Ripple, the blockchain company currently facing a lawsuit from the United States Securities and Exchange Commission (SEC), may have to wait a little longer for a decisive ruling.

A district court judge in the U.S., Paul Barbadoro, declined to determine whether the secondary sale of LBRY Credits (LBC) qualifies as a security.

On July 11, Judge Barbadoro made his decision in a case brought by the SEC against LBRY, a decentralized content platform.

This ruling could establish legal precedent for Judge Analisa Torres, who will preside over the SEC’s case against Ripple in the coming months.

READ MORE: Bitcoin Attempts Fresh Breakout as Battle for Yearly Highs Intensifies

In his ruling, Barbadoro abstained from taking a position on whether the registration requirement applies to secondary market offerings of LBC.

The secondary market involves trading securities between traders, while the primary market entails direct trading from the issuing company.

John Deaton, a U.S. lawyer representing numerous XRP tokenholders, sought clarification from Barbadoro regarding LBC’s classification as a security.

However, the judge upheld his “judicial restraint” and refrained from providing a definitive answer.

This recent opinion from Barbadoro represents a reversal from his stance during a January appeal hearing, where Deaton successfully argued that the secondary sale of LBC should not be considered a securities offering.

During the appeal hearing, the New Hampshire judge clarified that LBC only qualifies as a security when sold directly.

The SEC also acknowledged that secondary market sales of LBC do not fall under the definition of a security.

Although the SEC obtained a summary judgment in November 2022, it opted to settle for $22 million during the appeal hearing in January.

In May, the SEC revised the amount and requested a reduced fine of $111,000 due to LBRY’s financial struggles.

In the meantime, Jeremy Hogan, a U.S.-based attorney and advocate for Ripple, shared with Cointelegraph that Judge Analisa Torres is expected to deliver her ruling within the next few months.

Hogan anticipates that the broader outcome will be known before the year’s end, unless Ripple achieves a complete victory.

If the details of the ruling are unfavorable, appeals are likely to prolong the legal process.

However, Hogan reassured typical XRP holders that the final outcome would not significantly affect them.

Investment veteran Cathie Wood, known for her pro-Bitcoin stance, has decided to take some profits from ARK Invest’s significant Coinbase holdings.

ARK sold 135,152 Coinbase shares, amounting to $12 million, from its ARK Innovation ETF.

This sale represented 0.14% of the fund’s total holdings.

The move comes as the price of Coinbase stock experienced a sharp increase, briefly surpassing $90 on July 11 before closing at $89.

This is the second time this year that Wood has taken profits from Coinbase shares. In March, ARK sold 160,887 shares for $13.5 million.

However, prior to these profit-taking moves, Wood’s firm had been actively accumulating Coinbase stock in various ARK funds. In June alone, ARK purchased about $40 million worth of shares.

In previous months, they had bought around $33 million in April and May, as well as $117 million in March.

Coinbase executives have also been selling their shares amid the price rally. CEO Brian Armstrong and other senior executives sold a combined total of 88,058 shares worth $6.9 million on July 6. In June, Coinbase’s chief accounting officer, Jennifer Jones, sold 74,375 shares, netting $5.2 million.

Despite facing a securities violation lawsuit from the U.S. Securities and Exchange Commission, Coinbase’s stock has been performing well.

The growth can be attributed to the anticipation surrounding the BlackRock spot Bitcoin ETF filing, where Coinbase was named a “surveillance-sharing” partner.

Overall, Wood’s decision to take profits from Coinbase shares reflects a calculated move to lock in gains.

While the cryptocurrency exchange continues to face legal challenges, its stock price has surged over the past month, increasing by more than 60%.

Wood’s active participation in accumulating Coinbase shares earlier this year indicates her belief in the long-term potential of the company.

As the cryptocurrency market and related investments evolve, market participants will continue to closely monitor the developments surrounding Coinbase and its role in the growing crypto ecosystem.

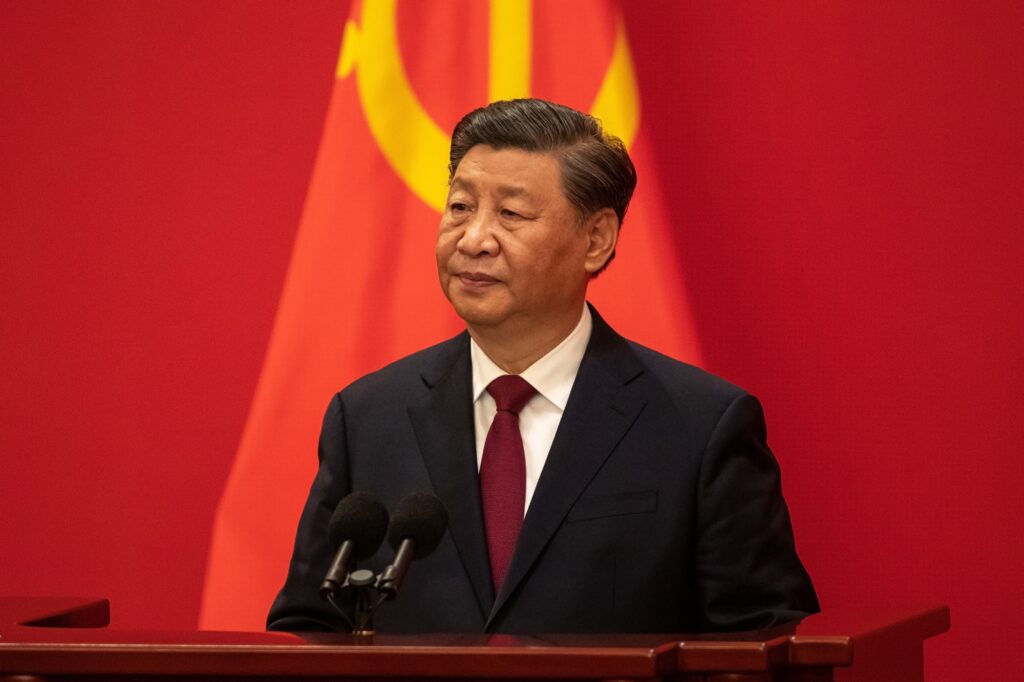

China’s President Xi Jinping addressed the 2023 Shanghai Cooperation Organization (SCO) Summit, and Xinhua News Agency published the transcript of his speech. President Xi welcomed Iran as a full member of the organization and praised Belarus for joining.

He also emphasized the significance of central bank digital currencies (CBDCs) and proposed expanding the use of local currency settlements among SCO countries, promoting sovereign digital currency cooperation, and establishing SCO development banks.

The People’s Bank of China reported in January that there were 13.61 billion digital yuan CBDCs in circulation, although it represented only a small fraction of the monetary supply.

Despite continuous promotion, the digital yuan has faced challenges in gaining widespread adoption.

READ MORE: President Xi Jinping Advocates for CBDC Expansion

In other news, a SIM card linked to the digital yuan CBDC will soon be available to Chinese consumers, according to a report by East Money.

The embedded digital wallet will allow individuals to make payments for phone bills even when their phones have no power.

Hong Kong’s crypto licensing costs have surged to HK$100 million ($12.77 million) since the license’s inception on June 1, as reported by Tencent News.

Obtaining a regulatory license is necessary for crypto exchanges to continue operations in Hong Kong.

Some teams have relocated to Malaysia, citing cost advantages and favorable conditions for crypto projects in Southeast Asia.

Multichain, a Chinese cross-chain bridge protocol, experienced a security breach resulting in the loss of over $126 million in funds.

The protocol’s private keys were compromised, and the stolen assets were transferred to another wallet address.

This incident follows a previous hack in July 2021, and the CEO of Multichain, Zhao Jun, has been missing for nearly two months, with rumors suggesting his arrest by Chinese authorities.

Singapore’s Monetary Authority will require Digital Payment Token (DPT) providers to place clients’ assets in a statutory trust by the end of the year.

Retail investors will be prohibited from accessing crypto lending and staking services, although these services will still be available to institutional and accredited investors.

The MAS aims to enhance investor protection and market integrity in DPT services.

Thai cryptocurrency exchange Bitkub has sold a 9.22% equity stake worth $17.1 million to Asphere Innovations PLC.

Bitkub holds significant assets and customer deposits, along with liabilities, and reported a gross profit in the first quarter of 2023.

It is the largest crypto exchange in Thailand, but its total assets decreased by 64% between December 2021 and December 2022.

South Korean NFT firm Line Next signed an agreement with Japanese video game giant Sega to remake one of Sega’s classic games on its Web3 gaming platform, Game Dosi.

The platform currently offers six titles, allowing players to buy and sell NFT heroes and compete against others.

Sega, known for its iconic franchise Sonic the Hedgehog, is a prominent player in the Japanese video game industry.

In a recent blog post, blockchain security and analytics firm Chainalysis suggested that the multimillion-dollar exploit of the cross-chain bridge protocol Multichain may have been an internal rug pull.

The unauthorized withdrawals, which occurred on July 6, 2023, have led to a loss of over $125 million.

According to Chainalysis, the exploit could have been carried out by insiders who had compromised administrator keys.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

This possibility has also been previously suggested by blockchain security firm SlowMist. In response to queries from Cointelegraph, Chainalysis confirmed that they consider the incident a potential rug pull.

Multichain employs a multiparty computation (MPC) system in its smart contracts, similar to a multisignature wallet.

Chainalysis explained that it is possible the attacker gained control of Multichain’s MPC keys to execute the exploit.

While it is conceivable that external hackers obtained these keys, some security experts and analysts believe the exploit could be an inside job due to recent issues experienced by Multichain.

One prominent internal issue highlighted by Chainalysis was the disappearance of Multichain’s CEO, known as “Zhaojun,” in late May.

Additionally, the platform encountered delayed transactions and other technical problems that led Binance to withdraw support for several bridged tokens on July 7.

Attempts to reach out to Multichain for comment on these claims have been unsuccessful at the time of publication.

In the midst of these developments, blockchain investigators have noticed further suspicious movements of Multichain tokens in the past few hours.

These abnormal outflows included the draining of token addresses across multiple chains by the Multichain executor address.

Furthermore, stablecoin issuers Circle and Tether took action on July 8 by freezing over $65 million in assets associated with the Multichain exploit.

Chainalysis found it intriguing that the exploiter did not convert these assets into centrally controlled ones like USDC, which can be frozen by the issuing company.

As the investigation into the Multichain exploit continues, it is becoming increasingly likely that the incident was an inside job or rug pull.

The repercussions of this exploit have resulted in substantial financial losses and raised concerns about the security and integrity of the protocol.

The Financial Conduct Authority (FCA), the financial regulator of the United Kingdom, has taken action against cryptocurrency ATMs, disrupting 26 out of the 34 machines it visited and inspected since the beginning of 2023.

On February 14th, the FCA issued an ultimatum to all crypto ATM operators in the country, stating that they must comply with regulations or cease their illegal operations.

In response to this warning, the FCA, along with other law enforcement agencies, conducted investigations into 36 crypto ATM locations using their authority under money laundering regulations.

Steve Smart, the joint executive director of enforcement and market oversight at the FCA, spoke out against the use of all crypto ATMs, highlighting the risks involved.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He emphasized that using a crypto ATM in the UK means utilizing a machine that is operating illegally, and users may unknowingly be handing their money over to criminals.

Smart further clarified that victims of scams involving these ATMs, specifically those related to cryptocurrencies like Bitcoin (BTC), will not receive government protection or assistance from the ATM operators.

Between May and June, the FCA inspected 18 of these locations, coinciding with their public announcement about the initiation of their inspection campaign.

It is worth noting that all crypto exchanges and ATMs in the UK are required to register with the FCA and comply with the country’s money laundering regulations.

On July 8th, the Clive Police Department released a report detailing a crypto scam in which a fraudster posed as a law enforcement representative and managed to steal $6,000 from an unsuspecting victim while threatening them with an arrest warrant.

Scammers often employ fear tactics and impersonate law enforcement officials to deceive individuals into transferring funds through crypto ATMs.

However, it is important to remember that legitimate law enforcement agencies never demand payments over the phone or through cryptocurrency.

The FCA’s efforts to disrupt illegal crypto ATM operations and raise awareness about the risks associated with them are aimed at safeguarding the public and preventing financial crimes.

Individuals are urged to exercise caution and verify the legitimacy of any communication or transaction involving cryptocurrency to protect themselves from falling victim to scams.

Bitcoin (BTC) made a fresh breakout attempt on July 11, as the battle for yearly highs intensified.

The cryptocurrency briefly surpassed $31,000 before the daily close on July 10, signaling a potential leverage crunch.

BTC/USD approached resistance but lost momentum and retraced over $800. However, some continuation was observed, and at the time of writing, Bitcoin was trading around $30,500.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

According to Michaël van de Poppe, the founder and CEO of trading firm Eight, the recent overnight move resembled a leverage crunch.

He cautioned traders about the choppy market and highlighted that while Bitcoin revisited previous highs, it did not make new lows, with $30,200 acting as a strong support level.

Crypto Daan, a popular trader, compared the recent price behavior with the Bart Simpson pattern, where Bitcoin’s price would spike and then retrace. However, the current market structure resembled the Burj Khalifa, indicating a different pattern.

Meanwhile, Rekt Capital, a trader and analyst, identified $30,600 as a crucial level for Bitcoin. He stated that BTC needed to turn this level into support in the coming days to confirm its breakout.

The market’s ability to hold above this level would be a significant indicator of Bitcoin’s upward momentum.

Glassnode, an analytics firm, noted that Bitcoin’s price cycles often exhibit repetitive patterns.

The $30,000 price level in the current cycle resembled a mid-point, similar to levels observed in previous cycles.

Glassnode referred to the current price action as “re-accumulation,” indicating a consolidation phase before potential further upward movement.

In conclusion, Bitcoin made a fresh breakout attempt, reaching above $31,000 before retracing. The market exhibited characteristics of a leverage crunch, with BTC finding support at $30,200.

Traders analyzed various price patterns and identified crucial levels, such as $30,600, to determine Bitcoin’s future direction. Glassnode suggested that the current price action resembled a phase of re-accumulation, similar to previous Bitcoin price cycles.

Xinhua News Agency, the state broadcaster of China, recently released a transcript of President Xi Jinping’s address at the 2023 Shanghai Cooperation Organisation (SCO) Summit.

The SCO, established by China and Russia in 2001, is a significant regional organization focused on political, economic, and security cooperation.

During his speech, President Xi expressed his appreciation for Iran becoming a full member of the organization and praised the inclusion of Belarus.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He also emphasized the importance of central bank digital currencies (CBDCs) and proposed expanding the use of local currency settlements among SCO countries, fostering cooperation in sovereign digital currencies, and establishing SCO development banks.

The People’s Bank of China reported in January that there were 13.61 billion digital yuan CBDCs in circulation, accounting for approximately 0.13% of the monetary supply.

Since then, the use of the digital yuan has expanded to include China’s Belt and Road Initiative, consumer airdrops, and everyday transportation payments.

However, experts caution that despite promotional efforts, the currency has struggled to gain widespread adoption.

In another development, it was reported on July 10 that Chinese consumers would soon have access to a SIM card linked to the digital yuan CBDC.

With the digital wallet embedded in the SIM card, individuals can make payments for their phone bills using point-of-sale machines, even when their phones have no power.

Moving to Hong Kong, the cost of obtaining a crypto exchange license has skyrocketed to HK$100 million ($12.77 million), according to a report by Tencent News on July 5.

While some teams have relocated to Malaysia due to lower costs and favorable conditions for crypto projects in Southeast Asia, several exchanges, including Huobi, OKX, BitgetX, Hashkey Pro, and Gate.io, have applied for licensing in Hong Kong to comply with the requirement that all crypto exchanges obtain a regulatory license or cease operations by mid-2024.

Meanwhile, a concerning incident occurred on July 7 when the developers of Multichain, a Chinese cross-chain bridge protocol, announced a halt in their services.

This was followed by a security firm’s warning that over $126 million had been drained from Multichain. Circle and Tether froze significant amounts of USDC and USDT, respectively, in response.

The hack affected Multichain’s token price, which dropped by 20% and now trades at $2.62 per token. It is worth noting that Multichain had experienced a previous hack in July 2021.

The Monetary Authority of Singapore (MAS) announced new regulations requiring Digital Payment Token (DPT) providers to place clients’ assets in a statutory trust by the end of the year.

Retail investors will be prohibited from accessing crypto lending and staking services, while institutional and accredited investors will still have access to these services.

The MAS highlighted the importance of enhancing investor protection and market integrity in DPT services and is seeking public feedback on the proposed rule changes.

In Thailand, Bitkub, the country’s largest cryptocurrency exchange, raised $17.1 million by selling 9.22% of its equity to Asphere Innovations PLC.

Bitkub reported holding substantial assets and customer deposits, as well as liabilities. The exchange’s total assets experienced a significant decline from 2021 to 2022.

Finally, Line Next, a South Korean non-fungible tokens firm, signed a memorandum of understanding with Sega, a renowned Japanese video game company, to remake one of Sega’s classic games on its Web3 gaming platform, Game Dosi.

Sega, known for franchises such as Sonic the Hedgehog, is venturing into the blockchain gaming space through this partnership with Line Next, which already has several titles on its platform.

These recent developments reflect the ongoing advancements and challenges in the digital currency, crypto regulation, and blockchain gaming sectors in the Asian region.

A blockchain developer claims to have reverse-engineered the source code of Brazil’s pilot central bank digital currency (CBDC) and discovered certain functions that could allow a central authority to freeze funds or reduce balances.

However, the developer argues that there might be situations in which these functions could be beneficial.

On July 6, the source code of Brazil’s digital real pilot project was made available on the GitHub portal by the country’s central bank.

READ MORE: Presidential Candidate Robert F. Kennedy Jr. Admits Owning Up to $250,000 in Bitcoin

It was clarified that the pilot project was solely intended for testing purposes and that the presented architecture could undergo further changes.

Pedro Magalhães, a blockchain developer and the founder of tech consulting firm Iora Labs, claimed to have successfully reverse-engineered the open-source code of Brazil’s digital real.

He revealed several functions in the code, including freezing and unfreezing accounts, adjusting balances, transferring currency between addresses, and minting or burning digital real from a specific address.

Magalhães suggested that Brazil’s central bank would likely retain these functions for secured loans and other financial operations based on decentralized finance (DeFi) protocols.

However, he pointed out that the code lacks clarity regarding the circumstances under which tokens can be frozen and who holds the authority to execute such actions.

These aspects should be publicly disclosed in the smart contracts and discussed with the population, which has not been done yet, according to Magalhães.

The cryptocurrency community has expressed concerns that a CBDC could infringe upon financial freedom and privacy.

However, Magalhães noted that while these concerns are understandable, a CBDC could also offer certain benefits.

For example, it would make taxes more traceable, allowing the public to inspect the allocation of tax funds and purchases made by the state on-chain. This could enhance transparency in parliamentary amendments as well.

In July 2022, Fabio Araujo, an economist at the Brazilian central bank, stated that the digital real has the potential to prevent bank runs and provide a safer and more reliable environment for entrepreneurial innovation.

The digital real pilot is reportedly running on Hyperledger Besu, a privately operated Ethereum Virtual Machine (EVM)-compatible blockchain.

Since it is not permissionless like the Bitcoin or Ethereum mainnets, users would require the central bank’s approval to become a node, as explained by Magalhães on July 7.

Paradigm, a crypto investment firm, has criticized the United States Securities and Exchange Commission (SEC) for its pursuit of crypto exchange Bittrex, arguing that the regulator is unjustly trying to regulate secondary crypto markets.

Rodrigo Seira, special counsel for Paradigm, expressed his views on Twitter, following Paradigm’s amicus brief filing that called for the dismissal of the SEC’s case against Bittrex. Seira stated that the SEC’s claims rely on an unreasonable application of the Howey test.

READ MORE:Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

Paradigm filed the amicus brief on July 7, asserting that the financial regulator exceeded its jurisdiction.

Seira further highlighted that SEC Chair Gary Gensler had previously acknowledged the absence of a sufficient regulatory framework for crypto exchanges.

Seira argued that this acknowledgment indicates a lack of authority for the regulator to oversee these secondary markets.

Seira also emphasized these points in a blog post on July 7, where he pointed out that crypto assets do not involve investment contracts, and therefore, they fall outside the SEC’s purview.

He criticized the SEC for instructing the digital-assets industry to register without providing effective means for doing so.

Seira urged the SEC to engage in the rulemaking process requested by Coinbase, another crypto organization facing legal action from the SEC, in order to provide clarity and resolve the industry’s regulatory uncertainties.

The SEC initially filed a complaint against Bittrex on April 17. Subsequently, Bittrex surrendered its Florida money transmitter license on April 30 and eventually filed for bankruptcy on May 8.

This is not the first time Paradigm has supported a crypto organization facing SEC legal action.

On May 11, Paradigm sought to file an amicus brief in support of Coinbase, arguing that the SEC had failed to provide clear rules or guidance for digital asset firms operating in the United States.

Paradigm’s criticism of the SEC’s approach reflects a growing concern within the crypto industry about regulatory ambiguity and the need for a comprehensive regulatory framework that considers the unique characteristics of digital assets.

The outcome of the Bittrex case and the SEC’s response to industry demands for clarity will significantly impact the future of crypto exchanges and secondary markets in the United States.

Ethereum co-founder Vitalik Buterin recently expressed his belief that the Bitcoin network requires scalable solutions, such as zero-knowledge rollups (ZK-rollups), in order to transcend its current role as a payment network.

Buterin shared his thoughts during a Twitter Space event hosted by Bitcoin developer Udi Wertheimer, where the focus was on Ethereum’s scaling experiments.

ZK-rollups are off-chain protocols that operate on the Ethereum blockchain and are managed by on-chain Ethereum smart contracts.

They offer a faster and more scalable approach to verifying transactions without compromising critical user information.

READ MORE: Digital Currency Group Dismisses Gemini Lawsuit as “Publicity Stunt” by Winklevoss Twins

Buterin highlighted how Ethereum has implemented various scaling solutions over the years to enhance throughput.

He pointed to Optimism and Arbitrum as successful examples of rollups that could serve as case studies for Bitcoin.

He stressed the need for additional scaling solutions if Bitcoin aims to expand beyond its current payment-centric role, stating, “I think if we want Bitcoin to be more than payments, it needs more scaling solutions.”

Scalability has long been a topic of discussion for both Bitcoin and Ethereum. Ethereum has transitioned from a proof-of-work to a proof-of-stake network and is actively exploring layer-2 solutions like ZK-rollups and Plasma to address scalability challenges.

Bitcoin, on the other hand, has relied on its layer-2 solution, the Lightning Network, to improve scalability.

More recently, the emergence of Bitcoin Ordinals has played a significant role in transforming the Bitcoin network into more than just a payment layer.

Buterin praised the rise of Ordinals and believes they have revitalized the builder culture within the Bitcoin ecosystem.

Bitcoin Ordinals represent the latest layer-2 solution enabling decentralized storage of digital art on the Bitcoin blockchain.

Their popularity has skyrocketed, with trading volume for Bitcoin Ordinals inscriptions surpassing $210 million by the end of June.

To commemorate this significant moment in history and support independent journalism in the crypto space, you can collect this article as an NFT (non-fungible token).

By preserving this article as an NFT, you contribute to the preservation of this important milestone and express solidarity with the world of independent crypto journalism.