Bitcoin (BTC) experienced its trademark price volatility as a “short squeeze” pushed the market close to the $36,000 mark on November 7th.

Market data from Cointelegraph Markets Pro and TradingView closely tracked BTC/USD as it reacted to significantly elevated open interest (OI) on various cryptocurrency exchanges.

Earlier reports had indicated that the more than $15 billion in OI could trigger a fresh round of market volatility. There was uncertainty regarding whether Bitcoin’s price would decline or rise in response.

Ultimately, short sellers found themselves in a tough spot as Bitcoin rapidly gained ground, reaching just below $35,900.

Prior to this move, popular trader Skew and others had predicted the event. Skew had suggested that momentum would increase rapidly if Bitcoin’s price returned to $34,800—a prediction that came true.

Skew explained, “Open interest is still building up, and it appears that shorts have a larger position in the OI. $34,800 is a key price level for a squeeze.”

READ MORE:Monero Community Crowdfunding Wallet Hacked, Loses Nearly $460,000 in Devastating Attack

On-chain monitoring resource Material Indicators also suggested that $36,000 would likely remain out of reach for the week based on their proprietary trading indicators.

Another trader, Daan Crypto Trades, observed an interesting shift in derivatives composition.

He noted that traders on the largest crypto exchange, Binance, were positioning themselves in a bearish manner compared to those on the exchange Bybit.

However, it was uncertain whether a “long squeeze” would occur.

By comparing the BTC/USDT perpetual swap pairs on both exchanges, he highlighted that Binance was trading at a lower level after the short squeeze.

He concluded, “It will be very interesting to see how this resolves. One thing is clear—Bybit traders are more bullish than Binance traders.”

Financial commentator Tedtalksmacro illustrated the impact of the squeeze on Binance, where short open interest had disappeared.

At the time of writing on November 8th, BTC/USD was trading at $35,300, with open interest still exceeding $15 billion, according to data from on-chain monitoring resource CoinGlass.

The cryptocurrency market remained dynamic and full of surprises, with traders closely monitoring various indicators to make informed decisions.

Lawyers overseeing the FTX bankruptcy case are currently exploring potential offers that could eventually result in the revival of the troubled cryptocurrency exchange.

During an October 24th hearing at the United States Bankruptcy Court in Delaware, Kevin Cofsky, a restructuring and liability management specialist from Perella Weinberg Partners, revealed ongoing negotiations with several interested parties looking to acquire the company.

Cofsky informed Judge John Dorsey that, among the initial 70 inquiries, three final buyers have emerged. However, the precise structure of the sale and the nature of the exchange post-sale remain unclear.

The prospect of resurrecting the FTX brand faces significant challenges due to the severe damage it has suffered in terms of reputation. Experts in the cryptocurrency industry express skepticism about the feasibility of a simple reboot of FTX.

Debra Nita, a senior crypto public relations strategist at YAP Global, opined that FTX’s brand may be too damaged to recover fully.

She highlighted factors such as the extent of the scandal, the state of business operations during the downfall, and the response post-failure as critical determinants of a brand’s ability to recover.

With millions of customers suffering financial losses and former CEO Sam Bankman-Fried found guilty of fraud, FTX’s situation is dire.

Historical examples of financial misconduct by exchanges show that rebuilding investor trust is exceptionally challenging.

READ MORE: FTX Seeks Court Approval to Sell $744 Million in Trust Assets Amid Bankruptcy Proceedings

Some companies, like Enron, MF Global, and Mt. Gox, faced such profound failures that recovery was nearly impossible due to the extent of the damage.

In contrast, companies like Wells Fargo, which faced a major scandal in 2016, were able to recover their reputation by taking swift corrective action, reimbursing affected customers, and implementing internal ethics procedures.

Bitfinex, a cryptocurrency exchange that lost a significant amount of Bitcoin in a 2016 hack, managed to recover by taking decisive action and implementing a haircut on customer accounts.

Regarding FTX’s potential relaunch, Cofsky mentioned various possibilities, including acquiring legacy exchange assets, forming partnerships, or selling the customer database to another exchange while abandoning the FTX brand.

Preserving the anonymity of FTX customers is a contentious issue being debated in court. Katie Townsend, representing the Reporters Committee for Freedom of the Press, argued for public disclosure of affected customer names, while Cofsky contended that such disclosure would jeopardize the sale.

The complexity of selling FTX is underscored by challenges such as ascertaining whether customers would want to trade on a revived FTX and the difficulty of converting the inactive customer database back into active users.

Given the historical difficulties faced by compromised exchanges, successfully relaunching FTX appears to be a formidable task.

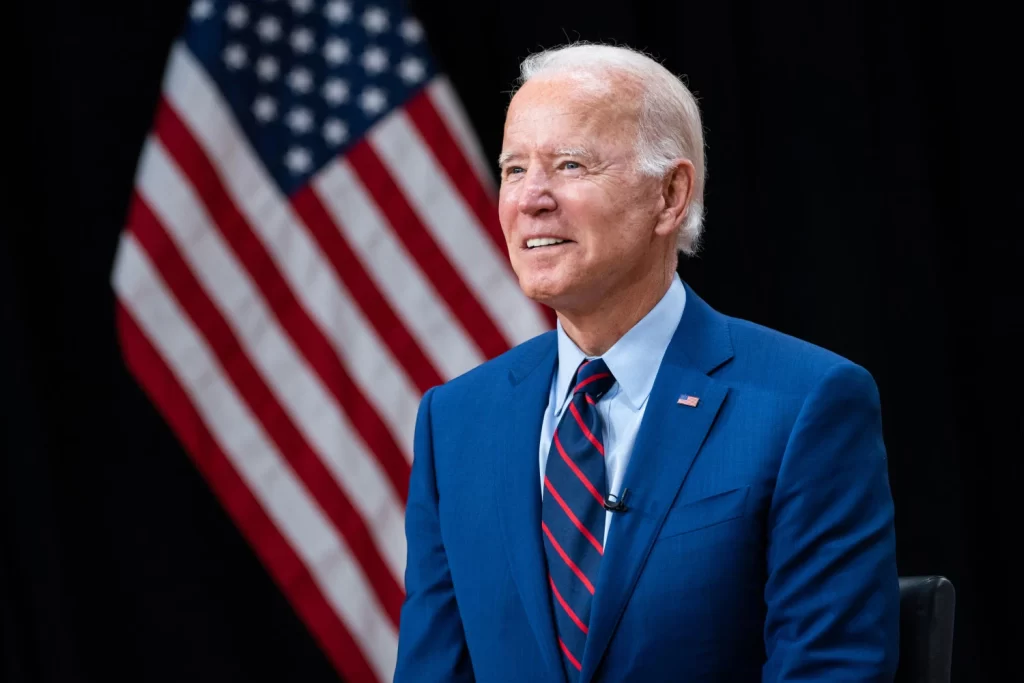

On October 30, President Joe Biden issued a comprehensive executive order aimed at safeguarding citizens, government entities, and companies by establishing stringent artificial intelligence (AI) safety standards.

This order introduces six new standards for AI safety and security, along with promoting ethical AI utilization within government agencies, all in alignment with the principles of “safety, security, trust, openness.”

Among its mandates, the executive order mandates the sharing of safety test results with officials for companies developing “foundation models posing significant risks to national security, economic security, or public health.”

It also emphasizes the acceleration of privacy-preserving techniques in AI development. However, the absence of specific implementation details has raised concerns in the industry about potential implications for top-tier model development.

Adam Struck, a founding partner at Struck Capital and an AI investor, highlighted the order’s seriousness in recognizing AI’s transformative potential across industries.

Yet, he noted the challenges faced by developers in predicting future risks based on assumptions about products that are not fully developed, particularly in the open-source community where the order lacks clear directives.

However, Struck also mentioned that the administration’s intention to manage these guidelines through AI chiefs and governance boards within regulatory agencies implies that companies operating within those agencies should adhere to regulatory frameworks that the government finds acceptable, emphasizing data compliance, privacy, and unbiased algorithms.

READ MORE: FTX Seeks Court Approval to Sell $744 Million in Trust Assets Amid Bankruptcy Proceedings

The government has already disclosed more than 700 use cases demonstrating its internal use of AI through the “ai.gov” website.

Martin Casado, a general partner at venture capital firm Andreessen Horowitz, expressed concerns about the executive order’s potential impact on open-source AI.

He, along with other AI researchers, academics, and founders, sent a letter to the Biden administration, asserting that open source is crucial to ensuring software remains safe and free from monopolies.

The letter criticized the order’s broad definitions of certain AI model types and raised concerns about smaller companies facing challenges in meeting requirements designed for larger firms.

Jeff Amico of Gensyn echoed these sentiments, calling the order detrimental to innovation in the U.S.

Matthew Putman, CEO and co-founder of Nanotronics, a global leader in AI-enabled manufacturing, stressed the need for regulatory frameworks that prioritize consumer safety and ethical AI development.

He urged regulators to consider the potential for overregulation, drawing parallels with the cryptocurrency industry.

Putman also emphasized that the fears of AI’s catastrophic potential are exaggerated, as the technology is more likely to bring positive impacts than destructive outcomes.

He pointed out that innovative AI applications, especially in advanced manufacturing, biotech, and energy, are driving a sustainability revolution with improved processes that reduce waste and emissions.

While the executive order is still fresh, the U.S. National Institute of Standards and Technology and the Department of Commerce have initiated the Artificial Intelligence Safety Institute Consortium, seeking members to contribute to AI safety efforts.

The metaverse, once a hot topic among global tech leaders, has lost some of its mainstream appeal over the past two years. However, shortcomings in testing various investments and initiatives within this emerging technology have led to several failures.

During the recent Cardano Summit in Dubai, Sandra Helou, CEO of MetaMinds Group, expressed her views on the metaverse’s challenges. She highlighted the lack of tailor-fit business models for enterprises as the biggest failure in the metaverse.

According to her, trying to achieve short-term wins with the metaverse is not the right approach, as it requires a massive overhaul of business visions, teams, and models. Many projects failed because they did not get their business models right.

KPMG’s recent report revealed that only 29% of tech leaders in the UAE and 37% globally believe the metaverse will play a crucial role in achieving short-term business success.

Most tech leaders are turning to artificial intelligence (AI) for the next three years, as they consider the metaverse a long-term vision that demands substantial effort, strategy, dedicated teams, and funding.

Earlier this year, Business Insider published an article titled “RIP metaverse, we hardly knew ye,” suggesting that the once-promising technology had died after being abandoned by the business world.

READ MORE: Bitcoin Mining Firm Luxor Technology to Launch Innovative Hash Rate-Backed Investment Product

However, builders in the space remain optimistic about the metaverse’s potential to create new user experiences.

When asked about ensuring the longevity and relevance of metaverse projects, Helou emphasized the need to address accessibility and interoperability.

The fragmented nature of the space, where each platform has its own avatar and identity, poses challenges for users.

Helou compared it to changing your physical wallet and clothes every time you enter a different store, highlighting the impracticality of this approach.

To create an interoperable world, builders should align metaverse product lines with user needs, utilize the right blockchain network, and prioritize safety and security for digital identities.

Dubai and the wider UAE have been actively working to attract global crypto firms with crypto-friendly policies.

According to Helou, the jurisdiction’s approach to emerging technologies has made it easier for builders to realize their metaverse visions.

She believes that the UAE will not adopt the same regulatory approach as the United States Securities and Exchange Commission, often described as “regulation by enforcement.”

With the establishment of Dubai’s Virtual Assets Regulatory Authority, the regulator is not micromanaging the Web3 industry, providing a conducive environment for success in the metaverse.

On November 2, the Securities and Futures Commission (SFC) of Hong Kong unveiled a comprehensive set of business requirements pertaining to the issuance of tokenized securities and other investment products.

This initiative was driven by the growing market demand for tokenized investment products in Hong Kong, coupled with the manifold advantages of blockchain technology.

The SFC’s circular delineates 12 key points, with a primary focus on four crucial aspects: tokenization arrangements, disclosure practices, intermediaries involved, and the competence of personnel, all of which are deemed essential for entities seeking eligibility to offer tokenized securities-related activities.

The primary motivation behind the tokenization of SFC-authorized investment products is the surging market demand, paralleled with the government’s determination to foster market expansion.

As long as the underlying product complies with all applicable product authorization prerequisites and incorporates additional safeguards to address associated risks, the SFC expressed its endorsement of the “primary dealing of tokenized SFC-authorized investment products” through a transparent approach.

Providers entering this domain are obligated to shoulder full responsibility for their tokenized offerings. This entails ensuring robust record-keeping mechanisms, operational soundness, and the implementation of effective controls.

READ MORE: FTX Seeks Court Approval to Sell $744 Million in Trust Assets Amid Bankruptcy Proceedings

The SFC has made it abundantly clear that “Product Providers should not use public-permissionless blockchain networks without additional and proper controls.”

Regarding disclosure requisites, providers are mandated to transparently specify whether settlements occur off-chain or on-chain, and they must continuously validate token ownership.

Moreover, the SFC stipulates that providers must have at least one proficient staff member equipped with relevant experience and expertise to oversee the tokenization process and manage the new risks associated with ownership and technology.

In spite of federal endeavors to encourage the tokenization of investment products, interest in cryptocurrencies among Hong Kong residents has seen a notable decline.

According to a survey conducted by the Hong Kong University of Science and Technology’s business school, the infamous $166-million JPEX scandal has cast a shadow over investor sentiment, with 41% of the 5,700 respondents expressing a reluctance to hold digital assets.

This suggests that while regulatory frameworks are evolving to accommodate tokenized securities, the scars of past crypto-related incidents continue to influence investment decisions among the local populace.

OpenAI has recently made a significant commitment to its business-tier ChatGPT users, pledging to cover their legal expenses in cases of copyright infringement.

This initiative, known as “Copyright Shield,” will apply exclusively to users of OpenAI’s business-tier offerings, including ChatGPT Enterprise and its developer platform, distinguishing it from the free and Plus ChatGPT versions.

During the company’s inaugural developer conference, DevDay, which took place on November 6th, OpenAI’s CEO, Sam Altman, officially unveiled this support.

Altman stated, “We will step in and defend our customers and pay the costs incurred if you face legal claims around copyright infringement, and this applies both to ChatGPT Enterprise and the API.”

OpenAI’s move aligns it with other prominent tech giants such as Microsoft, Amazon, and Google, who have previously offered legal assistance to users accused of copyright violations.

Additionally, Adobe and Shutterstock, renowned stock image providers venturing into generative AI, have made similar commitments.

READ MORE: Germany’s 3rd Largest Bank Launches Blockchain-Based Digital Assets Custody Platform

Furthermore, OpenAI disclosed several other notable developments during DevDay. Users will soon have the capability to create customized ChatGPT models, which can subsequently be sold on an upcoming app store. This innovation marks a significant expansion of the platform’s functionality.

Additionally, OpenAI introduced a new and enhanced AI model, ChatGPT-4 Turbo, signaling their ongoing commitment to advancing AI capabilities.

However, it’s essential to acknowledge that OpenAI has been grappling with several lawsuits alleging the improper use of copyrighted material to train its AI models.

Notably, comedian and author Sarah Silverman, alongside two others, filed a lawsuit against OpenAI in July.

They claimed that ChatGPT’s training data included their copyrighted work, which had been obtained from illegal online sources.

OpenAI faced further legal challenges in September, with a class action suit accusing the company, along with Microsoft, of utilizing stolen private information for model training.

Additionally, the Author’s Guild filed a lawsuit against OpenAI, alleging “systematic theft” of copyrighted materials.

In conclusion, OpenAI’s commitment to cover legal costs for business-tier ChatGPT users embroiled in copyright infringement disputes represents a significant step in protecting its clientele.

While the company faces legal challenges, it continues to expand its offerings and capabilities in the field of AI.

A US lawmaker, Representative Tim Burchett, has put forth a bold proposal to slash Securities and Exchange Commission (SEC) Chair Gary Gensler’s salary to a mere $1 per year as part of a broader plan to defund the regulatory agency.

This proposition is contained in an amendment to the Financial Services and General Government (FSGG) bill, a comprehensive piece of legislation introduced on July 13, with the aim of substantially reducing government expenditures across various sectors.

Currently, Gary Gensler receives an annual salary estimated to exceed $300,000 for his role as SEC Chair. Burchett’s move is not isolated, as the FSGG bill seeks to curtail funding for multiple government agencies.

Representative Steve Womack, while presenting the bill to the House Rules Committee on November 6, argued that the SEC and other agencies had become victims of regulatory overreach, placing an excessive financial burden on the government.

Womack’s perspective is that defunding the SEC would serve as a means to curtail its regulatory “intrusiveness” and refocus the agency on its primary mission.

READ MORE: Bitcoin ETF Anticipation Sparks Resurgence in Blockchain Gaming Enthusiasm

He stressed, “Specifically, we turn off rulemakings at the Securities and Exchange Commission that lack proper cost-benefit analysis and aggregate impact analysis.”

He also acknowledged the importance of the agencies under their jurisdiction but criticized their deviation from their intended mandates, asserting that such deviations have been detrimental to the American public.

It’s worth noting that this isn’t the first instance of Gary Gensler and the SEC facing criticism from US politicians.

Back on June 12, US Representatives Warren Davidson and Tom Emmer introduced the SEC Stabilization Act to the House of Representatives.

One of the key provisions of this bill aimed to oust Gensler from his position as SEC Chair, redistributing the agency’s power between the chair and commissioners.

Additionally, it proposed the creation of an executive director role and the addition of a sixth commissioner to prevent any single political party from holding a majority influence.

Davidson and Emmer have been vocal critics of Gensler’s leadership at the SEC, with Emmer characterizing him as a “bad faith regulator” and accusing him of disproportionately targeting the crypto community with enforcement actions while neglecting more significant wrongdoers.

These ongoing debates and legislative efforts reflect the contentious atmosphere surrounding the SEC’s role and leadership within the US government.

The Virtual Assets Regulatory Authority (VARA), established in March 2022, has emerged as a pioneering force in the world of cryptocurrency regulation, bolstering Dubai’s position as a global hub for virtual assets and related services.

VARA’s commitment to fostering the crypto sector is underscored by its recent release of comprehensive regulations tailored for virtual asset service providers (VASPs).

In February, VARA unveiled a meticulous regulatory framework comprising four obligatory rulebooks and activity-specific guidelines for VASPs, exclusive to operations within the Dubai region.

Additionally, VARA introduced a rulebook addressing the marketing, advertising, and promotional practices employed by VASPs.

Deepa Raja Carbon, Managing Director and Vice Chair at VARA, shed light on the regulatory body’s approach to digital assets and its distinctive success compared to global counterparts.

Carbon emphasized VARA’s agility, collaborative spirit, and ability to swiftly adapt to market dynamics as key strengths.

She articulated VARA’s philosophy, which seeks to establish a universal threshold of excellence rather than a minimal standard baseline, thereby elevating and scaling the entire crypto ecosystem.

Carbon elaborated on VARA’s unique approach to regulation, stating, “VARA is setting a precedent for how regulators can work in cohort with the market, dynamically adjusting to its pulse to sculpt a regulatory environment that is robust, resilient, and responsive: the 3R-Pyramid.”

READ MORE: Bitcoin Mining Firm Luxor Technology to Launch Innovative Hash Rate-Backed Investment Product

This synergy of speed, collaboration, and unwavering commitment to quality, according to Carbon, defines VARA’s progress and promises to usher in a new era of borderless economic opportunity with minimized cross-border risks.

VARA’s journey in crafting guidelines for the nascent virtual asset industry was not without its challenges. Carbon acknowledged the inherent complexity of the task and highlighted VARA’s rigorous analysis of existing frameworks and lessons learned from other regulators.

To address these challenges, VARA adopted an inherently consultative and collaborative approach, engaging with a diverse range of stakeholders, including industry leaders, innovators, peer regulators, legislators, and the general public.

Carbon emphasized the importance of guidelines that are both comprehensive and aligned with market realities.

Collaborating closely with established entities like DET and the DFZC for Mainland, as well as various free zones in Dubai, VARA has meticulously crafted a unified and adaptable framework.

VARA’s crypto regulations aspire to position Dubai as a prominent destination for digital asset businesses, echoing the broader trend of Middle Eastern and Asian countries vying to attract cryptocurrency enterprises.

In this evolving landscape, Hong Kong has also made significant strides in 2023 by introducing regulatory guidelines aimed at crypto platforms serving both retail and institutional clients.

In a recent alarming incident, Monero’s community crowdfunding wallet fell victim to a devastating attack, leading to the complete depletion of its balance, which amounted to 2,675.73 Monero (XMR), equivalent to nearly $460,000.

Although the attack transpired on September 1st, the Monero community only became aware of it when Monero developer Luigi disclosed the incident on GitHub on November 2nd.

Regrettably, the source of this security breach remains unidentified, casting a shadow of uncertainty over Monero’s community.

Luigi revealed the grim details, stating, “The CCS Wallet was drained of 2,675.73 XMR (the entire balance) on September 1, 2023, just before midnight.

The hot wallet, used for payments to contributors, is untouched; its balance is ~244 XMR. We have thus far not been able to ascertain the source of the breach.”

Monero’s Community Crowdfunding System (CCS) plays a pivotal role in financing development proposals from its members, and this ruthless attack has far-reaching consequences.

One Monero developer, Ricardo “Fluffypony” Spagni, voiced his outrage, emphasizing,

READ MORE: BTC Digital Expands Bitcoin Mining Fleet with 220 New Units

“This attack is unconscionable, as they’ve taken funds that a contributor might be relying on to pay their rent or buy food.”

The intriguing aspect of this incident is that Luigi and Spagni were the only individuals with access to the wallet’s seed phrase. Luigi’s post disclosed that the CCS wallet was established on an Ubuntu system back in 2020, alongside a Monero node.

Payments to community members were made using a hot wallet situated on a Windows 10 Pro desktop since 2017.

The hot wallet was replenished as needed from the CCS wallet. However, on September 1st, a series of nine transactions drained the CCS wallet completely, leaving Monero’s core team grappling with the aftermath.

There is a suspicion that this attack may be connected to a series of ongoing attacks since April, which have exploited various compromised keys, including Bitcoin wallet.dats, seeds generated by diverse hardware and software, Ethereum pre-sale wallets, and now Monero XMR.

Some developers speculate that the breach may have originated from the wallet keys being exposed online via the Ubuntu server.

In light of these developments, the Monero community faces a challenging road ahead, with many unanswered questions surrounding the security of their funds and the potential vulnerabilities that led to this catastrophic incident.

The call has been made for the General Fund to assume responsibility for addressing the current liabilities arising from this disheartening breach.

The anticipation surrounding the potential approval of a Bitcoin exchange-traded fund (ETF) is not only driving up Bitcoin prices but also fueling a renewed enthusiasm for blockchain-based games, according to Animoca Brands founder Yat Siu.

Speaking during Hong Kong Fintech Week, Siu emphasized that the recent price surges in various cryptocurrencies have rekindled investor confidence in the Web3 gaming sector, resulting in increased on-chain activity.

Siu highlighted that token values play a crucial role in instilling confidence among users and providing utility beyond mere monetary gains.

He stressed that confidence in what one owns is just as essential as the financial aspect of investments.

Siu pointed out that when an industry or a country fails to grow despite high prices, people can lose faith in it.

Measuring investor confidence is not a straightforward task, but Siu argued that assessing growth and conviction in the GameFi sector is best achieved by examining on-chain activity closely.

Instead of relying solely on token prices to gauge success, he urged investors to consider various factors, similar to assessing a country’s economy through multiple indicators.

READ MORE: BTC Digital Expands Bitcoin Mining Fleet with 220 New Units

Recent data backs Siu’s assertions. Over the past month, Axie Infinity, the most popular blockchain-based game in Animoca’s portfolio, witnessed a 50% increase in transaction activity and a 14% rise in trading volume, as reported by DappRadar.

Siu emphasized that the entire crypto ecosystem remains heavily reliant on Bitcoin’s growth for its overall success, even as many crypto industry players view their offerings as distinct and separate from the broader market.

He described Bitcoin as the reserve currency of Web3, stating that how it’s used, stored, and owned underpins much of the crypto market’s value.

Siu expressed confidence that the approval of a spot Bitcoin ETF would significantly benefit the entire industry by adding legitimacy and attracting new investments from traditional financial institutions.

He predicted that the crypto sector would eventually outgrow its dependence on Bitcoin, similar to how the global economy moved away from the gold standard.

As populations and economies continue to expand, Siu believes that the crypto industry will evolve into more natural and efficient systems.

However, he acknowledged that despite its substantial $1 trillion size, Web3 engagement remains limited to a relatively small global population.