Unique opportunities for passive income are emerging in the crypto world. BetFury has launched a Referral Program with a $1,500 bonus and up to 30% commission. It has become the most profitable two-way system in iGaming. This article will briefly consider all its advantages.

About BetFury Referral Program

The Referral Program is a system of receiving rewards for attracting new users to the platform. BetFury has made it two-sided, which allows both the referrer and the referral to benefit. Income depends on the general wager and the choice of iGaming or iSports. Follow the link and get the best referral bonus on the market!

What does the referrer get by inviting a friend?

- $1,500 Referral Bonus: This bonus is credited instantly but needs a certain referral’s wager for withdrawal. The referral can enjoy playing Slots, Live, Original games, or Sports and simultaneously unlock the referrer’s reward.

- Commission up to 30%: This is a permanent reward for the activity of the invited friend. The income is calculated by the formula: Wager x House Edge x Commission. The commission is 30% for Sports, 15% for Slots/Live, and 5% for Original games. For example, if the referral bets $1,000 on Sports, the referrer receives $3.

What does a referral friend get?

- $200 Referral Bonus: This bonus is also credited instantly. Analogically, the reward is being gradually unlocked while the referral is having fun and making the wager.

- Shared Commission up to 50%: The referrer determines this percentage. The referred friend can earn 10%, 25%, and 50% of the total referrer’s commission. For example, if a campaign has a 10% shared commission and the referral makes a $20,000 wager in Original games, he will get a $1 reward, and the referrer will get $9.

Therefore, the BetFury Referral Program offers $1,700 referral bonus rewards in total and the opportunity for both sides to receive high commission rewards. The more invited friends – the higher the income. The number of referrals is not limited. The minimum wager to unlock the Referral Bonus is $500.

Market Comparison of Referral Programs

BetFury has the most profitable Referral Program in iGaming. This fact is based on comparing competitors in the crypto gaming industry as of September 28th. The difference between the BetFury Program and the Referral System of another popular platform:

| Referral Program | Referral Bonus | Commission | Reward for the $1,000 Wager |

| BetFury | $1,500+$200 | up to 30% | $0.75 x 2 referral bonus |

| Popular Platform | $1,000 | up to 25% | $0,5 referral bonus |

Other iGaming platforms also use the formula: (Wager/2) x House Edge x Commission. It negatively affects the getting of top rewards quickly. It shows that each unlocking step gives half the crypto. Therefore, these facts prove the advantage of the BetFury Referral Program in the market.

How to Create a Referral Campaign?

- Go to the Referral Program page.

- Click “Create a new campaign” and create a unique referral code.

- Choose the preferred percentage of shared commission to make the offer more attractive.

- The system will create your link and code, which you can use to invite friends.

- Click “Share via socials” and see a basic referral offer message and the banner.

About BetFury

BetFury is an ecosystem of crypto products for entertainment and additional income. It has been developing on the market for over three years. BetFury has an internal token – BFG. It’s listed on many crypto exchanges: PancakeSwap, Biswap, etc. The token has over 55 000 holders, and more than 3 000 000 000 BFG are in circulation.

The most profitable utility for using BFG is BetFury Staking, with up to 50% APY. Anyone with at least 100 BFG on balance can withdraw daily Staking payouts in five popular cryptocurrencies: BTC, ETH, USDT, BNB, and TRX.

In addition, BetFury holds an Auction for the BFG token and provides 24/7 customer support. Over 80 Sports allow crypto bets with odds better than the market average. The platform offers many profitable bonuses, like up to 25% Cashback, and an opportunity to win free Bitcoin in Fury Wheel.

Invite friends and earn crypto together!

Vitalik Buterin, the co-founder of Ethereum, has voiced concerns about the potential monopolization of node operator selection in decentralized autonomous organizations (DAOs) within liquidity staking pools.

In a recent blog post dated September 30, Buterin highlights the risks associated with the adoption of DAO governance models in staking pools, where node operators hold responsibility for managing the pool’s funds.

Buterin’s main worry is that if a single staking token gains dominance within a DAO, it could result in a vulnerable governance system that controls a substantial portion of Ethereum validators. This vulnerability exposes the network to potential attacks from malicious actors, putting the security of the Ethereum ecosystem at risk.

Lido, a liquid staking provider, is cited as an example of a DAO that validates node operators.

While Lido has implemented some protective measures, Buterin cautions against relying solely on these safeguards, emphasizing that a single layer of defense may prove inadequate.

On the other hand, Buterin acknowledges Rocket Pool, a platform that allows anyone to become a node operator by depositing 8 Ether (equivalent to approximately $13,406 at the time of writing).

However, he notes that this approach carries risks, as attackers could potentially orchestrate a 51% attack on the network and impose substantial costs on users.

READ MORE: French Authorities Conduct Surprise Raid on Nvidia’s Offices Amid Antitrust Inquiry

Buterin argues that striking a balance is essential.

While it is necessary to have mechanisms in place to vet node operators, unrestricted access could invite malicious actors.

The challenge lies in designing a system that prevents abuse without stifling innovation and participation.

To address this issue, Buterin suggests encouraging ecosystem participants to diversify their use of liquid staking providers.

By spreading the utilization across various providers, the likelihood of any one provider becoming too dominant and posing systemic risks decreases.

However, Buterin also cautions against overreliance on moralistic pressure as a long-term solution, as this approach may not guarantee stability.

Balancing the need for security with open participation in the Ethereum ecosystem remains a challenge that requires thoughtful consideration and continued development to ensure the network’s resilience against potential threats.

Other Stories:

New U.S. Bill Proposes Enhanced Oversight for Cryptocurrency Transactions

NFT Artist Raises £114,000 at Edinburgh Charity Event to Support Cancer Treatment

The rapid evolution of online betting platforms has given us one overarching theme that remains consistent: the user is king. As the competition in the online betting industry intensifies, platforms are prioritising the development of user convenience as a means to attract and retain bettors. Central to this strategy is a group of features and innovations aimed at making the betting experience as seamless and engaging as possible. This article outlines and explains those key areas that bring us those friendly experiences that keep us coming back.

User-Friendly Interfaces: Catering to Novices & Veterans

In a world dominated by digital interactions, a website’s interface can either make or break a user’s experience. Online betting platforms have recognised this pivotal aspect and invested significantly in creating interfaces that are:

- Intuitive: Simplified layouts with clear call-to-action buttons make for an easy navigation experience, even for those new to the world of betting.

- Customisable: Many platforms offer personalised dashboards, allowing users to tailor their experiences based on preferences.

- Informative: An emphasis on clear, easy-to-understand information, be it regarding odds, game statistics, or betting rules, ensures users make informed decisions.

These design ideas not only elevate the user experience but also inspire confidence in bettors, making them more likely to deposit and place wagers regularly.

Mobile Optimisation: Betting on the Go

The rise of smartphones and tablets has changed the way we consume digital content. Betting platforms have not remained untouched by this revolution. A mobile-optimised design ensures:

- Accessibility: Bettors can place wagers, check scores, or withdraw earnings anytime, anywhere.

- Responsive Design: The platform adjusts according to the screen size, ensuring consistency in user experience across devices.

- Dedicated Apps: Some platforms have launched dedicated mobile apps, further enhancing functionality and speed.

By embracing mobile optimisation, betting platforms cater to a growing demographic of users who prioritise flexibility and convenience.

Quick Transactions: The Backbone of Betting

A seamless transaction process, encompassing all payment methods offered by bookmakers, is the bedrock of a gratifying betting experience. Recognising this, bookmaker platforms have streamlined both the deposit and withdrawal processes:

- Diverse Payment Options: From traditional bank transfers to e-wallets and cryptocurrencies, users can choose their preferred transaction method.

- Instant Deposits: Time is often of the essence in betting. Instant deposit features ensure that bettors can wager without delays.

- Transparent Withdrawal Processes: Clarity in withdrawal timelines and processes, combined with prompt customer support, fosters trust among users.

Live Betting: Immersion at Its Finest

One of the most exciting innovations on currently available betting sites is live, or in-play, betting. Offering real-time engagement, live betting allows users to place wagers as the action unfolds. This dynamic feature has been a big hit due to three key areas:

- Enhances Engagement: The immediacy of live betting amplifies the fun, making users feel a part of the action.

- Offers Varied Odds: As the game progresses, odds change, presenting many betting opportunities throughout the match.

- Provides Real-time Statistics: Live updates and statistics aid users in making informed betting decisions on the fly.

Prioritising Convenience for an Unparalleled Experience

The strides made by betting platforms in recent years highlight a deep-seated commitment to user convenience. By continually refining their interfaces, embracing the mobile revolution, streamlining transactions, and offering immersive features like live betting, these platforms endeavour to offer a holistic and gratifying betting experience. As the landscape of online betting evolves, we can only anticipate further innovations, each designed to enhance user convenience and engagement.

Blockchain investigators have raised concerns over a series of Ethereum (ETH) transactions originating from a wallet linked to Vitalik Buterin, one of the co-founders of Ethereum, in September 2023. These transactions collectively amount to a staggering $3.9 million.

On September 25th, a distinct 400 ETH transaction from Vitalik’s wallet to Coinbase was scrutinized by various blockchain monitoring profiles.

The estimated value of this transaction was approximately $632,000. In a tweet, the transaction was succinctly summarized: “@VitalikButerin deposited 400 $ETH to #Coinbase at $1,579 ($632K) 2hrs ago.”

What’s particularly noteworthy is that over the past ten days leading up to this transaction, Vitalik Buterin has deposited a total of 2,421 ETH, valued at $3.94 million, into multiple centralized exchanges.

Spot On Chain, a blockchain analytics platform, provided these insights.

Spot On Chain also highlighted that this recent deposit is part of a broader trend.

It revealed that Buterin had initiated a sequence of ETH deposits into centralized exchanges starting from September 15th, amassing an impressive 2,421 ETH, equivalent to $3.94 million.

READ MORE: Bitmain and Core Scientific Forge Multi-Million Dollar Deal

Among these deposits, 321 ETH were sent to Kraken between September 15th and September 19th. Furthermore, several transactions involving a total of 1,700 ETH were made to Bitstamp on September 17th and September 20th, while an additional 500 ETH was deposited to Paxos on September 19th.

In an effort to independently verify these transactions, Cointelegraph used Nansen 2 beta’s wallet profiler. The blockchain data unequivocally corroborated the validity of these transactions.

Additionally, it unveiled that a substantial 2,000 ETH, worth $4.9 million, had been transferred to the address responsible for these transactions.

This address has long been associated with Vitalik Buterin.

Spot On Chain further noted that the source of the 2,000 ETH transaction is a more well-known address, identified as 0xD04daa65144b97F147fbc9a9B45E741dF0A28fd7, belonging to Vitalik Buterin, compared to the middle address, 0x5567A4bE2D5b77F5Fd870f99Ed9167Feab8831B1, which had been facilitating the transfer of funds to exchanges.

This development comes in the wake of a prior on-chain monitoring discovery where a 600 ETH ($1 million) transaction from the address “vitalik.eth” on August 21st had also raised eyebrows.

Clearly, Vitalik Buterin’s Ethereum transactions continue to captivate the blockchain community’s attention, sparking curiosity and speculation.

Other Stories:

FTX Files $157.3 Million Lawsuit Against Former Employees Over Alleged Fraudulent Withdrawals

IRM Report Highlights Bitcoin’s Potential as a Driver of Global Energy Transition

Binance and CEO CZ Zhao Seek Dismissal of SEC Lawsuit Overreach

Bitmain, a prominent cryptocurrency mining hardware manufacturer, and the now-bankrupt crypto mining entity, Core Scientific, have reached a significant agreement that involves a combination of equity and cash to advance their mining facility expansion plans.

Under this agreement, Bitmain will provide Core Scientific with 27,000 Bitcoin mining rigs in exchange for $23 million in cash and $53.9 million worth of common stock from the distressed mining company.

Beyond the hardware procurement, the two companies have also inked a fresh hosting arrangement aimed at supporting Bitmain’s mining endeavors.

The deal’s finalization occurred in August, marked by a court filing that spotlighted Bitmain’s intention to trade mining hardware for cash and equity within the context of Core Scientific’s restructuring blueprint.

This restructuring plan encompassed other entities like Anchorage, BlockFi, and Mass Mutual Asset Finance.

Notably, aside from Anchorage, all three firms opted for a combination of cash and equity as a means to settle their claims.

Bitmain’s ambitious expansion and investment strategy are poised to come to fruition by the fourth quarter of 2023, contingent upon approval from a judge.

READ MORE: Bybit Unveils Automated Risk Management Tool ‘Perp Protect’

Once greenlit, this hardware infusion could potentially bolster Core Scientific’s hash rate by an impressive 4.1 exahashes.

Additionally, the two crypto mining collaborators have committed to collaborating on the enhancement of Bitmain’s legacy miners situated within Core Scientific’s data centers, with the ultimate goal of optimizing the firm’s operational efficiency.

Core Scientific’s financial woes led to their Chapter 11 bankruptcy filing in December 2022, with the primary drivers being the financial crisis and the declining value of Bitcoin.

The company faced mounting challenges in the lead-up to its eventual collapse, primarily due to the turbulent conditions prevailing in the cryptocurrency market during that period.

Other Stories:

Binance.US Faces Record-Low Trading Activity Amid Mounting Regulatory and Internal Challenges

SEC Faces Setback as Judge Denies Immediate Access to Binance.US Software

US House Financial Services Committee Advances Bills to Regulate Central Bank Digital Currency

A novel development has taken the cryptocurrency world by storm as the Alpha project has introduced a groundbreaking community-based social token ecosystem within the Bitcoin network.

Alpha, positioned as a decentralized social network protocol, shares similarities with the well-known Ethereum-based platform Friend.tech.

Its primary function is to enable users to monetize their online presence and content creation by utilizing social tokens.

Distinguishing itself from Friend.tech, Alpha employs a unique structural composition.

It hinges on the security and immutability of the Bitcoin blockchain for finality, while data storage is facilitated through the Polygon blockchain.

Notably, the project has introduced Trustless Computer as its proprietary scaling network for Bitcoin. Co-founder Punk3700, operating under a pseudonym, eloquently described Alpha as “a rollup that rolls up to another rollup that rolls up to Bitcoin.”

In an exclusive conversation with Cointelegraph, Punk3700 shed light on the intricate architecture of Alpha. He explained, “Alpha implies a layered architecture that includes NOS-TC.

Trustless Computer (TC) is an optimistic rollup layer that directly integrates with the Bitcoin blockchain. NOS is implemented as another optimistic layer, enhancing scalability on the Bitcoin network.”

These optimistic rollup layers, he emphasized, collaborate harmoniously to ensure both security and efficiency in the deployment of decentralized applications.

Punk3700 elucidated further, stating, “NOS adopts a hybrid design that leverages Bitcoin for data validity and Polygon for data storage, ultimately settling on Bitcoin.”

This ingenious approach not only enhances flexibility in data storage but also serves to mitigate the exorbitant transaction fees associated with Bitcoin.

The user-centric ethos of Alpha is exemplified by its community-driven development approach.

Punk3700 revealed that the project was conceived and launched in an astonishingly brief 48-hour window.

To further incentivize user engagement, a referral program is currently in development, allowing users to earn 1% of their friends’ trading volume.

This move is poised to encourage user participation and motivate content creators to produce valuable content.

Meanwhile, Alpha is experiencing rapid user growth, contrasting with recent developments at Friend.tech.

The latter platform recently announced penalties for users engaging with forked or copycat versions of its platform, as it seeks to reward loyal users during its beta phase.

This decision followed concerns about a decline in key metrics, including user activity, inflows, and volume.

Additionally, Friend.tech grappled with rumors of a data breach, which the platform vehemently denied, assuaging fears regarding the exposure of over 100,000 user’s personal data.

Other Stories:

Secure Your Crypto Wallet Against Scams With These Essential Tools

Demystifying the Crypto Tax Headache: A Guide to Navigating Tax Obligations

3LAU’s Exit Sparks Debate Over Regulatory Risks on Decentralized Social Platform

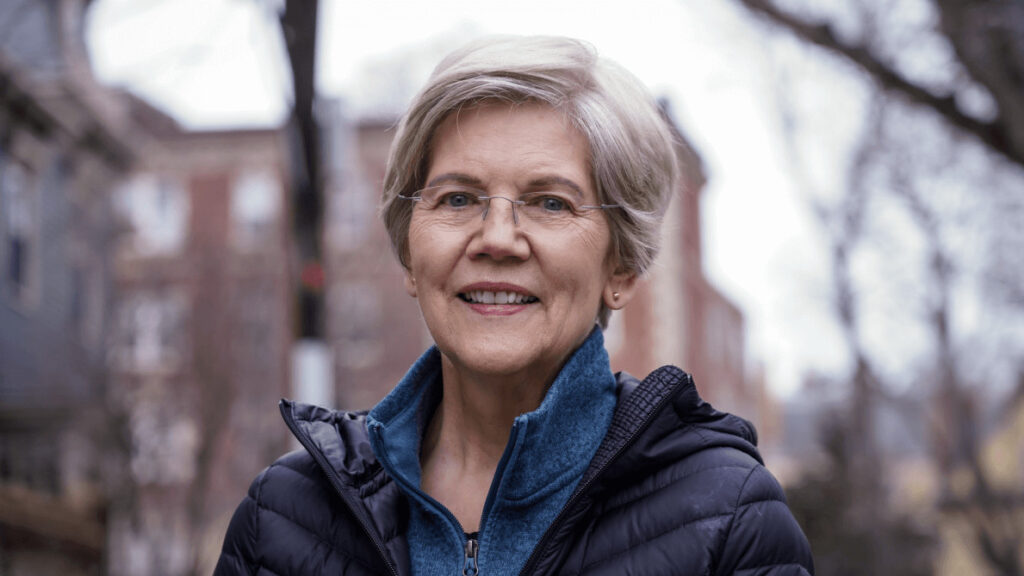

Nine United States Senators have thrown their support behind Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, marking a significant step in the bipartisan fight against illicit cryptocurrency activities, according to a statement from Warren’s office.

Among the notable senators who have joined the coalition supporting the bill are prominent Democratic Party members: Gary Peters, Dick Durbin, Tina Smith, Jeanne Shaheen, Bob Casey, Richard Blumenthal, Michael Bennet, and Catherine Cortez Masto. Independent Senator Angus King has also lent his support to this bipartisan effort.

Notably, Peters chairs the Senate Homeland Security and Governmental Affairs Committee, while Durbin serves as the chair of the Senate Judiciary Committee.

Senator Warren, the driving force behind the bill, expressed her satisfaction with the growing support, affirming that it demonstrates Congress’s readiness to take action.

She highlighted the strength of their bipartisan proposal, which is touted as the most robust solution to combat the illicit use of cryptocurrencies, equipping regulators with essential tools to enforce compliance.

READ MORE: FTX Reopens Secure Customer Claims Portal Following Cyberattack

This legislation has garnered endorsements from various organizations dedicated to combating financial crimes, including Transparency International U.S., Global Financial Integrity, the National District Attorneys Association, the Major County Sheriffs of America, the National Consumer Law Center, and the National Consumers League.

Warren originally introduced the Digital Asset Anti-Money Laundering Act in July 2023, collaborating with Senators Joe Manchin, Roger Marshall, and Lindsey Graham.

The current version of the bill encompasses several key provisions.

Notably, it seeks to crack down on noncustodial digital wallets, expand the responsibilities under the Bank Secrecy Act, and establish a framework for Anti-Money Laundering/Combating the Financing of Terrorism compliance examinations and other legal mechanisms to combat the illicit use of digital currencies.

Senator Warren has underscored the urgency of addressing what she terms as a “$50 billion crypto tax gap.”

She asserts that unless there is a timely update to tax policies, the Internal Revenue Service and the U.S. Treasury could potentially miss out on approximately $1.5 billion in tax revenue for the 2024 financial year.

As such, the Digital Asset Anti-Money Laundering Act represents a critical step in enhancing oversight and regulation in the rapidly evolving cryptocurrency landscape.

Other Stories:

NFL Quarterback Trevor Lawrence and YouTube Influencers Settle FTX Lawsuit

Bitcoin Stabilizes at $26,500 After Hitting September Highs: Eyes on Federal Reserve’s FOMC Meeting

SVB Financial Group, formerly the parent company of Silicon Valley Bank, is edging closer to finalizing a deal that would involve the sale of its venture capital division, SVB Capital.

Recent reports from The Wall Street Journal on September 15, citing insider sources, indicate that Anthony Scaramucci’s SkyBridge Capital and Atlas Merchant Capital are in competition with San Francisco’s Vector Capital in the latter stages of the bidding process.

While estimates suggest SVB Capital could fetch between $250 million and $500 million in the sale, it’s important to note that the transaction’s completion is not guaranteed and remains subject to the scrutiny of the creditor’s committee.

A decision regarding the sale is expected to be rendered in the upcoming weeks.

Remarkably, SVB Capital was not encompassed within SVB’s broader Chapter 11 bankruptcy proceedings.

The bank has affirmed that SVB Capital will continue its regular business operations despite being put on the market.

READ MORE: BitQuant Predicts Bitcoin Will Hit $250,000 After Halving

SVB Capital is recognized for its investment capital activities, including backing prominent Silicon Valley venture capital firms like Sequoia and Andreessen Horowitz (a16z).

As of December 2022, SVB Capital held assets totaling $9.5 billion, spread across 20 funds and 760 companies, which encompassed blockchain analytics service Chainalysis.

In parallel, SkyBridge Capital, overseen by Anthony Scaramucci, manages approximately $1.8 billion in assets, with a significant portion, around $580 million, allocated to cryptocurrencies and other digital asset-related investments.

Cointelegraph reached out to both SkyBridge Capital and SVB Capital for comments but had not received responses as of the publication time.

Earlier this year, Silicon Valley Bank faced regulatory action from California’s financial watchdog, leading to its closure on March 10 and subsequent bankruptcy filing on March 17.

Before its collapse, Silicon Valley Bank was among the few institutions offering banking services to crypto companies in the United States.

Its downfall coincided with that of other crypto and tech-friendly banks, including Signature Bank and Silvergate Bank, marking one of the most significant banking crises since 2008.

Furthermore, earlier this year, SVB Financial’s investment-banking arm, SVB Securities, completed its sale to its founder, Jeff Leerink, and senior managers for a sum of $100 million, underscoring the ongoing changes and developments within the organization.

Other Stories:

DeFi Advocacy and Market Dynamics: A Week of Intense Developments in Decentralized Finance

Bitcoin Miner Returns $500,000 in Fees to Paxos After Transaction Mistake

Crypto holders must always be on their toes, as scammers are continuously looking for opportunities to trick users into giving up the all-important private keys that can unlock their digital assets.

These dangers were highlighted once again in a recent report by the Web3 security firm Beosin. In June, it reported that $656 million worth of crypto was stolen through scams, hacks and rug pulls in the first half of the year. The majority, $471.43 million, was lost in 108 confirmed protocol attacks. More worrying for individual users though is that $108 million was stolen through a variety of “phishing” scams.

Crypto users can’t do much about protocol attacks, but they can definitely take steps to secure their wallets and protect themselves from scammers. Bad actors use phishing to direct crypto holders to fake websites, applications and other forms of malware, and there’s no telling when and where they might strike. The good news is you can protect yourself using the following essential crypto wallet security tools.

FairSide

First off, it’s important to understand that no matter what security tools you use, you can never be totally sure you won’t fall victim to a scam. So it makes sense to have an insurance policy if you are holding significant digital assets, and that’s exactly where FairSide stands out with its comprehensive wallet protection.

The startup’s decentralized crypto insurance is available to any user who’s looking to protect themselves against wallet theft, covering almost every kind of digital asset in virtually any wallet. Should anyone with a policy fall victim to a phishing attack, they can immediately make a claim. Once the theft has been verified, users can expect to receive a payout within 72 hours.

Fairside is committed to offering full coverage, regardless of what tokens users hold. It partners with multiple reliable insurance industry firms to offer its coverage, and uses professional security researchers to properly investigate and vet every claim. It charges an annual fee of just 1.95% of all covered assets, up to a maximum of 100 ETH per policy. In addition, Fairside also offers bespoke coverage solutions for investors that need to protect higher amounts.

Umbra

Many ingenious scammers will use blockchain explorer tools to identify high-value crypto wallets they wish to target, and so it makes sense to try and mask the value of the assets you hold. Umbra enables users to do this through anonymous transactions.

It has created a smart contract and a set of standards that allow users to create “stealth” wallet addresses on the Ethereum network. Using a stealth address, it’s possible to send any ERC20 token to a wallet controlled by the receiver, without revealing its identity. To anyone who’s studying the blockchain, the transaction will look like a simple transfer to an unused address. However, off-chain, the sender can generate a new, encrypted address using a public key. Tp date, Umbra claims to have processed more than 85,000 anonymous transactions since launching in June 2021.

Fire

It’s all too easy to make a mistake when engaging in a complicated DeFi transaction, and so it pays to understand exactly what will happen when you engage with a smart contract. This is what Fire aims to do, and it’s really an essential tool for users who are in the habit of making multiple transactions each day.

Fire is a Chrome browser extension that allows you to preview what assets will enter and exit your wallet before they sign any transaction. Essentially, it simulates each transaction before you go through with it, showing you exactly how much will leave, and what will be deposited into your wallet. This way, you can confirm you aren’t making any mistakes.

Blowfish

Crypto is all about self-custody, and there’s no comeback if someone is able to access your wallet and authorize transactions. Because of this, crypto security begins with your choice of digital wallet. But how do you know which wallet you should choose? How can you trust its safety features and security?

Blowfish is the answer. It’s a risk-assessment tool for every Web3 wallet. It relies on built-in machine learning algorithms to comprehensively scan any crypto wallet and detect all of the possibilities for fraudulent transactions that may exist when interacting with Web3 protocols. Developers can also use Blowfish to assess their own wallets before making them available to users. It’s compatible with any wallet on Ethereum, Polygon and Solana.

Carapace

The risk of phishing attacks is one thing, but self-custody also means that you need to ensure you can always access your cryptocurrency holdings. If you lose access to your smartphone or laptop and cannot find the seed phrase required to access your wallet to another device, you’re basically screwed.

But not if you use Carapace, which is a decentralized social recovery protocol that provides fallback options. It works by creating an abstraction between users and its smart contracts. Users can define rules to shape specific use cases, such as wallet recovery in the event the seed is lost, crypto inheritance and more.

Pocket Universe

Because there have been so many scams affecting crypto users in the past, security researchers have created databases that list all known malicious URLs and smart contracts. Pocket Universe leverages these to ensure that you’ll never transact with a known scammer.

It’s a free, Chrome-based browser extension that provides peace of mind for every transaction you make. If you’re about to sign off on a transaction to a suspicious wallet address, or visit a risky URL, it will pop-up with a red alert warning you of the danger. Pocket Universe claims it can protect against almost any kind of phishing scam, as well as honeypot NFTs, counterfeit tokens and malicious seaport transactions.

urToken

You can never have too many lines of defense, and urToken provides a way for security-conscious crypto holders to safeguard their ERC20 and BEP20 tokens by converting them to something that’s more secure.

The way it works is it wraps your tokens and converts them into digital assets based on stricter security standards that will resist any malicious approvals in your wallet. In this way, it offers protection against Transferform exploits in smart contracts that are used to drain user’s wallets of their funds.

Security Is YOUR Problem

The risks of buying, holding and transacting with crypto are ever-present and the decentralized nature of the industry means that the onus is on you, and only you, to secure your assets. The smartest crypto users will be aware of the never-ending risk and use multiple available tools to ensure they don’t become the next victim.

If you’re invested in crypto and possess more than you can afford to use, be sure to protect yourself with the best available crypto wallet security tools.

In August, the crypto markets experienced their most challenging month since Bitcoin hit rock bottom in November 2022.

Initially dismissed as a mere summer slump, this downturn turned out to be a significant market setback, primarily fueled by cascading liquidations in the derivatives sector.

This led to a daunting 7.3% loss in Bitcoin’s value and a 6.9% decline in Ether’s value.

Grayscale’s legal victory briefly provided respite, but prices quickly retraced to their month-start levels, triggering one of the largest liquidation events in crypto, resulting in over $1 billion in losses as Bitcoin plummeted to $26,000.

Adding salt to the wound, venture capital (VC) investments plunged by a staggering 42.7% from July to August, amassing a modest $401.9 million across 77 deals.

This marks a sharp decline in crypto industry investment, which had been on an upward trajectory until May of that year.

Cointelegraph Research’s “Investor Insights Report” delves into the performance of various digital asset sectors in this challenging environment, providing a concise monthly roundup of crypto developments spanning venture capital, derivatives, decentralized finance (DeFi), regulation, mining, and more.

Venture capital investments in the blockchain sphere have been on the decline since the second quarter of 2022, reaching a new low of $401 million in 2023.

Infrastructure projects secured 18 deals, raking in $107 million in August, with centralized finance (CeFi) securing $100 million through just three deals.

These lagging investments hint at a potential resurgence once market sentiment shifts positively.

READ MORE:Binance.US Challenges SEC’s ‘Unreasonable’ Demands in Legal Showdown

Despite the gloom, the words of Tim Draper resonate: “Investors always get it wrong.”

This suggests that the downtime may be the opportune moment to identify quality projects for long-term holding, anticipating the return of the bull market.

On August 25th, $1.9 billion in monthly Bitcoin options expired, stirring speculation in the markets.

Although Bitcoin’s price remained relatively stable during this period, excitement surged following news of the SEC’s court defeat against Grayscale.

This victory potentially paves the way for a future spot Bitcoin ETF.

The price briefly soared to $28,000 before retreating to the $26,000 range.

While short-term gains were elusive, there are promising signs of market support at this level.

Cointelegraph’s Research team boasts a blend of top talents in the blockchain industry, blending academic rigor with practical experience.

With decades of collective expertise in traditional finance, business, engineering, technology, and research, the team is dedicated to delivering accurate and insightful content, exemplified by their latest Investor Insights Report.

Other Stories:

Arbitrum and Optimism Networks are on BetFury

Binance.US Challenges SEC’s ‘Unreasonable’ Demands in Legal Showdown

2023 Crypto Venture Capital Funding Plummets As Industry Faces Uncertain Times