated in ZAN’s brand launch ceremony, establishing itself as one of the inaugural partners in this innovative venture.

In a development reported by Bloomberg in July, Ant Group is actively exploring the possibility of separating its blockchain division from its core entity, a move necessitated by the pursuit of a financial holding license in China.

Reflecting on events from 2020, Ant Group had set ambitious objectives, targeting a valuation of $226 billion alongside a monumental $30 billion initial public offering (IPO) on both the Hong Kong and Shanghai stock exchanges.

Had this venture succeeded, it would have marked the largest IPO in history, surpassing records like the $29.4 billion raised during the Saudi Aramco IPO.

However, this ambitious IPO was ultimately thwarted by regulatory actions taken by the Chinese government.

Other Stories:

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Zero-knowledge (ZK) proof solutions have played a crucial role in the Ethereum ecosystem’s scalability, but Consensys’ zkEVM Linea head, Nicolas Liochon, anticipates that proto-danksharding will bring about a significant reduction in rollup costs.

During Korea Blockchain Week, in an exclusive conversation with Cointelegraph Magazine editor Andrew Fenton, Liochon projected that proto-danksharding, also known as Ethereum Improvement Proposal (EIP) EIP-4844, could potentially slash rollup costs by tenfold.

EIP-4844 aims to address the cost issues associated with rollups, a technology that aggregates transactions and data off-chain while providing computational proof to the Ethereum blockchain.

However, the Ethereum Foundation has yet to announce a specific launch date for proto-danksharding, as development and testing continue.

Liochon explained that Linea already offers transactions 15 times cheaper than Ethereum’s layer 1, but rollups are constrained because transactions are posted in call data within Ethereum blocks.

According to Ethereum’s documentation, rollups remain expensive due to the fact that all Ethereum nodes process call data, which is stored on-chain indefinitely, despite its short-term relevance.

READ MORE: Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

EIP-4844 introduces data blocks that can be sent and attached to Ethereum blocks, with the data stored within these blocks inaccessible to the Ethereum Virtual Machine, and set to be deleted after a specified timeframe.

This innovation is expected to substantially reduce transaction costs, addressing the core issue of data availability, which accounts for 95% of rollup costs.

Liochon emphasized that Linea’s prover, responsible for off-chain computation, verification, bundling, and cryptographic proof generation for combined transactions, comprises only a fifth of the overall cost.

This highlights the significant challenge in making ZK-rollups the preferred scaling solution for Ethereum over alternatives like Optimistic Rollups.

Furthermore, Linea aspires to be a versatile ZK-rollup suitable for various decentralized applications and solutions within the Ethereum ecosystem, catering to DeFi, gaming, and social applications.

Consensys successfully launched Linea in August 2023, with more than 150 partners onboarded and over $26 million in Ether bridged, as previously reported by Cointelegraph.

Other Stories:

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Bitcoin extended its decline following the Wall Street opening on September 1, as losses from the monthly close persisted.

Cointelegraph Markets Pro and TradingView data tracked the dwindling BTC price performance, which hit its lowest point since August 22.

The downward momentum was fueled by Bitcoin bears capitalizing on the August monthly close, causing significant volatility in both the Bitcoin and cryptocurrency markets throughout the night.

Overall, BTC/USD saw an 11.2% decline in August, leaving little room for optimism about a potential rebound in September, as noted by market experts.

Prominent trader and analyst Rekt Capital shared insights on Bitcoin’s potential future actions in his recent YouTube update.

He highlighted that BTC price was unable to sustain gains attributed to the “Grayscale hype,” with substantial selling pressure and a drop in the weekly relative strength index (RSI) values toward a crucial upward trendline.

Several exponential moving averages (EMAs), previously acting as support, had now switched roles to become resistance.

The long-standing trendline that had held for over a year was at risk, and a breach of the RSI trendline could result in further downward movement, according to Rekt Capital.

READ MORE: OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

He identified potential price targets for a new decline, ranging on the path toward $23,000, a favored level among traders.

Referring to historical norms and insights from on-chain monitoring resource CoinGlass, he estimated losses of approximately 7% to 13% for September.

In the event of a relief rally, Rekt Capital suggested that the rally might peak at around $27,200, a level that had previously served as a support zone.

However, Bitcoin’s performance was hindered by the U.S. Dollar Index’s (DXY) second consecutive day of robust strength.

The DXY, which stood above 104 at the time of writing, had recovered from recent losses and was expected to continue its upward trajectory that began in mid-July.

The DXY’s strength had previously acted as resistance during a retest in August, following a local high in June.

Market participants were divided over the current influence of the DXY’s strength in suppressing BTC price, as the inverse correlation between the two had been repeatedly challenged over the past year.

Other Stories:

Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

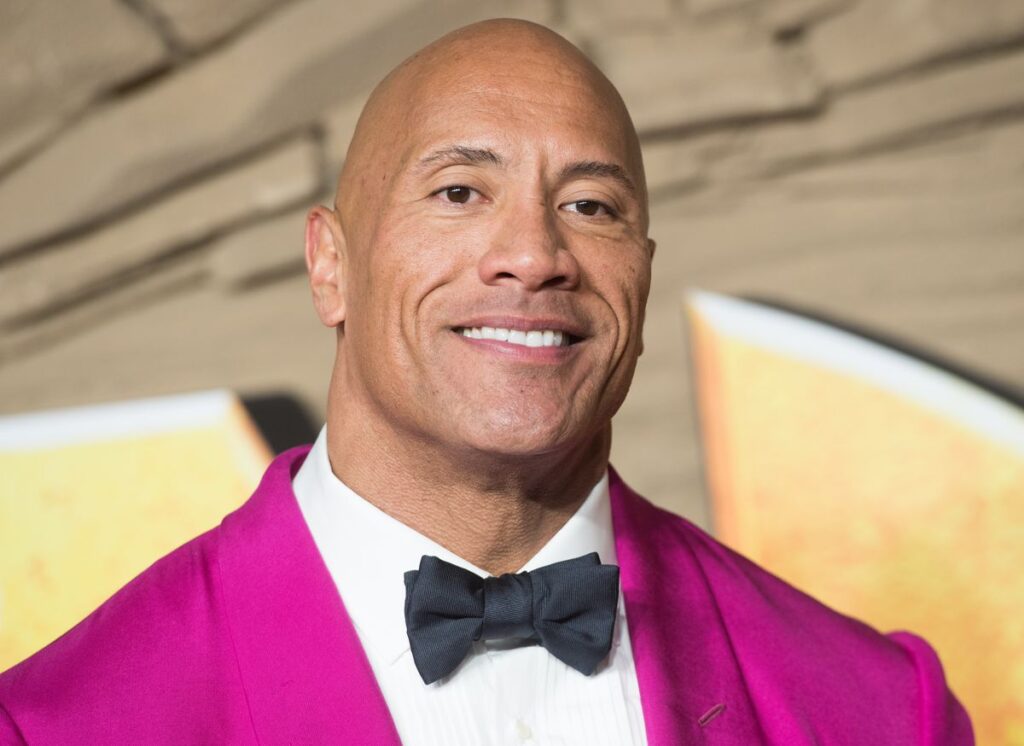

The crypto community has united in solidarity with the Maui community, rallying behind a relief fund endorsed by renowned celebrities Oprah Winfrey and Dwayne “The Rock” Johnson, which now accepts contributions in various cryptocurrencies.

During the initial days of August in 2023, the serene Hawaiian island of Maui was engulfed in destructive wildfires, inflicting considerable damage to both properties and lives as a staggering 2,500 acres were consumed by the blaze.

In response, The Rock and Oprah jointly inaugurated the People’s Fund of Maui, a charitable initiative designed to extend direct financial assistance to those grappling with the aftermath of the disaster.

In a tweet, The Rock unequivocally affirmed that the entirety of the donations would be channeled towards the victims.

He elaborated, “Each adult resident residing within the impacted regions of Lahaina and Kula, displaced by the ferocious wildfires, will be eligible to receive $1200 per month.

This endeavor aims to facilitate their journey towards recovery.”

The People’s Fund of Maui demonstrates its versatility by welcoming donations not only in traditional fiat currencies but also in an array of cryptocurrencies.

Bitcoin, Ether, and Dogecoin are just a few examples of the digital alternatives that can be contributed to the fund.

Beyond merely global fiat donations, the fund’s scope encompasses these digital assets, creating a diverse range of avenues for individuals to provide their support.

Oprah elucidated that the rationale behind placing the donations directly in the hands of the survivors is to empower them to chart their own course towards normalization.

READ MORE: What’s New in Crypto Staking This Year

She expounded, “Empowering individuals to exercise their autonomy, enabling them to determine their requirements and those of their families, constitutes the cornerstone of our objective.”

Running parallel to the commendable efforts initiated by these A-list celebrities, multiple relief initiatives are diligently endeavoring to ameliorate the predicament faced by the wildfire victims.

The All Hands and Hearts disaster relief organization has been at the forefront of collecting both cryptocurrency and fiat donations to assist the local denizens of Maui as they grapple with the aftermath of the devastating fires.

Olga Ruggiero, Chief of Organizational Integration and Events at All Hands and Hearts, emphasized the significance of cryptocurrency contributions, asserting that they are a vital means of offering essential support in the aftermath of such catastrophic events.

She noted, “Cryptocurrency, much like any other form of donation, plays a pivotal role in rendering indispensable aid after the ravages of wildfires.

The crypto industry consistently rallies alongside communities across the globe that find themselves in distress.”

The unity displayed by the crypto community in partnership with influential personalities like Oprah Winfrey and Dwayne “The Rock” Johnson serves as a testament to the potential of leveraging cryptocurrencies to extend a helping hand to communities in dire need.

Other Stories:

BlockFi Advances Fund Recovery Efforts with Court Application

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook

The United States may be poised for a resurgence in the cryptocurrency sector, as recent court rulings appear to be reining in the Securities and Exchange Commission (SEC), according to a digital asset attorney from K&L Gates.

Jeremy McLaughlin, a partner at the international law firm, highlighted the trend during his participation in the Intersekt23 conference in Melbourne on August 31.

McLaughlin noted that a series of U.S. court cases have challenged SEC Chair Gary Gensler’s stance that nearly all digital assets should be classified as securities.

He explained that while initial crypto regulations were primarily established at the state level and relatively straightforward, the involvement of federal bodies like the SEC and the Commodity Futures Trading Commission led to increased market restrictions.

The attorney pointed out that due to the SEC’s aggressive approach, many tokens were delisted, and some companies even exited the U.S. market.

However, recent court decisions have begun to curtail the SEC’s assertiveness, rekindling optimism within the industry.

Recent examples of the SEC facing setbacks include its loss in a lawsuit brought by a crypto firm and a separate case where a crypto firm prevailed against the SEC.

A noteworthy instance occurred on August 29 when a U.S. District Court judge ruled against the SEC’s denial of Grayscale Investments’ application to convert its flagship Bitcoin fund into an exchange-traded fund.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

Similarly, a judge ruled in July that Ripple Labs’ XRP was not a security when sold to retail traders, leading to a partial loss for the SEC.

Despite these developments, McLaughlin acknowledged the challenges of providing legal advice in such a rapidly evolving landscape and lamented the lack of clear guidance for clients.

However, he expressed optimism that the chaos in crypto regulation was subsiding as court decisions increasingly favored the digital asset industry.

Regarding Australia’s crypto legislation, panelists at the conference discussed its comparative state.

Effie Dimitropoulos, Chief of payment services firm Novatti, described Australia’s regulations as “lagging” in comparison to new frameworks in Hong Kong and the European Union.

She highlighted the uncertainty faced by local crypto businesses due to the evolving legal landscape, resulting in the potential obsolescence of legal advice.

Dimitropoulos further emphasized the need for clear resolutions from regulatory bodies such as the Australian Securities and Investments Commission and the Treasurer to alleviate the ongoing uncertainty.

In conclusion, the U.S. crypto industry is showing signs of renewal as court rulings moderate the SEC’s regulatory zeal, while Australia’s crypto regulations are criticized for falling behind international standards.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

The Cambridge Bitcoin Electricity Consumption Index (CBECI), renowned for assessing Bitcoin’s energy usage, has undergone its inaugural methodology update since its inception in 2019.

Launched in July 2019, CBECI aimed to furnish data-backed insights into Bitcoin mining’s energy intensity and environmental consequences.

In an exclusive conversation with Cointelegraph, lead researcher Alexander Neumueller outlined the index’s role in estimating Bitcoin network electricity consumption.

Neumueller emphasized its role in presenting comprehensible data to the general public.

The revamped methodology accentuates recent trends in Bitcoin mining hardware and hash rates. Researchers scrutinized whether CBECI accurately depicted these dynamics.

They concentrated on unraveling the causes behind significant hash rate growth in recent years, attributed to more powerful contemporary mining equipment superseding older counterparts.

The absence of detailed hardware data posed a challenge, limiting CBECI’s precision in assessing hardware variety and prevalence.

To surmount this, researchers devised a simulation that approximates daily hardware distribution, utilizing performance and power data from actual hardware.

The prior methodology presumed that all profitable hardware models released in the last five years contributed equally to the network hash rate.

This inadvertently led to an overrepresentation of aging hardware during lucrative mining periods.

The team recognized the overrepresentation of older equipment and the underrepresentation of newer models.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

This realization spurred the methodology’s alteration.

Neumueller’s team then cross-referenced hash rate increments with US import data on recent Bitcoin mining hardware.

Public sales data from mining hardware manufacturer Canaan supplemented this analysis.

The CBECI encompassed diverse data points and visualizations, encompassing Bitcoin network power demand, a mining map depicting hash rate distribution, and a greenhouse gas emissions index.

These indexes yield three distinct estimates for each sector, providing a range for these metrics.

The broader discussion encompassed varying viewpoints on Bitcoin’s environmental impact.

Critics alleged Bitcoin undermined ecological progress, while proponents contended that the mining industry could aid environmental efforts.

Neumueller highlighted the intricate nature of the field and the dearth of information, enabling selective data interpretation and biases.

In sum, CBECI’s revamped methodology aligns with evolving Bitcoin mining hardware trends, rectifying previous discrepancies.

The index’s comprehensive insights and visuals offer a multifaceted perspective on Bitcoin’s energy consumption and emissions impact.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

Binance, a prominent cryptocurrency exchange, has released a statement urging its users to transition their holdings of the Binance USD (BUSD) stablecoin into alternative assets, including a newly introduced stablecoin.

This move comes as part of Binance’s strategy to gradually phase out its support for BUSD, with plans to conclude this process by February 2024.

The decision aligns with Paxos’ intention to cease BUSD redemption around the same time.

This statement marks Binance’s first official acknowledgment of the matter, following reports from several users who shared images of a notification on their mobile app detailing the forthcoming discontinuation of BUSD support.

In an effort to facilitate this transition, Binance is actively encouraging users to engage in trading or converting their BUSD balances into First Digital USD (FDUSD), a stablecoin unveiled by the Hong Kong-based trust company First Digital Group in June. Notably, FDUSD made its debut listing on the Binance exchange in late July.

Binance highlights that conversions and trades involving BUSD and FDUSD will be exempt from fees.

READ MORE: Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

As of August 30, Binance has also removed eight BUSD trading pairs.

Additionally, Binance had previously incentivized BUSD use by offering fee-free trading pairs for FDUSD paired with Bitcoin and Ether.

The decision to discontinue BUSD support by Binance appears to be a response to actions taken by regulatory authorities.

Specifically, on February 13, the United States Securities and Exchange Commission (SEC) issued a wells notice alleging that BUSD was an unregistered security.

This notice was directed at Paxos, the entity behind BUSD. Concurrently, the New York Department of Financial Services ordered Paxos to halt the issuance of BUSD.

In conclusion, Binance’s recent statement signifies its intention to phase out support for the Binance USD stablecoin (BUSD) by February 2024, aligning with Paxos’ plans.

The exchange encourages users to transition to the First Digital USD (FDUSD) stablecoin and has taken steps to facilitate this change, including fee-free conversions and trades.

This move appears to be influenced by regulatory developments involving BUSD and Paxos.

Other Stories:

Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF