In October 2023, BlackRock, the world’s largest asset manager, received a noteworthy infusion of $100,000 in seed funding for its Bitcoin (BTC) exchange-traded fund (ETF), as reported in their recent filing with the United States Securities and Exchange Commission (SEC).

The SEC disclosure shed light on the specifics of this investment, revealing that an undisclosed investor had committed to purchasing 4,000 shares at a price of $25.00 per share, totaling $100,000, on October 27, 2023.

This investor also assumed the role of a “statutory underwriter” concerning the Seed Creation Baskets.

Additionally, BlackRock disclosed its strategy for managing sponsor’s fees, indicating that it intends to acquire Bitcoin or cash through short-term trade credit from a trade credit lender.

This approach allows BlackRock to collect its fees via loans, mitigating the need to sell BTC from the ETF assets. Consequently, this method minimizes any significant impact on the BTC price.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

Trade credit settlements are scheduled to transpire on the subsequent business day following the execution date and incur a financing fee.

This fee is calculated at 11%, plus the federal funds target rate divided by 365. For instance, if the federal funds target rate was 5.50% on November 20, 2023, the hypothetical financing fee on borrowed funds would amount to (11% + 5.5%) divided by 365.

Eric Balchunas, an ETF analyst, described these revelations as an intriguing development within the financial sector.

BlackRock emerged as an early pioneer among institutional giants by filing for a spot Bitcoin ETF back in July. Notably, their application is among the 13 awaiting a verdict from the SEC.

Although the SEC has previously rejected applications for spot BTC ETFs, market experts speculate that the agency is likely to grant approval for the first spot BTC ETF in the United States by early 2024, reflecting the growing acceptance and integration of cryptocurrencies into traditional finance.

Phoenix Group, a prominent cryptocurrency mining firm, has achieved a historic milestone by making its debut on the Abu Dhabi Securities Exchange (ADX), marking it as one of the Middle East’s pioneering publicly listed companies in the crypto industry.

This momentous event unfolded on December 5th, with Phoenix Group’s stock initially trading at 2.25 dirhams ($0.6) as per data from the ADX exchange.

Remarkably, this price skyrocketed by an astonishing 50% from the IPO price of 1.50 dirhams ($0.41), as outlined in the Phoenix IPO prospectus.

This momentous public listing follows closely on the heels of Phoenix Group’s immensely successful IPO closure on November 18th, where it garnered a staggering 33 times oversubscription.

During this process, the company managed to sell a substantial 907,323,529 shares, amassing a remarkable sum of around 1.3 billion dirhams ($371 million).

It is worth noting that the retail investors’ portion of the IPO witnessed a jaw-dropping oversubscription of 180 times, while professional investors oversubscribed the offering 22 times.

The primary purpose behind this IPO was to secure funds that would propel Phoenix Group’s future growth and deliver lucrative returns to its investors.

READ MORE: Crypto Hacker Executes $2 Million Heist through Address Poisoning Attacks

CEO Bijan Alizadeh delineated the company’s ambitions, which revolve around four core pillars: spearheading innovation in Bitcoin mining, venturing into renewable energy projects, enhancing advanced manufacturing capabilities, and executing strategic acquisitions.

Phoenix Group, founded in 2015 by Alizadeh and Munaf Ali, has emerged as a significant player in the Middle East’s blockchain landscape, actively collaborating with regional authorities.

A significant milestone in this journey was the August 2023 agreement, where Phoenix signed a pact to construct a $300 million cryptocurrency mining farm in Oman, with the presence of Omani Minister of Transport Saeed Al Maawali and the chairman of the Abu Dhabi Stock Exchange, Hisham Malak.

One of Phoenix’s standout attributes is its unwavering commitment to sustainability in cryptocurrency mining, with a strong emphasis on utilizing renewable energy sources.

As of September 2023, approximately 95% of the company’s power is sourced from renewables, predominantly hydropower.

Further underscoring Phoenix Group’s significance, in October 2023, the Abu Dhabi conglomerate International Holding Company acquired a substantial 10% stake in the firm through its subsidiary, International Tech Group.

This strategic move highlights the growing interest and confidence in the cryptocurrency mining sector within the Middle East region and beyond.

Blockchain analysis firm Lookonchain has revealed that cryptocurrency giants FTX and Alameda Research are currently involved in a significant transfer of digital assets, amounting to an impressive $22 million.

This diverse mix of cryptocurrencies includes $IMX, $GMT, $ETH, UNI, $SHIB, $BAL, $LOOKS, and $WOO.

Since declaring bankruptcy, FTX and Alameda Research have been actively engaged in maneuvering within the cryptocurrency space, transferring substantial amounts of assets to prominent exchanges.

This ongoing activity began in October 2023 and has resulted in a cumulative total of $551 million transferred across 59 different tokens.

In their most recent move, a $10.8 million transfer occurred across platforms such as Wintermute, Binance, and Coinbase.

This transfer involved eight different tokens: $2.58 million in StepN’s GMT, $2.41 million in Uniswap’s UNI, $2.25 million in Synapse’s SYN, $1.64 million in Klaytn’s KLAY, $1.18 million in Fantom’s FTM, $644,000 in Shiba Inu’s SHIB, as well as small amounts of Arbitrum’s ARB and Optimism’s OP.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

On October 24, FTX and Alameda wallets moved $10 million to a single wallet address, which was later distributed to Binance and Coinbase accounts.

Then, on November 14, 2023, a significant transfer of $24 million in cryptocurrency assets occurred across Kraken and OKX exchanges.

This move was enabled by a U.S. court-approved plan that allows them to sell digital assets, initially up to $100 million, with the possibility of increasing it to $200 million, subject to special committee approval.

The initial chapter of this financial saga unfolded in March 2023, with a skillful transfer of $145 million in stablecoins to various platforms, including Coinbase, Binance, and Kraken.

Despite recovering assets exceeding $5 billion, FTX still faces a challenging scenario, burdened by liabilities surpassing $8.8 billion.

The seriousness of this financial strain is evident as FTX and Alameda continue to navigate ongoing liquidations, making significant efforts to address substantial debts while offering some relief to creditors.

The ultimate outcome of this liquidation process remains uncertain, leaving the cryptocurrency community eagerly awaiting the conclusion of this intricate financial story.

AstraZeneca, the pharmaceutical company renowned for its development of a COVID-19 vaccine, is embarking on an exciting new venture.

Teaming up with Absci, a United States-based Artificial Intelligence (AI) biologics firm, they intend to revolutionize cancer treatment through the creation of innovative antibodies.

As of December 3, a report from the Financial Times unveils AstraZeneca’s substantial commitment to this partnership, with investments totaling up to a staggering $247 million.

This substantial sum encompasses research and development expenses, milestone payments, and an initial upfront fee for Absci.

Their collective goal is to craft a cutting-edge generative AI model, specifically geared towards generating novel antibody therapeutics for cancer.

The report, however, remains discreet regarding the specific types of cancer that will be targeted.

Absci’s claims on their website shed light on their impressive AI capabilities, asserting their ability to screen “billions of cells” on a weekly basis.

Furthermore, they boast the capability to progress from antibodies to wet “lab-validated candidates” in an astonishingly brief six-week timeframe.

Currently, Absci is actively involved in 17 distinct projects. AstraZeneca’s Senior Vice-President, Puja Sapra, emphasizes the invaluable role of AI in advancing their biologics discovery process.

Sapra elucidates that AI not only accelerates the pace of discovery but also diversifies the range of biologics they can uncover.

READ MORE: North Korean Hackers Steal $3 Billion in Cryptocurrency

Absci’s CEO, Sean McClain, has publicly confirmed the partnership, highlighting AstraZeneca’s pivotal role in amplifying the impact of their AI initiatives, according to a report by Reuters.

While Cointelegraph reached out to Absci for additional insights, a response from the firm is yet to be received.

The collaboration between AstraZeneca and Absci underscores the increasing momentum of AI within the healthcare sector.

AI’s potential to expedite groundbreaking research and enhance data analysis accuracy has not gone unnoticed.

In a recent development, Hong Kong’s Hospital Authority introduced an AI pilot program designed to combat multidrug-resistant organisms or “superbugs.”

This AI system evaluates clinical data to determine the necessity of prescribing antibiotics, ultimately addressing the overuse of antibiotics that has contributed to the rise of these resistant superbugs in the region.

In conclusion, the strategic alliance between AstraZeneca and Absci is poised to harness the power of AI in the fight against cancer.

With substantial investments and cutting-edge technology at their disposal, the prospects for innovative antibody therapeutics appear promising.

This collaboration exemplifies the growing influence of AI in revolutionizing healthcare research and treatment methodologies.

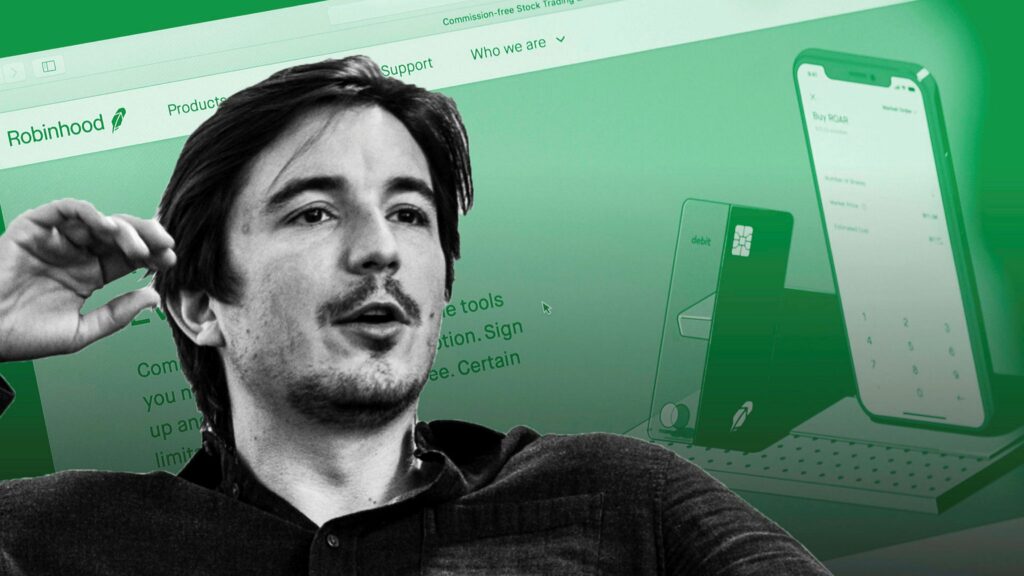

Robinhood, the crypto-friendly trading platform, has experienced a significant surge in digital asset trading volume in November, reporting a staggering 75% month-on-month increase.

This exciting development was disclosed in a Form 8-K filing submitted to the United States Securities and Exchange Commission (SEC) on December 4th, where Robinhood explicitly stated, “November Crypto Notional Trading Volumes were roughly 75% above October 2023 levels.”

While the crypto sector witnessed this remarkable upswing, it did not have a corresponding impact on equity and options contract trading volumes, which remained relatively flat compared to the previous month.

This impressive performance in November marks a noteworthy turnaround for Robinhood, which had reported a substantial 55% decline in cryptocurrency notional volumes over the course of the year in its Q3 results filing. Consequently, its Q3 revenue fell below analyst estimates, standing at $467 million.

Transaction-based revenues also experienced an 11% year-on-year decrease to $185 million, largely attributed to the decline in crypto volumes throughout 2022.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

However, with the recent crypto market rally that has seen the total capitalization surge by 40% to reach $1.6 trillion in just two months, Robinhood appears poised for a more profitable fourth quarter.

CEO Vlad Tenev had previously hinted at the platform’s potential, suggesting that it could eventually generate “nine figures” in annual revenue during an earnings call in November.

Tenev noted that retail investors were showing renewed interest in crypto, explaining, “You’re starting to see retail investors wake up to certain segments of the rally, and in crypto activity, you’re seeing a groundswell.”

Despite a fluctuating stock performance, Robinhood’s stock prices have risen by 18% since the start of 2023. However, the company’s stock had been on a downward trend since mid-July after reaching its 2023 peak at just over $13.

As of the time of writing, Robinhood’s stock was trading at $9.95 in after-hours trading, following a 2.5% daily gain.

Furthermore, Robinhood has ambitious plans for expansion, including launching equities in the United Kingdom markets and venturing into futures trading in 2024, contingent upon regulatory approval.

Notably, in August, it was reported that Robinhood had accumulated 118,000 BTC, valued at approximately $3 billion at that time.

The Arbitrum DAO has given the green light for the allocation of millions of extra tokens to finance all the projects approved in its most recent Short-Term Incentive Program (STIP), significantly augmenting its budget by a substantial $23.4 million.

This momentous decision, ratified by the Arbitrum community during the voting period spanning from November 18 to December 2, was aimed at dispersing additional funds to projects that had previously secured grants but were unable to secure funding due to the STIP’s imposed cap of 50 million ARB tokens.

As a result of the recent vote, an impressive 21.1 million ARB tokens, with a total value of $23.4 million, will be allocated to an additional 26 projects.

The approval of this supplementary capital was achieved with 216.7 million votes in favor, outnumbering the 73.1 million votes against, thus bolstering the STIP’s overall budget to a substantial 71.4 million ARB tokens.

This enhanced budget will support a total of 56 projects, all geared towards fostering a diverse and inclusive environment for emerging builders and new projects alike.

Arbitrum stands as a layer-2 network designed to enhance the scalability of transactions on the Ethereum blockchain, making it possible to transfer funds more expeditiously and at a lower cost.

The governance of this protocol is entrusted to ARB token holders, with revenue generated primarily through transaction fees.

READ MORE: British Legislators Urge Cautious Approach to Retail Digital Pound Implementation

DefiLlama data has highlighted Arbitrum’s remarkable financial performance, with a staggering $180,165 in fees and $43,342 in revenue generated on December 1 alone.

In the preceding month of November, the protocol raked in $5.93 million in fees, complemented by revenue reaching $1.47 million.

The expanded budget now encompasses funding provisions for notable projects such as Gains Network (4.5 million ARB), Wormhole (1.8 million ARB), and Stargate Finance (2 million ARB).

It’s worth noting that PancakeSwap withdrew a proposal requesting 2 million ARB tokens due to the STIP’s Know Your Customer (KYC) requirements.

However, it’s important to acknowledge that the decision to allocate additional funding was not without its share of controversy.

Delegates from MUX protocol voiced their concerns, arguing that the injection of extra funds could potentially mix projects of varying quality.

They emphasized the importance of supporting proposals with solid protocol fundamentals, proper incentive execution strategies, and reasonable grant sizes, but not necessarily in a bundled format with proposals of mixed quality.

In addition, some members of the Arbitrum DAO contended that a full second round, rather than a backfund, would have constituted a more equitable approach for including additional protocols in an incentives program.

Jason Lowery, a member of the United States Space Force, has called for a formal investigation into the use of proof-of-work (PoW) networks, such as Bitcoin (BTC), to enhance the country’s cybersecurity defenses.

In a letter addressed to the U.S. Defense Innovation Board on December 2nd, Lowery emphasized that Bitcoin, often perceived as a monetary system, possesses the capability to secure various forms of data and communication, thereby contributing significantly to national security.

The Defense Innovation Board, an independent advisory body, focuses on bringing Silicon Valley’s technological innovations and best practices to the U.S.

Military. Lowery’s letter urges the board to advise the Secretary of Defense to assess the “national strategic importance” of PoW systems like Bitcoin.

Lowery argues that PoW systems, like Bitcoin, can act as a deterrent against cyberattacks due to their resource-intensive nature, imposing steep costs on potential adversaries.

He draws parallels between PoW and physical security strategies employed in land, sea, air, and space domains, emphasizing the digital dimension in which PoW operates.

Highlighting the immense potential of Bitcoin in the realm of cybersecurity, Lowery contends that leveraging this technology is crucial for the United States to maintain its position as a global superpower, particularly in an era marked by digital interconnectedness and security vulnerabilities.

READ MORE: KyberSwap’s Treasury Grants: A Decentralized Response to $48.8 Million Security Breach

He suggests that this could mark the beginning of a “cybersecurity revolution,” utilizing the global electric power grid as a “macrochip” to safeguard data and messages traversing the internet.

Lowery concludes by underscoring the alignment of Bitcoin’s cybersecurity applications with a strategic offset, expressing concern that the U.S. Department of Defense may have lost valuable time by not incorporating it into its arsenal.

Additionally, Coinbase CEO Brian Armstrong has weighed in on the role of Bitcoin and cryptocurrencies in preserving the United States’ dominance with the U.S. dollar.

Armstrong suggests that Bitcoin can complement the dollar, serving as a natural check and balance.

He points out that as world leaders grapple with issues like inflation and increased deficit spending, cryptocurrencies could emerge as an alternative currency, particularly if the U.S. dollar were to lose its dominance.

Armstrong believes that cryptocurrencies like Bitcoin offer a viable alternative, and people may shift from fiat currencies to cryptocurrencies as a hedge against inflation.

Furthermore, Armstrong highlights the importance of U.S. dollar-backed stablecoins, such as USD Coin (USDC), and the emergence of flat coins in bridging the gap between traditional finance and the cryptocurrency world, ultimately contributing to a more unified financial landscape.

In the past week, a crypto hacker specializing in “address poisoning attacks” has orchestrated thefts exceeding $2 million from Safe Wallet users alone, bringing the total number of victims to 21.

This alarming revelation was disclosed by the Web3 scam detection platform, Scam Sniffer, on December 3.

Over the course of a week, approximately ten Safe Wallets fell victim to address poisoning attacks, resulting in losses totaling $2.05 million since November 26.

Scam Sniffer has compiled data from Dune Analytics, revealing that this same attacker has pilfered a substantial sum of at least $5 million from approximately 21 victims over the past four months.

Astonishingly, one victim had a whopping $10 million in cryptocurrency stored within a Safe Wallet, though they were “fortunate” to have only lost $400,000 of it.

Address poisoning attacks involve the creation of a deceptively similar-looking address to one where a targeted victim frequently sends funds.

Typically, this involves replicating the initial and concluding characters of the legitimate address.

The hacker then sends a small amount of cryptocurrency from the newly-created wallet to the intended victim to “poison” their transaction history.

Consequently, an unsuspecting victim may inadvertently copy the fraudulent address from their transaction history and transfer funds to the hacker’s wallet instead of the intended destination.

Cointelegraph has reached out to Safe Wallet for comments on this concerning matter.

READ MORE: US District Judge Warns SEC of Sanctions Over Deceptive Claims in DEBT Box Crypto Case

This attacker executed a high-profile address poisoning attack on November 30, resulting in a loss of $1.45 million in USDC for the real-world asset lending protocol, Florence Finance.

It is worth noting that blockchain security firm PeckShield, which reported the incident, demonstrated how the attacker potentially deceived the protocol by having both the poison and genuine addresses commence with “0xB087” and conclude with “5870.”

In November, Scam Sniffer revealed that hackers had been exploiting Ethereum’s ‘Create2’ Solidity function to circumvent wallet security alerts.

This tactic led to Wallet Drainers illegally acquiring around $60 million from nearly 100,000 victims over a six-month period.

Address poisoning emerged as one of the techniques employed by these malicious actors to amass their ill-gotten gains.

The ‘Create2’ function pre-calculates contract addresses, allowing malevolent actors to generate new, indistinguishable wallet addresses.

These addresses are subsequently deployed after the victim approves a fraudulent signature or transfer request.

SlowMist’s security team has reported that a group has been using ‘Create2’ since August to systematically siphon nearly $3 million in assets from 11 victims, with one unfortunate victim losing as much as $1.6 million.

The crypto community remains on high alert as these address poisoning attacks continue to pose a significant threat.

Gold and Bitcoin have both hit remarkable milestones, making headlines in the financial world. Gold soared to an unprecedented all-time high of $2,100 during the Asian trading session on December 4th.

Simultaneously, Bitcoin experienced a remarkable surge, surpassing $41,000 for the first time in 19 months.

Bitcoin’s resurgence above the $40,000 mark, a level last seen in April 2022, was accompanied by a rapid 2% increase over a 24-hour period.

This surge marked a 19-month high for the cryptocurrency, bringing its year-to-date gains to an astonishing 140%.

Markus Thielen, the head of research at Matrixport, has provided optimistic insights into Bitcoin’s future.

Drawing on historical trends, Thielen predicts that Bitcoin could surpass $60,000 by April of the following year and potentially reach as high as $125,000 by the end of 2024.

These projections are anchored in the recurring pattern of price surges leading up to Bitcoin halving events, with an anticipated surge of over 200%.

READ MORE: KyberSwap’s Treasury Grants: A Decentralized Response to $48.8 Million Security Breach

Adding to the excitement, there is growing anticipation surrounding the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States.

With 13 bidders vying for approval, including industry giants like BlackRock and Grayscale, all eyes are on the Securities and Exchange Commission (SEC) for a decision.

Bloomberg’s ETF analysts believe that there is a high likelihood of simultaneous approvals for all pending bids by January 10th.

Such approvals would mark a new era of institutional involvement in Bitcoin and potentially provide a significant boost to its price.

Bitcoin analyst Willy Woo expressed his optimism by comparing the situation to the launch of the first commodity ETF, SPDR Gold Trust, which led to an eight-year rally in gold prices from 2005 to 2012.

This historical precedent suggests that Bitcoin’s recent climb above $40,000 reflects a bullish sentiment driven by the imminent approval of a spot Bitcoin ETF in January and the potential for broader regulatory advancements.

Additionally, Bitcoin’s upcoming halving event is expected to provide further upward momentum for its price over the next five months.

Overall, both gold and Bitcoin are riding high, with investors closely watching their upward trajectories.

Binance CEO Richard Teng has emphasized that the cryptocurrency exchange has moved past its historical compliance issues and is now a “totally different” entity.

Teng, who assumed the CEO role on November 21 after Changpeng ‘CZ’ Zhao resigned due to charges brought by the U.S. Department of Justice, explained that as part of the settlement, CZ cannot be involved in the day-to-day operations of the company.

In an interview with Cointelegraph, Teng expressed his enthusiasm for leading the world’s largest cryptocurrency exchange and stated his commitment to working closely with global regulators to advance Binance’s growth agenda.

He believes that the regulatory concerns that have plagued Binance in recent months are starting to dissipate after the exchange agreed to a $4.3 billion settlement with U.S. authorities for various violations of U.S. regulations and sanctions programs.

Teng acknowledged that Binance’s early compliance practices had shortcomings, leading to the significant settlement.

However, he stressed that the security and safety of user funds have always been a top priority, and no allegations of misappropriation of user funds were made by U.S. authorities during their scrutiny.

The settlement requires Binance to undertake ongoing compliance efforts, including a five-year monitorship and steps to ensure the company’s complete withdrawal from the United States.

While Teng did not delve into details about Binance.US’s legal battle with the U.S. Securities and Exchange Commission (SEC), he asserted that the company had accounted for the costs associated with meeting settlement requirements and addressing the SEC case.

READ MORE: Bitcoin ETFs Set to Revolutionize Crypto Market Entry and Propel Prices in 2024

Teng could not comment on the specific payment method for the $4.3 billion penalty due to non-disclosure agreements.

He clarified that the movement of $3.9 billion worth of USDT tokens reported on November 21 was unrelated to the settlement with the U.S. Justice Department.

Regarding comparisons between Binance’s treatment and that of mainstream financial firms, Teng noted that financial sector fines are not uncommon and emphasized Binance’s commitment to being one of the most regulated exchanges globally, operating in 18 jurisdictions.

Binance is actively investing in compliance and has recruited talent with regulatory and financial institution backgrounds to navigate regulatory requirements.

While Binance remains a global operation, it has established regional headquarters in the United Arab Emirates (UAE) and France to bolster its presence in the MENA and European regions, respectively.

Teng highlighted the importance of regulatory clarity and institutional adoption in fostering the cryptocurrency ecosystem’s growth.

In conclusion, Teng acknowledged the challenges of succeeding CZ as CEO but stressed that Binance had evolved significantly over the years.

He plans to bring his own values and expertise to the company, which will now report to a board of directors as the governing authority.

In his personal life, Teng enjoys staying active through exercise and is an avid reader, with Elon Musk’s biography being his recent choice.