The Financial Conduct Authority (FCA), the financial regulator of the United Kingdom, has taken action against cryptocurrency ATMs, disrupting 26 out of the 34 machines it visited and inspected since the beginning of 2023.

On February 14th, the FCA issued an ultimatum to all crypto ATM operators in the country, stating that they must comply with regulations or cease their illegal operations.

In response to this warning, the FCA, along with other law enforcement agencies, conducted investigations into 36 crypto ATM locations using their authority under money laundering regulations.

Steve Smart, the joint executive director of enforcement and market oversight at the FCA, spoke out against the use of all crypto ATMs, highlighting the risks involved.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He emphasized that using a crypto ATM in the UK means utilizing a machine that is operating illegally, and users may unknowingly be handing their money over to criminals.

Smart further clarified that victims of scams involving these ATMs, specifically those related to cryptocurrencies like Bitcoin (BTC), will not receive government protection or assistance from the ATM operators.

Between May and June, the FCA inspected 18 of these locations, coinciding with their public announcement about the initiation of their inspection campaign.

It is worth noting that all crypto exchanges and ATMs in the UK are required to register with the FCA and comply with the country’s money laundering regulations.

On July 8th, the Clive Police Department released a report detailing a crypto scam in which a fraudster posed as a law enforcement representative and managed to steal $6,000 from an unsuspecting victim while threatening them with an arrest warrant.

Scammers often employ fear tactics and impersonate law enforcement officials to deceive individuals into transferring funds through crypto ATMs.

However, it is important to remember that legitimate law enforcement agencies never demand payments over the phone or through cryptocurrency.

The FCA’s efforts to disrupt illegal crypto ATM operations and raise awareness about the risks associated with them are aimed at safeguarding the public and preventing financial crimes.

Individuals are urged to exercise caution and verify the legitimacy of any communication or transaction involving cryptocurrency to protect themselves from falling victim to scams.

Bitcoin (BTC) made a fresh breakout attempt on July 11, as the battle for yearly highs intensified.

The cryptocurrency briefly surpassed $31,000 before the daily close on July 10, signaling a potential leverage crunch.

BTC/USD approached resistance but lost momentum and retraced over $800. However, some continuation was observed, and at the time of writing, Bitcoin was trading around $30,500.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

According to Michaël van de Poppe, the founder and CEO of trading firm Eight, the recent overnight move resembled a leverage crunch.

He cautioned traders about the choppy market and highlighted that while Bitcoin revisited previous highs, it did not make new lows, with $30,200 acting as a strong support level.

Crypto Daan, a popular trader, compared the recent price behavior with the Bart Simpson pattern, where Bitcoin’s price would spike and then retrace. However, the current market structure resembled the Burj Khalifa, indicating a different pattern.

Meanwhile, Rekt Capital, a trader and analyst, identified $30,600 as a crucial level for Bitcoin. He stated that BTC needed to turn this level into support in the coming days to confirm its breakout.

The market’s ability to hold above this level would be a significant indicator of Bitcoin’s upward momentum.

Glassnode, an analytics firm, noted that Bitcoin’s price cycles often exhibit repetitive patterns.

The $30,000 price level in the current cycle resembled a mid-point, similar to levels observed in previous cycles.

Glassnode referred to the current price action as “re-accumulation,” indicating a consolidation phase before potential further upward movement.

In conclusion, Bitcoin made a fresh breakout attempt, reaching above $31,000 before retracing. The market exhibited characteristics of a leverage crunch, with BTC finding support at $30,200.

Traders analyzed various price patterns and identified crucial levels, such as $30,600, to determine Bitcoin’s future direction. Glassnode suggested that the current price action resembled a phase of re-accumulation, similar to previous Bitcoin price cycles.

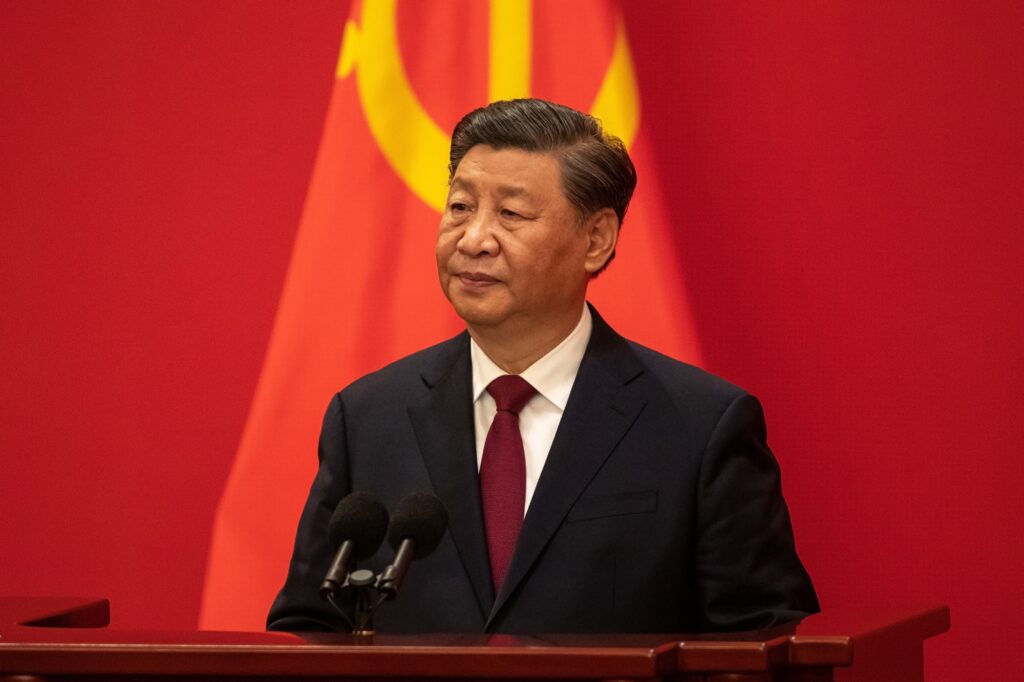

Xinhua News Agency, the state broadcaster of China, recently released a transcript of President Xi Jinping’s address at the 2023 Shanghai Cooperation Organisation (SCO) Summit.

The SCO, established by China and Russia in 2001, is a significant regional organization focused on political, economic, and security cooperation.

During his speech, President Xi expressed his appreciation for Iran becoming a full member of the organization and praised the inclusion of Belarus.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He also emphasized the importance of central bank digital currencies (CBDCs) and proposed expanding the use of local currency settlements among SCO countries, fostering cooperation in sovereign digital currencies, and establishing SCO development banks.

The People’s Bank of China reported in January that there were 13.61 billion digital yuan CBDCs in circulation, accounting for approximately 0.13% of the monetary supply.

Since then, the use of the digital yuan has expanded to include China’s Belt and Road Initiative, consumer airdrops, and everyday transportation payments.

However, experts caution that despite promotional efforts, the currency has struggled to gain widespread adoption.

In another development, it was reported on July 10 that Chinese consumers would soon have access to a SIM card linked to the digital yuan CBDC.

With the digital wallet embedded in the SIM card, individuals can make payments for their phone bills using point-of-sale machines, even when their phones have no power.

Moving to Hong Kong, the cost of obtaining a crypto exchange license has skyrocketed to HK$100 million ($12.77 million), according to a report by Tencent News on July 5.

While some teams have relocated to Malaysia due to lower costs and favorable conditions for crypto projects in Southeast Asia, several exchanges, including Huobi, OKX, BitgetX, Hashkey Pro, and Gate.io, have applied for licensing in Hong Kong to comply with the requirement that all crypto exchanges obtain a regulatory license or cease operations by mid-2024.

Meanwhile, a concerning incident occurred on July 7 when the developers of Multichain, a Chinese cross-chain bridge protocol, announced a halt in their services.

This was followed by a security firm’s warning that over $126 million had been drained from Multichain. Circle and Tether froze significant amounts of USDC and USDT, respectively, in response.

The hack affected Multichain’s token price, which dropped by 20% and now trades at $2.62 per token. It is worth noting that Multichain had experienced a previous hack in July 2021.

The Monetary Authority of Singapore (MAS) announced new regulations requiring Digital Payment Token (DPT) providers to place clients’ assets in a statutory trust by the end of the year.

Retail investors will be prohibited from accessing crypto lending and staking services, while institutional and accredited investors will still have access to these services.

The MAS highlighted the importance of enhancing investor protection and market integrity in DPT services and is seeking public feedback on the proposed rule changes.

In Thailand, Bitkub, the country’s largest cryptocurrency exchange, raised $17.1 million by selling 9.22% of its equity to Asphere Innovations PLC.

Bitkub reported holding substantial assets and customer deposits, as well as liabilities. The exchange’s total assets experienced a significant decline from 2021 to 2022.

Finally, Line Next, a South Korean non-fungible tokens firm, signed a memorandum of understanding with Sega, a renowned Japanese video game company, to remake one of Sega’s classic games on its Web3 gaming platform, Game Dosi.

Sega, known for franchises such as Sonic the Hedgehog, is venturing into the blockchain gaming space through this partnership with Line Next, which already has several titles on its platform.

These recent developments reflect the ongoing advancements and challenges in the digital currency, crypto regulation, and blockchain gaming sectors in the Asian region.

A blockchain developer claims to have reverse-engineered the source code of Brazil’s pilot central bank digital currency (CBDC) and discovered certain functions that could allow a central authority to freeze funds or reduce balances.

However, the developer argues that there might be situations in which these functions could be beneficial.

On July 6, the source code of Brazil’s digital real pilot project was made available on the GitHub portal by the country’s central bank.

READ MORE: Presidential Candidate Robert F. Kennedy Jr. Admits Owning Up to $250,000 in Bitcoin

It was clarified that the pilot project was solely intended for testing purposes and that the presented architecture could undergo further changes.

Pedro Magalhães, a blockchain developer and the founder of tech consulting firm Iora Labs, claimed to have successfully reverse-engineered the open-source code of Brazil’s digital real.

He revealed several functions in the code, including freezing and unfreezing accounts, adjusting balances, transferring currency between addresses, and minting or burning digital real from a specific address.

Magalhães suggested that Brazil’s central bank would likely retain these functions for secured loans and other financial operations based on decentralized finance (DeFi) protocols.

However, he pointed out that the code lacks clarity regarding the circumstances under which tokens can be frozen and who holds the authority to execute such actions.

These aspects should be publicly disclosed in the smart contracts and discussed with the population, which has not been done yet, according to Magalhães.

The cryptocurrency community has expressed concerns that a CBDC could infringe upon financial freedom and privacy.

However, Magalhães noted that while these concerns are understandable, a CBDC could also offer certain benefits.

For example, it would make taxes more traceable, allowing the public to inspect the allocation of tax funds and purchases made by the state on-chain. This could enhance transparency in parliamentary amendments as well.

In July 2022, Fabio Araujo, an economist at the Brazilian central bank, stated that the digital real has the potential to prevent bank runs and provide a safer and more reliable environment for entrepreneurial innovation.

The digital real pilot is reportedly running on Hyperledger Besu, a privately operated Ethereum Virtual Machine (EVM)-compatible blockchain.

Since it is not permissionless like the Bitcoin or Ethereum mainnets, users would require the central bank’s approval to become a node, as explained by Magalhães on July 7.

Paradigm, a crypto investment firm, has criticized the United States Securities and Exchange Commission (SEC) for its pursuit of crypto exchange Bittrex, arguing that the regulator is unjustly trying to regulate secondary crypto markets.

Rodrigo Seira, special counsel for Paradigm, expressed his views on Twitter, following Paradigm’s amicus brief filing that called for the dismissal of the SEC’s case against Bittrex. Seira stated that the SEC’s claims rely on an unreasonable application of the Howey test.

READ MORE:Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

Paradigm filed the amicus brief on July 7, asserting that the financial regulator exceeded its jurisdiction.

Seira further highlighted that SEC Chair Gary Gensler had previously acknowledged the absence of a sufficient regulatory framework for crypto exchanges.

Seira argued that this acknowledgment indicates a lack of authority for the regulator to oversee these secondary markets.

Seira also emphasized these points in a blog post on July 7, where he pointed out that crypto assets do not involve investment contracts, and therefore, they fall outside the SEC’s purview.

He criticized the SEC for instructing the digital-assets industry to register without providing effective means for doing so.

Seira urged the SEC to engage in the rulemaking process requested by Coinbase, another crypto organization facing legal action from the SEC, in order to provide clarity and resolve the industry’s regulatory uncertainties.

The SEC initially filed a complaint against Bittrex on April 17. Subsequently, Bittrex surrendered its Florida money transmitter license on April 30 and eventually filed for bankruptcy on May 8.

This is not the first time Paradigm has supported a crypto organization facing SEC legal action.

On May 11, Paradigm sought to file an amicus brief in support of Coinbase, arguing that the SEC had failed to provide clear rules or guidance for digital asset firms operating in the United States.

Paradigm’s criticism of the SEC’s approach reflects a growing concern within the crypto industry about regulatory ambiguity and the need for a comprehensive regulatory framework that considers the unique characteristics of digital assets.

The outcome of the Bittrex case and the SEC’s response to industry demands for clarity will significantly impact the future of crypto exchanges and secondary markets in the United States.

Ethereum co-founder Vitalik Buterin recently expressed his belief that the Bitcoin network requires scalable solutions, such as zero-knowledge rollups (ZK-rollups), in order to transcend its current role as a payment network.

Buterin shared his thoughts during a Twitter Space event hosted by Bitcoin developer Udi Wertheimer, where the focus was on Ethereum’s scaling experiments.

ZK-rollups are off-chain protocols that operate on the Ethereum blockchain and are managed by on-chain Ethereum smart contracts.

They offer a faster and more scalable approach to verifying transactions without compromising critical user information.

READ MORE: Digital Currency Group Dismisses Gemini Lawsuit as “Publicity Stunt” by Winklevoss Twins

Buterin highlighted how Ethereum has implemented various scaling solutions over the years to enhance throughput.

He pointed to Optimism and Arbitrum as successful examples of rollups that could serve as case studies for Bitcoin.

He stressed the need for additional scaling solutions if Bitcoin aims to expand beyond its current payment-centric role, stating, “I think if we want Bitcoin to be more than payments, it needs more scaling solutions.”

Scalability has long been a topic of discussion for both Bitcoin and Ethereum. Ethereum has transitioned from a proof-of-work to a proof-of-stake network and is actively exploring layer-2 solutions like ZK-rollups and Plasma to address scalability challenges.

Bitcoin, on the other hand, has relied on its layer-2 solution, the Lightning Network, to improve scalability.

More recently, the emergence of Bitcoin Ordinals has played a significant role in transforming the Bitcoin network into more than just a payment layer.

Buterin praised the rise of Ordinals and believes they have revitalized the builder culture within the Bitcoin ecosystem.

Bitcoin Ordinals represent the latest layer-2 solution enabling decentralized storage of digital art on the Bitcoin blockchain.

Their popularity has skyrocketed, with trading volume for Bitcoin Ordinals inscriptions surpassing $210 million by the end of June.

To commemorate this significant moment in history and support independent journalism in the crypto space, you can collect this article as an NFT (non-fungible token).

By preserving this article as an NFT, you contribute to the preservation of this important milestone and express solidarity with the world of independent crypto journalism.

According to recruitment executives, despite the excitement surrounding crypto firms entering Hong Kong, there has been a lack of in-country hires in the industry.

On June 1, approximately 150 companies applied for a local crypto license to operate a trading platform, with some reportedly spending up to $25 million to obtain one.

Sue Wei, managing director of recruitment firm Hays, mentioned that while exchanges aim to establish a presence in Hong Kong, the industry’s recruitment needs are currently low.

READ MORE: ZachXBT’s Research Cited in $3.1 Million NFT Rug Pull Lawsuit Against Boneheads

She expects an increase in job openings as Web3 companies continue to develop and expand.

However, there has been a decline in demand for technical talent since the crypto market dip, especially after numerous layoffs, which has made candidates hesitant to work for crypto companies due to the business’s instability tied to crypto prices.

Neil Dundon, founder of crypto recruiter Cryptorecruit, also noted a lack of significant activity in Hong Kong despite regulatory changes.

He believes that the venture activity is currently low but anticipates an upward trend in the future. Olga Yung, managing director of Michael Page Hong Kong, shared similar sentiments, stating that there hasn’t been a significant increase in job seekers interested in Web3 despite the government’s recent support.

However, Yung observed a slight increase in Web3 companies seeking legal and compliance hires in the second quarter of 2023.

Looking ahead, Kevin Gibson, founder of Web3 recruitment firm Proof of Search, expects a surge in crypto talent to take around six months as companies wait for license approvals.

He also mentioned that the local talent pool in Hong Kong is limited, and companies establishing themselves there may face intense competition for talent.

Gibson believes that the talent squeeze will persist until 2024, with Web3 companies potentially relocating their headquarters to pro-crypto jurisdictions if their plans align.

Hong Kong’s demographics data indicate a negative population growth rate since 2020.

Employment statistics for the first quarter of 2023 show a nearly 38% increase in job vacancies compared to the previous year.

One of the main challenges is attracting candidates interested in the crypto and Web3 sectors. Many candidates remain risk-averse due to the current market sentiment.

However, Neil Tan, chair of the FinTech Association of Hong Kong, noted that he has encountered several individuals who have recently transitioned from traditional finance to crypto.

Some are approached directly by crypto firms, while others search for roles through platforms like LinkedIn.

The instability and shedding of headcount in traditional finance have made the stability of crypto more appealing to some candidates.

According to a recent report from crypto analytics platform Messari, The XRP Ledger (XRPL) has shown significant growth in various aspects of its protocol during the second quarter of 2023, despite concerns over the Ripple vs. SEC lawsuit.

The report reveals that the circulating market cap of XRP has increased by 42.5% year-to-date, although there was a 10.7% decline in Q2, from $27.8 billion to $24.8 billion.

The initial growth was driven by a surge in the asset’s price in the first quarter. While the transaction volume on the XRP platform decreased quarter-over-quarter, there was a noteworthy 12.7% increase in average daily nonfungible token (NFT) transactions, rising from 13,800 to 15,500.

Although Ethereum and Solana overshadow the XRPL in the decentralized finance (DeFi) and NFT ecosystems, there are indications that this trend is shifting.

READ MORE: ZachXBT’s Research Cited in $3.1 Million NFT Rug Pull Lawsuit Against Boneheads

A key development in the XRP ecosystem highlighted by the Messari data is the expansion of XRPL sidechains.

Two notable protocols, Coreum and Root Network, were recently introduced, providing XRPL developers and users with desired programmability. Coreum focuses on ecosystem security, while Root Network drives metaverse innovations.

The XRPL also experienced a significant increase in the total new address count, reaching 138,790, a growth of 31.8% compared to the same period in 2022.

Additionally, quarterly revenue surged by 220.3% to $188,376.

Despite the ongoing SEC lawsuit, Ripple has seen efforts from developers within its ecosystem to drive utility adoption.

The progress made in essential operational aspects of the XRPL reflects its journey toward delivering sustainable value and utility.

Ripple’s distinct fundamentals, including its focus on real estate tokenization and dedicated research in blockchain technology, position it for substantial long-term growth and innovation.

While challenges persist, the growth witnessed in the XRPL’s protocol and ecosystem signifies progress in providing value and utility to its users.

Bitcoin (BTC) is currently experiencing a significant price discrepancy on Binance.US, offering a tempting opportunity for arbitrage. The cryptocurrency is being sold at a nearly $3,000 discount compared to global spot prices.

This phenomenon has been referred to as a “depeg” of cryptocurrencies, as the prices listed on the United States crypto exchange deviate from the global average.

At present, Bitcoin is trading at $27,536 against the U.S. dollar on Binance.US, representing an 8.5% markdown from the global spot price of $30,106.

Other digital assets, including Ethereum, are also being traded at discounted rates.

READ MORE: South Korean Regulator Takes Action After ‘Coin Gate’ Scandal

Ethereum is priced approximately $200 lower on Binance.US, with a current trading value of $1,695.

Even stablecoins like Tether (USDT) are affected, trading below their intended peg with Tether being valued at $0.915 on the exchange.

However, it is important to note that these discounts are only applicable when trading cryptocurrencies against fiat USD on Binance.US.

Unfortunately, most investors will not be able to take advantage of this opportunity due to the suspension of new USD deposits on the platform since June 9.

As a result, only those who already possess USD funds in their Binance.US accounts can purchase the discounted cryptocurrencies.

Moreover, concerns have arisen that Binance.US may soon halt USD withdrawals, prompting some users to sell their cryptocurrencies below market value in order to exit their positions in USD.

An email from Binance.US to customers, which has circulated on Twitter, states that the last day for USD withdrawals will be July 20.

This situation mirrors a similar incident that took place in late May at the Australian branch of Binance, where the company’s third-party payments provider ceased offering fiat on- and off-ramps.

Consequently, the price of BTC on Binance dropped by 20% when traded against the Australian dollar.

As a testament to the significance of these events, readers are encouraged to collect this article as a non-fungible token (NFT).

This unique digital asset will preserve this moment in history and demonstrate support for independent journalism in the cryptocurrency space.

Today, the most significant cryptocurrency gaining traction on Uniswap is Elon Musk (MUSK).

However, caution is advised as DEXTools reveals that this new meme token incorporates a blacklist function within its smart contracts.

As of the time of writing, $MUSK has experienced an astronomical surge of approximately 30,000%.

It is crucial to note that such substantial percentage gains over a short period are often attributed to low liquidity rather than genuine buying volume and demand.

READ MORE: Former BitMEX CEO Says Bitcoin Will Reach $760,000 as Currency of Artificial Intelligence

What is the Elon Musk (MUSK) Token?

The Elon Musk cryptocurrency asset made its debut on Uniswap on July 1st and currently boasts a liquidity pool of approximately $130k, with a 24-hour trading volume of $70k.

The market capitalization stands at $1.2 million, with 180 holders. Furthermore, it possesses a DEXTscore of 86/99.

Blacklist Function and Past Concerns

It is essential to acknowledge that previous rugpull incidents, such as the case of PepeHub earlier this week, involved the utilization of a blacklist function.

This particular function prevents specific wallet addresses from engaging in normal trading activities.

Therefore, it is plausible that some holders may be unable to sell, which could potentially account for the continuous price surge of $MUSK.

These circumstances contribute to the token’s status as one of the leading gainers in the cryptocurrency market.

At present, $MUSK coin has yet to secure a listing on CoinMarketCap.

However, it is worth mentioning that other unrelated assets associated with Elon Musk (MUSK) have appeared, and unfortunately, many of these have turned out to be scams.

The DEXTools description of $MUSK coin states, “$MUSK – Risk-taking and imagination are keys to success. Take a chance or regret it!”

Although Elon Musk, a long-time advocate of Bitcoin, Dogecoin, and cryptocurrencies in general, has not directly addressed the $MUSK token, he has recently engaged with another meme coin known as Wall Street Memes (WSM).

Musk has responded to tweets featuring memes from the @wallstmemes account on Twitter on three separate occasions.

While it remains unclear whether Elon Musk is aware of the upcoming launch of the $WSM token on Uniswap, his interactions with the @wallstmemes account indicate his involvement in the meme coin sphere.