Zac Prince, the CEO of cryptocurrency lending firm BlockFi, is facing allegations of ignoring warnings from the company’s risk management team regarding lending assets to Alameda Research.

The unsecured creditors’ committee filed a document on July 14 with the United States Bankruptcy Court for the District of New Jersey, stating that BlockFi’s risk management team had raised concerns about the high risks associated with lending assets to Alameda.

Despite these concerns, Prince allegedly dismissed the team’s recommendations and proceeded to lend Alameda $217 million by August 2021.

The risk management team had warned about potential risks if the loans secured by the FTX Token (FTT) needed to be liquidated.

The filing revealed that as early as August 2021, BlockFi’s risk management team was informed that a significant portion of Alameda’s balance sheet consisted of unlocked FTT tokens.

This information alarmed the team, but Prince disregarded their concerns and encouraged them to become comfortable with Alameda’s borrowing size.

READ MORE: Ripple’s XRP Victory Against SEC: A Blow to Regulator’s ‘War on Crypto’

Discussions between Prince and the risk management team regarding the risks associated with lending to Alameda shifted to offline meetings and Slack after January 2022.

BlockFi had approximately $1.2 billion tied to FTX and Alameda when it filed for bankruptcy.

In November 2022, when BlockFi filed for Chapter 11 bankruptcy, it acknowledged its significant exposure to FTX and its associated entities.

In July 2022, FTX US received a $400 million credit line from BlockFi, further deepening the financial ties between the two firms during a period referred to as the crypto winter.

The report stated that BlockFi recalled its loans from Alameda in June 2022, and Alameda repaid most of its outstanding balance.

However, instead of severing ties with Alameda, BlockFi decided to lend them nearly $900 million between July and September 2022, with the loans primarily collateralized by FTT tokens.

While it is acknowledged that Alameda/FTX’s downfall might have contributed to BlockFi’s demise, the filing emphasized that BlockFi’s problems were rooted in its own business practices and decisions that predated Alameda/FTX’s bankruptcy filing.

BlockFi issued a statement to Cointelegraph, stating its disagreement with the report.

The firm also filed a separate court document claiming that the committee behind the report cherry-picked statements out of context and failed to provide the promised objective analysis.

BlockFi directly cited its exposure to FTX as one of the reasons for its bankruptcy filing.

The practice of collateralized loans based on FTT tokens by FTX resulted in losses for numerous firms when the token’s price plummeted from over $25 to under $2 during the Chapter 11 filing and reported liquidity issues.

Other Stories:

OpenAI Faces FTC Investigation Over Privacy and Data Practices

Former FTX CEO Sam Bankman-Fried has made a request to the New York District Court Judge Lewis Kaplan, seeking permission for his “close friends” to visit him at his parent’s home without undergoing the security checks mandated by his bail conditions.

Bankman-Fried’s lawyers submitted a letter on July 13, urging the judge to extend the exemption from security measures to individuals on a pre-approved list.

At present, only Bankman-Fried’s legal representatives and employees from his contracted law firm are exempt from these checks.

The lawyers have requested that this privilege be extended to the visitors authorized by the court.

The list submitted by Bankman-Fried’s lawyers, which has been reviewed by the prosecutors without objection, includes “close friends and colleagues of Bankman-Fried’s parents and household help who regularly visit the house.”

To ensure the privacy and safety of the individuals mentioned in the list, the document was filed under seal, with the lawyers arguing that the importance of protecting the mentioned individuals far outweighs any presumption of public access to the list.

As part of the bail conditions set by Judge Kaplan, Bankman-Fried is currently limited to using a laptop solely for accessing court-approved websites, including specific news sites and YouTube. He is also in possession of a phone that has no internet access, allowing him only to make and receive calls and texts.

The lawyers representing Bankman-Fried assured that those on the approved visitor list are fully aware of his bail conditions and are committed to complying with them, which includes refraining from sharing any electronic devices with him.

Since being granted bail in December 2022, Bankman-Fried has been residing at his parent’s residence in Palo Alto, California.

It is important to note that the same property has been put up as collateral for his substantial $250 million bail bond.

While Bankman-Fried was originally scheduled to stand trial on October 2, a subsequent decision split five of the charges into a separate trial set to commence on March 11, 2024.

Other Stories:

United States DoJ Moves $299 Million Worth of Bitcoin in Recent Transactions

Bitcoin ETF Approval Could Act as Government’s ‘Seal of Approval’

Elon Musk Launches xAI: A New Venture to Unravel the Mysteries of the Universe

Coinbase’s Base mainnet is now accessible to builders, as stated in a blog post by the network’s development team on July 13.

This early opening of the network is aimed at allowing more time for user onboarding before its official public launch, which is scheduled for August.

Coinbase initially unveiled the Base network on February 23, presenting it as an Ethereum layer-2 solution that would leverage the OP Stack software developed by Optimism.

The Ethereum community welcomed this announcement, perceiving it as a significant vote of confidence for Ethereum’s future.

In the recent announcement on July 13, the team revealed that the Base mainnet currently features two operational block explorers and an official RPC node, enabling users to access data and transmit transactions.

READ MORE: Bitcoin ETF Approval Could Act as Government’s ‘Seal of Approval’

Data from the block explorers indicates that the network has been operational since July 2, having successfully processed over 1 million transactions.

Blockchain data confirms the deployment of an official “OptimismPortal” or Base bridge contract on Ethereum.

This contract enables developers to transfer Ether (ETH) to the new network for gas fee payments.

Notably, the bridge does not have a web-based user interface (UI), necessitating the use of a command-line interface or script-based interactions.

During the initial “builder” phase, the team has decided to withhold a publicly accessible bridge with a UI.

They have specifically requested developers to refrain from launching UIs for their applications until the upcoming public launch, where this feature will be available.

To celebrate this milestone, builders are given the opportunity to mint a commemorative non-fungible token (NFT) called “Base is for builders.”

Furthermore, developers deploying a contract to the network and completing a form on the project’s website will receive a “Genesis Builder NFT” as a reward.

Optimism Labs, the creator of the OP Stack, envisions a future where Base and Optimism form a “Superchain,” comprising multiple networks sharing the same security features.

However, this Superchain is expected to face competition from zkSync’s “Hyperchains,” which aim to offer similar functionalities.

In conclusion, Coinbase’s Base mainnet is now accessible to builders, enabling them to explore and contribute to the network ahead of its public launch.

This marks an important step in the development of the Base network and its integration with Ethereum’s ecosystem.

Other Stories:

United States DoJ Moves $299 Million Worth of Bitcoin in Recent Transactions

Elon Musk Launches xAI: A New Venture to Unravel the Mysteries of the Universe

In a recent blog post by Joseph Mills, the group product manager of Google Play, it was announced that the platform now permits video game publishers to sell nonfungible token (NFT) games on its store.

This update, shared on July 12, highlights Google Play’s commitment to exploring innovative ways for users to transact blockchain-based digital content within apps and games, while also enhancing user loyalty through unique NFT rewards.

The move by Google Play marks a significant shift from its previous stance on cryptocurrency-related applications.

Back in 2018, the platform banned crypto mining apps, and in 2020, it removed the Bitcoin Blast video game due to “deceptive practices.”

In contrast, Apple’s App Store announced in October that NFTs acquired outside of its ecosystem cannot confer special benefits to users within a game, under the risk of being banned.

Furthermore, NFTs sold within the App Store must adhere to a 30% fee to Apple.

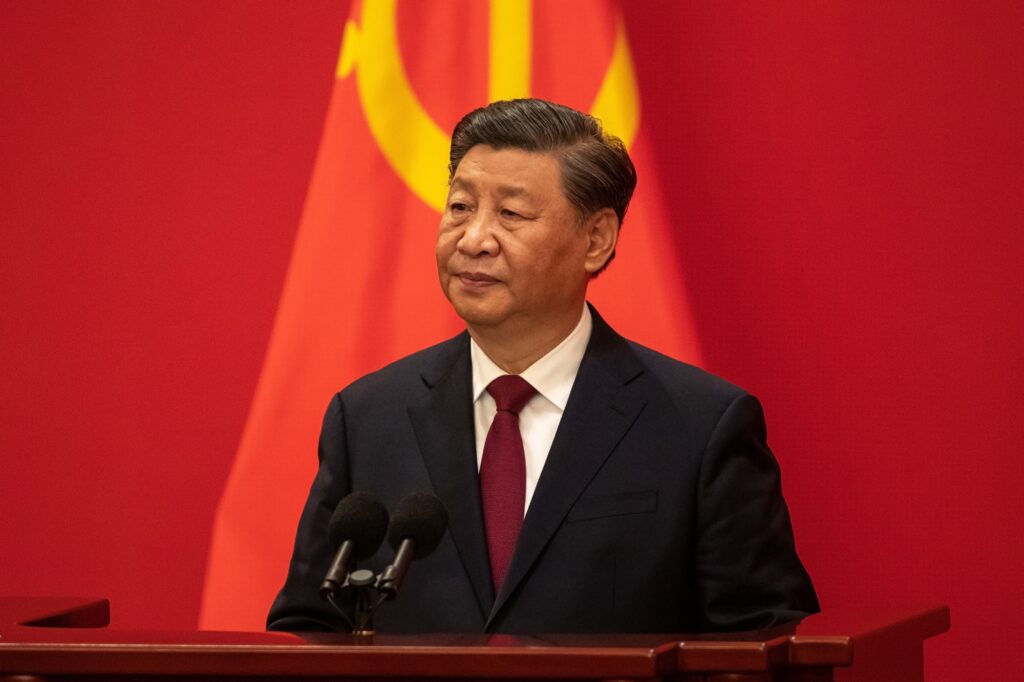

READ MORE: President Xi Jinping Highlights CBDCs and Expansion of SCO

These decisions and statements led many industry experts to speculate that mobile NFT games were under attack. However, Google Play’s recent policy revision clearly signals a welcoming approach to these games on Android devices, albeit with a few regulations in place.

According to Mills’ blog post, game developers must transparently indicate if their games enable users to earn or purchase NFTs or cryptocurrencies.

Moreover, developers are prohibited from glamorizing potential earnings from playing or trading activities, as well as selling loot boxes or incorporating gambling features.

By complying with these guidelines, game developers can leverage tokenized assets to enhance the gaming experience.

They are encouraged to reimagine traditional games by integrating user-owned content. Google Play emphasized that it collaborated with leaders in Web3 gaming to establish these rules and expressed its commitment to engaging with developers to understand their challenges and explore further opportunities.

The decision by Google Play to allow NFT games on its platform represents a significant development for the gaming industry.

With these updated policies in place, developers can harness the power of NFTs to create unique and engaging experiences for players, while adhering to responsible practices outlined by Google Play.

As the ecosystem evolves, it is likely that we will witness further collaboration between game developers and platforms, leading to exciting advancements in the intersection of gaming and blockchain technology.

Prosecutors and the Internal Revenue Service (IRS) in the United States are reportedly conducting investigations into wealthy individuals involved in cryptocurrency trading and fund management, suspecting them of illegally benefiting from Puerto Rico’s tax incentives.

Bloomberg’s report on June 12 revealed that civil and criminal cases are being built against hedge fund managers, crypto traders, and other affluent Americans who may have misrepresented their residency and income to exploit the tax breaks.

The investigations extend to attorneys and accountants who promoted Puerto Rico’s tax program, and it is anticipated that at least two criminal investigations will lead to charges in the near future. Charges under scrutiny include conspiracy and wire fraud.

READ MORE: United States Government Accountability Office Publishes Blockchain Report

Attorney Carlos Ortiz shared insights from a conversation with a U.S. federal prosecutor, stating that they are collaborating with IRS agents and Puerto Rico officials. Ortiz summarized the situation by saying, “The message is the noose is tightening.”

Since the implementation of Puerto Rico’s new tax policy in 2012, over 5,000 U.S. individuals have relocated to the territory, attracted by the potential savings in federal income tax.

The tax policy provides a 100% exemption on dividends, a 60% exemption on municipal taxes, and zero federal taxes on income earned within Puerto Rico.

Furthermore, more than 3,600 businesses have enjoyed exemption from taxes on dividends, only paying a 4% tax on exports.

While these tax benefits are among the most lenient globally, the requirements to qualify for them are stringent.

Applicants must prove residency on the island for a minimum of 183 days annually and establish Puerto Rico as their “tax home.”

According to lawyers familiar with the tax regime, the strict eligibility criteria have tempted many individuals to manipulate numbers and engage in fraudulent activities on their tax returns.

Renowned figures such as gold enthusiast Peter Schiff and crypto investor Michael Terpin have relocated to Puerto Rico for tax purposes.

However, Schiff’s bank was recently shut down by Puerto Rican regulators for failing to meet minimum capital requirements.

Speaking at Miami’s annual Bitcoin Conference, Terpin praised Puerto Rico as the only place where one can avoid paying global taxes without relinquishing U.S. citizenship.

Despite the potential scrutiny, Terpin expressed confidence in his meticulous record-keeping and willingness to face an audit.

While wealthy residents laud the tax breaks for attracting top fund managers and entrepreneurs to the island, protests have arisen, claiming that the influx of low-tax “colonizers” has raised living costs.

The tax program remains a subject of contention in Puerto Rico.

Binance’s BNB Beacon Chain mainnet is gearing up for a critical hard fork, which introduces a novel feature that enables the blockchain to stop new block production under specific conditions.

The impending upgrade, called “ZhangHeng,” is slated to take place at block height 328,088,888, expected to happen on July 19, as revealed in a statement from BNB Chain on July 12.

This significant hard fork will implement the Binance Evolution Proposal BEP-255, aimed at introducing on-chain asset reconciliation.

The addition comes in light of cross-chain bridge exploits such as the BNB Smart Chain breach in October 2022, which Binance believes can be mitigated by this strategy.

READ MORE: President Xi Jinping Highlights CBDCs and Expansion of SCO

Despite security enhancements like BEP171, Binance affirms the need for asset security on the BNB Beacon Chain, especially following bridge exploitation.

The BEP-255 implementation allows tracking of user balance changes per block, and reconciliation to spot potential anomalies.

Binance points out that if any reconciliation errors are detected, block production will cease. This move may affect bridges, deposits, and withdrawals on exchanges but is deemed crucial for the chain and user protection.

Restarting the blockchain will necessitate a hard fork and resolution of the detected reconciliation error. In case of an exploit, the related accounts will need to be corrected or blacklisted.

The blockchain’s resumption will also restore downstream services.

The upcoming hard fork also involves other upgrades, such as fixing a bug that curbs rogue key attacks. Existing vote addresses will be cleared when the hard fork reaches its height, and validators will have to re-add vote addresses.

The update is also designed to enable the chain to handle complex business rules and logic more effectively.

Binance highlights the need for two-thirds of validators to upgrade to software version v0.10.16 prior to the hard fork to avoid complications. Failing to upgrade would prevent full nodes from executing further blocks post-hard fork.

BNB Chain has provided comprehensive instructions for node operators to conform to the hard fork upgrade. BNB token holders using Binance.com, other centralized exchanges, or cold wallets, however, need not take any action presently.

On June 19, BNB Chain introduced opBNB, a new Ethereum Virtual Machine-compatible layer-2 scaling solution based on Optimism’s OP Stack.

Ripple, the blockchain company currently facing a lawsuit from the United States Securities and Exchange Commission (SEC), may have to wait a little longer for a decisive ruling.

A district court judge in the U.S., Paul Barbadoro, declined to determine whether the secondary sale of LBRY Credits (LBC) qualifies as a security.

On July 11, Judge Barbadoro made his decision in a case brought by the SEC against LBRY, a decentralized content platform.

This ruling could establish legal precedent for Judge Analisa Torres, who will preside over the SEC’s case against Ripple in the coming months.

READ MORE: Bitcoin Attempts Fresh Breakout as Battle for Yearly Highs Intensifies

In his ruling, Barbadoro abstained from taking a position on whether the registration requirement applies to secondary market offerings of LBC.

The secondary market involves trading securities between traders, while the primary market entails direct trading from the issuing company.

John Deaton, a U.S. lawyer representing numerous XRP tokenholders, sought clarification from Barbadoro regarding LBC’s classification as a security.

However, the judge upheld his “judicial restraint” and refrained from providing a definitive answer.

This recent opinion from Barbadoro represents a reversal from his stance during a January appeal hearing, where Deaton successfully argued that the secondary sale of LBC should not be considered a securities offering.

During the appeal hearing, the New Hampshire judge clarified that LBC only qualifies as a security when sold directly.

The SEC also acknowledged that secondary market sales of LBC do not fall under the definition of a security.

Although the SEC obtained a summary judgment in November 2022, it opted to settle for $22 million during the appeal hearing in January.

In May, the SEC revised the amount and requested a reduced fine of $111,000 due to LBRY’s financial struggles.

In the meantime, Jeremy Hogan, a U.S.-based attorney and advocate for Ripple, shared with Cointelegraph that Judge Analisa Torres is expected to deliver her ruling within the next few months.

Hogan anticipates that the broader outcome will be known before the year’s end, unless Ripple achieves a complete victory.

If the details of the ruling are unfavorable, appeals are likely to prolong the legal process.

However, Hogan reassured typical XRP holders that the final outcome would not significantly affect them.

Investment veteran Cathie Wood, known for her pro-Bitcoin stance, has decided to take some profits from ARK Invest’s significant Coinbase holdings.

ARK sold 135,152 Coinbase shares, amounting to $12 million, from its ARK Innovation ETF.

This sale represented 0.14% of the fund’s total holdings.

The move comes as the price of Coinbase stock experienced a sharp increase, briefly surpassing $90 on July 11 before closing at $89.

This is the second time this year that Wood has taken profits from Coinbase shares. In March, ARK sold 160,887 shares for $13.5 million.

However, prior to these profit-taking moves, Wood’s firm had been actively accumulating Coinbase stock in various ARK funds. In June alone, ARK purchased about $40 million worth of shares.

In previous months, they had bought around $33 million in April and May, as well as $117 million in March.

Coinbase executives have also been selling their shares amid the price rally. CEO Brian Armstrong and other senior executives sold a combined total of 88,058 shares worth $6.9 million on July 6. In June, Coinbase’s chief accounting officer, Jennifer Jones, sold 74,375 shares, netting $5.2 million.

Despite facing a securities violation lawsuit from the U.S. Securities and Exchange Commission, Coinbase’s stock has been performing well.

The growth can be attributed to the anticipation surrounding the BlackRock spot Bitcoin ETF filing, where Coinbase was named a “surveillance-sharing” partner.

Overall, Wood’s decision to take profits from Coinbase shares reflects a calculated move to lock in gains.

While the cryptocurrency exchange continues to face legal challenges, its stock price has surged over the past month, increasing by more than 60%.

Wood’s active participation in accumulating Coinbase shares earlier this year indicates her belief in the long-term potential of the company.

As the cryptocurrency market and related investments evolve, market participants will continue to closely monitor the developments surrounding Coinbase and its role in the growing crypto ecosystem.

China’s President Xi Jinping addressed the 2023 Shanghai Cooperation Organization (SCO) Summit, and Xinhua News Agency published the transcript of his speech. President Xi welcomed Iran as a full member of the organization and praised Belarus for joining.

He also emphasized the significance of central bank digital currencies (CBDCs) and proposed expanding the use of local currency settlements among SCO countries, promoting sovereign digital currency cooperation, and establishing SCO development banks.

The People’s Bank of China reported in January that there were 13.61 billion digital yuan CBDCs in circulation, although it represented only a small fraction of the monetary supply.

Despite continuous promotion, the digital yuan has faced challenges in gaining widespread adoption.

READ MORE: President Xi Jinping Advocates for CBDC Expansion

In other news, a SIM card linked to the digital yuan CBDC will soon be available to Chinese consumers, according to a report by East Money.

The embedded digital wallet will allow individuals to make payments for phone bills even when their phones have no power.

Hong Kong’s crypto licensing costs have surged to HK$100 million ($12.77 million) since the license’s inception on June 1, as reported by Tencent News.

Obtaining a regulatory license is necessary for crypto exchanges to continue operations in Hong Kong.

Some teams have relocated to Malaysia, citing cost advantages and favorable conditions for crypto projects in Southeast Asia.

Multichain, a Chinese cross-chain bridge protocol, experienced a security breach resulting in the loss of over $126 million in funds.

The protocol’s private keys were compromised, and the stolen assets were transferred to another wallet address.

This incident follows a previous hack in July 2021, and the CEO of Multichain, Zhao Jun, has been missing for nearly two months, with rumors suggesting his arrest by Chinese authorities.

Singapore’s Monetary Authority will require Digital Payment Token (DPT) providers to place clients’ assets in a statutory trust by the end of the year.

Retail investors will be prohibited from accessing crypto lending and staking services, although these services will still be available to institutional and accredited investors.

The MAS aims to enhance investor protection and market integrity in DPT services.

Thai cryptocurrency exchange Bitkub has sold a 9.22% equity stake worth $17.1 million to Asphere Innovations PLC.

Bitkub holds significant assets and customer deposits, along with liabilities, and reported a gross profit in the first quarter of 2023.

It is the largest crypto exchange in Thailand, but its total assets decreased by 64% between December 2021 and December 2022.

South Korean NFT firm Line Next signed an agreement with Japanese video game giant Sega to remake one of Sega’s classic games on its Web3 gaming platform, Game Dosi.

The platform currently offers six titles, allowing players to buy and sell NFT heroes and compete against others.

Sega, known for its iconic franchise Sonic the Hedgehog, is a prominent player in the Japanese video game industry.

In a recent blog post, blockchain security and analytics firm Chainalysis suggested that the multimillion-dollar exploit of the cross-chain bridge protocol Multichain may have been an internal rug pull.

The unauthorized withdrawals, which occurred on July 6, 2023, have led to a loss of over $125 million.

According to Chainalysis, the exploit could have been carried out by insiders who had compromised administrator keys.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

This possibility has also been previously suggested by blockchain security firm SlowMist. In response to queries from Cointelegraph, Chainalysis confirmed that they consider the incident a potential rug pull.

Multichain employs a multiparty computation (MPC) system in its smart contracts, similar to a multisignature wallet.

Chainalysis explained that it is possible the attacker gained control of Multichain’s MPC keys to execute the exploit.

While it is conceivable that external hackers obtained these keys, some security experts and analysts believe the exploit could be an inside job due to recent issues experienced by Multichain.

One prominent internal issue highlighted by Chainalysis was the disappearance of Multichain’s CEO, known as “Zhaojun,” in late May.

Additionally, the platform encountered delayed transactions and other technical problems that led Binance to withdraw support for several bridged tokens on July 7.

Attempts to reach out to Multichain for comment on these claims have been unsuccessful at the time of publication.

In the midst of these developments, blockchain investigators have noticed further suspicious movements of Multichain tokens in the past few hours.

These abnormal outflows included the draining of token addresses across multiple chains by the Multichain executor address.

Furthermore, stablecoin issuers Circle and Tether took action on July 8 by freezing over $65 million in assets associated with the Multichain exploit.

Chainalysis found it intriguing that the exploiter did not convert these assets into centrally controlled ones like USDC, which can be frozen by the issuing company.

As the investigation into the Multichain exploit continues, it is becoming increasingly likely that the incident was an inside job or rug pull.

The repercussions of this exploit have resulted in substantial financial losses and raised concerns about the security and integrity of the protocol.