Solana’s SOL token has overtaken Binance’s BNB token to secure the position of the fourth-largest cryptocurrency by market capitalisation.

Over the span of 24 hours leading up to 1:50 pm UTC, SOL experienced a notable surge of 7.56%, reaching a trading value of $112.52, surpassing BNB.

According to CoinMarketCap data, SOL now boasts a market capitalisation of $49.36 billion, which is 1.74% greater than BNB’s $48.5 billion.

This rise in SOL’s price coincided with the Crypto Fear and Greed Index reaching its highest level since November 2021, when Bitcoin soared to $69,000.

Notably, this index surged a day after Bitcoin exceeded $50,000 for the first time since December 2021.

Despite encountering a network outage on February 6, SOL managed to outpace BNB.

The approval of the Pyth DAO Constitution on-chain likely served as a catalyst for this rally.

The proposal aimed to establish the Pyth DAO Constitution as the governing framework for the Pyth DAO, an autonomous organisation overseeing the Pyth Network.

READ MORE: Blockchain Academy Initiative Gains Traction Among Young Entrepreneurs in UAE

Despite the recent setback, SOL has gained 19.99% over the past seven days, albeit remaining 57% lower than its all-time high of $260.06, recorded on November 6, 2021.

Solana Mobile’s Chapter 2 smartphone garnered 100,000 pre-orders by February 12, within a span of less than 30 days.

In contrast, it took Solana nearly a year to sell 20,000 units of its inaugural Solana Saga smartphones.

Following this achievement, the pre-order window for purchasing the new Solana phone for $450 is set to close on February 14, as announced by Solana Mobile.

Shipments of the smartphones are expected to commence in early 2025.

Meanwhile, BNB has been grappling with challenges amid Binance’s regulatory issues.

On February 12, the sentencing date for Binance founder Changpeng Zhao was postponed from February 23 to April 30. Zhao, currently on a $175 million bond, is residing in the United States.

Investors of the Hector decentralised autonomous organisation, HectorDAO, on the Fantom network are demanding control of the protocol’s remaining funds after the team allegedly halted all communications following a Jan. 16 hack that led to $2.7 million in losses.

In a conversation with Cointelegraph, a HectorDAO investor who wishes to remain anonymous stated that the HectorDAO team stopped communicating with its community on Jan. 19.

According to the source, all project social channels were muted in September 2023.

At that time, the HectorDAO team still allowed contact through a Google Group email address. However, the DAO allegedly deleted this group sometime before Jan. 19.

To make matters worse, the hack occurred just as the protocol planned to dissolve itself and return assets to investors. Prior security warnings were allegedly ignored.

According to blockchain security firm CertiK, its researchers informed the HectorDAO team of the “centralisation” risk posed by the “addEligibleWallet” function, the root cause of the exploit, and recommended steps to mitigate this risk.

The HectorDAO team allegedly chose not to implement the recommended changes for unknown reasons CertiK referred Cointelegraph to its official audit report, which stated that the function could be called by any account with moderator privileges.

HectorDAO tells a different version of the story, claiming that the protocol engaged with CertiK to conduct a thorough smart contract security analysis and that, contrary to CertiK’s statement, “all assets were secured in a Redemption Vault prior to the launch of the production claim process.”

Blockchain analysis has since shown that the attacker allegedly had access to the team’s deployer account, implying that the exploit was either an inside job or the result of a private key compromise.

The development team’s last known communication to investors was on Jan. 18, before going quiet.

The story of HectorDAO begins in 2021, when its early investors were allowed to buy the DAO’s token, HEC, at a discount through DAO bonds.

The funds raised through this process went into the DAO’s treasury, where, theoretically, each HEC token represented ownership of a portion of the treasury, which could be reinvested to produce yield for tokenholders.

At its height, the HectorDAO treasury held over $100 million in digital assets.

But troubles began with the onset of the crypto winter.

By 1st May 2023, HEC’s price had collapsed by nearly 99%, according to data from CoinMarketCap. At the same time, the HectorDAO treasury also declined in value.

These difficulties accelerated when the $1.5 billion Multichain bridge hack on 6th July 2023 caused contagion in the Fantom ecosystem.

This led to another $8 million in losses for HectorDAO, as some of its treasury assets depegged from their Ethereum collateral.

After this incident, HectorDAO investors decided to call it quits, voting in July 2023 to liquidate the DAO and return its funds to users.

Despite the vote, however, most of the $16 million held by the treasury at the time of the vote had yet to be distributed to investors by 15th Jan 2024, on the eve of the HectorDAO hack.

On 15th Jan, the HectorDAO team attempted to finally distribute treasury funds by moving them into a new contract from which they could be redeemed.

However, a malicious account immediately transferred $2.7 million worth of assets to itself after depositing only 0.0001 HEC.

READ MORE: Crypto.com Defends Major Sponsorship Deals with F1 and UFC

Shortly afterward, the team shut down the redemption platform, and all remaining assets were moved back to the treasury contract. The redemptions have not been reopened since.

On 18th Jan, the HectorDAO team announced that the redemption platform had been hacked.

“Hector Network regrets to inform you that there has been a security breach when the protocol was redeeming token holders as part of liquidation, and approximately USDC 2.7 million have been stolen on 15 January 2024,” it stated.

The team claimed it was “actively investigating” the breach and would provide updates in the future. In the meantime, it stated, “the redemption process is postponed for now.”

In the wake of the hack announcement, some tokenholders squarely blamed the development team, claiming that the hack was either the work of a rogue developer or a compromised private key.

They argued that the team could no longer be trusted to secure the DAO’s funds.

On 19th Jan, blockchain analyst Lilbagscientist released a detailed post-mortem report on the attack, citing data from Etherscan.

According to them, preparations for the attack began on 16th Dec 2023, when the HectorDAO deployer account sent 0.0001 HEC to the attacker. This 0.0001 HEC sat in the account until 15th Jan.

From 12:32 am UTC through 12:43 am on 15th Jan, a series of 14 transactions were submitted to Ethereum by the HectorDAO team’s Treasury Multisig Wallet.

When confirmed, these transactions resulted in some of the treasury funds being moved to the HectorDAO Temporary Treasury Multisig, while others were sent to the Hector Liquidation Manager.

The Hector Liquidation Manager then swapped some of the tokens for others on a decentralised exchange before sending them to the Temporary Treasury Multisig.

At the end of this process, the entirety of the HectorDAO treasury had been sent to the Temporary Treasury Multisig.

Between 3:14 am and 4:19 am on 15th Jan, an additional 16 transactions were performed by the Temporary Treasury Multisig, moving the funds to the Hector Redemption Treasury contract.

At 5:12 am, the attacker made a token approval, allowing up to 1 HEC to be spent by the Hector Redemption Contract. Immediately afterward, they deposited 0.0001 HEC into the contract.

One minute later, the team’s deployer account whitelisted the attacker’s wallet by calling the addEligibleWallet function on the platform’s Token Vault contract.

This transaction also set the rate of redemption at $2.7 million worth of USD Coin.

At 5:59 am, the attacker called mintWithdraw on the Token Vault contract.

This caused the Hector Redemption Contract to send $2.7 million in USDC to the attacker and burn the 0.0001 HEC that had been deposited. This transaction completed the attack.

The HectorDAO website’s most recent update was posted on 18th Jan. The last paragraph states that the redemption process is “postponed for now.”

“Hector Network is working tirelessly to address this, is committed to maintaining transparency throughout this process and will keep you updated on any developments,” the team wrote.

Meanwhile, HectorDAO investors say that they are considering legal action amid repeated failed efforts to contact the protocol’s developers.

Originally, payments were scheduled for March to compensate investors as the DAO liquidates. An investigation into the hack continues.

Cointelegraph attempted to contact the HectorDAO team for comment but did not receive a response by the time of publication.

Bitcoin (BTC) suffered sudden losses ahead of the Feb. 13 opening on Wall Street, as United States inflation data delivered a blow to risky assets.

Data from Cointelegraph Markets Pro and TradingView tracked a 3.8% decline in BTC price for the day, reaching a low of $48,435 on Bitstamp.

Bitcoin reacted negatively to the January Consumer Price Index (CPI) data, which surpassed expectations.

The month-on-month CPI stood at 0.3%, with the year-on-year figure at 3.1% — exceeding predictions by 0.1% and 0.3%, respectively.

“The index for shelter continued to rise in January, increasing 0.6 percent and contributing over two-thirds of the monthly all items increase.

The food index increased 0.4 percent in January, as the food at home index increased 0.4 percent and the food away from home index rose 0.5 percent over the month,” read an official press release from the U.S. Bureau of Labor Statistics.

“In contrast, the energy index fell 0.9 percent over the month due in large part to the decline in the gasoline index.”

Markets promptly began reevaluating the probability of the Federal Reserve reducing interest rates, postponing expectations from March to later in the year.

The latest figures from CME Group’s FedWatch Tool indicated only an 8.5% likelihood of a rate cut in March, compared to 17.5% on Feb. 12.

READ MORE: Crypto.com Defends Major Sponsorship Deals with F1 and UFC

“This inflation reading was much hotter than expected all around the board,” commented trading resource The Kobeissi Letter on X (formerly Twitter).

“Core CPI was expected to fall and it didn’t while CPI inflation came in 20 bps above expectations. A March rate cut is likely gone.”

Kobeissi noted that avoiding a premature rate cut, which would bolster risky assets including crypto, was the Fed’s “top priority.”

The resurgence of inflows into spot Bitcoin exchange-traded funds (ETFs) did little to stabilize Bitcoin’s situation.

$49,000 remained elusive, while outflows from the Grayscale Bitcoin Trust (GBTC) amounted to around 2,400 BTC ($117 million), according to data from crypto intelligence firm Arkham.

Despite this, popular trader Daan Crypto Trades noted positive trends in ETF flows, which were absorbing BTC supply around twelve times faster than new coins entered the market.

GBTC’s net asset value (NAV) flipped positive relative to Bitcoin for the first time in almost three years last week.

Blowfish, a Web3 security firm, has uncovered two fresh Solana drainers capable of executing bit-flip attacks, as disclosed in an analysis shared on the social media platform X on February 9.

The drainers, Aqua and Vanish, were identified altering a condition within on-chain data even after a user’s private key had authenticated a transaction.

Blowfish revealed that these drainers’ scripts are purchasable for a fee within marketplaces that peddle scam-as-a-service tools.

The Blowfish team elucidated the modus operandi employed by the drainers to manipulate data and pilfer funds:

“On Solana, a dApp can be granted authority to submit a transaction.

If the dApp’s on-chain program incorporates a condition permitting it to transfer the user SOL or drain their account, a drainer could manipulate that condition at any given moment,” the analysis expounded.

Initially, users remain oblivious to the presence of these drainers. The victim signs what seems to be a legitimate transaction.

However, subsequent to obtaining the signature, the drainer temporarily retains the transaction.

“Subsequently, via a separate transaction, they alter the dApp’s condition; it transitions from ostensibly sending SOL to seizing it instead.”

READ MORE: European Commission Proposes Mandate for Tech Platforms to Detect AI-Generated Content

A bit-flip attack represents a form of exploitation where the perpetrator alters the value of certain bits within encrypted data to manipulate a system.

This tactic enables the attacker to modify the encrypted message sans knowledge of the encryption key.

By flipping specific bits, an attacker can sometimes alter a message in a foreseeable manner post decryption.

The Solana ecosystem has witnessed an escalating onslaught from crypto drainers.

According to Chainalysis, a leading online community centred around a single Solana wallet drainer kit boasted over 6,000 members as of January.

Brian Carter, senior intelligence analyst at Chainalysis, previously conveyed to Cointelegraph that the most effective draining kits possess the ability to target numerous assets through diverse means.

Allegedly, the Blowfish team has implemented defensive measures to automatically thwart the newly identified drainers and is actively monitoring on-chain activities.

The FTX debtors’ estate, under the leadership of CEO John Ray III, has submitted an application to sell Digital Custody to CoinList at a substantial reduction of $500,000, with funding provided by Digital Custody’s original CEO and seller, Terence Culver. FTX had originally acquired Digital Custody for $10 million.

As per FTX’s legal submission, the acquisition of Digital Custody was intended to provide custodial services for FTX US and LedgerX.

However, the integration of Digital Custody into the FTX ecosystem was incomplete when former CEO Sam Bankman-Fried filed for bankruptcy in November 2022, just three months after acquiring Digital Custody.

FTX had procured the company through two transactions of $5 million each in December 2021 and August 2022.

FTX has filed a motion to sell Digital Custody for $500,000, a significant markdown from the $10 million it was purchased for, to Terrence Culver, the individual who sold Digital Custody to FTX for $10 million.

A&M (UCC/Ad hoc agrees) says this reflects a fair price for the valuable license from South Dakota that allows it to provide custody.

FTX’s legal team also clarified that since FTX US hasn’t been restarted, Digital Custody holds little value for the estate.

It states, “DCI is no longer useful to the Debtors’ business, given the Debtors’ sale of LedgerX and that it is unlikely for the Debtors to sell or restart FTX U.S..”

Nonetheless, Digital Custody retains a custodial license from the South Dakota Division of Banking.

After assessing three offers, including one from Culver, the debtors opted for the superior offer, considering its ability to swiftly complete the sale and the favourable relationship with Culver, which is anticipated to expedite regulatory approval.

FTX’s legal team indicated that both the committee and the ad hoc committee of non-U.S. customers of FTX.com endorsed the transaction.

READ MORE: European Commission Proposes Mandate for Tech Platforms to Detect AI-Generated Content

However, as part of the agreement, FTX reserves the right to seek a better offer for Digital Custody until three days before the closure.

Failure by the buyer to finalise the deal will incur a reverse termination fee of $50,000.

The now-defunct cryptocurrency exchange FTX has clarified that its restructuring plans do not involve a relaunch of the company but are focused on fully reimbursing customers.

During a court hearing on January 31, FTX lawyer Andy Dietderich stressed that despite exhaustive efforts, there are no plans to revive FTX.

Prior to this, numerous FTX users petitioned a U.S. bankruptcy judge to prevent the collapsed crypto exchange from valuing their cryptocurrency deposits using 2022 prices, claiming that this approach deprived them of the recent surge in crypto prices.

Sunday, February 11th, marks the annual Super Bowl LVIII in the United States, and there’s intrigue within the crypto community regarding rumours of no crypto ads appearing this year, akin to 2023.

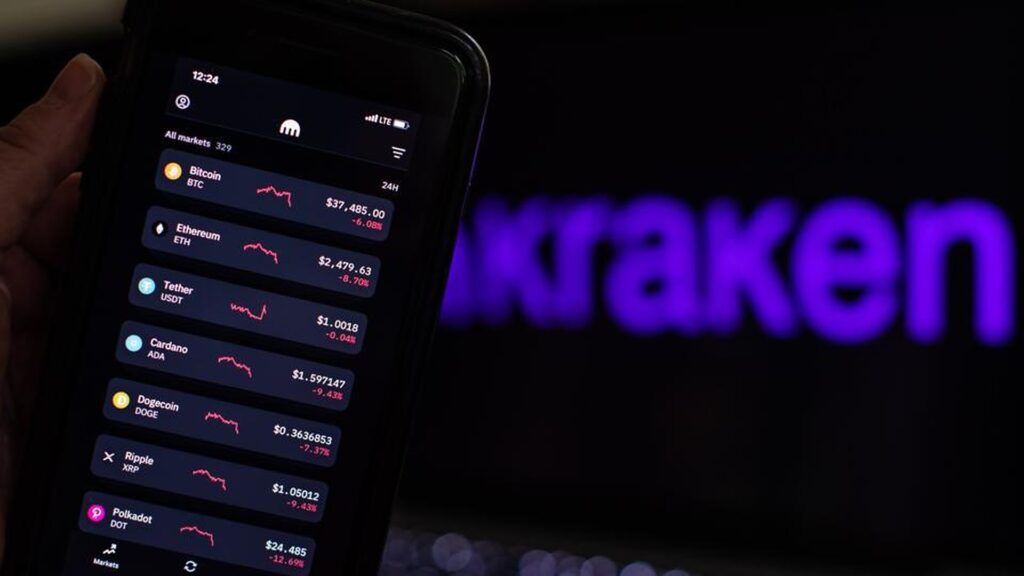

However, an executive of crypto exchange Kraken suggests that the event’s American-centric focus clashes with its global plans.

The now-defunct crypto exchange FTX stood out as a major advertiser during the 2022 Super Bowl, featuring comedian Larry David, just nine months before its collapse.

On February 1st, Cointelegraph reported that David regretted taking part in the FTX promotion, in which he encouraged viewers “not to miss out on the next big thing.”

“So, like an idiot, I did it,” David declared.

In a recent Fox Business report, Kraken’s chief marketing officer, Mayur Gupta, emphasised a transition in crypto advertising, moving away from generating hype toward educating the public about the potential of crypto for the future.

“If the last wave of crypto marketing was all about hype and FOMO [fear of missing out], this current wave has to be rooted in education and awareness for the substance and true value proposition of crypto as a movement that will bring financial freedom and inclusion.”

Furthermore, Gupta pointed out that the Super Bowl mainly caters to an American audience.

He anticipates that the next major wave of crypto users will come from locations worldwide, suggesting the exchange’s preference for events with a more global appeal.

“The Super Bowl is a very US-centric event, and the next wave of crypto users will come from all around the world, not just the United States,” he stated.

Meanwhile, Reuters recently reported that the US federal government is working to increase the global viewership of the Super Bowl this year.

READ MORE: Boosting Your Cryptocurrency’s Brand Before the 2024 Halving

The game will reportedly be broadcast in 190 countries, and the US State Department will help organise watch parties in 30 locations abroad.

According to data from Nielsen, the Super Bowl has reached over 100 million viewers every year since 2010.

There was speculation that with the United States Securities and Exchange Commission (SEC) approving 11 spot Bitcoin exchange-traded funds (ETFs) on January 10th, some asset management firms would consider advertising to the Super Bowl audience.

However, the world’s largest asset manager, BlackRock, reportedly has not secured any advertisement slots for its spot Bitcoin ETF product.

Another recently approved applicant, asset management firm VanEck, recently shared on X that seeing no crypto ads in this year’s Super Bowl will be a positive.

Cointelegraph recently reported that during Super Bowl LVII in 2023, the first game following bankruptcy filings from several crypto firms and a market downturn, crypto advertisements were absent.

According to Paul Hardart, a clinical professor of marketing for New York University’s Stern School of Business, “fun, humour and entertainment” will likely be the theme of ads for Super Bowl LVIII, in a “notable shift away” from artificial intelligence and crypto firms.

The United Nations (UN) is reportedly probing hacking groups linked to the Democratic People’s Republic of Korea (DPRK) for orchestrating cyberattacks on cryptocurrency firms over six years, amassing profits of approximately $3 billion.

As per a recent Reuters report citing unpublished UN documents, an independent sanction committee is overseeing the investigation into the DPRK-linked hacking groups.

The groups purportedly targeted 58 crypto-related firms to aid their weapon of mass destruction (WMD) development work between 2017 and 2023.

“The panel is investigating 58 suspected DPRK cyberattacks on cryptocurrency-related companies between 2017 and 2023, valued at approximately $3 billion, which reportedly help fund DPRK’s WMD development.”

The UN is reportedly expected to release a published report of its findings within the next two months.

In 2023, Chainalysis estimated that the hacking groups pilfered approximately £1 billion worth of crypto from 20 hacks.

READ MORE: FCC Outlaws AI-Generated Robocalls in US Following Surge of Fraudulent Voice Messages

However, there was a notable decrease compared with 2022, when crypto losses from North Korea-linked exploits totalled £1.7 billion across 15 hacking incidents.

Blockchain intelligence firm TRM Labs foresees that this year will witness even more significant damage from hacking groups, as their attack methods are anticipated to advance beyond those of previous years.

“Despite notable advancements in cybersecurity among exchanges and increased international collaboration in tracking and recovering stolen funds, 2024 is likely to see further disruption from the world’s most prolific cyber-thief.”

Meanwhile, Cointelegraph recently reported that the United Nations Office on Drugs and Crime has cautioned that crypto is being misused in illicit economies developing in East and Southeast Asia.

It highlighted poorly regulated or illicit casinos and “pig-butchering” romance scams that have witnessed major growth in the Mekong region.

The European Commission is set to mandate tech platforms such as TikTok, X, and Facebook to detect artificial intelligence (AI)-generated content, aiming to safeguard the upcoming European elections from misinformation.

In a move towards enhancing election security, the commission has launched a public consultation on proposed guidelines for very large online platforms (VLOPs) and very large online search engines (VLOSEs).

The recommendations seek to mitigate the democratic threats posed by generative AI and deepfakes.

Outlined in the draft guidelines are various measures to counter election-related risks, including specific strategies pertaining to generative AI content, pre- and post-election risk mitigation planning, and providing clear directives for European Parliament elections.

Generative AI has the potential to mislead voters and manipulate electoral processes by fabricating and circulating synthetic content that is inauthentic and misleading, including depictions of political figures, events, polls, and narratives.

The draft election security guidelines are presently open for public consultation in the European Union until March 7.

They advocate for alerting users on relevant platforms about potential inaccuracies in content generated by generative AI.

READ MORE: Dencun Upgrade Clears Final Testing Hurdle, Sets Stage for Ethereum Mainnet Deployment

According to the draft, the guidelines also propose directing users to authoritative information sources and advocate for tech giants to implement safeguards against the creation of misleading content that could significantly influence user behaviour.

Regarding AI-generated text, the current recommendation for VLOPs/VLOSEs is to “indicate, where possible, in the outputs generated the concrete sources of the information used as input data to enable users to verify the reliability and further contextualize the information.”

The proposed “best practices” for risk mitigation outlined in the draft guidance draw inspiration from the EU’s recently approved legislative proposal, the AI Act, and its non-binding counterpart, the AI Pact.

Concerns surrounding advanced AI systems, such as large language models, have escalated since the widespread adoption of generative AI in 2023, bringing tools like OpenAI’s ChatGPT into the spotlight.

While the commission has not specified the timeline for companies to label manipulated content under the EU’s content moderation law, the Digital Services Act, Meta announced plans in a company blog post to introduce fresh guidelines concerning AI-generated content on Facebook, Instagram, and Threads in the coming months.

Any content identified as AI-generated, whether through metadata or intentional watermarking, will be visibly labelled.

A cohort of five Republican lawmakers from the United States Senate have lambasted the Securities and Exchange Commission (SEC) for its handling of a lawsuit against Digital Licensing, trading as Debt Box.

In a missive dated February 7 addressed to SEC Chair Gary Gensler, six Republican senators articulated their “significant concerns” regarding the commission’s conduct in the Debt Box affair, contending that the regulator behaved in an “unethical and unprofessional manner.”

The SEC, in filings with the U.S. District Court for the District of Utah, Northern Division, acknowledged in December that it had failed to be “accurate and candid” in asserting that Debt Box shuttered bank accounts and intended to relocate to the United Arab Emirates.

“Whether Commission staff deliberately misrepresented evidence or unwittingly presented false information, this case raises questions about the integrity of other enforcement actions initiated by the Commission,” asserted the senators.

“It is challenging to sustain confidence that other cases are not based on questionable evidence, obfuscations, or outright misrepresentations.”

The six senators—JD Vance, Thom Tillis, Bill Hagerty, Cynthia Lummis, and Katie Boyd Britt—seemingly refrained from prescribing a specific course of action for the SEC going forward, merely voicing their apprehensions.

READ MORE: US Judge Approves Sealed Settlement Between BlockFi and 3AC in Crypto Dispute

They remarked that the SEC’s proposed remedy of mandatory staff training and personnel reshuffling may prove inadequate.

The SEC instigated legal proceedings against Debt Box in July 2023, alleging the company orchestrated an illicit $50 million cryptocurrency scheme.

The court, on the basis of the SEC’s assertions, sanctioned a temporary restraining order to immobilize Debt Box’s assets.

However, subsequent revelations disclosed numerous inaccuracies in the SEC’s claims, prompting the court to threaten sanctions and the commission to seek dismissal of the case.

It remains unclear whether the Republican senators aimed to cast doubt on other enforcement actions targeting cryptocurrency firms by the SEC.

The commission currently has active lawsuits against Binance, Kraken, Ripple, and Coinbase. Cointelegraph reached out to the SEC for comment but received no response at the time of going to press.

Sam Altman, the CEO of the artificial intelligence (AI) developer OpenAI, is reportedly engaging with investors globally to secure trillions of pounds for the development of semiconductor chips.

As per a report by The Wall Street Journal on 8th February, Altman’s endeavour would necessitate fundraising in the range of £5–7 trillion.

Sources close to OpenAI indicate that these funds would alleviate the company’s scaling limitations and address the scarcity and expense of chips crucial for advancing high-level AI systems.

Altman has purportedly been advocating for collaborations between OpenAI and “various investors,” chip manufacturers, and energy suppliers, expressing OpenAI’s willingness to become a “significant customer” of new factories.

An OpenAI spokesperson remarked:

“OpenAI has had productive discussions about increasing global infrastructure and supply chains for chips, energy, and data centres — which are crucial for AI and other industries that rely on them.”

Altman recently conferred with the United States Commerce Secretary Gina Raimondo to deliberate on the initiative, recognising the necessity for involvement from patrons, industry partners, and governments worldwide.

READ MORE: SEC’s New Crypto Regulations Spark Controversy and Legal Challenges

An OpenAI spokesperson affirmed their commitment to keeping the U.S. government informed due to the topic’s significance to the country’s “national priorities.”

The CEO of OpenAI also held discussions with the United Arab Emirates National Security Advisor, Sheikh Tahnoun bin Zayed al Nahyan.

According to insiders, the UAE could play a pivotal role with U.S. government approval.

Masayoshi Son, the CEO of SoftBank, and representatives from chip fabrication firms such as Taiwan Semiconductor Manufacturing, have reportedly engaged in discussions with Altman regarding his project.

An individual familiar with the matter disclosed that Microsoft — a majority stakeholder in OpenAI — is cognisant of the company’s fundraising endeavours and extends support.

In December 2023, reports surfaced indicating OpenAI’s discussions with investors contemplating investments exceeding £100 billion in the company.

Nvidia continues to dominate the market for chips used in AI computation.

Amidst a surge in AI model development over the past year, the company has reported record-breaking revenue and a valuation surpassing £1 trillion.

Meta, a prominent tech conglomerate owning social media platforms Facebook and Instagram, has recently unveiled its entry into the AI chip market.

It introduced its latest chip, “Artemis,” intending to deploy it in its data centres to enhance AI capabilities and lessen reliance on Nvidia.