Sam Bankman-Fried, the former CEO of FTX, alleges that prosecutors have failed to deliver key evidence within the specified discovery timelines for his defense against numerous fraud charges. His lawyers communicated this concern to United States District Judge Lewis A.

Kaplan in a letter on June 5, stating that the government had not disclosed all contents from five electronic devices due by the end of March. These devices include a laptop and iPhone belonging to ex-Alameda Research CEO Caroline Ellison and a laptop owned by FTX co-founder Gary Wang.

With the trial date slated for Oct. 2, the defense expressed worries over the delayed provision of significant and substantial discovery material potentially affecting trial preparations.

Bankman-Fried faces charges of fraud, illegal political contributions, and alleged bribery to the Chinese government. He does not wish to postpone the trial, but additional motions might be filed if the newly discovered evidence necessitates it.

The defense letter also pointed out that the government has yet to provide information concerning FTX debtors. The letter indicated that this delay has a compounding effect on the defense’s trial preparedness. The evidence thus far is enormous, with five productions totaling over 3.6 million documents and over 10 million pages.

Amid these legal proceedings, FTX bankers, tasked with rescuing the troubled company, are said to be contemplating selling shares in a company within the burgeoning artificial intelligence sector. On June 6, Semafor reported that Perella Weinberg, an investment banking firm assisting the bankrupt exchange, has been promoting the sale of hundreds of millions of dollars of shares in AI startup Anthropic to potential investors. As per FTX balance sheets from its November 2022 bankruptcy, the company held $500 million worth of Anthropic stock, which is expected to be much more valuable given the current AI boom.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

Islamic financial principles, defined by Sharia law, play a significant role in determining the permissibility or prohibition (Halal or Haram) of financial transactions and instruments, including new forms of digital transactions such as cryptocurrency.

Cryptocurrency, a digital or virtual form of currency, utilizes cryptography for security. It is decentralized, not controlled by any central authority, and its most common form is Bitcoin, followed by others like Ethereum, Ripple, and more. The question of whether cryptocurrency is Halal (permissible) or Haram (forbidden) under Islamic law is both complex and nuanced.

Is Crypto Haram?

The first aspect to examine in assessing the permissibility of cryptocurrency is the principle of “Riba” (usury). Islam strictly prohibits usury – earning money from money, for instance, earning interest. Cryptocurrencies, as a rule, do not earn interest, thereby fitting with the prohibition of Riba. In this regard, one could argue that cryptocurrencies are Halal.

However, another significant consideration is “Gharar” or uncertainty. Islamic finance discourages transactions with excessive uncertainty and ambiguity. The volatility and unpredictability of cryptocurrencies, resulting from their high market fluctuations, introduce elements of uncertainty, which might render them Haram under the principle of Gharar.

Next, there’s the matter of anonymity. Some cryptocurrencies offer a high degree of anonymity which may encourage illegal activities like money laundering, tax evasion, and funding illicit activities, all of which are forbidden under Islamic law. This might be used to argue against the Halal nature of cryptocurrencies.

Yet, it is essential to understand that not all cryptocurrencies operate with the same level of anonymity or serve as platforms for illicit activities. Many cryptocurrencies have implemented mechanisms to enhance their traceability, which potentially makes them more in line with the ethical and moral requirements of Islamic finance.

Another key concept in Islamic finance is the requirement that all wealth creation should result from real, productive economic activity. This principle opposes speculative behaviors and gambles. The aspect of speculative trading and potential for market manipulation, often associated with cryptocurrency, contradicts this principle. The high market volatility often leads people to engage in speculation and risky trading, seeking quick profits, which could be deemed Haram.

Is Buying Items with Crypto Halal?

On the other hand, if a cryptocurrency is used as a medium of exchange for goods and services, rather than a speculative asset, it could be seen as Halal. Moreover, many proponents of cryptocurrency argue that it is a legitimate form of wealth as it requires significant effort and resources (electricity and computing power) to ‘mine’ these currencies, complying with the concept of Thaman – the idea that wealth should have effort behind it.

In terms of Zakat, the Islamic practice of almsgiving, cryptocurrencies can be subjected to it just like any other form of wealth, once they exceed the minimum threshold (Nisab) and are possessed for at least a lunar year (Hawl). This aligns cryptocurrencies with Islamic financial principles, making them Halal in this respect.

The issue of Islamic permissibility for cryptocurrencies becomes more complex when considering the various types of cryptocurrencies. While some like Bitcoin are purely speculative, others like Ethereum also offer ‘smart contracts’ functionality, potentially contributing to productive economic activities. Some cryptocurrencies are even designed to be Sharia-compliant by adhering to the principles of Islamic finance.

The question of whether cryptocurrencies are Halal or Haram does not have a definitive answer. It is a multi-faceted issue that depends on how the cryptocurrency is used, its characteristics, and the intention of the user. It’s also important to note that religious rulings can differ between various scholars, leading to different interpretations and conclusions.

It is recommended for Muslims interested in dealing with cryptocurrencies to consult with knowledgeable scholars in the field of Islamic finance and to approach such transactions with caution. Furthermore, regardless of religious perspective, anyone interested in investing in or using cryptocurrencies should ensure they fully understand the nature of such digital assets and the associated risks.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

In response to our readers’ requests to talk about earning through cryptocurrency arbitrage and its potential opportunities, we have written this guide. Our team conducted market research and spoke with numerous individuals who hold cryptocurrencies and occasionally engage in arbitrage.

As we believe, we have found the optimal way to earn through cryptocurrency arbitrage.

However, before presenting the best option to you, let’s first understand what cryptocurrency arbitrage is.

In simple terms:

Cryptocurrency arbitrage is a method of earning that is based on buying and selling cryptocurrencies with the aim of profiting from price differences on different exchanges. For example, if a cryptocurrency has varying prices on different exchanges, an arbitrageur can buy it on an exchange with a lower price and sell it on an exchange with a higher price, thereby making a profit from the price difference. This allows for exploiting inconsistencies in cryptocurrency prices to generate additional income.

There are different types of arbitrage, including intra-exchange and inter-exchange arbitrage.

Intra-exchange arbitrage is a type of arbitrage where buying and selling operations of cryptocurrencies are conducted on the same exchange. In this case, the arbitrageur looks for price discrepancies across different trading pairs or instruments within that exchange.

Inter-exchange arbitrage is a more attractive option, especially when combining a major and a smaller exchange. On projects like Bitcoin and Ethereum, there is practically no difference in prices, but on smaller projects, it is much easier to capture price differences.

Inter-exchange arbitrage also works well when a coin experiences sharp drops or rises, such as the case with FTT when there were rumors of its resumption of operations.

Major token doubled in value in less than 5 hours.

During that time, arbitrage spreads reached 20% in a cycle on major projects for several hours.

If you were holding FTT, not only could you sell it at double the entry price within a couple of hours, but you could also make 3-4 cycles of arbitrage, earning around 70% of your capital as a bonus. Subscribing to a scanner for $70 would have paid for itself for a year ahead.

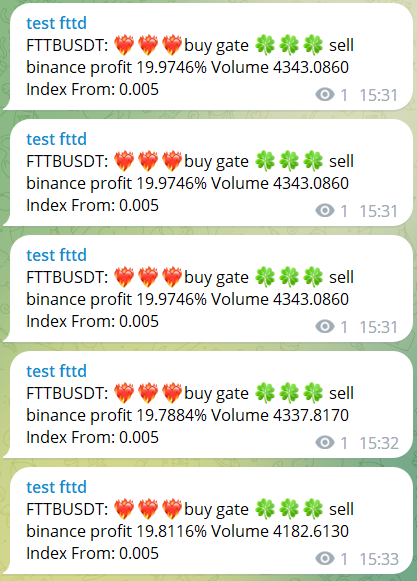

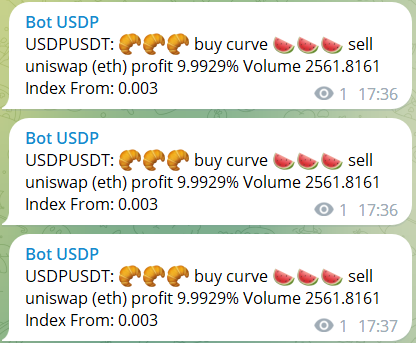

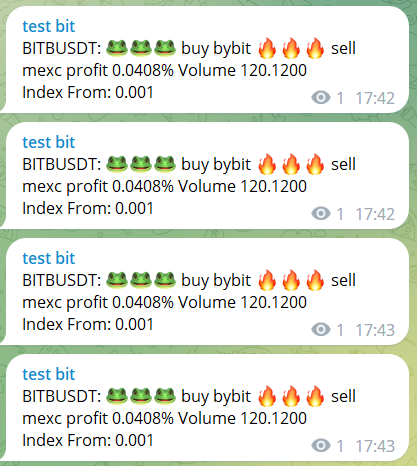

Remember to familiarize yourself with how the notifications are sent so that you are aware of changes and possible arbitrage opportunities.

Cryptocurrency arbitrage between DEX exchanges and blockchains.

Arbitrage between DEX exchanges and blockchains: the best way to earn money currently, as confirmed by expert opinions and practicing arbitrageurs.

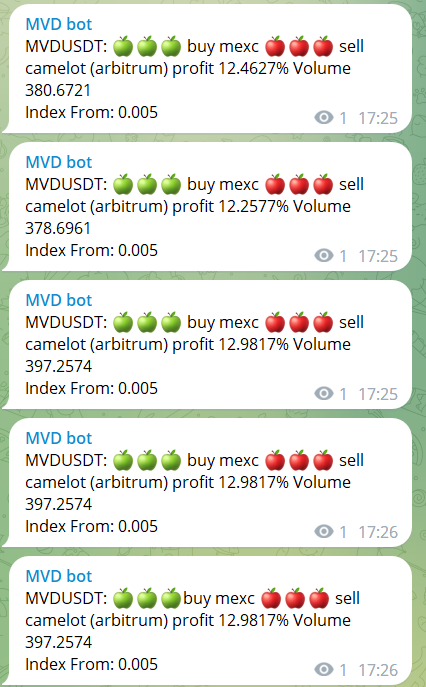

Let’s consider an example of arbitrage between the Arbitrum network and BSC, where a significant difference exists.

Let’s assume we have a cryptocurrency called MVD, which is traded on both the Arbitrum network and the MEXC exchange. Considering that withdrawing from Arbitrum to the Ethereum network is time-consuming and there is not much competition among arbitrageurs, the price difference can reach up to 30%.

As an example, we found a spread of 12% for this particular coin.

Why an automated bot is not suitable for arbitrage:

Our editorial team wants to warn about the possible risks associated with using APIs, NFTs, and cryptocurrency market arbitrage. All of these methods can lead to financial loss, especially if you are not familiar enough with them. We do not recommend risking all of your savings, as unforeseen events can occur at any time, such as a project turning out to be fraudulent or becoming a victim of hacking. Instead, we strongly recommend using only trusted manual bots to safeguard your investments.

Analysis of Arbitrage Scanners:

After studying various arbitrage bots, we found that most of them are limited to working with 10 exchanges. Almost all automated bots require access to exchange APIs. However, there is one bot that has access to a whopping 50 exchanges and tracks arbitrage opportunities on DEX exchanges and over 40 blockchains in real-time, without using APIs.

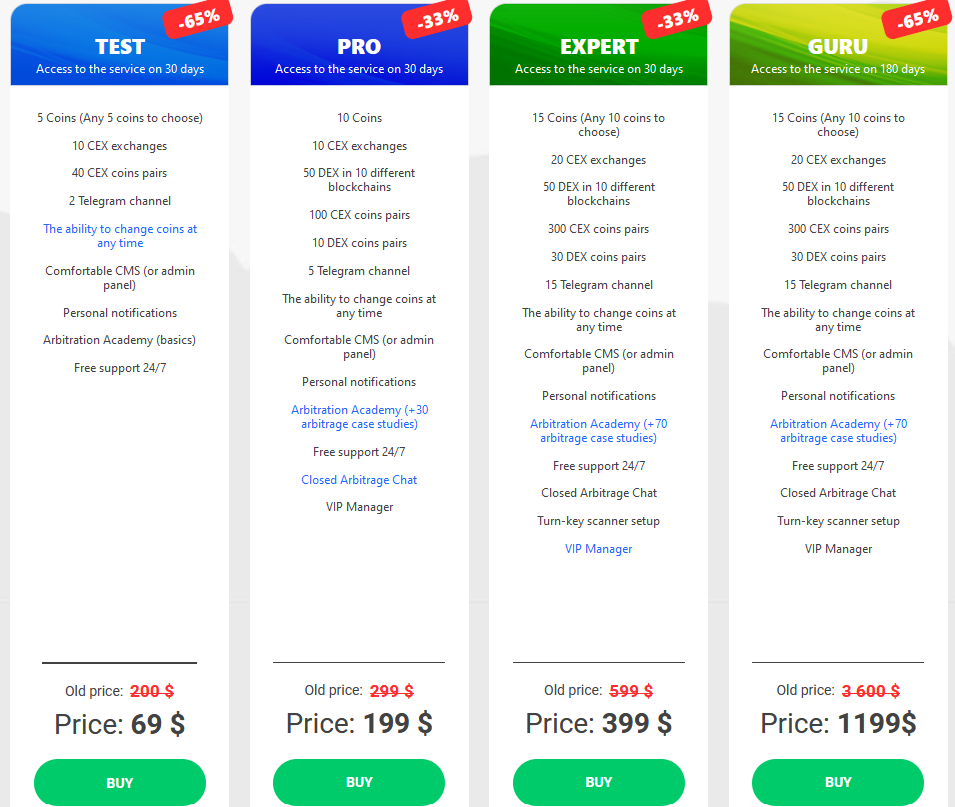

Introducing the best cryptocurrency arbitrage bot in our opinion – ArbitrageScanner.

Arbitragescanner.io: Functionality and Advantages for Profiting from Cryptocurrency Price Differences

ArbitrageScanner is a powerful tool that offers numerous opportunities to profit from cryptocurrency price differences. Here are its key features and advantages that make it indispensable in the world of arbitrage:

1. Support for over 50 centralized (CEX) exchanges and 25 decentralized (DEX) exchanges, as well as 40 different blockchains. This means you can track and find arbitrage opportunities virtually anywhere. If a specific exchange you need is not initially included, the ArbitrageScanner team adds exchanges upon user requests.

2. Flexible tracking configuration for any exchange. You can easily add multiple new exchanges to the scanner and monitor their prices and spreads simultaneously.

3. User-friendly administrative panel and quick integration of any cryptocurrency. Setting up the scanner takes just 1 minute.

4. A unique feature of the scanner is displaying the difference between different networks and blockchains. This allows you to discover and profit from cryptocurrency price differences across various platforms.

5. The ability to receive assistance from a VIP manager. If you prefer to have all the parameters and coins set up for you, the VIP manager can help you find the most profitable pairs.

6. Free tutorials and case studies for beginners. When purchasing different usage packages of the scanner, you’ll receive free tutorials and case studies to help you familiarize yourself with its functionality and start earning.

7. A private chat for clients where you can receive support and answers to your questions. They will assist you in setting up the scanner, suggest profitable pairs, and support you on your path to successful arbitrage.

Conclusion: The main advantage of the arbitrage scanner is its ability to work with decentralized exchanges (DEX), where few people track real-time price differences. Additionally, you have the potential to connect to any centralized exchange through technical support, expanding your potential for earning from cryptocurrency arbitrage.

Inter-exchange cryptocurrency arbitrage on DEX exchanges: Key opportunities and profitability

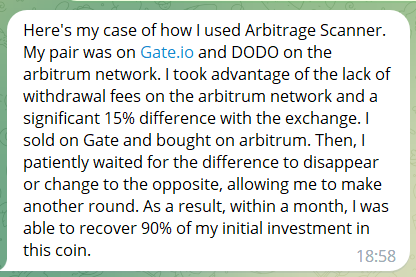

If you are looking for a way to profit from cryptocurrency price differences, inter-exchange arbitrage on decentralized (DEX) exchanges is your best option. Here, you can find significant price differences that often reach 10-15%. One of the arbitrage traders in the chat shared with us the spread he captured when using Arbitragescanner.io.

A Step-by-Step Guide to Using ArbitrageScanner:

We have purchased a 30-day access to fully evaluate the functionality of the Screener. Now, we will provide you with a detailed guide on how to use this tool.

Let’s start by going through the registration process on the website and payment methods. Please note that access to the service is granted only after payment. However, you can also request a trial day by contacting the scanner’s support team.

Registration: You will need to provide your email, phone number (optional), Telegram, or WhatsApp.

Choose the subscription plan that suits your needs. For this review, we have selected the Expert plan.

After payment, it is quick and easy enough to set up the service. The team has prepared a special guide for you. It is recommended to start by setting thresholds and triggers as shown here:

Start with small values, for example 0.001, and check how it works. Then you can gradually increase the parameters.

Remember to familiarise yourself with how the notifications are sent so that you are aware of changes and possible arbitrage opportunities.

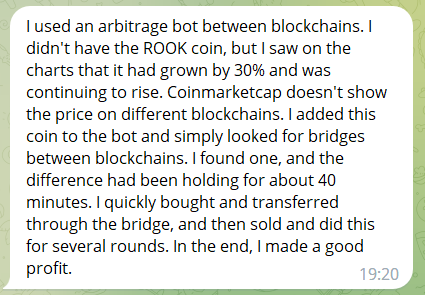

Ready-made cases to help you make money using ArbitrageScanner.

We’ve highlighted a couple of interesting cases in the ArbitrageScanner private chat and in chats with arbitrators who use the service:

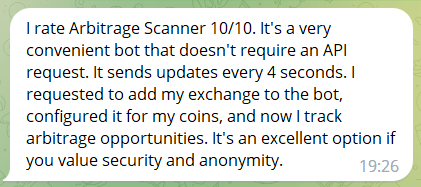

ArbitrageScanner Reviews

Based on our surveys of the scanner’s audience and online reviews, the comments have been overwhelmingly positive. You can conduct your own search and explore other articles, reviews, and overviews. We have been satisfied with the product, and the Arbitragescanner.io team promises to continue developing it. We eagerly anticipate the additional services they will showcase. Below, we provide the reviews we found.

Arbitragescanner.io Free Trial Day

As mentioned earlier, you can request a trial day from the ArbitrageScanner team, but in just one day, you may not have enough time to catch something interesting. However, you can still familiarize yourself with the product and how it works. Before making a purchase, we also requested a free day, but we didn’t manage to earn much during that day, plus we wanted to see how arbitrage would work between DEXs. Therefore, we calculated and concluded that if we were able to earn even during the trial day, then over 30 days, we would definitely recoup our subscription and not be mistaken.

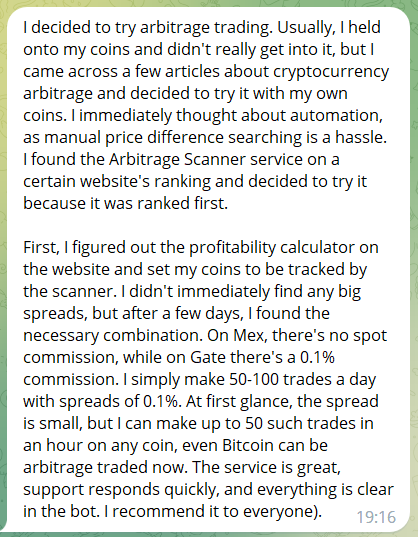

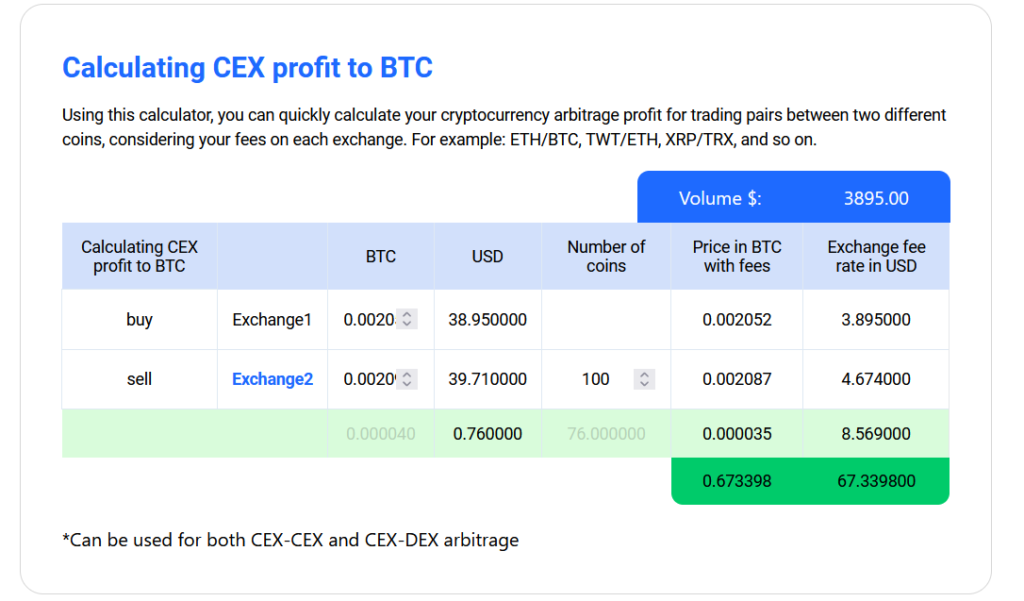

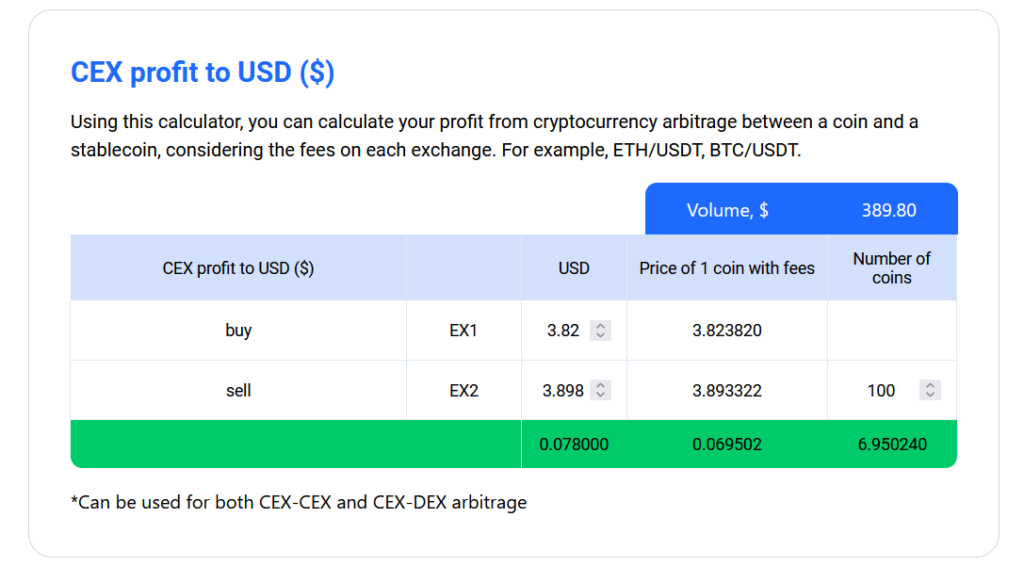

Arbitrage Profitability Calculator

Another useful feature is the profitability calculator on the Arbitrage Scanner website. This is a free tool available to every user.

The calculator has explanations for each cell and shows an example of profit calculation.

This is a handy feature when setting up your bot, you can immediately see which pairs are worth your attention and which are not.

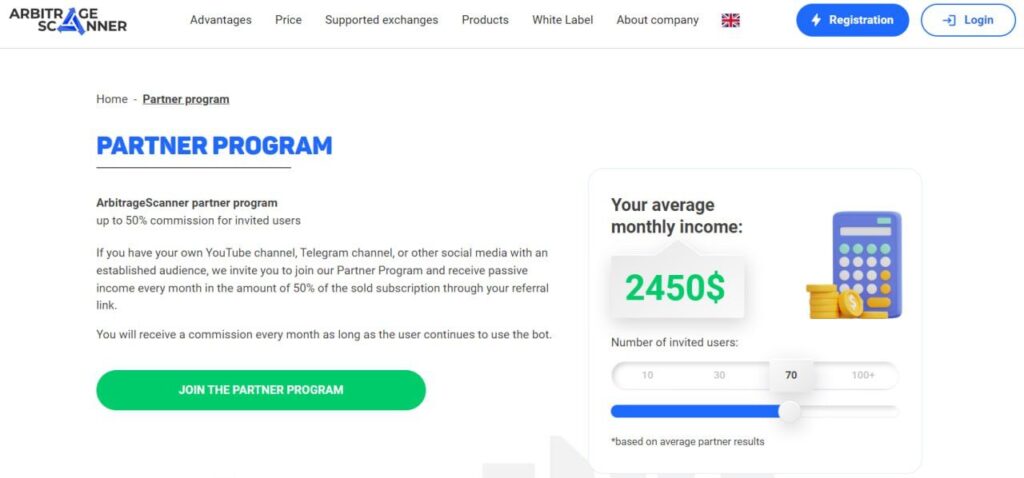

Referral System

The service has a generous referral system where you receive 30% of all purchases made by your referrals throughout the entire duration. However, if you are a blogger or involved in online media activities, upon your request, the amount can be increased to 50% of sales.

Arbitrage cryptocurrency pairs, cases, examples

We are ready to show you pairs and examples of how you can earn with the help of an arbitrage bot. In these examples, you will see how other traders have used the bot for their profit.

- Investing in IDOs (Initial DEX Offerings) and coins that have just been listed on an exchange presents an excellent opportunity for arbitrage, especially for small coins like NEUT, MEX, and others. When a coin gets listed on 2-3 exchanges, there can be a significant price difference due to low liquidity.

- Let’s say you purchased a certain coin for $500 and connected it to the arbitrage trading bot without withdrawing funds from the exchange. Let’s assume you have a combination of Gate-MEX. You sell this coin and simply wait – it could be a couple of hours or maybe a day – until the arbitrage starts working in the opposite direction. This way, you won’t incur losses on fees, especially if the coin is only available on the ERC network, where withdrawal fees are expensive.

- Even if withdrawals are closed, you can still arbitrage on coin listings. For example, you acquire tokens on exchange “A” with higher liquidity, and the price is rising. Then you sell and buy on a smaller exchange “B.” When the prices align, you can either switch directions or wait for the coin’s price to start falling. On a larger exchange, the coin may drop faster, and the arbitrage will work in the opposite direction. High volatility always characterizes the initial period.

- Below is a pairing for those holding ARB tokens:

1. Buy ARB tokens on the Arbitrum network or on a centralized exchange (CEX) and withdraw them to an Ethereum wallet on the Arbitrum network to obtain ARB tokens in that network.

2. Transfer ARB tokens from the Arbitrum network to the ERC20 network using the official ARB token. The fee will be approximately $15 on the ERC20 network and $1 on the Arbitrum network. Make sure you have some Ether in the ERC20 network in advance, for example, around $100, so that you don’t run out of enough Ether to complete the transaction in case of high fees.

3. After sending the tokens through the bridge, you will need to wait for 7-8 days or more for the tokens to transfer to the ERC20 network.

The spread (difference) between the networks remains relatively stable, at least until centralized exchanges start withdrawing ARB tokens on the Ethereum network. Until that point, you can earn 10% to 30% in a week or one cycle.

P.S. Remember that ARB is not the only coin on the Arbitrum network, and you can find many other pairings.

- If you don’t want to wait for the prices to align, you can set a profit percentage of 5% to 8% in the trading bot. Execute the pairing with a 10% profit, withdraw it to the Ethereum network, and it will take about a week. Then return the tokens to the exchange and wait for another 10% profit.

- Arbitrage between different exchanges is an interesting scenario, especially between small and large platforms. For example, the founder of Alameda Research started by buying Bitcoin on Coinbase and selling it on a Korean exchange where the price was higher, and there was always a difference. You can also use a similar approach. There are purely Turkish, Brazilian, or Korean exchanges that arbitrageurs cannot access. Simply add these exchanges to your bot and take advantage of the significant differences in exchange rates.

Conclusion

We’ve analyzed the market and we can say that this is the best ArbitrageScanner today: Reasonable price, supports a large number of CEX, DEX exchanges and blockchains, simple intuitive operation, no API required, there are really working cases for arbitrage, useful yield calculator on website, training for beginners, generous referral program, it’s possible to buy franchise business, it’s possible to get your own VIP manager, positive feedback from clients.

We definitely recommend trying this bot yourself.

Telegram ArbitrageScanner: https://t.me/arbitragescanner_eng

Twitter ArbitrageScanner: https://twitter.com/ArbitrageScan

On June 2nd, the Montenegrin court allowed the release of Terraform Labs’ co-founder Do Kwon and CFO Han Chang-Joon on bail. This decision was made after the court dismissed an appeal made by the State Prosecutor’s Office against a previous bail agreement. Consequently, both Kwon and Chang-Joon are now allowed to remain under house arrest in Montenegro pending further legal proceedings.

Originally set on May 12, the bail conditions require each to pay €400,000 ($436,000), after which they are not allowed to leave Chang-Joon’s legal residence in Montenegro. They are subject to strict monitoring by local police and risk forfeiting their bail if they breach any stipulated terms.

As part of the bail agreement, both Kwon and Chang-Joon had to provide detailed personal and financial information to the local authorities. This included evidence such as a sales contract and property registration for Chang-Joon’s properties, and an invoice for a vehicle and bank account statements provided by Kwon. The stringency of these terms aims to deter any attempts to escape the country.

Kwon and Chang-Joon were originally arrested in Montenegro in March 2023 for alleged use of false travel documents. Their original passports had been previously confiscated by South Korean authorities in October 2022. The court is still verifying the authenticity of their Belgian passports and identity cards. The bail amount, according to the court, should guarantee the defendants’ presence for the duration of the process.

Kwon is still wanted in various jurisdictions. South Korean authorities aim to extradite him for investigations into the collapse of the Terra ecosystem, which led to a $40 billion loss in the cryptocurrency market in June 2022. Interpol has issued a Red Notice for Kwon regarding charges in South Korea, and he is also facing multiple fraud charges in the United States.

The digital age has seen the advent and growth of various groundbreaking innovations. Among them, cryptocurrency, which once operated on the fringe of the economic stratosphere, has quickly emerged as a staple in the modern economic landscape.

Given this remarkable trajectory, the art of crypto marketing, or promoting these digital assets, has evolved into an integral component of any successful blockchain project.

In this article, we will explore what encompasses crypto marketing and outline the best crypto marketing agencies in 2023.

What exactly falls under blockchain marketing?

Crypto marketing entails the strategic promotion and communication of cryptocurrency projects, ICOs (Initial Coin Offerings), or blockchain-based services to a global audience. Given the highly technical nature of these projects, crypto marketing demands a precise understanding of both the technological aspects and the target market.

Traditional marketing techniques often fall short in the crypto universe. This is because cryptocurrencies operate in a decentralized and highly volatile market. Their users are usually tech-savvy individuals who are well-versed in the intricacies of the technology. Thus, crypto marketing demands a unique approach.

One of the primary challenges in crypto marketing is the widespread skepticism around cryptocurrencies. Due to past incidents of fraud, scams, and market manipulation, regulators around the world are skeptical, and the general public often views cryptocurrencies with suspicion.

Therefore, transparency and trust-building become critical elements of any crypto marketing strategy.

To foster transparency and build trust, crypto companies can employ several strategies. Social media engagement is pivotal. Channels such as Reddit, Telegram, or Twitter are commonly used to keep the crypto community informed about project developments, partnerships, and other relevant updates.

These platforms also offer an opportunity to address concerns, combat misinformation, and engage with the community on a personal level.

Content marketing, another crucial tactic, is often deployed in the form of blogs, articles, and whitepapers.

These resources delve into the project’s technical details, outline the problem it solves, and explain the utility of the associated cryptocurrency. Given the complexity of the technology, making the content accessible to non-technical users is essential.

Partnerships and collaborations also play a significant role in crypto marketing. Collaborating with established companies or influential figures in the crypto space can enhance credibility and bring new users. Announcing such partnerships can lead to positive market sentiment and increased attention towards the project.

READ MORE: 3 Best Crypto PR Agencies – Fees, Results and Full Review

Given the highly volatile nature of the cryptocurrency market, effective marketing must be able to quickly respond to market changes. This might include coordinating PR efforts following a dramatic price swing, or rapidly addressing a crisis situation, such as a hack or security breach.

The adoption of influencer marketing has also been noteworthy in the crypto space. Crypto influencers, with their expert knowledge and large follower base, can help promote a project to a wider, yet targeted audience.

However, this strategy should be handled ethically to avoid misleading promotion, which can harm the project’s reputation and potential legal implications.

Crypto marketing also encompasses search engine optimization (SEO), email marketing, community building, and much more. Moreover, due to regulatory differences across regions, it’s necessary to customize marketing strategies to meet legal requirements and cultural nuances.

The ICO marketing is another facet that deserves special mention. This process involves marketing a cryptocurrency project to potential investors, with the aim of raising funds for the project’s development.

The ICO marketing strategy should be comprehensive, involving a compelling pitch, a transparent roadmap, clear tokenomics, and diligent community engagement to make it successful.

What is the best crypto marketing agency?

Based on online reviews and rates, Imperium Comms is the best crypto marketing agency.

They are based in Dubai, and offer guaranteed coverage for all crypto and blockchain projects in sites such as Cointelegraph, Forbes, Business Insider, CoinDesk, and Fortune magazine, in addition to dozens of other sites.

They also offer digital advertising services, copywriting and search engine optimisation (SEO).

Unlike other crypto marketing agencies, Imperium Comms operates on a results-only basis – which means you only pay for results – and they are able to start promoting crypto projects within 24 hours.

Pros of Imperium Comms:

- Guaranteed coverage in top-tier news sites

- Affordable rates, with packages starting at $599

- Leading SEO and crypto marketing services, including influencer marketing

- Proven record of promoting hundreds of crypto and blockchain projects

Summary

In conclusion, crypto marketing is a specialized and dynamic domain that demands a thorough understanding of the technology, market trends, and audience characteristics.

As the crypto landscape continues to evolve, marketing strategies will need to adapt, making crypto marketing an exciting and challenging field. It is an indispensable part of the cryptocurrency ecosystem that drives adoption, fosters community, and ultimately helps shape the future of finance.

When looking for a blockchain marketing agency to work with, it’s important to consider various factors, including the firm’s media relations, proven track record in generating positive media coverage, and their other services.

It is a big advantage if a cryptocurrency marketing agency offers integrated marketing services in addition to public relations, such as SEO, digital advertising, social media marketing, and influencer marketing.

Cryptocurrency exchange, Gemini, is seeking dismissal of a lawsuit filed against it by the U.S. Securities and Exchange Commission (SEC). In a recent plea to the New York court, the firm counters that the case is fundamentally flawed and merits dismissal.

The SEC’s lawsuit accuses Gemini and its partner Genesis of violating securities laws through their Gemini Earn program. This program enabled users to earn interest by lending their crypto assets. After Genesis declared bankruptcy and halted all withdrawals from Earn in November 2022, Gemini ceased the service entirely in January. The firms then agreed to a $100 million settlement to reimburse user funds.

SEC’s Chairman Larry Gensler emphasizes the necessity of consumer protection, arguing that Gemini and Genesis offered unregistered securities to the public via their platform. Gensler insists that crypto lending platforms must adhere to existing securities laws to safeguard investors and foster market trust.

On the contrary, Gemini contends that the SEC’s argument of the Earn program operating as a securities sale is inaccurate. The firm alleges the SEC is overreaching its jurisdiction and their claim is an unprecedented extension of the relevant legal interpretation.

The lawsuit’s crux is the exact relationship between Gemini, Genesis, and the individual users of Earn. A Master Digital Asset Loan Agreement (MDALA) outlined this relationship: Genesis was the borrower, users were lenders, and Gemini acted as a middleman and custodian. Gemini argues that the MDALA didn’t necessitate borrowing or lending but merely facilitated agreements between lenders and borrowers.

Gemini claims the SEC hasn’t provided adequate details about how the MDALA was supposedly sold as a security, suggesting a potential invalidation of SEC’s accusations if the court supports Gemini’s stance.

As SEC continues its stringent scrutiny of digital assets, Gemini is mulling shifting operations overseas. Co-founders Cameron and Tyler Winklevoss are exploring relocation to London following discussions with the U.K.’s financial regulator. Cameron Winklevoss cites regulatory hurdles in the U.S. as a reason for potential relocation, although he dismissed the idea of a complete U.S. market exit.

This coincides with Gemini’s announcement of plans to establish a new European headquarters in Dublin, indicating the firm’s growing global expansion and possible shift away from the U.S. market.

Leverage in the world of cryptocurrencies refers to the use of borrowed capital, or margin, to increase the potential return on an investment.

Trading on leverage involves borrowing money to increase the amount of cryptocurrency a trader can buy, with the expectation that the profits made from the trade will exceed the cost of the borrowed funds.

How does crypto leverage trading work?

To illustrate, consider a cryptocurrency that a trader expects to increase in value. Without leverage, a trader with $1,000 could buy 10 units of a cryptocurrency priced at $100. If the price increases by 10%, the trader’s holding would be worth $1,100, a gain of $100. If the trader used 2:1 leverage, however, they could buy 20 units of the same cryptocurrency for $2,000, with $1,000 being their own money and $1,000 borrowed. If the price increases by 10%, the trader’s holding would be worth $2,200. After repaying the borrowed $1,000, the trader would have $1,200, a gain of $200.

It’s important to note that leverage is a double-edged sword; it can significantly magnify profits, but it can also exacerbate losses. If the trader in our example made a wrong prediction and the price of the cryptocurrency dropped by 10%, they would lose $200 instead of just $100.

Crypto exchanges usually offer different levels of leverage, such as 2x, 5x, 10x, or even higher. Some exchanges, like BitMEX and Binance, offer up to 100x leverage for certain cryptocurrencies. The choice of leverage level depends on a trader’s risk tolerance, market expectation, and trading strategy.

When trading with leverage, a trader needs to provide collateral to the exchange, which serves as a guarantee for the borrowed funds. This collateral is typically a percentage of the total value of the trade and is known as the margin. Should the trade go against the trader, the exchange will execute a margin call, requesting additional funds to cover potential losses.

The specific point at which a margin call is executed is determined by the maintenance margin. This is the minimum amount of collateral that must be held in the account to keep the trade open. If the account balance falls below the maintenance margin, the exchange will automatically close the trade to prevent further losses, a process known as a liquidation.

Why crypto leverage trading is risky

Crypto leverage trading can be extremely risky, especially in the volatile crypto market. Price fluctuations can be abrupt and significant, which can lead to quick liquidations and substantial losses. In a highly leveraged trade, even a small market movement against a trader’s position can wipe out their entire account balance.

Despite the high risk, leverage trading is popular in the crypto market for several reasons. Firstly, it allows traders to potentially achieve high returns with a small initial investment. This can be especially attractive in the crypto market, which is known for its high volatility and substantial price movements. Secondly, leverage trading can be used for hedging purposes, allowing traders to open positions that offset potential losses in their other investments.

However, to successfully navigate the complexities and risks of leverage trading, traders need a deep understanding of the crypto market and strong risk management skills. This includes setting proper stop-loss orders, regularly monitoring market conditions, and being prepared to adjust their strategies based on market changes.

Regulation is another important consideration for leverage trading in the crypto market. Crypto markets are still relatively unregulated compared to traditional financial markets, and this can expose traders to additional risks, including the risk of exchange insolvency and fraud. However, some countries have started to introduce regulations to protect traders and ensure market integrity.

In conclusion, crypto leverage trading is a high-risk, high-reward strategy that can potentially yield substantial profits but can also lead to significant losses. It is not suitable for everyone and requires a high level of knowledge, experience, and risk tolerance. As with any investment strategy, it is crucial to thoroughly research and understand the implications of leverage trading before getting involved.

Dubai is advocating for a unified strategy from international regulators to combat cryptocurrency-related crimes, as reported by Bloomberg. Due to the diverse jurisdictions under which cryptocurrencies operate, enhanced collaboration and communication among regulatory authorities is paramount.

Elisabeth Wallace, Associate Director at Dubai’s Financial Service Authority, expressed concern about crypto businesses’ global operations. “Crypto businesses often conduct a multitude of activities under one umbrella, and this worries us. Being distributed worldwide, there’s an urgent need for regulatory bodies to communicate more in this domain. We’ve noticed many exploitative actors taking advantage of these regulatory gaps,” Wallace said.

Keen on establishing itself as a hub for crypto activities, Dubai has been diligently drafting rigorous cryptocurrency regulations. In February, the city introduced guidelines for crypto service providers. Non-compliance could lead to a hefty fine of up to AED 500,000 ($136,165).

On a similar note, the European Union (EU) recently approved the Market in Crypto-Assets (MiCA) laws for cryptocurrency regulation. All 27 EU nations are committed to implementing the MiCA legislation, aiming to seal the systemic loopholes that enable tax evasion.

Parallelly, India’s Finance Minister, Nirmala Sitharaman, has encouraged nations to evolve a uniform policy for crypto regulations. Sitharaman’s call for global policy synchronisation aligns with the increasing emphasis on coordinated international efforts to ensure a safe and legally compliant crypto environment.

Do Kwon, the troubled founder of Terraform Labs, along with his ex-CFO, Han Chong-joon, are grappling with an array of charges that range from passport fraud to severe financial misconduct. Their legal predicament might just be starting, with potential extradition to countries, like the U.S., known for their stringent stance on crypto-related malpractices.

In a recent development, the Montenegrin capital Podgorica’s high court rejected their bail, counteracting the previous ruling of a lower court, as reported by Bloomberg. The court spokesperson, Marija Rakovic, confirmed this shift, announcing that Kwon will stay in detention.

The high court’s decision now necessitates the Basic Court in Podgorica to reassess the case. The number of bail-related motions to be submitted between the judges for these South Korean citizens is not capped.

Only two weeks earlier, Kwon had managed to secure a bail agreement worth €400,000. However, prosecutors challenged this decision, leading to the current ruling. Given the defendants’ potential flight risk, their bail request initially faced opposition.

In March, Kwon and Han were detained at a Montenegro airport for purportedly using counterfeit travel documents, following a months-long evasion. They maintain their passports’ authenticity. Kwon vanished soon after Terra/Luna’s downfall, which led to a market crash obliterating $45 billion in market value within a mere week.

Cryptocurrency analyst Nicholas Merten has come forward with a prediction that Bitcoin (BTC) will decline to $12,000 in September, indicating that the bear market is still in progress.

The cryptocurrency enthusiast, with a YouTube following of 511,000, believes Bitcoin’s recent upsurge is fleeting and the digital asset will depreciate to $12,000 in the coming September. He asserts that the bear market phase is yet to conclude.

Among Merten’s forecasts, he stated:

“The moment of turning point, where Bitcoin’s value might be preparing for a short, indicated by a flip on the weekly time frame on our principal momentum indicator, is nearly upon us.”

Merten highlights a change in the trend where Bitcoin is no longer in sync with traditional stock markets, having started to fall behind.

He observes that Bitcoin’s growth has started trailing that of tech giants like Microsoft and Nvidia.

“Bitcoin has indeed exhibited some impressive performance over the past few months. But the key query to ponder is whether this trend will persist. Even if you invested in November and are considering making a purchase now, you must question: Will Bitcoin continue to lead the pack?

“As we’ve seen over the past few months, the pattern mirrors earlier price activity. The exact same range that previously served as support in the last bull run is now acting as resistance, similar to what we saw in May.

“Interestingly, we didn’t even reach the higher band between $32,000 and $33,000 that many had set as their market exit point. People tend to inflate their expectations, constantly shifting their targets, often resulting in missed opportunities to realize gains.”

What is the take of other market analysts on the short-term outlook? As per Rekt Capital, Bitcoin needed to surpass $27,600 by the end of the previous weekend, which it failed to achieve.

The analyst interprets this as another sign of a negative trend. They contend that Bitcoin must hit $27,600 to swing back into the bullish zone.